Chow Sang Sang Holdings International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chow Sang Sang Holdings International Bundle

Uncover the external forces shaping Chow Sang Sang Holdings International's trajectory with our meticulously crafted PESTLE analysis. From evolving consumer preferences to shifting geopolitical landscapes, understand the critical factors influencing their operations and market position. This comprehensive breakdown will equip you with the foresight needed to navigate the complexities of the jewelry and luxury goods sector. Don't just react to market changes; anticipate them. Download the full PESTLE analysis now to gain a strategic advantage.

Political factors

Government policies, especially concerning taxes and import duties on luxury goods, directly affect Chow Sang Sang's bottom line and how they price their offerings. For example, in 2024, China's continued focus on domestic consumption and potential adjustments to luxury import tariffs could alter sales volumes and profitability. These policy shifts, particularly in mainland China and Hong Kong, are crucial for understanding consumer spending patterns and managing operational expenses.

Changes in consumption taxes or import/export regulations can steer consumers. If import duties on high-end jewelry rise, it might push consumers towards domestically produced items or shopping in duty-free locations. This dynamic was evident in previous years where varying tax structures between Hong Kong and mainland China significantly influenced cross-border shopping habits, a trend likely to continue shaping market strategies in 2024 and 2025.

Ongoing trade tensions, particularly between China and the United States, continue to pose a risk to global supply chains. For Chow Sang Sang, this could translate into higher costs for raw materials like gold and diamonds, impacting profit margins. A notable example of this disruption was observed in late 2023 and early 2024, with fluctuating import duties impacting the precious metals sector.

Broader geopolitical instability, including regional conflicts and political uncertainty in key markets, can dampen consumer confidence. This is especially true for discretionary spending on luxury goods such as jewelry. For instance, reports from early 2024 indicated a slowdown in tourist spending in major East Asian shopping destinations, a key demographic for Chow Sang Sang's high-end products.

Political stability in Hong Kong and mainland China directly impacts Chow Sang Sang's operations. Any unrest or uncertainty can significantly dampen consumer confidence and spending, crucial for a retail-focused business like Chow Sang Sang. This also affects tourism, a key driver for sales in Hong Kong.

The business environment can become unfavorable, potentially leading to store closures and reduced profitability. For instance, Hong Kong's retail sales saw a notable decrease in early 2024, partly attributed to shifting consumer habits and broader economic sentiment, which can be influenced by political factors.

Regulatory Changes in Financial Services

Regulatory shifts significantly impact Chow Sang Sang's financial services arm, which includes securities and futures brokerage, financial planning, and investment advisory. For instance, Hong Kong's evolving fintech landscape, marked by new stablecoin regulations and licensing for virtual asset trading platforms, necessitates ongoing adaptation and compliance efforts. These changes can directly influence operational costs and the complexity of managing financial operations.

Stricter regulations, such as enhanced anti-money laundering (AML) and know-your-customer (KYC) mandates, directly increase compliance burdens and operational overhead for financial service providers. The Hong Kong Securities and Futures Commission (SFC) continues to refine its oversight, with recent efforts focusing on investor protection and market integrity. These evolving requirements mean that financial institutions like Chow Sang Sang must continually invest in robust compliance systems and personnel to navigate the regulatory environment effectively.

- Increased Compliance Costs: Stricter AML/KYC rules can lead to higher spending on technology and personnel for compliance.

- Operational Complexity: New licensing requirements for virtual asset trading platforms add layers of operational and legal complexity.

- Fintech Regulation Advancement: Hong Kong's proactive approach to fintech, including stablecoin legislation, signals a dynamic regulatory future for financial services.

- Market Integrity Focus: Regulators are emphasizing market integrity, requiring firms to implement stronger risk management and governance frameworks.

Anti-Corruption Campaigns and Wealth Display Restrictions

China's ongoing anti-corruption initiatives, particularly those intensified in recent years, have continued to influence consumer behavior within the luxury goods sector. This has encouraged a more subdued approach to wealth display, impacting high-visibility purchases. For instance, during the 2013-2015 period, a significant slowdown in luxury sales was attributed in part to these campaigns, with reports indicating a noticeable drop in sales of items like high-end watches and jewelry at official functions. While the intensity may fluctuate, the underlying sentiment of discretion persists.

This shift can lead affluent consumers to favor less ostentatious jewelry, or to prioritize experiences over tangible luxury goods. The preference for "quiet luxury" or items with intrinsic value rather than overt branding aligns with this cautious approach to public spending. This phenomenon, often termed 'luxury shame,' encourages a redirection of spending towards personal enjoyment or more discreet forms of conspicuous consumption.

- Impact on Jewelry Sales: Campaigns discouraging extravagant gift-giving and overt displays of wealth can reduce demand for highly visible luxury jewelry items.

