China Telecom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Telecom Bundle

China Telecom operates in a dynamic telecom landscape, facing significant pressure from intense rivalry and the constant threat of new entrants eager to capture market share. Understanding the leverage held by powerful buyers and the availability of substitutes is crucial for navigating this competitive environment.

The complete report reveals the real forces shaping China Telecom’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Telecom faces considerable bargaining power from its network equipment suppliers due to the concentrated nature of the market. The company depends on a select group of global and domestic manufacturers for essential components like 5G base stations and fiber optic infrastructure. This reliance means suppliers of specialized or advanced technologies hold significant sway.

The landscape is further shaped by China's push to replace foreign processors in its networks by 2027. This policy significantly bolsters the bargaining power of domestic giants such as Huawei and ZTE, as they become the primary, if not sole, providers for critical network elements, potentially leading to less favorable pricing or terms for China Telecom.

China Telecom faces significant hurdles when considering changes to its core network infrastructure suppliers. The sheer cost of replacing established hardware, coupled with the intricate process of integrating new systems, presents a formidable barrier. This complexity extends to ensuring seamless compatibility with their existing network, a critical factor for maintaining service continuity.

The financial outlay for new core network equipment alone can run into billions of dollars. For instance, in 2024, major telecom operators globally invested heavily in 5G infrastructure upgrades, with equipment costs being a substantial portion. This substantial investment, combined with the operational downtime and the need for extensive retraining of technical staff, makes switching suppliers an extremely costly and disruptive undertaking for China Telecom.

Consequently, the high switching costs effectively lock China Telecom into existing relationships with its core infrastructure providers. This dependency grants these suppliers considerable leverage, allowing them to command higher prices and dictate terms, thereby strengthening their bargaining power within the industry.

China Telecom's significant investment in advanced technologies such as cloud computing, big data, and artificial intelligence directly increases its reliance on specialized technology providers. These suppliers, often possessing unique and proprietary solutions, are in a strong position to negotiate higher prices given the essential nature and advanced capabilities of their offerings.

In 2024, China Telecom's commitment to research and development, particularly in areas like quantum computing and AI, further solidifies this dependency. The company's strategic focus on these cutting-edge fields means that access to specialized hardware, software, and intellectual property from a limited number of providers becomes a critical factor, potentially enhancing supplier bargaining power.

Influence of Government Policies on Supply Chain

The Chinese government's push for domestic technological self-sufficiency significantly shapes the telecommunications supply chain. This policy landscape can bolster the bargaining power of local equipment and technology providers, potentially narrowing China Telecom's international sourcing options and fostering greater dependence on state-aligned companies. For instance, the government's Made in China 2025 initiative aims to boost domestic manufacturing capabilities across various sectors, including advanced technology, which directly impacts the telecom industry.

This strategic alignment can translate into more favorable pricing and contract terms for these favored domestic suppliers. The government's direct or indirect support, such as subsidies or preferential treatment in tenders, can enhance their negotiating leverage against buyers like China Telecom. In 2024, China continued to emphasize indigenous innovation, with significant state investment flowing into areas like 5G infrastructure development and semiconductor manufacturing, further solidifying the position of domestic players.

- Governmental Support for Domestic Suppliers: Policies promoting self-sufficiency empower local Chinese telecom equipment manufacturers.

- Limited International Procurement Options: China Telecom may face restrictions or higher costs when sourcing from non-domestic suppliers due to these policies.

- Influence on Pricing and Contracts: State backing for domestic firms can lead to more advantageous terms for them in negotiations with China Telecom.

- Strategic Alignment with National Goals: The government's focus on technological independence directly impacts supply chain dynamics and supplier relationships.

Decreasing Capital Expenditure Trends

China Telecom's decision to decrease capital expenditure for 2024 and 2025, with a strategic pivot towards AI infrastructure, directly impacts its suppliers. This shift away from traditional mobile broadband buildouts means fewer large-volume orders for network equipment.

