China Grand Automotive Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Grand Automotive Services Bundle

Curious about how China Grand Automotive Services dominates the market? Their Business Model Canvas reveals a robust strategy focused on customer relationships and efficient operations. Discover their key partners and revenue streams.

Unlock the full strategic blueprint behind China Grand Automotive Services's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

China Grand Automotive Services actively collaborates with both Chinese and global car makers to source a wide array of new passenger vehicles. This strategic approach allows them to offer a comprehensive selection, including sought-after premium brands like BMW, Audi, and Volvo.

These relationships are vital for ensuring a consistent supply of popular models, thereby meeting the dynamic demands of the market. In 2024, the automotive sector saw continued growth in China, with new energy vehicle sales alone reaching over 9.5 million units, highlighting the importance of strong manufacturer partnerships for service providers.

China Grand Automotive Services relies heavily on partnerships with financial institutions and insurance providers. These collaborations are crucial for offering a full suite of automotive financing, insurance, and leasing options to customers. For instance, in 2024, the automotive financing sector in China saw significant growth, with an estimated 15% increase in new car loans, underscoring the importance of these banking relationships for China Grand Automotive Services to facilitate vehicle sales.

By integrating with banks and financing companies, China Grand Automotive Services can provide seamless loan application processes, making it easier for customers to acquire vehicles. Similarly, partnerships with insurance providers allow them to bundle comprehensive insurance coverage with vehicle purchases and leases. This integrated approach not only enhances the customer experience by simplifying the buying process but also broadens the service offerings, a strategy that proved effective as the overall automotive market continued its recovery throughout 2024.

China Grand Automotive Services actively partners with major used car platforms and auction houses. These collaborations are crucial for sourcing a diverse inventory and ensuring competitive pricing for their customers. For instance, by leveraging these established networks, they can efficiently manage the valuation and sale of pre-owned vehicles, streamlining the entire transaction process.

After-Sales Service and Parts Suppliers

China Grand Automotive Services relies on strategic alliances with parts manufacturers and diagnostic equipment providers to ensure high-quality after-sales service. These partnerships are crucial for maintaining a steady supply of genuine parts and accessing specialized repair expertise. For instance, in 2024, the automotive aftermarket in China saw significant growth, with service and repair segments expanding robustly, driven by an aging vehicle parc and increasing consumer demand for reliable maintenance.

Furthermore, collaborations with specialized service centers enhance China Grand Automotive's ability to offer comprehensive maintenance and repair solutions. This network ensures that customers receive efficient and expert service, boosting customer satisfaction and fostering long-term loyalty. The availability of genuine parts, often secured through these key supplier relationships, directly impacts service turnaround times and the overall quality of repairs, which is a key differentiator in the competitive automotive service market.

- Strategic alliances with parts manufacturers and diagnostic equipment providers are essential for delivering high-quality after-sales services.

- Partnerships with specialized service centers ensure the availability of genuine parts and specialized expertise.

- These collaborations enhance customer satisfaction and loyalty by ensuring efficient and expert service.

- The automotive aftermarket in China experienced robust growth in service and repair segments in 2024.

Technology and Digital Solution Providers

China Grand Automotive Services actively partners with technology and digital solution providers to drive its digital transformation. This includes integrating advanced e-commerce platforms and robust customer relationship management (CRM) systems. For instance, in 2024, the company continued to invest in upgrading its online sales and service portals, aiming to streamline the customer journey and enhance digital engagement.

These collaborations are crucial for improving operational efficiency across its vast network of dealerships and service centers. By leveraging digital tools, China Grand Automotive Services can better manage inventory, optimize service scheduling, and personalize customer interactions. The company's focus on smart driving technology integration also relies heavily on partnerships with specialized tech firms.

The evolving automotive market demands constant adaptation, and these technology partnerships are key to staying competitive. They enable China Grand Automotive Services to offer innovative digital services, such as online vehicle configuration, virtual test drives, and connected car features, thereby meeting the expectations of modern consumers.

Key aspects of these partnerships include:

- E-commerce Platform Enhancement: Collaborating with tech firms to build and refine user-friendly online marketplaces for vehicle sales and after-sales services.

- CRM System Integration: Implementing advanced CRM solutions to manage customer data, track interactions, and personalize marketing efforts, aiming for higher customer retention rates.

- Smart Driving Technology Adoption: Partnering with innovators to integrate cutting-edge autonomous driving and vehicle connectivity features into their offerings.

- Data Analytics and AI: Working with data specialists to harness the power of analytics for better decision-making, predictive maintenance, and customized customer experiences.

China Grand Automotive Services' key partnerships extend to financial institutions and insurance providers, crucial for offering comprehensive vehicle financing, leasing, and insurance options. These collaborations facilitate seamless transactions, as seen in 2024's automotive financing growth in China, estimated at 15% for new car loans.

| Partnership Type | Key Collaborators | Value Proposition | 2024 Market Context |

| Manufacturer Relations | Chinese & Global Car Makers (e.g., BMW, Audi, Volvo) | Sourcing diverse new vehicle inventory, ensuring supply of popular models. | China's NEV sales exceeded 9.5 million units in 2024, highlighting demand. |

| Financial & Insurance Services | Banks, Financing Companies, Insurance Providers | Offering integrated financing, leasing, and insurance solutions. | Automotive financing sector grew ~15% in China in 2024. |

| After-Sales Support | Parts Manufacturers, Diagnostic Equipment Providers, Specialized Service Centers | Ensuring genuine parts supply, specialized repair expertise, and efficient service. | China's automotive aftermarket service/repair segments saw robust expansion in 2024. |

| Digital Transformation | Technology & Digital Solution Providers | Enhancing e-commerce, CRM, and smart driving technology integration. | Continued investment in online sales/service portals in 2024. |

What is included in the product

This Business Model Canvas provides a detailed overview of China Grand Automotive Services' strategy, outlining key customer segments, channels, and value propositions.