- Consumer Behavior Shift: Affluent consumers may opt for understated designs or focus on personal enjoyment of luxury goods rather than public showcasing.

- Rise of Experiential Luxury: There's a potential shift in spending towards luxury experiences, such as fine dining or high-end travel, over conspicuous material possessions.

- Market Adaptation: Retailers may need to adapt their product offerings and marketing strategies to cater to a more discreet and discerning consumer base.

Government policies on luxury goods taxation and import duties, particularly in China and Hong Kong, significantly influence Chow Sang Sang's pricing and sales volumes. For instance, in 2024, China's ongoing push for domestic consumption and potential adjustments to luxury import tariffs could impact profitability. These policy shifts directly affect consumer spending patterns and operational costs, a trend expected to continue through 2025.

Trade tensions, especially between China and the US, pose risks to raw material costs like gold and diamonds, affecting Chow Sang Sang's profit margins. Fluctuations in import duties observed in late 2023 and early 2024 highlight this vulnerability. Geopolitical instability can also dampen consumer confidence for discretionary luxury purchases, as seen in early 2024 reports of reduced tourist spending in key East Asian markets.

Political stability in Hong Kong and mainland China is vital for Chow Sang Sang's retail operations and consumer confidence. Any unrest can negatively impact sales, particularly in Hong Kong where tourism is a key driver. For example, Hong Kong's retail sales saw a downturn in early 2024, partly due to shifting consumer sentiment influenced by political and economic factors.

Regulatory changes in financial services, such as Hong Kong's fintech evolution with stablecoin regulations and virtual asset platform licensing, require continuous adaptation. Stricter AML/KYC mandates, like those refined by the Hong Kong SFC in 2024, increase compliance costs and operational complexity, necessitating ongoing investment in robust systems.

What is included in the product

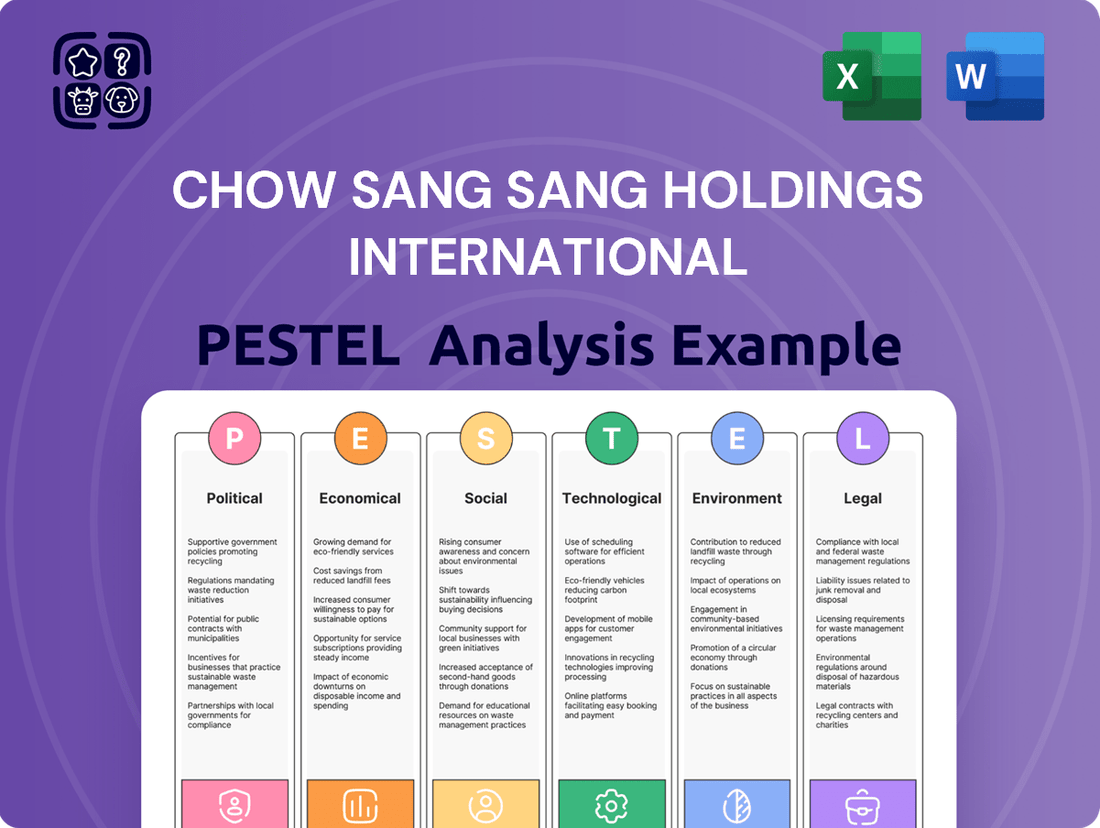

This PESTLE analysis of Chow Sang Sang Holdings International dissects the intricate interplay of political, economic, social, technological, environmental, and legal forces impacting its operations and strategic outlook.

