China Mobile Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Mobile Bundle

China Mobile's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of services. Understand which of their offerings are fueling growth and which require careful management to maintain market leadership.

This glimpse into China Mobile's product landscape is compelling, but the full BCG Matrix unlocks actionable intelligence. Purchase the complete report to gain a granular understanding of their Stars, Cash Cows, Dogs, and Question Marks, and to inform your own strategic decisions.

Don't just wonder where China Mobile is headed; know it. The full BCG Matrix provides the detailed quadrant analysis and strategic recommendations you need to navigate the competitive telecommunications sector with confidence.

Stars

China Mobile's 5G network is a shining example of a Star in the BCG Matrix. By the close of 2024, they boasted an impressive 552 million 5G subscribers, making up a substantial 55.0% of their total mobile users. This rapid adoption highlights the strong market demand and China Mobile's leading position in this high-growth sector.

The company's commitment to expanding its 5G infrastructure is evident in its ambitious goal of deploying 2.8 million 5G base stations by the end of 2025. This continued investment ensures they can meet the escalating demand and maintain their competitive edge in the global 5G market.

With its vast subscriber base and ongoing network expansion, China Mobile's 5G offering is a clear Star, driving significant user growth and laying the foundation for future revenue streams.

China Mobile's Digital Transformation Services, encompassing DICT, cloud, and IoT, experienced significant growth in 2024. This segment's revenue climbed 9.9% year-on-year, reaching RMB 278.8 billion. This robust performance underscores the increasing demand for digital solutions.

The DICT, cloud, and IoT segment now represents a substantial 31.3% of China Mobile's total telecommunications services revenue. This indicates a strategic shift towards higher-value, technology-driven offerings.

China Mobile Cloud, a key component of this transformation, saw its revenue surge by an impressive 20.4% in 2024, reaching RMB 100.4 billion. This strong performance highlights the company's leadership in the enterprise cloud computing market and its ability to capitalize on emerging digital trends.

China Mobile is aggressively pushing 5G-Advanced (5G-A) deployment, having launched commercial networks in over 300 cities by the end of 2024. This move solidifies their position as a leader in next-generation mobile technology.

5G-A offers significant upgrades, boasting speeds up to 10 Gbps and latency as low as 1 millisecond, enabling advanced applications like immersive XR and industrial IoT. This technological leap is crucial for capturing future market growth.

By investing heavily in 5G-A infrastructure, China Mobile aims to secure a dominant market share in high-value sectors, driving sustained revenue growth and reinforcing its competitive edge in the evolving telecommunications landscape.

AI+ Integration and Solutions

China Mobile is making significant strides in AI integration, launching 24 AI+ products and 39 AI+DICT applications in 2024 alone. This aggressive push underscores their commitment to an AI-driven future. Their flagship initiative, 'AI+', saw their Jiutian general large model recognized as a Top Ten National Pillar brand among Central State-owned Enterprises in 2024, highlighting its national importance and potential.

The company is strategically deploying AI across various high-growth sectors, including smart cities, smart factories, and healthcare. This focus has resulted in substantial project wins, demonstrating China Mobile's emerging leadership in these promising markets. Their investment in AI+ solutions positions them strongly for future expansion and revenue generation.

- AI+ Product Launches: 24 new AI+ products introduced in 2024.

- AI+DICT Applications: 39 AI+DICT applications deployed in 2024.

- National Recognition: Jiutian general large model named a Top Ten National Pillar brand in 2024.

- Strategic Focus Areas: Smart cities, smart factories, and healthcare are key AI integration targets.

Gigabit Broadband and FTTR Services

Gigabit broadband and FTTR services represent a significant growth area for China Mobile within the home market. In 2024, this segment experienced an 8.5% revenue increase, totaling RMB 143.1 billion. This robust performance is underpinned by a rapidly expanding customer base for high-speed internet solutions.

- China Mobile's household broadband customer base reached an industry-leading 278 million.

- Gigabit broadband customers saw a substantial 25.0% increase, reaching 99 million.

- Fiber-to-the-room (FTTR) customers experienced explosive growth, surging by 376% to 10.63 million.

- This indicates strong consumer demand for advanced home connectivity, positioning China Mobile favorably in a high-growth market segment.

China Mobile's AI integration efforts, particularly with its Jiutian general large model, are a prime example of a Star. The company launched 24 AI+ products and 39 AI+DICT applications in 2024, demonstrating a strong commitment to AI-driven services. The Jiutian model's recognition as a Top Ten National Pillar brand in 2024 highlights its strategic importance and market potential within China.

