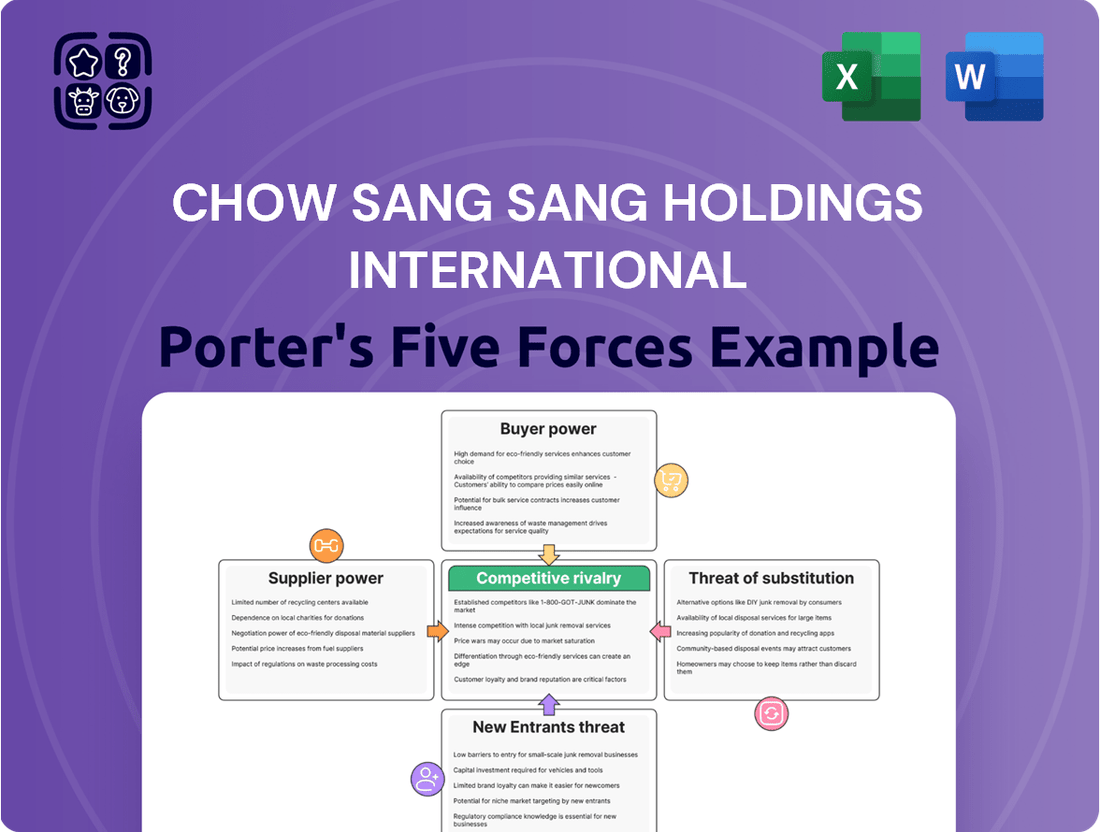

Chow Sang Sang Holdings International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chow Sang Sang Holdings International Bundle

Chow Sang Sang Holdings International navigates a complex landscape shaped by intense rivalry and formidable buyer power in the jewelry sector. The threat of new entrants is moderate, while supplier bargaining power is relatively low due to the industry's fragmented supply chain. Substitutes, however, pose a significant challenge as consumers increasingly opt for alternative luxury goods or experiences.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chow Sang Sang Holdings International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of raw material suppliers significantly influences Chow Sang Sang's bargaining power. For a company reliant on precious metals like gold and platinum, and natural diamonds, the market structure is crucial. If a few dominant mining companies or distributors control the supply of these essential materials, they inherently possess greater leverage.

In 2024, the global diamond supply chain, for instance, remains a complex network. While there isn't a single monopoly, De Beers and Alrosa are historically significant players, controlling substantial portions of rough diamond production. This concentration means these entities can exert considerable influence on pricing and availability, especially given the intricate and sometimes volatile nature of global mining operations and the impact of geopolitical events on supply routes.

The bargaining power of suppliers for Chow Sang Sang Holdings International is significantly influenced by the uniqueness and differentiation of the materials they procure. While gold is largely a commodity with many suppliers, the sourcing of specialized diamond cuts or ethically certified gemstones can concentrate power in the hands of a few. For instance, the growing consumer preference for traceable and ethically sourced diamonds means suppliers who can guarantee provenance gain considerable leverage. In 2024, the global polished diamond market saw continued emphasis on ethical sourcing, with a significant portion of retailers actively seeking diamonds with verifiable origins, potentially increasing supplier power in this segment.

