China Mobile PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Mobile Bundle

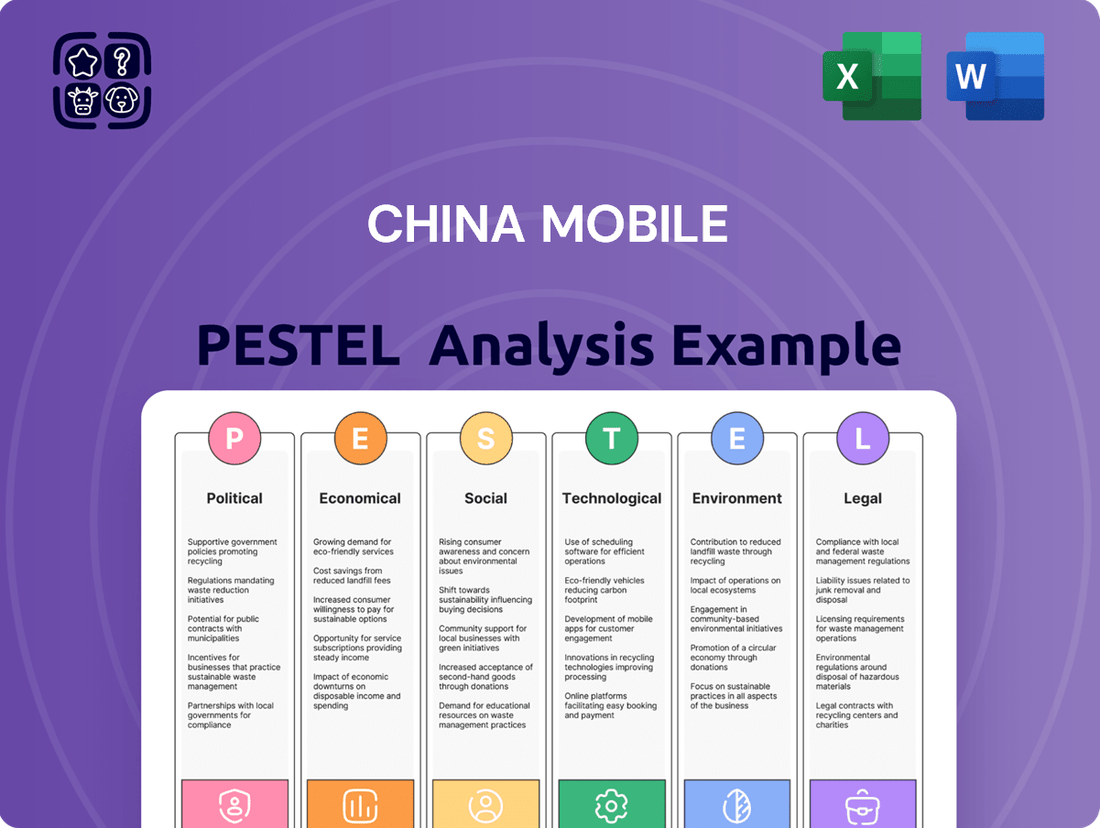

Navigate the dynamic landscape of China's telecommunications sector with our comprehensive PESTLE analysis of China Mobile. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Empower your strategic decisions with actionable intelligence. Download the full PESTLE analysis now and gain a competitive edge.

Political factors

China Mobile, being a state-owned enterprise, operates under significant influence from the Chinese government's strategic objectives. This government oversight shapes its investment priorities and operational direction, particularly in areas deemed critical for national development.

The government's strong emphasis on digital transformation and the rapid rollout of 5G technology directly impacts China Mobile's strategic planning. For instance, the national priority placed on 5G deployment in 2024 necessitates substantial capital expenditure and focused operational efforts from the company to meet these ambitious targets.

Geopolitical tensions, especially with the United States, pose significant political risks for China Mobile. These tensions can lead to restrictions in international markets, often citing data security and espionage concerns. For example, the U.S. government's actions against Chinese technology firms in 2024, such as Huawei, have had a broad impact across the telecommunications sector, highlighting the vulnerability of companies like China Mobile to such international political pressures.

