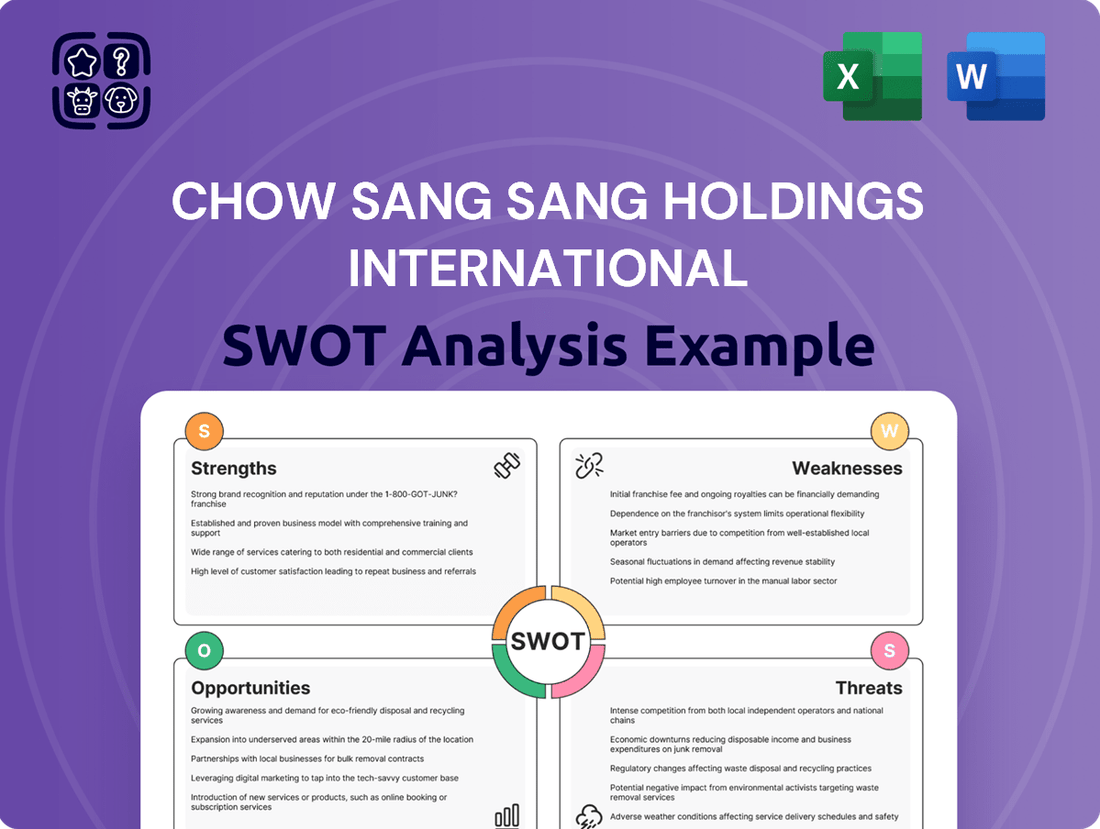

Chow Sang Sang Holdings International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chow Sang Sang Holdings International Bundle

Chow Sang Sang Holdings International boasts a strong brand reputation and a vast retail network, key strengths in the competitive jewelry market. However, the company faces significant threats from economic downturns and evolving consumer preferences, while its reliance on traditional product lines could limit future growth. Understanding these dynamics is crucial for any serious investor or strategist.

Want the full story behind Chow Sang Sang's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Chow Sang Sang Holdings International boasts a diversified business portfolio, a significant strength. Their operations span both the lucrative jewellery manufacturing and retail sectors, alongside a robust financial services division. This dual approach, combining luxury goods with financial brokerage, helps cushion against market downturns in any single area.

For instance, in fiscal year 2023, their jewellery segment continued to be a primary revenue driver, while their financial services, including securities and futures brokerage, provided a complementary income stream. This strategic diversification mitigates the inherent risks of being solely dependent on the cyclical luxury market, ensuring a more resilient financial foundation and wider market engagement.

Chow Sang Sang boasts an impressive retail footprint, operating over 1,000 stores across key Asian markets including Mainland China, Hong Kong, Taiwan, and Macau. This extensive network, a significant strength, translates directly into high brand recognition and accessibility for a vast customer base. For instance, as of their latest reporting, their physical presence is a cornerstone of their market strategy, facilitating direct customer engagement and impulse purchases.

