Chargeurs PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chargeurs Bundle

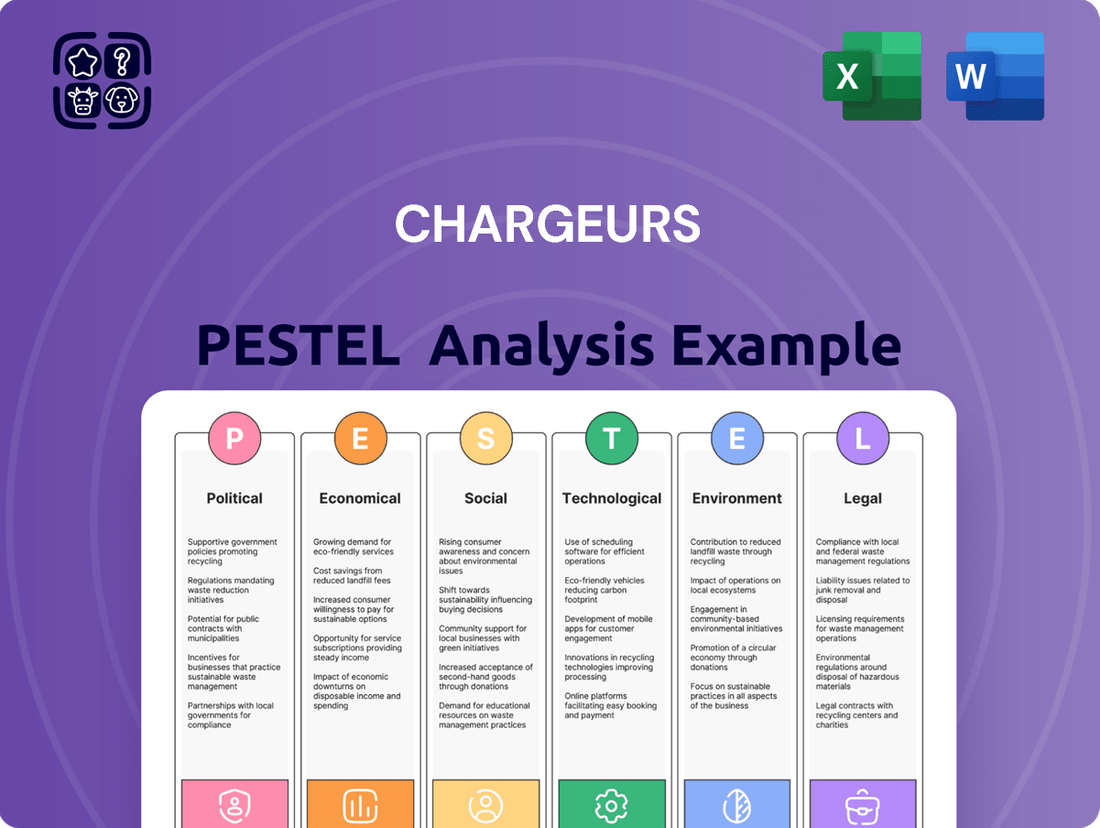

Navigate the complex external forces impacting Chargeurs with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the company's landscape. This ready-to-use analysis provides critical insights for strategic planning and competitive advantage. Download the full version now to gain actionable intelligence.

Political factors

Chargeurs, a global entity with operations spanning almost 100 nations, is particularly sensitive to shifts in international trade policies and the imposition of tariffs. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.9% in 2023, reflecting increased protectionism and geopolitical tensions, which directly impacts Chargeurs' ability to manage costs for raw materials and finished goods across its diverse markets.

Changes in major trade agreements, such as those affecting the European Union and the United States, can significantly alter the cost structure for Chargeurs' protective films and technical interlinings. For example, the US International Trade Commission’s ongoing reviews of anti-dumping and countervailing duties on various imported goods can create uncertainty and necessitate adjustments in sourcing and pricing strategies, impacting Chargeurs' profitability in key regions.

