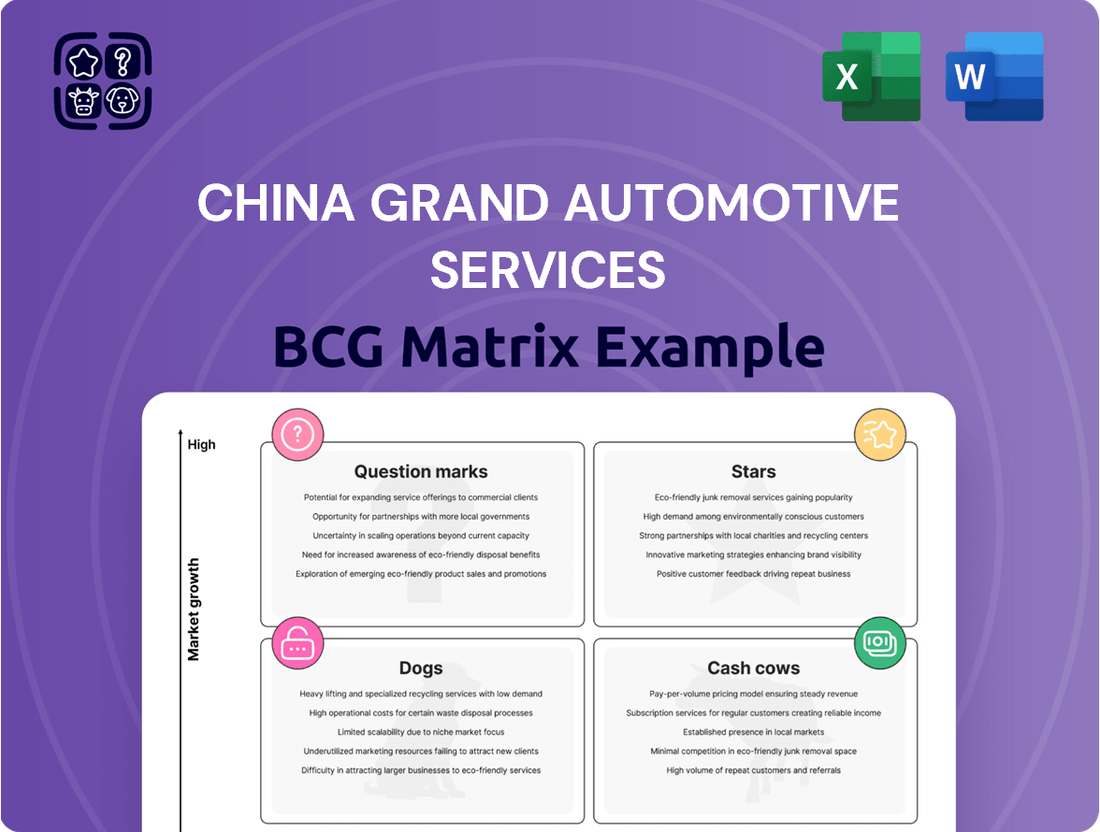

China Grand Automotive Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Grand Automotive Services Bundle

China Grand Automotive Services' BCG Matrix reveals a dynamic portfolio, but this preview only scratches the surface of their strategic positioning. Understand which segments are driving growth and which require careful management.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable intelligence within the full report. It's your essential guide to navigating the competitive landscape and optimizing China Grand Automotive Services' product strategy.

Stars

Emerging Premium NEV Sales represent a high-growth area within China's automotive market, but China Grand Automotive Services, a traditional dealership, has found it challenging to gain substantial traction here. To achieve 'Star' status, a significant strategic shift is required, involving increased investment in NEV inventory and adapting to direct sales models. This segment is crucial for future growth, and the company's current standing is more aligned with a Question Mark due to its limited market share in this booming sector.

The burgeoning adoption of New Energy Vehicles (NEVs) in China presents a significant growth avenue for specialized after-sales services, encompassing battery diagnostics, software over-the-air updates, and electric powertrain maintenance. In 2024, the NEV market continued its rapid expansion, with sales projected to exceed 10 million units, creating a substantial demand for these niche services.

