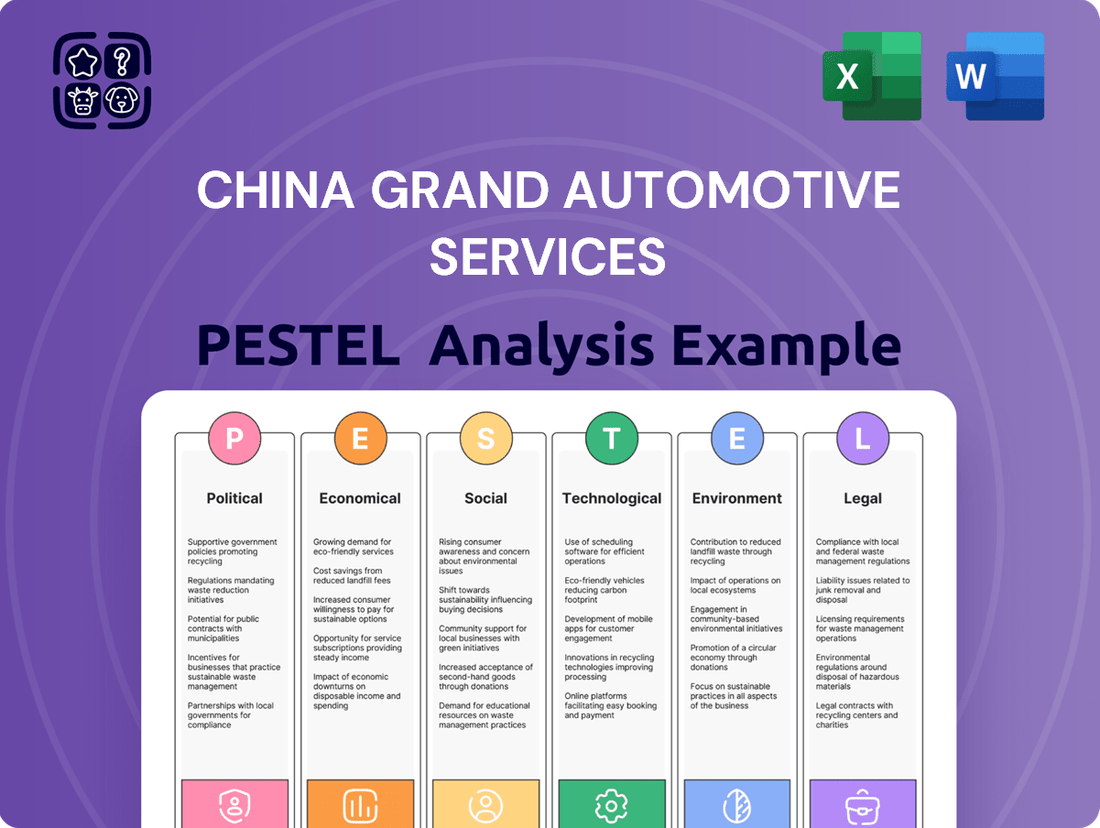

China Grand Automotive Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Grand Automotive Services Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping China Grand Automotive Services's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Download the full report to gain a strategic advantage.

Political factors

The Chinese government is actively stimulating the automotive sector through various policies. These include incentives like vehicle trade-in programs and direct subsidies for purchasing new cars, with a particular focus on New Energy Vehicles (NEVs). These initiatives significantly shape consumer purchasing behavior and the competitive dynamics for automotive service providers such as China Grand Automotive Services.

For 2025, a renewed car trade-in subsidy scheme is in place, offering up to RMB20,000 (approximately USD 2,730) for buyers of new electric vehicles and RMB15,000 (approximately USD 2,047) for those opting for new internal combustion engine (ICE) vehicles. This directly impacts how dealerships like China Grand Automotive Services plan their sales strategies and manage their vehicle inventories.

China's automotive sector navigates a dynamic regulatory landscape, particularly concerning foreign investment and market access. While historically favoring domestic brands, recent policy shifts encourage deeper collaboration, evidenced by growing partnerships between joint ventures, foreign automakers, and Chinese suppliers. This trend is set to enhance China's domestic production capabilities.

Ongoing geopolitical tensions, especially trade disputes with the United States, significantly affect the automotive supply chain and export opportunities. For example, tariffs imposed by the US on imported vehicles and parts, coupled with China's strategic control over rare earth magnet exports, directly influence sourcing decisions and international growth strategies for Chinese automotive firms.