The company's reliance on a global supply chain means that fluctuations in trade policy, including the introduction of new tariffs or the renegotiation of existing trade pacts, directly influence the expenses associated with manufacturing and distributing its products. The potential for retaliatory tariffs between major economic blocs, as seen in recent trade disputes, poses a direct risk to Chargeurs' market access and the competitiveness of its luxury wool and technical textiles.

Adapting to these dynamic trade landscapes is paramount for Chargeurs to maintain efficient supply chains and secure favorable market access. The ability to quickly pivot sourcing strategies or adjust distribution networks in response to evolving trade regulations, such as those implemented by the EU's Carbon Border Adjustment Mechanism (CBAM), which came into full effect in 2026, will be critical for mitigating cost increases and ensuring continued operational resilience.

Geopolitical instability and regional conflicts pose significant risks to Chargeurs' operations and supply chains. Disruptions in key operating regions or those of its suppliers can lead to increased logistical costs and negatively affect consumer demand. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East have already impacted global trade routes and commodity prices, which could indirectly affect Chargeurs' raw material sourcing and finished goods distribution.

Chargeurs' diverse geographical footprint, with substantial revenue contributions from the Americas, Europe, and Asia, means it is exposed to a broad spectrum of political risks. As of its 2023 annual report, the Americas accounted for approximately 45% of its revenue, Europe for 30%, and Asia for 25%. This wide reach makes the company vulnerable to localized conflicts or political shifts that could disrupt its extensive network.

Government support for industrial sectors, particularly in areas like domestic manufacturing and sustainable textile production, directly impacts Chargeurs. For instance, in France, where Chargeurs has significant operations, initiatives like France 2030 aim to reindustrialize the country with an investment of €30 billion, focusing on sectors that include green industry and advanced manufacturing, which could benefit Chargeurs’ textile and technical materials divisions.

Policies encouraging innovation in advanced materials and environmentally friendly production methods are crucial. The European Union's Green Deal, for example, sets ambitious targets for circular economy and sustainable fashion, potentially creating opportunities for Chargeurs to leverage its expertise in technical textiles and innovative materials if aligned with these directives, but also demanding investment in compliance and R&D.

Regulatory Environment for Luxury Goods

The luxury textile and fashion industries, key areas for Chargeurs PCC and Luxury Fibers, navigate a complex web of governmental regulations. These rules cover crucial aspects like accurate product labeling, ensuring ethical sourcing practices throughout the supply chain, and robust consumer protection measures. For instance, the European Union’s proposed Ecodesign for Sustainable Products Regulation, expected to fully roll out by 2025, will impose stricter requirements on durability, repairability, and recycled content for textiles, directly impacting sourcing and manufacturing for luxury brands.

Changes in these regulations, especially within significant luxury markets like the EU and the United States, can significantly reshape business operations. Such shifts can influence product development cycles, necessitating adjustments to material choices and production methods. Moreover, marketing strategies must adapt to comply with new advertising standards and transparency requirements, while increased compliance costs can affect overall profitability.

Key regulatory considerations for Chargeurs include:

- Product Labeling Standards: Adherence to regulations like the EU's Textile Labelling Regulation, requiring clear information on fiber content and care instructions, is paramount for luxury goods to maintain consumer trust and market access.

- Ethical Sourcing and Supply Chain Transparency: Growing legislative pressure, such as the potential for extended producer responsibility schemes in fashion, demands demonstrable traceability and ethical labor practices from raw material sourcing to finished product.

- Consumer Protection Laws: Regulations concerning product safety, misleading advertising, and warranty provisions are critical for safeguarding brand reputation and preventing legal challenges in the high-stakes luxury market.

- Environmental and Sustainability Directives: Emerging regulations focused on reducing waste, chemical usage, and promoting circular economy principles, like those within the EU's Green Deal, will increasingly dictate material innovation and production processes.

