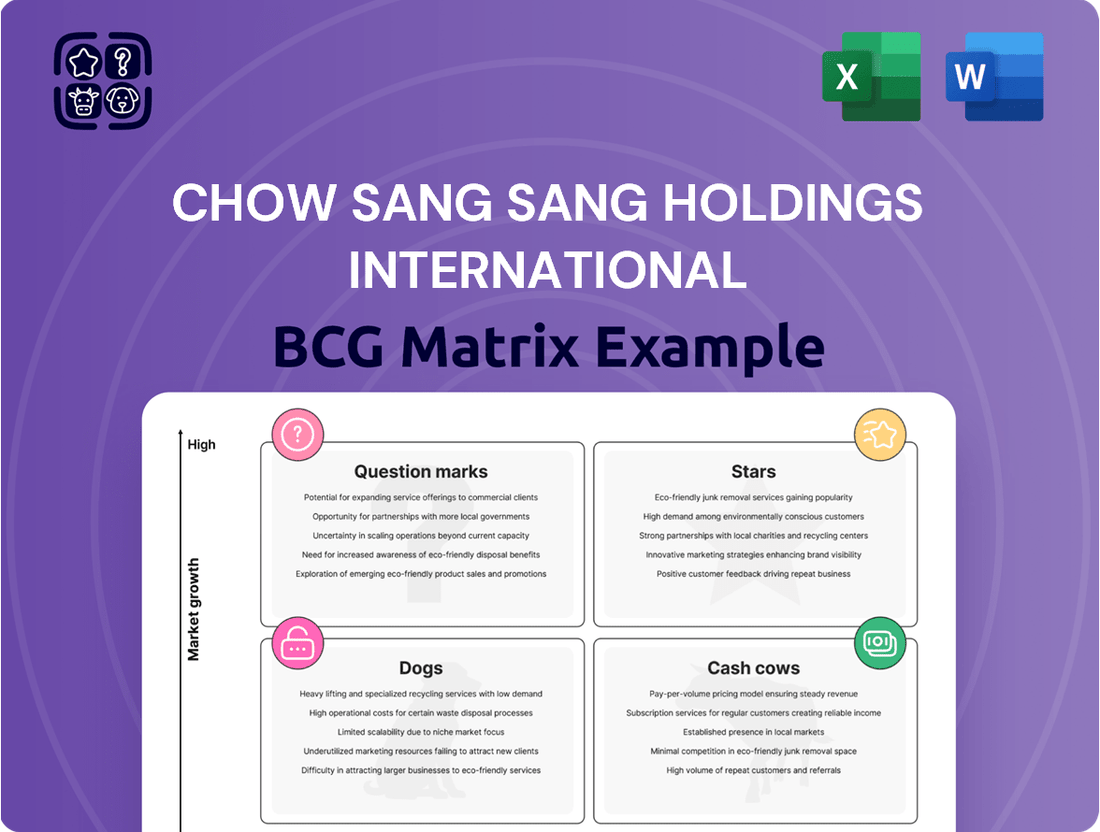

Chow Sang Sang Holdings International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chow Sang Sang Holdings International Bundle

Explore the strategic positioning of Chow Sang Sang Holdings International within the BCG Matrix. This foundational analysis reveals their product portfolio's health, highlighting potential Stars and Cash Cows, alongside areas that might be experiencing challenges.

Understanding these dynamics is crucial for informed investment and resource allocation. Are their iconic jewelry lines Cash Cows, generating steady revenue, or are emerging product categories poised to become future Stars?

This preview offers a glimpse, but the full BCG Matrix report unlocks the complete picture. Gain access to detailed quadrant placements, expert commentary, and data-backed recommendations tailored to Chow Sang Sang's market performance.

Don't miss the opportunity to leverage these strategic insights for your own business planning. Purchase the full BCG Matrix today for a comprehensive roadmap to optimizing Chow Sang Sang's product portfolio and securing competitive advantage.

Stars

Chow Sang Sang's focus on expanding its digital commerce footprint is a clear indicator of its strategic positioning within the BCG matrix. This investment in online sales channels taps into a rapidly growing market segment, crucial for future revenue streams.

The robust e-commerce growth observed by major players in Mainland China underscores the importance of this digital shift. For instance, in 2023, China's online retail sales of physical goods reached approximately 9.8 trillion yuan, a significant jump that Chow Sang Sang aims to leverage.