For instance, China Telecom announced plans to cut its 2024 capital expenditure by 10% compared to 2023, focusing on computing power. This reduction in spending signals a more selective procurement strategy, potentially diminishing the bargaining power of suppliers who rely on consistent, large-scale orders.

- Reduced Order Volumes: Suppliers may face lower overall sales volumes as China Telecom prioritizes AI investments over extensive 5G network expansion.

- Shift in Product Demand: The focus on AI infrastructure could create demand for new types of specialized components, potentially benefiting suppliers in that niche while disadvantaging those focused on traditional telecom equipment.

- Negotiating Leverage: With fewer, more targeted capital projects, China Telecom may gain greater negotiating leverage on pricing and terms with its remaining suppliers.

China Telecom's bargaining power with suppliers is significantly influenced by government policies favoring domestic technology companies. This trend, amplified by initiatives like Made in China 2025 and a focus on indigenous innovation in 2024, strengthens the negotiating position of local giants like Huawei and ZTE. Consequently, China Telecom faces reduced options for international procurement and potentially less favorable terms from these favored domestic suppliers.

| Supplier Characteristic | Impact on China Telecom's Bargaining Power | Supporting Data/Context (2024 Focus) |

|---|---|---|

| Concentration of Suppliers | Decreases bargaining power | Reliance on a few key global and domestic manufacturers for critical 5G and fiber optic components. |

| Government Policy (Domestic Focus) | Decreases bargaining power | China's push for domestic processors by 2027 and emphasis on indigenous innovation in 2024 bolsters domestic players like Huawei and ZTE. |

| Switching Costs | Decreases bargaining power | High costs associated with replacing billions of dollars worth of core network infrastructure and integrating new systems. |

| Specialized Technology Dependence | Decreases bargaining power | Increased reliance on providers of unique AI, cloud, and big data solutions, often with proprietary offerings. |

| Shift in Capital Expenditure | Potentially Increases bargaining power | Reduced overall capital expenditure in 2024-2025, with a pivot to AI infrastructure, may lead to more selective procurement and greater leverage on pricing. |