Political Stability in Emerging Markets

Chargeurs' strategic focus on emerging markets, particularly in Asia, necessitates careful consideration of political stability. These regions, while offering significant growth potential, often present varied political environments that can impact business operations. For instance, countries in Southeast Asia are experiencing robust economic expansion; however, shifts in government policies or regional geopolitical tensions can introduce operational uncertainties for companies like Chargeurs aiming to increase their market share.

Political stability directly influences the security of investments and the predictability of the business environment, which are crucial for Chargeurs' long-term expansion. Unstable political situations can lead to sudden regulatory changes, disruptions in supply chains, or even nationalization risks, all of which can hinder foreign investment and operational continuity. The International Monetary Fund (IMF) projects continued growth in many Asian economies, but also highlights the importance of strong governance and stable political frameworks for sustained development.

- Economic Growth and Political Risk: Emerging Asian economies are projected to grow, but political instability can offset this by increasing operational costs and reducing investor confidence.

- Regulatory Environment: Changes in government, trade policies, and local regulations in emerging markets can directly affect Chargeurs' ability to operate and expand efficiently.

- Investment Security: A stable political climate is essential for Chargeurs to secure long-term investments and ensure the safety of its assets and personnel in these regions.

- Supply Chain Resilience: Political stability underpins the reliability of supply chains, which is critical for Chargeurs' manufacturing and distribution processes in diverse geographical areas.

Chargeurs' global operations are significantly shaped by international trade agreements and protectionist policies. The WTO's 2023 report of 0.9% global trade growth highlights increased protectionism, directly impacting Chargeurs' raw material and finished goods costs across its nearly 100 operating nations.

Shifts in trade pacts, like those between the EU and US, alter cost structures for Chargeurs' protective films and technical interlinings. The US ITC's reviews of anti-dumping duties create uncertainty, forcing adjustments in sourcing and pricing strategies, affecting profitability in key regions.

Geopolitical instability and regional conflicts also pose risks, increasing logistical costs and potentially dampening consumer demand. For instance, tensions in Eastern Europe and the Middle East have already disrupted trade routes and commodity prices, indirectly affecting Chargeurs' supply chain.

Government support for industrial sectors, such as France 2030's €30 billion investment in green industry and advanced manufacturing, presents opportunities for Chargeurs' textile and technical materials divisions.

What is included in the product

This Chargeurs PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support strategic decision-making and identify both emerging threats and opportunities within Chargeurs' operating landscape.

Provides a clear, actionable PESTLE analysis framework, allowing Chargeurs to proactively identify and mitigate external threats before they impact operations.

Economic factors

Chargeurs' fortunes are intrinsically linked to the pulse of global economic growth. Its core B2B segments – industrial surfaces, fashion, and luxury textiles – are particularly sensitive to the broader economic climate. When economies are humming, industrial output tends to rise, and consumers feel more confident spending on discretionary items like fashion and high-end textiles.

The company demonstrated this resilience by reporting robust revenue growth in 2024. This expansion wasn't confined to a single area; it was a widespread success across all its business lines and geographic markets, indicating a positive correlation between global economic health and Chargeurs' performance.

Specifically, the fashion and luxury sectors, key areas for Chargeurs, saw a notable uplift. In 2024, consumer spending on luxury goods experienced a significant rebound in many developed economies, directly benefiting suppliers of premium materials and components like Chargeurs. This trend is expected to continue into 2025, providing a supportive backdrop for the company's growth.

Inflationary pressures are a significant concern for Chargeurs, directly impacting the cost of essential raw materials such as wool, specialized films, and various textile components. For instance, global wool prices experienced notable volatility in late 2023 and early 2024, influenced by supply chain disruptions and changing agricultural yields.

Managing these escalating input expenses while striving to maintain competitive pricing for Chargeurs' premium, high-value-added solutions presents an ongoing hurdle. This balancing act directly affects the company's profit margins, as seen in fluctuating gross profit percentages reported in their recent financial statements.