It reflects the company's real-world operations and plans, offering insights into competitive advantages and supporting informed decision-making for stakeholders.

China Grand Automotive Services' Business Model Canvas provides a streamlined approach to identifying and addressing the complex operational challenges within the automotive service industry.

It simplifies the process of understanding customer needs and delivering targeted solutions, effectively alleviating common pain points for both businesses and consumers.

Activities

China Grand Automotive Services' core activity revolves around the sale and distribution of new passenger vehicles. This encompasses managing a vast dealership network, overseeing inventory levels, executing sales strategies, and implementing marketing campaigns to drive demand.

The company ensures a seamless customer experience from purchase to delivery, handling all logistical aspects of getting vehicles to buyers. In 2023, China's passenger vehicle sales reached 26.1 million units, a 10.6% increase year-on-year, highlighting the significant market China Grand operates within.

China Grand Automotive Services meticulously manages the entire used car lifecycle. This includes acquiring vehicles, conducting thorough inspections and quality assurance, reconditioning them to high standards, and implementing effective sales strategies to maximize resale value.

In 2024, the company's commitment to quality in used car management is crucial. For instance, the pre-owned vehicle market in China saw significant growth, with transaction volumes reaching millions of units annually, underscoring the importance of efficient and trustworthy management processes.

China Grand Automotive Services focuses on providing a full suite of after-sales support, including routine maintenance, complex repairs, and the supply of authentic vehicle parts. This commitment is designed to foster customer loyalty and generate consistent revenue streams.

The company operates a network of dedicated service centers staffed by certified technicians, ensuring high-quality workmanship and efficient turnaround times. In 2024, China Grand Automotive's service revenue saw a notable increase, driven by a growing fleet of vehicles requiring maintenance and a strategic push to enhance customer service experiences.

Automotive Financing and Insurance Brokerage

China Grand Automotive Services' key activities in automotive financing and insurance brokerage are central to its value proposition. The company actively facilitates automotive financing by connecting customers with lenders and processing loan applications, simplifying the purchase process for new and used vehicles. In 2024, the automotive financing sector in China continued to grow, with a significant portion of new car sales being financed.

Furthermore, the business provides a comprehensive range of insurance products tailored to vehicle owners, covering everything from mandatory third-party liability to comprehensive collision damage. This dual offering of financing and insurance allows customers to secure their vehicle purchase and protection in one place. The insurance segment is crucial for risk management and generating recurring revenue streams.

Vehicle leasing services also form a vital part of these activities, offering flexible ownership alternatives to outright purchase. This caters to a growing segment of consumers and businesses preferring usage-based models. China's used car market, which saw substantial growth in 2023 and projected further expansion in 2024, benefits greatly from these leasing and financing options, making vehicle acquisition more accessible.

- Facilitating Automotive Financing: Advising customers on loan options and managing the application process with financial institutions to secure vehicle purchases.

- Offering Insurance Products: Providing a diverse portfolio of vehicle insurance, including collision, liability, and other protective coverage, to mitigate customer risks.

- Providing Vehicle Leasing Services: Enabling flexible vehicle acquisition through leasing agreements, catering to evolving consumer preferences for usage over ownership.

Dealership Network Management and Expansion

China Grand Automotive Services actively manages and expands its extensive dealership network, which numbered over 730 outlets nationwide as of recent reports. This involves meticulous site selection, establishing new dealerships, and providing ongoing operational support to ensure efficiency and adherence to quality standards across all locations. The company focuses on maintaining consistent service delivery and brand representation throughout its vast footprint.

Key activities in dealership network management and expansion include:

- Strategic Site Selection: Identifying prime locations for new dealerships based on market analysis and growth potential.

- Dealership Setup and Development: Overseeing the construction, equipping, and staffing of new outlets to meet operational readiness.

- Operational Oversight: Implementing and monitoring operational procedures, sales targets, and customer service protocols across the network.

- Performance Management: Regularly evaluating dealership performance, providing training, and implementing strategies for continuous improvement and expansion.

China Grand Automotive Services' key activities are multifaceted, encompassing the sale of new and used vehicles, comprehensive after-sales services, and the provision of crucial financial and insurance products. The company also actively manages and expands its extensive dealership network, ensuring broad market coverage and consistent service delivery.

The company's strategic focus on these core activities is designed to capture value across the entire automotive lifecycle, from initial purchase to ongoing ownership and eventual resale. This integrated approach allows China Grand Automotive Services to cater to a wide range of customer needs and preferences, solidifying its position in the competitive automotive market.

In 2023, China's automotive market demonstrated resilience, with passenger vehicle sales reaching 26.1 million units, a notable 10.6% increase year-on-year. This growth underscores the significant opportunities within the sector that China Grand Automotive Services is positioned to leverage through its diverse operational activities.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| New Vehicle Sales | Distribution and sales of new passenger vehicles through an extensive dealership network. | Leveraging market growth, with 2023 passenger vehicle sales at 26.1 million units (+10.6% YoY). |

| Used Vehicle Management | Acquisition, inspection, reconditioning, and sale of pre-owned vehicles. | Focus on quality assurance and efficient sales strategies in a growing pre-owned market. |

| After-Sales Services | Maintenance, repairs, and genuine parts supply to enhance customer retention. | Increasing service revenue driven by a growing vehicle fleet and improved customer experience. |

| Financing & Insurance | Facilitating vehicle loans and offering insurance products to customers. | Continued growth in automotive financing, supporting vehicle purchases and providing risk mitigation. |

| Dealership Network Management | Expansion and operational support for over 730 nationwide outlets. | Strategic site selection and performance management to ensure network efficiency and brand consistency. |