It provides a comprehensive evaluation of external macro-environmental factors, offering actionable insights for identifying market opportunities and navigating potential threats within the jewelry retail sector.

Offers a streamlined understanding of Chow Sang Sang's external environment, enabling proactive strategy adjustments and reducing the stress of navigating complex market forces.

Economic factors

Chow Sang Sang's success is intrinsically linked to how much consumers feel they can spend on non-essential items, like jewelry. This discretionary spending is a direct reflection of the broader economic health and how confident people feel about their financial future.

Economic growth and rising disposable incomes are key drivers for this sector. For instance, in 2024, while overall economic activity might show resilience in certain regions, the luxury market, particularly in China, experienced a noticeable slowdown. This directly impacted sales of high-value jewelry as consumers became more cautious.

Consumer confidence plays a crucial role; when people are optimistic about the economy and their job security, they are more likely to make purchases of luxury goods. Conversely, any dip in confidence, perhaps due to inflation concerns or geopolitical uncertainties, can lead to a sharp reduction in discretionary spending, directly affecting companies like Chow Sang Sang.

Data from early 2024 indicated a cooling in consumer sentiment in key Asian markets, with some analysts reporting a softening demand for premium goods. This trend underscores the sensitivity of Chow Sang Sang's revenue streams to shifts in consumer psychology and overall economic stability.

Inflationary pressures in 2024 have significantly impacted consumer spending on discretionary items like luxury jewelry. For Chow Sang Sang, this means a potential reduction in purchasing power for its customer base, making high-value gold pieces less accessible. For example, a persistent inflation rate, even if moderating from 2023 highs, continues to test affordability.

Interest rate hikes, a common tool to combat inflation, directly affect Chow Sang Sang's operating costs and consumer demand. Increased borrowing costs can dampen consumer confidence and reduce the likelihood of purchasing significant jewelry items, especially if financed. Central bank policies throughout 2024 and into 2025 will be crucial in shaping this dynamic.

The direct correlation between gold prices and sales volume is a critical factor. When gold prices surge, as they have at various points leading into 2025, the cost of Chow Sang Sang's core products increases, potentially leading to sales volume declines unless price increases are absorbed or offset by other strategies.

Fluctuations in exchange rates between the Hong Kong Dollar, Chinese Renminbi, and other major currencies directly impact Chow Sang Sang's operational costs. For instance, a stronger USD against the HKD could increase the cost of sourcing precious metals like gold and diamonds, which are often priced in dollars. Conversely, a weaker RMB could make Chow Sang Sang's products more expensive for mainland Chinese consumers purchasing in Hong Kong, potentially dampening sales.

Recent trends show significant currency movements. As of late 2024, the US Dollar has shown resilience, maintaining a relatively strong position against many Asian currencies. This can translate to higher import costs for raw materials for Chow Sang Sang.

Furthermore, exchange rate dynamics influence international tourism spending patterns. When currencies like the Japanese Yen weaken significantly, as observed at various points in 2024, it can make Japan a more attractive destination for Chinese tourists, diverting some luxury spending away from Hong Kong and impacting Chow Sang Sang's domestic sales in that key market.

Economic Growth Rates in Key Markets

Economic growth rates in mainland China and Hong Kong are pivotal for Chow Sang Sang Holdings International, directly impacting the size and potential of its key markets. A sluggish economic environment in these regions presents a significant headwind for the jewelry retailer.

Projections for 2025 suggest a flat luxury market in China, a crucial growth engine for Chow Sang Sang. This stagnation implies limited expansion opportunities and increased competition for market share.

Furthermore, Hong Kong retail sales have experienced a decline, adding to the challenging economic landscape. This downturn directly affects Chow Sang Sang's performance in its historically strong Hong Kong market.

- Projected flat luxury market growth in China for 2025

- Observed decline in Hong Kong retail sales

- Impact on Chow Sang Sang's core market demand

Impact of E-commerce and Digitalization

The relentless growth of e-commerce is a seismic shift in retail, and Chow Sang Sang must navigate this digital tide. By the end of 2024, global e-commerce sales are projected to reach a staggering $7.5 trillion, highlighting the immense market potential online. This digital transformation necessitates not only a strong online presence but also significant investment in sophisticated digital marketing and robust supply chain capabilities to meet evolving consumer expectations.

For Chow Sang Sang, this means strategically enhancing its digital sales channels. The company's ability to adapt its strategy to capture demand, particularly in emerging Tier 2 and Tier 3 cities where digital adoption is rapidly accelerating, will be crucial for sustained growth. For instance, in China, online jewelry sales saw a significant surge, with platforms like Tmall reporting substantial year-on-year increases in luxury goods, including precious metals and gemstones.