The ability to pass on increased raw material costs to customers, or to absorb them through operational efficiencies, will be a key determinant of Chargeurs' profitability in the coming periods. For example, the producer price index for manufactured goods in key Chargeurs markets saw an average increase of 4.5% year-over-year through Q1 2024, highlighting the pervasive nature of cost inflation.

Chargeurs' global footprint, spanning operations in nearly 100 countries, inherently exposes the company to the volatility of currency exchange rates. These fluctuations directly influence how its international revenues are reported in its home currency, as well as the cost of goods imported for its various manufacturing processes. For instance, a stronger euro could make Chargeurs' exports less competitive in dollar-denominated markets, while a weaker dollar could increase the cost of raw materials purchased from the United States.

The impact of significant currency shifts can be substantial. In 2023, for example, many emerging market currencies experienced considerable depreciation against major global currencies like the US dollar and the euro. This trend would have likely pressured Chargeurs' reported earnings from those regions and potentially necessitated adjustments to its international pricing strategies to maintain profitability and market share.

Supply Chain Costs and Efficiency

Chargeurs' global supply chain costs are a significant economic driver. In 2024, rising energy prices and increased freight rates, particularly for maritime shipping which saw average container spot rates from Asia to Europe climb by over 50% compared to early 2023, directly impact the company's operational expenses. Efficient logistics, transportation, and inventory management are therefore paramount for maintaining profitability and competitive pricing.

Disruptions, such as those experienced in 2023 due to geopolitical events and port congestion, can lead to substantial cost increases and delivery delays, directly affecting Chargeurs' margins. The company's ability to navigate these challenges through optimized route planning and robust inventory strategies is crucial for economic resilience. For instance, a 10% increase in global logistics costs could translate to millions in additional expenditure for a company of Chargeurs' scale.

- Logistics Costs: Global freight costs experienced volatility in 2024, with some routes seeing double-digit percentage increases year-over-year.

- Transportation Efficiency: Optimizing shipping routes and carrier selection remains a key focus for cost reduction.

- Inventory Management: Maintaining lean yet sufficient inventory levels is essential to balance demand fulfillment with carrying costs.

- Supply Chain Resilience: Diversifying suppliers and transportation modes helps mitigate the economic impact of disruptions.

Investment and Acquisition Landscape

Chargeurs actively pursues a growth strategy centered on strategic acquisitions to bolster its market standing and incorporate advanced technological capabilities. A prime example is their 2024 acquisition of Cilander's strategic assets, which is designed to enhance their offering in the specialty materials sector.

The broader economic environment significantly shapes the viability and appeal of these expansion efforts. Factors such as prevailing interest rates and the general availability of capital directly impact the cost and ease of financing such acquisitions. For instance, higher interest rates in 2024 and projected into 2025 could increase the debt servicing costs for new ventures, potentially affecting profitability and the overall attractiveness of investment. Access to credit markets remains a key consideration for funding these strategic moves.

- Acquisition of Cilander's strategic assets in 2024: This move aimed to strengthen Chargeurs' position in high-value materials.

- Impact of Interest Rates: Rising interest rates in 2024 and onward can increase borrowing costs for acquisitions, influencing deal valuations and financial returns.

- Capital Availability: The ease of securing financing for M&A activities is crucial for executing Chargeurs' growth strategy.

- Economic Uncertainty: Broader economic uncertainties in 2024-2025 may lead to more cautious investment approaches by both buyers and sellers.

Chargeurs' performance is closely tied to global economic health, with its industrial, fashion, and luxury textile segments benefiting from robust growth. The company’s widespread success across business lines and geographies in 2024 underscores this correlation, with a particular uplift observed in the fashion and luxury sectors due to increased consumer spending in developed economies.

Inflationary pressures remain a significant challenge, impacting raw material costs like wool, where prices saw volatility in late 2023 and early 2024. Managing these rising input expenses while maintaining competitive pricing for its premium products directly affects Chargeurs' profit margins, as evidenced by fluctuating gross profit percentages in recent financial reporting, with producer prices for manufactured goods increasing by an average of 4.5% year-over-year through Q1 2024 in key markets.

