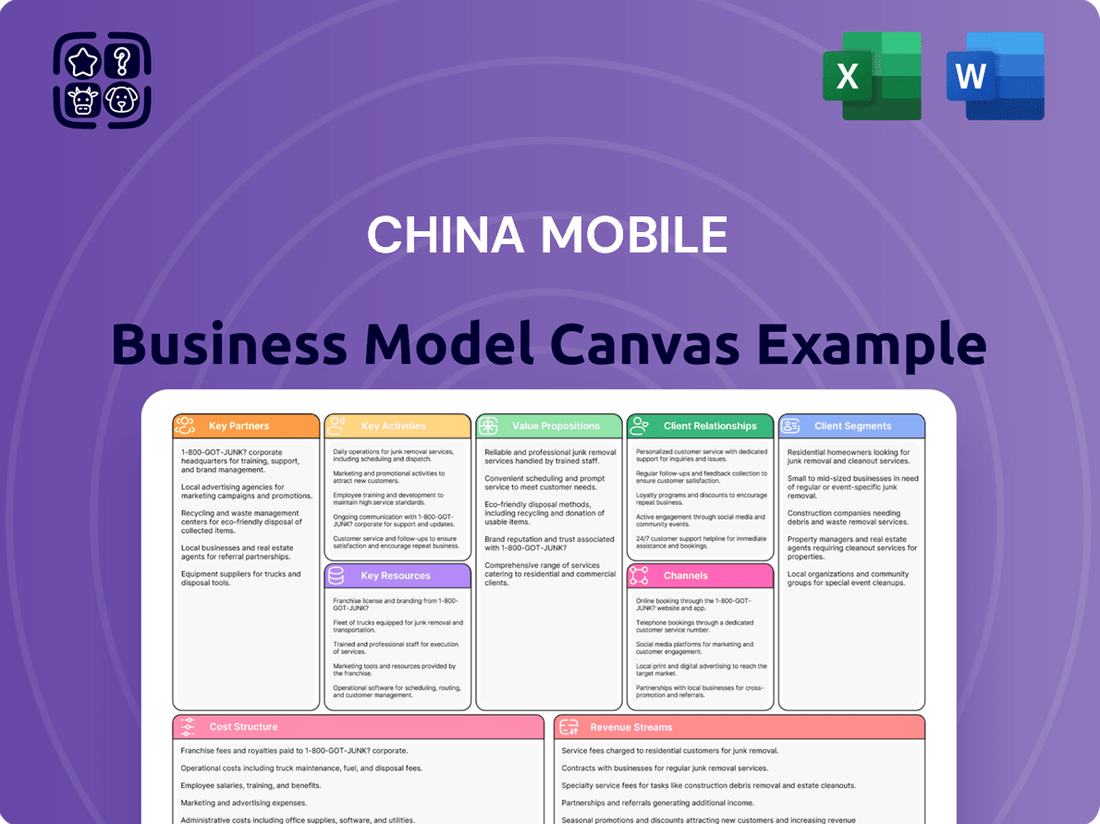

China Mobile Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Mobile Bundle

Uncover the strategic brilliance behind China Mobile's dominance with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Ready to gain a competitive edge? Download the full China Mobile Business Model Canvas to explore their innovative value propositions and cost structures, empowering your own strategic planning and market analysis.

Partnerships

China Mobile's state-owned status fosters robust partnerships with government entities, vital for navigating regulatory landscapes and securing approvals for network expansion. These collaborations are instrumental in aligning business objectives with national digital transformation agendas, such as the ongoing 5G rollout and smart city initiatives.

These strategic alliances ensure China Mobile benefits from favorable policies and access to critical infrastructure development opportunities. For instance, its role in national cybersecurity frameworks and data governance initiatives solidifies its position as a key player in China's technological advancement, a sector that saw significant government investment in 2024.

China Mobile heavily relies on partnerships with top-tier global and domestic technology vendors to build and maintain its cutting-edge network infrastructure. This includes collaborations for 5G equipment, essential for deploying the latest generation of mobile technology, and advanced optical fiber solutions that form the backbone of its high-speed data transmission capabilities.

These strategic alliances extend to data center solutions, ensuring robust and scalable infrastructure for cloud services and data processing. By teaming up with leaders in telecommunications technology, China Mobile guarantees its network is equipped with the most advanced hardware and software, crucial for delivering superior service quality and supporting a vast array of digital applications.

In 2023, China Mobile continued to invest significantly in network upgrades, with capital expenditure reaching ¥190.2 billion, much of which directly supports these vendor partnerships for 5G and fiber deployment. For instance, Huawei and ZTE are key suppliers of 5G base stations and core network equipment, enabling China Mobile to expand its 5G coverage to over 3.37 million base stations by the end of 2023.

China Mobile actively collaborates with a wide array of content creators, media companies, and application developers to bolster its value-added services. These strategic alliances are crucial for curating a rich and diverse offering of entertainment, productivity, and lifestyle applications for its massive subscriber base. For instance, in 2023, China Mobile saw significant growth in its mobile video services, driven by partnerships with major content providers, contributing to its overall revenue streams.

Enterprise Solution Integrators

China Mobile actively collaborates with enterprise solution integrators to expand its reach in the enterprise and cloud services market. These partnerships are crucial for delivering sophisticated digital transformation projects, including IoT deployments and customized cloud solutions for diverse industries.

These strategic alliances enable China Mobile to offer specialized expertise and end-to-end solutions, catering to the unique needs of corporate clients. For example, in 2023, China Mobile reported a significant increase in its enterprise business revenue, partly driven by successful integrations facilitated by its partners.

- System Integrators: Partnering with major system integrators allows China Mobile to bundle its connectivity and cloud offerings with broader IT solutions, enhancing value for enterprise customers.

- Specialized Solution Providers: Collaborations with niche technology firms provide access to specialized capabilities in areas like AI, big data analytics, and cybersecurity, enabling more comprehensive digital transformation packages.

- Industry-Specific Solutions: These partnerships are key to developing and deploying tailored solutions for sectors such as manufacturing, healthcare, and finance, addressing specific industry challenges.