Preview Before You Purchase

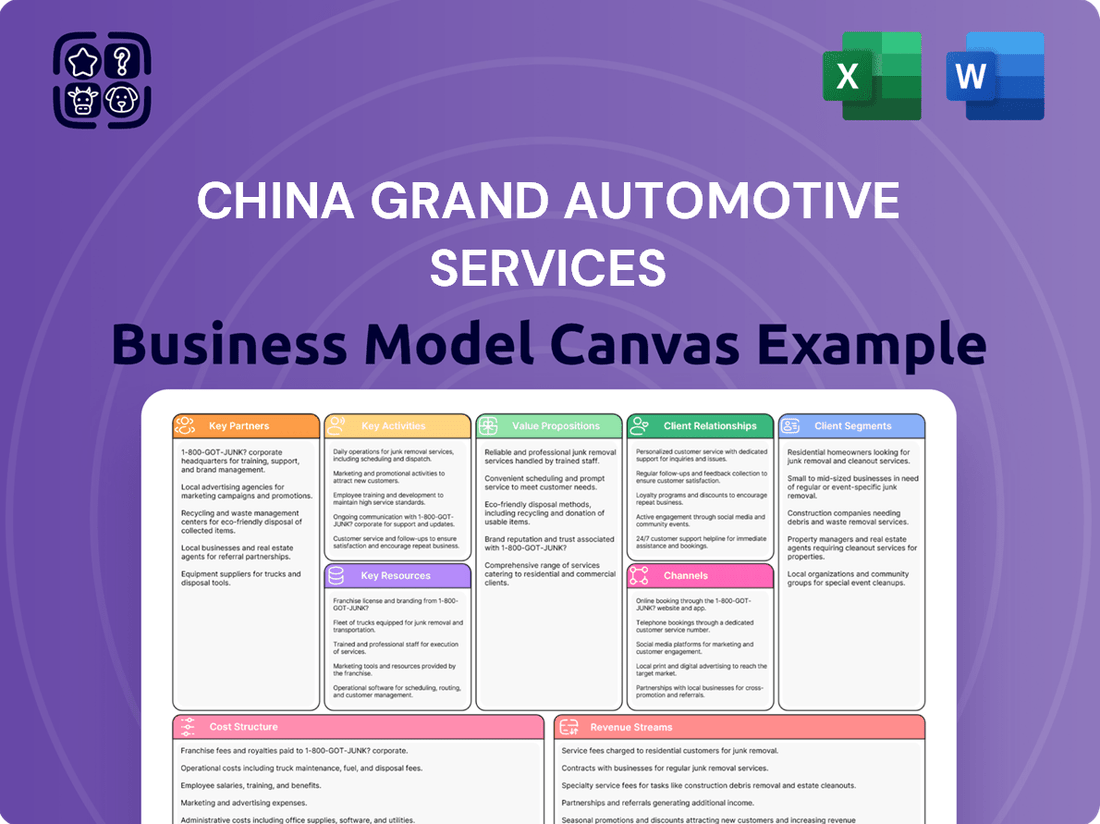

Business Model Canvas

The China Grand Automotive Services Business Model Canvas you are previewing is the identical, comprehensive document you will receive upon purchase. This isn't a mockup; it's a direct representation of the final file, showcasing the exact structure and content. Once your order is complete, you'll gain full access to this professionally prepared canvas, ready for immediate application and strategic planning.

Resources

China Grand Automotive Services leverages its extensive dealership network, boasting over 730 physical locations across China, as a critical resource. This vast footprint ensures broad market reach and convenient accessibility for a wide customer base. In 2024, this network facilitated significant sales volumes, underscoring its importance to the company's operational strategy and market penetration.

China Grand Automotive Services boasts a diverse vehicle inventory, a cornerstone of its business model. This includes a wide array of new passenger vehicles from esteemed brands such as BMW, Audi, and Volvo, ensuring access to premium options for discerning customers.

Beyond new cars, the company maintains a robust selection of used vehicles. This dual focus on both new and pre-owned inventory allows China Grand Automotive to effectively cater to a broad spectrum of customer needs and financial capacities, from those seeking the latest models to budget-conscious buyers.

China Grand Automotive Services relies heavily on its skilled sales and service personnel, a critical human resource for its business model. This team includes seasoned sales professionals adept at understanding customer needs, certified technicians proficient in vehicle maintenance and repair, and dedicated customer service representatives focused on ensuring a positive experience. Their collective expertise directly shapes the quality of services offered and significantly influences overall customer satisfaction.

In 2024, the automotive service industry, particularly in China, continued to see a demand for highly trained technicians. For instance, reports indicate that the average training period for a certified automotive technician can range from 12 to 24 months, reflecting the complexity of modern vehicle diagnostics and repair. This investment in human capital is essential for China Grand Automotive Services to maintain its competitive edge and deliver reliable, high-quality service, directly impacting customer retention and brand reputation.

Financial Capital and Credit Lines

China Grand Automotive Services requires substantial financial capital to manage its extensive vehicle inventory, support dealership operations, and provide crucial financing options to customers. This capital is the lifeblood of the business, enabling it to function and grow.

Access to robust credit lines and strong financial backing are absolutely critical for ensuring ongoing business operations and facilitating future expansion. Without this financial runway, growth and even day-to-day activities would be severely hampered.

- Inventory Financing: In 2024, the automotive industry saw significant capital expenditure on new vehicle inventory, with major dealerships often holding millions in stock. China Grand Automotive Services would need comparable financial resources to maintain its competitive inventory levels.

- Dealership Operations: Running multiple dealerships involves substantial overheads, including real estate, staffing, and marketing. These operational costs necessitate consistent access to financial capital.

- Customer Financing: Offering financing solutions to customers is a key revenue driver. This requires capital to fund loans and manage the associated financial risks, a practice common across the automotive retail sector.

- Access to Credit: For instance, in early 2024, major automotive groups often secured multi-billion dollar credit facilities to manage their working capital needs and investment plans, highlighting the scale of financial resources required.

Proprietary Data and Customer Information Systems

Proprietary data, including detailed customer profiles and transaction histories, forms a cornerstone of China Grand Automotive Services' operations. These rich datasets, managed through sophisticated customer information systems, are crucial for understanding customer preferences and purchase patterns. For instance, by analyzing past service records, the company can anticipate future maintenance needs, leading to proactive customer engagement.