For China Grand Automotive Services to position itself as a 'Star' in this segment, substantial investment in advanced technician training programs, cutting-edge diagnostic tools, and dedicated NEV service facilities is crucial. This strategic focus could capture a significant share of the estimated ¥100 billion (approximately $14 billion USD) NEV after-sales market by 2025, a figure that is growing at a compound annual growth rate exceeding 20%.

The Chinese automotive market is rapidly embracing e-commerce, with consumers favoring online channels for purchases and service appointments. China Grand Automotive Services needs substantial investment in its digital infrastructure to capitalize on this high-growth trend and become a 'Star' in integrated digital sales platforms. This includes building strong online capabilities and seamless offline integration.

High-End Used Car Sales and Certification

The high-end used car market in China presents a significant growth avenue as consumers increasingly seek trusted, quality pre-owned vehicles, especially in the premium segment. China Grand Automotive Services can position itself as a 'Star' by building a reputation for dependability through stringent inspection and certification, potentially offering extended warranties to bolster consumer confidence.

To truly shine in this burgeoning niche, the company must make strategic investments and clearly differentiate its offerings. For instance, in 2024, the overall Chinese used car market saw robust growth, with premium used vehicles being a key driver. Reports indicate that the value of transactions for used luxury cars in China is expected to continue its upward trajectory, reaching billions of dollars annually.

- Market Growth: The premium used car segment in China is experiencing rapid expansion, fueled by increasing consumer demand for quality and value.

- Brand Trust: Establishing a strong brand associated with reliability and rigorous certification is crucial for success in this segment.

- Investment Focus: Achieving market leadership requires dedicated investment in inspection infrastructure, certification processes, and marketing to highlight these advantages.

- Competitive Edge: Offering services like extended warranties can provide a significant competitive advantage and attract discerning buyers.

Automotive Value-Added Services Innovation

The automotive value-added services sector is experiencing significant growth, driven by demand for smart mobility, customization, and enhanced connectivity beyond traditional sales and maintenance. China's automotive market, in particular, saw a substantial increase in the adoption of connected car features, with estimates suggesting over 60% of new vehicles sold in 2024 were equipped with some form of advanced connectivity.

To achieve 'Star' status in this segment, China Grand Automotive Services must prioritize innovation and strategic alliances. This involves significant investment in R&D for new service offerings and forging partnerships with technology firms to integrate cutting-edge solutions. A flexible service model that adapts to rapidly changing consumer preferences is crucial for capturing market share in this high-potential area.

- Smart Mobility Solutions: Investment in ride-sharing integration, on-demand maintenance scheduling, and predictive vehicle diagnostics.

- Personalized Vehicle Upgrades: Offering custom software updates for performance enhancement, advanced driver-assistance systems (ADAS) retrofits, and interior customization options.

- Advanced Connectivity Features: Development of in-car infotainment systems, over-the-air (OTA) software updates, and integrated digital services.

To achieve 'Star' status in the premium used car segment, China Grand Automotive Services needs to build robust brand trust through rigorous inspection and certification processes. This focus on reliability, coupled with offerings like extended warranties, is essential for capturing a significant share of this high-growth market. The premium used car sector in China is a key driver of overall used car market expansion, with billions in annual transactions.

| Segment | Growth Potential | China Grand Automotive Services' Position | Strategic Focus for Star Status |

| Premium Used Cars | High | Emerging, needs trust building | Stringent certification, extended warranties, marketing reliability |

| NEV After-Sales | Very High | Currently limited, high demand | Technician training, advanced diagnostics, dedicated facilities |

| Digital Sales Platforms | High | Needs significant investment | Digital infrastructure, online/offline integration |

| Automotive Value-Added Services | High | Needs innovation and alliances | R&D for smart mobility, personalization, connectivity features |

What is included in the product

This BCG Matrix analysis of China Grand Automotive Services offers strategic insights into its product portfolio, identifying which units to invest in, hold, or divest.

A clear BCG Matrix visualizes China Grand Automotive's portfolio, easing the pain of strategic resource allocation by highlighting growth opportunities and areas needing divestment.