China Mobile operates within a tightly controlled telecommunications landscape, primarily overseen by the Ministry of Industry and Information Technology (MIIT). The MIIT's authority extends to crucial areas like issuing licenses, setting technical standards, and enforcing data security protocols. This regulatory framework directly shapes how China Mobile can develop its network infrastructure and introduce new services to the market.

Looking ahead to 2024 and 2025, regulatory shifts are expected to continue impacting China Mobile. For instance, the MIIT's ongoing focus on stricter data security and privacy measures will necessitate significant investment in compliance and potentially influence the types of data-driven services the company can offer. These evolving regulations are a key political factor that China Mobile must navigate to maintain its competitive edge and ensure operational continuity.

'Made in China 2025' Initiative

The Made in China 2025 initiative, launched in 2015, aims to transform China into a global manufacturing powerhouse by focusing on ten key industries, including information technology and telecommunications equipment. This strategic push for technological self-sufficiency directly benefits China Mobile by fostering a domestic ecosystem for advanced telecommunications infrastructure, potentially leading to lower costs and greater control over its supply chain. The initiative encourages significant government and private sector investment in research and development within China, with a particular emphasis on areas like 5G technology and artificial intelligence, which are crucial for China Mobile's future growth and service offerings.

This policy directly supports China Mobile's strategic objectives by encouraging domestic innovation and reducing reliance on foreign technology providers. For instance, by 2023, China's domestic production of key telecommunications components saw a notable increase, driven by such initiatives. This shift is vital for China Mobile as it navigates geopolitical tensions and seeks to secure its technological backbone.

- Technological Self-Reliance: Made in China 2025 prioritizes indigenous innovation in sectors like telecommunications, aligning with China Mobile's goal to reduce dependence on foreign suppliers.

- R&D Investment: The initiative stimulates substantial investment in research and development within China, particularly in areas like 5G and AI, which are critical for China Mobile's network evolution.

- Supply Chain Security: By promoting domestic manufacturing, the policy enhances the security and stability of China Mobile's supply chain for essential network equipment and services.

Cross-border Telecom Scams and Enforcement

In 2024, governments globally intensified their fight against cross-border telecom scams, a trend that directly impacts China Mobile. This increased enforcement means stricter regulations on how telecom providers handle customer data and prevent fraudulent activities. For China Mobile, this translates to a greater need for robust security measures and proactive consumer protection strategies to comply with evolving international standards.

The heightened focus on combating these scams is reflected in collaborative efforts between countries. For instance, in early 2024, China's Ministry of Public Security reported significant progress in joint operations with Southeast Asian nations to dismantle scam networks. This regulatory environment compels China Mobile to invest more in advanced fraud detection and prevention technologies, potentially affecting operational costs but also enhancing customer trust and brand reputation.

- Increased Regulatory Scrutiny: Policymakers are prioritizing the crackdown on cross-border telecom fraud, leading to more stringent operational requirements for telecom operators like China Mobile.

- Enhanced Enforcement Actions: Governments are actively pursuing and prosecuting individuals and organizations involved in these scams, creating a more challenging operating environment for illicit actors and a need for greater diligence from legitimate providers.

- Focus on Consumer Protection: A key outcome of these efforts is a stronger emphasis on protecting consumers from financial and personal data theft, necessitating improved security protocols and customer support from China Mobile.

Government policies in China continue to heavily influence China Mobile's operations, with a strong push for technological self-reliance through initiatives like Made in China 2025. This strategy bolsters domestic R&D and supply chain security for critical components, a trend that saw increased domestic production of telecom equipment by 2023.

The government's commitment to 5G deployment, a national priority for 2024, drives significant capital expenditure and strategic focus for China Mobile. Furthermore, intensified global efforts against telecom fraud in 2024 necessitate greater investment in fraud detection and consumer protection measures by the company.