This intensified competition online requires a differentiated approach. Chow Sang Sang's investment in digital infrastructure, including user-friendly websites and mobile applications, along with targeted digital marketing campaigns, will be key differentiators. The company's success hinges on its agility in responding to consumer behavior shifts, ensuring its omnichannel strategy seamlessly integrates online and offline experiences.

Key considerations for Chow Sang Sang include:

- Expanding digital storefronts: Investing in and optimizing e-commerce platforms to reach a wider customer base.

- Digital marketing proficiency: Developing targeted online advertising and social media strategies to engage consumers.

- Omnichannel integration: Creating a seamless customer journey across online and physical stores.

- Data analytics: Leveraging customer data to personalize offerings and improve marketing effectiveness.

Economic growth and consumer spending power are paramount for Chow Sang Sang. In 2024, while some economies showed resilience, luxury markets, particularly in China, experienced a slowdown, impacting discretionary spending on high-value jewelry. Inflationary pressures and interest rate hikes throughout 2024 and into 2025 continue to test affordability and dampen consumer confidence, directly affecting sales volumes.

Fluctuations in gold prices and currency exchange rates also present significant challenges. As of late 2024, a strong US Dollar can increase the cost of sourcing precious metals, while a weaker RMB could make products more expensive for mainland Chinese consumers. Economic growth rates in mainland China and Hong Kong remain pivotal, with projections for 2025 indicating a flat luxury market in China and a decline in Hong Kong retail sales, posing headwinds for the company.

Full Version Awaits

Chow Sang Sang Holdings International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Chow Sang Sang Holdings International details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers a comprehensive overview crucial for strategic decision-making and market understanding.

Sociological factors

Consumer preferences for jewelry are clearly shifting. There's a noticeable rise in demand for pieces that are not just beautiful, but also have a story behind them, whether through personalization or ethical sourcing. This includes a growing interest in lab-grown diamonds, which offer a more sustainable and often more affordable alternative to mined diamonds.

Chow Sang Sang needs to stay nimble to keep up with these evolving tastes. This means finding a good balance between their classic, timeless designs that many customers still cherish and incorporating new trends that resonate with younger, value-conscious buyers. Think about how they can offer more customization options or highlight the ethical origins of their materials.

For instance, the global market for lab-grown diamonds saw significant growth, with some reports indicating a doubling in sales for certain retailers between 2022 and 2023, reaching billions of dollars. This trend is expected to continue into 2024 and 2025, suggesting that brands that embrace this segment will likely see increased market share and customer engagement.

The burgeoning middle class in China, particularly those in their 30s and 40s, are demonstrating increased spending power and a preference for established luxury brands like Chow Sang Sang Holdings. By 2025, China's middle-income population is projected to exceed 600 million people, a significant demographic shift driving demand for high-quality jewelry. This group often values stability and brand reputation in their purchasing decisions.

Younger consumers, specifically millennials and Gen Z, are reshaping luxury consumption by prioritizing experiences over mere possessions and showing a growing interest in sustainable and ethically sourced products. For instance, a 2024 survey indicated that over 70% of Gen Z consumers in China consider sustainability when making purchasing decisions. This trend presents an opportunity for brands to emphasize responsible sourcing and unique, personalized offerings to capture this evolving market segment.

In key markets like Mainland China and Hong Kong, jewelry holds deep cultural significance, particularly for major life events such as weddings and the Lunar New Year. Chow Sang Sang strategically capitalizes on these traditions, with a significant portion of its revenue tied to these gifting occasions. For instance, during the 2023 Lunar New Year period, the company reported robust sales, indicating continued strong consumer demand for auspicious jewelry pieces.

The company's success is closely linked to its ability to navigate evolving consumer preferences. While traditional gifting remains strong, there's a growing trend towards more understated luxury and personalized pieces. Chow Sang Sang's product development, therefore, must balance classic designs with contemporary styles to appeal to a broader demographic and ensure sustained demand in a dynamic cultural landscape.

Influence of Social Media and Online Trends

Social media platforms are pivotal in shaping consumer sentiment and purchasing habits within the jewelry sector. Chow Sang Sang must actively leverage platforms such as Instagram and TikTok to build its brand, engage directly with consumers, and present its collections to a broader demographic. For instance, in 2024, influencer marketing on social media is expected to continue its upward trajectory, with brands allocating significant budgets to reach younger, digitally-native audiences.

Online trends, driven by social media, directly influence jewelry design preferences and demand for specific styles. The rise of short-form video content, particularly on TikTok, has created opportunities for brands to showcase product craftsmanship and styling in engaging ways. In Q1 2024, brands that effectively utilized user-generated content and responded to viral trends saw an average increase of 15% in online engagement.

- Growing importance of visual content on platforms like Instagram and TikTok for jewelry showcasing.

- Direct consumer engagement and feedback loops facilitated by social media interactions.

- Impact of online trends and influencer marketing on jewelry design preferences and purchasing decisions.