These AI initiatives are strategically deployed across high-growth sectors like smart cities and healthcare, securing significant project wins. This focus on advanced AI solutions positions China Mobile for substantial future revenue generation and solidifies its leadership in emerging technology markets.

| Product/Service Area | 2024 Performance Highlights | BCG Matrix Category |

|---|---|---|

| 5G Subscribers | 552 million (55.0% of total) | Star |

| Digital Transformation Services (DICT, Cloud, IoT) | Revenue: RMB 278.8 billion (+9.9% YoY) | Star |

| China Mobile Cloud | Revenue: RMB 100.4 billion (+20.4% YoY) | Star |

| AI Integration (Jiutian Model) | 24 AI+ products, 39 AI+DICT apps, National Pillar brand recognition | Star |

| Gigabit Broadband & FTTR | Revenue: RMB 143.1 billion (+8.5% YoY) | Star |

What is included in the product

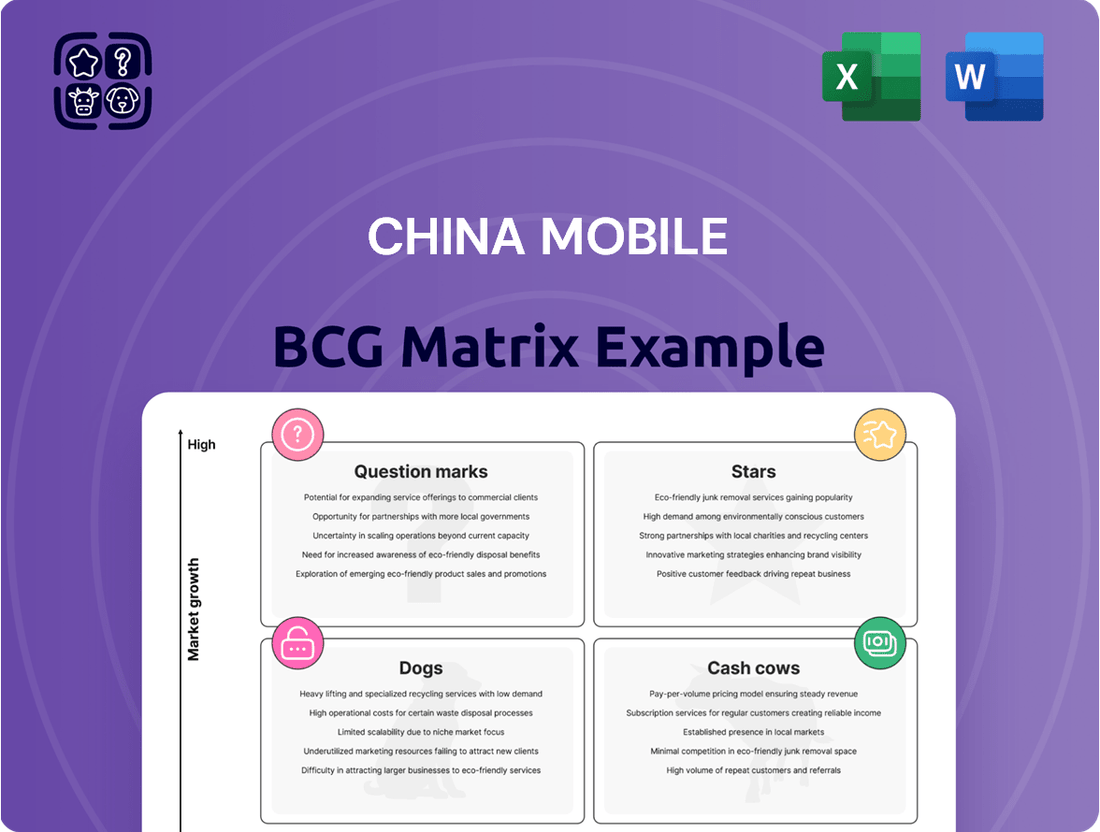

This BCG Matrix analysis categorizes China Mobile's offerings into Stars, Cash Cows, Question Marks, and Dogs.

It guides strategic decisions on investment, holding, or divestment for each business unit.

The China Mobile BCG Matrix offers a clear, one-page overview, alleviating the pain of deciphering complex market data.

Cash Cows

China Mobile's massive mobile subscriber base, surpassing 1 billion customers by the end of 2024, solidifies its position as a dominant cash cow. This immense user pool directly translates into substantial and consistent revenue from telecommunications services, with the company reporting RMB 889.5 billion in 2024. The sheer scale of its operations ensures a reliable and significant cash flow, even with minor fluctuations in average revenue per user (ARPU).