Research and Development Institutions

China Mobile actively collaborates with universities and research institutions to drive innovation, especially in cutting-edge fields like artificial intelligence, the Internet of Things (IoT), and next-generation communication technologies.

These strategic alliances are crucial for developing advanced solutions and ensuring China Mobile remains a leader in the rapidly evolving telecommunications landscape. For instance, in 2023, China Mobile announced collaborations with several leading universities on 6G research, aiming to explore new spectrum technologies and network architectures.

- University Collaborations: Partnerships with institutions like Tsinghua University and Peking University focus on fundamental research in areas such as AI-driven network optimization and advanced wireless communication protocols.

- R&D Institute Engagement: Collaborations with national research bodies contribute to the development of new standards and the testing of emerging technologies, ensuring China Mobile is prepared for future market demands.

- Talent Development: These partnerships also serve to cultivate a pipeline of skilled talent, essential for maintaining a competitive edge in technological advancement.

China Mobile's key partnerships are crucial for its operational success and market expansion. These include collaborations with government entities for regulatory alignment and infrastructure access, technology vendors for network equipment, and content creators for value-added services.

The company also partners with enterprise solution integrators to penetrate the business market and with universities for research and development in emerging technologies.

These alliances are vital for innovation, service diversification, and maintaining a competitive edge in the rapidly evolving telecommunications sector.

| Partner Type | Examples | Impact/Focus |

| Government Entities | National Development and Reform Commission, Ministry of Industry and Information Technology | Regulatory navigation, infrastructure access, national digital strategy alignment |

| Technology Vendors | Huawei, ZTE, Ericsson, Nokia | 5G network deployment, optical fiber solutions, advanced hardware and software |

| Content & App Developers | Tencent, ByteDance, iQiyi | Value-added services, entertainment, productivity applications, revenue diversification |

| System Integrators | IBM, Accenture, Infosys | Enterprise solutions, IoT deployments, cloud services, digital transformation projects |

| Research Institutions | Tsinghua University, Peking University, CAS Institutes | AI, IoT, 6G research, talent development, technological innovation |

What is included in the product

China Mobile's business model canvas focuses on its vast customer base and extensive network infrastructure to deliver a wide range of telecommunications services, including mobile, broadband, and emerging digital solutions.

It details key partnerships with technology providers and content creators, alongside revenue streams from subscriptions, data usage, and value-added services, all supported by a robust cost structure.

Provides a structured framework to pinpoint and address China Mobile's operational inefficiencies and market challenges.

Offers a clear visual representation of China Mobile's value proposition, enabling the identification of unmet customer needs and potential service gaps.

Activities

China Mobile's network infrastructure development and maintenance is paramount, encompassing the ongoing planning, deployment, and upgrading of its vast 4G and 5G networks. This critical activity ensures the delivery of reliable and high-speed communication services to its immense subscriber base across mainland China.

As of the first half of 2024, China Mobile reported a significant expansion of its 5G network, reaching over 3.4 million 5G base stations. This robust infrastructure underpins its ability to offer advanced services and maintain market leadership.

China Mobile's core business revolves around providing a wide array of mobile communication services. This includes voice calls, text messaging (SMS), and crucially, mobile data services that power the digital lives of millions.

Beyond mobile, the company is a significant player in fixed-line broadband internet services, connecting homes and businesses to the digital world. This dual offering ensures a comprehensive connectivity solution for its diverse customer base.

Managing these services involves intricate operations like developing and offering various service plans, handling billing for millions of subscribers, and ensuring reliable connectivity for both individual consumers and business clients.

As of the first half of 2024, China Mobile reported a substantial 777 million mobile users and 277 million broadband users, underscoring the massive scale of its service provision activities.

China Mobile actively develops and delivers a broad spectrum of value-added services. These include mobile payments, a crucial area for digital transactions, and a growing portfolio of digital content, from streaming services to educational platforms.

The company is also heavily invested in emerging sectors like cloud gaming, offering immersive entertainment experiences, and Internet of Things (IoT) solutions, connecting devices for various industries. In 2023, China Mobile's revenue from value-added services reached approximately 233.3 billion RMB, demonstrating their importance in diversifying revenue streams beyond core telecommunications.

These services are designed to deepen customer engagement and create new avenues for revenue generation. By expanding beyond basic connectivity, China Mobile aims to become a comprehensive digital lifestyle provider, catering to evolving consumer needs.

Enterprise and Cloud Solutions Offering

China Mobile is significantly boosting its enterprise and cloud offerings, aiming to capture a larger share of the business market. This strategic push involves developing and marketing comprehensive solutions tailored for businesses, including robust cloud computing services and digital transformation platforms designed for specific industries. This focus addresses the increasing need for integrated IT and communication solutions among enterprises.

The company's efforts in this area are reflected in its substantial investments and market penetration. For instance, China Mobile's cloud business has seen considerable growth, with its market share in China's public cloud sector expanding. By 2024, China Mobile was a key player, competing with both domestic and international cloud providers, offering a wide array of services from basic infrastructure to advanced data analytics and AI solutions.

- Enterprise Solutions Development: China Mobile actively develops and markets a suite of enterprise solutions, encompassing network infrastructure, private cloud, and hybrid cloud services.

- Cloud Computing Expansion: The company is a major provider of cloud computing services, offering scalable and secure solutions to businesses across various sectors, including finance, government, and manufacturing.

- Industry-Specific Digital Transformation: China Mobile provides tailored digital transformation platforms and services designed to meet the unique needs of different industries, facilitating their modernization and efficiency improvements.

- B2B Segment Growth: These activities are central to China Mobile's strategy to expand its business-to-business (B2B) segment, driving revenue diversification beyond its traditional consumer mobile services.

Customer Relationship Management and Support

China Mobile actively manages and supports its enormous customer base through a multi-channel approach. This includes extensive call centers, robust online self-service portals, and a widespread network of physical retail stores across China. The company prioritizes customer acquisition, aiming to onboard new users efficiently, and focuses heavily on retention through loyalty programs and personalized service offerings. In 2023, China Mobile reported serving over 980 million mobile customers, underscoring the scale of its customer relationship management efforts.

