China Grand Automotive Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Grand Automotive Services Bundle

China Grand Automotive Services operates within a dynamic automotive aftermarket, where intense competition and evolving customer demands shape its landscape. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this complex market.

The complete report reveals the real forces shaping China Grand Automotive Services’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical automotive components significantly impacts China Grand Automotive Services. Should a few key suppliers dominate the market for specialized parts, such as advanced battery management systems or high-performance electric motors, their ability to dictate terms and prices would be substantial.

The cost and difficulty China Grand Automotive Services (CGAS) faces when switching between suppliers directly influence the bargaining power of those suppliers. If CGAS must invest heavily in new equipment or extensive training to adopt a different supplier's parts or services, existing suppliers gain significant leverage. For instance, a 2024 report indicated that for automotive manufacturers, the average cost to retool a single assembly line can range from $5 million to $15 million, a substantial barrier to switching.

Conversely, if CGAS can easily integrate components from alternative suppliers with minimal disruption or upfront investment, the bargaining power of current suppliers is diminished. The availability of multiple, interchangeable suppliers for critical components like specialized electronic systems or high-performance tires can create a competitive environment that favors CGAS. In 2023, the global automotive supplier market saw increased competition, with many suppliers offering standardized parts that reduce integration complexities for major automotive groups.

Suppliers providing unique or highly specialized components, like advanced EV battery technology or sophisticated ADAS systems, hold significant leverage. China Grand Automotive Services' reliance on these differentiated offerings restricts its capacity to negotiate favorable pricing or contract terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the automotive dealership or service sector can significantly bolster their bargaining power against entities like China Grand Automotive Services. If suppliers can credibly threaten to bypass the dealership network and sell directly to end consumers, they gain leverage in negotiations. For instance, a major automotive parts manufacturer could potentially establish its own service centers or even direct sales channels, thereby competing directly with dealerships.

While less common for component suppliers to large dealership groups, this threat remains a strategic consideration. In 2024, the automotive aftermarket service sector in China continued to grow, presenting opportunities for various players. China Grand Automotive Services, as a major dealership group, would need to monitor any moves by its key suppliers towards direct-to-consumer models. The potential for suppliers to capture a larger share of the customer relationship and profit margins by moving forward in the value chain is a constant underlying pressure.

- Supplier Forward Integration Threat: Suppliers may establish direct sales or service channels, bypassing dealerships.

- Impact on Bargaining Power: This threat allows suppliers to negotiate more favorable terms with dealership groups.

- Market Context (2024): The growing Chinese aftermarket service sector presents opportunities for supplier forward integration.

- Strategic Implication: Dealerships must monitor supplier strategies to mitigate potential disintermediation.

Importance of China Grand Automotive Services to Suppliers

The bargaining power of suppliers to China Grand Automotive Services is influenced by how crucial China Grand Automotive Services is as a customer. If China Grand Automotive Services accounts for a significant percentage of a supplier's total sales, that supplier will likely be more accommodating in negotiations to secure continued business.

Conversely, if China Grand Automotive Services represents a minor portion of a supplier's revenue stream, the supplier's leverage increases, and China Grand Automotive Services' ability to dictate terms diminishes. This dynamic is critical in managing supply chain costs and ensuring reliable access to necessary automotive parts and services.

- Customer Dependence: Suppliers who rely heavily on China Grand Automotive Services for a large share of their revenue are more susceptible to its demands for better pricing or terms.

- Supplier Concentration: If a particular component or service is provided by only a few suppliers, those suppliers gain more bargaining power.

- Switching Costs: High costs associated with finding and onboarding new suppliers can reduce China Grand Automotive Services' power over existing ones.

The bargaining power of suppliers to China Grand Automotive Services is significantly shaped by the concentration of suppliers and the uniqueness of their offerings. When few suppliers provide critical, specialized components like advanced EV battery technology, their leverage increases substantially, limiting CGAS's negotiation flexibility.