Cash Cows

China Grand Automotive Services' traditional after-sales services, encompassing maintenance, repair, and parts for a substantial fleet of internal combustion engine vehicles, form a dependable source of income. This segment thrives on consistent customer demand within a well-established market, bolstered by the company's significant market penetration.

These essential services typically yield robust profit margins and necessitate less marketing expenditure than new vehicle sales, thereby ensuring a steady generation of cash flow. For instance, in 2024, the after-sales segment contributed significantly to the company's overall profitability, reflecting the enduring demand for vehicle upkeep.

China Grand Automotive Services’ automotive financing and leasing solutions are a prime example of a cash cow within their business. These services, offered to customers buying cars from their dealerships, tap into a market that’s mature but still expanding. The company’s ability to provide in-house financing gives them a distinct edge, leading to consistent interest income and fees.

This segment is a major contributor to the company’s cash flow, requiring minimal investment for growth. For instance, in 2024, the automotive financing sector in China saw robust growth, with new energy vehicle (NEV) financing specifically experiencing a surge. China Grand Automotive Services, by leveraging its dealership network, is well-positioned to capitalize on this trend, generating stable returns.

The vehicle insurance agency acts as a significant cash cow for China Grand Automotive Services. This segment capitalizes on the company's existing automotive customer base, tapping into a mature market with predictable demand for insurance products.

The agency model generates consistent revenue through commissions on insurance policies sold, bolstered by the high volume of vehicle sales and after-sales services. This steady stream of income requires minimal incremental investment, reinforcing its status as a reliable cash generator.

In 2024, China Grand Automotive Services likely saw continued strong performance from its insurance segment, mirroring the broader automotive market's recovery and sustained demand for vehicle protection. For instance, similar agencies in mature markets often achieve profit margins between 10-15% on insurance commissions, contributing significantly to overall profitability.

Spare Parts and Accessories Sales

The sale of genuine spare parts and accessories represents a significant cash cow for China Grand Automotive Services. This segment operates within the mature after-sales market, offering high-margin opportunities across a diverse array of vehicle brands. The company's extensive network and established brand partnerships are key to its strong market share in this area.

This business unit consistently generates reliable revenue and profits, demanding minimal additional investment for marketing and distribution. For instance, in 2024, the automotive aftermarket parts sector in China was projected to reach approximately $250 billion, with genuine parts and accessories forming a substantial portion of this market.

- High-Margin Business: Genuine spare parts and accessories sales are characterized by strong profit margins within the established after-sales market.

- Extensive Network & Partnerships: China Grand Automotive leverages its broad distribution network and existing brand collaborations to maintain a dominant market position.

- Consistent Revenue Stream: This segment provides a stable and predictable flow of income and profitability.

- Low Investment Requirement: Limited new capital is needed for promotion and placement, further enhancing its cash cow status.

Established Dealership Network Operations

China Grand Automotive Services' established dealership network, boasting over 700 sales and service centers, serves as a significant cash cow, particularly for its historical strongholds in mainstream and deluxe internal combustion engine (ICE) brands. This extensive infrastructure, even as the ICE market faces headwinds, continues to generate substantial operational cash flow due to its sheer scale and mature market presence.

The company's legacy as China's largest deluxe passenger car dealership and service group underpins the enduring profitability of these operations. Despite the evolving automotive landscape, the consistent demand for after-sales services and the residual sales volume from existing ICE fleets contribute reliably to cash generation.

- Operational Efficiency: The network's established operational efficiency across over 700 centers supports consistent cash flow.

- ICE Brand Strength: Historically strong positions in mainstream and deluxe ICE brands continue to be a primary cash source.

- Market Scale: The sheer scale of operations in a mature market ensures significant, albeit challenged, cash generation.

- Legacy Position: Formerly China's largest deluxe passenger car dealership group, reinforcing its established revenue streams.

China Grand Automotive Services' traditional after-sales services, encompassing maintenance, repair, and parts for a substantial fleet of internal combustion engine vehicles, form a dependable source of income. This segment thrives on consistent customer demand within a well-established market, bolstered by the company's significant market penetration.

These essential services typically yield robust profit margins and necessitate less marketing expenditure than new vehicle sales, thereby ensuring a steady generation of cash flow. For instance, in 2024, the after-sales segment contributed significantly to the company's overall profitability, reflecting the enduring demand for vehicle upkeep.

