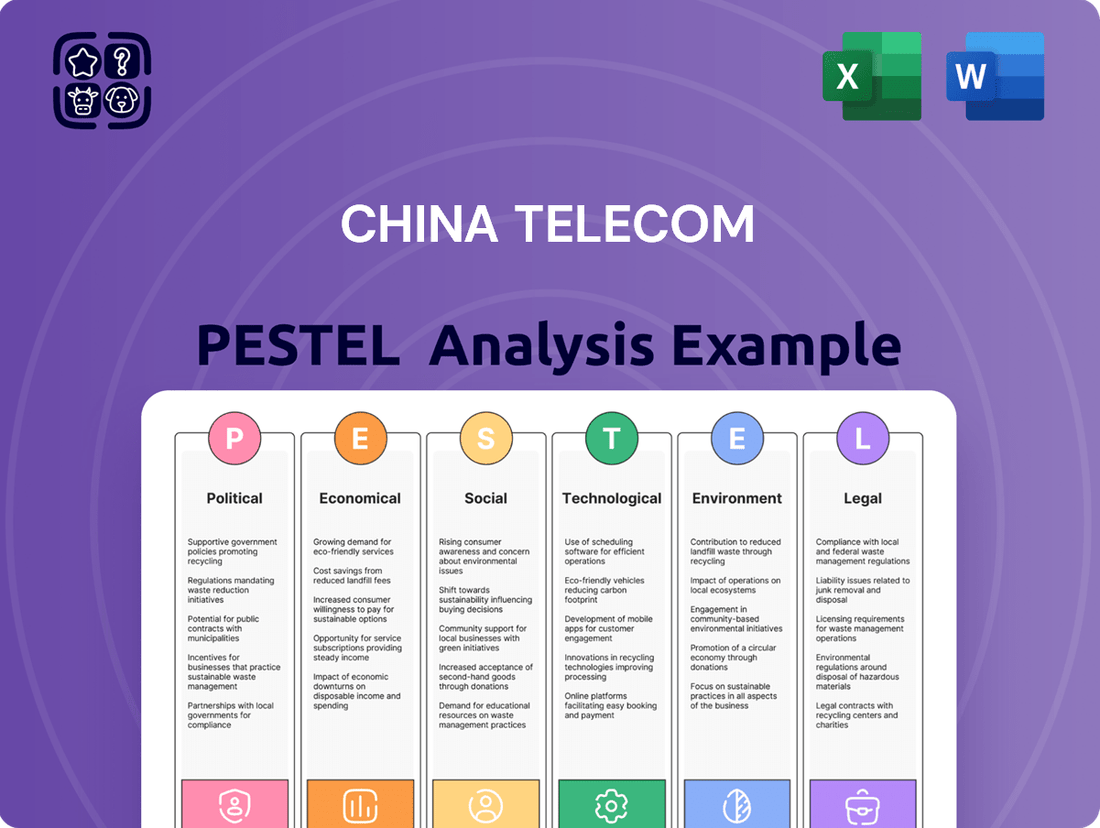

China Telecom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Telecom Bundle

Unlock the complex external forces shaping China Telecom's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for this telecommunications giant. Gain the strategic advantage you need to navigate this dynamic market—download the full report now for actionable intelligence.

Political factors

China Telecom operates as a state-owned enterprise, meaning its strategic direction is significantly shaped by the Chinese government's policies and national objectives. This close relationship ensures alignment with government initiatives, such as the ambitious digital transformation agenda. For instance, the 'Made in China 2025' strategy, which aims to upgrade China's manufacturing capabilities, directly influences China Telecom's investment in advanced network infrastructure and digital services to support these goals.

This government backing provides China Telecom with a degree of stability and preferential access to state-backed projects and funding. However, it also necessitates a constant focus on aligning its business strategies with overarching national priorities. In 2024, the Chinese government continued to emphasize the development of 5G networks and artificial intelligence, areas where China Telecom is a key player, receiving substantial state support for infrastructure build-out and research and development.

Geopolitical tensions, especially those involving the United States, present a significant risk for China Telecom. Concerns around data security and potential espionage have resulted in various international markets imposing restrictions on Chinese telecommunications firms, impacting their global expansion strategies.