Geopolitical tensions, particularly with the US, present ongoing risks, potentially impacting market access and supply chains, as evidenced by actions taken against other Chinese tech firms in 2024. China Mobile's operational framework is also shaped by the Ministry of Industry and Information Technology (MIIT), which sets standards and enforces data security regulations, with continued evolution expected through 2025.

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors influencing China Mobile, providing actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how China Mobile navigates political and economic shifts to mitigate operational risks and ensure continued growth.

Economic factors

China's economic growth is a significant driver for China Mobile. The country's GDP is projected to expand by approximately 5% in 2024. This robust economic expansion directly translates into higher consumer spending power, fueling demand for telecommunications services, especially the premium offerings China Mobile provides.

As disposable incomes rise, consumers are more inclined to adopt advanced, high-bandwidth services. This trend is particularly evident with the increasing uptake of 5G technology, which requires more sophisticated devices and data plans. China Mobile is well-positioned to capitalize on this shift towards higher-value services.

China Mobile's capital expenditure (CapEx) trajectory reflects a strategic pivot. For 2024, the company invested a substantial 164 billion yuan. Looking ahead to 2025, the forecast CapEx is 151.2 billion yuan, signaling a managed decrease following the intensive phase of 5G network build-out.

This reduction in CapEx is not a sign of slowdown but rather a reallocation of resources. The company is now channeling its investment focus towards next-generation technologies, notably artificial intelligence (AI). This strategic shift aims to capitalize on emerging growth areas and maintain a competitive edge in the evolving telecommunications landscape.

China Mobile's revenue trajectory in 2024 showcases a strong performance, with operating revenue reaching 1.04 trillion yuan, marking a 3.1% increase from the previous year. This growth is significantly bolstered by its digital transformation services, which saw a remarkable 9.9% surge in revenue.

The increasing contribution of digital transformation services to overall telecommunications revenue underscores China Mobile's strategic pivot. These services now represent a substantial segment, reflecting a successful diversification effort that moves beyond traditional mobile offerings.

Market Saturation and Emerging Opportunities

China Mobile is navigating a maturing domestic market where the growth rate of mobile internet users has notably slowed, indicating a near saturation point. In 2023, the company reported over 1.1 billion mobile users, a testament to its vast reach but also highlighting the challenge of acquiring new subscribers at previous rates.

To counter this, China Mobile is strategically pivoting towards new revenue streams. A significant focus is placed on the enterprise segment, where the company aims to leverage its robust infrastructure for business solutions. Furthermore, the integration of Artificial Intelligence (AI) into its services is a key initiative, promising to unlock new value for both consumers and businesses.

- Market Saturation: Growth in mobile internet users has decelerated as the Chinese market approaches saturation.

- Enterprise Focus: China Mobile is actively expanding its offerings and services tailored for the enterprise sector.

- AI Integration: The company is investing in and incorporating AI technologies to enhance its product portfolio and operational efficiency.

- New Revenue Streams: Expansion into emerging markets and development of advanced enterprise solutions are key strategies for future growth.

Dividend Payout and Shareholder Returns

China Mobile has committed to a significant increase in its dividend policy, aiming to distribute over 75% of its attributable profit as cash dividends annually for the three years commencing in 2024. This strategic move underscores the company's robust financial health and its dedication to rewarding its investors.

This enhanced dividend payout is expected to bolster shareholder returns, making China Mobile a more attractive proposition for income-focused investors. The company's strong financial performance in recent periods provides a solid foundation for this increased commitment.

- Dividend Payout Target: Over 75% of profit attributable to shareholders from 2024 onwards.

- Strategic Rationale: To enhance shareholder returns and reflect strong financial performance.

- Financial Context: Supported by the company's consistent profitability and cash flow generation.

- Investor Impact: Expected to attract investors seeking stable and growing dividend income.