Technical support and prompt resolution of customer inquiries are paramount to maintaining satisfaction and reducing churn. China Mobile invests in training its support staff and developing advanced troubleshooting tools to address a wide range of technical issues, from network connectivity problems to device compatibility. This dedication to service excellence is a key differentiator in the competitive telecommunications landscape.

- Customer Acquisition: China Mobile focuses on attracting new subscribers through competitive pricing, bundled service packages, and aggressive marketing campaigns.

- Customer Retention: Programs like loyalty points, exclusive offers for long-term customers, and proactive customer service are employed to keep subscribers engaged.

- Technical Support: Providing accessible and effective technical assistance via phone, online chat, and in-store support to resolve network and service-related issues.

- Customer Inquiry Management: Efficiently handling a high volume of customer queries and feedback through various channels to ensure a positive user experience.

China Mobile's key activities center on building and maintaining its extensive telecommunications network, offering a comprehensive suite of mobile and broadband services, and developing innovative value-added digital services. The company also aggressively pursues growth in the enterprise sector by providing cloud and digital transformation solutions.

These core operations are supported by robust customer management, ensuring a positive experience for its vast subscriber base. China Mobile's strategic focus on 5G deployment and expanding its B2B cloud offerings positions it for continued market leadership.

| Key Activity | Description | 2024 Data/Context |

|---|---|---|

| Network Infrastructure | Planning, deploying, and upgrading 4G and 5G networks. | Over 3.4 million 5G base stations deployed by H1 2024. |

| Core Services | Providing mobile voice, SMS, and data; fixed-line broadband. | 777 million mobile users and 277 million broadband users (H1 2024). |

| Value-Added Services | Developing mobile payments, digital content, cloud gaming, IoT. | Revenue from value-added services was ~233.3 billion RMB in 2023. |

| Enterprise & Cloud | Developing B2B solutions, cloud computing, digital transformation. | Significant expansion in public cloud market share; key player in enterprise IT. |

| Customer Management | Acquisition, retention, and technical support across multiple channels. | Serving over 980 million mobile customers (2023). |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for China Mobile that you are previewing is the exact document you will receive upon purchase. This isn't a simplified sample or a marketing mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed Business Model Canvas, ready for your strategic planning.

Resources

China Mobile's extensive network infrastructure is its bedrock, boasting the world's largest and most sophisticated mobile network. This includes a massive footprint of 4G and 5G base stations, extensive fiber optic backbones, and a growing number of data centers strategically located across China.

This robust physical asset is critical for delivering its core telecommunications services, from basic mobile calls and data to advanced 5G applications. As of the first half of 2024, China Mobile had deployed over 3.37 million 5G base stations, underscoring its commitment to leading in next-generation mobile technology.

China Mobile's operations are underpinned by essential spectrum licenses and regulatory approvals, granted by the Chinese government. As a state-owned entity, these approvals are critical for building and operating its extensive mobile network infrastructure.

These intangible assets are not merely permissions; they represent a significant competitive advantage, allowing China Mobile to deploy advanced technologies like 5G. For instance, by the end of 2023, China Mobile had established over 3.37 million 5G base stations, a testament to the effective utilization of its licensed spectrum.

China Mobile's vast customer base, exceeding 1.03 billion mobile subscribers as of the end of 2023, is a cornerstone of its business model. This enormous reach translates into substantial and predictable revenue streams, providing a solid foundation for its operations and growth initiatives.

The company's strong brand recognition in China acts as a powerful intangible asset, fostering customer loyalty and trust. This well-established reputation not only helps retain existing users but also serves as a significant draw for new customers, reinforcing its dominant market position.

This immense subscriber count enables China Mobile to achieve significant economies of scale in its network infrastructure, marketing, and service delivery. These efficiencies contribute to cost advantages, allowing the company to offer competitive pricing and further solidify its market leadership.

Skilled Workforce and R&D Capabilities

China Mobile leverages its extensive pool of highly skilled employees, comprising engineers, IT specialists, and customer service professionals, as a cornerstone of its operations. This human capital is crucial for maintaining and advancing its vast network infrastructure and delivering quality customer experiences.

The company's robust internal research and development (R&D) capabilities are directly supported by this skilled workforce. These capabilities are instrumental in driving innovation across its service offerings, optimizing network performance, and developing cutting-edge technologies. For instance, in 2023, China Mobile reported significant investment in R&D, focusing on areas like 5G-Advanced and AI integration, which directly benefits from its engineering talent.

- Skilled Workforce: Over 460,000 employees as of the end of 2023, with a significant proportion in technical and R&D roles.

- R&D Investment: China Mobile's R&D expenditure reached approximately RMB 27.3 billion in 2023, a substantial increase year-on-year, fueling innovation in 5G, AI, and cloud technologies.

- Innovation Focus: Development of proprietary technologies and services, including advancements in network slicing for 5G, IoT solutions, and digital transformation platforms.

Proprietary Technologies and Intellectual Property

China Mobile's competitive advantage is significantly bolstered by its extensive collection of proprietary technologies and intellectual property. This includes a substantial patent portfolio, especially in crucial areas like 5G network development, advanced cloud computing solutions, and sophisticated network management systems.

These technological assets are not just defensive; they actively drive innovation, allowing China Mobile to create and offer cutting-edge services that differentiate it in the market. For instance, their investments in 5G core technologies position them to lead in areas like enhanced mobile broadband and massive machine-type communications.

By the end of 2023, China Mobile reported holding over 78,000 domestic invention patents and more than 23,000 overseas patents, with a significant portion dedicated to 5G and emerging technologies. This deep well of intellectual property is fundamental to their strategy of providing integrated, high-quality digital life services.

- Proprietary 5G Technologies: China Mobile holds a leading position in 5G standard essential patents, contributing significantly to global 5G development.

- Cloud Computing Innovations: Their intellectual property extends to cloud infrastructure, big data analytics, and AI-driven cloud services, enhancing their enterprise solutions.

- Network Management Systems: Patents in intelligent network operations and maintenance ensure efficient, reliable, and scalable network performance, a key differentiator.