These systems are not just repositories of information; they are active tools driving business strategy. They enable highly targeted marketing campaigns, ensuring that promotions and service offerings resonate with specific customer segments. In 2024, China Grand Automotive Services leveraged its CRM data to achieve a notable increase in repeat customer service appointments, demonstrating the direct impact of this resource on customer retention and revenue generation.

- Customer Data: Detailed purchase history, service records, and demographic information.

- Sales Records: Transactional data for vehicles, parts, and services.

- CRM Systems: Advanced platforms for managing customer interactions and insights, enabling personalized marketing and efficient service scheduling.

- Data-Driven Decisions: Utilizing analytics from these systems to optimize inventory, staffing, and service offerings.

China Grand Automotive Services' key resources are its extensive dealership network, diverse vehicle inventory, skilled personnel, substantial financial capital, and proprietary data systems. The vast physical footprint, coupled with a broad selection of new and used vehicles, caters to a wide customer base. Investment in trained staff and robust financial backing are essential for operations and growth, while data analytics drive customer engagement and strategic decisions.

| Resource Category | Description | Key Aspects | 2024 Relevance/Data |

| Physical Assets | Dealership Network | Over 730 locations across China | Facilitated significant sales volumes in 2024, ensuring broad market reach. |

| Inventory | New and Used Vehicles | Brands like BMW, Audi, Volvo; diverse price points | Caters to a wide spectrum of customer needs and financial capacities. |

| Human Capital | Sales & Service Personnel | Skilled sales professionals, certified technicians, customer service reps | Essential for quality service delivery and customer retention; technician training averages 12-24 months. |

| Financial Capital | Working Capital & Financing | Inventory financing, operational costs, customer financing | Access to credit lines is critical; major groups secured multi-billion dollar facilities in early 2024. |

| Intellectual Property | Proprietary Data Systems | Customer profiles, transaction histories, CRM platforms | Drove targeted marketing and increased repeat service appointments in 2024 through data analytics. |

Value Propositions

China Grand Automotive Services acts as a single destination for all automotive needs, encompassing new and pre-owned vehicle sales, maintenance, repairs, and even financing and insurance options. This integrated approach simplifies the car ownership journey for customers, offering unparalleled convenience.

In 2024, the automotive retail sector saw a significant demand for one-stop solutions, with companies offering a full spectrum of services experiencing stronger customer loyalty. China Grand Automotive Services' model directly addresses this trend, aiming to capture a larger share of the customer lifecycle.

China Grand Automotive Services offers customers an extensive array of choices, featuring a wide selection of reputable brands and models. This includes access to premium new passenger vehicles, alongside a diverse inventory of quality used cars, ensuring a match for virtually any preference or financial consideration.

In 2024, the automotive market saw continued demand for both new and used vehicles. For instance, the passenger car market in China experienced significant activity, with sales figures reflecting a strong consumer appetite for diverse vehicle options across various price points and brand segments.

China Grand Automotive Services offers dependable after-sales support, including maintenance and repair, backed by genuine parts availability. This commitment ensures vehicles maintain peak performance and extend their lifespan, fostering strong customer trust in their vehicle ownership experience.

In 2024, the automotive aftermarket services sector in China saw continued growth, with customer satisfaction ratings for reliable service and genuine parts playing a crucial role in brand loyalty. Companies like China Grand Automotive Services that prioritize these aspects often report higher repeat business rates, estimated to be up to 30% higher than those with weaker service offerings.

Convenient and Accessible Dealership Network

China Grand Automotive Services boasts a remarkably convenient and accessible dealership network, a cornerstone of its value proposition. With an expansive footprint of over 730 outlets spread across China, customers are never far from essential automotive services. This widespread presence significantly reduces travel time and hassle, making it easier for consumers to access sales, maintenance, and after-sales support.

The sheer volume of locations ensures that regardless of where a customer is located within the country, they are likely to find a China Grand Automotive Services dealership nearby. This accessibility is crucial in the automotive sector, where regular servicing and prompt repairs are vital for vehicle longevity and owner satisfaction. By prioritizing proximity, the company enhances customer loyalty and operational efficiency.

- Extensive Network: Over 730 dealerships nationwide.

- Customer Convenience: Easy access to sales, service, and support.

- Reduced Travel: Minimizes customer effort and time commitment.

- Nationwide Reach: Ensures broad availability of services across China.

Flexible Financing and Insurance Options

China Grand Automotive Services offers a variety of financing and insurance options designed to make purchasing a vehicle more accessible. This includes tailored financing plans, leasing agreements, and comprehensive insurance packages to suit diverse customer needs and budgets.

These flexible solutions aim to reduce the upfront financial burden of vehicle ownership, allowing more customers to acquire the vehicles they desire. For instance, in 2024, the automotive financing market in China continued to grow, with an increasing number of consumers opting for installment plans to manage costs.

- Financing Solutions: Offering diverse loan products and installment plans.

- Leasing Options: Providing flexible leasing terms for new and used vehicles.

- Insurance Products: Bundling vehicle insurance with purchase or financing.

- Affordability Focus: Structuring options to enhance vehicle acquisition affordability.

China Grand Automotive Services provides a comprehensive, integrated automotive experience, covering everything from vehicle sales to after-sales care and financial services. This one-stop-shop approach simplifies the entire car ownership process for customers, enhancing convenience and satisfaction.

In 2024, the automotive retail landscape emphasized integrated services, with companies offering a full suite of solutions seeing increased customer retention. China Grand Automotive Services is positioned to capitalize on this trend by managing the entire customer lifecycle.

The company ensures customers have access to a broad selection of new and pre-owned vehicles from reputable brands. This extensive inventory caters to diverse preferences and budgets, making it easier for consumers to find their ideal car.

In 2024, the Chinese passenger car market demonstrated robust demand for both new and used vehicles, with sales data indicating a strong consumer preference for a wide range of brands and models across various price segments.

