China Telecom Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Telecom Bundle

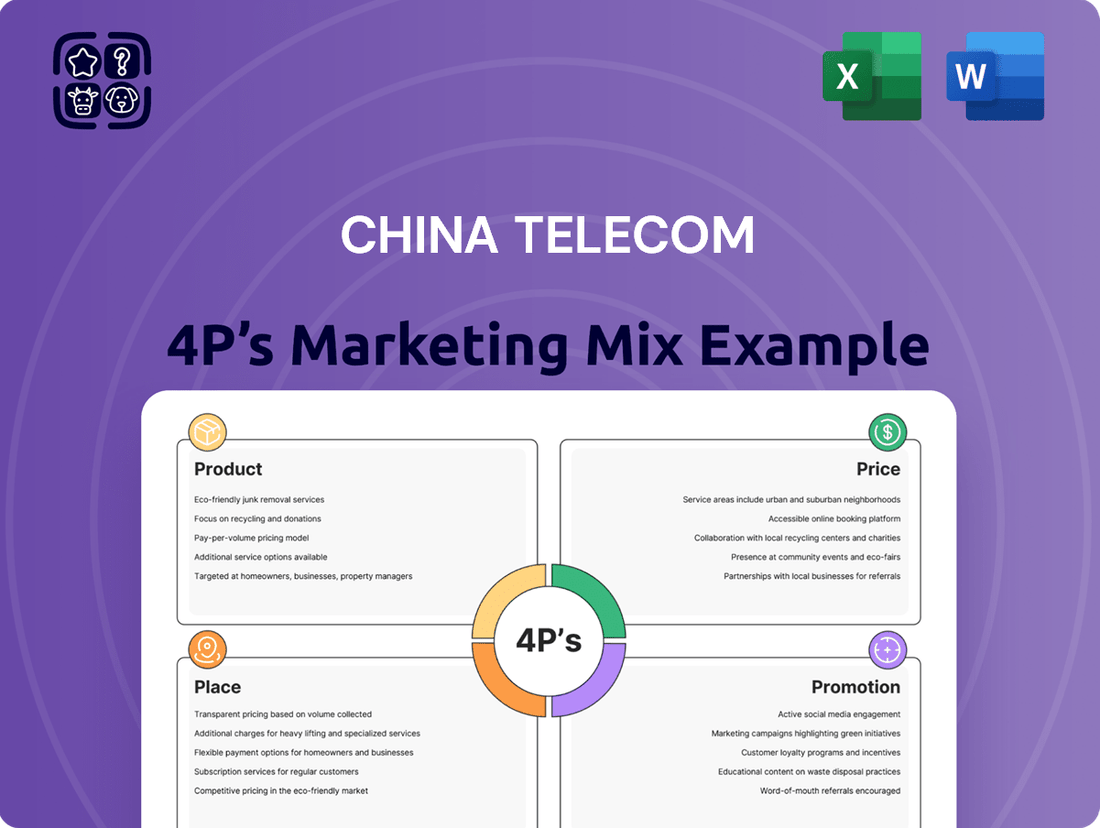

China Telecom's marketing success is built on a robust 4Ps strategy, from its diverse product offerings and competitive pricing to its extensive distribution network and impactful promotional campaigns. Understanding these elements is crucial for anyone looking to navigate the telecommunications landscape.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering China Telecom's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

China Telecom's product strategy encompasses a broad spectrum of telecommunication services, notably fixed-line telephony, mobile communications, and broadband internet. These core offerings are designed to serve a diverse customer base, from individual households to major corporations, solidifying their position in the market.

The company actively invests in service enhancement, demonstrated by its transition to 5G technology and the ongoing expansion of its high-speed optical fiber infrastructure. This commitment to technological advancement ensures they remain competitive, with China Telecom reporting over 250 million broadband users by the end of 2024.

China Telecom is aggressively expanding its 5G footprint, targeting substantial subscriber increases and enhancing 5G messaging services. By the end of 2024, China had over 3.38 million 5G base stations, with China Telecom a major contributor to this infrastructure.

The company is also a pioneer in rolling out 5G-Advanced (5G-A), exploring innovative applications such as real-time screen sharing and interactive gaming within voice calls. This strategic push underscores China Telecom's dedication to leading the evolution of mobile communication technologies.

China Telecom's Product strategy heavily emphasizes its Cloudification and Digital Transformation initiatives, with Tianyi Cloud serving as a central pillar. This offering provides a comprehensive suite of public, private, and hybrid cloud solutions designed to meet diverse enterprise needs.