By enhancing its digital transformation, including adopting AI for demand forecasting, Chow Sang Sang is actively working to capture a larger share of the expanding online consumer base. This proactive approach is vital for maintaining competitiveness and driving growth in the evolving retail landscape.

Chow Sang Sang's 'The Future Rocks' brand is aggressively expanding its lab-grown diamond offerings, tapping into a market that saw substantial growth in 2024. This strategic move positions the company to capture a larger share of a segment increasingly favored by consumers due to its ethical appeal and affordability. The company's investment here is particularly notable as it counters the reported slowdown in the traditional natural diamond market.

Chow Sang Sang's targeted 'affordable luxury' collections are a key component of their BCG Matrix strategy, aiming to capture a growing segment of the market. These collections are designed with modern, stylish aesthetics, specifically appealing to younger consumers. This demographic is increasingly seeking jewelry that can be worn daily, moving beyond traditional special occasion pieces.

This strategic focus on 'affordable luxury' positions Chow Sang Sang to capitalize on evolving consumer preferences. By offering accessible yet fashionable jewelry, the company is well-placed to attract new customers and gain market share. For instance, in 2024, the demand for everyday fine jewelry saw a notable increase, particularly among Gen Z and Millennials, a trend Chow Sang Sang's collections are designed to meet.

Innovative Themed and Gender-Fluid Jewelry

Chow Sang Sang's innovative themed and gender-fluid jewelry lines are strategically positioned to capture a burgeoning 'blue ocean' in the market. This segment is experiencing a notable surge in demand, particularly from male consumers who are increasingly seeking expressive and unconventional adornments. The company's foresight in exploring these niche areas is a crucial step towards future market relevance and growth.

The potential for high growth in this segment is significant, especially if Chow Sang Sang can solidify its position as an early market leader. By investing in these forward-thinking designs, the company is not just catering to current trends but is actively shaping the future landscape of the jewelry industry. For instance, the global men's jewelry market was projected to reach USD 8.2 billion in 2023 and is expected to grow, demonstrating the tangible market opportunity.

- Market Trend Alignment: Taps into growing consumer interest in personalized and inclusive fashion.

- Blue Ocean Potential: Offers a chance to dominate a less saturated, high-growth market segment.

- Investment in Future Relevance: Positions Chow Sang Sang ahead of competitors by anticipating evolving consumer preferences.

- Consumer Demographic Expansion: Actively targets and appeals to the expanding male consumer base interested in jewelry.

Advanced AI and Data-Driven Operations

Chow Sang Sang Holdings International's commitment to advanced AI and data-driven operations is a significant driver for its 'Stars' quadrant. The company has heavily invested in AI for optimizing its supply chain, improving predictive analytics, and refining demand forecasting. This technological foundation is key to supporting their high-growth strategies.

By integrating the o9 Digital Brain platform, Chow Sang Sang is building greater agility and responsiveness into its operations. This allows them to quickly adapt to market changes and efficiently scale new product launches and digital sales channels. This strategic technological investment directly supports accelerated market penetration and enhanced profitability.

- AI Investment Focus: Supply chain management, predictive analytics, and demand forecasting.

- Key Technology Platform: o9 Digital Brain.

- Operational Benefits: Enhanced agility and responsiveness.

- Strategic Impact: Accelerates scaling of new products and digital channels, driving market penetration and profitability.

Chow Sang Sang's investment in advanced AI and data-driven operations places it firmly in the 'Stars' quadrant of the BCG matrix. The company's focus on optimizing its supply chain, predictive analytics, and demand forecasting, exemplified by its adoption of the o9 Digital Brain platform, is designed to enhance agility and efficiency.

This technological push directly supports the rapid scaling of new product introductions and the expansion of digital sales channels, crucial for capturing market share in high-growth segments. The company's strategic technological investments are geared towards accelerated market penetration and improved profitability, aligning with the characteristics of a star performer.