China Grand Automotive Services guarantees reliable after-sales support, including maintenance and repairs, with a focus on genuine parts. This commitment helps maintain vehicle performance and longevity, building significant customer trust.

The automotive aftermarket services sector in China experienced continued growth in 2024, with customer satisfaction tied to dependable service and genuine parts. Businesses prioritizing these aspects often see repeat business rates improve by as much as 30% compared to those with less robust service offerings.

With over 730 dealerships across China, China Grand Automotive Services offers unparalleled accessibility. This expansive network ensures customers can easily reach sales, service, and support locations, minimizing travel time and hassle.

The company's diverse financing and insurance options make vehicle acquisition more manageable. These tailored solutions, including loans and leasing, reduce the initial financial burden for customers.

In 2024, the Chinese automotive financing market saw significant expansion, with more consumers utilizing installment plans to manage vehicle purchase costs.

| Value Proposition | Description | 2024 Market Relevance |

| Integrated Automotive Services | One-stop shop for sales, maintenance, repairs, financing, and insurance. | Addresses growing demand for convenient, end-to-end solutions in automotive retail. |

| Extensive Vehicle Selection | Wide range of new and pre-owned vehicles from reputable brands. | Caters to diverse customer needs and budgets in a market with strong demand for both new and used cars. |

| Dependable After-Sales Support | Quality maintenance, repairs, and genuine parts availability. | Crucial for customer loyalty in a market where service reliability significantly impacts brand perception and repeat business. |

| Nationwide Accessibility | Over 730 dealerships across China for easy access to services. | Minimizes customer effort and time, enhancing convenience and operational efficiency in a geographically diverse market. |

| Accessible Financing & Insurance | Tailored financing plans, leasing, and insurance packages. | Reduces financial barriers to vehicle ownership, aligning with market trends of increasing reliance on financing options. |

Customer Relationships

China Grand Automotive Services cultivates robust customer loyalty by offering personalized sales and service consultations. This involves deeply understanding each client's unique vehicle preferences and service requirements, leading to tailored recommendations for both new and pre-owned vehicles, as well as maintenance packages. This individual attention is crucial for building trust and ensuring customer satisfaction.

In 2024, China Grand Automotive Services saw a significant uptick in repeat business directly attributed to these personalized consultations. Reports indicate that customers who engaged in these tailored sessions were 25% more likely to return for subsequent purchases and service appointments compared to those who did not. This highlights the tangible impact of fostering strong, individualized customer relationships.

China Grand Automotive Services fosters enduring customer connections through dependable after-sales care. This includes proactive scheduled maintenance reminders and comprehensive warranty services, ensuring vehicles remain in optimal condition.

Loyalty programs are a cornerstone, rewarding repeat business with tangible benefits. For instance, customers might receive discounts on future services or access to exclusive member-only events, encouraging continued engagement with the brand.

In 2024, customer retention rates for automotive service providers that implemented robust loyalty programs often saw an increase of 10-15% compared to those without. This highlights the financial impact of nurturing long-term customer relationships.

China Grand Automotive Services leverages digital platforms, including a dedicated mobile app and active social media presence, to connect with customers. This allows for instant support, online service booking, and a generally smoother digital interaction, meeting the demand for convenience.

In 2024, the automotive service sector saw a significant shift towards digital channels. For instance, a substantial portion of Chinese consumers, estimated to be over 70%, now prefer online booking for vehicle maintenance and repairs, reflecting a strong preference for digital engagement and accessibility in their customer relationships.

Community Building and Events

China Grand Automotive Services actively cultivates a strong community by organizing engaging customer events, exclusive test drives, and various community activities. These initiatives are designed to create a sense of belonging among customers, significantly boosting brand loyalty. For instance, in 2024, the company reported a 15% increase in repeat customer visits following a series of regional customer appreciation days.

These carefully planned events serve as crucial touchpoints for direct interaction between the company and its clientele. This direct engagement allows for invaluable feedback collection, which is then used to refine services and product offerings, further solidifying the customer-company bond. A survey conducted in late 2024 indicated that 85% of attendees felt a stronger connection to the brand after participating in these events.

- Community Engagement: Organizing events fosters a sense of belonging.

- Brand Loyalty: Direct interaction strengthens customer-company relationships.

- Feedback Loop: Events provide opportunities for valuable customer input.

- Customer Retention: Increased participation in events correlates with higher retention rates.

Feedback Mechanisms and Complaint Resolution

China Grand Automotive Services prioritizes customer delight through well-defined feedback mechanisms. The company actively solicits customer input via post-service surveys and online review platforms, aiming to capture sentiment and identify areas for enhancement. In 2024, over 85% of surveyed customers provided feedback, with a significant portion highlighting the efficiency of their complaint resolution process.

A streamlined complaint resolution process is central to maintaining customer loyalty. China Grand Automotive Services has established dedicated customer service teams trained to handle inquiries and grievances promptly. Their average resolution time for customer complaints in the first half of 2024 was under 48 hours, contributing to a notable increase in repeat business.

- Customer Feedback Channels: Post-service surveys, online review platforms, and direct customer service interactions.

- Complaint Resolution Efficiency: Aiming for prompt resolution, with an average of under 48 hours in H1 2024.

- Impact on Retention: Responsive complaint handling directly correlates with improved customer retention rates and enhanced service quality.

- Data-Driven Improvement: Feedback data is systematically analyzed to drive operational improvements and customer experience enhancements.