What is included in the product

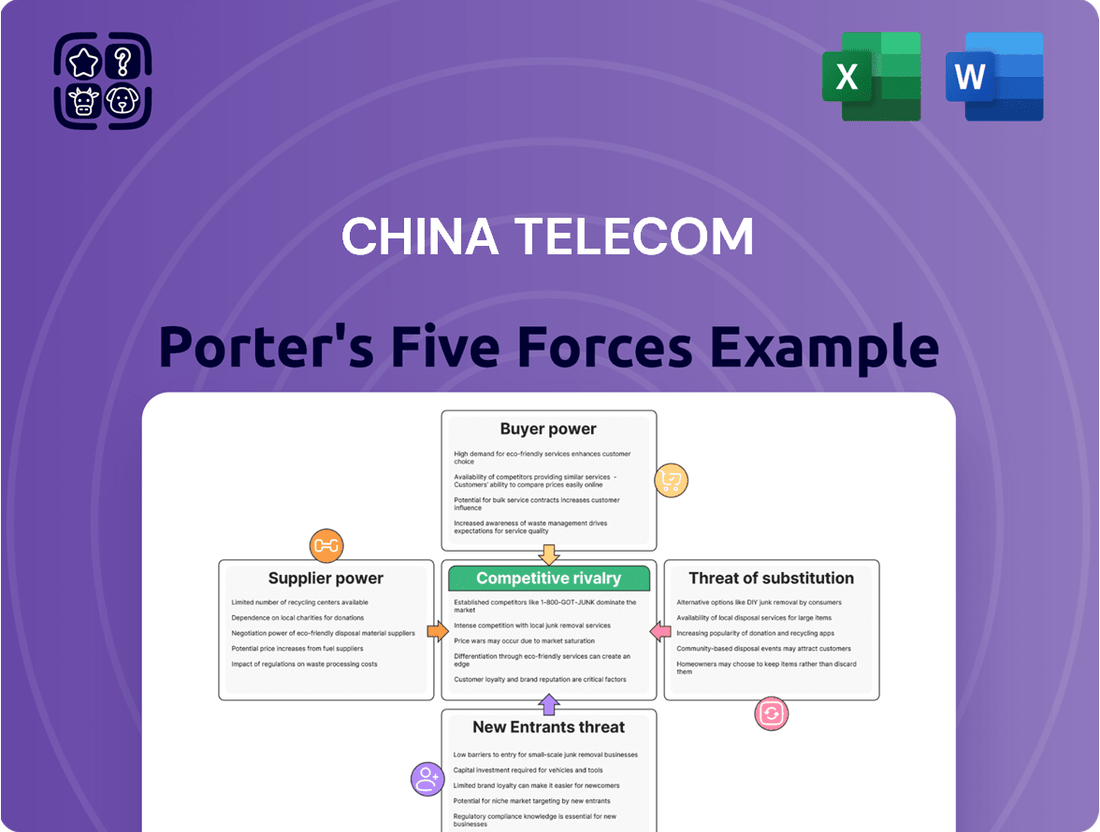

Uncovers the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes impacting China Telecom's market position.

Effortlessly identify and mitigate competitive threats by visualizing China Telecom's Porter's Five Forces with interactive charts.

Customers Bargaining Power

China Telecom's customer base is enormous, encompassing everyone from individual users to major corporations. However, a significant portion of its consumer market is acutely sensitive to price, particularly for essential services like mobile and broadband. This sensitivity is amplified by the fierce rivalry among the three major state-owned telecom providers in China.

In 2023, China Telecom reported a broadband user base of 275.99 million, with a net addition of 21.43 million users. This sheer volume means that even small price adjustments can have a substantial impact on revenue and market share. The competitive landscape forces China Telecom to continuously introduce appealing offers and bundles to keep existing customers and attract new ones.

For standard mobile and fixed-line broadband services in China, customer switching costs are notably low. This is largely due to the implementation of mobile number portability, allowing customers to keep their existing numbers when changing providers. In 2023, China's mobile penetration rate reached approximately 128.7%, indicating a highly competitive landscape where consumers have numerous choices.

The availability of multiple alternative providers for these essential services further empowers customers. They can easily compare plans and prices, and switch to competitors offering more attractive deals or superior service quality without facing significant financial or logistical hurdles. This ease of migration directly translates into increased bargaining power for consumers in the telecommunications sector.

China Telecom's strategic push into integrated Information and Communication Technology (ICT) solutions, encompassing cloud computing, big data, and artificial intelligence, significantly reduces the bargaining power of its customers, especially large enterprise clients. By offering a comprehensive digital infrastructure, the company fosters higher switching costs for businesses that depend on its advanced services.

This integration creates stickiness, making it more challenging and expensive for clients to transition to competitors. For instance, in 2023, China Telecom's cloud revenue saw substantial growth, indicating increased reliance on its integrated offerings by businesses.

The expansion into emerging areas like smart services, advanced video networks, satellite communications, and quantum technologies further solidifies this differentiation. This diversification not only strengthens customer loyalty but also positions China Telecom as a vital partner in digital transformation, thereby diminishing customer leverage.

Impact of Over-the-Top (OTT) Services

The widespread adoption of Over-the-Top (OTT) services like WeChat and QQ has dramatically weakened the bargaining power of China Telecom's customers regarding traditional communication. These platforms offer free or very low-cost alternatives for messaging and voice calls, directly competing with China Telecom's legacy revenue streams. This forces the company to pivot towards data-centric services and innovative value-added offerings to retain customer loyalty and revenue.

The shift in customer preference towards OTT platforms is evident in user statistics. For instance, as of the first half of 2024, China’s total internet users reached over 1.09 billion, with a significant portion actively using messaging and social media applications. This widespread engagement with OTT services means customers have readily available, often superior, alternatives for basic communication, thereby increasing their leverage against traditional telcos.

