China Telecom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Telecom Bundle

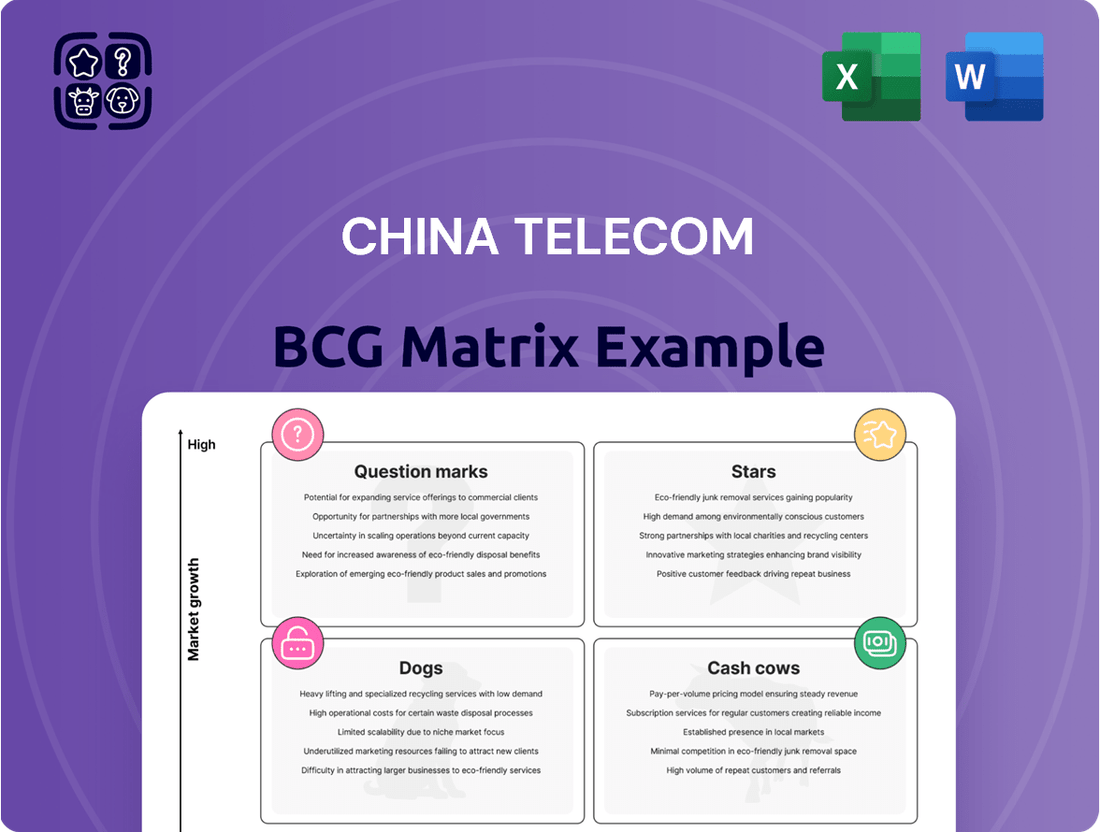

Uncover the strategic positioning of China Telecom's diverse product portfolio with a glimpse into its BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

This preview offers a foundational understanding, but for a comprehensive strategic roadmap, dive into the full China Telecom BCG Matrix report. Gain detailed quadrant placements, actionable insights, and data-driven recommendations to optimize your investment and product decisions.

Don't miss out on the complete picture; purchase the full BCG Matrix today to unlock expert commentary, visual quadrant mapping, and editable formats that will empower your strategic planning.

Stars

China Telecom's AI and intelligent computing services are a clear Star in its BCG matrix. This segment experienced explosive growth, with revenue jumping a remarkable 195.7% year-on-year in 2024. This surge highlights the company's successful strategy in capitalizing on the booming demand for AI-powered solutions.

The company's commitment to AI is evident in its substantial investments and the integration of advanced technologies. China Telecom's 'Xirang' intelligent computing service platform is a cornerstone of this strategy, providing robust infrastructure and support for a wide array of AI models and applications across diverse industries.

Quantum business is a burgeoning Star for China Telecom, showcasing remarkable expansion. In 2024, its revenue surged by an impressive 238.7% compared to the previous year. This segment, encompassing quantum-encrypted messaging and calls, highlights China Telecom's commitment to high-growth, advanced technologies as they actively broaden their user base and enhance product portfolios.

Satellite communication services are a booming Star for China Telecom. In 2024, revenue surged by an impressive 71.2% year-on-year, fueled by a growing user base that now exceeds 2.4 million direct-to-cell satellite users.