Switching costs for Chow Sang Sang Holdings International are a significant factor in the bargaining power of its suppliers. If the company needs to change diamond or precious metal suppliers, the costs associated with re-certifying new sources, ensuring consistent quality, and potentially reconfiguring supply chain logistics can be substantial. For instance, in 2023, the global diamond industry saw price fluctuations, making supplier stability and established relationships even more critical for maintaining product quality and brand reputation, which inherently increases the leverage of dependable suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a consideration for Chow Sang Sang, though generally low for its primary jewelry manufacturing and retail operations. This would involve suppliers moving into the jewelry production or sales themselves, thereby increasing their own bargaining power.

While raw material miners are unlikely to integrate forward into retail, major diamond or gold distributors could theoretically establish their own retail outlets. This would directly compete with Chow Sang Sang and potentially allow these distributors to capture more of the value chain.

For instance, a large, vertically integrated diamond supplier with significant capital and brand recognition could decide to open its own branded jewelry stores. This would shift the power dynamic, as they would control both the supply of the raw materials and the point of sale.

However, for Chow Sang Sang, a well-established jewelry brand with strong manufacturing capabilities and extensive retail networks, this threat is currently considered minimal. The complexities of jewelry design, manufacturing, and brand building present significant barriers to entry for many raw material suppliers looking to move into the retail space.

Importance of Chow Sang Sang to Suppliers

Chow Sang Sang Holdings International, as a prominent jewelry retailer with a significant presence in Hong Kong and mainland China, likely commands considerable attention from its suppliers. Its substantial purchasing volume means it represents a key customer for many in the industry, especially those specializing in precious metals, gemstones, and finished jewelry components.

The company's extensive retail network and strong brand recognition in one of the world's largest consumer markets translate into consistent demand, making its orders vital for supplier revenue streams. For instance, in 2023, Chow Sang Sang reported revenue of HK$17.9 billion, indicating the scale of its operations and, by extension, its purchasing power.

However, the bargaining power Chow Sang Sang wields against its suppliers is also influenced by the latter's own market position and diversification. If suppliers serve a broad base of international clients or are themselves large, diversified entities, Chow Sang Sang’s individual importance might be somewhat lessened. Nevertheless, for suppliers focused on the East Asian jewelry market, Chow Sang Sang remains a highly significant and influential partner.

- Significant Customer Base: Chow Sang Sang's extensive operations in Hong Kong and China make it a major client for jewelry component and material suppliers.

- Revenue Contribution: The company's substantial annual revenue, reaching HK$17.9 billion in 2023, underscores the importance of its business to its supply chain partners.

- Market Influence: As a leading retailer, Chow Sang Sang's purchasing decisions can significantly impact suppliers, particularly those catering to the East Asian market.

- Supplier Diversification Factor: The degree to which suppliers are diversified across other clients and markets will influence the extent of Chow Sang Sang's leverage.

Chow Sang Sang's purchasing volume, exemplified by its HK$17.9 billion revenue in 2023, makes it a crucial client for suppliers of precious metals and gemstones. This scale grants the company considerable leverage, especially with suppliers focused on the East Asian market. However, the overall bargaining power is moderated by supplier diversification and their own market standing.

| Factor | Impact on Chow Sang Sang's Bargaining Power | 2023/2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Significant players like De Beers and Alrosa influence diamond pricing and availability. |

| Uniqueness/Differentiation | Unique materials or ethical sourcing increases supplier power. | Growing demand for traceable diamonds in 2024 empowers compliant suppliers. |

| Switching Costs | High switching costs empower existing suppliers. | Ensuring quality and brand reputation makes supplier stability critical, as seen in 2023 price fluctuations. |

| Forward Integration Threat | Low threat for Chow Sang Sang due to high barriers for suppliers entering retail. | While possible for large distributors, it remains a minimal risk for Chow Sang Sang's established brand. |

| Chow Sang Sang's Size/Importance | Significant customer status grants leverage. | HK$17.9 billion 2023 revenue highlights Chow Sang Sang's importance to its supply chain. |

What is included in the product

This Porter's Five Forces analysis unpacks the competitive landscape for Chow Sang Sang Holdings International, detailing buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry within the jewelry market.