China's economic landscape presents a mixed but generally positive outlook for China Mobile. While GDP growth is projected to moderate slightly to around 4.5% in 2025, down from an estimated 5% in 2024, this still represents a healthy expansion. This sustained economic activity underpins consumer spending power, crucial for telecommunications demand.

| Metric | 2024 (Est.) | 2025 (Proj.) |

|---|---|---|

| China GDP Growth | ~5.0% | ~4.5% |

| China Mobile Operating Revenue | ~1.04 trillion yuan (2024 actual) | N/A |

| China Mobile CapEx | 164 billion yuan (2024 actual) | 151.2 billion yuan |

Preview the Actual Deliverable

China Mobile PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive China Mobile PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough understanding of the external forces shaping China Mobile's strategic landscape.

Sociological factors

The swift integration of 5G in China is fundamentally changing how people connect and live, with over 800 million 5G users by the close of 2024. This widespread adoption fuels a digital-first culture, impacting everything from social interactions to how businesses operate.

Chinese consumers are increasingly seeking digital services that offer a strong blend of affordability, advanced technology, and emotional connection. This trend is evident in the growing adoption of smart devices and the expectation for seamless, personalized digital experiences.

China Mobile is actively responding to this demand by enhancing its artificial intelligence capabilities to deliver more personalized services in the consumer segment. For instance, in 2024, the company reported a significant increase in the usage of its AI-powered virtual assistants, handling millions of customer queries daily, demonstrating a tangible shift towards high-tech, value-driven interactions.

Furthermore, China Mobile is accelerating the development of its smart home ecosystem, aiming to provide integrated, high-emotional value solutions that simplify daily life. By the end of 2024, the company had connected over 50 million households to its smart home platform, showcasing a direct response to the sociological shift towards digitally integrated living environments.

By the close of 2024, a significant 80% of China's population, totaling 1.17 billion individuals, were actively using mobile internet. This high penetration rate suggests a narrowing gap in mobile internet usage across the population.

Looking ahead, the growth in mobile internet users is projected to slow, with an estimated addition of only 45 million users by 2030. This indicates that the Chinese mobile internet market is nearing saturation, implying a mature and well-established ecosystem.

Impact of Smart Cities Development

China's aggressive push towards smart city development, with significant investments projected through 2025, directly fuels demand for advanced information and communication services. This trend is particularly evident in initiatives like the national "New Infrastructure" plan, which prioritizes digital connectivity and smart urban solutions.

China Mobile, with its vast 5G network coverage, is strategically positioned to capitalize on this. By the end of 2024, China Mobile reported over 3.4 million 5G base stations, a critical asset for supporting the data-intensive needs of smart cities, from IoT devices to autonomous transportation systems.

- Growing Demand: Smart city initiatives are expected to drive a significant increase in data traffic and demand for reliable connectivity.

- Infrastructure Advantage: China Mobile's extensive 5G network provides a competitive edge in serving these burgeoning urban tech ecosystems.

- Digital Solutions: The company's portfolio of digital solutions, including cloud services and IoT platforms, directly aligns with the requirements of smart city infrastructure.

Changing Consumer Expectations for AI-driven Services

Consumers in China are increasingly expecting AI to enhance their daily lives, driving demand for smarter devices and intelligent services across personal, automotive, and home environments. This shift is particularly evident in the rapid adoption of AI-powered features in smartphones and smart home appliances.

China Mobile is actively catering to these evolving expectations by investing heavily in AI-driven information services. The company is at the forefront of developing innovative applications, such as its 5G New Calling service, which integrates AI capabilities to offer richer communication experiences.

- AI Integration: Consumers are actively seeking AI-powered smart devices and intelligent services in personal, vehicle, and home settings.

- China Mobile's Response: The company is enhancing its AI-powered information services and pioneering new applications like 5G New Calling.

- Market Growth: The smart home market in China saw significant growth, with AI-enabled devices becoming increasingly popular among households. For instance, shipments of smart speakers, a key AI-driven home device, reached tens of millions units in 2023.