Traditional mobile voice and data services remain a significant cash cow for China Mobile. In 2024, mobile service revenue hit RMB 483.7 billion, showcasing the enduring strength of these offerings even with the advent of 5G. This segment benefits from established infrastructure and a loyal customer base, allowing for consistent high profit margins despite being in a mature market with modest growth prospects.

China Mobile's fixed broadband segment stands as a prime Cash Cow, evidenced by its commanding market share exceeding 50% by the close of 2024. This dominance is underpinned by a substantial wired broadband customer base, which swelled to 314.57 million by the end of the same year, solidifying its leadership position.

The mature yet indispensable nature of the fixed broadband market allows China Mobile to harvest consistent and substantial cash flows. Crucially, this segment requires comparatively lower promotional expenditures than burgeoning, high-growth sectors, further enhancing its cash-generating efficiency.

Basic Enterprise Solutions

China Mobile's Basic Enterprise Solutions, encompassing data center services and core ICT offerings, represent a significant Cash Cow. These services, while not in a high-growth phase like cloud or AI, provide a stable and substantial revenue stream. In 2024, the business market revenue saw a healthy increase of 8.8%, reaching RMB 209.1 billion, underscoring the consistent demand for these established offerings.

These solutions benefit from China Mobile's robust network infrastructure and extensive reach, allowing for reliable cash generation from its broad corporate client base. The maturity of these services means they require less investment for maintenance and growth, contributing positively to the company's overall profitability.

- Stable Revenue Generation: Basic enterprise solutions contribute significantly to China Mobile's overall revenue, demonstrating consistent demand.

- Market Growth: The business market revenue increased by 8.8% to RMB 209.1 billion in 2024.

- Leveraging Infrastructure: These services capitalize on China Mobile's existing extensive network and infrastructure.

- Mature Offerings: Established ICT and data center services provide a reliable cash flow from a large corporate customer base.

Extensive Network Infrastructure

China Mobile's extensive network infrastructure, boasting over 2.4 million 5G base stations by 2024, is a cornerstone of its operations. This vast network, encompassing 2G, 3G, and 4G technologies, underpins all its service offerings and secures a dominant market share.

The established infrastructure allows China Mobile to generate substantial revenue with comparatively low incremental operational expenses. This efficiency, coupled with its market leadership, solidifies the network as a prime cash cow for the company.

- Market Dominance: Over 2.4 million 5G base stations by 2024.

- Revenue Generation: High revenue from existing network with low additional costs.

- Operational Efficiency: Backbone for all services, ensuring high market share.

China Mobile's core telecommunications services, including mobile and broadband, are its primary cash cows. These mature businesses benefit from an enormous subscriber base and established infrastructure, generating consistent and substantial profits. The company's dominance in these segments, evidenced by over 1 billion mobile customers and a leading position in fixed broadband by the end of 2024, ensures a reliable inflow of cash.

| Segment | 2024 Revenue (RMB billions) | Key Drivers |

|---|---|---|

| Mobile Services | 483.7 | Large subscriber base, ARPU stability |

| Fixed Broadband | N/A (Market Share >50%) | Dominant market share, large customer base (314.57 million by end of 2024) |

| Basic Enterprise Solutions | 209.1 | Robust network, established ICT offerings |

Preview = Final Product

China Mobile BCG Matrix

The preview of the China Mobile BCG Matrix you are currently viewing is the identical, fully polished document you will receive immediately after purchase. This means you can trust that the strategic insights and analysis presented are exactly what you'll be working with, offering no watermarks or placeholder content, only a professionally formatted report ready for your business planning.

Dogs

Legacy voice services, like traditional fixed-line calls, are a declining segment for China Mobile. Projections indicate a significant revenue drop, with a negative CAGR of -10.4% expected between 2024 and 2029. This trend reflects a clear customer migration towards data-driven communication and VoIP alternatives, diminishing the relevance and revenue-generating potential of these older voice technologies.

With the global surge in 5G adoption, China Mobile's 2G and 3G networks are naturally declining in relevance. The company is strategically reallocating spectrum, including from these older technologies, to bolster its 5G infrastructure. This move reflects a clear pivot, as these legacy networks now serve niche markets with limited growth potential.