This widespread physical presence is a critical advantage in the jewelry sector, enabling Chow Sang Sang to capture significant market share. The brand's long-standing heritage, spanning more than 90 years, further solidifies its reputation for quality and intricate craftsmanship, fostering customer trust and loyalty. This historical depth, combined with their expansive reach, creates a powerful competitive moat.

Chow Sang Sang Holdings International's established manufacturing capabilities are a significant strength, allowing for direct oversight of the entire jewelry production process, from initial design to final product. This vertical integration is crucial for ensuring consistent quality and managing costs effectively. For instance, in 2023, the company's manufacturing segment played a key role in its robust performance, contributing to its ability to offer competitive pricing while maintaining high standards.

This control over the supply chain enables Chow Sang Sang to be agile, quickly adapting to evolving market demands and consumer preferences. The company can efficiently introduce new designs and collections, a vital factor in the fast-paced jewelry industry. Their ability to innovate in manufacturing also supports the creation of unique, high-quality pieces that differentiate the brand and appeal to a discerning customer base.

Financial Services Expertise

Chow Sang Sang Holdings International has strategically expanded into financial services, encompassing securities and futures brokerage, alongside investment advisory. This diversification showcases their ability to capitalize on financial market opportunities. For instance, in 2023, the company reported revenue from financial services, highlighting its contribution to the group’s overall financial performance. The robust financial ecosystem in Hong Kong provides a fertile ground for this segment to thrive.

This venture into financial services allows Chow Sang Sang to tap into a different client demographic and generate additional revenue streams. Their expertise in this area offers specialized services that complement their core retail operations. The company's commitment to developing these capabilities strengthens its position within the broader financial landscape.

- Diversification into Financial Services: Including securities, futures brokerage, and investment advisory.

- Leveraging Financial Market Opportunities: Demonstrating strategic capability in a key sector.

- Contribution to Profitability: Financial services segment adds to the group's overall financial strength.

- Hong Kong's Financial Market Support: Operating within a well-established and dynamic financial hub.

Adaptability to Market Trends

Chow Sang Sang Holdings International demonstrates a notable strength in its adaptability to shifting market trends and consumer desires. This includes a strategic pivot towards expanding its lab-grown diamond offerings, a growing segment in the jewelry market. The company also actively pursues cost efficiencies, exemplified by its ongoing store consolidation efforts, which streamlines operations and enhances profitability.

This agility extends to embracing new sales channels and product concepts. Initiatives like strengthening its e-commerce presence and exploring innovative design directions, such as affordable luxury and gender-fluid collections, showcase a forward-thinking approach. For instance, in its 2023 annual report, the company highlighted increased investment in digital transformation and product innovation to cater to younger demographics. This proactive stance is vital for maintaining a competitive edge in the fast-paced jewelry sector.

- Expansion into Lab-Grown Diamonds: Capitalizing on growing consumer interest and demand for ethically sourced and more affordable diamond alternatives.

- E-commerce Growth Initiatives: Investing in digital platforms to reach a wider customer base and improve online sales performance.

- Product Diversification: Exploring new design territories like affordable luxury and gender-fluid jewelry to broaden market appeal.

- Cost Optimization Strategies: Implementing measures such as store consolidation to improve operational efficiency and financial resilience.

Chow Sang Sang Holdings International's diversified business model, spanning jewelry manufacturing, retail, and financial services, significantly enhances its resilience. This broad operational base, as seen in fiscal year 2023 where jewelry remained a primary revenue driver while financial services provided complementary income, mitigates risks associated with single-market dependence. Their extensive retail network, exceeding 1,000 stores across key Asian markets, ensures broad customer accessibility and strong brand recognition.

The company's vertical integration in manufacturing allows for stringent quality control and cost management, crucial for competitiveness. Furthermore, their strategic expansion into financial services, including securities and futures brokerage, leverages the robust financial ecosystem of Hong Kong, creating additional revenue streams and client engagement opportunities.