- Opportunity for Chow Sang Sang to expand reach and build brand loyalty through strategic social media campaigns.

Ethical Consumerism and Responsible Sourcing

Ethical consumerism is increasingly shaping purchasing decisions, particularly in the jewelry sector where the provenance of precious materials like diamonds and gold is under scrutiny. Consumers are actively seeking brands that demonstrate a commitment to transparency and responsible sourcing throughout their supply chains. This trend is evident in the growing demand for certifications and assurances regarding fair labor practices and environmental impact.

Chow Sang Sang, like other major jewelry retailers, faces pressure to proactively address these consumer concerns. This means not only ensuring the ethical sourcing of raw materials but also communicating these efforts effectively to build trust. Demonstrating robust supply chain management and a clear commitment to sustainability is becoming a competitive imperative to align with the values of a significant and growing consumer segment.

- Growing Demand for Transparency: A significant portion of consumers, particularly younger demographics, actively research brand ethics before purchasing.

- Focus on Responsible Sourcing: Consumers are increasingly aware of issues like conflict minerals and unfair labor, influencing their choices in gold and diamond purchases.

- Brand Reputation and Trust: Companies that openly share their sourcing practices and sustainability initiatives tend to build stronger customer loyalty.

- Sustainability as a Differentiator: For 2024, sustainability reporting and ethical sourcing are moving from a niche concern to a mainstream expectation for leading brands.

Societal shifts are significantly influencing the jewelry market, with a growing emphasis on personalization and ethical sourcing. Consumers, especially younger ones, are increasingly interested in lab-grown diamonds, which saw a notable sales surge in 2023, with projections indicating continued growth through 2024-2025. This trend highlights a demand for both sustainability and affordability.

Technological factors

The ongoing expansion of e-commerce platforms and the increasing digitalization of retail are significant technological shifts impacting Chow Sang Sang. A user-friendly website and robust online shopping capabilities are now crucial for accessing a wider customer base and meeting modern consumer expectations for convenience.

In 2024, global e-commerce sales are projected to reach over $7 trillion, highlighting the sheer scale and importance of digital channels. Chow Sang Sang's investment in its digital presence, including its website and mobile app, directly addresses this trend, aiming to capture a larger share of this growing market by offering seamless online purchasing experiences.

Chow Sang Sang can harness data analytics and AI to tailor marketing efforts, ensuring promotions resonate with individual customer preferences. This technology also aids in predicting demand, allowing for more efficient inventory management, potentially reducing waste and optimizing stock levels. In 2024, the global AI market was projected to reach over $200 billion, highlighting its pervasive influence.

Furthermore, AI-driven personalization extends to enhancing the customer journey, from targeted product recommendations to seamless online and in-store experiences. The ability to offer customized jewelry through AI-powered design tools opens new avenues for customer engagement, allowing them to actively participate in creating unique pieces, a trend gaining traction in the luxury goods sector.

Blockchain technology is increasingly being explored to enhance transparency within the diamond and precious materials supply chain. This innovation offers a robust way to track the origin and journey of these valuable items, ensuring their provenance. For Chow Sang Sang, adopting blockchain can significantly strengthen consumer confidence in their ethical sourcing practices, a critical factor for today's conscious consumers.

The demand for ethically sourced goods continues to rise, with reports indicating that over 70% of consumers are willing to pay more for sustainable products. By leveraging blockchain, Chow Sang Sang can provide verifiable proof of ethical sourcing, directly addressing this consumer expectation and potentially differentiating itself in a competitive market. This can lead to a stronger brand reputation and increased customer loyalty.

Advanced Manufacturing Techniques

Advanced manufacturing techniques, like additive manufacturing (3D printing), are transforming the jewelry industry by enabling intricate designs and personalized pieces. This allows companies such as Chow Sang Sang to explore new aesthetic possibilities and offer greater customization to consumers. For instance, advancements in 3D printing metals have significantly improved the quality and speed of creating complex jewelry components.

These technologies can directly impact Chow Sang Sang's operational efficiency by streamlining production processes and reducing waste. By adopting these methods, the company can shorten lead times from design to finished product, responding more agilely to market trends and customer demands. The global 3D printing market, projected to reach over $40 billion by 2027, highlights the significant growth and adoption of these transformative technologies across various sectors, including luxury goods.

The integration of advanced manufacturing can lead to:

- Enhanced design complexity: Enabling the creation of previously impossible or prohibitively expensive jewelry structures.

- Increased customization: Allowing for on-demand production of bespoke items tailored to individual customer preferences.

- Reduced production costs: Optimizing material usage and potentially lowering labor requirements for certain manufacturing steps.

- Faster product development cycles: Accelerating the time from concept to market for new collections.