High switching costs further empower suppliers. For instance, retooling an assembly line can cost between $5 million to $15 million in 2024, making it difficult for CGAS to change suppliers easily. Conversely, the availability of interchangeable parts and a competitive supplier market in 2023, with many offering standardized components, can reduce supplier power.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Context |

|---|---|---|

| Supplier Concentration | High for specialized components | Few suppliers for advanced EV battery tech or ADAS systems |

| Switching Costs | Increases power for existing suppliers | Average retooling cost: $5M-$15M (2024) |

| Component Uniqueness | High leverage for differentiated offerings | Reliance on specialized electronic systems |

| Availability of Alternatives | Reduces power for suppliers | Competitive global automotive supplier market (2023) |

What is included in the product

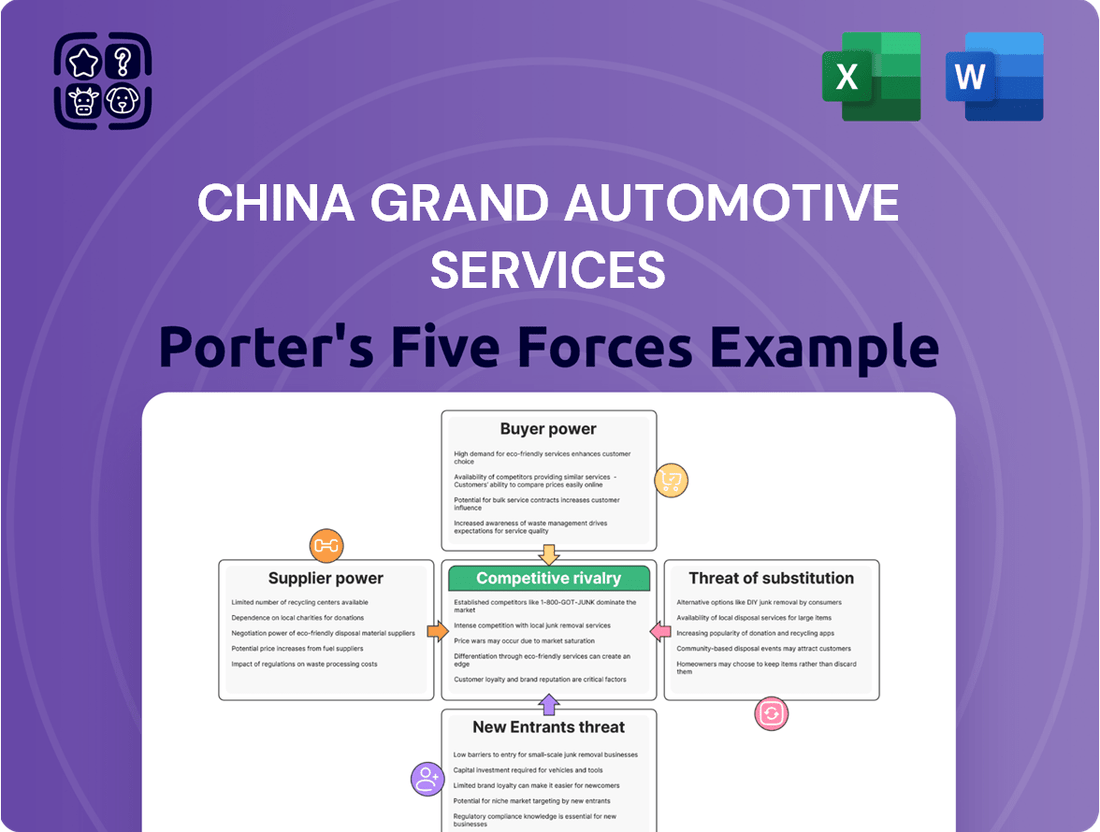

This Porter's Five Forces analysis for China Grand Automotive Services dissects the competitive intensity within the automotive services sector, focusing on threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitute services.

Gain a competitive edge by easily identifying and mitigating threats from new entrants and substitute products, allowing for proactive strategic adjustments.