As China's sole domestic satellite mobile communication operator, China Telecom enjoys a distinct advantage. The company is actively broadening its reach, establishing a comprehensive network that spans land, sea, air, and even space, solidifying its position in this high-growth sector.

Industrial Digitalization (Advanced Solutions)

China Telecom's advanced industrial digitalization solutions, especially those leveraging 5G and the industrial internet, are a significant growth driver, positioning them as a Star in the BCG matrix.

This segment achieved a substantial revenue of 146.6 billion yuan in 2024, marking a healthy 5.5% year-on-year increase.

- Strategic Focus: China Telecom is heavily investing in these advanced solutions to spearhead digital transformation across diverse industries.

- Revenue Contribution: In 2024, this sector generated 146.6 billion yuan in revenue.

- Growth Rate: The segment experienced a 5.5% year-on-year revenue growth.

- Key Offerings: Solutions include 5G+ industrial internet scenarios and integrated digital platforms.

Internet of Video Things (IoVT)

The Internet of Video Things (IoVT) is a significant growth area for China Telecom, positioning it as a Star in the BCG matrix. Its revenue saw a substantial 40.1% year-on-year increase in 2024. This surge is driven by China Telecom's strategic expansion into integrated video surveillance and smart monitoring solutions, enhancing its existing IoT and smart home ecosystems.

This growth highlights the market's strong appetite for intelligent visual applications. China Telecom's success in IoVT is a testament to its ability to capitalize on evolving consumer and enterprise needs for enhanced security and data-driven insights through video technology.

- IoVT Revenue Growth: 40.1% year-on-year in 2024.

- Strategic Focus: Integration of video surveillance and smart monitoring.

- Market Demand: Increasing for intelligent visual applications.

- Contribution to Ecosystem: Enhances IoT and smart family offerings.

China Telecom's AI and intelligent computing services are a clear Star, with revenue jumping 195.7% year-on-year in 2024, showcasing successful capitalization on AI demand.

The quantum business is another burgeoning Star, experiencing a 238.7% revenue surge in 2024, driven by advanced technologies like quantum-encrypted messaging.

Satellite communication services are a booming Star, with 2024 revenue up 71.2% and over 2.4 million direct-to-cell satellite users.

Advanced industrial digitalization, particularly 5G and industrial internet, is a significant Star, generating 146.6 billion yuan in revenue in 2024 with 5.5% year-on-year growth.

The Internet of Video Things (IoVT) is a notable Star, with 2024 revenue increasing by 40.1% year-on-year, fueled by integrated video surveillance and smart monitoring solutions.

| Segment | 2024 Revenue Growth (YoY) | Key Driver | 2024 Revenue (Billion Yuan) |

| AI & Intelligent Computing | 195.7% | Booming AI demand | N/A |

| Quantum Business | 238.7% | Advanced technologies | N/A |

| Satellite Communications | 71.2% | Growing user base | N/A |

| Industrial Digitalization (5G/IoT) | 5.5% | Digital transformation | 146.6 |

| Internet of Video Things (IoVT) | 40.1% | Video surveillance & smart monitoring | N/A |

What is included in the product

This BCG Matrix overview dissects China Telecom's business units, identifying Stars for growth and Cash Cows for funding.

The China Telecom BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

China Telecom's core mobile communication services are a strong Cash Cow. In 2024, these services generated a substantial 202.5 billion yuan in revenue, marking a healthy 3.5% increase year-on-year. This segment benefits from a mature yet stable market, ensuring consistent and reliable cash flow for the company.

With over 425 million mobile subscribers by the end of 2024 and reaching 429.47 million in the first quarter of 2025, China Telecom demonstrates a commanding market share. This large and loyal customer base in a well-established sector solidifies its position as a dependable source of income.

Fixed-line broadband services are a cornerstone Cash Cow for China Telecom. In 2024, this segment demonstrated stable revenue growth of 2.1%, underscoring its reliable income-generating capacity. The company boasts a massive subscriber base of 197 million for these services.

China's extensive fiber optic network deployment has solidified its position as the world's largest broadband market. This robust infrastructure ensures a consistent and predictable revenue stream for China Telecom's fixed-line broadband offerings, making them a vital component of its financial stability.

Tianyi Cloud is a strong Cash Cow for China Telecom, demonstrating robust financial performance. In 2024, its revenue hit 113.9 billion yuan, marking a substantial 17.1% year-over-year increase.