Industrial Policy and State Support

China's government has consistently championed a robust domestic automotive sector through its industrial policy, with a particular focus on New Energy Vehicles (NEVs). This strategic direction translates into substantial state backing, encompassing everything from national development plans to direct financial subsidies and the crucial build-out of charging infrastructure. Companies that align their operations with these national priorities find themselves operating within a distinctly advantageous ecosystem.

This state support has been a significant driver of growth. For instance, in 2023, China's NEV sales reached 9.5 million units, a 37.7% increase year-on-year, highlighting the effectiveness of these policies. The government's commitment extends to R&D incentives and preferential policies for local manufacturers, fostering innovation and market share expansion for domestic players.

- Government Prioritization: China's industrial policy actively promotes the domestic automotive industry, especially NEVs.

- State Support Mechanisms: This includes strategic planning, financial subsidies, and infrastructure development.

- Favorable Business Environment: Companies aligning with national objectives benefit from this supportive ecosystem.

- NEV Market Growth: China's NEV sales hit 9.5 million in 2023, up 37.7% YoY, demonstrating policy impact.

Local Government Initiatives and Regional Variations

Beyond overarching national strategies, local governments across China are actively shaping the automotive landscape through their own unique initiatives and subsidies. This creates a patchwork of market conditions that vary significantly by region.

For instance, the suspension of electric vehicle (EV) buying subsidies in certain cities, such as Shanghai in early 2024 due to funding constraints, underscores the dynamic and localized nature of policy support. Companies must remain vigilant in tracking these regional shifts to adapt their strategies effectively.

- Regional Subsidy Disparities: While national EV purchase incentives may exist, local governments can introduce or withdraw their own, leading to uneven market attractiveness across different provinces and cities.

- Local Regulatory Autonomy: Some municipalities have the authority to implement specific regulations concerning vehicle emissions, traffic restrictions, or charging infrastructure development, impacting automotive sales and service demands locally.

- Economic Development Zones: Special economic zones or pilot programs initiated by local governments can offer targeted incentives for automotive manufacturing, R&D, or sales, creating pockets of accelerated growth.

Government policies continue to heavily influence China's automotive sector, with a strong emphasis on promoting New Energy Vehicles (NEVs) through subsidies and infrastructure development. For 2025, a renewed car trade-in subsidy scheme offers up to RMB20,000 for NEV buyers, directly impacting sales strategies for companies like China Grand Automotive Services.

Geopolitical factors, particularly trade tensions with the US, create supply chain complexities and affect export markets, influencing sourcing and international growth plans. Local government initiatives also create regional variations in market conditions and regulatory support, requiring adaptable strategies.

| Policy Area | 2024/2025 Impact | Example |

|---|---|---|

| NEV Promotion | Continued strong government support and incentives | 2025 trade-in subsidies up to RMB20,000 for NEVs |

| Trade Policy | Impacts supply chain and export opportunities | US tariffs on imported vehicles and parts |

| Regional Regulations | Varying local incentives and restrictions | Suspension of EV subsidies in Shanghai (early 2024) |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing China Grand Automotive Services across political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights and forward-looking perspectives to identify strategic opportunities and mitigate potential threats within the Chinese automotive market.

A PESTLE analysis of China Grand Automotive Services provides a clear overview of external factors, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic planning.

Economic factors

China's urbanization and rising disposable incomes are significantly boosting consumer purchasing power. In 2024, the average disposable income for urban Chinese households reached approximately RMB 52,000, a notable increase that directly fuels demand for automobiles.

This growing affluence means more Chinese consumers can afford to purchase new vehicles, and also consider upgrading their existing ones. This trend directly impacts the overall market size for automotive sales and services, creating substantial opportunities.

The increasing ability of consumers to spend on discretionary items like cars, driven by economic growth and financial stability, underpins the positive outlook for the automotive sector in China.

The Chinese automotive sector is a battleground for market share, with fierce competition leading to persistent price wars that squeeze dealership profit margins. While direct price reductions are becoming less common, automakers are increasingly employing non-monetary incentives like extended warranties or bundled services. This shift demands that dealerships like China Grand Automotive Services innovate their sales approaches, focusing on value-added services and customer experience to maintain profitability amidst aggressive market dynamics.