- Reduced Reliance on Traditional Services: Customers can now communicate globally via OTT apps, bypassing traditional SMS and voice charges.

- Increased Price Sensitivity: The availability of free alternatives makes customers more sensitive to pricing for data and other telecom services.

- Demand for Data and Value-Added Services: Customers are willing to pay for data but expect more than basic connectivity, pushing China Telecom to innovate.

- Competitive Pressure on Core Offerings: OTT services directly erode revenue from high-margin voice and SMS services, compelling telcos to adapt their business models.

Government Influence on Consumer Pricing and Service Quality

While individual consumers in China possess some bargaining power, the pervasive influence of the Chinese government significantly shapes the telecom landscape. Government regulations dictate pricing frameworks and establish minimum service quality benchmarks for all operators, including China Telecom. This regulatory environment can temper customer leverage by ensuring a floor for service standards and curbing excessive price hikes, thereby limiting the scope for aggressive price competition among providers.

For instance, in 2023, China's Ministry of Industry and Information Technology (MIIT) continued its focus on improving user experience and data privacy, which indirectly reinforces service quality expectations for consumers. While specific pricing interventions vary, the government's role in setting overall telecom policy means that customer bargaining power is often mediated through these broader regulatory objectives, rather than direct negotiation on individual service terms.

- Government sets baseline service quality standards, limiting extreme price differentiation.

- Regulatory oversight influences pricing structures, impacting competitive dynamics.

- MIIT's focus on user experience and data privacy in 2023 indirectly benefits consumers.

- Customer bargaining power is often exercised within the parameters of government policy.

China Telecom's individual customers wield significant bargaining power due to low switching costs and intense market competition, especially for basic mobile and broadband services. The widespread availability of mobile number portability in 2023, coupled with China's high mobile penetration rate of approximately 128.7%, means consumers can easily switch providers for better deals. This forces China Telecom to offer competitive pricing and bundles to retain its vast customer base, which saw 21.43 million net broadband additions in 2023, reaching a total of 275.99 million users.

| Factor | Impact on China Telecom | Supporting Data (2023/H1 2024) |

|---|---|---|

| Low Switching Costs | Increases customer bargaining power | Mobile number portability widely available. |

| Intense Competition | Drives price sensitivity and demand for value | Approx. 128.7% mobile penetration rate. |

| OTT Services | Weakens power regarding traditional communication | Over 1.09 billion total internet users (H1 2024), heavy OTT usage. |

| Government Regulation | Mediates power through service standards and pricing oversight | MIIT focus on user experience and data privacy. |

Preview the Actual Deliverable

China Telecom Porter's Five Forces Analysis

This preview shows the exact China Telecom Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It thoroughly examines the bargaining power of buyers, the threat of new entrants, the threat of substitute products or services, the intensity of rivalry among existing competitors, and the bargaining power of suppliers within China's telecommunications market.

Rivalry Among Competitors

The Chinese telecommunications landscape is a clear oligopoly, with China Mobile, China Telecom, and China Unicom, all state-owned entities, holding sway. This limited number of major players intensifies competition as they battle for dominance across mobile, broadband, and enterprise services.

China Mobile consistently leads as the largest operator, which naturally fuels aggressive competition for China Telecom. For instance, as of the first half of 2024, China Mobile reported 394.7 million 5G users, a significant benchmark that China Telecom actively works to match and surpass in its strategic planning.

Competitive rivalry within China's telecommunications sector is exceptionally intense, especially concerning the rollout and marketing of 5G and advanced broadband services. This includes aggressive pushes in areas like fiber-to-the-room (FTTR) and widespread Gigabit broadband availability.

Companies are pouring significant capital into expanding their network infrastructure and enhancing service quality. This heavy investment fuels a price war and drives the creation of attractive service packages designed to win over and keep customers.

This continuous "network arms race" is a clear signal of the high level of competition. For instance, China Telecom's capital expenditure for 5G network construction was substantial in 2023, reflecting the industry-wide drive to build out these next-generation networks.