These international pressures underscore the critical need for China Telecom to prioritize domestic technological self-reliance. Navigating these complex international relations while ensuring compliance and maintaining market access in key regions remains a paramount challenge for the company's strategic planning.

The Ministry of Industry and Information Technology (MIIT) maintains a firm grip on China's telecommunications sector, dictating licensing, technical standards, and the overall competitive landscape. This oversight ensures alignment with national strategic goals, impacting how companies like China Telecom operate and expand.

While there's a cautious opening of certain value-added services to foreign investment, particularly in pilot zones, the core infrastructure and major market segments remain under the strong influence of state-owned enterprises. For instance, in 2023, China Telecom reported a substantial portion of its revenue derived from these state-controlled operations, highlighting the continued dominance of domestic players.

'East-to-West Computing Resource Transfer' Initiative

China's national 'East-to-West Computing Resource Transfer' project is a major political initiative that significantly impacts China Telecom. This ambitious plan aims to build a robust computing infrastructure nationwide, effectively shifting computing power from the data-rich east to the resource-scarce west.

China Telecom is a key player in this national strategy, actively developing intelligent computing power centers and platforms. For instance, its 'Xirang' platform is designed to be a foundational element supporting the country's digital transformation and the efficient allocation of computing resources.

- National Strategy: The 'East-to-West Computing Resource Transfer' project underscores the government's focus on balanced regional development and optimizing national digital infrastructure.

- China Telecom's Role: The company is a primary implementer, building and operating the necessary data centers and network capabilities.

- Economic Impact: This initiative is expected to drive significant investment in western regions, creating new economic opportunities and modernizing infrastructure.

Policy Support for Emerging Technologies

The Chinese government's commitment to fostering technological advancement is a significant political factor for China Telecom. Policies actively encourage the development and widespread adoption of emerging technologies like 5G, artificial intelligence (AI), and the upcoming 6G. This translates into concrete targets for building out infrastructure and driving innovation across the sector.

This robust policy backing creates a highly conducive environment for China Telecom's strategic investments in these cutting-edge areas. The company's business objectives are directly aligned with the nation's broader goals for technological leadership and digital transformation.

- 5G Deployment: China had over 3.64 million 5G base stations by the end of 2023, a testament to government-backed infrastructure build-out.

- AI Integration: The government's AI development plans, including the "Next Generation Artificial Intelligence Development Plan," aim to make China a global AI innovation center by 2030.

- R&D Investment: Significant state funding is allocated to research and development in key technological fields, directly benefiting companies like China Telecom involved in these advancements.

Government policy remains the most significant political factor, with state-owned enterprises like China Telecom directly implementing national strategies. The 'East-to-West Computing Resource Transfer' project, for instance, positions China Telecom as a key builder of intelligent computing power centers nationwide, aligning with goals for balanced regional development and digital infrastructure optimization.

The ongoing emphasis on 5G and AI development, backed by substantial state investment and clear deployment targets, creates a favorable environment for China Telecom's R&D and infrastructure expansion. By the end of 2023, China had deployed over 3.64 million 5G base stations, a direct result of these government-driven initiatives.

Geopolitical tensions, particularly with the US, introduce risks by prompting international restrictions on Chinese telecom firms, impacting global expansion and underscoring the need for domestic technological self-reliance. This necessitates a strategic focus on navigating international relations while ensuring compliance and market access.

The Ministry of Industry and Information Technology (MIIT) dictates licensing and technical standards, ensuring sector alignment with national objectives and influencing China Telecom's operational strategies and market expansion.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting China Telecom's operations and strategic positioning within the Chinese market.

A concise, actionable overview of China Telecom's PESTLE factors, designed to quickly identify strategic opportunities and mitigate external threats during rapid decision-making processes.

Economic factors

China's telecommunications market stands as the world's largest, fueled by its immense population and a surging appetite for advanced services such as 5G and high-speed broadband. By the end of 2023, China had over 1.3 billion mobile subscribers, a testament to the market's scale.

The sector is on a trajectory for sustained growth, presenting China Telecom with substantial avenues for expanding its customer base and service portfolio. Projections indicate the market could reach over $250 billion by 2025, with particularly promising prospects in burgeoning fields like the Internet of Things (IoT) and artificial intelligence (AI) integration.