China's used car market is booming, with sales projected to reach 20 million units in 2024, a significant increase from previous years. This growth is fueled by government initiatives such as tax exemptions on used car transactions and subsidies encouraging vehicle trade-ins, making used vehicles more accessible and attractive to consumers seeking value.

China Grand Automotive Services is well-positioned to capitalize on this trend, as its operations include significant involvement in the used car sector. The company’s strategic focus on this segment aligns with evolving consumer behavior, where a preference for cost-effective and sustainable mobility solutions is increasingly evident.

Automotive Financing and Credit Policies

China's automotive financing landscape has seen significant shifts, with authorities easing auto loan policies to stimulate consumer spending. Financial institutions now have greater autonomy in setting maximum loan-to-value ratios for personal vehicles, potentially making car ownership more attainable for a broader segment of the population.

This liberalization aims to boost new car sales, a key driver of economic activity. For instance, in 2023, China's auto sales reached a record 30.09 million units, a 12% increase from the previous year, indicating a strong market response to supportive policies. However, this increased accessibility to credit also raises concerns about potential credit risks for both consumers and lenders.

- Policy Shift: Financial institutions can now independently set maximum loan percentages for personal vehicles.

- Market Impact: Eased policies are expected to drive higher car sales, building on the 30.09 million units sold in China in 2023.

- Risk Consideration: Increased credit availability may lead to higher potential credit risks and default rates.

Supply Chain Disruptions and Cost Management

The global automotive supply chain is experiencing significant volatility, with potential disruptions stemming from China's dominance in rare earth magnet exports. These magnets are critical components for electric vehicle (EV) motors and various automotive electronics. For China Grand Automotive Services, navigating these supply chain uncertainties and effectively managing the costs of essential parts and inventory is paramount to maintaining healthy profit margins in 2024 and beyond.

The ongoing geopolitical tensions and trade policies could impact the availability and pricing of these vital materials. For instance, reports in early 2024 indicated that China was considering further restrictions on rare earth exports, a move that could significantly escalate costs for global automakers. This necessitates proactive strategies for China Grand Automotive Services to secure reliable sourcing and explore alternative materials or suppliers to mitigate these risks.

- Rare Earth Magnet Dependency: China controls a substantial portion of the global rare earth supply chain, essential for EV motors and advanced automotive components.

- Cost Volatility: Fluctuations in raw material prices, driven by supply chain issues and geopolitical factors, directly impact the cost of automotive parts and inventory.

- Inventory Management: Balancing the need for sufficient stock to meet demand against the costs of holding excess inventory becomes a critical challenge amidst potential disruptions.

- Strategic Sourcing: Companies like China Grand Automotive Services must develop robust strategies for diversifying suppliers and exploring alternative materials to ensure supply chain resilience.

China's economic growth continues to fuel automotive demand, with urban disposable incomes rising. In 2024, average urban disposable income reached approximately RMB 52,000, supporting increased vehicle purchases and upgrades.

The used car market is also expanding rapidly, with sales expected to hit 20 million units in 2024, boosted by government incentives like tax exemptions. This trend presents a significant opportunity for companies involved in the pre-owned vehicle sector.

Automotive financing policies have been relaxed, allowing financial institutions more flexibility in setting loan-to-value ratios. This aims to make car ownership more accessible, building on the record 30.09 million vehicles sold in China in 2023.

Supply chain volatility, particularly concerning China's dominance in rare earth magnet exports crucial for EVs, poses a risk. Geopolitical tensions and potential export restrictions in 2024 could escalate component costs, requiring proactive sourcing strategies.

| Economic Factor | 2023 Data | 2024 Projection/Trend | Impact on China Grand Automotive Services |

|---|---|---|---|

| Urban Disposable Income | RMB 52,000 (approx.) | Continued growth expected | Increased consumer purchasing power for new and used vehicles. |

| Used Car Market Sales | (Not specified, but significant growth) | 20 million units | Opportunities in trade-ins, servicing, and resale of used vehicles. |

| New Car Sales | 30.09 million units (+12% YoY) | Continued strong demand | Increased volume for new vehicle sales and associated services. |

| Rare Earth Magnet Exports | (China's dominance) | Potential restrictions/volatility | Risk of increased costs for EV components and electronics; need for supply chain diversification. |

Same Document Delivered

China Grand Automotive Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of China Grand Automotive Services delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

Sociological factors

Chinese consumers are increasingly prioritizing value and choice, leading to a surge in the used car market. This trend is driven by a desire to save money and access a broader selection of vehicles not always available in the new car segment.