The vehicle insurance agency acts as a significant cash cow for China Grand Automotive Services. This segment capitalizes on the company's existing automotive customer base, tapping into a mature market with predictable demand for insurance products.

The agency model generates consistent revenue through commissions on insurance policies sold, bolstered by the high volume of vehicle sales and after-sales services. This steady stream of income requires minimal incremental investment, reinforcing its status as a reliable cash generator.

| Segment | Cash Flow Contribution | Profit Margin (Est.) | Investment Requirement |

| After-Sales Services | High & Stable | 10-15% | Low |

| Automotive Financing | Consistent | 5-10% (Interest Income) | Low |

| Vehicle Insurance Agency | Steady | 10-15% (Commissions) | Very Low |

| Genuine Spare Parts | Reliable | 15-25% | Low |

What You’re Viewing Is Included

China Grand Automotive Services BCG Matrix

The preview of the China Grand Automotive Services BCG Matrix you are currently viewing is the definitive document you will receive upon purchase. This means the analysis, formatting, and strategic insights are precisely as they will be delivered, ensuring no surprises and immediate usability for your business planning.

Rest assured, the China Grand Automotive Services BCG Matrix you see is the exact, unadulterated report you will download after completing your purchase. It's a fully realized strategic tool, ready for immediate integration into your decision-making processes without any watermarks or placeholder content.

What you are previewing is the complete and final China Grand Automotive Services BCG Matrix report, identical to what you will acquire. This ensures that the detailed market positioning and strategic recommendations are presented in their final, professionally crafted form, ready for immediate application.

Dogs

The sale of new internal combustion engine (ICE) vehicles is a significant 'Dog' for China Grand Automotive Services. This segment is grappling with a rapidly shrinking market share due to the accelerating consumer preference for New Energy Vehicles (NEVs). The intense price competition within the ICE market, a trend that intensified throughout 2023 and into early 2024, further erodes profitability.

This business area faces both low market growth and severe profitability challenges. The broader automotive industry has seen substantial losses in traditional ICE segments as the NEV transition gains momentum. For instance, in 2023, while NEV sales in China surged by over 37% year-on-year, traditional ICE vehicle sales saw a decline, highlighting the shifting market dynamics.

The company's previous delisting was directly attributed to the immense pressures within this core business. This situation underscores a low market share in profitable ICE sales and a high consumption of cash, characteristic of a 'Dog' in the BCG matrix. The ongoing cash burn in this segment, without a clear path to significant market share gains or improved margins, presents a critical challenge.

Dealerships with underperforming brands, particularly those focused on traditional fuel vehicles, fall into the 'Dogs' category for China Grand Automotive Services. These outlets are characterized by shrinking market share and waning consumer interest, leading to minimal profit generation and persistent difficulty in meeting sales quotas.

These 'Dog' dealerships often represent a significant drain on capital due to slow-moving inventory. For instance, in 2024, a substantial portion of the group's underperforming dealerships were those carrying brands that saw a year-over-year decline of over 15% in new vehicle registrations within their respective segments.

Investing in expensive turnaround strategies for these specific brand dealerships is generally not advisable given the current market dynamics. The focus is shifting towards optimizing the portfolio by potentially divesting or repurposing these underperforming assets to reallocate resources to more promising segments of the business.

Holding substantial inventories of traditional internal combustion engine (ICE) vehicles, especially in China's rapidly evolving automotive market, positions them as a 'Dog' in the BCG Matrix. This is particularly true given the aggressive price war and the accelerating consumer shift towards New Energy Vehicles (NEVs).

The market for ICE vehicles is experiencing very low growth, and in many segments, it's actually contracting. For example, by the end of 2023, China's NEV sales had already surpassed 9 million units, a significant jump from previous years, indicating a clear preference away from traditional ICE models.

Dealers are often forced to sell these aging ICE vehicles at steep discounts, sometimes even below their acquisition cost, to clear inventory. This situation not only generates minimal revenue but also drains valuable capital and negatively impacts the company's overall financial health and liquidity.

