Chargeurs SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chargeurs Bundle

Chargeurs leverages strong brand recognition and a diversified product portfolio to capitalize on global trends, yet faces potential threats from intense competition and evolving market demands.

Understanding these dynamics is crucial for any investor or strategist looking to navigate the company's landscape. Our full SWOT analysis delves deeper into these factors, providing a comprehensive view.

Discover the complete picture behind Chargeurs’ market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Want the full story behind Chargeurs’ strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Chargeurs boasts a robust portfolio of high-value-added B2B businesses, spanning crucial sectors like temporary protective films through Novacel, technical interlinings for the fashion industry via Chargeurs PCC, and luxury wool transformation under Luxury Fibers. This strategic diversification across specialized industrial and service niches inherently lowers the company's dependence on any single market, fostering greater operational resilience.

The company's strategic shift, marked by its rebranding to Compagnie Chargeurs Invest, underscores its commitment to actively operating and developing global leaders within these valuable business segments. This focus on high-value assets positions Chargeurs for sustained growth and market leadership across its diverse operational areas.

Chargeurs showcased impressive financial strength throughout 2024. The group reported an 11.9% surge in revenue, reaching €729.6 million, with a solid like-for-like growth of 10.7% across all its business segments and global markets.

This robust top-line growth translated into significant profitability improvements. Recurring operating profit saw a remarkable increase of 73.9%, climbing to €39.3 million, highlighting the company's enhanced operational efficiency and pricing power.

Furthermore, Chargeurs demonstrated exceptional cash generation capabilities, with operating cash flow reaching €63.8 million. This strong cash flow indicates effective working capital management and the ability to fund operations and investments internally.

Chargeurs boasts an impressive global reach, operating in close to 100 countries and employing around 2,500 individuals. This extensive network ensures it can effectively serve a diverse international clientele.

Key business segments, such as Chargeurs PCC, hold world-leading positions, particularly in interlining solutions for the luxury and fashion industries. This dominance stems from a combination of innovation and deep market penetration.

The company's established market leadership, evidenced by its global footprint and strong positions in specialized sectors, provides a significant competitive advantage. This allows Chargeurs to leverage its scale and expertise across various markets.

Innovation and Sustainability Focus

Chargeurs distinguishes itself through a robust focus on innovation and sustainability. This commitment is clearly demonstrated by Chargeurs PCC's proactive sales approach, which centers on achieving technological superiority and introducing novel materials, such as H2, designed for advanced technical textiles.

The company's dedication to environmental responsibility is further highlighted by its NATIVATM program, which ensures the traceability of natural fibers. Chargeurs has also made significant strides in reducing its carbon footprint, achieving a 30% decrease in CO2 emissions between 2019 and 2023, and prioritizes eco-friendly products and transparent supply chains.

- Technological Excellence: Chargeurs PCC's offensive sales strategy is built on delivering cutting-edge technology.

- New Material Development: The introduction of materials like H2 for technical textiles showcases their innovative product pipeline.

- Traceable Natural Fibers: The NATIVATM program underscores a commitment to ethical sourcing and transparency.

- CO2 Emission Reduction: A tangible achievement of a 30% CO2 reduction from 2019 to 2023 demonstrates environmental progress.

- Eco-Responsible Focus: Chargeurs actively promotes environmentally sound products and supply chain integrity.

Strategic Acquisitions and Growth Momentum

Chargeurs demonstrates a robust growth strategy through targeted acquisitions. The company recently acquired Cilander's assets, bolstering Chargeurs PCC's capabilities, and secured a majority stake in Grand Palais Immersif, significantly expanding Museum Studio's technological prowess and market presence. These strategic moves are complemented by strong organic expansion within key business units.

The company's development is further highlighted by impressive performance figures. Museum Studio, for instance, reported a substantial growth of 33.3% in 2024, showcasing the success of its immersive exhibition ventures. Similarly, Novacel continues to show strong momentum. This combination of strategic acquisitions and impressive organic growth underscores Chargeurs' effective execution of its expansion plans and its capacity to capture new market opportunities.

- Strategic Acquisitions: Cilander assets for Chargeurs PCC, majority stake in Grand Palais Immersif for Museum Studio.

- Market Expansion: Acquisitions enhance technological expertise and broaden market reach.