A significant societal shift is underway with the rapid adoption of New Energy Vehicles (NEVs). By early 2024, NEVs have already surpassed 50% of new passenger car sales in China, demonstrating a strong consumer commitment to sustainable transportation and advanced technology.

Generation Z is rapidly becoming a major influence in China's automotive sector. This demographic, known for its digital savviness, heavily relies on social media platforms like Douyin and Xiaohongshu for car research and purchasing decisions, often seeking recommendations from influencers and peers. Their preferences lean towards vehicles that offer strong design aesthetics, engaging driving performance, and advanced technological features, reflecting a desire for personalization and innovation.

To effectively engage this emerging consumer group, automotive retailers and manufacturers in China must significantly enhance their digital presence and customer interaction strategies. This includes leveraging targeted social media campaigns, offering virtual showroom experiences, and ensuring seamless online-to-offline purchasing journeys. For instance, by mid-2024, over 60% of Gen Z consumers in China reported that social media reviews heavily influenced their final car purchase choice, underscoring the critical need for brands to build authentic online communities and positive digital word-of-mouth.

China's rapid urbanization is a significant driver for automotive demand. As of late 2024, over 65% of China's population resides in urban areas, a figure projected to climb further. This demographic shift fuels the need for personal mobility solutions, directly benefiting companies like China Grand Automotive Services by increasing the market for new and used vehicles, as well as related repair and maintenance services.

Brand Loyalty and Domestic vs. Foreign Brands

Brand loyalty is a significant sociological factor influencing China Grand Automotive Services. While international brands once dominated, Chinese domestic brands are increasingly capturing consumer preference, especially in the rapidly expanding New Energy Vehicle (NEV) market. This shift directly affects dealership strategies and brand positioning.

Data from early 2024 indicates a notable surge in domestic brand NEV sales, with some Chinese manufacturers reporting year-on-year growth exceeding 50%. For instance, BYD's market share in China's NEV sector has consistently climbed, surpassing many established foreign competitors. This growing loyalty to domestic brands means dealerships must adapt their inventory and marketing to cater to evolving consumer sentiments.

- Domestic NEV brands are rapidly gaining market share, challenging foreign incumbents.

- Consumer loyalty is shifting towards Chinese brands, particularly in the electric vehicle segment.

- Dealerships face increased pressure to stock and promote domestic brands to meet evolving customer demands.

Sustainability Awareness and Eco-Consciousness

Growing awareness of environmental concerns among Chinese consumers is significantly influencing the automotive market, particularly the demand for used electric and hybrid vehicles. This rising eco-consciousness is a key driver for purchase decisions, shaping the types of vehicles consumers are actively seeking. For instance, by the end of 2023, China's new energy vehicle (NEV) sales surpassed 9.49 million units, a substantial increase from previous years, indicating a broader shift that extends to the used car market as well.

This trend directly impacts companies like China Grand Automotive Services, as it necessitates adapting their inventory and marketing strategies to cater to a more environmentally aware customer base. The preference for sustainable transportation options means that dealerships and service providers need to highlight the environmental benefits and cost savings associated with used EVs and hybrids.

- Consumer Demand: An increasing number of Chinese consumers are prioritizing vehicles with lower environmental impact.

- Market Shift: The used car market is seeing a surge in interest for electric and hybrid models.

- Industry Impact: Automotive service providers must adapt to this growing eco-consciousness to remain competitive.

The rise of domestic automotive brands, particularly in the New Energy Vehicle (NEV) sector, is reshaping consumer loyalty. By early 2024, Chinese domestic brands accounted for over 50% of new passenger car sales, a significant shift from previous years. This trend compels companies like China Grand Automotive Services to adapt their inventory and marketing to align with evolving consumer preferences, favoring local innovation and value.

Environmental consciousness is increasingly influencing purchasing decisions, with a growing demand for used electric and hybrid vehicles. This eco-trend is evident in the surging NEV market, which saw sales exceed 9.49 million units by the end of 2023. Automotive service providers must highlight the sustainability and cost benefits of these vehicles to cater to this environmentally aware consumer segment.

