Chubb Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chubb Bundle

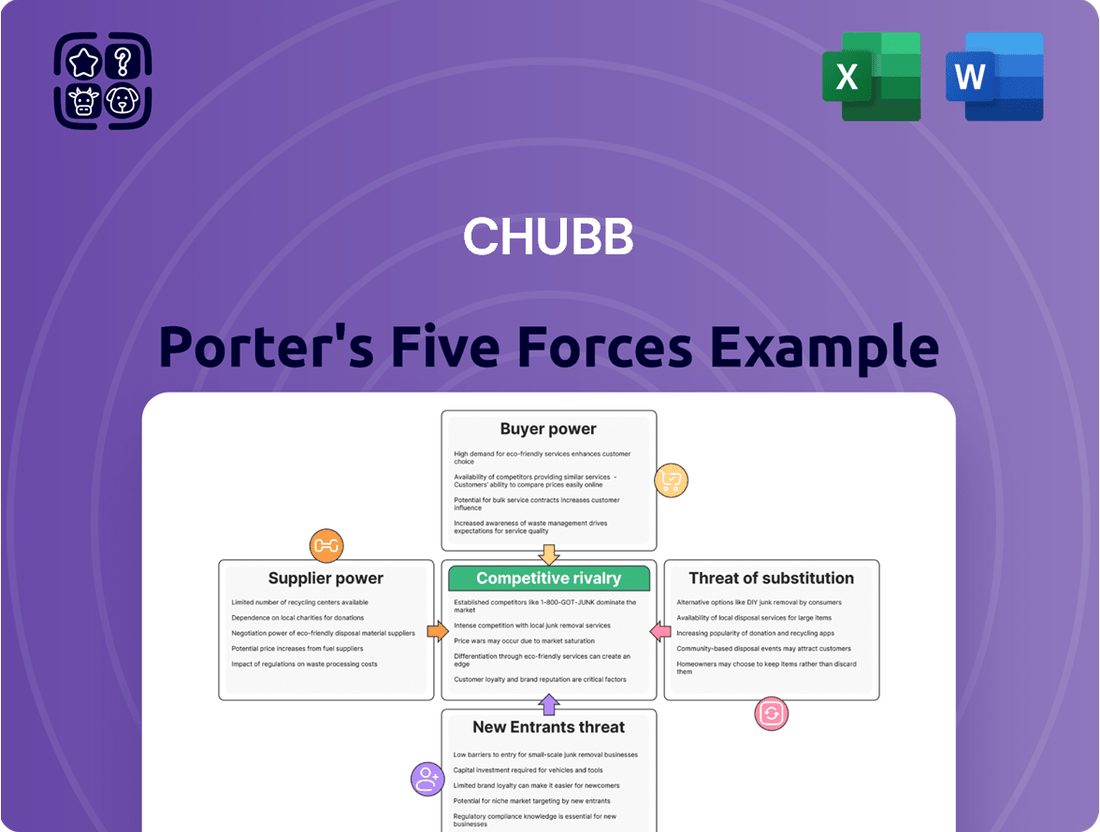

Chubb's position in the insurance industry is shaped by the interplay of five key forces: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chubb’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Chubb, like many large insurers, depends on reinsurers to manage its exposure to substantial risks, such as major catastrophes. The bargaining power of these reinsurers can be significant, especially when capital in the reinsurance market is constrained or when there's a surge in major claims. A healthy global reinsurance market in 2024, marked by capital growth, suggests a more balanced, though still potent, supplier landscape.

The insurance sector's growing dependence on sophisticated technology, data analytics, and artificial intelligence for core functions like underwriting, claims, and customer engagement significantly bolsters the bargaining power of technology and data providers. These specialized suppliers are becoming indispensable partners.

Chubb's substantial commitment to technological advancement, with projected annual expenditures between $1.1 billion and $1.2 billion for 2024, underscores the critical role and leverage these technology and data vendors possess in shaping the company's operational efficiency and competitive edge.

Catastrophe modeling firms wield considerable bargaining power, especially as the frequency and severity of natural disasters escalate. Their specialized data and proprietary analytical tools are essential for insurers like Chubb to accurately assess and price risks associated with climate change. For instance, the economic losses from natural catastrophes globally reached $110 billion in 2023, according to Swiss Re, highlighting the critical need for these modeling services.