The company's commitment to digital commerce and expanding lab-grown diamond offerings, coupled with its innovative themed and gender-fluid jewelry lines, demonstrates a clear strategy to capture future growth. These initiatives are designed to appeal to evolving consumer preferences and tap into emerging market opportunities, further solidifying its 'Star' status.

| Key Initiatives | BCG Matrix Quadrant | Strategic Rationale | Supporting Data/Examples |

| Digital Commerce Expansion | Stars | Capitalizing on growing online retail market share. | China's online retail sales of physical goods reached ~9.8 trillion yuan in 2023. |

| Lab-Grown Diamond Offerings | Stars | Targeting a growing segment with ethical and affordability appeal. | Significant growth observed in the lab-grown diamond market in 2024, contrasting with natural diamond market slowdowns. |

| Affordable Luxury Collections | Stars | Attracting younger consumers seeking everyday fine jewelry. | Notable increase in demand for everyday fine jewelry among Gen Z and Millennials in 2024. |

| Themed & Gender-Fluid Jewelry | Stars | Exploring niche markets with high growth potential. | Global men's jewelry market projected to grow, reaching USD 8.2 billion in 2023. |

| AI & Data-Driven Operations | Stars | Enhancing efficiency, agility, and scalability. | Integration of o9 Digital Brain platform for supply chain optimization and predictive analytics. |

What is included in the product

This BCG Matrix analysis highlights Chow Sang Sang's strategic positioning of its jewelry brands, identifying growth opportunities and areas for resource allocation.

A clear BCG Matrix visualizes Chow Sang Sang's portfolio, alleviating strategic planning pain by pinpointing growth opportunities and divestment candidates.

Cash Cows

Traditional gold jewelry offerings are a definite cash cow for Chow Sang Sang Holdings International. This segment benefits from deeply ingrained cultural significance and a loyal customer base, maintaining a solid market share.

Even with gold prices reaching record highs in 2024, this core business continues to be the main engine for revenue. The consistent demand, driven by strong brand equity and broad consumer acceptance, ensures a steady stream of cash flow, even if growth isn't explosive.

Chow Sang Sang's extensive established retail store network, cultivated over 90 years, serves as a prime example of a Cash Cow within its BCG Matrix. This network, particularly its flagship stores in mature markets like Hong Kong and Mainland China, commands a significant market share and consistently generates substantial cash flow. As of the first half of 2024, the company reported continued strength in its Hong Kong operations, with retail sales showing resilience, underscoring the enduring value of its physical presence.

Despite some strategic consolidation, the core of these profitable outlets remains a formidable asset. These well-positioned stores benefit from deeply entrenched customer loyalty and a strong, recognized brand presence, allowing them to maintain high sales volumes and profit margins with relatively low investment needs. This stability is crucial for funding growth initiatives in other areas of the business.

The established watch distribution business is a cornerstone of Chow Sang Sang Holdings International, much like their jewelry offerings. This segment benefits significantly from the company's extensive retail network and established customer base, ensuring consistent sales. In 2024, it continued to be a reliable source of income, even though the watch market itself isn't experiencing explosive growth. This stability is crucial for the company's overall financial health, providing a predictable revenue stream that supports other, potentially higher-growth ventures within the Chow Sang Sang portfolio.

Wholesale of Precious Metals

The wholesale of precious metals for Chow Sang Sang Holdings International functions as a classic cash cow. This segment thrives on substantial, consistent deals with established business partners, generating predictable revenue streams. Its operational costs remain relatively lean when contrasted with the more customer-facing retail operations.

Leveraging decades of industry experience and a strong reputation, Chow Sang Sang's wholesale precious metals division commands a significant market share. This stability allows it to reliably fund other, perhaps more growth-oriented, ventures within the company's portfolio. For instance, in 2023, the company reported wholesale revenue contributing substantially to its overall financial performance, underscoring its cash-generating capacity.

- Stable Cash Flow: Large-volume, repeat transactions ensure a consistent revenue stream.

- Lower Overhead: Wholesale operations typically have fewer customer-facing expenses than retail.

- Market Dominance: Long-standing expertise supports a high market share in this segment.

- Funding Growth: Profits generated here can be reinvested in other business areas.

Securities and Futures Brokerage Services

Chow Sang Sang's securities and futures brokerage services function as a stable cash cow within their diversified business portfolio. This segment operates in a well-established financial market, characterized by significant competition from numerous domestic and international firms. While the sector’s growth might be moderate compared to emerging industries, it benefits from a consistent demand for investment and trading activities.

These services are designed to generate reliable, fee-based income, contributing a steady stream of cash flow to the parent company. The brokerage business typically relies on transaction volumes and asset under management, both of which can provide predictable revenue streams even in fluctuating market conditions. For instance, in 2023, the Hong Kong stock market saw a significant number of IPOs and secondary listings, providing a base for brokerage activities.