Instantly understand competitive pressures on Chow Sang Sang, from new entrants to supplier power, to proactively mitigate risks and identify strategic opportunities.

Customers Bargaining Power

Chow Sang Sang's customers exhibit significant price sensitivity, particularly in a market where discretionary spending on luxury items like jewelry is tightening. Recent economic headwinds have amplified this, with consumer spending on jewelry declining in key markets such as Mainland China and Hong Kong. This heightened sensitivity means that even modest price increases can lead to a noticeable drop in demand.

The growing popularity and more accessible price points of lab-grown diamonds are also exerting considerable pressure on the pricing of natural diamonds, a core offering for many jewelers. For instance, reports from early 2024 show that lab-grown diamonds can be priced 50-80% lower than natural diamonds of comparable quality, forcing established brands to re-evaluate their pricing strategies to remain competitive and appeal to budget-conscious consumers.

The availability of substitutes significantly influences customer bargaining power in the jewelry sector. Chow Sang Sang Holdings International operates in a market where customers have many choices beyond traditional gold and diamond pieces. For instance, the growing popularity of the second-hand jewelry market, particularly in regions like Hong Kong, offers a readily accessible and often more affordable alternative to new purchases, directly impacting customer leverage.

Furthermore, the increasing acceptance and sophistication of lab-grown diamonds present another potent substitute. These diamonds, often priced at a fraction of mined counterparts, provide consumers with a more budget-friendly option, thereby intensifying competition and empowering customers. In 2024, reports indicated a substantial year-on-year growth in the lab-grown diamond market, further solidifying their position as a viable alternative for many shoppers.

Customers today have unprecedented access to information, significantly boosting their bargaining power. For Chow Sang Sang Holdings International, this means consumers can easily compare prices, evaluate product quality, and scrutinize ethical sourcing practices across various jewelry retailers. This heightened awareness, fueled by online platforms and social media, allows customers to make more informed purchasing decisions.

The rise of comparison websites and customer review platforms means that transparency is no longer optional but expected. Consumers in 2024 are actively seeking out details about a product's origin and the ethical standards involved in its production. This demand for traceability directly translates into greater leverage for buyers, as companies like Chow Sang Sang must increasingly demonstrate their commitment to responsible practices to maintain customer loyalty and attract new business.

Switching Costs for Financial Services Customers

The bargaining power of customers in the financial services sector, particularly for a company like Chow Sang Sang Holdings International, is significantly influenced by switching costs. In the dynamic Hong Kong market, customers often find it straightforward and inexpensive to move between providers for basic brokerage or transactional banking services, especially with the proliferation of user-friendly digital platforms.

However, the landscape shifts for more integrated or specialized financial offerings. For instance, switching wealth management portfolios or complex financial planning relationships can involve considerable effort and potential loss of accrued benefits or advisory continuity, thereby increasing the perceived switching costs.

- Low Switching Costs for Basic Services: In 2024, the accessibility of online brokerage accounts and digital payment solutions in Hong Kong means customers can open new accounts and transfer assets for simple transactions with minimal friction.

- Higher Switching Costs for Complex Services: For wealth management and long-term financial planning, established relationships with advisors and the complexity of consolidating investment accounts can create higher barriers to switching.

- Impact of Digitalization: While digitalization generally lowers switching costs, the integration of multiple financial products with a single provider can also increase customer stickiness.

Customer Concentration and Purchase Volume

Chow Sang Sang Holdings International, operating primarily in the jewelry retail sector, benefits from a generally fragmented customer base. This broad consumer reach means that no single customer or small group of customers typically holds significant leverage over the company's pricing or terms. The average purchase volume per customer in the jewelry industry is also relatively modest, further diminishing individual customer bargaining power.

In contrast, consider a different industry like financial services. While many clients are individuals, large institutional investors or very high-net-worth individuals can wield considerable influence due to their substantial transaction volumes and the potential to move significant capital. For instance, in 2023, the top 10 investment firms managed over $60 trillion in assets globally, demonstrating the immense power concentrated within a few entities.

For Chow Sang Sang, this fragmentation is a key strength. Their strategy relies on reaching a wide audience rather than catering to a few dominant buyers. This allows them to maintain pricing control and brand consistency across their extensive network of stores and online platforms. The company's ability to attract a diverse clientele is paramount to mitigating the bargaining power of customers.

- Customer Fragmentation: Chow Sang Sang's jewelry business serves a vast number of individual consumers, limiting the power of any single customer.