Fintech Innovations in Financial Services

Fintech innovations, such as digital brokerage and robo-advisors, are fundamentally reshaping how financial services are delivered. For Chow Sang Sang, this means its financial services arm must integrate these advancements to stay competitive. The company needs to offer modern, efficient solutions that cater to evolving customer expectations in the digital age.

The global fintech market is projected to reach $33.5 trillion by 2027, highlighting the immense growth and adoption of these technologies. In 2024, digital payments alone are expected to exceed $15 trillion. This surge presents both an opportunity and a challenge for established players like Chow Sang Sang.

- Digital Adoption: By the end of 2024, it is estimated that over 70% of consumers will prefer digital channels for banking and financial transactions.

- Robo-Advisor Growth: Assets under management by robo-advisors are anticipated to surpass $3 trillion globally by 2025, indicating a strong client preference for automated investment management.

- Efficiency Gains: Fintech solutions can reduce operational costs by up to 40% in certain financial processes, allowing for more competitive pricing and better service.

- Customer Experience: Companies that embrace fintech can enhance customer engagement through personalized digital interfaces and faster service delivery, crucial for retaining and attracting clients.

The increasing prevalence of advanced analytics and AI in retail allows Chow Sang Sang to personalize customer experiences, from targeted marketing to product recommendations. These technologies are also vital for optimizing inventory management and supply chain efficiency, with the global AI market projected to exceed $200 billion in 2024. Furthermore, blockchain technology offers enhanced transparency in the supply chain, crucial for verifying the ethical sourcing of diamonds and precious metals, a factor increasingly important to consumers who are reportedly willing to pay more for sustainable products.

The company must also adapt to fintech innovations, as digital channels and automated services become the norm in financial transactions. With global fintech market projected to reach $33.5 trillion by 2027, and over 70% of consumers preferring digital banking, integration is key. Advanced manufacturing, such as 3D printing, enables intricate designs and customization, with the global 3D printing market expected to surpass $40 billion by 2027, allowing for faster production cycles and potentially reduced costs.

| Technology Area | 2024/2025 Impact/Projection | Chow Sang Sang Relevance |

|---|---|---|

| E-commerce & Digitalization | Global e-commerce sales projected over $7 trillion (2024) | Crucial for broader customer reach and convenience. |

| Artificial Intelligence (AI) | Global AI market projected over $200 billion (2024) | Personalization, demand forecasting, inventory optimization. |

| Blockchain Technology | Consumer willingness to pay more for sustainable products (over 70%) | Ensuring provenance and ethical sourcing, building consumer trust. |

| Advanced Manufacturing (3D Printing) | Global 3D printing market projected over $40 billion by 2027 | Enabling intricate designs, customization, and faster production. |

| Fintech Innovations | Global fintech market projected $33.5 trillion by 2027 | Modernizing financial services, enhancing customer experience. |

Legal factors

Chow Sang Sang Holdings International operates within a framework of robust consumer protection laws, particularly concerning jewelry sales. These regulations mandate transparency in product quality, accurate labeling of materials like gold purity and gemstone authenticity, and fair pricing practices. For instance, in mainland China, the Standardization Administration of the People's Republic of China (SAC) oversees standards for precious metals and stones, ensuring consumers receive products that match their descriptions. Failure to comply can result in significant fines and reputational damage.

The company must also navigate regulations around return policies and dispute resolution. In Hong Kong, the Consumer Goods Safety Ordinance and the Trade Descriptions Ordinance are key pieces of legislation that Chow Sang Sang must adhere to, ensuring products are safe and descriptions are not misleading. Adherence to these consumer protection measures is not just a legal necessity but a cornerstone for building and maintaining customer loyalty, a critical factor in the competitive retail jewelry market. In 2023, consumer complaints related to misleading advertising in the retail sector saw an uptick in several Asian markets, highlighting the ongoing importance of strict compliance.

Chow Sang Sang, operating within financial services, faces stringent regulations across securities, futures brokerage, and anti-money laundering (AML) and know-your-customer (KYC) protocols. These rules are constantly adapting, requiring rigorous compliance to avoid penalties and maintain trust. For instance, Hong Kong's evolving digital asset landscape, including the virtual asset trading platform licensing regime, necessitates proactive adaptation.

Chow Sang Sang Holdings International places a high priority on safeguarding its intellectual property, including its distinctive trademarks and jewelry designs. This protection is crucial for maintaining its competitive edge in the vibrant and often crowded jewelry sector.

The ongoing challenge of counterfeit goods poses a significant threat, potentially diminishing Chow Sang Sang's brand reputation and negatively affecting its revenue streams. For instance, in 2024, the global luxury goods market continued to grapple with the issue of counterfeiting, with estimates suggesting significant losses across industries.

The company actively engages in measures to combat the spread of fake products, recognizing that brand authenticity is a cornerstone of customer trust and loyalty. Legal frameworks surrounding intellectual property protection and enforcement are therefore critical operational considerations.