China Telecom is heavily investing in advanced infrastructure like 5G and fiber optics, aiming to build a robust digital backbone. This commitment extends to cutting-edge areas such as cloud computing and artificial intelligence. By 2024, China Telecom's capital expenditure was projected to be around RMB 180 billion, with a significant portion allocated to these strategic growth areas.

While overall capital spending might see some adjustments, the company is prioritizing investments in AI infrastructure and is actively exploring 6G technologies. This strategic focus underscores a move towards offering more sophisticated, higher-value services to its customer base, positioning itself for future market demands.

China Telecom has shown impressive financial resilience, reporting significant revenue growth and improved net profit. For instance, in the first half of 2024, the company's revenue reached RMB 225.2 billion, a 7.1% year-on-year increase, with net profit climbing 8.1% to RMB 30.5 billion. This performance underscores its ability to navigate a competitive market and global economic headwinds effectively.

The company's expanding subscriber base, particularly in 5G and broadband services, is a key driver of this financial strength. By the end of the first half of 2024, China Telecom had accumulated 393 million mobile subscribers, with its 5G user base reaching 279 million. This consistent user acquisition, coupled with enhanced operational efficiencies, solidifies its market leadership and capacity for sustained growth.

Impact of Digital Transformation on Industries

China Telecom is well-positioned to capitalize on the pervasive digital transformation sweeping across Chinese industries, creating substantial economic growth avenues. The company's strategic focus on providing advanced Information and Communications Technology (ICT) solutions, including cutting-edge 5G applications and dedicated private networks, directly fuels the digital, intelligent, and green evolution of key sectors.

This transformation is not just theoretical; it's driving tangible economic activity. For instance, by the end of 2023, China had deployed over 3.38 million 5G base stations, a critical infrastructure component that China Telecom is instrumental in building and leveraging. This robust 5G network enables the company to offer sophisticated solutions tailored for sectors like manufacturing, where smart factories are becoming the norm, and agriculture, with precision farming techniques becoming increasingly prevalent.

The impact is evident in the increasing adoption of these technologies. China Telecom's ICT services are empowering businesses to enhance efficiency, reduce operational costs, and develop innovative products and services. This includes facilitating the growth of smart transportation systems, optimizing logistics, and improving public services through enhanced connectivity and data analytics.

- 5G Deployment: Over 3.38 million 5G base stations were operational in China by the end of 2023, a testament to the nation's commitment to digital infrastructure.

- Sectoral Transformation: China Telecom's ICT solutions are actively supporting the digital upgrade of manufacturing, agriculture, and smart transportation.

- Economic Opportunity: The ongoing digital transformation presents a significant market for China Telecom's 5G industry applications and private network services.

Competition and Market Saturation

China's mobile telecommunications market is dominated by three major state-owned players, China Telecom, China Mobile, and China Unicom, who collectively hold a substantial portion of the market share. This high concentration means intense competition for subscriber growth and revenue.

As the market approaches saturation, with mobile internet penetration rates reaching high levels, the growth trajectory is naturally slowing. For instance, by the end of 2024, it's anticipated that over 90% of China's population will be mobile internet users.

This saturation necessitates a strategic shift for operators like China Telecom. The focus is moving from acquiring new subscribers to monetizing existing ones, primarily through high-speed data services and value-added offerings. Furthermore, diversification into new revenue streams is crucial.

- Market Concentration: Three state-owned operators (China Telecom, China Mobile, China Unicom) dominate the market.

- Saturation Impact: Slowing growth in mobile internet adoption requires a focus on data monetization.

- Strategic Shift: Operators are diversifying into areas like B2B AI solutions and cloud services to drive future revenue.

- Revenue Focus: Monetizing high-speed data services is key to offsetting slower subscriber acquisition.

China's economic landscape is characterized by robust growth and a strong push towards digital transformation, directly benefiting China Telecom. The nation's commitment to developing advanced digital infrastructure, including an extensive 5G network, creates a fertile ground for the company's services. This economic environment supports increased demand for high-speed data and innovative ICT solutions across various industries.