Tianyi Cloud boasts impressive adoption, supporting over 2 million enterprise users worldwide, underscoring its market reach and the demand for its services. This extensive user base highlights China Telecom's success in delivering scalable and reliable cloud infrastructure.

The company is actively accelerating its intelligent computing infrastructure upgrades, a critical component of its product development. By integrating advanced cloud-network capabilities, China Telecom aims to provide seamless and powerful digital transformation solutions across numerous industries.

AI-Powered s and Solutions

China Telecom is significantly advancing its product strategy by embedding AI across its offerings. This includes developing operator-customized AI phones, a move that directly addresses consumer demand for smarter devices. The company is also investing heavily in foundational AI infrastructure, evidenced by its work on building core AI models and developing a substantial ecosystem of over 80 industry-specific large models.

These AI-driven products and solutions are designed to deliver tangible benefits. For consumers, this means an enhanced user experience with more intuitive and personalized services. On the operational side, AI is being used to optimize network performance and efficiency, a critical factor for a telecommunications giant. Furthermore, China Telecom's focus on industry-specific models underscores its commitment to driving digital transformation across various sectors, aiming to boost productivity and innovation.

- AI Integration: China Telecom is actively incorporating AI into its product lines, from consumer devices to enterprise-level solutions.

- Customized AI Phones: The release of operator-customized AI phones highlights a strategic push to provide tailored smart device experiences.

- Large Model Development: The company's creation of over 80 industry-specific large AI models demonstrates a broad commitment to specialized AI applications.

- Digitalization Drive: These AI initiatives are geared towards improving user experience, optimizing network operations, and accelerating industrial digitalization.

ICT and Industrial Digitalization Offerings

China Telecom extends beyond basic connectivity, offering robust Information and Communication Technology (ICT) solutions. These include advanced services in big data analytics, cybersecurity, quantum technology, and comprehensive digital platforms, catering to the evolving needs of modern businesses.

The company has a significant footprint in industrial digitalization, having completed over 36,000 5G industry application projects. This extensive deployment highlights their commitment to driving innovation across various sectors.

Serving thousands of clients with industry-specific private networks, China Telecom is a key enabler of digital transformation. Their ICT and digitalization offerings are instrumental in fostering intelligent and green advancements for a wide array of industries.

- 5G Industry Projects: Over 36,000 completed application projects.

- Private Network Clients: Thousands of enterprise clients served.

- Key Technologies: Big data, security, quantum, and digital platforms.

- Strategic Goal: Empowering digital, intelligent, and green transformation.

China Telecom's product portfolio is a dynamic blend of core connectivity and advanced digital solutions. This includes a vast array of mobile, broadband, and fixed-line services, complemented by a strong push into cloud computing through its Tianyi Cloud platform, which serves over 2 million enterprise users.

The company is heavily invested in next-generation technologies, notably 5G and 5G-Advanced, aiming to enhance user experience and create new service paradigms like interactive gaming within calls. By the end of 2024, China Telecom was a significant contributor to China's over 3.38 million 5G base stations.

Furthermore, China Telecom is embedding AI across its offerings, developing customized AI phones and building foundational AI infrastructure with over 80 industry-specific large models. This strategic integration aims to boost consumer experience and drive industrial digitalization, evidenced by over 36,000 5G industry application projects completed.

| Product Category | Key Offerings | 2024/2025 Data Points |

|---|---|---|

| Connectivity | Mobile, Fixed-line, Broadband | Over 250 million broadband users (end of 2024) |

| 5G Services | 5G Network, 5G-Advanced | Major contributor to over 3.38 million 5G base stations (end of 2024) |

| Cloud & ICT | Tianyi Cloud, Big Data, Cybersecurity | Over 2 million enterprise users for Tianyi Cloud |

| AI Integration | AI Phones, Industry Large Models | Over 80 industry-specific large AI models developed |

| Industrial Digitalization | 5G Industry Applications, Private Networks | Over 36,000 5G industry application projects completed |

What is included in the product

This analysis provides a comprehensive examination of China Telecom's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It offers a deep dive into China Telecom's marketing positioning, ideal for professionals seeking to understand its competitive landscape and benchmark their own strategies.

Simplifies complex China Telecom marketing strategies into actionable 4Ps insights, alleviating the pain of strategic ambiguity for executive teams.