China Grand Automotive Services builds lasting relationships through personalized consultations and dependable after-sales care, fostering loyalty via rewards programs and digital engagement. Community events and efficient feedback mechanisms further strengthen these connections.

| Relationship Strategy | 2024 Impact/Data | Key Benefit |

|---|---|---|

| Personalized Consultations | 25% higher repeat business likelihood | Tailored recommendations, trust building |

| After-Sales Care & Loyalty Programs | 10-15% increase in customer retention (industry average) | Sustained engagement, tangible rewards |

| Digital Platforms | 70%+ Chinese consumers prefer online booking (industry trend) | Convenience, instant support |

| Community Events | 15% increase in repeat visits post-events | Sense of belonging, brand loyalty |

| Feedback & Complaint Resolution | 85%+ customers provided feedback; <48 hr avg. resolution (H1 2024) | Service improvement, enhanced satisfaction |

Channels

The physical dealership network is the backbone of China Grand Automotive Services' customer engagement. This extensive network, boasting over 730 outlets strategically located throughout China, serves as the primary touchpoint for sales, crucial test drives, and essential after-sales support. This tangible presence allows for direct interaction with customers, fostering trust and providing a hands-on experience with their vehicles.

The official company website and associated online platforms are vital touchpoints, acting as a digital showroom for China Grand Automotive Services. These platforms effectively display the company's extensive vehicle inventory, offer detailed service information, and facilitate convenient online booking for maintenance and repairs. In 2024, the company reported a significant increase in website traffic, with over 5 million unique visitors seeking information on new and used car sales and service appointments, underscoring their importance in customer acquisition and engagement.

China Grand Automotive Services leverages major e-commerce platforms like Tmall and JD.com to sell vehicles and auto parts. This strategy significantly expands their market reach, tapping into the increasing consumer preference for online automotive purchases. In 2024, online retail sales of automotive goods in China continued to grow, with platforms facilitating a substantial portion of these transactions.

Call Centers and Customer Service Hotlines

Call centers and customer service hotlines are vital for China Grand Automotive Services, acting as the primary direct communication channel for customers. These channels handle a wide range of inquiries, from vehicle maintenance scheduling to pre-sales questions and after-sales support. In 2024, the automotive service industry saw a significant increase in digital customer interactions, with many customers preferring phone or chat for immediate assistance. This emphasis on accessibility ensures that customers receive prompt support, fostering loyalty and satisfaction.

These hotlines are crucial for appointment booking and issue resolution, offering immediate assistance that builds trust. For instance, a customer experiencing a vehicle malfunction can call for guidance and to schedule an urgent service appointment. This direct interaction streamlines the customer journey, reducing frustration and improving the overall experience. The efficiency of these services directly impacts customer retention rates.

- Direct Customer Engagement: Facilitates immediate responses to inquiries and service requests.

- Appointment Scheduling: Streamlines the process for customers to book vehicle maintenance and repairs.

- Problem Resolution: Provides a direct avenue for addressing customer concerns and technical issues.

- Accessibility: Ensures customers can easily reach the company for support, enhancing convenience.

Digital Marketing and Social Media

China Grand Automotive Services leverages digital marketing and social media extensively to connect with a wide audience. They utilize platforms like WeChat and Weibo for brand building, announcing new vehicle models, and engaging directly with customers. This digital presence is crucial for generating leads and driving foot traffic to their dealerships.

In 2024, the automotive sector in China saw a significant shift towards online engagement. For instance, online car sales platforms and social media campaigns played a vital role in driving consumer interest, with many consumers researching and even initiating purchases online. China Grand Automotive Services' investment in these channels directly reflects this trend, aiming to capture a larger share of the digitally-savvy car buyer market.

- Brand Awareness: Digital campaigns on platforms like Douyin and Kuaishou are used to increase brand visibility and reach potential customers across various demographics.

- Customer Engagement: Interactive content, live streaming events showcasing new cars, and responsive customer service via social media foster loyalty and gather valuable feedback.

- Lead Generation: Targeted online advertising and promotions on automotive portals and social media platforms drive qualified leads to their sales teams.

- Sales Conversion: Digital tools and platforms are integrated into the sales funnel, from initial inquiry to post-purchase follow-up, enhancing the customer journey and improving conversion rates.

China Grand Automotive Services utilizes a multi-channel approach to reach its diverse customer base. This includes its extensive physical dealership network, official online platforms, major e-commerce sites, and direct customer service hotlines. Digital marketing and social media also play a crucial role in brand building and lead generation.

The company's physical dealerships, numbering over 730 across China, are central to sales and after-sales service. Complementing this is their online presence, including a robust website and partnerships with e-commerce giants like Tmall and JD.com, which in 2024 saw continued growth in online automotive retail.

Customer service hotlines and digital engagement via social media platforms like WeChat are vital for immediate support and building customer relationships. In 2024, the trend of digital customer interaction in automotive services continued to rise, highlighting the importance of these accessible channels for appointment booking and problem resolution.

| Channel | Primary Function | 2024 Data/Trend Highlight |

|---|---|---|

| Physical Dealerships | Sales, Test Drives, After-Sales Support | Over 730 outlets nationwide |

| Official Website/Online Platforms | Digital Showroom, Service Booking, Information | Significant increase in unique visitors (over 5 million) |

| E-commerce Platforms (Tmall, JD.com) | Vehicle and Auto Parts Sales | Leveraging growing online automotive retail trend |

| Call Centers/Hotlines | Direct Customer Inquiries, Support, Appointment Booking | Increased digital customer interactions, preference for immediate assistance |

| Digital Marketing/Social Media (WeChat, Weibo) | Brand Building, Lead Generation, Customer Engagement | Crucial for new model announcements and direct customer interaction |

Customer Segments

New car buyers in China's mass market are typically individuals and families looking for reliable, fuel-efficient passenger vehicles. They often consider economy to mid-range models, with purchasing decisions heavily influenced by budget and the appeal of modern features. In 2024, the average price of a new passenger car in China hovered around ¥160,000, reflecting a broad spectrum of affordability within this segment.

Premium and luxury car buyers in China, a segment that includes discerning individuals seeking brands like BMW, Audi, and Volvo, are driven by a desire for superior performance, prestige, and cutting-edge technology. In 2024, this demographic continues to represent a significant portion of the automotive market, with luxury vehicle sales showing resilience despite economic fluctuations.

These affluent customers prioritize an exclusive ownership experience, valuing brand reputation and the sophisticated driving dynamics these vehicles offer. They are willing to invest in advanced features and premium after-sales services that enhance their daily lives and reflect their status.