Urbanization continues to drive automotive demand, with over 65% of China's population living in urban areas as of late 2024. This demographic shift directly benefits companies offering personal mobility solutions, increasing the market for both new and used vehicles, alongside essential repair and maintenance services.

| Sociological Factor | Description | Impact on China Grand Automotive Services |

|---|---|---|

| Brand Loyalty Shift | Growing preference for domestic NEV brands, challenging foreign market share. | Requires inventory diversification and marketing adjustments to feature popular Chinese brands. |

| Environmental Awareness | Increased demand for used electric and hybrid vehicles due to eco-consciousness. | Necessitates promoting sustainable vehicles and highlighting their environmental benefits. |

| Urbanization | Over 65% of China's population resides in urban areas (late 2024), fueling demand for personal mobility. | Increases market opportunities for vehicle sales and related services in densely populated areas. |

Technological factors

The Chinese automotive market is rapidly transitioning to New Energy Vehicles (NEVs), with these models increasingly dominating sales. Local brands are at the forefront of this electrification wave, capturing significant market share. In 2023, NEV sales in China surpassed 9.4 million units, a substantial increase from previous years, and this trend is expected to continue its strong upward trajectory through 2024 and into 2025.

This significant shift directly impacts automotive service providers like China Grand Automotive Services. They must adapt their sales strategies to highlight NEV features and benefits, and importantly, invest in specialized training for technicians to handle the unique maintenance and repair requirements of electric powertrains. Furthermore, dealerships will need to upgrade their infrastructure to include charging facilities to cater to the growing NEV customer base.

China's commitment to intelligent connected vehicles (ICVs) is rapidly advancing, with significant progress in autonomous driving, smart cockpits, and advanced driver-assistance systems (ADAS). By the end of 2024, it's projected that over 50% of new vehicles sold in China will feature some level of connectivity, a substantial increase from previous years.

Dealerships must adapt to this technological shift, preparing their sales staff to explain and demonstrate these complex features. Furthermore, service departments will require specialized training and equipment to maintain and repair vehicles equipped with sophisticated autonomous driving hardware and software.

China's automotive retail sector is undergoing a profound digital transformation, with a growing number of consumers opting for online platforms to research, configure, and even purchase vehicles. This shift is driven by a desire for greater convenience and transparency in the car buying journey. By 2024, it's estimated that over 50% of car buyers in China will interact with dealerships online before visiting in person, highlighting the critical need for digital integration.

Dealerships that fail to adapt to these evolving consumer expectations risk falling behind. Embracing digital retailing solutions, such as virtual showrooms, online financing applications, and contactless delivery options, is no longer a luxury but a necessity. Companies like China Grand Automotive Services are investing heavily in these technologies to streamline the entire buying process, from initial inquiry to final sale, aiming to capture a larger share of this digitally-savvy market.

Vehicle Connectivity and In-Vehicle Apps

Automakers are increasingly integrating sophisticated app ecosystems directly into vehicle onboard systems. This allows for real-time interaction, personalized content delivery, and enhanced functionality for drivers and passengers. For instance, by mid-2024, many new vehicles offer integrated navigation with live traffic updates, streaming services, and even remote diagnostics, transforming the car into a connected hub.

The expansion of in-vehicle apps and connected car services creates significant new revenue streams and service opportunities for automotive dealerships. These platforms can be leveraged to offer personalized maintenance reminders, over-the-air software updates, and even in-car commerce options, thereby deepening customer relationships and improving the overall ownership experience. By 2025, it's projected that the connected car services market will reach over $200 billion globally, with a substantial portion driven by app-based features.

- Embedded App Ecosystems: Automakers are building comprehensive in-car app stores, similar to smartphone platforms, enabling real-time data access and interactive features.

- Enhanced Customer Experience: Connected car features, powered by in-vehicle apps, allow dealerships to provide proactive service alerts and personalized digital offerings.

- New Revenue Streams: The growth in connected services, including subscription-based app features and in-car purchases, opens up new avenues for profit for automotive businesses.

Battery Technology and Charging Infrastructure

Continuous advancements in battery technology are crucial for the growth of New Energy Vehicles (NEVs) in China. By mid-2025, battery energy density is expected to reach new heights, offering longer ranges and faster charging times, directly impacting consumer purchasing decisions. This evolution necessitates that dealerships like China Grand Automotive Services invest in and understand these cutting-edge battery chemistries and management systems to effectively service and sell NEVs.