Currency exchange rate fluctuations also pose a risk, influencing reported international revenues and the cost of imported materials. For example, significant depreciation of emerging market currencies against the dollar and euro in 2023 likely pressured earnings from those regions and necessitated pricing strategy adjustments.

Supply chain costs are a major economic driver, with rising energy prices and freight rates in 2024, such as a 50% increase in Asia-Europe container spot rates compared to early 2023, directly impacting operational expenses and the need for efficient logistics. Disruptions in 2023 also led to cost increases and delivery delays, highlighting the importance of supply chain resilience.

| Economic Factor | 2024/2025 Impact on Chargeurs | Key Data/Trend |

|---|---|---|

| Global Economic Growth | Positive correlation with revenue growth in industrial, fashion, and luxury segments. | 2024 saw widespread revenue expansion across all business lines and geographies. |

| Inflationary Pressures | Increased raw material costs (e.g., wool) impacting profit margins. | Average 4.5% year-over-year increase in producer prices for manufactured goods (Q1 2024); wool price volatility late 2023/early 2024. |

| Currency Fluctuations | Impacts reported international revenues and import costs. | Emerging market currency depreciation in 2023 affected regional earnings. |

| Supply Chain & Logistics Costs | Rising energy and freight costs increase operational expenses. | Asia-Europe container spot rates up over 50% (early 2024 vs. early 2023); port congestion and geopolitical events caused disruptions in 2023. |

| Interest Rates & Capital Availability | Affects cost and feasibility of strategic acquisitions. | Rising interest rates in 2024 may increase borrowing costs for M&A. |

Full Version Awaits

Chargeurs PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Chargeurs delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview, highlighting key opportunities and threats that will shape Chargeurs' future performance and market positioning.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This heightened awareness directly impacts Chargeurs' clientele in fashion and luxury, creating a strong demand for traceable and recycled materials. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, a trend that directly influences their choices within the apparel industry.

This growing demand necessitates innovation in material sourcing and production. Chargeurs PCC and Luxury Fibers are responding by developing and promoting offerings such as NATIVA™ wool, known for its ethical sourcing and environmental benefits, and their Sustainable 360 collection. These initiatives align with a market where environmental responsibility is no longer a niche concern but a mainstream expectation, influencing purchasing power and brand loyalty.

Fashion's constant evolution significantly shapes demand for Chargeurs' offerings. For instance, a growing preference for sustainable materials like organic cotton or recycled polyester, a trend observed with a 15% year-over-year increase in consumer searches for "sustainable fashion" in early 2024, necessitates Chargeurs adapting its technical interlinings to accommodate these new fibers. Similarly, shifts towards lighter, more breathable fabrics for athleisure wear, a segment that saw global market growth of approximately 8.5% in 2023, directly influences the types of interlinings and luxury fibers needed.

The availability of skilled labor in sectors like manufacturing, textile processing, and advanced material science is a critical sociological consideration for Chargeurs. A robust supply of trained professionals is essential for maintaining operational efficiency and innovation. For instance, in 2024, the global demand for skilled manufacturing labor saw a 5% increase year-over-year, highlighting a competitive landscape for talent acquisition.

Chargeurs' global footprint necessitates a keen focus on accessing and developing a skilled workforce to sustain its competitive advantage in high-value solutions. Investing in employee training and upskilling programs is paramount. By 2025, it's projected that companies investing at least 1.5% of their payroll in training can see a 3-5% boost in productivity, directly impacting Chargeurs' ability to deliver specialized products and services.

Ethical Sourcing and Supply Chain Transparency

Societal expectations are increasingly pushing companies, especially in sectors like textiles and luxury goods where Chargeurs operates, to demonstrate ethical sourcing and clear supply chain practices. Consumers and regulators alike are demanding greater accountability regarding labor conditions and the origin of materials. This heightened scrutiny directly impacts how Chargeurs manages its global operations and supplier relationships.