Societal shifts in China are marked by a deep embrace of digital connectivity, with over 800 million 5G users by the end of 2024, fostering a culture that prioritizes seamless online experiences. Consumers are actively seeking services that blend affordability with advanced technology and emotional resonance, driving demand for AI-enhanced solutions across personal, automotive, and home sectors.

China Mobile is responding by bolstering its AI capabilities, evident in the millions of daily customer queries handled by its virtual assistants in 2024, and by expanding its smart home ecosystem, connecting over 50 million households by year-end. This reflects a societal move towards digitally integrated living, with 80% of China's population, or 1.17 billion people, using mobile internet by the close of 2024, indicating a mature market nearing saturation.

| Sociological Factor | Description | China Mobile's Relevance/Action |

|---|---|---|

| Digital Culture & Connectivity | High adoption of 5G and mobile internet fuels digital-first lifestyles. | China Mobile leads with over 800 million 5G users (end 2024) and 1.17 billion mobile internet users (end 2024). |

| Demand for Smart Services | Consumers expect AI-enhanced, personalized digital experiences. | Investing in AI for personalized services; AI virtual assistants handle millions of queries daily (2024). |

| Smart Home Ecosystem Growth | Increasing desire for integrated, high-emotional value home solutions. | Expanding smart home platform, connecting over 50 million households (end 2024). |

Technological factors

China Mobile is a major player in 5G, planning to add 340,000 new 5G base stations in 2025, pushing their total to almost 2.8 million. This aggressive expansion is crucial for providing faster and more reliable mobile services.

The company is also at the forefront of 5G-Advanced (5G-A) development, with plans for commercial rollout in over 300 cities by the close of 2024. This next-generation technology promises enhanced capabilities, supporting a wider range of applications and services.

China Mobile is significantly boosting its artificial intelligence capabilities, embedding AI throughout its network infrastructure and creating new services powered by this technology. This strategic push is evident in their 'AI+' initiatives, aiming to elevate their cloud services to a leading position through a comprehensive cloud-to-intelligence transformation.

By the end of 2023, China Mobile reported that its cloud revenue had grown by 35.5% year-on-year, reaching 137.7 billion yuan. This growth underscores their commitment to leveraging digital intelligence and AI to drive future business expansion and service innovation.

China is heavily investing in 6G technology, aiming for commercialization between 2028 and 2030, positioning itself as a global leader in next-generation wireless communication.

China Mobile is a key player in this advancement, actively participating in 6G research and development, which is expected to unlock substantial new investment opportunities in the telecommunications sector.

Cloud Services and Enterprise Solutions Growth

China Mobile is significantly expanding its cloud services and enterprise solutions, recognizing this as a primary growth engine. The company's strategic push into these markets is yielding substantial results, as evidenced by its financial performance.

In 2024, China Mobile's cloud revenue surged to 100.4 billion yuan, marking an impressive 20.4% increase compared to the previous year. This growth is directly linked to the company's ongoing efforts to develop standardized, productized, and platform-based solutions tailored for enterprise clients.

- Cloud Revenue Milestone: China Mobile achieved 100.4 billion yuan in cloud revenue in 2024.

- Year-on-Year Growth: This represents a robust 20.4% increase from the prior year.

- Strategic Focus: The company is prioritizing standardized, productized, and platform-based enterprise solutions to drive this expansion.

IoT Connections and Smart Home Ecosystems

The Internet of Things (IoT) is experiencing explosive growth in China, with projections indicating 10 billion IoT connections by 2025. This surge presents a massive opportunity for connectivity providers. China Mobile is strategically positioning itself to leverage this trend by developing comprehensive smart home ecosystems.

To support this ambition and capitalize on the expanding IoT landscape, China Mobile is actively investing in advanced network infrastructure. This includes significant upgrades to technologies like Gigabit and Fiber-to-the-Room (FTTR). These network enhancements are crucial for delivering the high-speed, reliable connectivity demanded by a growing number of interconnected devices within smart homes and beyond.

- IoT Connection Growth: China's IoT connections are expected to hit 10 billion by 2025.

- Smart Home Focus: China Mobile is building an intelligent home ecosystem to capture this market.