Customers Bargaining Power

Chinese automotive consumers, particularly in the dynamic 2024 market, demonstrate significant price sensitivity. This is largely due to the aggressive competition and ongoing price wars between automakers and dealerships. For China Grand Automotive Services, this translates into a constant pressure to offer competitive pricing, which can directly impact their profitability.

The bargaining power of customers in China's automotive market is significantly amplified by the sheer availability of substitutes and alternatives. Customers can choose from a vast spectrum of vehicle brands, encompassing traditional internal combustion engine (ICE) vehicles, rapidly growing new energy vehicles (NEVs), and a robust used car market. This extensive selection, coupled with diverse purchasing channels, diminishes the reliance on any single dealership, including China Grand Automotive Services.

Customers in China's automotive market have significantly more power due to readily available information. Online platforms and dedicated automotive review sites empower buyers, allowing them to easily compare prices, features, and service quality across various dealerships. This transparency means customers can make more informed decisions, strengthening their position when negotiating.

Low Switching Costs for Customers

For customers, the cost of switching between different car brands or dealerships remains relatively low. This ease of switching directly impacts China Grand Automotive Services by increasing customer bargaining power. In 2024, the automotive market continued to see aggressive pricing and promotional activities from various manufacturers and dealerships, further reinforcing this low switching cost dynamic.

The competitive landscape in China's automotive sector is intense, with numerous domestic and international brands vying for market share. This pressure compels China Grand Automotive Services to consistently offer attractive incentives and maintain superior service standards to ensure customer retention. For instance, reports from early 2024 indicated that average discounts on new vehicles in China could range from 5% to 15%, depending on the brand and model, highlighting the cost sensitivity of consumers.

- Low Switching Costs: Customers can easily move between dealerships or brands without incurring significant financial penalties or operational disruptions.

- Competitive Pressure: The presence of many alternatives forces China Grand Automotive Services to compete on price, service quality, and customer experience.

- Customer Retention Focus: To counter this bargaining power, the company must invest in loyalty programs and exceptional after-sales service.

- Market Dynamics: In 2024, aggressive promotions and evolving consumer preferences in China's auto market amplified the bargaining power of customers.

Direct Sales Models by OEMs

The increasing adoption of direct sales models by automotive Original Equipment Manufacturers (OEMs), especially for electric vehicles, is a significant factor impacting customer bargaining power. This shift allows customers to bypass traditional dealerships, directly engaging with manufacturers for new vehicle purchases. For instance, by 2024, several major EV manufacturers have expanded their direct sales networks, offering a streamlined purchasing experience that reduces customer dependence on franchised dealer groups.

This trend directly alters the power dynamic for companies like China Grand Automotive Services. By removing the dealership as an intermediary, customers gain more leverage as they can compare prices and options directly from the source. This can lead to increased price sensitivity and a greater demand for transparency in the automotive sales process.

Key implications for dealer groups include:

- Reduced Dealer Margin Pressure: Direct sales models can squeeze traditional dealer margins as OEMs control pricing more directly.

- Shift in Customer Relationship: The primary customer relationship shifts from the dealership to the OEM, potentially diminishing the dealer's role in after-sales service and brand loyalty.

- Increased Competition for Services: While new car sales shift, dealers may see increased competition for after-sales services as OEMs explore their own service networks.

The bargaining power of customers in China's automotive market is substantial, driven by readily available information, low switching costs, and a vast array of substitutes including NEVs and used cars. In 2024, aggressive pricing strategies and promotions by manufacturers and dealerships further amplified this power, forcing companies like China Grand Automotive Services to compete fiercely on price and service. The rise of direct sales models by OEMs, particularly in the EV sector, also empowers consumers by offering direct engagement and price transparency, potentially impacting dealer margins and customer relationships.

| Factor | Impact on China Grand Automotive Services | 2024 Market Context |

|---|---|---|

| Information Availability | Customers can easily compare prices and features, increasing negotiation leverage. | Online platforms and review sites provide extensive data, leading to informed purchasing decisions. |

| Availability of Substitutes | A wide range of brands and vehicle types (ICE, NEV, used) reduces reliance on a single dealer. | The NEV market saw significant growth in 2024, offering more alternatives to traditional vehicles. |

| Low Switching Costs | Customers can easily move between dealerships or brands without penalty. | Aggressive promotions and discounts in 2024 further incentivized brand and dealership switching. |

| Direct Sales Models | OEM direct sales bypass dealerships, giving customers direct access and price control. | Several EV manufacturers expanded direct sales networks in 2024, altering the traditional dealer role. |