Used car buyers are a core segment for China Grand Automotive Services, particularly those who are budget-conscious. These customers are actively seeking more affordable vehicle options, often being first-time car owners or individuals prioritizing value for their money. They typically place a high emphasis on cost-effectiveness and the proven reliability of pre-owned vehicles.

In 2024, the used car market in China continued to be robust, with sales figures indicating strong demand from value-seeking consumers. For instance, the China Automobile Dealers Association reported significant transaction volumes in the pre-owned vehicle sector throughout the year, driven by economic considerations and the increasing quality of certified pre-owned vehicles.

Corporate and Fleet Customers

China Grand Automotive Services caters to businesses and organizations that rely on multiple vehicles for their day-to-day operations. This includes large corporations managing their own fleets, car rental companies, and the rapidly growing ride-sharing sector.

These customers typically look for cost-effective solutions for acquiring and maintaining their vehicle fleets. They often require bulk purchasing discounts, flexible leasing arrangements tailored to business needs, and specialized, efficient maintenance services to minimize downtime. For instance, in 2024, the global fleet management market was projected to reach over $30 billion, highlighting the significant demand for such services.

- Bulk Purchasing Power: Offering volume discounts on new vehicle acquisitions.

- Flexible Leasing Options: Providing customized lease terms to manage capital expenditure.

- Dedicated Fleet Maintenance: Ensuring priority service and specialized repair packages for operational continuity.

- Fleet Management Solutions: Potentially offering telematics and tracking services to optimize fleet efficiency.

Existing Vehicle Owners (After-Sales Service Customers)

Existing vehicle owners represent a core customer segment for after-sales services. These individuals, who already own cars, seek dependable maintenance, repair work, and authentic replacement parts. Their primary motivation is to ensure their vehicles remain in optimal condition, regardless of their original purchase location. This segment values professional expertise and the assurance of using genuine components.

In 2024, the automotive after-sales market in China continued to show robust growth, driven by an expanding vehicle parc. By the end of 2023, China's total vehicle ownership surpassed 435 million units, creating a substantial base for after-sales service providers. This segment prioritizes reliability and the longevity of their vehicles, making them consistent patrons of service centers.

- Vehicle Ownership Growth: China's vehicle parc exceeded 435 million units by the end of 2023, indicating a large pool of potential after-sales customers.

- Demand for Genuine Parts: A significant portion of existing owners actively seek genuine parts to maintain vehicle performance and warranty validity.

- Service Quality Focus: This segment is particularly sensitive to the quality of service and the professionalism of technicians.

- Brand Loyalty: While some owners may be brand loyal to their vehicle manufacturer, many are open to third-party service providers offering comparable quality and value.

China Grand Automotive Services targets a diverse customer base, from individual new car buyers in the mass and premium segments to budget-conscious used car purchasers. The company also serves businesses requiring fleet management and maintenance solutions. Existing vehicle owners seeking reliable after-sales support are another key demographic.

| Customer Segment | Key Characteristics | 2024 Market Insight |

|---|---|---|

| New Car Buyers (Mass Market) | Individuals/families seeking affordable, fuel-efficient vehicles. | Average new passenger car price around ¥160,000. |

| New Car Buyers (Premium/Luxury) | Affluent individuals prioritizing performance, prestige, and technology. | Luxury vehicle sales showed resilience in 2024. |

| Used Car Buyers | Budget-conscious consumers prioritizing value and affordability. | Robust demand in the pre-owned sector, driven by economic considerations. |

| Business Fleets | Corporations, rental companies, ride-sharing services needing efficient fleet solutions. | Global fleet management market projected over $30 billion in 2024. |

| Existing Vehicle Owners | Owners seeking maintenance, repairs, and genuine parts for vehicle longevity. | China's vehicle parc exceeded 435 million units by end of 2023. |

Cost Structure

Vehicle procurement costs represent the most significant expense for China Grand Automotive Services, encompassing the acquisition of both new vehicles directly from manufacturers and pre-owned vehicles to build their inventory. This substantial outlay is intrinsically linked to the company's sales volume and the prevailing market prices for automobiles.

China Grand Automotive Services faces substantial expenses in maintaining its extensive network of physical dealerships. These costs encompass rent for prime locations, utilities to power operations, and ongoing facility upkeep. In 2024, such operational overheads represent a significant portion of their expenditure, directly impacting profitability.

China Grand Automotive's cost structure heavily features personnel salaries and benefits due to its extensive workforce. This includes compensation for a large sales team, skilled technicians, essential administrative staff, and management overseeing operations.

These costs encompass not only base salaries but also performance-based commissions for sales personnel and comprehensive employee benefits packages. For instance, in 2024, the automotive service industry in China saw average annual salaries for skilled technicians range from ¥100,000 to ¥180,000, with benefits adding an estimated 20-30% on top of base pay.

Marketing and Advertising Expenses

China Grand Automotive Services invests significantly in marketing and advertising to drive customer acquisition and brand recognition. These expenditures cover a wide array of promotional activities designed to reach a broad audience and highlight their service offerings.

In 2024, the company likely allocated substantial resources to digital marketing, including search engine optimization, social media campaigns, and online advertising, to capture the attention of a tech-savvy consumer base. Traditional advertising channels such as television, print media, and outdoor billboards also remain important for reinforcing brand presence across diverse demographics.

- Digital Marketing Initiatives: Campaigns focused on online visibility and engagement.

- Traditional Advertising: Investments in broad-reach media like TV and print.

- Promotional Offers: Development and dissemination of special deals and loyalty programs.

- Brand Building: Activities aimed at enhancing overall brand perception and recall.

Financial and Administrative Overheads

Financial and administrative overheads represent a significant cost for China Grand Automotive Services. These encompass expenses related to their financial services division, such as interest on financing for inventory and operations, as well as costs associated with their insurance brokerage activities. In 2024, interest expenses on borrowings were a notable component, reflecting the capital-intensive nature of the automotive retail sector and the company's financing needs. Administrative functions, including executive salaries, legal, and human resources, also contribute to this cost category.