- Organic Growth: Museum Studio saw a 33.3% increase in 2024; Novacel also shows strong performance.

- Growth Trajectory: Combined acquisition and organic growth signal a clear and successful development strategy.

Chargeurs possesses leading market positions in its core B2B segments, particularly Chargeurs PCC in interlinings, giving it a significant competitive edge. The company's global presence, operating in nearly 100 countries, allows for broad market access and customer service. Furthermore, Chargeurs demonstrates a strong commitment to innovation and sustainability, developing advanced materials and actively reducing its environmental impact, evidenced by a 30% CO2 reduction between 2019 and 2023.

| Strength | Description | Supporting Data/Facts |

| Market Leadership | Dominant positions in key B2B sectors. | Chargeurs PCC is a world leader in interlinings. |

| Global Reach | Extensive international operations. | Operates in nearly 100 countries with 2,500 employees. |

| Innovation & Sustainability | Focus on advanced materials and environmental responsibility. | Developed H2 material; achieved 30% CO2 reduction (2019-2023); NATIVATM traceability program. |

| Financial Performance | Strong revenue growth and profitability. | 11.9% revenue surge to €729.6M in 2024; 73.9% increase in recurring operating profit to €39.3M. |

What is included in the product

Delivers a strategic overview of Chargeurs’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform its strategic direction.

Helps identify and leverage Chargeurs' strengths to mitigate weaknesses and threats.

Weaknesses

Chargeurs' reliance on certain business segments, such as Luxury Fibers and parts of Chargeurs PCC, makes it vulnerable to economic cycles affecting the luxury goods industry and traditional markets like wool. For example, the Luxury Fibers division saw a like-for-like revenue decrease of 21.5% in the fourth quarter of 2024, directly linked to the unpredictable nature of the wool market. Furthermore, Chargeurs PCC encountered a downturn within the European luxury sector, highlighting the inherent risks of revenue instability and potential profitability impacts in these divisions.

While Chargeurs demonstrates overall profitability, certain business segments are facing challenges. For instance, the Personal Goods sector reported a recurring operating loss of €6.8 million in 2024. This highlights an internal disparity where not every division is a positive contributor to the group's financial health, suggesting potential needs for strategic adjustments or increased capital allocation in these specific areas to improve their performance.

Chargeurs faces a significant weakness with its geographical concentration in Europe. Despite efforts to diversify, the European market represented 39% of the group's revenue in 2024. This heavy reliance makes the company vulnerable to regional economic downturns and sector-specific challenges, such as the slowdown observed in the luxury sector.

The financial performance data for 2024 highlights this concentration issue. While the Americas saw robust like-for-like revenue growth of 26.4%, and Asia, Africa, and the Middle East grew by 10.3%, Europe's growth was considerably slower at just 0.7%. This disparity underscores the risk associated with a substantial portion of revenue being tied to a region exhibiting less dynamic economic momentum.

Integration Risks from Acquisitions

Chargeurs has recently embarked on a growth strategy through acquisitions, notably including Cilander and Grand Palais Immersif. While these moves are intended to expand its market reach and capabilities, the integration process itself presents significant potential weaknesses. Successfully merging diverse operational structures, aligning distinct corporate cultures, and fully realizing the anticipated synergies from these deals are complex undertakings.

A failure to manage these integration risks effectively could result in considerable downsides. These might include unforeseen operational disruptions that impact day-to-day business, escalating integration costs that erode profitability, or a general inability to achieve the strategic advantages these acquisitions were meant to deliver. For instance, if the anticipated €15 million in synergies from a recent acquisition are not realized due to poor integration, it directly impacts the bottom line and strategic objectives.

- Operational Misalignment: Difficulty in harmonizing IT systems, supply chains, and business processes between acquired entities and Chargeurs' existing operations.

- Cultural Clashes: Differences in organizational culture can lead to employee resistance, decreased morale, and reduced productivity, hindering synergy realization.

- Synergy Realization Failure: Overestimation of revenue or cost synergies, or ineffective strategies to capture them, can leave the company with the cost of acquisition without the expected benefits.

- Increased Costs: Unexpected expenses related to integration, such as severance packages, system upgrades, or legal fees, can strain financial resources.