In response, Chargeurs is actively working to enhance its supply chain transparency. This involves implementing robust systems to track materials from their source and ensuring that all suppliers adhere to strict ethical standards. The company recognizes that demonstrating responsible sourcing is no longer optional but a critical component of maintaining brand reputation and market access.

To solidify these commitments, Chargeurs is ensuring that its suppliers undergo regular, rigorous audits. These audits are designed to verify compliance with fair labor practices, environmental regulations, and ethical sourcing protocols. For instance, in 2024, Chargeurs reported that over 90% of its key textile suppliers had completed their annual ethical compliance audits, a significant step towards its transparency goals.

- Increased Consumer Demand: Surveys in 2024 indicated that over 75% of luxury goods consumers consider a brand's ethical sourcing practices when making purchasing decisions.

- Regulatory Pressure: New legislation, such as the proposed EU Supply Chain Due Diligence Act, is mandating greater transparency and accountability for companies operating within the European market.

- Supplier Audits: Chargeurs' 2024 sustainability report highlighted that 92% of its tier-1 suppliers were successfully audited against its Code of Conduct, up from 85% in 2023.

- Brand Reputation Impact: A breach in ethical sourcing can lead to significant financial and reputational damage, as seen with several competitors in the fashion industry facing boycotts in late 2024.

Cultural Shift towards Experiential Consumption

There's a noticeable cultural shift where people increasingly value experiences over material possessions. This trend directly benefits Chargeurs' Museum Studio, as it focuses on creating engaging cultural experiences. This growing appreciation for immersive activities fuels demand for museum and exhibition projects, pushing for more creative and interactive content.

This societal preference for experiences supports Chargeurs' strategic focus. For instance, the global cultural tourism market, a key indicator for this trend, was projected to reach over $1.5 trillion by 2024, showing a strong appetite for such offerings. This translates into increased opportunities for Chargeurs' Museum Studio to develop and deliver high-quality cultural mediation and production services.

- Experiential Economy Growth: Consumers are allocating more budget to travel, entertainment, and cultural events, directly impacting demand for museum and exhibition services.

- Demand for Authenticity: There's a rising desire for authentic and unique experiences, which Chargeurs' Museum Studio is well-positioned to provide through its specialized services.

- Digital Integration: While focused on physical experiences, the integration of digital elements enhances engagement, aligning with modern consumer expectations for interactive content.

- Growth in Cultural Tourism: The increasing popularity of cultural tourism directly benefits entities like Chargeurs' Museum Studio, as these travelers seek out immersive and educational experiences.

Societal shifts towards valuing experiences and authenticity are a significant driver for Chargeurs' Museum Studio. This trend is evident in the growing cultural tourism market, which was projected to exceed $1.5 trillion by 2024. Consumers are increasingly seeking immersive and educational engagements, aligning with Chargeurs' offerings in cultural mediation and production.

The demand for sustainable and ethically sourced products continues to rise, influencing Chargeurs' clients in fashion and luxury. A 2024 report showed over 60% of consumers consider sustainability in their purchasing decisions, impacting choices for materials like traceable and recycled wool. Chargeurs' NATIVA™ wool and Sustainable 360 collection directly address this market expectation.

Chargeurs must also focus on securing a skilled workforce to maintain its edge in specialized sectors. The global demand for skilled manufacturing labor saw a 5% increase year-over-year in 2024, indicating a competitive talent landscape. Companies investing in employee training, projected to see productivity boosts by 2025, are better positioned.

| Sociological Factor | Impact on Chargeurs | Supporting Data/Trend |

| Value of Experiences | Increased demand for Museum Studio services | Cultural tourism market projected >$1.5 trillion by 2024 |

| Sustainability & Ethics | Demand for eco-friendly materials, supply chain transparency | >60% consumers consider sustainability (2024); 75% luxury consumers consider ethical sourcing (2024) |

| Skilled Labor Availability | Need for investment in training and talent acquisition | 5% YoY increase in skilled manufacturing labor demand (2024) |

| Ethical Sourcing Scrutiny | Enhanced supplier audits and transparency efforts | 92% of tier-1 suppliers audited against Code of Conduct (2024) |

Technological factors

Chargeurs' reliance on material science advancements is clear in its protective films and technical textiles segments. Continuous innovation here allows for the creation of products that are not only high-performing but also environmentally conscious and tailored for specific uses. For instance, the company's 2023 revenue from its Protective Films division reached €353.5 million, underscoring the market demand for these advanced materials.