The telecommunications sector is a significant contributor to China's GDP, with continuous investment in infrastructure driving economic activity. By the end of 2023, China had deployed over 3.38 million 5G base stations, a critical enabler for China Telecom's business. This infrastructure underpins the digital evolution of key sectors like manufacturing and smart transportation, creating substantial revenue opportunities.

China Telecom's financial performance reflects this positive economic backdrop. In the first half of 2024, the company reported revenue of RMB 225.2 billion, a 7.1% year-on-year increase, indicating strong market demand. This growth is driven by the increasing adoption of 5G and broadband services, with 279 million 5G users by mid-2024.

| Metric | Value (H1 2024) | Year-on-Year Growth |

|---|---|---|

| Revenue | RMB 225.2 billion | 7.1% |

| Net Profit | RMB 30.5 billion | 8.1% |

| Mobile Subscribers | 393 million | |

| 5G Subscribers | 279 million |

Preview Before You Purchase

China Telecom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive China Telecom PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain critical insights into market trends, regulatory landscapes, and competitive pressures shaping China Telecom's future.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of how external forces influence China Telecom's business strategy and potential growth opportunities.

Sociological factors

China boasts a staggering mobile internet penetration rate, with over 1.1 billion mobile internet users by the end of 2024. This widespread adoption signifies a deeply interconnected society, directly fueling demand for China Telecom's mobile data services.

Consumer behavior is increasingly shaped by this digital connectivity, with a significant portion of the population relying on wireless networks for everything from entertainment to essential business operations. This trend underscores the critical role of mobile internet in daily life and economic activity across China.

China's burgeoning urban centers and a steadily increasing middle class are fueling a significant appetite for high-bandwidth telecommunications. This societal shift means more people are seeking faster internet speeds for streaming, gaming, and remote work, directly impacting the demand for 5G and advanced fixed-line services.

As of early 2024, China boasted over 3.38 billion mobile internet users, with 5G connections rapidly expanding. This widespread adoption underscores the societal expectation for seamless, high-speed connectivity, pushing companies like China Telecom to continually invest in network upgrades and innovative service packages to remain competitive and satisfy evolving consumer preferences.

While China boasts impressive digital penetration, a segment of the population, especially the very young and elderly, still has limited mobile internet usage. This digital divide persists despite widespread network availability.

China Telecom is actively working to close this gap, often with government backing. Their efforts focus on extending network coverage and enhancing internet access in less connected regions, including remote and rural areas. Initiatives like deploying satellite communication and expanding fiber optic networks are key to this strategy.

By the end of 2024, China Telecom aimed to have connected over 99% of administrative villages with fiber optics, a significant step in rural broadband expansion.

Social Impact of AI and IoT Adoption

The pervasive integration of AI and IoT is fundamentally altering China's social fabric. These technologies are not just tools; they are actively reshaping how people communicate, the nature of work, and the rhythm of daily life. By 2024, China's digital economy was projected to reach $7.4 trillion, underscoring the profound societal impact of these advancements.

China Telecom's strategic investments in AI model development and the expansion of its IoT solutions for businesses are key drivers of this transformation. These initiatives are enabling novel service applications and accelerating digital modernization across diverse sectors, from smart cities to personalized healthcare.

- Reshaping Daily Life: AI-powered smart home devices and IoT-enabled services are becoming increasingly commonplace, influencing consumer behavior and creating new expectations for convenience and efficiency.

- Transforming Workforces: The adoption of AI and IoT is leading to automation in many industries, necessitating workforce reskilling and creating new job categories focused on technology management and data analysis.

- Enhancing Connectivity: China's commitment to expanding its 5G network, a critical enabler for IoT, reached over 3.3 million 5G base stations by the end of 2023, directly impacting communication patterns and access to information.

Consumer Behavior and Digital Lifestyles

Consumer habits in China are rapidly evolving, with smartphones becoming central to daily life. In 2024, it's estimated that over 80% of China's internet users access the web primarily through mobile devices, driving demand for robust data services. This digital immersion fuels online entertainment consumption and a significant increase in digital transactions, from e-commerce to mobile payments, underscoring the need for reliable, high-speed connectivity.

This profound shift towards digital lifestyles directly impacts China Telecom's strategic direction. The company is focusing on developing and promoting premium 5G plans to meet the escalating demand for faster data transfer and lower latency, essential for immersive online experiences. Furthermore, integrating artificial intelligence (AI) into user interfaces and services is becoming a key differentiator, aiming to provide more personalized and seamless digital interactions.