Claims Service Providers

Chubb may leverage specialized claims service providers for niche expertise, such as forensic accounting or complex engineering assessments. The bargaining power of these providers is influenced by their unique skill sets and the overall market demand, particularly in the wake of widespread catastrophic events. For instance, following major natural disasters in 2024, the demand for specialized claims adjusters and investigators surged, potentially increasing their leverage. Chubb's commitment to a robust claims process underscores the critical role these external partners play in ensuring efficient and satisfactory resolution for policyholders.

The bargaining power of these specialized claims service providers can be significant, especially when their expertise is highly sought after. Consider the impact of climate-related events in 2024, which led to a heightened need for services like structural damage assessment and environmental remediation. In such scenarios, providers with proven track records and specialized certifications can command higher fees. Chubb, like other insurers, must carefully manage these relationships to balance cost-effectiveness with the quality of service delivery, which is paramount to customer satisfaction and retention.

- Specialized Expertise: Providers offering niche skills like forensic engineering or complex litigation support often have higher bargaining power due to limited competition.

- Market Demand Fluctuations: The power of these suppliers can increase significantly following widespread events (e.g., natural disasters) that drive up demand for their specific services.

- Cost of Switching: The investment Chubb makes in vetting and onboarding new claims service providers can make switching to alternatives costly and time-consuming, reinforcing the power of existing partners.

- Performance Impact: The efficiency and effectiveness of these outsourced claims services directly impact Chubb's operational costs and customer satisfaction, giving strong performers more leverage.

Human Capital/Talent

The bargaining power of suppliers in the context of human capital for Chubb hinges on the availability of specialized insurance professionals. A scarcity of skilled underwriters, actuaries, and data scientists can significantly amplify their leverage, potentially driving up recruitment and compensation expenses for the company. Chubb's substantial global workforce of 43,000 employees highlights the strategic importance of attracting and retaining this vital talent pool.

Key considerations regarding human capital as a supplier force include:

- Talent Scarcity: Limited supply of highly specialized insurance professionals increases their negotiation power.

- Compensation Demands: Shortages can lead to upward pressure on salaries and benefits, impacting operational costs.

- Recruitment Challenges: Intense competition for top talent can escalate hiring expenses and time-to-fill critical roles.

- Retention Importance: High turnover of skilled employees can disrupt operations and increase the cost of replacing them.

The bargaining power of suppliers for Chubb is a critical factor in its operational costs and profitability. This power is most pronounced with specialized providers whose services are essential and difficult to substitute. In 2024, the insurance industry's reliance on advanced technology and data analytics means that providers in these areas hold significant sway, directly impacting Chubb's ability to innovate and manage risk effectively.

Catastrophe modeling firms, for instance, possess substantial leverage due to the increasing frequency and severity of natural disasters. Their proprietary data and analytical tools are indispensable for accurate risk assessment, a need amplified by the $110 billion in global natural catastrophe economic losses reported for 2023. Similarly, specialized claims service providers, particularly those with niche expertise in areas like forensic engineering, see their bargaining power rise when demand spikes after major events.

The availability of skilled human capital also influences supplier power. A shortage of specialized insurance professionals, such as actuaries and data scientists, can increase recruitment and compensation costs for Chubb, which employs around 43,000 people globally. The cost and time involved in vetting and onboarding new service providers further solidify the position of established partners, reinforcing their bargaining power.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Chubb | 2024 Data/Context |

|---|---|---|---|

| Reinsurers | Capital availability, market concentration, demand for coverage | Affects cost of risk transfer and capital management | Global reinsurance capital showed growth in 2024, suggesting a more balanced market. |

| Technology & Data Providers | Uniqueness of solutions, switching costs, industry dependence | Influences operational efficiency, innovation, and data security | Chubb's 2024 tech investment projected between $1.1-$1.2 billion highlights dependence. |

| Catastrophe Modeling Firms | Data exclusivity, analytical sophistication, regulatory requirements | Crucial for accurate risk pricing and underwriting | Global natural catastrophe economic losses were $110 billion in 2023. |

| Specialized Claims Service Providers | Niche expertise, availability of skilled personnel, event-driven demand | Impacts claims handling efficiency, cost, and customer satisfaction | Demand for specialized adjusters increased post-2024 events. |

| Human Capital (Specialized Talent) | Talent scarcity, competition, specialized skill sets | Affects recruitment costs, compensation, and operational capacity | Chubb's global workforce of 43,000 underscores the need for skilled talent. |

What is included in the product

Analyzes the competitive intensity within the insurance industry, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players, all specifically for Chubb.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling targeted strategic responses.