Labor Laws and Employment Regulations

Chow Sang Sang Holdings International, with its significant retail presence and manufacturing facilities, navigates a complex web of labor laws and employment regulations across its operating regions. These legal frameworks dictate crucial aspects of the employer-employee relationship, ensuring fair treatment and safe working conditions. Adherence to these standards is paramount for maintaining operational continuity and corporate reputation.

Key areas of compliance include:

- Wages and Working Hours: Ensuring minimum wage laws and overtime regulations are met, such as the statutory minimum wage in Hong Kong, which was HK$40 per hour as of May 2024, and adhering to standard working hour limits.

- Workplace Safety: Complying with occupational health and safety standards to prevent accidents and injuries in both retail environments and manufacturing plants, referencing regulations like those enforced by the Occupational Safety and Health Administration (OSHA) in relevant international contexts.

- Employee Benefits: Providing legally mandated benefits, which can include sick leave, annual leave, maternity/paternity leave, and contributions to social security or pension schemes, varying significantly by country.

- Non-Discrimination and Equal Opportunity: Upholding laws that prohibit discrimination based on age, gender, race, religion, or other protected characteristics in hiring, promotion, and all aspects of employment.

Data Privacy Regulations

Chow Sang Sang Holdings International operates in an environment where data privacy is increasingly scrutinized. In Hong Kong, the Personal Data (Privacy) Ordinance (PDPO) sets strict guidelines for data collection, usage, and protection. Similarly, mainland China's Personal Information Protection Law (PIPL), effective since November 1, 2021, imposes robust requirements on how companies handle personal information, including cross-border data transfers. These regulations mandate clear consent mechanisms, data minimization, and security measures to safeguard customer data. Failure to comply can result in significant fines and reputational damage, impacting customer trust and brand loyalty.

The company's commitment to data privacy is therefore not just a legal obligation but a critical aspect of maintaining customer confidence. As Chow Sang Sang continues to leverage digital channels for sales and marketing, adherence to these evolving data privacy laws is paramount. For instance, the increasing focus on consent management and data breach notification protocols in both jurisdictions means that robust internal policies and technological safeguards are essential to avoid penalties. In 2023, data privacy enforcement actions globally saw a notable increase, underscoring the importance of proactive compliance.

Chow Sang Sang Holdings International is subject to rigorous consumer protection laws, particularly concerning product authenticity and fair trade practices, with regulations in Hong Kong and mainland China mandating transparency. These include strict labeling requirements for precious metals and gemstones, ensuring compliance with standards set by bodies like the Standardization Administration of the People's Republic of China (SAC). The company must also adhere to consumer rights legislation, like Hong Kong's Trade Descriptions Ordinance, to prevent misleading advertising, a critical factor given the rise in consumer complaints observed in 2023 across Asian markets.

Environmental factors

The environmental toll of obtaining precious materials like diamonds, gold, and various gemstones is a major issue for jewelry companies. Chow Sang Sang, like its peers, faces growing demands from both consumers and regulators to prove its sourcing is responsible and ethical, reflecting a strong push for sustainability in the sector.

For instance, in 2023, the Responsible Jewellery Council reported that 90% of its certified members had implemented policies addressing environmental impact in their supply chains, a trend Chow Sang Sang is actively participating in to enhance its brand reputation and market access.

Chow Sang Sang Holdings International’s supply chain, extending from raw material extraction to finished product, faces increasing scrutiny regarding sustainability and ethical sourcing. The company’s commitment to minimizing environmental impact throughout this process is crucial for maintaining consumer trust. For instance, the Responsible Jewellery Council's 2023 audit highlighted that 99% of the industry's gold supply chain participants reported adherence to ethical labor practices, a benchmark Chow Sang Sang aims to meet and exceed.

Ensuring transparency and conducting rigorous due diligence across all suppliers is paramount for Chow Sang Sang's brand reputation. Consumers are increasingly aware of the origins of their purchases, particularly in the jewelry sector, where ethical mining practices have become a significant differentiator. A 2024 survey indicated that over 70% of luxury consumers consider a brand's environmental and social responsibility when making purchasing decisions.

The carbon footprint stemming from Chow Sang Sang's manufacturing, retail, and logistics significantly shapes its environmental impact. In 2023, the global jewelry industry faced increasing scrutiny over its energy-intensive processes. For instance, the production of precious metals often requires substantial energy inputs, contributing to greenhouse gas emissions.

Chow Sang Sang's commitment to reducing energy consumption is therefore paramount. Initiatives such as optimizing lighting in retail stores and implementing more energy-efficient machinery in workshops are key to lowering their operational carbon footprint. By the end of 2024, many businesses in the Asia-Pacific region are expected to have increased their investments in energy efficiency technologies by an average of 15% compared to 2022 figures.