- Intellectual Property Growth: The company consistently invests in R&D, evidenced by a year-on-year increase in patent filings, particularly in next-generation communication technologies.

China Mobile's key resources encompass its vast network infrastructure, including over 3.37 million 5G base stations as of mid-2024, and its substantial customer base, exceeding 1.03 billion mobile subscribers by the end of 2023. These are complemented by essential government-granted spectrum licenses and regulatory approvals, which are critical for its operations. The company also relies on its workforce of over 460,000 employees as of end-2023, many of whom are in technical and R&D roles, and its significant R&D investments, totaling approximately RMB 27.3 billion in 2023, which fuel innovation in 5G and AI. Furthermore, its intellectual property portfolio, with over 78,000 domestic and 23,000 overseas patents by end-2023, particularly in 5G technology, provides a distinct competitive edge.

| Key Resource | Description | Supporting Data (as of late 2023/mid-2024) |

|---|---|---|

| Network Infrastructure | World's largest mobile network | Over 3.37 million 5G base stations (mid-2024) |

| Customer Base | Massive subscriber reach | Over 1.03 billion mobile subscribers (end-2023) |

| Spectrum Licenses & Approvals | Government-granted operational rights | Essential for network deployment and expansion |

| Skilled Workforce | Technical and R&D expertise | Over 460,000 employees (end-2023) |

| R&D Investment | Driving innovation | Approx. RMB 27.3 billion in 2023 |

| Intellectual Property | Proprietary technologies and patents | Over 78,000 domestic, 23,000 overseas patents (end-2023) |

Value Propositions

China Mobile's ubiquitous and reliable connectivity is a cornerstone of its value proposition, boasting an extensive network that blankets mainland China, even reaching remote regions. This ensures customers, whether individuals or businesses, have consistent access to voice and data services, a critical need in today's connected world.

This commitment to coverage translates into tangible benefits. For instance, as of the first half of 2024, China Mobile reported over 1.1 billion mobile customers, a testament to the widespread trust in its network's reach and dependability. This vast user base underscores the importance of their reliable infrastructure.

China Mobile delivers a superior mobile experience through its advanced 4G network and its leading 5G infrastructure. This means users enjoy incredibly fast download and upload speeds, along with minimal delay, making everything from streaming high-definition video to engaging in real-time online gaming incredibly smooth.

This commitment to speed and low latency directly addresses the growing consumer and business need for robust mobile data capabilities. In 2023, China Mobile's 5G network covered over 3.5 million base stations, supporting the increasing demand for bandwidth-intensive applications and services.

China Mobile goes far beyond just phone calls and internet access, offering a wide array of integrated services. Think digital content like streaming videos and music, convenient mobile payment solutions, and even smart home devices that connect your living space. This creates a complete digital ecosystem for its customers.

In 2023, China Mobile reported that its IoT terminal connections reached 426 million, showcasing the breadth of its smart device offerings. Furthermore, its cloud services segment saw significant growth, with revenue increasing by 43.5% year-on-year in the first half of 2024, demonstrating the increasing demand for its integrated digital solutions.

Cost-Effective Plans and Wide Accessibility

China Mobile's extensive scale allows it to offer highly competitive pricing across a wide range of plans. This strategy makes its telecommunication services accessible to a vast customer base, from individual consumers to large enterprises.

This commitment to affordability, coupled with its expansive network coverage, is a key driver in appealing to the mass market. For instance, in 2023, China Mobile reported over 988 million mobile subscribers, highlighting its significant reach.

The company's value proposition is further strengthened by its diverse plan options:

- Affordable Data Packages: Offering budget-friendly data plans that cater to varying usage needs.

- Flexible Contract Options: Providing both prepaid and postpaid services with adaptable terms.

- Bundled Services: Integrating mobile, broadband, and sometimes TV services for added value.

- Targeted Segment Pricing: Developing specific plans for students, seniors, and business users to maximize accessibility.

Tailored Enterprise Digital Solutions

China Mobile provides businesses with highly customized digital solutions designed to drive their transformation. These offerings span critical areas like the Internet of Things (IoT), advanced cloud computing, powerful big data analytics, and specialized dedicated network services. These tailored services are crucial for companies looking to modernize their operations and embrace digital advancements.

By leveraging these solutions, enterprises can significantly enhance their operational efficiency and foster innovation within their existing business models. For instance, in 2024, China Mobile's enterprise cloud services saw substantial growth, supporting over 5 million businesses in their digital journeys. This focus on customization allows clients to address specific industry challenges and capitalize on new market opportunities.

- IoT Solutions: Enabling smart manufacturing and supply chain optimization.

- Cloud Computing: Providing scalable infrastructure for data storage and processing.

- Big Data Analytics: Offering insights for improved decision-making and customer understanding.

- Dedicated Network Services: Ensuring secure and high-performance connectivity for critical operations.

China Mobile's value proposition is built on delivering reliable, high-speed connectivity through its extensive network, complemented by a broad suite of integrated digital services. This dual focus ensures both individual and business customers benefit from seamless communication and advanced digital solutions.

The company's commitment to network excellence is evident in its vast subscriber base and continuous investment in 5G infrastructure, as highlighted by over 1.1 billion mobile customers in the first half of 2024 and more than 3.5 million 5G base stations in 2023. This robust foundation supports a growing demand for data-intensive applications.

Furthermore, China Mobile offers tailored digital solutions for enterprises, including IoT, cloud, and big data services, which are crucial for digital transformation. The significant growth in its enterprise cloud services in 2024, supporting over 5 million businesses, underscores its role as a key enabler of business innovation and efficiency.

| Value Proposition Area | Key Offerings | Supporting Data (as of H1 2024 or latest available) |

|---|---|---|

| Ubiquitous & Reliable Connectivity | Extensive network coverage, dependable voice and data services | Over 1.1 billion mobile customers |

| Advanced Mobile Experience | Leading 5G infrastructure, high speeds, low latency | Over 3.5 million 5G base stations (2023) |

| Integrated Digital Ecosystem | Digital content, mobile payments, smart home devices | 426 million IoT terminal connections (2023) |

| Affordability & Accessibility | Competitive pricing, diverse plan options | Over 988 million mobile subscribers (2023) |

| Enterprise Digital Solutions | IoT, Cloud Computing, Big Data, Dedicated Networks | Enterprise cloud services revenue up 43.5% YoY (H1 2024); Supporting over 5 million businesses |

Customer Relationships

China Mobile leverages extensive self-service options to manage its vast subscriber base. Its mobile app and online portals are central to this strategy, allowing millions of users to handle tasks like bill payments, plan changes, and troubleshooting without direct human intervention. This automation is crucial for efficiency, especially considering China Mobile reported over 987 million mobile subscribers by the end of 2023.