Customers Bargaining Power

Large commercial clients, especially multinational corporations, wield considerable bargaining power in the insurance market. Their substantial premium volumes give them leverage to negotiate tailored coverage and favorable terms, particularly in competitive sectors like large account property and casualty insurance where pricing has softened. For instance, in 2024, the global commercial P&C insurance market experienced increased competition, leading to more price flexibility for large buyers.

Chubb's reliance on independent agents and brokers means these intermediaries hold a degree of bargaining power. As they represent a significant volume of business and can shift their allegiances to competing insurers, they influence which products reach customers, giving them leverage.

These agents and brokers, acting as gatekeepers to numerous policyholders, can negotiate terms or seek better commission structures. For instance, in 2024, the insurance brokerage sector saw continued consolidation, with larger firms wielding more influence over insurers like Chubb.

Chubb's strategy to mitigate this involves providing robust tools and resources to support its agent and broker network. This includes advanced digital platforms and marketing support, aiming to foster loyalty and reduce the incentive for brokers to seek out competitors.

For personal lines insurance like auto and homeowners, individual customers typically have limited bargaining power. However, their collective ability to compare quotes and switch providers significantly influences pricing and service offerings.

Data from J.D. Power in early 2025 highlighted a notable increase in consumers actively shopping for new insurance policies, with many citing price as the primary driver. This trend suggests that customers are becoming more empowered to leverage competitive offers.

Small and Middle Market Businesses

Small and middle market businesses, while individually having less sway than large corporations, can still wield bargaining power. This is particularly true when they band together in purchasing groups, amplifying their collective demand. Furthermore, a competitive insurance landscape for these segments can shift power towards the buyer.

The commercial property and casualty (P&C) market for small and middle commercial segments has demonstrated more consistent and favorable pricing trends. For instance, in 2024, many middle-market businesses experienced stable or even decreasing premium renewals, a welcome change from prior hardening markets.

- Aggregated Purchasing Power: Small and middle market businesses can increase their bargaining power by forming purchasing alliances or joining industry-specific groups to negotiate collectively with insurers.

- Competitive Insurance Market: A market with numerous insurers competing for business allows these smaller entities to shop around and secure more favorable terms and pricing.

- 2024 Pricing Trends: The commercial P&C market for small and middle commercial segments in 2024 has shown stable to positive pricing trends, indicating a more buyer-friendly environment compared to previous years.

Customers Utilizing Digital Channels

Customers leveraging digital channels gain increased bargaining power due to enhanced transparency and simplified product comparison. This shift is evident as more consumers can readily access and evaluate insurance offerings online, forcing providers to compete more aggressively on price and features.

Chubb's strategic investments in digital platforms, including its digital life insurance products, underscore its recognition of this trend. By focusing on digital initiatives, Chubb aims to meet evolving customer expectations for convenience and accessibility, thereby mitigating some of the increased customer power.

- Increased Transparency: Digital platforms allow customers to easily compare policy terms, premiums, and customer reviews across multiple insurers.

- Ease of Comparison: Online tools and comparison websites simplify the process of evaluating different insurance products, empowering consumers to find the best value.

- Chubb's Digital Push: Chubb's launch of digital life insurance in 2023, for instance, reflects a direct response to the demand for more accessible and digitally-native insurance solutions.

- Embedded Insurance Growth: The increasing prevalence of embedded insurance, where coverage is offered at the point of sale for other goods or services, further simplifies customer access and can amplify their ability to switch providers.

The bargaining power of customers for Chubb is influenced by several factors, including the size of the client, the competitive landscape, and the accessibility of information. Large commercial clients, in particular, can negotiate favorable terms due to their significant premium volumes, a trend observed in the competitive global commercial P&C market in 2024 where pricing softened.