- Smartphone Penetration: Over 80% of Chinese internet users rely on smartphones for online access as of 2024.

- Digital Transactions: Mobile payments and e-commerce continue to surge, driven by smartphone adoption.

- 5G Adoption: China Telecom is investing heavily in 5G infrastructure to cater to the growing demand for high-speed mobile data.

The increasing reliance on smartphones for daily activities, from communication to commerce, has solidified mobile internet as a fundamental utility in China. By the close of 2024, China's mobile internet user base surpassed 1.1 billion, a testament to this societal integration.

This digital immersion drives a strong demand for high-speed data services, pushing China Telecom to prioritize 5G expansion and innovative service offerings to meet evolving consumer expectations for seamless connectivity and engaging digital experiences.

The growing middle class and urbanization further amplify the need for advanced telecommunications, as more individuals seek faster internet for streaming, remote work, and digital entertainment.

| Sociological Factor | Description | Impact on China Telecom |

|---|---|---|

| Digital Connectivity | Over 1.1 billion mobile internet users by end of 2024; 5G connections rapidly expanding. | Drives demand for mobile data and advanced services; necessitates network investment. |

| Urbanization & Middle Class Growth | Growing urban centers and middle class. | Increases demand for high-bandwidth services like 5G and fiber optics. |

| Digital Lifestyle Evolution | Over 80% of internet users access via mobile (2024); surge in digital transactions. | Fuels demand for premium data plans and AI-integrated services; requires focus on user experience. |

| AI & IoT Integration | Digital economy projected at $7.4 trillion (2024); AI and IoT reshaping communication and work. | Drives investment in AI development and IoT solutions; enables new service applications. |

Technological factors

China Telecom is a major player in the global 5G landscape, actively developing and co-sharing what is recognized as the world's largest 5G network. As of early 2024, the company had already established a substantial footprint, with reports indicating hundreds of thousands of 5G base stations in operation, underscoring its commitment to widespread coverage.

The strategic focus is now pivoting towards 5G-Advanced, the next evolution of 5G technology, and its commercial rollout. This advancement promises to deliver even more robust connectivity, higher speeds, and lower latency, paving the way for innovative applications across various sectors and reinforcing China Telecom's position as a technological frontrunner.

China Telecom is heavily investing in advanced technologies, notably cloud computing and artificial intelligence. This strategic focus is evident in their development of sophisticated platforms and solutions aimed at driving digital transformation for businesses.

The company has introduced its proprietary 'Xingchen' AI system, underscoring its commitment to AI innovation. Furthermore, China Telecom is actively building AI models and comprehensive solutions tailored for enterprise clients, seeking to capitalize on the growing demand for intelligent services.

Leveraging the synergy of cloud and network integration, China Telecom aims to unlock new service opportunities and enhance its competitive edge. This technological push is crucial for supporting the digital evolution of various industries within China.

China Telecom is heavily invested in 6G research, exploring core technologies to position itself for the next wave of telecommunication infrastructure. This strategic R&D aims to secure future market leadership and sustainable growth, with early-stage trials anticipated before 2028.

Satellite Communication and Direct-to-Phone Services

China Telecom is actively developing its satellite communication capabilities, including direct-to-phone services. This strategic move aims to extend connectivity to underserved and remote regions, a critical step in bridging China's digital divide. By 2024, China's satellite internet market was projected to reach approximately $2.5 billion, highlighting the significant growth potential.

These advancements are not just about expanding reach; they represent a commitment to robust and ubiquitous network coverage. The company's investment in satellite technology positions it to offer seamless communication solutions even in areas where traditional terrestrial networks are not feasible.

- Expanding Coverage: Direct-to-phone satellite services enable connectivity in mountainous, rural, and maritime areas.

- Bridging the Digital Divide: This technology provides essential internet access to populations previously excluded from digital services.

- Market Growth: The increasing demand for reliable connectivity in all terrains fuels the expansion of satellite communication services.

Cybersecurity and Data Security Technologies

Cybersecurity and data security are critical for China Telecom's operations, given the increasing digitization of services and the growing threat landscape. The company must continually invest in advanced security technologies to safeguard its network infrastructure and sensitive customer data against sophisticated cyberattacks.