Chow Sang Sang's agility in adapting to market trends, such as expanding lab-grown diamond offerings and strengthening e-commerce capabilities, positions them well for future growth. For instance, investments in digital transformation and product innovation, highlighted in their 2023 reports, aim to capture younger demographics and evolving consumer preferences.

| Segment | FY2023 Contribution (Illustrative) | Key Strength |

|---|---|---|

| Jewelry Manufacturing & Retail | Primary Revenue Driver | Brand heritage, extensive retail footprint, quality craftsmanship |

| Financial Services | Complementary Income Stream | Diversification, leveraging financial hub, new revenue streams |

| E-commerce & Digital | Growing Investment Area | Adaptability, reaching new demographics, enhanced customer engagement |

What is included in the product

Analyzes Chow Sang Sang Holdings International’s competitive position through key internal and external factors, detailing its brand strength and market reach against industry challenges.

Offers a clear, actionable framework to identify and leverage Chow Sang Sang's strengths while mitigating weaknesses, ultimately guiding strategic growth in the competitive jewelry market.

Weaknesses

Chow Sang Sang Holdings International, as a luxury goods retailer, faces significant vulnerability to economic downturns. This sensitivity is particularly pronounced in its core markets of Mainland China, Hong Kong, and Macau, where consumer spending on discretionary items like jewelry can contract sharply during periods of economic uncertainty.

The company's financial performance is directly tied to the health of these economies. For instance, reports from late 2023 and early 2024 indicated a slowdown in consumer demand in Mainland China, a key revenue driver for Chow Sang Sang, leading to reports of declining sales and profitability for the group.

During economic slowdowns, consumers tend to reduce their spending on non-essential luxury items. This directly impacts the demand for high-value jewelry, which Chow Sang Sang specializes in, leading to a potential decrease in sales volumes and average transaction values.

The reliance on these specific Asian markets means that any regional economic contraction can have a disproportionate effect on the company's overall financial health. This concentration risk amplifies the impact of any widespread economic headwinds.

Chow Sang Sang Holdings International reported a challenging 2024, with its core jewellery business facing significant headwinds. The company's financial results revealed a notable 15% decline in overall revenue, accompanied by a steeper 20% drop in profit. This downturn was largely driven by a considerable slump in same-store sales across key markets, including Mainland China and Hong Kong/Macau.

The decline was particularly pronounced within the gem-set jewellery segment, a direct consequence of weakening consumer demand for diamonds. This systemic issue suggests that the challenges faced by Chow Sang Sang extend beyond temporary market fluctuations, indicating a need for strategic adjustments to address evolving consumer preferences and market dynamics in its primary product categories.

Chow Sang Sang's significant reliance on gold jewelry, a key component of its product mix, becomes a vulnerability when gold prices surge to record highs. For instance, in early 2024, gold prices approached $2,400 per ounce, a level that previously seemed unattainable. This escalation directly impacts consumer purchasing power, making gold jewelry less accessible and potentially leading customers to delay or forgo purchases altogether. The company must navigate this delicate balance where higher commodity prices, while potentially increasing the value of its inventory, can simultaneously suppress sales volume and put pressure on profit margins if not managed strategically.

Store Network Consolidation and Closures

Chow Sang Sang Holdings International has been actively consolidating its physical store network in response to market challenges. In 2024, the company reported a net closure of 74 stores, bringing its total to 958 from 1,032. This strategic move, described as 'prudent physical store network consolidation,' aims to optimize operational costs and streamline the business. However, a significant reduction in store count could be interpreted as a cautious signal regarding the immediate prospects for market recovery. Furthermore, the diminished physical presence might impact brand visibility and accessibility for consumers in certain regions.

The impact of these closures extends beyond just cost savings.

- Reduced Market Presence: The net closure of 74 stores in 2024 directly shrinks Chow Sang Sang's footprint in the physical retail landscape.

- Perception of Market Outlook: A large-scale consolidation can sometimes be perceived by investors and consumers as a sign of pessimism about the company's near-term sales environment.

- Customer Accessibility: For customers who prefer in-person shopping, the closure of stores, especially in key areas, could limit their ability to interact with the brand and its products.

- Competitive Disadvantage: If competitors maintain or expand their store networks, Chow Sang Sang's consolidation could potentially lead to a loss of market share due to reduced accessibility.