Individual customers, especially in personal lines like auto and homeowners insurance, have limited individual power but can collectively influence pricing by comparing quotes and switching providers. Data from early 2025 indicated a rise in consumers actively shopping for insurance, driven by price sensitivity.

The increasing use of digital channels by customers significantly enhances their bargaining power through greater transparency and easier comparison of offerings. Chubb's investment in digital platforms, such as its digital life insurance initiatives, aims to address this evolving customer empowerment.

| Customer Segment | Bargaining Power Drivers | 2024/2025 Trends/Data |

|---|---|---|

| Large Commercial Clients | High volume of premiums, negotiation for tailored coverage | Softening prices in competitive commercial P&C market |

| Individual Customers (Personal Lines) | Collective comparison and switching, price sensitivity | Increased shopping for policies, price as a key driver (early 2025 data) |

| Small & Middle Market Businesses | Purchasing groups, competitive market dynamics | Stable to decreasing premium renewals in commercial P&C |

| Digitally Engaged Customers | Transparency, ease of comparison, access to information | Growing demand for accessible, digitally-native solutions |

Preview Before You Purchase

Chubb Porter's Five Forces Analysis

This preview showcases the complete Chubb Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the insurance industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or placeholders. You can confidently download and utilize this professionally formatted analysis to understand Chubb's strategic positioning.

Rivalry Among Competitors

Chubb's extensive global footprint, spanning 54 countries and territories, significantly tempers competitive rivalry. This broad operational base, coupled with a diverse offering of property and casualty, accident and health, and life insurance products, allows the company to absorb pressures in specific markets or product segments by leveraging strengths elsewhere. For instance, in 2023, Chubb reported total revenues of $45.1 billion, demonstrating the scale at which it operates and its ability to diversify risk.

Chubb distinguishes itself through its rigorous underwriting expertise and disciplined approach, a key factor in its competitive standing. This focus has consistently yielded robust financial performance, notably reflected in its industry-leading combined ratios. For instance, in 2023, Chubb reported a P&C combined ratio of 86.1%, underscoring its ability to manage risks effectively and profitably.

This specialized knowledge in assessing, assuming, and managing diverse risks provides Chubb with a significant competitive advantage, particularly in today's unpredictable market landscape. The company's underwriting discipline allows it to price risk accurately, avoid excessive losses, and maintain profitability even when competitors struggle.

Chubb's formidable financial strength and extensive capital base act as a substantial barrier to entry and a powerful competitive weapon. This robust financial foundation allows Chubb to underwrite larger and more complex risks than many competitors, thereby capturing more profitable business.

The company's impressive operating return on tangible equity reached 21.6% in 2024. This figure underscores Chubb's ability to generate strong profits efficiently from its capital, reinforcing its financial stability and capacity for strategic investments and growth.

Innovation and Technology Investment

The insurance sector is seeing a significant shift driven by technological progress, directly impacting competitive rivalry. Chubb's strategic focus on innovation and technology investment is a key differentiator in this evolving landscape.

Chubb's commitment to advanced visualization, analytics, and digital solutions is evident in its operational enhancements and customer-centric product development. For instance, the establishment of new engineering centers and the rollout of digital life insurance products underscore this dedication.

These investments empower Chubb to refine its underwriting processes, streamline claims handling, and offer more personalized customer experiences, thereby strengthening its competitive edge against rivals who may lag in technological adoption. This proactive approach is crucial for maintaining market share and driving future growth.

- Technological Advancements: The insurance industry is increasingly shaped by innovations in areas like AI, big data analytics, and digital platforms.

- Chubb's Investment Strategy: Chubb actively invests in advanced visualization, analytics, and digital solutions, including new engineering centers and digital life insurance products.

- Competitive Advantage: These investments improve operational efficiency, enhance customer offerings, and strengthen Chubb's position against competitors.

- Impact on Rivalry: Companies that fail to invest in technology risk falling behind in product innovation, customer service, and operational effectiveness.

Market Conditions and Pricing Trends

The property and casualty (P&C) insurance market in 2024 has presented a mixed bag of conditions. While some sectors have witnessed a softening of prices due to intensified competition, others have maintained pricing discipline. Chubb has adeptly managed these dynamics, continuing to achieve growth and profitability even as competition has escalated in areas such as large account property insurance.