China Mobile maintains a robust network of physical customer service centers and dedicated hotlines to offer personalized support. These centers are crucial for addressing more complex issues that require direct human interaction and expert assistance, ensuring specific customer needs are met and problems are resolved effectively.

China Mobile actively cultivates customer relationships through robust loyalty programs and online communities. These initiatives are designed to foster a strong sense of belonging and drive long-term customer retention. For instance, in 2023, China Mobile reported a significant increase in its membership base, with millions of users actively participating in tiered loyalty programs offering exclusive benefits and rewards.

Personalized Offers and Proactive Communication

China Mobile leverages extensive data analytics to tailor service recommendations and proactively communicate important updates. This includes informing customers about potential service upgrades, new product launches, or even network maintenance that might affect their service. By anticipating needs, they aim to significantly boost customer satisfaction and loyalty.

In 2024, China Mobile reported a substantial increase in its subscriber base, reaching over 1.1 billion mobile customers, with a significant portion actively using its digital services. This vast user data allows for sophisticated personalization.

- Data-Driven Personalization: Analysis of user behavior and preferences enables targeted offers for data plans, entertainment bundles, and value-added services.

- Proactive Service Notifications: Customers receive timely alerts about network enhancements in their area or personalized upgrade opportunities based on their usage patterns.

- Enhanced Customer Experience: This approach fosters a sense of being valued, leading to higher retention rates and reduced churn.

- New Revenue Streams: Personalized offers can drive uptake of new services and increase average revenue per user (ARPU).

Business Relationship Management for Enterprise Clients

China Mobile cultivates robust relationships with its enterprise and corporate clientele through dedicated account managers and specialized support teams. This personalized approach fosters tailored service delivery and facilitates direct, effective communication.

These dedicated teams enable collaborative problem-solving, addressing the unique needs of each business. This focus on partnership is crucial for building and sustaining long-term B2B relationships.

- Dedicated Account Management: China Mobile assigns specific account managers to enterprise clients, ensuring a single point of contact for all service and support needs. This personalized relationship management is key to understanding and meeting complex business requirements.

- Specialized Support Teams: Beyond account managers, specialized technical and service teams are available to address the intricate demands of enterprise clients, offering expert solutions and prompt issue resolution.

- Direct Communication Channels: Establishing clear and direct communication lines allows for efficient feedback loops and rapid response to client inquiries and challenges, fostering trust and reliability.

- Collaborative Problem-Solving: By working closely with clients, China Mobile's teams engage in joint efforts to overcome operational hurdles and optimize the use of mobile services, driving mutual success.

China Mobile prioritizes a multi-faceted approach to customer relationships, blending extensive digital self-service with personalized human support. By the end of 2023, with over 987 million mobile subscribers, the company relies heavily on its mobile app and online portals for efficient customer management, handling millions of transactions daily. This digital-first strategy is complemented by physical service centers and hotlines for more complex needs.

Loyalty programs and online communities are key to fostering long-term engagement, with millions actively participating in tiered benefits in 2023. Furthermore, China Mobile leverages sophisticated data analytics to offer tailored service recommendations and proactive communications, enhancing customer satisfaction and driving new revenue streams through personalized offers.

| Customer Relationship Aspect | Description | Key Data/Initiatives (as of late 2023/early 2024) |

|---|---|---|

| Digital Self-Service | Mobile app & online portals for billing, plan changes, etc. | Handles millions of transactions daily; supports >987 million subscribers (end 2023) |

| Human Support | Physical service centers & dedicated hotlines | Addresses complex issues requiring direct interaction |

| Loyalty & Community | Tiered loyalty programs & online communities | Millions actively participating, fostering retention |

| Data-Driven Personalization | Tailored offers & proactive communications | Utilizes vast user data for personalized service recommendations |

| Enterprise Client Management | Dedicated account managers & specialized support teams | Fosters tailored solutions and direct communication for B2B clients |

Channels

China Mobile boasts an extensive retail store network, comprising both owned and authorized outlets. This vast physical presence spans across China's urban and rural landscapes, acting as a crucial touchpoint for customers.

These stores are instrumental in acquiring new subscribers, facilitating device sales, and handling essential services like bill payments. They also provide vital in-person customer support, reinforcing customer relationships.

As of the end of 2023, China Mobile operated over 100,000 retail outlets nationwide, a testament to their commitment to accessible service delivery.

China Mobile's official online portals and mobile applications are central to its customer engagement strategy. These platforms, including the primary China Mobile website and its dedicated app, facilitate a wide range of self-service options, from checking data usage and paying bills to managing account details. In 2023, China Mobile reported over 980 million mobile customers, with a significant portion actively utilizing these digital channels for their telecommunications needs.

These digital touchpoints are not just for service management; they are also key sales channels. Customers can easily browse and purchase new mobile plans, upgrade devices, and subscribe to various value-added services directly through the app or website. This digital-first approach enhances customer convenience and accessibility, driving sales and improving operational efficiency for the company.

China Mobile relies heavily on a vast network of third-party retailers, including electronics stores, authorized dealers, and even convenience stores, to get its SIM cards and devices into customers' hands. This expansive distribution strategy is crucial for reaching a broad customer base across China.

These partnerships are key to China Mobile's market penetration, making it easier for customers to purchase SIM cards, top up their accounts, and buy new phones. By the end of 2024, China Mobile reported over 1.1 billion mobile customers, a testament to the effectiveness of its widespread distribution channels.