What You See Is What You Get

China Grand Automotive Services Porter's Five Forces Analysis

This preview showcases the exact Porter's Five Forces analysis for China Grand Automotive Services, providing a comprehensive examination of competitive forces within the industry. You're viewing the actual document, meaning the detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are precisely what you'll receive upon purchase. This professionally formatted analysis is ready for immediate use, offering no surprises and no placeholders.

Rivalry Among Competitors

The Chinese automotive market is incredibly crowded, with both established global brands and a rapidly growing number of domestic manufacturers vying for market share. This intense competition means companies like China Grand Automotive Services must constantly innovate and offer compelling value to customers.

China Grand Automotive Services directly competes with other major dealership conglomerates, but also with a multitude of smaller, independent dealerships scattered across the country. Furthermore, the rise of direct-to-consumer sales models by Original Equipment Manufacturers (OEMs) adds another layer of competitive pressure, bypassing traditional dealership networks.

In 2023, China's automotive sales reached approximately 30.09 million units, a 12% increase year-over-year, highlighting the market's dynamism and the sheer volume of transactions, but also underscoring the fierce battle for each sale among numerous players.

The automotive market in China, especially for new energy vehicles (NEVs), is currently experiencing a fierce price war. This intense competition is squeezing profit margins for dealerships across the board. For instance, in early 2024, major automakers like BYD and Tesla engaged in aggressive price cuts, which trickled down to the dealership level.

This environment forces many dealerships, potentially including China Grand Automotive Services, to operate on razor-thin margins or even sell vehicles at a loss to maintain sales volume and market share. Reports from early 2024 indicated that some dealerships were indeed selling popular NEV models below their acquisition cost, leading to significant financial strain and reduced profitability for the fiscal year.

Competitors in China's automotive sector are aggressively differentiating their products, particularly with advancements in electric vehicle (EV) technology and integrated digital services. This innovation directly intensifies rivalry, as seen with brands like BYD launching numerous new EV models throughout 2024, often featuring proprietary battery technology and advanced driver-assistance systems. China Grand Automotive Services needs to counter this by innovating its own service offerings, including flexible financing plans and premium after-sales support, to maintain customer loyalty.

Market Growth Rate and Consolidation

The Chinese automotive market, while showing growth, is seeing significant consolidation within its dealership sector. Thousands of dealerships are facing financial strain, leading to closures and a more intense competitive landscape among the survivors. This dynamic means remaining players are fighting harder for market share in a market that is maturing but still offers opportunities.

- Market Maturation: The Chinese auto market, while still growing, is entering a more mature phase, increasing pressure on dealerships.

- Dealership Consolidation: Reports indicate thousands of dealerships in China have faced financial difficulties and closures in recent years.

- Intensified Rivalry: As the number of dealerships shrinks, the competition among the remaining ones to capture customers and market share becomes fiercer.

- Financial Pressures: Dealerships are often squeezed by manufacturers on pricing and incentives, exacerbating the impact of consolidation.

Shift Towards New Energy Vehicles (NEVs) and Direct Sales

The automotive industry in China is undergoing a dramatic transformation with a strong pivot towards New Energy Vehicles (NEVs). This shift directly impacts traditional dealership models. For instance, by the end of 2023, NEVs accounted for over 30% of all new car sales in China, a significant leap from previous years, indicating a fundamental change in consumer preference.

Many emerging NEV manufacturers are bypassing established dealership networks and adopting direct-to-consumer sales models. This approach allows them to control the customer experience and potentially offer more competitive pricing. Companies like Tesla have pioneered this strategy, and many Chinese NEV startups are following suit, creating new competitive pressures.