The stability offered by securities and futures brokerage is crucial for a conglomerate like Chow Sang Sang Holdings International. It allows the company to fund investments in its other, potentially higher-growth but also higher-risk ventures. This financial cushion is invaluable for maintaining operational stability and pursuing strategic initiatives across the group.

- Mature Market: Operates in a competitive but stable financial services sector.

- Stable Income: Generates consistent fee-based revenue from brokerage activities.

- Diversification: Provides a reliable cash flow source, balancing other business segments.

- Market Activity: Benefits from ongoing trading and investment trends in financial markets.

Chow Sang Sang's traditional gold jewelry remains a significant cash cow, underpinned by strong cultural demand and brand loyalty. Despite fluctuating gold prices, this segment consistently generates substantial revenue, as evidenced by its solid performance in 2024, where gold jewelry sales continued to be a primary income source.

The company's extensive retail network, a result of decades of expansion, also functions as a cash cow. These established stores, particularly in mature markets like Hong Kong, hold a dominant market share and produce reliable cash flow. The resilience of their Hong Kong retail sales in the first half of 2024 highlights the enduring strength of this physical presence.

The wholesale of precious metals further solidifies Chow Sang Sang's cash cow status. This division benefits from consistent, high-volume deals with business partners, leading to predictable revenue and lower operational costs compared to retail. Its substantial contribution to overall financial performance in 2023 underscores its cash-generating capacity.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Traditional Gold Jewelry | Cash Cow | Strong cultural demand, loyal customer base, high market share | Primary revenue engine, resilient despite high gold prices |

| Retail Store Network | Cash Cow | Extensive presence, established brand, strong customer loyalty | Consistent cash flow, proven resilience in mature markets |

| Wholesale of Precious Metals | Cash Cow | Large-volume deals, predictable revenue, lower overhead | Significant contributor to financial performance, supports other ventures |

Full Transparency, Always

Chow Sang Sang Holdings International BCG Matrix

The comprehensive Chow Sang Sang Holdings International BCG Matrix report you are previewing is the exact, unwatermarked document you will receive immediately after purchase. This professionally formatted analysis provides a clear strategic overview, ready for immediate implementation in your business planning. You can be confident that the full version contains no placeholder content, ensuring you get a complete and actionable BCG Matrix analysis for strategic decision-making.

Dogs

Chow Sang Sang Holdings International's underperforming physical retail stores, particularly those in Mainland China, were a significant factor in their 2024 strategy. The company reported a net closure of 74 stores during the year, a move directly linked to locations experiencing low footfall and sales. This indicates these stores held a small market share within shrinking segments of the retail landscape.

These underperforming outlets were likely acting as drains on the company's resources, failing to generate enough revenue to justify their operational costs. The decision to divest from these locations aligns with a broader strategy of 'prudent physical store network consolidation,' aimed at cutting loose these unprofitable ventures and improving overall financial efficiency.

Chow Sang Sang's traditional diamond jewelry lines are facing headwinds, as evidenced by a significant decline in same-store sales for gem-set jewelry. This downturn is largely attributed to a noticeable drop in diamond demand, indicating that established diamond collections are not resonating with today's consumers.

These products likely hold a low market share, a consequence of shifting consumer tastes and the increasing popularity of lab-grown diamonds, which offer a more accessible price point and ethical appeal. The company's continued investment in these older lines could be a drain on financial resources, locking up capital that could be deployed more effectively.

For instance, in the first half of 2024, Chow Sang Sang reported a 7.1% decrease in same-store sales for its Hong Kong and Macau operations, with diamond jewelry being a key underperformer. This situation suggests these traditional offerings are firmly in the Dogs quadrant of the BCG matrix, requiring strategic re-evaluation to manage inventory and potentially pivot towards more contemporary or alternative diamond offerings.

Niche or undifferentiated financial advisory services within Chow Sang Sang Holdings International would likely reside in the 'Dogs' quadrant of the BCG matrix. These are services that haven't found a strong market footing or haven't managed to stand out from competitors. Consequently, they experience low client engagement and contribute very little to profits, acting as a drain on the company's financial services division.

The reported 35% decline in revenue from 'other businesses' in 2023 is a strong indicator that some of these less successful advisory services might be included in this segment. This downturn suggests a struggle to attract and retain clients for these particular offerings, potentially leading to their underperformance.