The adoption of renewable energy sources is also becoming a critical strategy for mitigating environmental impact. Exploring solar power for manufacturing facilities or sourcing electricity from renewable providers for retail locations can substantially decrease reliance on fossil fuels. By 2025, it's projected that corporate adoption of renewable energy will see a notable uptick, driven by both regulatory pressures and consumer demand for sustainable practices.

Waste Management and Recycling Initiatives

Effective waste management and recycling initiatives are becoming increasingly important, especially in industries that handle valuable materials like precious metals. For Chow Sang Sang Holdings International, focusing on gold recycling, in particular, can significantly boost its commitment to a circular economy. This approach not only reduces environmental impact but also offers economic benefits by reclaiming valuable resources.

Chow Sang Sang has an opportunity to implement robust programs for recycling old gold jewelry brought in by customers. Furthermore, streamlining manufacturing processes to minimize waste generation is a key strategy. In 2023, the global jewelry market, valued at approximately USD 280 billion, saw a growing consumer demand for sustainable practices, with a notable increase in interest in recycled gold. By actively participating in these initiatives, Chow Sang Sang can enhance its brand reputation and appeal to environmentally conscious consumers.

- Circular Economy Focus: Implementing gold recycling programs aligns with the growing global demand for sustainable luxury goods.

- Waste Reduction in Manufacturing: Optimizing production processes to minimize scrap and by-products is essential for environmental stewardship.

- Resource Reclamation: Recovering precious metals from old jewelry and manufacturing waste contributes to resource efficiency.

- Consumer Engagement: Offering incentives for customers to recycle old gold can foster loyalty and attract new clientele interested in ethical sourcing.

Consumer Awareness and Demand for Eco-Friendly Products

Consumer awareness around environmental impact is surging, directly shaping purchasing choices. This trend is particularly noticeable in the luxury goods sector, where ethical sourcing and sustainability are increasingly valued. For instance, a 2024 report indicated that over 60% of consumers consider a brand's environmental stance when making a purchase, a significant jump from previous years.

Chow Sang Sang can leverage this by expanding its range of sustainable jewelry. Offering pieces crafted from recycled gold, which saw a 15% increase in demand globally in 2024 according to industry analysts, and ethically sourced or lab-grown diamonds presents a clear opportunity. Effectively communicating the eco-friendly attributes of these products through marketing and in-store displays will be crucial for capturing this growing market segment.

- Growing Consumer Preference: Data shows a significant portion of consumers now prioritize sustainability in their purchasing decisions.

- Sustainable Product Offerings: Chow Sang Sang can enhance its appeal by increasing the availability of jewelry made from recycled metals and lab-grown diamonds.

- Enhanced Brand Image: Highlighting eco-friendly practices can improve brand perception and attract environmentally conscious customers.

- Market Differentiation: A strong commitment to sustainability can set Chow Sang Sang apart from competitors in the jewelry market.

Chow Sang Sang, like other jewelry retailers, faces growing pressure regarding its environmental footprint, from material sourcing to operational energy use. The industry's reliance on precious metals and gemstones necessitates a strong focus on responsible extraction and processing. By 2024, global awareness of these impacts has intensified, with consumers increasingly demanding transparency and sustainable practices from brands like Chow Sang Sang.

The company's operations, including manufacturing and retail, contribute to its carbon footprint. In 2023, the jewelry sector saw a rise in investments towards energy efficiency, with companies aiming to reduce energy consumption in production and store operations. This trend is expected to continue through 2025 as sustainability becomes a key performance indicator.

Chow Sang Sang can significantly enhance its environmental stewardship by adopting circular economy principles, particularly through gold recycling initiatives. This approach not only minimizes waste but also aligns with consumer preferences for recycled materials, which saw a notable increase in demand globally in 2024.

A 2024 survey revealed that over 60% of consumers consider a brand's environmental stance, highlighting the importance of sustainable product offerings and transparent sourcing for Chow Sang Sang's brand image and market appeal.

| Environmental Factor | Impact on Chow Sang Sang | Industry Trend (2023-2025) | Chow Sang Sang Opportunity |

| Material Sourcing & Extraction | Environmental toll of mining precious metals | Increased scrutiny on responsible sourcing | Promote ethically sourced and recycled materials |

| Carbon Footprint | Energy consumption in manufacturing, retail, logistics | Growing investment in energy efficiency | Implement renewable energy and optimize operations |

| Waste Management | Scrap and by-products from manufacturing | Rise in circular economy initiatives, gold recycling | Expand customer gold recycling programs, minimize waste |

| Consumer Awareness | Demand for sustainable and transparent practices | Over 60% of consumers prioritize environmental stance (2024) | Enhance brand image through eco-friendly products and communication |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Chow Sang Sang Holdings International is meticulously built on a foundation of diverse and credible data sources. We draw from official government publications, international economic databases, and reputable industry-specific market research reports to capture the multifaceted macro-environment impacting the jewelry sector.