Direct Sales Force for Enterprise Clients

China Mobile leverages a specialized direct sales force and dedicated account management teams to serve its enterprise and government clients. These teams act as the primary point of contact, building relationships and understanding the unique requirements of each organization.

These professionals are crucial for identifying opportunities and proposing customized solutions, including cloud services and other enterprise-grade offerings. Their direct engagement ensures that China Mobile can effectively address the complex needs of its business clientele.

- Dedicated Enterprise Sales Teams: China Mobile deploys specialized sales representatives focused solely on business and government accounts.

- Account Management: Experienced account managers provide ongoing support and relationship management for key enterprise clients.

- Tailored Solutions: Sales teams work to understand client needs and offer customized enterprise solutions, including cloud and connectivity services.

- Direct Engagement: This direct approach allows for a deeper understanding of client challenges and more effective solution delivery.

Customer Service Hotlines and Social Media Platforms

Customer service hotlines offer direct, immediate telephonic assistance for urgent issues. In 2024, China Mobile continued to invest in its hotline infrastructure, aiming for quicker resolution times. This direct line ensures customers can get real-time help for billing inquiries, technical support, and service changes, reinforcing a reliable support system.

Official social media platforms and messaging apps like WeChat act as dynamic, interactive channels. China Mobile utilizes these platforms not only for responding to customer queries and gathering feedback but also for broadcasting promotions and service updates. This multi-channel approach significantly boosts accessibility and responsiveness, allowing for engagement on preferred customer platforms.

- Customer Service Hotlines: Provide immediate telephonic support for urgent inquiries and issue resolution.

- Social Media Platforms (e.g., WeChat): Serve as interactive channels for queries, feedback, and promotional activities, enhancing engagement.

- Accessibility & Responsiveness: These channels collectively improve how quickly and easily customers can connect with China Mobile for support and information.

China Mobile utilizes a multi-faceted channel strategy, encompassing a vast physical retail network, robust online platforms, extensive third-party partnerships, dedicated enterprise sales teams, and responsive customer service hotlines and social media engagement.

By the close of 2024, China Mobile served over 1.1 billion mobile customers, with its digital channels and extensive retail presence playing a pivotal role in customer acquisition, service delivery, and sales.

| Channel Type | Key Functions | Customer Reach (End 2024) | Key Data/Activity (2024) |

|---|---|---|---|

| Retail Stores (Owned & Authorized) | New subscriptions, device sales, bill payments, customer support | Extensive nationwide coverage | Over 100,000 outlets |

| Online Portals & Mobile Apps | Self-service, plan purchases, device upgrades, value-added services | Significant portion of 1.1B+ customers | High digital engagement for services |

| Third-Party Retailers | SIM card distribution, account top-ups, device sales | Broad market penetration | Crucial for widespread access |

| Direct Sales & Account Management | Enterprise/government client engagement, tailored solutions | Key business clients | Focus on customized enterprise offerings |

| Customer Service Hotlines & Social Media | Immediate support, issue resolution, feedback, promotions | All customer segments | Investment in faster resolution times |

Customer Segments

Mass market consumers represent China Mobile's largest customer base, encompassing virtually all individual mobile phone users across mainland China. This segment is characterized by its broad demographic reach and a primary demand for dependable voice, data, and essential value-added services. In 2023, China Mobile reported serving over 987 million mobile subscribers, highlighting the sheer scale of this segment.

These users are driven by the fundamental need for ubiquitous connectivity to support their daily lives, from communication and information access to entertainment and essential services. Their purchasing decisions are heavily influenced by competitive pricing, making cost-effectiveness a critical factor in China Mobile's service offerings for this group.

This segment comprises users who are constantly connected, relying heavily on their mobile devices for entertainment and productivity. They are the power users who stream high-definition video, engage in competitive online gaming, and utilize cloud-based applications extensively. For them, a seamless and fast connection is paramount.

China Mobile recognizes that these high-value customers are willing to invest more for superior performance. In 2024, the demand for premium data plans catering to these needs continued to surge, with 5G adoption driving increased data consumption per user. These users are less price-sensitive and prioritize network quality and data allowances.

Fixed-line broadband subscribers are primarily households and small businesses. These customers need reliable, high-speed internet for activities like streaming entertainment, working from home, and running essential business operations. Many of these users also look for bundled deals that combine their broadband service with mobile phone plans.

As of the end of 2023, China Mobile reported over 270 million fixed-line broadband customers, demonstrating a significant and growing demand for this service. This segment represents a core user base that values consistent connectivity and often seeks integrated telecommunication solutions.

Small and Medium-sized Enterprises (SMEs)

Small and Medium-sized Enterprises (SMEs) represent a crucial customer segment for China Mobile, seeking robust communication solutions that extend beyond simple mobile plans. These businesses require a suite of services, including corporate mobile plans, dedicated internet lines, and increasingly, foundational cloud services to manage their operations efficiently. China Mobile's offerings are tailored to meet the demand for reliable, scalable, and cost-effective solutions that can adapt to the evolving needs of growing businesses.

In 2023, SMEs accounted for a significant portion of China's economic activity, contributing over 60% of GDP and employing more than 80% of the urban workforce. This vast market underscores the importance of providing them with the digital infrastructure necessary for competitiveness. China Mobile's strategy involves bundling services to offer comprehensive packages that address these diverse requirements.

- Core Needs: Corporate mobile plans, dedicated internet access, and basic cloud computing services.

- Value Proposition: Reliability, scalability, and cost-effectiveness to support operational growth.

- Market Significance: SMEs are vital to China's economy, driving innovation and employment.

- China Mobile's Role: Providing integrated communication and digital solutions to empower these businesses.

Large Enterprises and Government Organizations

Large enterprises and government organizations represent a critical customer segment for China Mobile, characterized by their substantial scale and intricate digital transformation requirements. These entities, including major corporations and state-owned enterprises, seek sophisticated solutions that go beyond basic connectivity. Their needs often encompass advanced technologies such as the Internet of Things (IoT) for operational efficiency, private 5G networks for secure and high-performance communication, robust cloud computing infrastructure, and powerful big data analytics capabilities. China Mobile aims to provide these clients with integrated communication services that streamline operations and foster innovation.