This growth positions Tianyi Cloud as a dominant force in China's cloud market. Reports indicate China Telecom has overtaken Alibaba as the largest cloud service provider by revenue in the country, signifying a commanding market share.

This high market share translates into significant cash generation for the company. Despite its maturity, Tianyi Cloud continues to experience growth, reinforcing its status as a valuable Cash Cow within China Telecom's portfolio.

Smart Home Services

Smart home services represent a significant Cash Cow for China Telecom, demonstrating robust growth. In 2024, this segment saw its revenue climb by an impressive 16.8% year-on-year, underscoring its stability and profitability.

These services effectively utilize China Telecom's established fixed-line network and vast customer reach. By integrating advanced AI and cloud technologies, the company delivers a diverse portfolio of smart home applications. This strategic combination not only enhances household connectivity but also ensures a consistent and reliable income stream, solidifying its Cash Cow status.

- Revenue Growth: Smart home services revenue increased by 16.8% year-on-year in 2024.

- Infrastructure Leverage: Utilizes China Telecom's extensive fixed-line network.

- Customer Base: Benefits from a broad existing customer base.

- Technology Integration: Incorporates AI and cloud technologies for enhanced offerings.

IDC (Internet Data Center) Services

China Telecom's Internet Data Center (IDC) services represent a strong Cash Cow within its business portfolio. In 2024, these services generated a significant 33 billion yuan in revenue, marking a healthy 7.3% increase year-on-year. This demonstrates the consistent and reliable income stream provided by this segment.

The company's position as a key player in the burgeoning data center market is a major advantage. Demand for data storage and processing continues to surge, fueled by the widespread adoption of cloud computing and the rapid advancements in artificial intelligence. China Telecom is well-positioned to capitalize on this growth.

- Revenue Generation: IDC services brought in 33 billion yuan in 2024.

- Growth Trajectory: Achieved a 7.3% year-on-year revenue increase.

- Market Position: China Telecom is a leading provider in the expanding data center sector.

- Demand Drivers: Benefits from increased demand due to cloud computing and AI.

China Telecom's core mobile communication services continue to be a robust Cash Cow, evidenced by 429.47 million subscribers in Q1 2025 and 202.5 billion yuan in revenue for 2024. This segment benefits from a mature market, ensuring consistent cash flow.

Fixed-line broadband, with 197 million subscribers and 2.1% revenue growth in 2024, also functions as a stable Cash Cow. China's extensive fiber network underpins this reliable income stream.

Tianyi Cloud's 17.1% revenue growth in 2024, reaching 113.9 billion yuan, positions it as a dominant and high-generating Cash Cow. Smart home services, with 16.8% revenue growth in 2024, leverage existing infrastructure for consistent income.

Internet Data Center (IDC) services are another key Cash Cow, generating 33 billion yuan in revenue with a 7.3% year-on-year increase in 2024. This segment thrives on the growing demand for data storage and processing.

| Business Segment | 2024 Revenue (Billion Yuan) | 2024 YoY Growth | Subscriber Base (Millions) | Market Position |

|---|---|---|---|---|

| Mobile Communication | 202.5 | 3.5% | 425+ (End 2024) | Dominant |

| Fixed-line Broadband | N/A | 2.1% | 197 | Strong |

| Tianyi Cloud | 113.9 | 17.1% | N/A | Market Leader |

| Smart Home | N/A | 16.8% | N/A | Growing |

| Internet Data Center (IDC) | 33 | 7.3% | N/A | Key Player |

Full Transparency, Always

China Telecom BCG Matrix

The China Telecom BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, is designed to provide actionable insights into China Telecom's business units, allowing for immediate strategic planning and decision-making. You are seeing the final, professionally formatted report, ready for integration into your business strategy or client presentations, without any additional edits or modifications required.

Dogs

China Telecom's traditional fixed-line telephone services are firmly in the Dog quadrant of the BCG matrix. This segment is experiencing a persistent decline in its subscriber base, a trend that continued through 2024.

By the end of December 2024, China Telecom's fixed-line telephone subscriber count had fallen to 96.90 million. This reduction is indicative of a wider market shift, where mobile phones and internet-based communication methods are increasingly replacing traditional landlines, positioning this service as a low-growth, low-market-share offering.

Legacy 2G/3G network services represent the Dogs in China Telecom's BCG Matrix. As the global telecommunications industry accelerates its shift towards 5G, these older technologies are naturally declining in relevance and usage.