Dependence on B2B Market Dynamics

Chargeurs' heavy reliance on the B2B market means its financial health is directly linked to the economic cycles and investment patterns within the industrial and fashion industries. For instance, a slowdown in global manufacturing or a shift in consumer spending impacting fashion trends can significantly curb demand for Chargeurs' protective films and technical textiles. This concentration makes the company particularly vulnerable to industry-specific downturns.

The company's performance is therefore sensitive to fluctuations in its key client sectors. A report from July 2024 indicated that the global industrial production index experienced a slight contraction, a factor that could directly translate to reduced orders for Chargeurs' specialized solutions. This dependency highlights a key weakness in its business model, as external shocks within these sectors can have a magnified impact on the company's revenue streams and overall profitability.

- Sector Sensitivity: Chargeurs' revenue is directly correlated with the investment and production cycles of its core B2B markets, such as automotive and apparel.

- Economic Vulnerability: Downturns in these specific industries, like the projected slowdown in European automotive production for late 2024, can disproportionately affect Chargeurs' sales volumes.

- Demand Fluctuations: Shifts in consumer preferences or industrial demand can lead to unpredictable swings in the need for Chargeurs' specialized products.

Chargeurs' financial performance is hampered by the underperformance of certain divisions. The Personal Goods sector, for example, reported a recurring operating loss of €6.8 million in 2024. This indicates internal financial disparities, suggesting a need for strategic reassessment or increased investment in underperforming segments to bolster overall group profitability.

The company's significant reliance on Europe, which accounted for 39% of revenue in 2024, exposes it to regional economic volatility. While other regions showed stronger growth, Europe's modest 0.7% expansion in 2024 underscores the risk associated with concentrated revenue streams in a less dynamic market.

Chargeurs' recent acquisitions, such as Cilander and Grand Palais Immersif, present integration challenges. Failure to effectively merge operations, cultures, and realize projected synergies, estimated at €15 million, could lead to operational disruptions, increased costs, and unmet strategic objectives.

The company's B2B focus makes it susceptible to industrial and fashion market cycles. A contraction in global industrial production, as observed in mid-2024, can directly reduce demand for Chargeurs' specialized products, highlighting vulnerability to sector-specific downturns.