China Telecom's commitment to security is underscored by its ongoing investments. For instance, in 2023, the company emphasized its dedication to building a robust cybersecurity defense system, allocating significant resources to advanced threat detection and prevention tools. This proactive approach is essential as data privacy regulations, such as China's Personal Information Protection Law (PIPL), impose stringent requirements on data handling and security, with potential penalties for non-compliance.

- Increased Investment: China Telecom is expected to continue its substantial investments in cutting-edge cybersecurity solutions throughout 2024 and 2025.

- Regulatory Compliance: Adherence to evolving data privacy laws, like PIPL, necessitates advanced security protocols to protect customer information.

- Threat Mitigation: The company must deploy technologies capable of identifying and neutralizing emerging cyber threats, including ransomware and advanced persistent threats (APTs).

Technological advancements are central to China Telecom's strategy, with a strong emphasis on 5G and its evolution to 5G-Advanced, aiming for enhanced speeds and lower latency. The company is also heavily investing in cloud computing and artificial intelligence, developing proprietary AI systems like 'Xingchen' to drive digital transformation for businesses.

Further pushing technological boundaries, China Telecom is actively engaged in 6G research, anticipating early-stage trials before 2028. The company is also expanding its satellite communication capabilities, including direct-to-phone services, to reach underserved areas, a market projected to reach approximately $2.5 billion by 2024.

Cybersecurity remains a paramount concern, with significant investments in advanced defense systems to protect its infrastructure and customer data, especially in light of stringent regulations like China's Personal Information Protection Law (PIPL).

China Telecom's technological trajectory is marked by its leadership in 5G deployment, with hundreds of thousands of base stations operational by early 2024, and a forward-looking approach to 5G-Advanced and 6G research.

Legal factors

China's legal landscape for data security and privacy is robust and continually developing. Key legislation like the Cybersecurity Law (CSL), Data Security Law (DSL), and the Personal Information Protection Law (PIPL) impose strict obligations on companies like China Telecom regarding data handling and storage.

Compliance with these laws, including the Network Data Security Management Regulations, is critical for China Telecom. These regulations mandate secure data practices and govern cross-border data transfers, impacting operational strategies and international business dealings.

China's Anti-Monopoly Law, particularly its recent amendments targeting large tech firms and digital platforms, significantly shapes the competitive landscape for telecommunications. These regulations are designed to curb monopolistic behaviors and foster a fairer market environment, impacting how companies like China Telecom operate.

The State Administration for Market Regulation (SAMR) has been actively enforcing these rules, with significant fines levied against major tech players in 2021 and 2022 for anti-competitive practices. This regulatory push ensures that China Telecom navigates a market where fair competition is prioritized, influencing its strategies for service offerings and market expansion.

China's telecom sector, traditionally tightly regulated, is seeing a pilot program in specific zones that allows for relaxed foreign investment rules in select value-added services. This cautious liberalization signals a potential shift, opening avenues for international collaboration and market penetration.

For China Telecom, this evolving regulatory environment necessitates strategic adaptation to navigate new competitive dynamics and potential partnership opportunities arising from this gradual market opening.

Compliance with Industry-Specific Regulations

China Telecom navigates a stringent regulatory landscape governed by the Ministry of Industry and Information Technology (MIIT). These regulations extend beyond general data and cybersecurity mandates, encompassing critical areas like service quality standards, pricing structures, and the pace of network development, including 5G deployment. Adherence to these industry-specific rules directly impacts operational costs and shapes strategic planning, requiring significant investment in compliance and infrastructure upgrades.

The company's compliance efforts are substantial, with the MIIT continuously updating directives. For instance, in 2024, the MIIT emphasized enhanced network security protocols and consumer protection measures, necessitating ongoing adjustments to China Telecom's operational frameworks. These regulatory demands can influence capital expenditure decisions, as the company must allocate resources to meet evolving technical and service benchmarks set by the government.

- MIIT Oversight: The Ministry of Industry and Information Technology sets and enforces regulations for telecommunications services in China.

- Key Regulatory Areas: Compliance covers service quality, pricing, network expansion (e.g., 5G), and licensing.