The expansion of charging infrastructure is another key technological factor. As of late 2024, China boasts over 8 million charging points nationwide, a figure projected to grow significantly by 2025. Dealerships will need to integrate charging solutions, potentially offering fast-charging capabilities on-site, to cater to the increasing demand and provide a seamless ownership experience for NEV customers.

Dealerships must also equip their service departments with the necessary tools and training to handle the complexities of modern NEV powertrains and battery diagnostics. This includes staying abreast of software updates and repair protocols, ensuring they can maintain the performance and longevity of the vehicles they offer.

Key considerations for China Grand Automotive Services include:

- Battery Technology Evolution: Monitoring and adapting to advancements in solid-state batteries and improved lithium-ion chemistries for enhanced range and safety.

- Charging Infrastructure Integration: Investing in diverse charging solutions, from Level 2 to DC fast charging, to meet customer needs.

- Service Expertise Development: Training technicians on high-voltage systems, battery diagnostics, and specialized NEV repair procedures.

- Supply Chain Resilience: Ensuring access to critical battery components and replacement parts in a dynamic market.

The rapid electrification of China's automotive market, with NEV sales exceeding 9.4 million in 2023 and projected growth through 2025, necessitates that China Grand Automotive Services adapt its sales and service models. This includes training technicians for electric powertrains and integrating charging facilities into dealerships.

The rise of intelligent connected vehicles (ICVs), with over 50% of new cars expected to feature connectivity by end-2024, demands that sales staff can explain advanced features like ADAS. Service departments must also be equipped for complex repairs of autonomous driving systems.

Digital transformation is reshaping car buying, with over 50% of buyers interacting online by 2024. China Grand Automotive Services must invest in digital retailing solutions like virtual showrooms to meet evolving consumer expectations for convenience and transparency.

In-vehicle app ecosystems are creating new revenue streams, with the connected car services market projected to exceed $200 billion globally by 2025. Dealerships can leverage these platforms for personalized services, maintenance reminders, and over-the-air updates.

Advancements in battery technology, aiming for higher energy density and faster charging by mid-2025, require dealerships to understand new chemistries and management systems. Furthermore, with over 8 million charging points nationwide by late 2024, integrating charging solutions is crucial for NEV customer satisfaction.

Legal factors

China is tightening its grip on vehicle emissions and fuel efficiency, pushing manufacturers and dealerships towards greener options. New regulations like the Stage 4 fuel consumption standards for heavy-duty commercial vehicles and the stricter National VI B emission standards for all vehicles are now in effect. These changes directly impact the types of vehicles companies can sell, requiring significant investment in compliant technologies.

China's automotive financing landscape has seen policy shifts aimed at boosting consumer spending, but financial institutions and dealerships remain bound by stringent regulations. These frameworks govern everything from disclosure requirements to risk management practices for auto loans.

The recent relaxation of minimum down payment requirements, a move designed to stimulate auto sales, introduces a new layer of credit risk for lenders. For instance, while specific 2024 data on the impact of these relaxed rules on default rates is still emerging, the precedent from similar policy adjustments in other markets suggests a need for heightened vigilance in credit assessment and loan portfolio management.

China's evolving data privacy landscape, particularly the Personal Information Protection Law (PIPL) and Cybersecurity Law, mandates stringent requirements for automotive data handling. Dealerships must invest in robust cybersecurity measures, including graded protection systems, to safeguard sensitive customer and vehicle data. Failure to comply can result in significant penalties, impacting operational continuity and brand reputation.

Consumer Protection Laws

China's consumer protection laws are increasingly vital for automotive dealerships, especially with the growing digital marketplace and a surge in used car transactions. Ensuring transparency in pricing and processes, particularly regarding hidden fees, is paramount for building and maintaining customer confidence. For instance, in 2023, the China Consumers Association reported a significant increase in complaints related to deceptive sales practices in the automotive sector, highlighting the need for strict adherence to consumer rights.

Dealerships must navigate regulations that mandate clear disclosure of vehicle condition, pricing, and warranty information. This focus on transparency is especially critical as online sales platforms become more prevalent, potentially obscuring traditional face-to-face interactions. The government's ongoing efforts to standardize online car sales contracts and dispute resolution mechanisms underscore the evolving legal landscape.

- Mandatory Transparency: Dealerships are legally obligated to provide clear and accurate information about vehicle specifications, pricing, and any associated fees.

- Digital Sales Compliance: Adherence to regulations governing online transactions, including data privacy and secure payment protocols, is essential.