Chubb's competitive rivalry is influenced by several factors:

- Intense Competition in Key Segments: The P&C insurance market, particularly for large commercial accounts, has seen increased competition, leading to some pricing pressure.

- Chubb's Resilience: Despite this competitive environment, Chubb has demonstrated a strong ability to maintain its growth trajectory and profitability.

- Market Segmentation: Pricing trends vary across different P&C insurance segments, with some experiencing softening while others remain firm.

- Strategic Navigation: Chubb's success indicates a strategic approach to navigating these varied market conditions and competitive pressures.

Chubb's competitive rivalry is characterized by a dynamic interplay of market conditions and strategic differentiation. While the property and casualty insurance market, especially for large accounts, experienced heightened competition in 2024, Chubb has consistently maintained its growth and profitability. This resilience stems from its disciplined underwriting, global diversification, and significant investments in technology. The company's ability to navigate varying pricing trends across different segments underscores its strategic acumen in a competitive landscape.

| Metric | 2023 Value | 2024 Projection/Trend | Impact on Rivalry |

|---|---|---|---|

| P&C Combined Ratio | 86.1% | Expected to remain strong due to underwriting discipline | Strong underwriting allows Chubb to compete effectively on price and profitability |

| Total Revenues | $45.1 billion (2023) | Continued growth expected, driven by diversification | Scale provides an advantage against smaller, less diversified competitors |

| Operating Return on Tangible Equity | 21.6% (2024) | Indicates efficient capital utilization and profitability | High profitability attracts capital and supports competitive pricing strategies |

| Technological Investment | Ongoing investment in AI, analytics, digital solutions | Continued focus on innovation | Enables superior customer experience and operational efficiency, creating a gap with less tech-savvy rivals |

SSubstitutes Threaten

Large corporations increasingly explore self-insurance or establish captive insurance companies. This strategy allows them to retain more control over risk management and financing, often proving more cost-effective than traditional insurance, particularly for unique or significant risk exposures. For instance, in 2024, the captive insurance market continued its robust growth, with industry estimates suggesting the total gross written premiums for captives globally could reach hundreds of billions of dollars, demonstrating a significant shift in risk financing away from traditional insurers.

Alternative Risk Transfer (ART) solutions, like structured programs and parametric insurance, are increasingly stepping in as substitutes for traditional insurance. These ART products offer bespoke risk management and financing, moving beyond standard insurance policies.

Their growing appeal stems from enhanced flexibility, cost-effectiveness, and the capacity to insure risks that were once considered uninsurable. For example, the global ART market saw significant growth, with gross written premiums for ART solutions estimated to reach over $100 billion in 2024, indicating a strong shift away from conventional coverage.

Government-backed schemes and disaster relief funds can indeed act as a significant substitute for private insurance, especially in scenarios involving widespread catastrophic events. These programs often step in when private insurers find it economically unfeasible or too risky to offer comprehensive coverage, particularly in regions with high exposure to natural disasters.

For instance, the National Flood Insurance Program (NFIP) in the United States, while not a direct substitute in all cases, provides flood coverage where private options are limited or prohibitively expensive. In 2023, the NFIP covered approximately $1.3 trillion in insurance-in-force, demonstrating its crucial role in areas prone to flooding. Similarly, various disaster relief funds disbursed by federal and state governments following major events like hurricanes or wildfires can offset financial losses that might otherwise have been covered by insurance, thereby reducing the perceived need for certain types of private coverage.

Risk Mitigation and Loss Prevention Services

Investments in robust risk engineering and loss prevention services, like those offered by Chubb, can significantly reduce the need for extensive insurance coverage. By actively preventing or minimizing potential losses, these proactive measures diminish the overall demand for high-limit insurance policies. For instance, Chubb's commitment to resilience services aims to build stronger, more secure operations for its clients.

This focus on mitigation creates a substitute for traditional insurance, as clients may opt for enhanced safety protocols over larger coverage amounts. This strategic approach can impact the insurance market by shifting demand towards preventative solutions. In 2023, Chubb reported a substantial portion of its revenue was derived from commercial property and casualty insurance, where risk engineering plays a crucial role.

- Risk Engineering as a Substitute: Chubb's proactive risk management services directly address potential losses, offering an alternative to solely relying on insurance payouts.