Less Popular or Seasonal Jewelry Designs

Certain jewelry designs at Chow Sang Sang Holdings International, particularly those tied to very specific seasonal trends or niche cultural celebrations, might fall into the 'dog' category of the BCG matrix. These items typically see a surge in interest only during their particular event, failing to maintain consistent sales throughout the rest of the year. For instance, collections exclusively designed for a particular Lunar New Year zodiac animal or a very localized festival might not resonate with a broader customer base beyond that short window. This leads to a low market share and minimal contribution to the company's overall revenue, necessitating careful inventory control.

These less popular or seasonal designs often struggle to gain traction, resulting in a low market share and slow sales growth. By the end of 2023, Chow Sang Sang Holdings International reported a slight decrease in overall sales compared to the previous year, underscoring the challenge of managing diverse product lines. Products that don't adapt well to broader market demands or evolving fashion trends become stagnant inventory, tying up capital and warehouse space. This makes them prime candidates for the dog quadrant, requiring strategic decisions regarding their future.

Consider these points for less popular or seasonal jewelry designs:

- Limited Appeal: Designs heavily reliant on specific, short-lived trends or cultural events may have a restricted customer base, hindering consistent sales.

- Low Market Share: These products typically occupy a small segment of the market and do not drive significant revenue for the company.

- Inventory Risk: Holding stock of seasonal items outside their peak periods can lead to obsolescence and increased carrying costs, impacting profitability.

- Strategic Review: Chow Sang Sang may need to evaluate the ongoing viability of these designs, potentially phasing them out or redesigning them to appeal to a wider audience to improve their market position.

Inefficient Legacy IT Systems and Infrastructure

While Chow Sang Sang Holdings International is actively investing in upgrading its technology, certain older, inefficient legacy IT systems and infrastructure continue to pose challenges. These systems, often costly to maintain and unable to support current business requirements, can be categorized as 'dogs' within the BCG Matrix framework when evaluating operational efficiency.

These legacy systems exhibit low internal adoption rates, meaning they are not widely utilized or integrated across the company's operations, effectively giving them a low 'market share' in terms of internal impact. Simultaneously, their high maintenance costs drain resources that could otherwise be allocated to more strategic initiatives, thereby hindering the company's overall agility and responsiveness to market changes.

- High Maintenance Costs: For instance, in 2024, IT maintenance for legacy systems can represent a significant portion of a company's IT budget, often exceeding 60-80% of the total spend, as reported by industry analyses.

- Low Internal Adoption: The limited integration and usability of these systems result in a low 'market share' within the organization, as employees often bypass them for more efficient, albeit unofficial, workarounds.

- Hindered Agility: The inability of these outdated systems to support modern business processes, such as real-time data analytics or seamless omnichannel customer experiences, directly impedes Chow Sang Sang's ability to adapt quickly to evolving market demands and competitive pressures.

Certain jewelry designs at Chow Sang Sang Holdings International, particularly those tied to very specific seasonal trends or niche cultural celebrations, might fall into the 'dog' category of the BCG matrix. These items typically see a surge in interest only during their particular event, failing to maintain consistent sales throughout the rest of the year. For instance, collections exclusively designed for a particular Lunar New Year zodiac animal or a very localized festival might not resonate with a broader customer base beyond that short window, leading to a low market share and minimal contribution to the company's overall revenue. By the end of 2023, Chow Sang Sang Holdings International reported a slight decrease in overall sales compared to the previous year, underscoring the challenge of managing diverse product lines that don't adapt well to broader market demands or evolving fashion trends, becoming stagnant inventory that ties up capital.

Question Marks

Chow Sang Sang Holdings International is strategically exploring new geographic markets where its brand presence is currently minimal, indicating low penetration. These initiatives represent opportunities in regions with strong projected growth potential. For instance, while specific recent entries for 2024 are still unfolding, the company has historically shown interest in expanding its footprint in Southeast Asia, a region with a burgeoning middle class and increasing demand for branded jewelry.

These new market ventures are categorized as Question Marks within the BCG matrix, signifying their uncertain future. They necessitate substantial initial investments in building brand awareness through targeted marketing campaigns and developing essential retail infrastructure. The success of these endeavors hinges on effectively capturing market share from established competitors and adapting to local consumer preferences.

For example, if Chow Sang Sang were to enter a new market like Vietnam in 2024, the initial investment in setting up flagship stores and comprehensive digital marketing would be considerable. The company would need to understand local purchasing power and fashion trends, which differ significantly from its core markets.

The company’s performance in these nascent markets requires diligent oversight. Key performance indicators such as customer acquisition cost, brand recall, and initial sales volume will be critical in assessing progress and making informed decisions about continued investment or potential divestment.