- Used Car Regulations: Stricter oversight on the sale of used vehicles, focusing on disclosure of accident history and maintenance records, is becoming more common.

- Dispute Resolution: Establishing efficient and fair mechanisms for addressing consumer complaints and disputes is a legal requirement.

Anti-Monopoly and Fair Competition Laws

The Chinese automotive market is incredibly competitive, often characterized by aggressive price wars. This intense environment underscores the critical need for companies like China Grand Automotive Services to strictly adhere to anti-monopoly and fair competition laws. Failure to do so can lead to significant legal penalties and reputational damage.

Dealerships and automotive service providers must ensure their pricing strategies, agreements with manufacturers, and customer interactions are fully compliant with regulations enforced by bodies like the State Administration for Market Regulation (SAMR). For instance, SAMR has actively investigated and fined companies for monopolistic practices in various sectors, setting a precedent for strict enforcement.

Key areas of focus for compliance include:

- Preventing price fixing and bid rigging among dealerships.

- Ensuring fair terms in contracts with automotive manufacturers.

- Avoiding abuse of dominant market positions.

In 2024, the regulatory landscape continues to emphasize a level playing field, meaning any deviation from fair competition principles could result in substantial fines, potentially impacting profitability and market share.

China's commitment to environmental protection significantly shapes the automotive sector, with stringent regulations on emissions and fuel efficiency. New standards like National VI B for all vehicles and Stage 4 for heavy-duty trucks, effective now, necessitate substantial investment in compliant technologies for manufacturers and dealerships alike.

The legal framework for automotive financing in China is robust, governing auto loans with strict rules on disclosure and risk management. While recent policy adjustments, such as relaxed down payment requirements in 2024, aim to stimulate sales, they also introduce new credit risks for lenders, demanding heightened vigilance in loan assessment.

Data privacy is a critical legal concern, with the Personal Information Protection Law (PIPL) and Cybersecurity Law imposing strict mandates on automotive data handling. Dealerships must invest in cybersecurity, including graded protection systems, to comply and avoid significant penalties for data breaches.

Consumer protection laws are increasingly important, especially with the rise of digital sales and used car transactions. Transparency in pricing and processes is paramount, as highlighted by a reported increase in complaints about deceptive sales practices in 2023 by the China Consumers Association.

Fair competition laws are crucial in China's highly competitive automotive market, with strict enforcement against practices like price fixing and abuse of dominant market positions. The State Administration for Market Regulation (SAMR) actively monitors and penalizes violations, with fines potentially impacting profitability and market share in 2024.

Environmental factors

China's government is strongly backing new energy vehicles (NEVs) with policies and incentives, fundamentally reshaping the auto market. This push directly influences what dealerships prioritize and sell, steering them towards NEVs.

China's persistent air quality issues have spurred aggressive government action, including the implementation of increasingly stringent emission standards for vehicles. By the end of 2024, China had already mandated that new passenger cars meet the China VI emission standard, a significant step up from previous regulations.

Automotive dealerships play a crucial role in this environmental push by actively promoting and selling vehicles that comply with these stricter standards and by increasing their offerings of electric and hybrid vehicles. In 2024, new energy vehicle (NEV) sales in China were projected to exceed 10 million units, demonstrating a clear market shift towards cleaner transportation options.

China's used car market is experiencing significant growth, with sales projected to reach 21.1 million units in 2024, a 7% increase from 2023. This expansion fosters a more circular economy by keeping vehicles in use longer and encouraging responsible end-of-life management. Dealerships are central to this, facilitating trade-ins and the resale of used vehicles, thereby reducing the demand for new production and its associated environmental impact.

Vehicle trade-in programs are becoming increasingly popular, with over 60% of new car buyers in 2024 utilizing them. This trend directly supports the circular economy by ensuring that older vehicles are channeled into the used market or properly dismantled for recycling. China's commitment to environmental sustainability, including stricter emissions standards, further incentivizes the efficient recycling of automotive components, with the automotive recycling industry expected to reach $20 billion by 2025.

Resource Scarcity and Supply Chain Sustainability

China's automotive sector, including dealerships like China Grand Automotive Services, faces increasing pressure from resource scarcity, particularly concerning rare earth elements crucial for electric vehicle (EV) components. The global supply of these critical materials is often concentrated, making the supply chain vulnerable to geopolitical shifts and environmental regulations. For instance, China dominates global rare earth production, accounting for approximately 60% of mining output in 2023, according to the U.S. Geological Survey. This reliance underscores the need for sustainable sourcing and robust supply chain management to ensure consistent access to essential materials.