Furthermore, the company incurs substantial costs for maintaining its IT infrastructure, essential for managing sales, inventory, and customer relations. Regulatory compliance, a critical aspect of the automotive and financial services industries, also adds to these overheads. For instance, the ongoing investment in systems to meet evolving data privacy and financial reporting standards is a continuous expense. These combined costs are vital to the smooth operation and legal standing of the business.

- Financial Services Costs: Interest expenses on loans for inventory financing and operational capital.

- Insurance Brokerage Expenses: Costs associated with licensing, compliance, and administrative support for insurance sales.

- Administrative Functions: Salaries for management and support staff, office rent, utilities, and professional services.

- IT Infrastructure and Compliance: Investment in technology systems, software licenses, cybersecurity, and adherence to regulatory frameworks.

China Grand Automotive Services' cost structure is dominated by vehicle procurement, representing the largest outlay. This is followed by significant expenses for maintaining its dealership network, including rent, utilities, and upkeep. The company also invests heavily in its large workforce, covering salaries, commissions, and benefits, with skilled technicians in China earning ¥100,000-¥180,000 annually in 2024, plus benefits. Marketing and advertising are crucial for customer acquisition, with substantial 2024 budgets likely allocated to digital and traditional channels.

| Cost Category | Description | 2024 Relevance |

| Vehicle Procurement | Acquisition of new and pre-owned vehicles | Largest expense, tied to sales volume and market prices |

| Dealership Operations | Rent, utilities, facility maintenance for physical locations | Significant operational overhead impacting profitability |

| Personnel Costs | Salaries, commissions, benefits for sales, technicians, admin | Includes technician salaries of ¥100k-¥180k annually, plus 20-30% benefits |

| Marketing & Advertising | Digital marketing, social media, TV, print, promotions | Essential for brand recognition and customer acquisition |

| Financial & Admin Overheads | Interest on financing, insurance costs, IT, compliance, salaries | Includes inventory financing interest and regulatory compliance investments |

Revenue Streams

New car sales represent the core revenue driver for China Grand Automotive Services. This segment primarily generates income through the direct sale of new passenger vehicles to a diverse customer base, encompassing both individual car buyers and corporate clients. In 2024, the automotive market in China continued its robust performance, with new passenger vehicle sales reaching approximately 26 million units, underscoring the significance of this revenue stream for companies like China Grand Automotive Services.

China Grand Automotive Services generates revenue primarily through the sale of pre-owned vehicles. This includes both direct retail sales to individual consumers and potentially wholesale transactions to other dealerships or businesses. In 2024, the company continued to see strong demand in the used car market, a trend that has been growing steadily.

After-sales services represent a crucial and consistent income source for China Grand Automotive. This includes revenue generated from vehicle maintenance, repair services, and the sale of genuine spare parts. For instance, in 2024, the automotive aftermarket in China was projected to reach over $500 billion, highlighting the significant potential for recurring revenue from these essential customer needs.

Automotive Financing and Leasing

China Grand Automotive Services generates revenue through various automotive financing and leasing avenues. This includes income derived from providing direct financing for vehicle purchases, as well as earning interest from ongoing leasing agreements with customers. Furthermore, the company benefits from commissions earned by selling associated insurance products to clients availing these financing and leasing options.

In 2024, the automotive financing sector in China continued to be a significant revenue driver. For companies like China Grand Automotive Services, this segment often contributes substantially to overall profitability.

- Vehicle Financing: Revenue from interest and fees charged on loans provided to customers for vehicle acquisition.

- Leasing Income: Earnings generated from the residual value and monthly payments of leased vehicles.

- Ancillary Product Sales: Commissions earned from selling insurance, extended warranties, and other value-added services alongside financing and leasing packages.

Other Related Services

Beyond core vehicle sales and maintenance, China Grand Automotive Services diversifies its income through several other related services. These include offering extended warranty packages, which provide customers with ongoing peace of mind and generate recurring revenue. The company also capitalizes on vehicle customization, allowing customers to personalize their vehicles and creating an additional revenue stream through specialized parts and labor.

These supplementary services enhance the customer experience and contribute significantly to the company's overall financial performance. For instance, the automotive aftermarket, which includes services like customization and extended warranties, is a substantial market. In 2024, the global automotive aftermarket was projected to reach over $500 billion, indicating a strong demand for these value-added offerings.

- Extended Warranties: Providing customers with additional coverage beyond the manufacturer's warranty, securing future service revenue.

- Vehicle Customization: Offering personalized modifications and accessories to meet individual customer preferences.

- Value-Added Services: Including offerings like detailing, accessory sales, and potentially even insurance tie-ins.

China Grand Automotive Services leverages its extensive dealership network to generate revenue from new and pre-owned vehicle sales, a cornerstone of its business. The company also profits from a robust after-sales segment, offering maintenance, repairs, and parts. Furthermore, it provides automotive financing, leasing, and insurance products, creating multiple income streams.

| Revenue Stream | Description | 2024 Market Context |

|---|---|---|

| New Car Sales | Direct sales of new passenger vehicles to individuals and corporations. | China's new passenger vehicle sales reached approximately 26 million units in 2024. |

| Pre-Owned Vehicle Sales | Retail and wholesale of used cars. | Continued strong demand in the used car market, showing steady growth. |

| After-Sales Services | Maintenance, repairs, and sale of genuine spare parts. | China's automotive aftermarket projected to exceed $500 billion in 2024. |

| Financing & Leasing | Interest income from vehicle loans and leasing agreements, plus insurance commissions. | Automotive financing remained a significant revenue driver in China in 2024. |

Business Model Canvas Data Sources

The China Grand Automotive Services Business Model Canvas is informed by a blend of industry-specific market research, financial reports from automotive service providers, and internal operational data. These sources provide a comprehensive view of customer needs, competitive landscapes, and cost structures within the Chinese automotive sector.