- Reduced Demand for High-Limit Coverage: Successful loss prevention can lower the overall exposure for businesses, thereby decreasing their need for expensive, high-value insurance policies.

- Chubb's Service Offering: The company actively provides these mitigation services, which, while supporting its core insurance business, also present a form of substitution for clients seeking to reduce their insurance spend.

Non-Traditional Financial Products

Non-traditional financial products, such as derivatives and structured products, pose a threat by offering alternative risk management solutions. For instance, companies might use credit default swaps instead of credit insurance for specific counterparty risk exposures. In 2024, the global derivatives market continued to be substantial, with over-the-counter (OTC) derivatives outstanding reaching trillions of dollars, indicating a significant avenue for hedging financial risks outside of traditional insurance.

These instruments can be tailored to address very specific risk components, potentially fragmenting the market for comprehensive insurance policies. For example, a company facing currency fluctuation risk might opt for forward contracts or options rather than relying solely on a broad business interruption policy that might not adequately cover currency-related losses. This flexibility allows businesses to manage granular risks efficiently.

- Derivatives Market Size: The notional value of outstanding OTC derivatives globally remained in the hundreds of trillions of dollars in 2024, highlighting their significant role in financial risk management.

- Alternative Hedging: Specific financial instruments like futures, options, and swaps provide direct substitutes for certain insurance coverages, particularly in areas like commodity price risk or interest rate risk.

- Risk Component Focus: Non-traditional products often target specific risk elements, allowing businesses to build bespoke hedging strategies that may be more cost-effective than comprehensive insurance for certain exposures.

The threat of substitutes for traditional insurance is significant, driven by evolving risk management strategies and financial innovation. Companies are increasingly turning to self-insurance, captive insurance companies, and alternative risk transfer (ART) solutions. These alternatives offer greater control, cost-effectiveness, and customization for specific risk exposures.

Government programs and enhanced risk engineering also serve as substitutes, reducing the reliance on private insurance. Furthermore, sophisticated financial instruments like derivatives provide tailored hedging capabilities, fragmenting the market for comprehensive insurance policies. The sheer scale of these alternatives underscores their impact on the insurance landscape.

| Substitute Category | Description | Estimated Market Impact/Size (2024 Data) |

|---|---|---|

| Self-Insurance/Captives | Companies retaining risk or forming dedicated insurance entities. | Global captive insurance premiums potentially reaching hundreds of billions USD. |

| Alternative Risk Transfer (ART) | Bespoke solutions like structured programs and parametric insurance. | Global ART market gross written premiums estimated over $100 billion USD. |

| Government Schemes/Relief | Public programs covering risks deemed uninsurable by private markets. | NFIP in the US insuring approximately $1.3 trillion USD in 2023. |

| Risk Engineering/Loss Prevention | Proactive measures reducing the need for extensive insurance coverage. | Significant portion of Chubb's revenue derived from P&C where risk engineering is key. |

| Derivatives/Structured Products | Financial instruments for specific risk hedging. | Over-the-counter (OTC) derivatives outstanding in the hundreds of trillions USD. |

Entrants Threaten

Insurtech startups represent a significant threat of new entrants for established insurers like Chubb. These agile companies are leveraging technology to bypass traditional distribution channels and offer specialized, often cheaper, insurance products directly to consumers. For instance, by mid-2024, Insurtech funding continued to flow, with significant investments in platforms focused on embedded insurance and parametric solutions, allowing them to quickly gain traction in specific market segments.

The insurance sector is heavily regulated, demanding significant upfront capital for licensing and operational solvency. This creates a formidable hurdle for aspiring competitors. For instance, in 2024, a new property and casualty insurer might need tens of millions of dollars in capital reserves to meet state regulatory requirements alone.

Chubb benefits immensely from its robust capital position and deep experience in navigating complex regulatory landscapes. This established compliance framework and substantial financial backing make it difficult for new entrants to match Chubb's operational stability and market credibility, thereby reducing the threat.

Building a strong brand reputation and customer trust in the insurance sector is a lengthy and resource-intensive endeavor. Chubb, a company with decades of operational history and a significant global footprint, already possesses a well-established level of trust and recognition among consumers. This makes it a formidable challenge for new companies entering the market to compete effectively, especially if they are trying to do so solely on the strength of their brand alone.