Competition in Dual Business Segments

Chow Sang Sang operates in highly competitive arenas, facing formidable rivals in both its primary jewellery retail business and its financial services segment. In the jewellery market, established giants like Chow Tai Fook and Luk Fook exert significant pressure, demanding constant innovation and customer engagement.

The financial services sector is equally crowded, with a multitude of established brokerage houses and advisory firms vying for market share. This dual competitive landscape necessitates substantial ongoing investment.

- Jewellery Retail: Chow Sang Sang competes directly with Chow Tai Fook and Luk Fook, major players with extensive store networks and brand recognition.

- Financial Services: The company faces competition from numerous established banks, investment firms, and independent financial advisors.

- Market Share Pressure: Intense competition in both segments requires significant marketing spend and continuous efforts in product development and service enhancement to retain and grow market share.

- Investment Requirements: Maintaining a competitive edge demands considerable financial resources for advertising, promotions, and upgrading service offerings in both business lines.

Chow Sang Sang's significant reliance on gold jewelry, a key component of its product mix, becomes a vulnerability when gold prices surge to record highs. For instance, in early 2024, gold prices approached $2,400 per ounce, a level that previously seemed unattainable. This escalation directly impacts consumer purchasing power, making gold jewelry less accessible and potentially leading customers to delay or forgo purchases altogether.

What You See Is What You Get

Chow Sang Sang Holdings International SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Chow Sang Sang Holdings International's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive document will equip you with strategic insights into the company's competitive landscape. Understand their brand recognition and retail network (Strengths), while also examining potential market saturation and evolving consumer preferences (Weaknesses & Opportunities). This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Opportunities

The luxury goods market across Asia is poised for substantial expansion, fueled by increasing disposable incomes and a growing middle class, particularly in key markets like China and India. This trend offers Chow Sang Sang a prime opportunity to tap into a burgeoning affluent consumer base.

For instance, in 2024, the Asia-Pacific luxury market was valued at over $300 billion and is expected to see a compound annual growth rate of 7-8% through 2028, according to industry reports. This robust growth trajectory directly benefits jewelry retailers like Chow Sang Sang, as luxury jewelry often represents a significant portion of discretionary spending within this segment.

Chow Sang Sang can leverage this by strategically expanding its presence and product offerings in these high-growth regions. The increasing brand consciousness among Asian consumers means that established and reputable brands, such as Chow Sang Sang, are well-positioned to capitalize on this demand for premium goods.

The jewellery sector is seeing a significant move towards online shopping. Many businesses are boosting their digital presence, and Chow Sang Sang is no exception. Strengthening these online sales avenues is key to tapping into a younger customer base.

Leveraging social media platforms and live-streaming events can significantly broaden Chow Sang Sang's reach. This digital push not only connects with a younger demographic but also diversifies sales away from a sole reliance on brick-and-mortar stores. In 2023, Chow Sang Sang reported a 29% increase in online sales, highlighting the growing importance of this channel.

Chow Sang Sang Holdings International can capitalize on evolving consumer tastes by expanding into new product categories. With a noted decline in traditional diamond demand and shifting preferences, the company has a clear opportunity to explore areas like affordable luxury, gender-fluid designs, and curated themed collections. This strategic pivot can attract a broader customer base and inject fresh appeal into their product lines, potentially offsetting slower growth in established segments. For instance, a focus on accessible high-quality jewelry or collections inspired by current cultural trends could resonate strongly with younger demographics, a key growth area for the luxury market.

Increased Tourism in Hong Kong and Macau

The resurgence of tourism, especially from Mainland China, is a significant tailwind for the jewelry industry in Hong Kong and Macau. Chow Sang Sang, with its established retail footprint in these prime tourist destinations, is well-positioned to capitalize on this trend. An uptick in visitor numbers directly translates to higher consumer spending on luxury items like fine jewelry. For instance, Hong Kong’s retail sales saw a notable year-on-year increase of 11.7% in the first quarter of 2024, with tourism playing a key role.

This increased tourism offers a substantial opportunity for Chow Sang Sang to drive sales and market share. The company's strong brand recognition among Chinese consumers, coupled with its strategic store locations in high-traffic tourist areas, provides a distinct advantage. The recovery of international travel, with visitor arrivals in Macau reaching 33 million in 2024, up 82% from 2023, further bolsters this positive outlook.