- NEV sales in China exceeded 9.5 million units in 2023, representing a substantial portion of the overall automotive market.

- Direct sales models offer manufacturers greater control over branding, pricing, and customer data, challenging traditional dealership revenue streams.

- Established dealership groups face increased rivalry from these agile, digitally-native competitors, necessitating adaptation to new sales and service paradigms.

Competitive rivalry within China's automotive sector is exceptionally high, fueled by a vast number of domestic and international brands, alongside a fragmented dealership landscape. This intense competition is further amplified by aggressive pricing strategies, particularly in the burgeoning New Energy Vehicle (NEV) segment, as evidenced by the over 9.5 million NEVs sold in China during 2023.

The market is characterized by rapid innovation, with manufacturers like BYD consistently launching new models and technologies throughout 2024. This forces established players, including dealership conglomerates, to adapt swiftly or risk losing market share. Additionally, the rise of direct-to-consumer sales models by NEV manufacturers presents a significant challenge to traditional dealership revenue streams.

Financial pressures are mounting, with many dealerships reportedly operating on thin margins or even at a loss to maintain sales volume, a trend exacerbated by price wars initiated by major automakers in early 2024. This environment is also driving dealership consolidation, with thousands facing financial strain and closures, intensifying the fight for customers among the remaining entities.

| Key Competitive Factors | Description | Impact on China Grand Automotive Services |

| Market Saturation | Numerous domestic and international auto brands compete fiercely. | Requires constant differentiation and customer value propositions. |

| Price Wars (NEVs) | Aggressive price cuts by OEMs like BYD and Tesla. | Squeezes dealership profit margins, necessitates volume focus. |

| Direct-to-Consumer Models | NEV startups bypassing traditional dealerships. | Challenges existing sales channels and customer relationships. |

| Dealership Consolidation | Thousands of dealerships facing financial difficulties. | Increases rivalry among surviving dealerships for market share. |

SSubstitutes Threaten

While personal car ownership remains a strong preference for many in China's rapidly urbanizing landscape, the increasing accessibility and efficiency of public transportation, coupled with the pervasive growth of ride-sharing platforms like Didi Chuxing, present a growing threat of substitution. These alternatives offer convenient and often more cost-effective mobility solutions, particularly in densely populated urban centers where parking and traffic congestion are significant concerns.

The booming Chinese used car market is a formidable substitute for new car sales, directly impacting companies like China Grand Automotive Services. In 2023, China's used car sales reached 16.4 million units, a significant 15.8% increase year-on-year, demonstrating a clear consumer shift towards pre-owned vehicles as a more budget-friendly option.

Emerging vehicle leasing and subscription models are presenting a growing threat to traditional car sales in China. These flexible alternatives, offering lower upfront costs and greater adaptability, are gaining traction, particularly among younger consumers and those who prefer not to own a vehicle outright. For instance, by early 2024, the car subscription market in China was showing significant growth, with some reports indicating a doubling in user numbers year-over-year, directly impacting the demand for new vehicle purchases through dealerships.

Alternative Mobility Solutions

Alternative mobility solutions, such as electric bicycles and scooters, present a growing threat to traditional automotive services, particularly for short-distance urban travel. In 2024, the micromobility market continued its expansion, with significant growth in shared e-scooter and e-bike services in major Chinese cities. This trend directly impacts the demand for car ownership and related services for certain consumer segments.

While these options may not fully replace the need for a private vehicle, they can significantly reduce reliance on car ownership for daily commutes and errands. For instance, the increasing adoption of electric scooters for last-mile connectivity in cities like Shanghai and Beijing offers a convenient and often more cost-effective alternative to driving and parking a car.

- Growing Micromobility Market: The global shared e-scooter market was valued at approximately $10.5 billion in 2023 and is projected to reach over $20 billion by 2028, indicating a substantial shift in urban transportation preferences.

- Urban Congestion and Cost Savings: In China's megacities, where traffic congestion is a major issue and parking is expensive, e-bikes and e-scooters offer a practical and economical solution for many residents, potentially reducing the need for car ownership.