The demand from this segment is driven by the imperative to modernize operations and enhance public services through digital means. For instance, in 2024, China Mobile has been actively involved in deploying 5G networks for industrial applications, supporting smart manufacturing and logistics for large enterprises. Government bodies are leveraging China Mobile's platforms for smart city initiatives, public safety, and digital governance. These projects often require highly customized solutions and a commitment to dedicated, high-touch support to ensure successful implementation and ongoing operation.

China Mobile's strategy for this segment involves offering comprehensive, end-to-end solutions tailored to specific industry verticals and governmental mandates. This includes:

- Customized 5G private network deployments for enhanced security and performance in industrial settings.

- Integrated IoT solutions to enable smart city functionalities, asset tracking, and remote monitoring.

- Cloud and big data services for data-intensive analytics, AI-driven insights, and digital transformation initiatives.

- Dedicated account management and technical support to address the complex operational and strategic needs of these large organizations.

China Mobile's customer segments are diverse, ranging from the massive individual consumer base to specialized enterprise and government clients. Each segment has unique needs, from basic connectivity to advanced digital transformation solutions. The company's strategy involves catering to these varied demands with tailored service packages and technological advancements.

The company's extensive reach is evident in its subscriber numbers. By the end of 2023, China Mobile had over 987 million mobile subscribers and more than 270 million fixed-line broadband customers. This broad base highlights the company's dominance in serving both individual and household needs across China.

For businesses, China Mobile provides essential services to SMEs and large enterprises. SMEs require scalable and cost-effective communication and cloud solutions, while large enterprises and government bodies demand sophisticated IoT, private 5G, and big data analytics. These offerings are crucial for driving digital transformation and operational efficiency.

| Customer Segment | Key Needs | 2023/2024 Relevance |

|---|---|---|

| Mass Market Consumers | Voice, Data, Value-Added Services, Affordable Pricing | 987+ million mobile subscribers; 5G adoption driving data usage. |

| High-Value Consumers | Fast Data, Premium Services, Entertainment, Productivity | Increased demand for premium data plans; less price-sensitive. |

| Fixed-Line Broadband Users | Reliable High-Speed Internet, Bundled Services | 270+ million fixed-line broadband customers; value consistent connectivity. |

| SMEs | Corporate Mobile, Dedicated Internet, Cloud Services | Crucial for economic activity; require scalable, cost-effective digital infrastructure. |

| Large Enterprises & Government | IoT, Private 5G, Cloud, Big Data, Customized Solutions | Driving digital transformation; active in industrial 5G and smart city initiatives. |

Cost Structure

China Mobile's cost structure is heavily influenced by its substantial investments in network infrastructure, particularly for 4G and the ongoing rollout of 5G. These capital expenditures are essential for expanding coverage and enhancing service capabilities.

In 2023, China Mobile reported capital expenditures of approximately 180.5 billion yuan, with a significant portion dedicated to 5G network construction and technological upgrades. This ongoing investment is crucial for maintaining a competitive edge in the telecommunications market.

Beyond initial build-out, the company incurs substantial operational costs to maintain this vast network. These recurring expenses include energy consumption for base stations and data centers, as well as ongoing maintenance and repair of equipment, ensuring network reliability and performance.

China Mobile's cost structure is significantly impacted by spectrum license fees, a substantial outlay for any telecommunications operator. These fees are paid to the government for the right to use specific radio frequency bands, crucial for mobile network operations. For instance, in 2023, China Mobile, along with other operators, participated in auctions for 5G spectrum, with prices reflecting the immense value of these limited resources.

Beyond initial acquisition, ongoing regulatory compliance forms another significant cost. This includes adhering to data privacy laws, network security standards, and service quality mandates set by the Ministry of Industry and Information Technology (MIIT). These compliance measures require continuous investment in systems, audits, and personnel, ensuring operations meet national telecommunications regulations.

China Mobile's sales, marketing, and customer service are significant cost drivers. In 2023, the company invested heavily in advertising and promotions to attract new subscribers, a common strategy in the competitive Chinese telecom market. These efforts are crucial for maintaining market share and acquiring users for their expanding 5G services.

Managing a vast retail network and numerous call centers also contributes substantially to these costs. China Mobile operates thousands of physical stores across China, requiring significant expenditure on rent, staff, and inventory. Furthermore, maintaining efficient online and offline customer support channels to handle millions of inquiries is a continuous investment.

Personnel Costs

Personnel costs are a significant expenditure for China Mobile, encompassing salaries, comprehensive benefits, and continuous training for its extensive workforce. This includes engineers, technical specialists, sales teams, customer service agents, and administrative personnel, all crucial for maintaining service delivery and driving innovation.

In 2023, China Mobile's employee-related expenses, including salaries and social security contributions, amounted to approximately RMB 128.9 billion. This substantial investment underpins the operational capabilities and future development of the company's vast network and service offerings.

- Salaries and Wages: Covering a diverse range of roles from network engineers to customer support staff.

- Employee Benefits: Including health insurance, retirement plans, and other social security contributions.

- Training and Development: Investing in skill enhancement to keep pace with technological advancements and service quality.

- Total Personnel Expenses: Representing a substantial portion of China Mobile's overall operating costs, crucial for talent retention and operational excellence.

Research and Development (R&D) and Technology Costs

China Mobile dedicates substantial resources to research and development (R&D) to maintain its edge in evolving telecommunications landscapes. This investment is crucial for innovation in areas such as 5G advancements, artificial intelligence (AI), the Internet of Things (IoT), and cloud computing, ensuring they remain at the forefront of technological progress.

These R&D efforts translate into significant expenditures, encompassing the acquisition of software licenses, the maintenance and upgrade of IT infrastructure, and various other technology-related costs. These outlays are essential to support the breadth and depth of China Mobile's extensive service portfolio, from mobile connectivity to digital services.

- R&D Investment: China Mobile's commitment to innovation is reflected in its continuous R&D spending, vital for developing next-generation network technologies and services.