- Network Upgrades: Investments in 'Gigabit + FTTR' are key to supporting increased IoT demand.

China Mobile is aggressively expanding its 5G network, aiming for nearly 2.8 million base stations by the end of 2025, a significant increase that will enhance service capabilities and reach.

The company is also a frontrunner in 5G-Advanced (5G-A), with commercial rollouts planned for over 300 cities by the end of 2024, paving the way for more sophisticated applications.

Significant investments in artificial intelligence are being made, integrating AI across its infrastructure and developing new AI-powered services, as exemplified by its 'AI+' strategy to boost cloud offerings.

China Mobile's cloud revenue demonstrated strong growth, reaching 137.7 billion yuan by the end of 2023, a 35.5% year-on-year increase, highlighting the success of its digital intelligence initiatives.

| Technology Focus | 2024/2025 Projections & Achievements | Impact |

| 5G Base Stations | ~2.8 million by end of 2025 (adding 340,000 in 2025) | Enhanced speed, reliability, and coverage |

| 5G-Advanced (5G-A) | Commercial rollout in over 300 cities by end of 2024 | Support for advanced applications and services |

| Cloud Revenue | 137.7 billion yuan (end of 2023, +35.5% YoY) | Growth engine driven by AI and digital intelligence |

| IoT Connections | Projected 10 billion by 2025 in China | Opportunity for connectivity providers, smart home ecosystems |

Legal factors

China Mobile operates under the stringent oversight of the Ministry of Industry and Information Technology (MIIT), which dictates licensing, technical standards, and overall market operations. This regulatory environment significantly shapes the company's strategic decisions and operational scope.

As a state-owned enterprise, China Mobile's trajectory is closely aligned with national policy objectives, including digital infrastructure development and technological self-sufficiency. For instance, the government's push for 5G network expansion directly benefits China Mobile, with the company investing heavily in this area, reporting over 3.5 million 5G base stations by the end of 2023.

China's commitment to data security and privacy is intensifying, with new regulations bolstering data compliance obligations for network data handlers set to take effect from January 1, 2025. These laws, building on existing frameworks like the Personal Information Protection Law (PIPL), mandate stricter protocols for data collection, storage, and processing. For China Mobile, this means a critical need to fortify its cybersecurity infrastructure and data handling practices to align with these enhanced legal requirements.

Failure to comply with these evolving regulations could expose China Mobile to significant penalties, potentially impacting its operational continuity and brand reputation. The company must proactively invest in advanced data protection technologies and transparent data governance policies to safeguard customer information and maintain trust in an increasingly regulated digital landscape. By prioritizing robust data security, China Mobile can navigate these legal complexities and build a more resilient business model.

China's telecom market, historically dominated by state-owned entities, is seeing a slow but deliberate shift towards greater openness. In 2024, pilot programs were initiated to lift foreign ownership caps in specific value-added telecommunication services, a move that could introduce new competitive pressures for established players like China Mobile.

This gradual liberalization, though focused on niche services initially, signals a potential for increased foreign participation in the broader telecom sector. Such changes necessitate that China Mobile remain agile and responsive to evolving market dynamics and competitive strategies from new entrants.

Anti-monopoly and Unfair Competition Regulations

China's Ministry of Industry and Information Technology (MIIT) has been actively implementing measures to curb monopolistic behavior and unfair competition within the digital sector. These efforts directly impact how internet companies operate, including those in the mobile space. For instance, in late 2023 and early 2024, the MIIT continued to scrutinize app store practices and data handling, aiming for a more level playing field for all market participants.

These regulations are designed to promote a fairer market environment, which could influence China Mobile's strategic decisions and how it competes with other players. The focus on preventing improper practices means that companies must be more diligent in their market conduct, ensuring they do not leverage dominant positions to stifle innovation or disadvantage smaller competitors.

- MIIT's ongoing focus on anti-monopoly actions in the digital economy, with particular attention to app ecosystems.