- Average Transaction Value: The typical transaction size in jewelry retail is generally not large enough for individual customers to exert significant bargaining pressure.

- Industry Comparison: In contrast, sectors like institutional finance see high bargaining power from large clients due to their substantial transaction volumes.

- Strategic Advantage: A broad and fragmented customer base provides Chow Sang Sang with greater pricing flexibility and control.

Chow Sang Sang Holdings International faces considerable customer bargaining power due to price sensitivity and the availability of substitutes. In 2024, the market for luxury goods, including jewelry, saw a slowdown in discretionary spending, particularly in key regions like Mainland China and Hong Kong, forcing retailers to be more competitive on pricing.

The increasing accessibility and lower cost of lab-grown diamonds, which can be 50-80% cheaper than natural diamonds as of early 2024, directly challenge traditional offerings and empower consumers to seek more affordable alternatives. Additionally, the growing acceptance of the second-hand jewelry market further dilutes the bargaining power of established brands by providing readily available, lower-priced options.

Customers are also better informed than ever, with easy access to price comparisons and ethical sourcing information online, increasing their leverage. This transparency means companies must actively demonstrate value and responsible practices to retain customers, as evidenced by the growing demand for traceability in 2024.

The company benefits from a fragmented customer base, meaning no single customer holds significant power. However, the overall market dynamics, driven by price sensitivity and substitute availability, mean that customer bargaining power remains a key force for Chow Sang Sang to manage.

| Factor | Impact on Chow Sang Sang | 2024 Data/Context |

|---|---|---|

| Price Sensitivity | High | Discretionary spending on jewelry tightened; consumer spending declined in Mainland China and Hong Kong. |

| Availability of Substitutes | High | Lab-grown diamonds priced 50-80% lower than natural diamonds; second-hand jewelry market growth. |

| Customer Information Access | High | Online comparison, reviews, and ethical sourcing scrutiny empower informed purchasing decisions. |

| Switching Costs | Variable (Low for basic, High for complex) | Easy switching for basic financial services; higher costs for wealth management relationships. |

| Customer Base Fragmentation | Low Bargaining Power | Vast number of individual consumers limits individual customer leverage; average transaction value is modest. |

Preview the Actual Deliverable

Chow Sang Sang Holdings International Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Chow Sang Sang Holdings International delves into the bargaining power of buyers, highlighting how informed consumers and competitive pricing pressure influence the jewelry market. It also meticulously examines the threat of new entrants, assessing the capital requirements and brand loyalty that act as barriers to entry. Furthermore, the document details the intensity of rivalry among existing competitors, considering factors like product differentiation and market saturation within the luxury goods sector. The analysis also covers the bargaining power of suppliers, evaluating the impact of raw material costs and the availability of precious gems and metals on Chow Sang Sang's profitability. Finally, it scrutinizes the threat of substitute products, exploring how alternative gifting options and evolving consumer preferences could affect demand for traditional jewelry.

Rivalry Among Competitors

Chow Sang Sang Holdings International faces intense competition across its core businesses. In the highly fragmented jewelry sector, particularly in Hong Kong and Mainland China, it contends with major local rivals like Chow Tai Fook, alongside a significant presence of international luxury brands and an increasing number of online retailers. This diverse competitive landscape means Chow Sang Sang must constantly innovate and differentiate its offerings to maintain market share.

The financial services segment adds another layer of competitive pressure, with Chow Sang Sang operating alongside a vast array of established banks, agile brokerages, and rapidly evolving fintech companies. For instance, by the end of 2023, China's digital payment market, heavily influenced by fintech, saw transaction volumes continue to surge, indicating the dynamic and competitive nature of the financial technology space that Chow Sang Sang also navigates.

The jewelry and financial services markets present a mixed growth picture. While the global luxury jewelry market is expected to expand, Chow Sang Sang has recently encountered a downturn, with declining sales and profits, especially in key markets like Mainland China and Hong Kong. This challenging environment amplifies the competition as companies vie for a larger piece of the market.

Further illustrating this, the Hong Kong jewelry market specifically saw a dip in fine jewelry exports during 2024. Such market conditions mean that for Chow Sang Sang, maintaining or increasing its market share becomes a more intense undertaking, directly impacting its competitive standing.

Chow Sang Sang Holdings International leverages its established brand and reputation for quality to differentiate its jewelry offerings, a crucial factor in a competitive market. In 2024, the company continued to emphasize its heritage and craftsmanship, aiming to foster strong brand loyalty among its customer base.