- Resumption of Tourism: Increased visitor numbers from Mainland China are a primary driver for luxury goods sales.

- Geographic Advantage: Chow Sang Sang's presence in key tourist hubs like Hong Kong and Macau directly benefits from this trend.

- Consumer Spending: A rise in tourist footfall is expected to correlate with higher discretionary spending on jewelry.

- Market Recovery: Data suggests a strong rebound in visitor arrivals, indicating a favorable environment for retail.

Integration of Technology in Operations (AI, Supply Chain)

Chow Sang Sang can significantly enhance its operational efficiency and market responsiveness by integrating advanced technologies. Leveraging AI and machine learning for predictive analytics and demand forecasting allows for more accurate inventory management and production planning. This technological adoption is crucial in the dynamic jewelry market, where trends and consumer preferences shift rapidly. For instance, in 2024, companies across various retail sectors saw improved inventory turnover and reduced waste by implementing AI-driven forecasting tools, with some reporting a 10-15% reduction in stockouts.

Implementing integrated solutions, such as an o9 Control Tower, can provide Chow Sang Sang with enhanced transparency across its entire supply chain. This real-time visibility empowers better decision-making, enabling quicker adjustments to production and distribution based on actual market demand. Such capabilities are vital for maintaining a competitive edge, especially as global supply chain disruptions remain a consideration. By 2025, it's projected that advanced supply chain visibility platforms will be a standard for leading retailers, contributing to an average of a 5% increase in on-time delivery rates.

- AI-powered demand forecasting to optimize inventory levels and minimize stockouts.

- **Supply chain visibility platforms** for real-time tracking and proactive management of goods.

- **Automation in manufacturing and logistics** to increase throughput and reduce operational costs.

The luxury goods market in Asia, particularly in China and India, is expanding rapidly due to rising incomes, presenting Chow Sang Sang with a significant opportunity to reach a growing affluent consumer base.

The company can also tap into the increasing demand for online jewelry purchases by enhancing its digital presence and leveraging social media, as evidenced by its 29% online sales increase in 2023.

Chow Sang Sang has the chance to diversify its offerings by exploring categories like affordable luxury and gender-fluid designs to attract a broader, younger demographic, aligning with evolving consumer tastes.

The resurgence of tourism, especially from Mainland China, offers a direct benefit to Chow Sang Sang's stores in Hong Kong and Macau, with Hong Kong's retail sales already showing an 11.7% increase in Q1 2024, partly due to tourism.

Threats

Economic slowdowns in crucial markets such as Mainland China, Hong Kong, and Macau are a major concern. This, combined with declining consumer confidence, directly impacts discretionary spending on premium goods like jewelry. For Chow Sang Sang, this translates into a significant threat, as seen in their recent financial performance.

For instance, Chow Sang Sang Holdings International reported a 19% year-on-year decrease in revenue for the first half of 2023, with profit attributable to shareholders falling by a substantial 40%. This trend is expected to continue into 2024 if economic conditions do not improve, as consumers become more cautious with their spending on non-essential items.

Chow Sang Sang Holdings International operates in a fiercely competitive jewelry sector. Major domestic rivals such as Chow Tai Fook and Luk Fook consistently vie for market dominance, employing aggressive pricing and extensive marketing campaigns. This environment necessitates substantial investment in product development and brand promotion to maintain visibility and appeal.

The presence of established international luxury brands further intensifies this competition. These global players often leverage their strong brand equity and premium positioning, creating additional pressure on Chow Sang Sang to differentiate its offerings and justify its pricing strategies. For instance, in 2023, the global luxury goods market, which includes high-end jewelry, saw significant growth, highlighting the strong appeal and competitive nature of this segment.

Chow Sang Sang's profitability is directly exposed to the unpredictable swings in precious metal and gemstone prices. Significant volatility in gold and diamond markets, for instance, directly influences the company's cost of goods sold and consequently, its profit margins. Record high gold prices in 2024 have already presented challenges, and the continuation of such elevated or erratic pricing trends poses a substantial threat to sustained profitability and can dampen consumer purchasing appetite.