- Increased scrutiny on unfair competition tactics, potentially impacting pricing strategies and service bundling by mobile operators.

- Emphasis on data privacy and security as part of broader regulatory efforts, influencing how China Mobile handles user information.

Supply Chain Regulations and Self-Sufficiency Push

China's drive for technological self-sufficiency is significantly reshaping its telecom sector. In April 2024, a directive was issued for operators to transition away from foreign processors by 2027. This move directly impacts China Mobile's supply chain, necessitating a pivot towards domestic component manufacturers and potentially increasing costs associated with this transition.

This policy, fueled by geopolitical tensions, encourages China Mobile to deepen its reliance on homegrown technology providers. Such a shift could foster innovation within China's semiconductor and network equipment industries, but also presents challenges in ensuring the performance and reliability of domestically sourced components compared to established international suppliers.

- 2027 Deadline: Operators must phase out foreign processors by this year.

- Geopolitical Drivers: The policy aims to reduce reliance on foreign technology amid international disputes.

- Domestic Sourcing: China Mobile is compelled to increase procurement from Chinese suppliers.

- Supply Chain Impact: This necessitates a strategic realignment of procurement and partnership strategies.

China Mobile navigates a complex legal landscape shaped by government policies and evolving regulations. The Ministry of Industry and Information Technology (MIIT) plays a crucial role, setting standards and overseeing operations, with a strong emphasis on national security and technological independence. For instance, a directive issued in April 2024 mandates a transition away from foreign processors by 2027, directly impacting China Mobile's supply chain and requiring a strategic shift towards domestic technology providers.

Furthermore, intensified data privacy laws, such as those building on the Personal Information Protection Law (PIPL) and set to take effect from January 1, 2025, impose stricter obligations on data handling. China Mobile must invest in robust cybersecurity and transparent data governance to comply with these requirements, avoiding potential penalties and maintaining customer trust. The government's anti-monopoly drive also influences market dynamics, pushing for fairer competition and potentially affecting China Mobile's strategies.

| Regulatory Body | Key Focus Areas | Impact on China Mobile |

| MIIT | Licensing, technical standards, 5G expansion, anti-monopoly actions | Shapes operational scope, investment priorities, and competitive landscape |

| Data Protection Authorities | Data security, privacy compliance (PIPL) | Requires enhanced cybersecurity infrastructure and data governance |

| Government Policy | Technological self-sufficiency, phasing out foreign processors by 2027 | Necessitates supply chain realignment towards domestic manufacturers |

Environmental factors

China Mobile's extensive network expansion, driven by escalating demand for digital services, significantly elevates its energy consumption. This includes the build-out of 5G infrastructure, which is inherently more power-intensive than previous generations. For instance, by the end of 2023, China Mobile reported operating over 3.37 million 5G base stations, a substantial increase that directly correlates with higher energy needs.

The company is actively implementing strategies to mitigate this environmental impact. A key focus is optimizing the energy efficiency of its 5G core network and data centers. China Mobile aims to reduce its carbon footprint through technological advancements and operational improvements, recognizing the critical link between network growth and sustainable energy practices.

China Mobile is actively contributing to China's ambitious climate goals, aligning with national directives for a low-carbon economy and green development. This commitment is evident in their sustainability reporting, which details significant efforts to curb emissions.

The company is making strides in energy efficiency across its operations and is increasingly integrating renewable energy sources into its power infrastructure. For instance, by the end of 2023, China Mobile had achieved a significant reduction in its carbon intensity, with a 24.8% decrease compared to 2020 levels, showcasing tangible progress in their environmental stewardship.

Furthermore, China Mobile extends its green initiatives to its supply chain, encouraging partners to adopt sustainable practices. This holistic approach underscores their dedication to fostering a more environmentally responsible telecommunications sector.

As China Mobile continues to expand its extensive network infrastructure, the efficient use of resources and effective waste management are becoming increasingly important environmental considerations. The company's commitment to sustainability likely involves implementing practices aimed at reducing the environmental footprint of its operations.