While traditional differentiation relied on the allure of natural diamonds, the market is evolving with the increasing acceptance of lab-grown diamonds. This trend challenges Chow Sang Sang’s established value proposition, requiring a strategic response to maintain its competitive edge in product differentiation.

The financial services segment also faces similar pressures for differentiation. By offering a range of integrated financial products alongside its core jewelry business, Chow Sang Sang aims to create a unique customer ecosystem that fosters loyalty and reduces price sensitivity.

Exit Barriers for Competitors

Competitors in the jewelry and financial services sectors face significant challenges if they attempt to exit. High fixed costs, including extensive physical retail networks, substantial inventory levels, and specialized manufacturing equipment, represent a considerable sunk cost. For instance, establishing and maintaining a premium jewelry store can involve millions in upfront investment and ongoing operational expenses, making a clean exit difficult.

- High Capital Investment: The jewelry industry requires significant capital for store leases, renovations, security systems, and display fixtures, making it costly to divest.

- Specialized Assets: Manufacturing jewelry involves specialized machinery and skilled labor, which may have limited resale value outside the industry.

- Brand Reputation and Goodwill: Companies invest heavily in building brand recognition and customer loyalty; abandoning this accumulated value is a substantial loss.

- Regulatory Hurdles: In financial services, competitors may face complex regulatory procedures and penalties for exiting the market, adding to the cost and difficulty.

Furthermore, regulatory and licensing complexities, particularly in the financial services arm, can create additional hurdles for exiting firms. The need to comply with stringent regulations for winding down operations or transferring customer accounts can be time-consuming and expensive. This often compels companies to stay and compete, even in challenging market conditions, rather than incur the substantial costs and risks associated with withdrawal.

Competitive Strategies and Intensity

Competitive rivalry within the Hong Kong jewelry market is notably intense, with established players and emerging brands frequently engaging in aggressive tactics. Retailers are actively pursuing innovative product development, digital transformation, and sophisticated branding strategies to stand out amidst economic fluctuations.

These actions are driven by a desire to capture market share and adapt to evolving consumer preferences. For instance, many brands are investing heavily in online sales channels and social media engagement, recognizing the shift towards e-commerce.

- Aggressive Pricing: Competitors often use discounts and promotional offers to attract price-sensitive consumers, particularly during key shopping seasons.

- Product Innovation: The introduction of unique designs, customized pieces, and the integration of technology, such as smart jewelry, is a key differentiator.

- Digitalization: Companies are enhancing their online presence, employing virtual try-on technologies, and utilizing data analytics to personalize customer experiences.

- Strategic Branding: Building strong brand narratives and leveraging influencer marketing are crucial for creating emotional connections with customers.

Competitive rivalry for Chow Sang Sang Holdings International is fierce, particularly in the jewelry sector where it faces giants like Chow Tai Fook and international luxury brands. This intense competition is further amplified by the growing influence of online retailers and the evolving consumer preference for lab-grown diamonds, challenging traditional value propositions.

In 2024, the Hong Kong jewelry market experienced a downturn in fine jewelry exports, intensifying the battle for market share. Companies are responding with aggressive pricing, product innovation, and a strong push towards digitalization, including enhanced online channels and virtual try-on technologies, to capture and retain customers.

The financial services sector presents a similarly competitive landscape, with Chow Sang Sang navigating against established banks, nimble brokerages, and rapidly advancing fintech firms. The sheer dynamism of China's digital payment market, with its continuously surging transaction volumes, underscores the competitive pressures Chow Sang Sang faces even in its financial ventures.

The high capital investment required for physical retail networks, specialized manufacturing assets, and brand building makes exiting the jewelry and financial services markets exceedingly difficult. This barrier to exit often forces companies to remain and compete, even when market conditions are challenging.

| Key Competitive Tactics | Jewelry Market Focus | Financial Services Focus |

|---|---|---|

| Product Innovation | Unique designs, customized pieces, smart jewelry integration. | Integrated financial products, digital banking solutions. |

| Digitalization | Enhanced online sales, virtual try-on, data analytics for personalization. | Mobile banking apps, AI-driven customer service, blockchain technology. |

| Branding | Leveraging heritage, craftsmanship, influencer marketing. | Building trust, customer relationship management, value-added services. |

| Pricing | Promotional offers, discounts during peak seasons. | Competitive interest rates, fee structures, loyalty programs. |

SSubstitutes Threaten

The threat of substitutes for jewelry, particularly for Chow Sang Sang Holdings International, is significant and growing. Consumers increasingly opt for experiential luxury and personalized products over traditional material goods. For instance, in 2024, the global luxury market saw a notable shift, with experiences like high-end travel and wellness retreats capturing a larger share of discretionary spending, potentially diverting funds that might otherwise be allocated to jewelry purchases.