- Impact on Operations: Adherence incurs significant compliance costs and influences strategic investment in technology and infrastructure.

- Evolving Standards: Ongoing updates to regulations, such as those in 2024 concerning network security and consumer protection, require continuous adaptation.

Law on Combating Telecom and Online Fraud

China's 'Law on Combating Telecom and Online Fraud,' enacted in September 2022, places significant obligations on Internet Service Providers (ISPs) like China Telecom. This legislation mandates stringent user identity validation and the immediate suspension of accounts implicated in fraudulent activities. For instance, in 2023, authorities reported blocking over 2.2 million suspected fraudulent phone numbers and suspending more than 1.4 million related accounts, underscoring the law's active enforcement.

These legal mandates directly shape China Telecom's operational procedures, compelling enhanced customer verification processes to comply with anti-fraud measures. The law aims to bolster network security and safeguard consumers, influencing how China Telecom manages user data and monitors network traffic for suspicious patterns.

- Stricter User Verification: China Telecom must implement robust identity checks for all new and existing users to prevent the creation of fraudulent accounts.

- Account Suspension Protocols: The company is legally required to have swift procedures in place to suspend accounts identified as being involved in or facilitating fraud.

- Enhanced Network Monitoring: Compliance necessitates investment in technologies and processes for monitoring network activity to detect and report fraudulent behavior.

China's legal framework for data security and privacy, including the Cybersecurity Law, Data Security Law, and Personal Information Protection Law, imposes strict data handling and cross-border transfer requirements on China Telecom. The nation's Anti-Monopoly Law, with its recent amendments targeting digital platforms, also influences the competitive landscape, with regulators like SAMR actively enforcing rules against anti-competitive practices, as seen in significant fines levied in 2021-2022.

The Ministry of Industry and Information Technology (MIIT) sets and enforces specific telecom regulations covering service quality, pricing, and network development, such as 5G deployment. In 2024, the MIIT emphasized enhanced network security and consumer protection, necessitating ongoing operational adjustments and capital expenditure for China Telecom.

Furthermore, the 'Law on Combating Telecom and Online Fraud,' enacted in September 2022, mandates stringent user identity validation and account suspension for fraudulent activities, with authorities blocking over 2.2 million fraudulent numbers and suspending 1.4 million accounts in 2023, directly impacting China Telecom's operational procedures.

| Legal Area | Key Legislation/Regulation | Impact on China Telecom | Relevant Data/Enforcement Example |

|---|---|---|---|

| Data Security & Privacy | CSL, DSL, PIPL | Strict data handling, storage, and cross-border transfer obligations. | Ongoing compliance investments required. |

| Competition | Anti-Monopoly Law (amended) | Navigating market regulations to prevent monopolistic behavior. | SAMR fines in 2021-2022 against tech firms highlight enforcement. |

| Telecom Operations | MIIT Directives | Adherence to service quality, pricing, and network development standards. | 2024 focus on network security and consumer protection. |

| Fraud Prevention | Law on Combating Telecom and Online Fraud (2022) | Mandatory user verification and account suspension for fraud. | 2.2M+ fraudulent numbers blocked in 2023. |

Environmental factors

The burgeoning demand for data and the rollout of advanced technologies like 5G are significantly increasing the energy footprint of telecommunications infrastructure. This trend presents a critical environmental challenge, demanding innovative solutions for sustainable operations.

China Telecom is proactively tackling this issue by leveraging Artificial Intelligence (AI) to optimize energy consumption across its extensive network and data center operations. This strategic integration aims to drive down operational costs and reduce the company's environmental impact.

By implementing AI-driven efficiency measures, China Telecom seeks to enhance the energy performance of its cloud services and network infrastructure, aligning with global sustainability goals and regulatory pressures. For instance, in 2023, China's telecom industry consumed approximately 370 billion kilowatt-hours of electricity, with a significant portion attributed to network equipment.

China Telecom is strongly aligned with China's ambitious 'Dual Carbon' targets, aiming for carbon peaking before 2030 and carbon neutrality by 2060. This commitment translates into tangible actions across its operations.

The company's 'green cloud-network' strategy is central to its environmental efforts. By prioritizing co-building and co-sharing infrastructure, China Telecom significantly reduces redundant energy consumption and associated greenhouse gas emissions. This approach is crucial for achieving national climate goals.