Provides a clear, concise overview of China Telecom's 4Ps, resolving the challenge of communicating intricate marketing plans to diverse stakeholders.

Place

China Telecom boasts a truly massive network, a cornerstone of its marketing strategy. They operate the world's largest LTE-FDD network, a significant achievement. This extensive infrastructure is key to reaching customers everywhere in China.

Their commitment to advanced technology is evident with their shared 5G SA, NB-IoT, and gigabit optical fiber networks. This widespread coverage, reaching from bustling cities to remote villages, is crucial for their distribution effectiveness. By 2024, China Telecom had already deployed over 3.3 million 5G base stations nationwide, underscoring their rapid expansion.

China Telecom operates an extensive network of physical retail stores and service centers across China. As of late 2023 and early 2024, the company maintained tens of thousands of such outlets, providing essential touchpoints for customers. These locations are crucial for direct sales of mobile plans, broadband services, and the latest devices, alongside offering vital technical support and customer service.

These brick-and-mortar establishments are instrumental in fostering customer relationships and addressing diverse needs, from initial plan sign-ups to troubleshooting complex technical issues. They offer a tangible presence, allowing for personalized consultations and demonstrations, which remain highly valued by a significant portion of China's vast consumer base. This in-person interaction is key to both acquiring new customers and ensuring the loyalty of existing ones in a competitive telecommunications landscape.

China Telecom actively utilizes its official website and a range of online platforms to promote its services, facilitate subscriptions, and offer robust customer self-service options. This digital ecosystem is crucial for their marketing mix, providing a convenient avenue for customers to discover new plans, manage their accounts, and access support without physical interaction.

The company's strategic focus on e-commerce, particularly evident in its increasing digital sales figures, underscores a commitment to enhancing online accessibility and driving transactions through digital channels. For instance, in the first half of 2024, China Telecom reported a significant year-on-year increase in its digital channel sales, contributing to its overall revenue growth.

Direct Enterprise and Government Sales

China Telecom leverages dedicated sales forces for direct engagement with major enterprises and government bodies, focusing on their industrial digitalization and Information and Communication Technology (ICT) solutions. This direct sales strategy is crucial for fostering tailored solutions and building robust client relationships within key sectors such as finance, energy, and public services.

This B2B focus is a significant driver of their market penetration. For instance, in 2023, China Telecom's government and enterprise business revenue grew by 11.8% year-on-year, reaching RMB 230.1 billion, highlighting the importance of this segment. Their offerings are designed to meet the specific, often complex, needs of these large organizations.

- Dedicated Sales Teams: Specialized teams for large enterprise and government accounts.

- Tailored Solutions: Custom ICT and digitalization offerings for specific client needs.

- Key Sectors Served: Finance, energy, transportation, and public services are primary targets.

- Revenue Contribution: Government and enterprise business accounted for a substantial portion of their 2023 revenue, demonstrating strong B2B market performance.

Strategic Ecosystem Partnerships

China Telecom strategically cultivates partnerships with both domestic and international Original Equipment Manufacturers (OEMs) and technology firms. This approach is crucial for broadening its product ecosystem and extending the reach of its services across various platforms and devices.

These collaborations are instrumental in embedding China Telecom's offerings into a more extensive array of hardware and software solutions, thereby boosting market penetration. For instance, in 2024, China Telecom announced collaborations with several leading smartphone manufacturers to pre-install its 5G services and applications, aiming to capture a larger share of the rapidly growing 5G user base.

Furthermore, these alliances are vital for pioneering next-generation technologies. China Telecom is actively engaged with partners to develop and integrate advanced solutions, including AI-powered devices and the upcoming 5G-Advanced (5G-A) network capabilities. These joint efforts are expected to drive innovation and create new revenue streams in the evolving telecommunications landscape.

- OEM Collaborations: Partnerships with companies like Huawei and Xiaomi to integrate China Telecom's 5G services into their latest smartphone models.

- Technology Integration: Joint development projects with AI and IoT specialists to create smarter, connected devices leveraging China Telecom's network infrastructure.

- Ecosystem Expansion: Collaborations with cloud service providers and content platforms to offer bundled services, enhancing customer value and retention.

- 5G-A Development: Strategic alliances with network equipment vendors to test and deploy 5G-A technologies, aiming for enhanced speed and capacity.