While precise revenue breakdowns for 2G/3G are not publicly itemized, the strategic redirection of capital towards 5G deployment and the repurposing of spectrum for advanced services clearly signal a diminishing investment and eventual sunsetting of these low-growth, low-return segments. For instance, China Telecom's ongoing investments in 5G infrastructure, which reached significant figures in 2023 and are projected to continue robustly into 2024, directly illustrate this strategic pivot away from legacy networks.

Outdated ICT solutions at China Telecom, those lacking cloud, AI, or big data integration, are firmly positioned as Dogs. These legacy systems struggle to keep pace with the rapid digital transformation, offering little to no growth potential. In 2023, China Telecom reported significant investments in cloud and AI, highlighting their strategic shift away from such outdated technologies.

Non-digitalized Value-Added Services

Non-digitalized value-added services within China Telecom's portfolio, those not yet integrated with AI or digital platforms, are likely candidates for the question mark or even dog category in a BCG matrix. These offerings face the challenge of potentially stagnant demand and declining market relevance as the company prioritizes and invests heavily in AI-driven applications and smart services. For instance, traditional landline-based customer support or non-interactive broadcast services might fall into this segment.

In 2024, China Telecom's strategic focus is on digital transformation, aiming to enhance user experience and operational efficiency through advanced technologies. Services that lag behind this digital push risk becoming less competitive. While specific financial data for individual non-digitalized services is not publicly broken down, the broader trend indicates a shift away from traditional models. For example, China Telecom reported a 10.1% year-on-year increase in revenue from its cloud and big data segment in the first half of 2024, highlighting the growth in digital services.

- Stagnant Demand: Services lacking digital integration may see a plateau or decline in customer adoption as users increasingly expect digital-first interactions.

- Diminishing Relevance: In an AI-focused era, traditional, non-digitalized offerings risk becoming obsolete compared to advanced, personalized alternatives.

- Resource Allocation: China Telecom's investment in AI and smart services suggests resources may be diverted from maintaining or developing purely traditional services.

Underperforming Niche Enterprise Solutions

Underperforming Niche Enterprise Solutions in China Telecom's BCG Matrix represent specialized offerings that have struggled to gain traction. These solutions, despite initial investment, have seen limited market penetration and slow growth. For instance, certain highly tailored cloud-based analytics platforms designed for specific industries may fall into this category if they haven't scaled effectively or adapted to the broader digital transformation landscape.

These solutions often exhibit low market share and dim future prospects. A prime example could be a proprietary IoT management system for a single manufacturing vertical that failed to attract wider adoption due to integration challenges or a lack of competitive features. By 2024, China Telecom's focus on consolidating its enterprise offerings means such underperforming niche products are likely candidates for divestment or significant restructuring.

- Low Market Share: Many niche solutions possess less than 10% market share within their targeted segments.

- Limited Growth Potential: Projected annual growth rates for these offerings are often below 5%.

- High Specialization: Solutions are often too narrowly focused, hindering broader applicability.

- Resource Drain: Continued investment in these areas yields diminishing returns, impacting overall portfolio efficiency.

China Telecom's legacy 2G/3G mobile services are firmly in the Dog quadrant, characterized by declining subscriber numbers and limited investment. As the company prioritizes 5G, these older networks are becoming increasingly irrelevant.

The fixed-line telephone segment also resides in the Dog category, with a shrinking subscriber base as users migrate to mobile and internet-based communication. By the end of 2024, China Telecom reported 96.90 million fixed-line subscribers, a clear indicator of this segment's decline.

Outdated ICT solutions and non-digitalized value-added services, lacking AI or cloud integration, also fall into the Dog quadrant. These offerings face stagnant demand and diminishing relevance in a rapidly digitizing market.

| Service Segment | BCG Quadrant | Key Characteristics | 2024 Data/Trend |

|---|---|---|---|

| Fixed-line Telephony | Dog | Declining subscriber base, low growth | 96.90 million subscribers (end of 2024) |

| Legacy 2G/3G Networks | Dog | Low usage, diminishing investment, being phased out | Strategic pivot to 5G deployment |

| Outdated ICT Solutions | Dog | Lack of modern integration (AI, Cloud), low growth potential | Significant investment in cloud and AI in 2023/2024 |

| Non-digitalized VAS | Dog | Stagnant demand, risk of obsolescence | 10.1% YoY revenue growth in cloud/big data (H1 2024) |

Question Marks

Early-stage AI-driven consumer applications, like advanced AI assistants embedded in smart home devices, represent a promising but nascent area for China Telecom. These applications are characterized by high growth potential as AI adoption expands, yet they currently hold a low market share.