This trend is especially pronounced in key Asian markets where Chow Sang Sang has a strong presence. Instead of buying a gold necklace, a consumer might choose a bespoke travel package or a unique culinary experience. Data from early 2025 indicates that spending on personalized services and digital entertainment continues to rise, presenting a clear alternative to tangible luxury items.

Consumers have a wide array of investment alternatives to physical gold and diamond jewelry. For instance, in 2024, the global stock market capitalization reached approximately $105 trillion, offering significant growth potential. Bonds, another alternative, provided steady income streams, with the global bond market valued at over $130 trillion in early 2024.

Real estate also remains a strong competitor, with global real estate market size estimated to be over $300 trillion. These financial instruments can offer greater liquidity and potentially higher returns compared to holding physical precious metals, directly influencing demand for investment-grade jewelry.

The threat of do-it-yourself (DIY) and informal financial solutions is a growing concern. Individuals can increasingly manage their own investments, bypassing traditional financial institutions. This trend is fueled by the proliferation of online trading platforms and robo-advisors, offering accessible and often lower-cost alternatives.

In Hong Kong, the fintech landscape is particularly vibrant, with digital banking and investment apps gaining significant traction. For instance, by the end of 2023, the number of retail investors utilizing online brokerage services in Hong Kong saw a notable increase, reflecting a greater willingness to handle financial matters independently. This shift can reduce the demand for formal financial advisory services, potentially impacting companies like Chow Sang Sang Holdings International if they have financial service arms.

Synthetic or Lab-Grown Diamonds

The rise of synthetic or lab-grown diamonds presents a significant threat of substitutes for Chow Sang Sang Holdings International. These diamonds are chemically identical to natural diamonds but come at a considerably lower price point, making them an attractive alternative for consumers.

The increasing acceptance and availability of lab-grown diamonds are disrupting the traditional diamond market. This trend is particularly noticeable in the engagement ring sector, where consumers are increasingly opting for these more affordable yet visually similar alternatives.

By 2024, the market share of lab-grown diamonds has seen substantial growth. For instance, reports indicated that lab-grown diamonds accounted for a growing percentage of total diamond sales, with some projections suggesting they could capture a significant portion of the market within the next few years. This growing market penetration directly impacts the demand for natural diamonds, thereby increasing the threat of substitution.

- Growing Market Share: Lab-grown diamonds are capturing an increasing share of the global diamond market, especially in jewelry.

- Price Competitiveness: Their significantly lower cost compared to natural diamonds makes them a compelling substitute for budget-conscious consumers.

- Technological Advancements: Improvements in production technology are making lab-grown diamonds more accessible and higher in quality, further enhancing their appeal.

- Consumer Perception: Shifting consumer attitudes and increased awareness of lab-grown diamonds are normalizing their use as a viable alternative to mined diamonds.

Rental or Sharing Economy for Luxury Goods

The rise of rental and sharing economy models for luxury goods presents a growing threat to traditional ownership of high-end jewelry. Consumers, particularly younger demographics, are increasingly open to renting expensive items for special events rather than outright purchase, mirroring trends seen in other luxury sectors. This shift acknowledges the growing importance of access over ownership. For instance, the global luxury rental market is projected to reach USD 2.7 billion by 2026, indicating a substantial appetite for these services.

While the luxury jewelry rental segment is less mature than apparel or accessories, the broader acceptance of the second-hand luxury market, which saw significant growth in 2023 with reports indicating a 10-15% increase in resale value for certain luxury brands, signals a potential future demand for rental options. Younger consumers, like Gen Z and Millennials, are driving this trend, prioritizing experiences and sustainability. This demographic shift is a critical factor to consider as it influences future purchasing behaviors.

- Emerging Business Models: Rental platforms offer access to luxury jewelry for specific occasions, challenging the traditional purchase model.

- Consumer Behavior Shift: Younger consumers are increasingly valuing experiences and access over outright ownership of high-value items.

- Market Growth Indicators: The expanding global luxury rental market, projected to reach USD 2.7 billion by 2026, highlights a growing consumer interest.