- Technology Infrastructure: Costs associated with maintaining and enhancing sophisticated IT systems and acquiring necessary software licenses are integral to operational efficiency and service delivery.

- Emerging Technologies: Significant portions of these costs are allocated to exploring and implementing new technologies like AI and IoT to create future revenue streams and enhance customer experiences.

- Competitive Advantage: These investments are strategically designed to secure a competitive advantage in the rapidly changing global telecommunications market.

China Mobile's cost structure is dominated by its extensive capital expenditures on network infrastructure, especially for 5G deployment, which was a major focus in 2023. Operational costs, including energy and maintenance for its vast network, are also significant recurring expenses. Spectrum license fees represent a substantial outlay, with ongoing investments in regulatory compliance for data privacy and network security.

| Cost Category | 2023 (Approx. RMB Billion) | Key Drivers |

|---|---|---|

| Capital Expenditures (Network Infrastructure) | 180.5 | 5G network construction, technological upgrades |

| Operational Costs | N/A (Included in various operating expenses) | Energy consumption, network maintenance, repairs |

| Spectrum License Fees | N/A (Variable, based on auctions) | Acquisition of radio frequency bands for mobile operations |

| Sales, Marketing, and Customer Service | N/A (Significant investment) | Advertising, promotions, retail network management, call centers |

| Personnel Costs | 128.9 | Salaries, benefits, training for a large workforce |

| Research & Development | N/A (Significant investment) | 5G advancements, AI, IoT, cloud computing, software licenses |

Revenue Streams

China Mobile's core revenue driver is its mobile communication services, encompassing voice calls, SMS, and increasingly, mobile data. This segment serves millions of individual subscribers through a variety of prepaid and postpaid plans.

In 2024, China Mobile reported significant growth in its mobile business. The company had over 1.1 billion mobile subscribers by the end of the first half of 2024, with a substantial portion actively using its data services.

China Mobile's fixed-line broadband services are a significant and expanding revenue source. This segment primarily earns income through recurring monthly subscription fees, catering to both residential and corporate customers. The company offers a range of speed tiers and bundled packages, allowing for diverse revenue generation. As of the first half of 2024, China Mobile reported a substantial increase in its broadband customer base, contributing significantly to its overall revenue growth.

China Mobile's revenue streams are significantly boosted by its Value-Added Services (VAS). These services go beyond basic mobile connectivity, offering customers a richer digital experience.

In 2024, VAS income was a substantial contributor, driven by a diverse portfolio including mobile payments, digital content like music and video streaming, and emerging areas like cloud gaming. These offerings are key to customer retention and increased average revenue per user.

Smart home solutions and the Internet of Things (IoT) connectivity also represent growing VAS segments for China Mobile. The company's strategic expansion into these connected ecosystems further diversifies its revenue and strengthens its position in the digital economy.

Enterprise and Cloud Solutions

Enterprise and Cloud Solutions represent a significant revenue driver for China Mobile, stemming from tailored offerings to corporate and governmental entities. This segment encompasses a broad range of services designed to facilitate digital transformation and enhance operational efficiency for its clients.

Key revenue generators within this category include advanced cloud computing services, robust big data analytics platforms, and comprehensive Internet of Things (IoT) solutions. Furthermore, the provision of dedicated network services, ensuring reliable and high-speed connectivity for businesses, contributes substantially to this revenue stream. China Mobile actively engages in industry-specific digital transformation projects, further diversifying its income from enterprise clients.

- Cloud Computing: China Mobile's cloud services are a major income source, supporting businesses with scalable infrastructure and advanced computing capabilities.

- Big Data and IoT: Revenue is generated from providing sophisticated big data analytics and IoT platforms, enabling clients to leverage data for insights and connectivity.

- Dedicated Networks: The company earns income by offering specialized, high-performance network solutions to enterprises requiring secure and reliable connectivity.

- Digital Transformation Projects: Customized digital transformation initiatives for various industries represent a growing revenue stream, addressing specific business needs.

Equipment Sales and Interconnection Fees

China Mobile generates revenue through the sale of various telecommunication equipment, including mobile handsets, modems, and other devices, primarily via its extensive retail network. In 2023, the company reported significant sales in this segment, contributing to its overall financial performance.

Interconnection fees are another crucial revenue stream for China Mobile. These fees are levied on other telecommunication operators for terminating traffic on China Mobile's vast network infrastructure. This ensures fair compensation for network usage and capacity.

- Equipment Sales: China Mobile's retail outlets and online platforms facilitate the sale of smartphones and other communication devices, directly impacting revenue streams.

- Interconnection Fees: Charges applied to rival operators for accessing China Mobile's network to complete calls or data transmissions contribute to its income.

- 2023 Performance Highlight: While specific figures for equipment sales and interconnection fees are part of broader financial reporting, China Mobile's overall revenue in 2023 reached approximately 974.5 billion RMB, indicating the scale of its operations and the importance of these revenue components.

China Mobile's revenue streams are diverse, encompassing core telecommunications services, value-added offerings, and enterprise solutions. The company also generates income from equipment sales and interconnection fees.

| Revenue Stream | Description | 2023/2024 Data Highlight |

|---|---|---|

| Mobile Communication Services | Voice, SMS, and mobile data subscriptions | Over 1.1 billion mobile subscribers by H1 2024 |

| Fixed-line Broadband | Monthly subscription fees for residential and corporate users | Significant customer base growth reported in H1 2024 |

| Value-Added Services (VAS) | Mobile payments, digital content, cloud gaming, smart home, IoT | Key contributor to ARPU and customer retention in 2024 |

| Enterprise & Cloud Solutions | Cloud computing, big data, IoT, dedicated networks, digital transformation projects | Tailored services for corporate and government clients |

| Equipment Sales & Interconnection Fees | Sales of handsets, modems; fees from other operators for network usage | Overall 2023 revenue reached ~974.5 billion RMB |

Business Model Canvas Data Sources

The China Mobile Business Model Canvas is constructed using a blend of internal company data, including financial reports and operational metrics, alongside extensive market research and competitive analysis. This comprehensive approach ensures all facets of the business model are grounded in verifiable information and current industry trends.