China Telecom's extensive physical presence is a key element of its "Place" strategy. They operate tens of thousands of retail stores and service centers across China, serving as crucial points of sale and customer support. This widespread network ensures accessibility for customers seeking mobile plans, broadband, and devices, facilitating both acquisition and retention through direct interaction.

The company also heavily relies on its digital channels, including its official website and various online platforms. These digital touchpoints allow for convenient service promotion, subscription management, and self-service options, significantly enhancing customer reach and transaction efficiency. In the first half of 2024, digital channel sales saw a notable year-on-year increase, bolstering overall revenue.

Furthermore, China Telecom employs dedicated sales teams to engage directly with enterprises and government bodies, offering tailored ICT and digitalization solutions. This B2B focus is a significant growth driver, with their government and enterprise business revenue growing by 11.8% in 2023. Strategic partnerships with OEMs and technology firms also expand their service reach and drive innovation.

| Channel | Key Features | 2023/2024 Data Points |

|---|---|---|

| Physical Retail | Direct sales, customer service, technical support | Tens of thousands of outlets nationwide |

| Digital Platforms | Online sales, account management, self-service | Significant year-on-year increase in digital sales (H1 2024) |

| Direct Sales (B2B) | Enterprise and government solutions, ICT services | 11.8% revenue growth in government/enterprise sector (2023) |

| Partnerships | OEM integration, technology co-development | Collaborations with smartphone manufacturers for 5G pre-installation (2024) |

What You Preview Is What You Download

China Telecom 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive China Telecom 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

China Telecom's 'Cloudification and Digital Transformation' strategy is a core element of its marketing, showcasing its leadership in combining cloud, network, and AI technologies. This approach is designed to position the company as a vital force in advancing China's digital economy and building an intelligent future. The company's investment in this area is substantial, with a reported 2024 capital expenditure plan of approximately RMB 89.7 billion, a significant portion of which is allocated to cloud and digital transformation initiatives.

This strategic narrative underscores China Telecom's technological prowess and dedication to ongoing innovation, aiming to attract businesses and consumers seeking cutting-edge digital solutions. Their commitment is reflected in the expansion of their cloud services, which saw a notable year-on-year revenue growth in their cloud business segment during 2023, demonstrating market traction and the effectiveness of their strategy.

China Telecom's presence at major industry events like the Mobile World Congress (MWC) and the Digital China Summit is a key promotional strategy. These gatherings serve as vital stages for unveiling cutting-edge technologies, particularly in AI and 5G, and for fostering connections with global industry leaders.

In 2024, MWC Barcelona saw significant focus on 5G advancements and AI integration, areas where China Telecom actively demonstrates its capabilities. Participation in these high-profile events not only generates considerable media coverage, estimated to reach millions of potential customers and stakeholders annually, but also solidifies the company's image as a technological frontrunner.

China Telecom actively engages on platforms like Facebook and YouTube, highlighting innovations in augmented reality, IoT, and big data. This digital strategy aims to position the company as a leader in technological advancements, reaching a wide audience keen on emerging tech trends.

Showcasing Industrial Digitalization Successes

China Telecom actively showcases its industrial digitalization successes to enterprise and government clients, emphasizing practical applications of 5G and AI. This strategy highlights tangible benefits, such as the implementation of 5G-enabled fully connected factories and bespoke solutions for key sectors. For instance, by mid-2024, China Telecom reported over 3,000 5G industrial internet projects nationwide, demonstrating significant market penetration and client trust.

The company focuses on demonstrating the real-world impact of its technologies across various industries. This includes detailed case studies in manufacturing, healthcare, and education, illustrating how 5G and AI drive efficiency and innovation. By Q1 2025, China Telecom’s industrial digitalization services had contributed to an average productivity increase of 15% for its manufacturing clients, solidifying its credibility with business decision-makers.

- 5G Industrial Internet Projects: Over 3,000 nationwide by mid-2024.

- Productivity Gains: 15% average increase for manufacturing clients (Q1 2025).

- Sector Focus: Manufacturing, healthcare, and education are key areas for tailored solutions.

Emphasis on National Development and Cybersecurity

China Telecom's promotional activities frequently underscore their commitment to national development, aligning with Beijing's objectives for a robust digital infrastructure. For instance, their campaigns often showcase investments in 5G network expansion and fiber optic deployment, crucial for advancing China's modernization agenda. In 2024, China Telecom continued its significant capital expenditure on network infrastructure, with a substantial portion dedicated to 5G base stations and optical fiber upgrades, aiming to cover over 90% of administrative villages with broadband access by the end of the year.