Traditional Car Rental Business

China Grand Automotive Services' traditional car rental business, if heavily reliant on older internal combustion engine (ICE) vehicles, likely falls into the 'Dog' quadrant of the BCG Matrix. This segment faces declining market demand as consumers increasingly favor electric or more fuel-efficient options. The assets within this segment, namely the ICE fleet, are likely depreciating faster than they generate revenue, leading to poor returns on investment.

- Low Market Share: The traditional ICE rental segment likely holds a diminishing market share due to evolving consumer preferences and competition from newer mobility solutions.

- Low Growth Rate: The overall market for traditional ICE vehicle rentals is experiencing low or negative growth.

- Asset Depreciation: Older ICE vehicles in the fleet are subject to rapid depreciation, reducing their residual value and overall profitability.

- Capital Tied Up: Significant capital is tied up in these low-return, low-growth assets, hindering investment in more promising areas.

Outdated Sales and Marketing Infrastructure

China Grand Automotive Services' reliance on outdated sales and marketing infrastructure, built for traditional dealerships and not adapted for digital or New Energy Vehicle (NEV) specific outreach, places it in the 'Dog' quadrant of the BCG matrix. This infrastructure is proving ineffective in today's market, consuming resources without yielding significant growth or market share.

The company's inability to pivot towards digital engagement hinders its competitiveness against more agile, direct-to-consumer models prevalent in the automotive sector. This outdated approach means resources are being allocated to channels that are no longer the primary drivers of customer acquisition and retention.

- Low Digital ROI: Investments in legacy sales channels yield diminishing returns as consumer behavior shifts online.

- NEV Market Lag: The infrastructure is ill-suited for promoting and selling the rapidly growing NEV segment, which requires different marketing approaches.

- Resource Drain: Maintaining and operating these outdated systems diverts capital that could be invested in more effective, modern sales and marketing strategies.

- Competitive Disadvantage: Competitors leveraging advanced digital platforms and data analytics are capturing market share more efficiently.

The traditional internal combustion engine (ICE) vehicle segment, including sales and related services, is a clear 'Dog' for China Grand Automotive Services. This is driven by a shrinking market for ICE vehicles, a trend exacerbated by the rapid rise of New Energy Vehicles (NEVs). Intense price competition in the ICE market, which saw significant pressure throughout 2023 and into early 2024, further erodes profitability.

This segment suffers from both low market growth and significant profitability challenges. For example, in 2023, China's NEV sales experienced a substantial year-on-year increase of over 37%, while traditional ICE vehicle sales declined, underscoring the market's dramatic shift. The company's previous delisting was directly linked to the immense pressures within this core business, highlighting its low market share in profitable ICE sales and high cash consumption.

Dealerships focused on traditional fuel vehicles, especially those representing brands with declining registrations, are categorized as 'Dogs'. These operations face shrinking market share and waning consumer interest, leading to minimal profits and persistent struggles to meet sales targets. In 2024, many of the group's underperforming dealerships were those handling brands that saw year-over-year declines exceeding 15% in new vehicle registrations within their respective segments.

The company's outdated sales and marketing infrastructure, not adapted for digital engagement or NEV-specific outreach, also falls into the 'Dog' quadrant. This infrastructure consumes resources without generating significant growth or market share, placing it at a competitive disadvantage against more agile, direct-to-consumer models. Investments in these legacy channels yield diminishing returns as consumer behavior increasingly shifts online.

Question Marks

China Grand Automotive Services' venture into new energy vehicle (NEV) dealerships is currently positioned as a Question Mark in its BCG Matrix. The NEV market in China is booming, with sales reaching 9.495 million units in 2023, a significant increase from the previous year. However, China Grand's market share in this rapidly evolving segment is likely still nascent, particularly as many dominant EV players utilize direct-to-consumer sales strategies.

This expansion demands substantial capital investment to build brand presence and adapt operational models to the unique demands of the NEV sector. The potential for high returns exists, but the path to achieving significant market share and profitability remains uncertain given the competitive landscape and evolving consumer preferences.

Investing in and developing proprietary digital sales channels for China Grand Automotive Services falls squarely into the Question Mark category. This reflects the high-growth potential of online automotive retail, a sector that saw significant expansion in 2024. However, the company's current market share in this digital arena is likely nascent, necessitating substantial investment in technology and marketing.