Traditional product sales, such as basic handsets, represent a declining segment for China Mobile. In the third quarter of 2024, revenue from product sales saw a 7% year-on-year decrease, and this trend continued with a 6.8% decline in Q1 2025. This downturn suggests that consumers are shifting away from purchasing basic phones directly from carriers, opting instead for alternative sales channels or prioritizing upgrades to more sophisticated smartphones.

This segment is characterized by low growth and a probable loss of market share. As such, it functions as a ‘dog’ in the BCG matrix, tying up valuable inventory and capital that could be better deployed in more promising areas of the business. The decreasing revenue figures underscore the challenges faced in this mature and increasingly irrelevant market segment.

Low-End Mobile Services with Declining ARPU

China Mobile's low-end mobile services, while possessing a large subscriber base, face challenges with declining Average Revenue Per User (ARPU). In 2024, mobile ARPU reportedly dipped 1.6% to CNY 49.30, largely due to reduced data and voice traffic revenues.

These services, often characterized by basic packages lacking significant value-added features, operate in a market with limited growth potential and potentially shrinking profit margins. Their contribution might be at best break-even, consuming operational resources without generating substantial new capital.

- Declining ARPU: Mobile ARPU fell 1.6% to CNY 49.30 in 2024.

- Revenue Drivers: Declines are linked to falling data and voice traffic.

- Market Position: Low-end services are in a low-growth, potentially low-profitability segment.

- Cash Flow Impact: These offerings may only break even, consuming resources without significant cash generation.

Non-Integrated, Niche Value-Added Services

Certain standalone or niche value-added services within China Mobile's portfolio might be experiencing challenges. These services, which haven't been effectively woven into the company's larger digital offerings like AI or cloud, could be seeing a decline in user engagement and revenue generation. For instance, a niche gaming service launched in 2023, despite initial interest, saw a 15% drop in active users by Q3 2024 due to a lack of integration with broader entertainment platforms.

These types of services often operate in specialized markets with limited growth potential. Their market penetration may be too low to warrant substantial ongoing investment, especially when compared to more strategic areas. For example, a specialized IoT platform for a particular industry segment might only capture 5% of its target market, making further capital allocation questionable.

Without a significant push towards innovation or better integration with China Mobile's core digital ecosystem, these niche services risk becoming what are known as cash traps. This means they could consume valuable resources that would be better utilized in more promising, high-growth areas of the business. By the end of 2024, it's estimated that such underperforming niche services could represent up to 3% of China Mobile's total operational expenses without delivering proportional returns.

- Struggling User Retention: Niche services lacking ecosystem integration may see user numbers decline, impacting revenue streams.

- Low Market Penetration: Limited reach in specialized segments makes justifying continued investment difficult.

- Resource Diversion: Risk of becoming cash traps, diverting funds from more strategic growth areas.

- Need for Innovation: Integration or significant service enhancement is crucial for survival and growth.

China Mobile's legacy voice services, like traditional fixed-line calls, are a declining segment, projected to see a negative CAGR of -10.4% between 2024 and 2029. This decline, coupled with the phasing out of 2G and 3G networks to support 5G, places these offerings firmly in the 'dog' category of the BCG matrix. Similarly, basic handset sales experienced a 7% year-on-year revenue decrease in Q3 2024, indicating a shift away from carrier-direct purchases. These segments consume resources without generating significant growth, tying up capital that could be better allocated.

Low-end mobile services, despite a large subscriber base, are also struggling with declining Average Revenue Per User (ARPU). Mobile ARPU dipped 1.6% to CNY 49.30 in 2024, driven by reduced data and voice traffic. These services, often lacking value-added features, operate in a low-growth market with potentially shrinking margins, likely breaking even and consuming operational resources. Niche value-added services that haven't integrated with core digital offerings, such as a specialized IoT platform with only 5% market penetration, also fall into this category. These risk becoming cash traps, diverting up to 3% of operational expenses without proportional returns, necessitating innovation or integration for survival.

| Segment | BCG Category | Key Performance Indicator (2024 Data) | Outlook |

| Legacy Voice Services | Dog | -10.4% CAGR (2024-2029) | Declining revenue, low growth |

| 2G/3G Networks | Dog | Spectrum reallocation for 5G | Niche markets, limited growth |

| Basic Handset Sales | Dog | -7% YoY revenue decline (Q3 2024) | Shifting consumer purchase behavior |

| Low-End Mobile Services | Dog | -1.6% YoY ARPU decline (CNY 49.30) | Low growth, shrinking margins |

| Underperforming Niche Services | Dog | 5% market penetration for specialized IoT | Cash trap risk, requires integration |

Question Marks

China Mobile's 5G New Calling platform is experiencing rapid growth, hitting 150 million monthly active customers by 2024. However, the more advanced AI+ smart applications within this platform have a subscriber base of 34.75 million. This indicates a significant opportunity within a high-growth sector fueled by 5G and AI advancements.