Distribution Network and Relationships

The threat of new entrants into the insurance market, particularly for a company like Chubb, is significantly mitigated by its established distribution network and deep-seated relationships. Building a comparable network of independent agents, brokers, and direct sales channels is a monumental task for any newcomer.

New entrants face the daunting challenge of replicating Chubb's extensive reach, which has been cultivated over decades. This requires substantial investment in time and capital to establish trust and secure access to a broad client base. For instance, as of 2024, the insurance distribution landscape continues to be dominated by established players with strong broker relationships, making it difficult for new entities to gain traction without significant upfront investment in building similar channels.

- Established Distribution Channels: Chubb leverages a vast network of independent agents and brokers, a critical asset for market penetration.

- High Entry Costs: Replicating this network requires substantial financial resources and time, creating a significant barrier.

- Customer Loyalty and Trust: Long-standing relationships with intermediaries and clients foster loyalty, making it hard for new entrants to attract business.

- Regulatory Hurdles: Navigating complex insurance regulations in various jurisdictions further adds to the difficulty for new market participants.

Data and Underwriting Expertise

New entrants face a substantial barrier in replicating the extensive historical data and advanced underwriting expertise that established insurers like Chubb have cultivated over decades. This proprietary data allows for more precise risk assessment and the development of highly competitive pricing strategies, making it difficult for newcomers to match. For instance, in 2024, the insurance industry continued to rely heavily on actuarial data analytics, with companies investing billions in AI and machine learning to refine underwriting processes.

The ability to accurately price risk is paramount in the insurance sector. Chubb's deep understanding of loss trends and customer behavior, built from years of underwriting diverse portfolios, provides a significant competitive advantage. New entrants often struggle to gather and analyze comparable datasets, leading to potential underpricing or overpricing of risks, which can erode profitability.

Consider the following points regarding the barrier of data and underwriting expertise:

- Data Accumulation: New entrants must invest heavily and wait years to build a comparable historical data repository.

- Underwriting Sophistication: Developing and validating advanced underwriting models requires specialized talent and significant R&D expenditure.

- Pricing Accuracy: Established players can offer more competitive premiums due to their superior understanding of risk, a feat difficult for new entrants to immediately replicate.

- Regulatory Compliance: Navigating complex regulatory requirements for data handling and model validation adds another layer of difficulty for aspiring insurers.

The threat of new entrants for Chubb is moderate, primarily due to high capital requirements and regulatory complexities. For example, in 2024, establishing a new insurance carrier often necessitates hundreds of millions of dollars in initial capital to meet solvency and regulatory standards across multiple jurisdictions. This financial barrier, coupled with the time and expertise needed to navigate licensing and compliance, deters many potential competitors.

While Insurtech startups offer innovative models, they still face significant hurdles in scaling and achieving profitability comparable to incumbents like Chubb. By mid-2024, many Insurtechs focused on niche markets or specific product lines, demonstrating that broad market penetration remains challenging without substantial infrastructure and established trust. The difficulty in replicating Chubb's extensive broker relationships and brand recognition further limits the immediate impact of new entrants.

| Barrier Type | Description | Impact on New Entrants | Chubb's Advantage |

|---|---|---|---|

| Capital Requirements | High initial capital needed for licensing and solvency. | Significant financial barrier. | Strong financial backing and established capital reserves. |

| Regulatory Hurdles | Complex licensing and compliance in multiple jurisdictions. | Time-consuming and costly to navigate. | Extensive experience and dedicated compliance teams. |

| Distribution Channels | Established networks of agents and brokers. | Difficult and expensive to replicate. | Decades of cultivated relationships and broad market access. |

| Brand Reputation & Trust | Long-standing customer and intermediary loyalty. | Challenging for new entrants to build quickly. | Well-established global brand and proven track record. |

| Data & Underwriting Expertise | Accumulated historical data and sophisticated models. | New entrants lack comparable risk assessment capabilities. | Advanced analytics for precise risk pricing and product development. |

Porter's Five Forces Analysis Data Sources

Our Chubb Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Chubb's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports and data from leading financial information providers to ensure a comprehensive understanding of the competitive landscape.