Emerging digital-only jewelry brands or sub-brands represent Chow Sang Sang's potential Question Marks. These ventures, focusing on specific online niches, are positioned in a high-growth digital market but currently hold a low market share. Significant investment in aggressive marketing and rapid product development is crucial for their ascent.

These digital-native brands need to demonstrate substantial traction to transition from Question Marks to Stars. For instance, if a new digital sub-brand achieves a 30% year-over-year online sales growth in 2024 and captures a 1% share of the online luxury jewelry market, it signals promising momentum.

Chow Sang Sang's personalized and custom jewelry services likely represent a Question Mark in the BCG matrix. While this segment is experiencing growing consumer interest for self-expression, its current market share within Chow Sang Sang's overall portfolio may be relatively small compared to their more established, mass-produced lines. This is a high-growth area, but it necessitates significant investment in advanced design technologies and specialized craftsmanship to capture a larger piece of the market.

Integration of AI for Hyper-Personalized Marketing

The integration of AI for hyper-personalized marketing is a significant opportunity for Chow Sang Sang Holdings, potentially placing it in the "Question Mark" quadrant of the BCG matrix. This advanced application of AI moves beyond operational efficiencies to directly influence customer engagement and sales conversion.

While the potential for high growth is evident, with AI-driven personalization expected to boost customer lifetime value, Chow Sang Sang’s current market share in this specific area is likely nascent. Significant investment in AI technology and data infrastructure is required to fully leverage this potential across all customer touchpoints.

For instance, in 2024, the global AI in retail market was projected to reach over $10 billion, highlighting the substantial growth trajectory. Chow Sang Sang’s ability to capture a meaningful share of this market depends on its strategic implementation and innovation in personalized marketing campaigns.

- High Growth Potential: AI enables tailored product recommendations, customized promotions, and personalized customer service, driving higher engagement and conversion rates.

- Low Current Market Share: Widespread adoption and direct revenue contribution from hyper-personalized marketing AI are likely still in early stages for the company.

- Significant Investment Required: Developing and deploying sophisticated AI algorithms and data analytics platforms necessitates substantial R&D and capital expenditure.

- Competitive Advantage: Early and effective integration can create a strong competitive edge by fostering deeper customer loyalty and brand affinity.

Expansion into New Fintech Offerings within Financial Services

Chow Sang Sang Holdings International could explore expanding into innovative fintech offerings like digital wealth management platforms or embedded finance solutions. These ventures, while in high-growth areas, would likely begin with a low market share for Chow Sang Sang.

Significant capital investment and specialized expertise would be necessary to effectively compete and achieve the necessary scale in these rapidly evolving markets. For instance, the global fintech market was valued at over $11 trillion in 2023 and is projected to grow substantially.

- Digital Wealth Management: Offering AI-driven investment advice and personalized portfolio management, targeting a younger, digitally native demographic.

- Embedded Finance: Integrating financial services, such as lending or insurance, directly into non-financial platforms, potentially within their existing retail ecosystem.

- Blockchain-based Solutions: Investigating the use of blockchain for supply chain transparency or tokenized asset management, leveraging the company's experience with precious metals.

- Data Analytics for Financial Advisory: Developing advanced analytics tools to provide deeper insights for both internal financial advisory services and potentially as a B2B offering.

Chow Sang Sang's ventures into new geographic markets, such as potential expansion in Southeast Asia during 2024, represent Question Marks. These initiatives are characterized by high growth potential but currently low market share, requiring substantial investment in brand building and infrastructure.

The company’s exploration of digital-only jewelry brands or sub-brands also falls into the Question Mark category. These online ventures operate in a high-growth digital space but need significant marketing and product development to gain traction and transition into Stars.

Personalized and custom jewelry services are another Question Mark, tapping into a growing consumer demand for self-expression. However, these segments require investment in advanced technologies and craftsmanship to compete effectively.

The integration of AI for hyper-personalized marketing is a key Question Mark, offering high growth potential but currently having a nascent market share for Chow Sang Sang. Significant investment in AI and data infrastructure is crucial for success in this area, especially considering the global AI in retail market was projected to exceed $10 billion in 2024.

BCG Matrix Data Sources

Our BCG Matrix for Chow Sang Sang Holdings International is constructed using a blend of financial disclosures, market growth data, and competitor analysis. This ensures a robust foundation for strategic evaluation.