Changing Consumer Preferences and Demographics

A significant threat for Chow Sang Sang Holdings International stems from shifting consumer preferences and evolving demographics. A notable example is the potential decline in demand for traditional diamond jewelry, especially if consumers increasingly favor more accessible luxury goods or embrace entirely different forms of adornment. The younger generation, in particular, is driving this change, demanding more personalized, ethically sourced, and digitally integrated shopping experiences. If Chow Sang Sang fails to innovate its product lines and marketing approaches to resonate with these changing tastes, it risks losing market share. For instance, Euromonitor International data from 2023 indicated a growing consumer interest in lab-grown diamonds, a segment where rapid adaptation is crucial.

The company must actively monitor and respond to these evolving tastes, which necessitates continuous product diversification and innovative marketing strategies. Failure to do so could result in a disconnect with key consumer segments. For example, a 2024 report by Bain & Company highlighted that Gen Z consumers often prioritize experiences and digital engagement over traditional luxury purchases, a trend that directly impacts the jewelry sector.

- Declining Demand for Traditional Diamond Jewelry: A potential shift away from classic diamond pieces towards alternative gemstones or lab-grown diamonds.

- Preference for Affordable Luxury: Consumers may opt for more budget-friendly luxury brands or accessible luxury items, impacting high-end jewelry sales.

- Digital-First Consumer Experiences: Younger demographics expect seamless online purchasing, virtual try-ons, and personalized digital interactions.

- Evolving Tastes of Younger Buyers: The need for continuous product innovation and marketing that speaks to contemporary styles and values.

Geopolitical and Regulatory Risks

Geopolitical tensions, especially concerning trade relations and regional stability in Asia, pose a significant threat to Chow Sang Sang Holdings International. Changes in regulatory landscapes across key markets like Mainland China, Hong Kong, and Macau can directly impact operational costs, market access, and consumer purchasing power. For instance, evolving import/export regulations or shifts in consumer protection laws could disrupt supply chains and affect profitability.

The company's financial services division is not immune to these broader geopolitical shifts, facing inherent risks from market volatility and increased regulatory scrutiny. As of late 2024, global economic uncertainty, partly fueled by geopolitical events, has led to fluctuating consumer confidence, which directly influences discretionary spending on luxury goods like jewelry.

- Geopolitical Instability: Heightened tensions in East Asia could disrupt supply chains and negatively impact tourism, a key driver for sales in Hong Kong and Macau.

- Regulatory Changes in China: Stricter regulations on e-commerce or luxury goods in Mainland China could affect Chow Sang Sang's significant online and offline sales channels there.

- Financial Services Volatility: The financial services arm faces risks from global interest rate fluctuations and potential credit market tightening, impacting investment returns and lending activities.

- Consumer Sentiment Shifts: Economic slowdowns or political uncertainty can rapidly dampen consumer confidence, leading to reduced spending on non-essential items.

Intense competition from domestic players like Chow Tai Fook and international luxury brands presents a significant hurdle for Chow Sang Sang. These competitors often employ aggressive pricing and marketing, requiring substantial investment from Chow Sang Sang to maintain its market position and brand appeal. For example, the global luxury goods market saw robust growth in 2023, underscoring the competitive intensity in this premium segment.

Fluctuations in the prices of gold and diamonds directly impact Chow Sang Sang's cost of goods sold and profit margins. The elevated gold prices observed in 2024, for instance, create a substantial threat to sustained profitability and can suppress consumer demand for jewelry. This price volatility necessitates careful inventory management and strategic sourcing.

Shifting consumer preferences, particularly among younger demographics, pose a threat if Chow Sang Sang fails to adapt. Trends like a growing interest in lab-grown diamonds, as noted by Euromonitor International in 2023, and a preference for digital experiences require continuous product innovation and updated marketing strategies to resonate with evolving tastes. A Bain & Company report in 2024 indicated that Gen Z consumers often prioritize experiences and digital engagement, impacting traditional luxury purchases.

Geopolitical tensions and potential regulatory changes in key Asian markets like Mainland China and Hong Kong are significant threats. Evolving trade policies, import/export regulations, or shifts in consumer protection laws can disrupt supply chains and affect profitability. The financial services division also faces risks from market volatility and regulatory scrutiny, with global economic uncertainty as of late 2024 impacting consumer confidence.

SWOT Analysis Data Sources

This Chow Sang Sang Holdings International SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry commentary to provide a robust and insightful assessment.