What You See Is What You Get

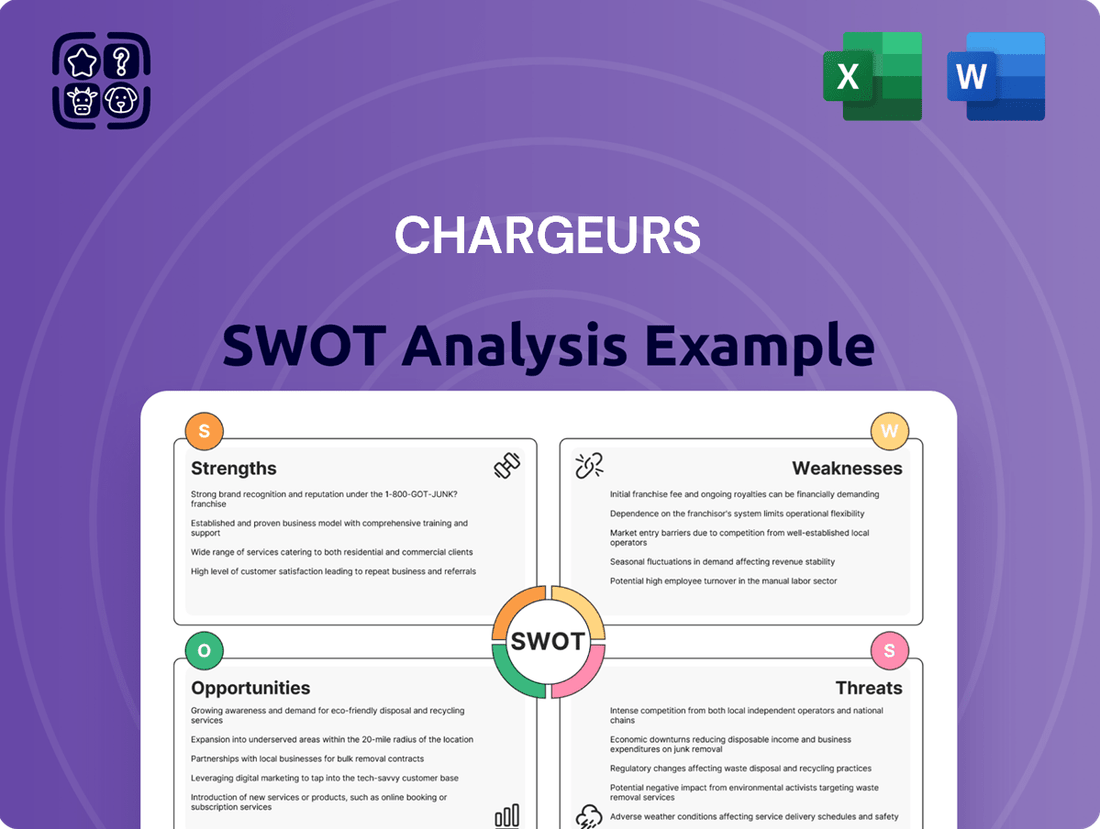

Chargeurs SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of Chargeurs' Strengths, Weaknesses, Opportunities, and Threats, providing a solid foundation for strategic planning. The full, detailed analysis will be available immediately after purchase. This ensures you get exactly what you need to understand Chargeurs' market position and future potential.

Opportunities

Chargeurs is actively capitalizing on high-growth geographical markets, as evidenced by its robust performance in the Americas, which saw a 26.4% like-for-like increase in 2024. The Asian market also contributed significantly, with a 10.3% like-for-like growth in the same year, driven by key segments like Novacel and Chargeurs PCC.

This strong track record highlights the potential for further expansion and market share gains in these dynamic economies. Chargeurs can leverage this momentum to penetrate fast-growing regions such as India and Central Europe, areas poised for substantial economic development and increased demand for the company's offerings.

Strategic investments and tailored market approaches in these emerging economies can unlock significant revenue growth opportunities. By focusing on these vibrant markets, Chargeurs is well-positioned to enhance its global footprint and capitalize on evolving consumer and industrial needs.

The growing worldwide desire for environmentally friendly products and sustainable business operations presents a significant opening for Chargeurs. This aligns perfectly with their existing initiatives, such as the NATIVATM program, which ensures the traceability of natural fibers, and their expanding portfolio of sustainable goods. Chargeurs is well-positioned to capitalize on this trend.

Ongoing advancements in sustainable materials and manufacturing methods are key differentiators. For example, the development of entirely monomaterial interlinings and techniques for reducing water usage in dyeing processes allow Chargeurs to stand out in the market. These innovations are crucial for attracting and retaining customers in increasingly eco-conscious sectors.

In 2023, the global sustainable fashion market was valued at over $7.0 billion and is projected to grow significantly, offering Chargeurs a substantial addressable market. Their commitment to NATIVATM and water-saving technologies directly appeals to brands and consumers prioritizing environmental impact, potentially capturing a larger share of this expanding market in 2024 and beyond.

The Museum Studio segment is experiencing significant tailwinds. In 2024, revenue surged by an impressive 33.3%, and the segment achieved a record order backlog totaling €330.4 million, underscoring robust demand for its offerings.

Strategic acquisitions, such as that of Grand Palais Immersif, are bolstering Museum Studio's capabilities in content creation and the commercialization of cultural assets, positioning it strongly within this niche.

The increasing global appetite for immersive cultural experiences and the ongoing development of museum infrastructure, especially in emerging markets like the Middle East, represent a substantial opportunity for further growth and market penetration.

Strategic Acquisitions and Partnership

Chargeurs' strategic focus as Compagnie Chargeurs Invest, emphasizing active asset management and cultivating global leaders, creates a fertile ground for strategic acquisitions and partnerships. By pinpointing and integrating businesses that complement existing operations or tap into new, lucrative markets, the company can significantly accelerate its growth trajectory and solidify its market dominance.

This approach is particularly relevant given the dynamic nature of the industries Chargeurs operates within. For instance, in 2024, the company continued to explore opportunities that align with its vision of building a diversified portfolio of specialized industrial and technological businesses. The successful integration of past acquisitions, such as those bolstering its advanced materials or technical textiles segments, demonstrates a proven capability in this area.

Potential opportunities include:

- Acquiring innovative technology firms to enhance its product offerings in high-growth sectors.

- Forming strategic alliances with key players in emerging markets to expand its global footprint.

- Partnering with research institutions to foster innovation and develop next-generation materials and solutions.

- Integrating businesses with strong ESG credentials to align with sustainability goals and attract conscious investors.