Significant investment is needed to scale these personalized AI services, aiming to capture a larger portion of the rapidly evolving consumer tech market. For instance, by 2024, the global market for AI in consumer electronics was projected to reach tens of billions of dollars, highlighting the substantial growth trajectory these applications are poised to follow.

China Telecom's 5G New Calling services, designed to enhance calls with features like screen sharing and interactive gaming, are currently positioned as Question Marks within the BCG Matrix. These services represent a strategic focus for the company, with significant development efforts prioritized for 2025, signaling an expectation of high future growth. However, their novelty means they currently possess low market penetration, necessitating substantial investment in building a supporting ecosystem and driving widespread user adoption to realize their potential.

Direct-to-cell satellite services, while a promising area, currently represent a Question Mark for China Telecom within the BCG matrix. The technology itself is innovative, but widespread consumer adoption is still in its early stages.

While the number of direct-to-cell users globally reached over 2.4 million in 2024, this figure, though growing, is a fraction of the total mobile subscriber base. This indicates significant growth potential, but also highlights the substantial investment required to capture a larger market share and solidify its position.

Overseas Strategic Emerging Businesses (Specific Markets)

Overseas strategic emerging businesses, such as new cloud or IoT ventures in less mature international markets, are positioned as Stars or Question Marks within China Telecom's BCG Matrix. These ventures are likely experiencing rapid growth in their target regions, reflecting the increasing demand for digital services globally. For instance, China Telecom's international expansion efforts in Southeast Asia, targeting the burgeoning digital economy, exemplify this category.

While these businesses show promising growth trajectories, they often operate in markets where China Telecom is still establishing its presence. This means they likely command relatively low market shares compared to established global players. To capitalize on their high growth potential and move towards becoming market leaders, these ventures require significant and focused investment. This investment is crucial for building brand recognition, expanding infrastructure, and securing a competitive edge in these emerging markets.

- High Growth Potential: Ventures in emerging markets like IoT solutions in Africa or specialized cloud services in Latin America are tapping into rapidly expanding digital ecosystems.

- Low Market Share: Despite growth, these businesses are often new entrants, meaning their current market share in these specific overseas regions is modest compared to incumbents.

- Investment Needs: Significant capital is required to scale operations, develop localized offerings, and build robust sales and support networks to gain traction.

- Strategic Focus: China Telecom's strategy involves prioritizing these emerging businesses to foster future international revenue streams and diversify its global footprint.

Next-Generation Access Technologies (e.g., 50G-PON)

China Telecom's investment in next-generation access technologies like 50G-PON is currently a Question Mark within its BCG Matrix. These advancements promise speeds up to 50 Gbps, positioning China Telecom for future broadband leadership. However, the technology is in its nascent stages of commercial rollout, meaning market penetration is presently low.

This early stage necessitates significant capital investment for China Telecom to build out the necessary infrastructure. The potential for high future growth is evident, but the current low market share and high investment requirements place it firmly in the Question Mark quadrant. For instance, by the end of 2023, China had already deployed over 3 million 50G-PON ports, indicating a growing but still early adoption phase.

- Technology: 50G-PON, targeting 50 Gbps speeds.

- Market Position: Early commercial deployment, low market penetration.

- Strategic Implication: High future growth potential, but requires substantial capital expenditure.

- Industry Context: Aims to maintain China's leadership in broadband infrastructure.

China Telecom's 5G New Calling services are a prime example of a Question Mark, requiring substantial investment to gain traction in a market still defining its needs. Their potential for high growth is undeniable, but the current low market share necessitates strategic efforts to build user adoption and an accompanying ecosystem.

Similarly, direct-to-cell satellite services, while innovative, remain a Question Mark due to early consumer adoption stages. Despite a growing user base, it's a fraction of the total mobile market, underscoring the significant investment needed to capture a larger share.

Overseas strategic emerging businesses, like IoT ventures in less mature markets, also fall into the Question Mark category. They exhibit high growth potential but currently hold low market shares in these regions, demanding focused investment to compete effectively.

Next-generation access technologies like 50G-PON are Question Marks, promising future leadership with high speeds but facing low market penetration during their early commercial rollout. This necessitates significant capital expenditure to build infrastructure and capitalize on anticipated growth.

BCG Matrix Data Sources

Our China Telecom BCG Matrix is built on comprehensive data, incorporating financial reports, market share analysis, industry growth forecasts, and internal performance metrics.