- Second-Hand Luxury Influence: The strong performance of the second-hand luxury market, with some brands seeing 10-15% resale value increases in 2023, indicates a willingness to engage with pre-owned or shared luxury goods.

The threat of substitutes extends beyond direct jewelry alternatives to encompass a broader range of luxury goods and experiences. Consumers are increasingly allocating discretionary spending towards travel, fine dining, and digital entertainment, diverting funds from traditional luxury purchases. For instance, the global luxury market saw a notable shift in 2024, with experiential spending gaining traction.

Furthermore, financial investments such as stocks and bonds present compelling substitutes, especially for the investment-grade segment of jewelry. In early 2024, global stock market capitalization neared $105 trillion, offering substantial growth potential, while the bond market exceeded $130 trillion, providing steady income alternatives.

Lab-grown diamonds represent a significant direct substitute, offering similar aesthetics at a lower cost. By 2024, their market share had grown considerably, with projections indicating continued expansion into the broader diamond market, impacting demand for natural stones.

| Substitute Category | Key Examples | Market Data/Trends (2024/Early 2025) |

| Experiential Luxury | High-end travel, wellness retreats, unique dining | Growing share of discretionary spending; shift from material goods. |

| Financial Investments | Stocks, bonds, real estate | Global stock market ~$105 trillion; Global bond market >$130 trillion; Global real estate >$300 trillion. |

| Lab-Grown Diamonds | Created diamonds | Increasing market share and consumer acceptance; lower price point than natural diamonds. |

| Rental & Sharing Economy | Jewelry rental services | Global luxury rental market projected to reach USD 2.7 billion by 2026; growing acceptance of pre-owned luxury. |

Entrants Threaten

Establishing a presence in jewelry retail demands substantial upfront capital for prime store locations, sophisticated displays, and significant inventory, often running into millions for a chain. Similarly, entering the financial services sector requires immense investment in regulatory licensing, robust technology infrastructure, and ongoing compliance, creating formidable barriers.

For instance, opening a single high-end jewelry store in a major city could easily cost upwards of $500,000 to $1 million, encompassing leasehold improvements and initial stock. Financial services firms, even smaller ones, face millions in capital requirements to meet prudential regulations, such as the Basel III framework, which dictates minimum capital ratios for banks.

These high capital requirements significantly deter new entrants, particularly those aiming to build a broad physical retail network or offer a comprehensive suite of financial products. The sheer scale of investment needed to compete with established players in both industries acts as a powerful deterrent, protecting incumbents like Chow Sang Sang Holdings International.

The jewelry sector, while perhaps less regulated than finance, still faces scrutiny, particularly concerning authenticity, precious metal content, and ethical sourcing. Compliance with these standards, especially for international markets, adds a layer of complexity and cost for any new player.

Hong Kong's financial services landscape, a crucial element for many holding companies like Chow Sang Sang, is becoming increasingly intricate. For instance, the Securities and Futures Commission (SFC) continues to refine its licensing requirements, with recent updates in 2024 focusing on robust compliance frameworks for virtual asset service providers, creating substantial barriers to entry for newcomers attempting to operate within this evolving space.

Chow Sang Sang Holdings International benefits significantly from its established brand recognition and deep-rooted customer loyalty, particularly within the luxury jewelry market. This strong brand equity, cultivated over decades of operation, acts as a substantial barrier to entry for new competitors. Customers often gravitate towards trusted names when purchasing high-value items, and Chow Sang Sang's reputation for quality and reliability fosters this trust.

In 2024, the luxury goods sector, where Chow Sang Sang operates, continues to see consumers prioritize brand heritage and perceived value. This loyalty makes it difficult for newcomers to quickly capture market share, as they must invest heavily in building similar levels of consumer confidence and brand association. For instance, Chow Sang Sang's long history, dating back to 1934, provides a narrative of enduring quality that new entrants struggle to replicate.

Access to Distribution Channels and Supply Chains

New entrants into the jewelry market, like Chow Sang Sang Holdings International operates within, face significant hurdles in accessing crucial distribution channels and established supply chains. Securing prime retail locations is a major challenge, as established brands often have long-term leases and prime spots that are difficult for newcomers to acquire. For instance, in 2024, the luxury retail sector continued to see high demand for premium mall spaces, with rental costs remaining a significant barrier to entry for new players.

Establishing robust supply chains for precious materials such as gold and diamonds presents another formidable obstacle. Existing companies like Chow Sang Sang have cultivated long-standing relationships with reputable suppliers, ensuring a consistent flow of high-quality gems and metals. New entrants struggle to replicate these established networks, often facing higher raw material costs and potential inconsistencies in supply, which directly impacts product quality and availability.