China Telecom's competitive rivalry is escalating beyond traditional telecommunications into the rapidly growing cloud computing, big data, and AI markets. This dynamic shift presents a significant challenge as established tech giants are deeply entrenched in these advanced digital services.

The primary rivals in this space are Alibaba Cloud, Huawei Cloud, and Tencent Cloud. These companies, often referred to as the "BAT" of cloud services, currently command a substantial majority of the market share, creating a formidable competitive barrier for China Telecom.

For instance, in 2023, Alibaba Cloud continued to lead the Chinese public cloud market with a significant share, followed closely by Huawei Cloud and Tencent Cloud, underscoring the concentrated nature of this emerging competitive landscape.

Government Mandates and Strategic Alignment

The Chinese government significantly influences competitive rivalry within the telecommunications sector through its directives. These mandates often dictate investment priorities and market strategies for state-owned enterprises like China Telecom. For instance, government push for 6G development in 2024 encourages coordinated efforts among major players in this strategic area, potentially reducing direct head-to-head competition on this specific technology while intensifying it in other segments.

This policy-driven environment means competition can be shaped by national strategic goals, such as digital infrastructure expansion or cybersecurity enhancements, rather than solely by market forces. While this can foster collaboration on national projects, it also means that the competitive landscape is subject to shifts based on evolving government priorities. By 2024, China Telecom, alongside its peers, was heavily invested in national digital transformation initiatives, a direct result of government policy.

- Government Directives: Chinese government mandates shape investment and strategy for state-owned telecom firms.

- Strategic Alignment: Initiatives like 6G development in 2024 encourage coordinated efforts, influencing competition.

- Policy vs. Market Forces: Competition is often driven by policy goals, such as digital infrastructure, rather than purely market dynamics.

Focus on Digital Transformation and New Growth Areas

The competitive landscape for China Telecom is intensifying as all major players pivot towards digital transformation and emerging growth sectors. This strategic shift means companies like China Mobile and China Unicom are aggressively pursuing opportunities in areas such as cloud computing, artificial intelligence, and the Internet of Things (IoT). For instance, China Telecom reported significant growth in its cloud services segment, with revenue reaching ¥72.5 billion in 2023, indicating the high stakes involved in capturing this market.

The race to dominate these advanced technology segments, including smart services, quantum computing, and satellite communications, is fierce. Each telecommunications giant is investing heavily in research and development to secure a leading position. China Telecom, for example, has been actively expanding its smart city solutions and 5G applications, aiming to leverage its infrastructure for new revenue streams and competitive advantage.

- Digital Transformation Focus: Companies are channeling resources into ICT solutions, cloud services, and AI to meet evolving enterprise and consumer demands.

- Emerging Business Competition: Strategic investments in quantum computing and satellite communications are creating new battlegrounds for market leadership.

- Market Share Pursuit: Rivals are locked in a struggle to capture market share in these high-growth, innovation-driven segments, necessitating substantial R&D expenditure.

- Innovation Investment: Success in these areas hinges on continuous innovation and significant capital allocation to develop cutting-edge technologies and services.

Competitive rivalry within China's telecom sector is fierce, driven by a few dominant state-owned players like China Mobile, China Telecom, and China Unicom. This intense competition is evident in aggressive marketing and infrastructure build-outs, particularly in 5G and broadband services, with companies like China Mobile boasting nearly 400 million 5G users by mid-2024.

Beyond traditional services, rivalry extends into burgeoning cloud computing, big data, and AI markets, where China Telecom faces established tech giants like Alibaba Cloud, Huawei Cloud, and Tencent Cloud, which held significant market share in 2023.

Government directives significantly shape this rivalry, guiding investment priorities and fostering coordinated efforts in areas like 6G development, as seen in 2024 initiatives, influencing how companies compete.