Chargeurs’ financial flexibility, as evidenced by its consistent performance and strategic capital allocation, supports these expansionary moves. The company’s ability to identify synergies and manage integration effectively will be crucial in unlocking the full potential of these strategic opportunities, further solidifying its position as a global industrial champion.

Technological Advancements and Product Diversification

Chargeurs' commitment to research and development, exemplified by Chargeurs PCC's innovative H2 textile membrane, is a significant opportunity. This technological leap not only enhances existing product capabilities but also paves the way for entirely new product lines and applications, broadening the company's market reach.

The strategic expansion of product portfolios, such as extending the NATIVATM program to include cotton and cashmere, presents another key opportunity. This diversification allows Chargeurs to cater to a wider range of consumer preferences and market demands within existing segments, thereby strengthening its competitive position and potentially increasing market share.

Chargeurs' focus on technological advancements and product diversification is poised to unlock significant growth avenues. For instance, the company's 2024 financial reports indicate a continued uplift in revenue from specialized technical textiles, a segment directly benefiting from these R&D efforts.

- H2 Textile Membrane: Opens new markets for advanced material applications.

- NATIVATM Expansion: Broadens appeal in the luxury and sustainable textile sectors.

- R&D Investment: Fuels innovation for future product development, supporting revenue growth in specialized segments.

- Market Penetration: Diversified offerings enhance competitiveness and tap into unmet consumer needs.

Chargeurs' strategic focus on high-growth geographical markets, particularly the Americas with a 26.4% like-for-like increase in 2024 and Asia's 10.3% growth, presents a significant opportunity for further expansion. The company can leverage this momentum to penetrate emerging economies like India and Central Europe, capitalizing on their substantial economic development and increasing demand for Chargeurs' diverse product portfolio. These dynamic regions offer a fertile ground for increasing market share and revenue.

The increasing global demand for sustainable products and practices aligns perfectly with Chargeurs' existing initiatives, such as the NATIVATM program and its growing range of eco-friendly goods. With the global sustainable fashion market valued at over $7.0 billion in 2023 and projected for strong growth, Chargeurs is well-positioned to capture a larger share by appealing to environmentally conscious brands and consumers. Innovations like monomaterial interlinings and water-saving dyeing techniques further enhance its competitive edge in this expanding market.

The Museum Studio segment is experiencing exceptional growth, with 2024 revenues up 33.3% and a record order backlog of €330.4 million, indicating strong demand for immersive cultural experiences. Strategic acquisitions like Grand Palais Immersif are enhancing its capabilities, positioning it to capitalize on the global appetite for cultural tourism and museum infrastructure development, especially in regions like the Middle East.

Chargeurs' commitment to R&D, including the H2 textile membrane and the expansion of NATIVATM to include cotton and cashmere, opens new market avenues and diversifies its product offerings. This focus on technological advancement supports revenue growth in specialized segments and strengthens its competitive position by meeting evolving consumer needs.

Threats

The specter of global economic downturns, amplified by rising interest rates, presents a significant threat to Chargeurs. These headwinds can directly dampen consumer spending, especially within its luxury goods segments, and also stall critical industrial investments, impacting demand for its textile and technical materials. For instance, a significant slowdown in major economies could translate to a noticeable drop in orders for high-end apparel linings or industrial fabrics.

Geopolitical instability further exacerbates these economic vulnerabilities. Tensions and conflicts can trigger supply chain disruptions, making it harder and more expensive for Chargeurs to source raw materials or deliver finished products. This unpredictability can lead to increased operational costs and a reduction in overall group revenue, directly affecting profitability across its varied business units.

Chargeurs' operations are significantly exposed to the fluctuating costs of essential raw materials. For instance, the Luxury Fibers division depends heavily on wool, a commodity known for its price swings influenced by factors like weather patterns affecting sheep farming and global demand. Similarly, the Novacel segment utilizes polyethylene, a petrochemical derivative whose pricing is tied to crude oil markets. These volatilities can directly inflate production expenses.

When raw material prices surge, Chargeurs faces the challenge of absorbing these higher costs. If the company cannot effectively pass these increases onto its customers through price adjustments, its profit margins are likely to be squeezed. For example, a 10% increase in wool prices could substantially impact the profitability of high-end textile products, especially if market conditions limit pricing power.