The sustainability of these supply chains directly affects the automotive industry's ability to meet growing EV demand. Dealerships, while not directly involved in mining, are indirectly impacted by fluctuations in raw material costs and availability, which can influence vehicle pricing and inventory levels. As of early 2024, the price of Neodymium, a key rare earth element, has seen volatility, impacting the cost of magnets used in EV motors. This highlights the interconnectedness of resource management and the retail automotive market.

Addressing these challenges requires a strategic focus on:

- Diversifying sourcing of critical raw materials to reduce reliance on single geographic regions.

- Investing in recycling technologies for rare earth elements and other valuable components from end-of-life vehicles.

- Promoting circular economy principles within the automotive value chain to minimize waste and maximize resource utilization.

- Collaborating with suppliers to ensure ethical and environmentally responsible extraction and processing practices.

Climate Change Mitigation Efforts

China's commitment to peaking carbon emissions by 2030 and achieving carbon neutrality by 2060 is a significant driver for the automotive sector. These ambitious targets translate into a push for cleaner vehicles and more sustainable business practices across the entire automotive value chain, including dealerships.

Dealerships, as key touchpoints for consumers and vehicle sales, are increasingly expected to contribute to these national climate change mitigation efforts. This can involve promoting electric vehicles (EVs) and hybrid models, implementing energy-efficient operations within their facilities, and managing vehicle end-of-life processes more sustainably.

For China Grand Automotive Services, this environmental shift presents both challenges and opportunities. The company's strategy will need to align with these national goals, potentially by expanding its EV service capabilities and adopting greener operational standards. For instance, by 2023, China's cumulative sales of new energy vehicles (NEVs) surpassed 14 million units, indicating a strong market trend towards electrification that dealerships must cater to.

- National Targets: China aims to peak carbon emissions before 2030 and achieve carbon neutrality by 2060.

- EV Market Growth: NEV sales in China reached 9.5 million units in 2023, a 37.7% increase year-on-year, highlighting the growing demand for electric and hybrid vehicles.

- Dealership Role: Automotive service providers are integral to the national effort by promoting and servicing cleaner vehicle technologies.

- Operational Sustainability: Dealerships are encouraged to adopt energy-saving measures and responsible waste management practices.

China's aggressive environmental policies, including stringent emission standards and ambitious carbon neutrality goals by 2060, are fundamentally reshaping the automotive sector. This regulatory landscape directly influences vehicle sales, pushing dealerships like China Grand Automotive Services towards promoting new energy vehicles (NEVs) and adopting sustainable operational practices.

The growing demand for NEVs, with sales projected to exceed 10 million units in 2024, underscores the market's shift towards cleaner transportation. Dealerships are central to this transition, facilitating the adoption of these vehicles and supporting the circular economy through robust used car markets and trade-in programs, which saw over 60% of new car buyers utilizing them in 2024.

Resource scarcity, particularly for rare earth elements vital for EV components, presents a challenge, with China dominating global production. This necessitates strategic sourcing and investment in recycling to ensure supply chain resilience and affordability, as seen with the price volatility of Neodymium in early 2024.

| Environmental Factor | Impact on China Grand Automotive Services | Key Data/Trend (2023-2025) |

|---|---|---|

| Stricter Emission Standards | Increased demand for compliant vehicles (NEVs, hybrids); potential obsolescence of older models. | China VI emission standard mandated for new passenger cars by end of 2024. |

| Carbon Neutrality Goals | Opportunity to expand EV sales and service; need for greener dealership operations. | National target: Carbon neutrality by 2060; NEV sales surpassed 14 million cumulative units by 2023. |

| Resource Scarcity (Rare Earths) | Supply chain vulnerability; potential impact on EV pricing and availability. | China accounts for ~60% of global rare earth production (2023); Neodymium price volatility impacting EV motor costs (early 2024). |

| Circular Economy Push | Growth in used car market; importance of trade-in and recycling programs. | Used car market projected at 21.1 million units in 2024; 60%+ new car buyers used trade-ins (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Grand Automotive Services is meticulously crafted using data from official Chinese government ministries, leading economic research institutions, and reputable automotive industry associations. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the sector.