The push for digital transformation sees all major players investing heavily in emerging sectors like IoT and AI, with China Telecom reporting ¥72.5 billion in cloud services revenue for 2023, highlighting the high stakes in these new growth areas.

| Competitor | 5G Users (H1 2024 est.) | Cloud Revenue (2023 est.) | Key Focus Areas |

|---|---|---|---|

| China Mobile | 394.7 million | Not explicitly stated, but largest operator | 5G, Broadband, Enterprise Services |

| China Telecom | Not explicitly stated, but actively competing | ¥72.5 billion | 5G, Broadband, Cloud, AI, IoT |

| China Unicom | Not explicitly stated, but actively competing | Not explicitly stated | 5G, Broadband, Enterprise Services |

| Alibaba Cloud | N/A | Leading market share | Cloud Computing, Big Data, AI |

| Huawei Cloud | N/A | Significant market share | Cloud Computing, AI, Enterprise Solutions |

| Tencent Cloud | N/A | Significant market share | Cloud Computing, AI, Digital Services |

SSubstitutes Threaten

The proliferation of Over-the-Top (OTT) communication services poses a significant threat to China Telecom. Platforms like WeChat, WhatsApp, and Telegram offer free or low-cost voice, video, and messaging services directly competing with traditional telecom offerings.

These OTT applications leverage the internet to bypass traditional carrier networks, directly impacting China Telecom's revenue streams from SMS and voice calls. For instance, by mid-2024, the active user base for super-apps like WeChat in China surpassed 1.3 billion, highlighting the widespread adoption of these substitute services.

While fiber broadband is China Telecom's stronghold, emerging alternatives could chip away at its market share. Satellite internet, exemplified by services like Starlink, presents a potential long-term substitute, offering connectivity independent of traditional infrastructure. Although Starlink's direct presence in China is currently restricted by regulations, the underlying technology represents a viable alternative for remote or underserved areas.

For large enterprises, the threat of substitutes for China Telecom's communication solutions can be significant. These substitutes include the development of in-house communication networks, particularly for organizations with extensive IT departments and specialized needs. Private cloud deployments also offer an alternative, allowing businesses to manage their communication infrastructure more directly and potentially with greater control over data security and customization.

Furthermore, specialized enterprise-grade VPN and data solutions from non-telecom vendors present a viable substitute, especially for companies handling highly sensitive operations or requiring dedicated, secure channels that bypass public telecom infrastructure. While China Telecom actively provides comprehensive ICT solutions, the allure of bespoke systems tailored precisely to an enterprise's unique requirements, often from niche technology providers, can divert market share.

Decline in Traditional Pay-TV and Voice Services

The shift in consumer preferences towards video-on-demand (VoD) and a multitude of online streaming services presents a significant substitute threat to China Telecom's traditional pay-TV offerings. This evolving landscape means customers are increasingly opting for flexible, on-demand content consumption over bundled cable packages.

Furthermore, the persistent decline in demand for fixed voice services directly impacts China Telecom. Consumers are rapidly migrating to mobile telephony and internet-based communication methods like instant messaging and VoIP, diminishing the relevance and revenue streams from legacy voice products.

- Consumer Shift: By the end of 2023, China's online video users reached 1.04 billion, highlighting the strong preference for digital content over traditional TV.

- VoIP Dominance: Mobile voice traffic in China continued its downward trend, with a significant portion of communication now occurring over data networks.

- Streaming Growth: Major streaming platforms reported substantial user growth throughout 2023 and into early 2024, further fragmenting the video consumption market.

Emerging Technologies as Future Substitutes

Future technological advancements, such as more ubiquitous Wi-Fi Mesh networks or innovative decentralized communication protocols, could emerge as substitutes for traditional cellular or fixed broadband services offered by China Telecom. While these technologies are currently nascent or limited, continuous innovation in connectivity solutions presents a long-term potential for substitution, impacting market share and revenue streams.

For instance, the expansion of 5G standalone networks by competitors and the increasing availability of affordable Wi-Fi 6E access points could offer alternative high-speed internet solutions. China Telecom's 2023 annual report indicated a significant increase in broadband subscribers, but the evolving landscape of connectivity necessitates vigilance against disruptive substitute technologies that could offer similar or superior performance at a lower cost.