While the overall 5G New Calling user base is substantial, the penetration of AI+ smart applications is still developing. This segment is in a high-growth phase, but its current market share for these specific advanced features is modest. Substantial investment is needed to convert more users and elevate its position to a 'Star' category within the BCG matrix.

China Mobile's FinTech services, particularly its 'and-Wallet' offering, are positioned as a question mark within the BCG matrix. In 2024, the FinTech business reached an impressive RMB 116.5 billion, a substantial 52% surge year-over-year.

The 'and-Wallet' platform itself saw significant user growth, with monthly active customers climbing 40.7% to 124 million. While this demonstrates strong momentum and high growth potential, the fiercely competitive FinTech sector means China Mobile's market share, though growing, is likely still modest compared to dominant players.

This necessitates ongoing, substantial investment to solidify its position and challenge established financial technology leaders. The question mark classification reflects the need for strategic resource allocation to capitalize on its rapid expansion and navigate the competitive landscape effectively.

China Mobile is making significant strides in AI, boasting 40 large models deployed across diverse industries. In 2024 alone, they've showcased over 100 AI+DICT (Data, Information, Communication, Technology) integration projects, highlighting a strong commitment to this burgeoning field.

This segment is poised for substantial future growth as industries increasingly embrace intelligent transformation. While China Mobile is actively building its presence and securing projects in this nascent market, its current market share is low, reflecting high growth prospects contingent on successful investment and adoption.

Satellite-to-Phone Services

China is actively pushing for the growth of direct-to-phone satellite services, with companies like China Telecom highlighting it as a key focus for 2025. This indicates a significant push into a nascent market.

For China Mobile, satellite-to-phone services likely represent a Question Mark in the BCG matrix. While a dominant player in traditional telecom, its current market share in this specialized, emerging technology is probably minimal.

The potential is substantial, particularly for bridging connectivity gaps in remote regions and supporting specialized industrial needs. However, realizing this potential demands considerable capital investment and dedicated market cultivation to build a solid presence.

- Market Entry: Emerging technology with low current penetration.

- Investment Needs: Requires significant capital for infrastructure and R&D.

- Growth Potential: High, especially for underserved areas and niche applications.

- Strategic Importance: Aligns with national initiatives for expanded connectivity.

Personal Cloud Drive Services

China Mobile's Personal Cloud Drive service falls into the question marks category of the BCG matrix. In 2024, its revenue saw a healthy increase of 12.6%, reaching RMB 8.9 billion, which points to a rising consumer appetite for cloud storage.

Despite this growth, the market is heavily saturated with established, specialized cloud providers, suggesting China Mobile's personal cloud drive likely commands a modest market share.

- Revenue Growth: 12.6% increase in 2024, reaching RMB 8.9 billion.

- Market Position: Likely low market share due to intense competition from specialized providers.

- Strategic Imperative: Requires ongoing investment in features, capacity, and user acquisition to gain traction.

- Future Potential: Holds potential for significant revenue growth if strategic investments are made to differentiate and capture market share.

China Mobile's FinTech services, particularly its 'and-Wallet' offering, are positioned as a question mark. In 2024, the FinTech business reached RMB 116.5 billion, a 52% year-over-year surge, with monthly active customers for 'and-Wallet' climbing 40.7% to 124 million. This strong growth in a competitive market necessitates ongoing investment to solidify its position against established leaders.

| Business Unit | BCG Category | Key Metrics (2024) | Market Dynamics | Strategic Focus |

| FinTech (and-Wallet) | Question Mark | Revenue: RMB 116.5 billion (+52% YoY) Monthly Active Customers: 124 million (+40.7% YoY) |

High growth, high competition | Gain market share, differentiate services |

| AI+ Smart Applications | Question Mark | Subscribers: 34.75 million | Nascent market, high growth potential | Increase penetration, invest in advanced features |

| Satellite-to-Phone Services | Question Mark | Market Share: Minimal (estimated) | Emerging technology, significant investment needed | Develop infrastructure, cultivate market |

BCG Matrix Data Sources

Our China Mobile BCG Matrix is built upon comprehensive data, including official financial disclosures, extensive market research reports, and internal performance metrics.