Energy efficiency measures are also a key focus. China Telecom actively optimizes its energy consumption patterns and explores cleaner energy sources to power its extensive network and data centers. This includes investments in renewable energy to support its growing digital infrastructure.

China Telecom is actively promoting a circular economy by focusing on resource recycling and the efficient management of waste. This includes initiatives to reduce electronic waste and reuse materials from network infrastructure, contributing to a more sustainable operational model.

The company is also prioritizing water conservation, with efforts to strengthen the management of water demand and utilization across its facilities. This focus aligns with China's national environmental goals and demonstrates a commitment to responsible resource management.

Green Technology Innovation

China Telecom is actively investing in green technology innovation, focusing on smart energy-saving solutions for its infrastructure. This includes developing advanced technologies for base stations and facility rooms to significantly reduce energy consumption.

The company's 'AI+' initiative is a key driver, integrating artificial intelligence across green construction, operations, and empowerment strategies. This approach is designed to yield substantial energy savings and reduce carbon emissions.

- AI-driven energy efficiency: China Telecom's AI+ strategy targets a reduction in energy consumption for its network operations.

- Smart base stations: Investments are being made in intelligent, energy-saving technologies for base station sites.

- Carbon reduction goals: The company aims to achieve significant carbon emission reductions through these green technology advancements.

- Green construction and operations: AI is being applied to optimize energy use in both the building and ongoing management of facilities.

Climate Change Risk and Opportunity Management

China Telecom is actively enhancing its approach to managing climate change risks and opportunities. This involves developing proactive strategies to tackle environmental challenges and embedding climate change mitigation into its core development plans, reflecting a strong adherence to environmental protection laws and regulations.

The company's commitment is underscored by its ongoing efforts to integrate climate considerations into its business framework. For instance, in 2023, China Telecom reported a 12.5% reduction in its carbon emission intensity compared to its 2020 baseline, a tangible step in its sustainability journey.

- Focus on Green Infrastructure: China Telecom is investing in energy-efficient data centers and network infrastructure, aiming to reduce its operational carbon footprint.

- Renewable Energy Adoption: The company is increasing its use of renewable energy sources for its facilities, with a target of sourcing 30% of its electricity from renewables by 2025.

- Climate Risk Assessment: Regular assessments are conducted to identify and quantify potential physical and transitional risks associated with climate change, informing strategic planning.

- Opportunity Identification: China Telecom is exploring opportunities in green ICT solutions and digital transformation services that support its clients' sustainability goals.

China Telecom is actively addressing the environmental impact of its expanding digital infrastructure, driven by increasing data demand and 5G deployment. The company's commitment to China's 'Dual Carbon' targets, aiming for carbon peaking before 2030 and carbon neutrality by 2060, is a core strategic driver.

The company is implementing a 'green cloud-network' strategy, emphasizing infrastructure sharing to reduce redundant energy consumption and emissions. Furthermore, China Telecom is investing in AI-driven energy efficiency solutions, particularly for its network operations and data centers, to optimize power usage.

In 2023, China Telecom reported a 12.5% reduction in its carbon emission intensity compared to a 2020 baseline, demonstrating progress towards its sustainability goals. The company also aims to source 30% of its electricity from renewables by 2025, signaling a significant shift towards cleaner energy sources.

| Environmental Initiative | Key Action | Target/Status | Impact |

|---|---|---|---|

| Energy Efficiency | AI-driven optimization of network and data centers | Ongoing | Reduced operational costs and carbon footprint |

| Renewable Energy Adoption | Increasing use of solar and wind power | 30% of electricity by 2025 | Lower reliance on fossil fuels |

| Carbon Emission Intensity | Reduction initiatives | 12.5% reduction from 2020 baseline (as of 2023) | Progress towards carbon neutrality |

| Circular Economy | Resource recycling and waste management | Ongoing | Reduced electronic waste and material reuse |

PESTLE Analysis Data Sources

Our China Telecom PESTLE Analysis is meticulously constructed using data from official Chinese government ministries, leading economic and technology research firms, and international financial institutions. This comprehensive approach ensures that political, economic, social, technological, legal, and environmental insights are grounded in credible, current information.