Chargeurs navigates intensely competitive B2B landscapes. In protective films, rivals like tesa, Henkel, and Sika are significant players. The fashion interlinings and luxury fibers sectors also host numerous established competitors.

The risk of market saturation in some of Chargeurs' more mature business segments is a genuine concern. This saturation, coupled with the potential arrival of disruptive technologies, could directly impact the company's pricing power and its established market share.

For instance, the global protective films market, valued at an estimated $15.5 billion in 2023, is projected to grow at a CAGR of 4.2% through 2030, indicating continued but potentially slowing expansion in key areas. This growth rate highlights both opportunity and the persistent challenge of established competition.

Regulatory Changes and Environmental Compliance Costs

Increasingly strict environmental rules pose a significant threat. For instance, the Corporate Sustainability Reporting Directive (CSRD) in Europe demands substantial investment in compliance and sustainable operations. While Chargeurs is already focused on sustainability, these evolving regulations could increase operational expenses, requiring adjustments to manufacturing and product innovation.

These regulatory shifts could lead to unexpected cost increases. For example, new emissions standards might necessitate upgrades to existing equipment or the adoption of entirely new production technologies. Chargeurs' commitment to sustainability is a strength, but the pace and nature of regulatory change remain a key concern for managing costs and maintaining competitiveness.

- Increased Compliance Costs: New environmental regulations, like the CSRD, could add significant operational expenses for reporting and sustainable practices.

- Process Modification Needs: Evolving standards may require costly changes to manufacturing processes or product design.

- Potential for Fines: Non-compliance with new environmental mandates could result in substantial penalties.

- Competitive Disadvantage: If competitors adapt more quickly or face less stringent regulations, it could impact Chargeurs' market position.

Supply Chain Disruptions and Logistics Challenges

Chargeurs, as a global player, faces significant threats from supply chain disruptions. These can manifest as logistical hurdles, trade policy shifts, or unexpected events like the continued impact of geopolitical tensions on shipping routes. For instance, the Red Sea shipping crisis in early 2024 led to rerouting of vessels, causing delays and boosting freight costs by as much as 150% on some key trade lanes, directly impacting companies like Chargeurs that rely on efficient global transport.

These disruptions can directly hinder Chargeurs' ability to meet customer demand promptly, potentially leading to lost sales and damaged client relationships. Increased transportation expenses, driven by factors such as fuel price volatility and the need for alternative, more expensive shipping methods, can also significantly erode profit margins. Chargeurs' operational efficiency is intrinsically linked to the smooth functioning of its global logistics network, making it vulnerable to these external shocks.

- Supply Chain Vulnerability: Global operations expose Chargeurs to risks from geopolitical events, trade disputes, and natural disasters affecting raw material sourcing and finished goods delivery.

- Logistical Cost Increases: Disruptions in shipping and air freight, as seen with the Red Sea crisis in 2024, can inflate transportation costs, impacting profitability.

- Production Delays: Inability to secure components or transport finished products on time can lead to production stoppages and missed delivery windows.

- Market Responsiveness: Challenges in logistics can slow down Chargeurs' ability to respond to rapidly changing market demands and customer orders.

Chargeurs faces the threat of intense competition across its diverse business segments. In protective films, major players like tesa and Henkel offer significant challenges, while the fashion interlinings and luxury fibers markets are populated by numerous established competitors. This competitive pressure can limit pricing power and market share growth.

The risk of market saturation in some of Chargeurs' more mature business areas is a genuine concern. This saturation, coupled with the potential emergence of disruptive technologies, could erode the company's pricing power and established market positions. For example, the global protective films market, valued at approximately $15.5 billion in 2023, is projected to grow at a CAGR of 4.2% through 2030, indicating continued but potentially slowing expansion in key areas.

| Segment | Key Competitors | Market Dynamics |

|---|---|---|

| Protective Films | tesa, Henkel, Sika | High competition, moderate growth (4.2% CAGR projected for 2023-2030) |

| Fashion Interlinings | Numerous established players | Mature market, potential for saturation |

| Luxury Fibers | Specialized suppliers | Sensitive to fashion trends and raw material costs |

SWOT Analysis Data Sources

This Chargeurs SWOT analysis is built upon a robust foundation of verified financial statements, current market research, and expert industry commentary to provide accurate and actionable strategic insights.