- Impact on Short-Distance Travel: These alternatives directly substitute for car usage in scenarios covering distances typically under 5 kilometers, a segment of travel that contributes to overall vehicle miles traveled and demand for automotive services.

Long-term Trends in Urban Planning and Car Restrictions

Government policies in major Chinese cities are increasingly focused on managing traffic and environmental concerns. For instance, cities like Shanghai and Beijing have implemented license plate lotteries and auctions, making private car ownership more challenging and expensive. In 2023, the average price for a Shanghai license plate reached approximately 92,000 RMB, a significant barrier for many potential buyers.

These policies indirectly bolster the threat of substitutes for private car ownership. As urban planning evolves to prioritize public transportation and sustainable mobility, alternatives like ride-sharing services, improved metro systems, and cycling infrastructure become more attractive. This shift could diminish the demand for traditional car sales and related services offered by companies like China Grand Automotive Services.

- License Plate Restrictions: Cities like Shanghai and Beijing continue to use lotteries and auctions, making car ownership a costly endeavor.

- Public Transport Investment: Significant government investment in expanding metro networks and bus rapid transit systems offers viable alternatives. For example, China's urban rail transit mileage exceeded 30,000 kilometers by the end of 2023, facilitating easier commutes without private vehicles.

- Growth of Shared Mobility: The rise of ride-hailing platforms and bike-sharing services provides convenient, on-demand transportation options.

The threat of substitutes for traditional car ownership and related services is significant and growing in China. Public transportation improvements, ride-sharing platforms, and the burgeoning used car market all offer compelling alternatives. For instance, in 2023, China's used car sales hit 16.4 million units, a nearly 16% increase year-over-year, highlighting a strong consumer preference for more affordable options.

| Substitute Type | Key Characteristic | 2023/2024 Data Point |

| Used Cars | Cost-effectiveness | 16.4 million units sold (15.8% YoY growth) |

| Ride-Sharing | Convenience, Cost | Dominant platforms like Didi Chuxing |

| Public Transport | Accessibility, Cost | Over 30,000 km of urban rail transit by end of 2023 |

| Micromobility (E-scooters/bikes) | Short-distance efficiency | Global shared e-scooter market valued at ~$10.5 billion in 2023 |

| Vehicle Leasing/Subscription | Flexibility, Lower upfront cost | Significant user growth reported by early 2024 |

Entrants Threaten

Establishing a robust automotive dealership network, akin to China Grand Automotive Services, demands immense upfront capital. This includes significant investment in prime real estate for showrooms, state-of-the-art service facilities, maintaining a diverse and up-to-date vehicle inventory, and building a skilled workforce. These high capital requirements act as a formidable deterrent for potential new competitors looking to enter the market.

Established dealership groups, like China Grand Automotive Services, leverage deep-rooted relationships with major automotive brands. These long-standing partnerships are crucial for securing desirable franchises and accessing the latest models, a significant barrier for newcomers. For instance, in 2024, securing a franchise for a premium electric vehicle brand often involves substantial upfront investment and proven operational history, which new entrants typically lack.

Furthermore, existing players have built extensive distribution and service networks across China's vast geography. Replicating this provincial reach and customer touchpoint density requires immense capital and time, making it difficult for new entrants to compete on scale and accessibility. China Grand Automotive Services, operating hundreds of dealerships nationwide, exemplifies this established network advantage.

The automotive retail and service sector in China presents significant regulatory hurdles for new entrants. Navigating stringent licensing requirements and compliance with evolving automotive industry standards, including those for electric vehicle servicing and data privacy, can be a costly and time-consuming endeavor. For instance, obtaining the necessary operational permits and adhering to environmental regulations for vehicle disposal and repair facilities requires substantial investment and expertise, acting as a considerable barrier.

Economies of Scale and Experience Curve

Established giants like China Grand Automotive Services leverage significant economies of scale, particularly in bulk purchasing of vehicles and parts, and in widespread marketing efforts. This allows them to offer more competitive pricing and invest heavily in brand building, creating a substantial barrier for newcomers.