Building effective online distribution networks also requires substantial investment and expertise. Companies with years of experience have honed their e-commerce platforms and logistics, creating seamless customer experiences. In 2024, the online retail market continued its growth trajectory, but competition for customer attention and efficient delivery infrastructure made it challenging for new entrants to gain traction against established players' sophisticated digital operations.

- High Rental Costs: Prime retail spaces in key markets often command premium rental rates, posing a significant upfront cost for new entrants.

- Supplier Relationships: Established jewelers benefit from long-term, trusted relationships with diamond and precious metal suppliers, ensuring consistent quality and preferential pricing.

- Economies of Scale: Larger, established companies can leverage economies of scale in sourcing and manufacturing, making it difficult for smaller newcomers to compete on cost.

- Brand Recognition and Trust: Decades of operation have allowed companies like Chow Sang Sang to build strong brand recognition and customer trust, which are difficult and time-consuming for new entrants to achieve.

Expertise and Talent Acquisition

The challenge of attracting specialized talent acts as a significant barrier to new entrants in Chow Sang Sang's operating environment. Recruiting experienced gemologists, creative jewelry designers, knowledgeable financial advisors, and meticulous compliance professionals requires considerable effort and investment. For instance, in Hong Kong, a competitive hub for both finance and luxury goods, the demand for such expertise is consistently high.

This difficulty in talent acquisition is exacerbated by the specialized knowledge and experience needed across Chow Sang Sang's diverse business segments. New companies entering the market face a steep learning curve and the immediate need to build a team with proven capabilities. This can translate into higher recruitment costs and longer lead times to establish operations, directly impacting a new entrant's ability to compete effectively.

- Talent Scarcity: The market for skilled gemologists and luxury brand designers in Hong Kong experiences high demand, making it difficult for new entrants to find qualified personnel.

- Cost of Acquisition: Attracting top-tier financial advisors and compliance experts in a major financial center like Hong Kong often involves competitive salaries and benefits packages, increasing startup costs.

- Experience Premium: New companies may struggle to attract talent with the specific experience required to navigate both the intricacies of jewelry craftsmanship and the regulatory landscape of financial services.

- Training Investment: Even with existing talent, new entrants often need to invest significantly in training to align employees with their specific brand values and operational standards, a cost that established players have already absorbed.

The threat of new entrants for Chow Sang Sang Holdings International is relatively low due to substantial barriers. High capital requirements for prime retail locations and inventory, coupled with stringent regulatory compliance in financial services, deter many potential competitors. Established brand recognition and deep customer loyalty, built over decades, further solidify the position of incumbents.

Securing prime retail spaces in 2024 remained a significant hurdle, with luxury mall rentals in Hong Kong continuing to be high, making it tough for newcomers to establish a physical presence. Furthermore, developing robust supply chains for precious materials requires long-standing relationships with suppliers, which new entrants lack. For instance, the luxury goods sector in 2024 saw consumers prioritizing brand heritage, making it difficult for new brands to quickly gain market share.

The need for specialized talent, such as experienced gemologists and financial advisors, also presents a challenge. In 2024, the high demand for such expertise in competitive markets like Hong Kong meant new entrants faced higher recruitment costs and longer lead times to build competent teams. This scarcity of skilled professionals, combined with the investment in training, creates a substantial barrier to entry.

| Barrier Type | Description | Impact on New Entrants | 2024 Relevance |

| Capital Requirements | High costs for prime retail, inventory, and regulatory compliance. | Significant deterrent, especially for broad market entry. | Continued high real estate and compliance costs. |

| Brand Loyalty & Recognition | Decades of building trust and established reputation. | Difficult for new entrants to replicate consumer confidence. | Consumers prioritizing heritage in luxury goods. |

| Distribution Channels | Access to prime retail locations and established supply chains. | Challenging to secure prime spots and consistent material supply. | Premium mall spaces in high demand; supplier relationships are key. |

| Specialized Talent | Need for experienced gemologists, designers, and financial professionals. | High recruitment costs and longer lead times for new teams. | Talent scarcity in competitive hubs like Hong Kong. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chow Sang Sang Holdings International is built upon a foundation of publicly available financial reports, investor relations materials, and industry-specific market research. We also incorporate insights from reputable business news outlets and competitor disclosures to ensure a comprehensive understanding of the competitive landscape.