In 2023, China Mobile reported a 2.3% year-on-year decrease in energy consumption per unit of business, highlighting efforts towards resource efficiency. Furthermore, the company has been actively promoting the recycling and reuse of network equipment, with over 1.2 million sets of equipment being refurbished or recycled in the past year.

Compliance with Environmental Laws and Regulations

China's commitment to environmental protection is escalating, with its first comprehensive energy law set to take effect in early 2025. This legislation is designed to bolster national energy security while championing a transition towards a greener, low-carbon economic model. China Mobile, like all major corporations, must navigate this evolving regulatory landscape with diligence.

Adhering to these new environmental mandates is not merely a matter of compliance but a strategic imperative. China Mobile needs to proactively integrate these requirements into its operational framework, ensuring its risk management strategies are robust and specifically tailored to environmental regulations. This includes staying abreast of any updates or specific directives related to telecommunications infrastructure and energy consumption.

Key areas of focus for China Mobile will likely include:

- Energy Efficiency: Implementing measures to reduce the energy footprint of its vast network infrastructure, potentially through more efficient base stations and data centers.

- Waste Management: Developing comprehensive strategies for the disposal and recycling of electronic waste generated from network upgrades and equipment decommissioning.

- Emissions Reduction: Exploring renewable energy sources for its operations and optimizing logistics to minimize carbon emissions from its fleet and supply chain.

- Water Usage: Managing water consumption, particularly in cooling systems for data centers, in line with national conservation goals.

Promotion of Sustainable Digital Transformation

China Mobile is actively promoting sustainable digital transformation, recognizing its crucial role in economic growth and environmental protection. The company is investing in AI to enhance the efficiency of its operations.

A prime example is their development of AI-driven green and energy-saving 5G cloudified core networks. This initiative aims to reduce the environmental footprint of their infrastructure while improving performance.

China Mobile's commitment is underscored by its ongoing efforts to integrate digital intelligence for broader economic development. In 2023, the company reported significant progress in its green network initiatives, with energy consumption per unit of traffic seeing a notable decrease.

- AI Integration for Efficiency: China Mobile is leveraging artificial intelligence to optimize network operations, aiming for both economic and environmental benefits.

- Green 5G Networks: The company is a leader in developing 5G core networks that are designed to be energy-efficient and environmentally friendly.

- Digital Intelligence for Growth: The company views digital intelligence as a key driver for national economic development, aligning technological advancement with sustainability goals.

China Mobile faces increasing pressure to manage its environmental footprint, particularly concerning energy consumption from its expanding 5G network. The company reported operating over 3.37 million 5G base stations by the end of 2023, a significant driver of energy demand. China is also enacting new environmental legislation, like its comprehensive energy law taking effect in early 2025, which will necessitate strict adherence to green mandates.

The company is actively working to improve energy efficiency and reduce emissions, aiming to align with China's climate goals. By the end of 2023, China Mobile achieved a 24.8% reduction in carbon intensity compared to 2020 levels. They are also promoting sustainable practices within their supply chain and focusing on waste management, with over 1.2 million equipment sets refurbished or recycled in the past year.

China Mobile is leveraging AI for operational efficiency and developing energy-saving 5G cloudified core networks. This strategic integration of digital intelligence supports both economic growth and environmental protection, as seen in the reported 2.3% year-on-year decrease in energy consumption per unit of business in 2023.

| Metric | 2023 Data | Trend/Impact |

|---|---|---|

| 5G Base Stations | Over 3.37 million | Increased energy demand |

| Carbon Intensity Reduction | 24.8% (vs. 2020) | Progress in emission control |

| Energy Consumption per Unit of Business | 2.3% decrease (YoY) | Improved resource efficiency |

| Equipment Refurbished/Recycled | Over 1.2 million sets | Waste management efforts |

PESTLE Analysis Data Sources

Our China Mobile PESTLE Analysis is built on a robust foundation of data from official Chinese government agencies, leading global economic institutions, and reputable industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting China Mobile.