A key element of their promotion is the emphasis on cybersecurity, portraying China Telecom as a guardian of national digital assets. They highlight their advanced security protocols and their role in protecting critical information infrastructure. This focus is particularly relevant given the increasing sophistication of cyber threats and the government's heightened attention to data security. By reinforcing their cybersecurity capabilities, China Telecom aims to build public trust and solidify its image as a reliable and essential national service provider, especially as digital transformation accelerates across all sectors of the economy.

- National Development Alignment: Promotional efforts are strategically linked to national goals like building a strong network nation and supporting Chinese modernization.

- Digital Infrastructure Focus: Emphasis is placed on enhancing digital infrastructure capacity, including 5G and fiber optics, to support economic growth and connectivity.

- Cybersecurity Assurance: Campaigns highlight robust cybersecurity measures to protect national data and critical information infrastructure, fostering public trust.

- Responsible Service Provider Image: By aligning with national interests and ensuring security, China Telecom reinforces its image as an essential and responsible national service provider.

China Telecom's promotional strategy heavily leverages its technological leadership, particularly in cloud, network, and AI, as demonstrated by its significant 2024 capital expenditure of approximately RMB 89.7 billion, with a substantial portion directed towards these areas. Their active participation in global events like MWC and domestic summits like the Digital China Summit serves to showcase innovations and build industry connections.

The company effectively uses digital platforms like Facebook and YouTube to highlight advancements in AR, IoT, and big data, aiming to capture the attention of tech-savvy audiences. Furthermore, China Telecom emphasizes practical, real-world applications of its technologies, such as 5G-enabled factories, with over 3,000 industrial internet projects reported nationwide by mid-2024, leading to an average 15% productivity increase for manufacturing clients by Q1 2025.

Their promotional narrative is strongly aligned with national development goals, focusing on expanding 5G and fiber optic networks, with plans to cover over 90% of administrative villages with broadband by the end of 2024. Crucially, China Telecom promotes its robust cybersecurity measures, positioning itself as a guardian of national digital assets and a trusted provider of essential services.

| Promotional Focus Area | Key Initiatives/Data Points | Impact/Objective |

|---|---|---|

| Technological Leadership | Cloud, Network, AI integration; 2024 CAPEX ~RMB 89.7 billion | Positioning as a digital economy driver |

| Industry Events & Digital Platforms | MWC, Digital China Summit; Facebook, YouTube presence | Showcasing innovation, building connections, reaching tech audiences |

| Industrial Digitalization | 3,000+ 5G industrial projects (mid-2024); 15% avg. manufacturing productivity gain (Q1 2025) | Demonstrating tangible benefits, securing enterprise clients |

| National Development & Security | 5G/fiber expansion (90%+ villages broadband by end-2024); Cybersecurity focus | Aligning with national strategy, building public trust as a secure provider |

Price

China Telecom's pricing strategy is built around tiered service plans, offering a spectrum of options for mobile, broadband, and fixed-line services. These plans are meticulously crafted to address the diverse needs of its customer base, ranging from individual users to major corporations.

The differentiation in these plans is primarily driven by key service attributes such as data allowances, internet connection speeds, and the inclusion of bundled services. For instance, in 2024, China Telecom continued to offer 5G data plans starting from around ¥39 for basic usage, scaling up to ¥199 or more for high-volume, high-speed data and premium content bundles.

This tiered approach provides significant flexibility, enabling customers to select plans that align precisely with their specific usage patterns and financial constraints. This customer-centric pricing model is crucial for maximizing market penetration and ensuring customer satisfaction across various demographic and business segments.

China Telecom's revenue growth is increasingly fueled by its value-added services (VAS) and applications. This segment, encompassing mobile VAS and smart home solutions, demonstrates a pricing approach that incentivizes customers to opt for features beyond standard network access. For instance, in the first half of 2024, China Telecom reported a 5.1% year-on-year increase in operating revenue, with VAS playing a crucial role in this expansion.

The company's strategy involves bundling these VAS to boost their appeal and increase the average revenue per user (ARPU). This bundling tactic enhances the overall perceived value for customers, encouraging them to spend more on integrated service packages rather than just basic connectivity. This focus on VAS reflects a shift towards a more diversified revenue stream that capitalizes on evolving consumer demands for enhanced digital experiences.