New entrants would face immense difficulty matching these cost efficiencies. For instance, a new dealership would need to secure substantial initial inventory and marketing budgets to even approach the operational leverage enjoyed by a company that sold over 1.6 million vehicles in 2023.

- Economies of Scale: China Grand Automotive Services benefits from lower per-unit costs due to its large operational volume, impacting everything from vehicle acquisition to administrative overhead.

- Experience Curve: Years of operation have allowed the company to refine processes, reduce waste, and improve efficiency, further lowering costs and enhancing service quality.

- Capital Requirements: The sheer capital needed to establish a network of dealerships, service centers, and marketing campaigns comparable to existing players is a major deterrent for new entrants.

- Brand Loyalty: Established brands often command greater customer trust and loyalty, making it harder for new entrants to attract and retain customers without significant differentiation or aggressive pricing.

Direct-to-Consumer Models by OEMs

The emergence of direct-to-consumer (DTC) sales models by Original Equipment Manufacturers (OEMs), particularly in the new energy vehicle (NEV) sector, poses a significant threat of new entrants for traditional automotive dealerships. These OEMs are effectively bypassing established dealership networks, creating new competition directly within the retail sales channel.

This shift intensifies competitive pressure on existing dealership groups. For instance, in 2024, several prominent NEV manufacturers continued to expand their DTC operations, with some reporting substantial year-over-year growth in direct sales volume, impacting the market share of franchised dealers.

The DTC approach allows these new entrants to control the customer experience and pricing more directly. This can lead to:

- Disintermediation: Cutting out the traditional dealership layer.

- Brand Control: Maintaining a consistent brand message and sales process.

- Data Ownership: Direct access to customer data for marketing and service.

The threat of new entrants into China's automotive retail and service sector is significantly mitigated by substantial capital requirements, with establishing a comprehensive dealership network demanding immense upfront investment in real estate, inventory, and skilled personnel. Existing players like China Grand Automotive Services benefit from established relationships with OEMs, securing franchises and access to the latest models, a hurdle for newcomers. Furthermore, replicating the extensive nationwide distribution and service infrastructure built by incumbents requires considerable capital and time, making it difficult for new entrants to compete on scale and accessibility.

Regulatory hurdles, including stringent licensing and compliance with evolving standards for electric vehicles and data privacy, also act as a considerable barrier. New entrants would struggle to match the economies of scale enjoyed by established companies, which translate into lower per-unit costs for vehicle acquisition and marketing. For instance, China Grand Automotive Services' operational leverage, demonstrated by selling over 1.6 million vehicles in 2023, creates a significant cost advantage that new competitors would find challenging to overcome.

The rise of direct-to-consumer (DTC) sales models by OEMs, particularly in the new energy vehicle (NEV) segment, introduces a new form of competition. These manufacturers bypass traditional dealerships, controlling the customer experience and pricing directly, leading to disintermediation and brand control. In 2024, several prominent NEV manufacturers reported substantial year-over-year growth in direct sales, directly impacting the market share of franchised dealers and presenting a dynamic challenge to the established order.

| Factor | Impact on New Entrants | Example for China Grand Automotive Services (2023-2024) |

|---|---|---|

| Capital Requirements | Very High Barrier | Investment in hundreds of dealerships, service centers, and inventory. |

| OEM Relationships | Significant Barrier | Long-standing franchises with major automotive brands, securing desirable models. |

| Distribution Network Scale | Very High Barrier | Nationwide presence, difficult and costly to replicate. |

| Regulatory Compliance | High Barrier | Navigating licensing, environmental, and data privacy standards. |

| Economies of Scale | Significant Barrier | Lower per-unit costs from bulk purchasing and marketing; sold 1.6M+ vehicles in 2023. |

| DTC Competition | Emerging Threat | NEV manufacturers bypassing dealerships, gaining direct market access. |

Porter's Five Forces Analysis Data Sources

Our analysis for China Grand Automotive Services leverages data from company annual reports, industry expert interviews, and market research databases like Statista and IBISWorld to provide a comprehensive view of the competitive landscape.