- Ubiquitous Wi-Fi Mesh Networks: These could provide seamless connectivity within homes and businesses, potentially reducing reliance on cellular data plans for certain uses.

- Direct Device-to-Device Communication: Emerging protocols could enable direct communication between devices, bypassing traditional network infrastructure for specific applications.

- Decentralized Communication Protocols: Innovations in decentralized networks might offer alternative, resilient communication channels less dependent on large service providers.

The threat of substitutes for China Telecom is substantial, primarily driven by Over-the-Top (OTT) communication services like WeChat and WhatsApp, which offer free or low-cost voice and messaging, directly impacting traditional revenue streams. By mid-2024, WeChat's user base exceeded 1.3 billion, underscoring the widespread adoption of these alternatives. Emerging technologies like satellite internet also pose a long-term threat, offering connectivity independent of traditional infrastructure, even if currently restricted in China.

For businesses, in-house networks, private cloud solutions, and specialized enterprise VPNs from non-telecom providers represent viable substitutes, particularly for those with unique security or customization needs. The consumer shift towards video-on-demand and streaming services further erodes China Telecom's traditional pay-TV market share, with online video users reaching 1.04 billion by the end of 2023. The ongoing decline in fixed voice services, as users migrate to mobile and internet-based communication, also diminishes the relevance of legacy products.

| Substitute Category | Key Examples | Impact on China Telecom | Supporting Data (2023-2024) |

|---|---|---|---|

| OTT Communication | WeChat, WhatsApp, Telegram | Erosion of voice and SMS revenue | WeChat active users > 1.3 billion (mid-2024) |

| Alternative Connectivity | Satellite Internet (e.g., Starlink) | Potential for remote/underserved areas | N/A directly in China, but technology threat |

| Enterprise Solutions | In-house networks, Private Cloud, Specialized VPNs | Diversion of corporate ICT spending | Growing enterprise IT investment |

| Digital Content Consumption | VoD, Streaming Services | Decline in traditional pay-TV subscriptions | Online video users > 1.04 billion (end-2023) |

| Legacy Services | Fixed Voice | Rapid migration to mobile and VoIP | Continued decline in fixed voice traffic |

Entrants Threaten

The telecommunications sector in China, particularly for foundational services, demands substantial capital outlays. This includes the cost of building out extensive network infrastructure, acquiring necessary spectrum licenses, and the continuous investment in maintenance and technological upgrades.

These high initial costs act as a formidable barrier, effectively deterring most new entrants. Only entities with considerable financial backing, often state-affiliated, can realistically consider entering this competitive landscape.

For instance, the rollout of 5G networks alone represents a massive undertaking. In 2023, China's total investment in 5G infrastructure was reported to be over 1.5 trillion yuan, a figure that underscores the immense financial commitment required to compete.

The threat of new entrants into China's telecom sector is significantly dampened by stringent regulatory oversight and the entrenched dominance of state-owned giants like China Mobile, China Telecom, and China Unicom. While a recent pilot program initiated in late 2024 has allowed for some foreign investment in select value-added services, the core infrastructure and basic telecom services remain under tight government control, presenting a formidable barrier to entry.

China Telecom's significant advantage lies in its deeply ingrained brand loyalty and a vast, established customer base, cultivated over years of operation as a state-owned entity. This loyalty is a formidable barrier, making it exceedingly difficult for new players to gain traction in the highly competitive telecommunications market.

As of the first half of 2024, China Telecom reported serving approximately 397 million mobile users and over 170 million fixed broadband customers, demonstrating the sheer scale of its existing network and subscriber relationships. Attracting these customers away would require new entrants to offer exceptionally compelling value propositions and invest heavily in building comparable brand trust and network reach.

Economies of Scale and Scope

China Telecom, as an incumbent, enjoys substantial economies of scale in its network operations, procurement, and customer service. For instance, in 2023, China Telecom reported a capital expenditure of RMB 107.4 billion, a significant portion of which is dedicated to network infrastructure and upgrades, demonstrating the scale of investment required to maintain and expand its services. This massive scale allows for lower per-unit costs compared to potential new entrants.