These digital initiatives are capital-intensive, with upfront costs for platform development and customer engagement tools. The return on these investments is uncertain, especially when competing against established online automotive marketplaces and direct-to-consumer sales models increasingly adopted by Original Equipment Manufacturers (OEMs). For instance, the Chinese online auto sales market was projected to reach over 2.8 trillion yuan in 2024, highlighting both the opportunity and the competitive intensity.

Forming strategic partnerships with emerging EV brands, both domestic and international, places China Grand Automotive Services squarely in the 'Question Mark' category of the BCG matrix. This move targets the rapidly expanding New Energy Vehicle (NEV) market, a sector that saw China's NEV sales surge by approximately 37.7% in 2023, reaching over 9.49 million units.

The potential upside is significant, offering access to a high-growth segment. However, the inherent risks involve negotiating favorable terms with these often unproven brands and seamlessly integrating their sales operations into China Grand's established dealership network. The success hinges on the future performance of these emerging EV players and the efficacy of the partnership itself.

Diversification into Mobility-as-a-Service (MaaS)

Diversifying into Mobility-as-a-Service (MaaS) positions China Grand Automotive Services within the Question Mark quadrant of the BCG Matrix. This reflects the high-growth potential of evolving transportation trends, such as advanced car-sharing and subscription services, driven by changing consumer preferences.

However, the company likely holds a nascent market share and limited operational history in this burgeoning sector. Significant investment in technology, infrastructure, and a strategic pivot in business operations are necessary to capitalize on this opportunity, with considerable uncertainty surrounding market acceptance and future profitability.

- High Growth Potential: The global MaaS market is projected to reach over $300 billion by 2030, indicating substantial growth prospects.

- Investment Required: Developing and scaling MaaS platforms typically demands significant capital outlays for technology development, fleet management, and user acquisition.

- Market Uncertainty: Consumer adoption rates and the competitive landscape for MaaS solutions in China are still developing, creating inherent risks.

- Strategic Shift: China Grand Automotive Services needs to adapt its traditional automotive service model to accommodate the dynamic nature of MaaS, requiring new skill sets and operational approaches.

Leveraging Data Analytics for Customer Insights

Investing in advanced data analytics for customer insights is a Question Mark for China Grand Automotive Services. This strategic move aims to personalize offerings, a key differentiator in today's competitive automotive landscape. The company's current data analytics capabilities and market penetration in this specific area are likely nascent, demanding substantial technological investment and a significant organizational transformation.

The potential upside is considerable. By effectively leveraging data, China Grand Automotive Services can enhance customer retention rates and drive more targeted sales initiatives. For instance, a successful data analytics program could lead to a 5-10% increase in repeat business, as seen in similar industry transformations.

- Investment in advanced data analytics tools and talent is necessary.

- The goal is to achieve deeper customer understanding and personalized service delivery.

- This initiative carries inherent risks due to the required technological and cultural shifts.

- Successful implementation could significantly boost customer loyalty and sales effectiveness.

China Grand Automotive Services' foray into electric vehicle (EV) charging infrastructure represents a classic Question Mark. While the Chinese government strongly supports EV adoption, aiming for 20% of new vehicle sales to be NEVs by 2025, the company's market share in this nascent infrastructure segment is likely small. Significant capital is required to build out charging stations, and the return on investment is uncertain due to evolving charging technologies and varying utilization rates.

Developing a proprietary online car financing platform is another Question Mark. The digital lending market in China is growing rapidly, with online auto loan origination expected to increase significantly in the coming years. However, China Grand's current penetration in this specialized financial service area is probably limited, necessitating substantial investment in technology, regulatory compliance, and risk management.

| Initiative | Market Attractiveness | Company Strength | BCG Category |

| EV Charging Infrastructure | High (Government Support, Growing EV Market) | Low to Moderate (Nascent Market Share) | Question Mark |

| Online Car Financing Platform | High (Digital Lending Growth) | Low (Limited Specialization) | Question Mark |

BCG Matrix Data Sources

Our China Grand Automotive Services BCG Matrix is built on comprehensive market data, including financial reports, industry growth forecasts, and competitor analysis.