China Telecom navigates a competitive landscape against fellow state-owned behemoths, making competitive pricing a cornerstone for subscriber acquisition and retention. While government regulations play a role, the company strategically adjusts its service costs to remain attractive to consumers without compromising profitability.

For instance, in 2024, China Telecom continued to offer various tiered data plans, with entry-level packages often priced to undercut competitors for basic mobile services, aiming to capture market share among price-sensitive users. This approach is crucial given the sheer volume of subscribers, exceeding 400 million mobile users as of early 2024, requiring constant price point evaluation.

Customized Enterprise and ICT Solution Pricing

China Telecom's pricing for customized enterprise and ICT solutions is inherently flexible, adapting to the unique demands of its industrial clients. This often translates into project-based fees, reflecting the intricate nature of digital transformation initiatives. For instance, a large-scale smart city project might be priced based on the integration complexity and the duration of deployment, a common approach for bespoke solutions.

Long-term contracts are a cornerstone of this strategy, providing revenue stability for China Telecom and predictable costs for clients. These agreements frequently include service level agreements (SLAs) that dictate performance metrics and uptime guarantees. Subscription models are also prevalent, particularly for cloud infrastructure and managed platform services, where recurring revenue streams are established based on resource utilization and feature access.

The pricing architecture directly correlates with the value delivered, acknowledging the significant return on investment clients expect from enhanced operational efficiency and digital capabilities. Factors influencing this include:

- Scope of Services: The breadth of ICT solutions offered, from network infrastructure to AI-driven analytics.

- Complexity of Integration: The technical challenges involved in merging new systems with existing enterprise architectures.

- Value Proposition: The quantifiable benefits, such as cost savings or revenue growth, that the solution is designed to achieve.

Strategic Discounts and Bundling Offers

China Telecom actively uses strategic discounts and bundling to boost demand and customer loyalty. For instance, in 2023, the company continued to offer attractive packages combining 5G mobile plans with high-speed broadband and smart home devices, often at a significant saving compared to purchasing services individually. These bundled deals are a cornerstone of their strategy to increase average revenue per user and deter customers from switching to competitors.

These bundled offerings are designed to encourage customers to adopt multiple services, thereby increasing stickiness and reducing churn. For example, a typical bundle might include a 5G mobile plan with 100GB of data, a 1000Mbps home broadband connection, and a smart Wi-Fi router, all for a monthly price that represents a notable discount over separate subscriptions. Such promotions are crucial in the competitive Chinese telecom market, where customer acquisition costs can be high.

- Bundling Synergy: China Telecom's bundled packages, often combining 5G mobile, broadband, and smart home services, aim to offer greater value and convenience, driving higher adoption rates.

- Promotional Impact: In 2023, these strategic discounts and special offers were instrumental in attracting new subscribers and retaining existing ones amidst intense market competition.

- Customer Retention: By providing cost-effective bundled solutions, China Telecom seeks to lower customer churn and increase the overall lifetime value of its subscriber base.

China Telecom's pricing strategy is a multi-faceted approach, leveraging tiered plans for individual consumers and customized solutions for enterprises. The company strategically uses discounts and bundling to enhance customer value and retention, particularly evident in its 2023 and 2024 offerings.

For instance, in early 2024, 5G plans started around ¥39, with premium packages reaching ¥199+, reflecting a tiered structure based on data and speed. Value-added services (VAS) are also priced to encourage adoption, contributing to a 5.1% revenue increase in H1 2024.

Competitive pricing remains critical, with entry-level plans often undercutting rivals to capture market share among China Telecom's over 400 million mobile users as of early 2024. Enterprise solutions are project-based, emphasizing value delivered and long-term contracts.

| Service Segment | Example Pricing (2024) | Key Pricing Drivers |

|---|---|---|

| Mobile (5G) | Starting from ¥39/month (basic) to ¥199+/month (premium) | Data allowance, speed, bundled content |

| Broadband | Varies by speed tier (e.g., 1000Mbps) | Connection speed, bundled services |

| Value-Added Services (VAS) | Integrated into bundles, priced to incentivize adoption | Enhanced features, smart home solutions |

| Enterprise ICT Solutions | Project-based, contractually defined | Scope, integration complexity, value proposition |

4P's Marketing Mix Analysis Data Sources

Our China Telecom 4P's Marketing Mix Analysis leverages official company reports, regulatory filings, and detailed industry research. We also incorporate data from e-commerce platforms, competitor pricing, and promotional campaign evaluations.