Furthermore, China Telecom benefits from economies of scope by offering a diverse portfolio of integrated services, including mobile, broadband, ICT solutions, and cloud computing. This synergy across different service lines enhances operational efficiency and customer retention. For example, the company's cloud services, a key area of growth, leverage its existing network infrastructure, reducing the incremental cost of offering these new services.

New entrants would face considerable challenges in matching these cost efficiencies. Achieving comparable economies of scale and scope would necessitate enormous initial capital investment and a substantial period to gain significant market share. Without this scale, new players would likely operate at a higher cost base, making it difficult to compete on price or service breadth with established giants like China Telecom.

- Economies of Scale: China Telecom's vast network infrastructure and customer base allow for lower per-user costs in operations and service delivery.

- Economies of Scope: The integration of mobile, broadband, cloud, and ICT services creates cost synergies and enhances value proposition.

- Barriers to Entry: New entrants require massive upfront investment to replicate the scale and scope of incumbent operators, posing a significant hurdle.

Government Support and Strategic Importance of Incumbents

The Chinese government considers its major telecom operators as vital for national development and technological leadership. This strategic importance translates into substantial government backing, which significantly raises the barrier for new entrants. For instance, in 2024, China continued its aggressive push into advanced technologies, with significant state investment directed towards 6G research and development, a sector dominated by incumbents like China Telecom.

This implicit and explicit government support, including policy alignment and investment directives, solidifies the position of existing players. It effectively deters potential new large-scale entrants into core telecom services by ensuring incumbents have preferential access to resources and regulatory frameworks. China Telecom, as one of the three major state-owned operators, benefits directly from these national strategies, reinforcing its competitive moat.

- Government Prioritization: China's national strategy heavily emphasizes telecommunications as a pillar for economic growth and technological advancement.

- Investment Directives: State-backed investments, particularly in next-generation technologies like 6G and AI infrastructure, are channeled through established operators.

- Policy Alignment: Regulatory frameworks and future policy decisions are designed to support and strengthen existing national champions.

- Deterrence of New Entrants: The combined effect of government support and strategic importance makes it exceptionally difficult for new, large-scale competitors to emerge in the core telecom market.

The threat of new entrants into China's core telecommunications market is exceptionally low. This is primarily due to the immense capital required for network infrastructure, estimated at trillions of yuan for 5G alone as of 2023. Furthermore, stringent government regulations and the dominant position of state-owned giants like China Telecom, which boasts nearly 400 million mobile users as of mid-2024, create significant hurdles.

New players would struggle to match China Telecom's economies of scale and scope, exemplified by its 2023 capital expenditure of over RMB 107 billion on network development. The government's strategic prioritization of major telecom operators, including directing significant state investment into areas like 6G research in 2024, further solidifies the incumbents' advantage and deters potential large-scale competition.

| Factor | China Telecom's Position | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Massive investment in 5G (over 1.5 trillion yuan in 2023) and ongoing upgrades. | Prohibitive cost for new entrants to build comparable infrastructure. |

| Regulatory Environment | Tight government control over core services, with limited foreign investment in value-added services (late 2024 pilot). | Significant barriers to entry, especially for foreign companies. |

| Economies of Scale & Scope | Nearly 400 million mobile users (H1 2024), integrated services (mobile, broadband, cloud). | New entrants cannot match cost efficiencies and service breadth. |

| Government Support | Strategic national importance, state investment in advanced tech (e.g., 6G in 2024). | Incumbents receive preferential treatment and backing, deterring competition. |

Porter's Five Forces Analysis Data Sources

Our China Telecom Porter's Five Forces analysis is built upon a foundation of official company filings, annual reports, and publicly available financial statements. We also incorporate insights from reputable industry research reports and market intelligence platforms to provide a comprehensive view of the competitive landscape.