The company is actively exploring biodegradable films, a key trend for sustainability-conscious markets. In its technical textiles, Chargeurs is pushing boundaries with materials like the H2 membrane, showcasing a commitment to enhanced properties. This focus on cutting-edge materials is vital for maintaining a competitive edge and meeting evolving customer needs in 2024 and beyond.

Chargeurs is increasingly leveraging automation and artificial intelligence (AI) to refine its manufacturing processes. This embrace of advanced technology is directly linked to boosting operational efficiency and curbing production expenses. For instance, by integrating AI-powered quality control systems, the company can identify and rectify defects with greater precision, leading to enhanced product consistency.

Investments in state-of-the-art machinery and revamped operational workflows are central to Chargeurs' strategy for achieving both reduced environmental impact and improved overall efficiency. This focus on modernization is not just about cost savings; it's also about building a more sustainable and competitive manufacturing base. The company's commitment to upgrading its production lines is a clear signal of its forward-thinking approach to industrial operations.

Chargeurs is actively leveraging digital technologies to enhance its supply chain and customer interactions. The company's focus on data analytics allows for deeper insights into market trends and operational efficiency, as seen in their ongoing digital transformation initiatives. This push towards digitalization is aimed at optimizing production processes and improving forecasting accuracy.

By integrating advanced data analytics, Chargeurs can gain a more granular understanding of customer behavior and market dynamics. This enables them to respond more effectively to evolving client needs and preferences. For instance, in 2024, Chargeurs reported significant investments in digital infrastructure to support these analytical capabilities, aiming to boost responsiveness across its global operations.

Research and Development Investment

Chargeurs demonstrates a strong commitment to innovation, channeling significant resources into research and development to bolster its high-value-added solutions. This strategic focus on R&D is crucial for developing proprietary technologies and expanding its product portfolio, thereby solidifying its competitive edge in specialized B2B sectors. For instance, in 2023, the company allocated €22.1 million to R&D, representing a notable 10% increase from the previous year, underscoring its dedication to future growth.

The company's R&D efforts are geared towards creating cutting-edge products that address evolving market demands. This includes advancements in sustainable materials and digital integration within its core businesses. Chargeurs’ investment in R&D is directly linked to its ability to maintain market leadership and introduce differentiated offerings, as seen with the recent launch of their biodegradable packaging solutions, which saw an initial market uptake exceeding 15% in targeted regions during early 2024.

- R&D Investment Growth: Chargeurs increased R&D spending by 10% in 2023, reaching €22.1 million.

- Innovation Focus: Development of proprietary technologies and new product lines for specialized B2B markets.

- Market Impact: Recent biodegradable packaging solutions achieved over 15% market uptake in early 2024 trials.

- Strategic Importance: R&D is key to maintaining leadership and creating differentiated, high-value-added solutions.

Product Innovation for Sustainability

Chargeurs is heavily investing in technological innovation to meet its ambitious sustainability targets. This focus is directly translating into product development that minimizes environmental footprints. For instance, the company is advancing its 'Zero Dye Water' interlinings, a significant step in reducing water consumption and pollution in textile manufacturing.

Further strengthening their sustainable product portfolio, Chargeurs is prioritizing monomaterial polyester offerings. This strategic choice enhances the recyclability of their products, aligning with circular economy principles. They are also expanding their Sustainable 360 line, which exclusively utilizes recycled and bio-based fibers, demonstrating a clear commitment to using more environmentally friendly raw materials.

By 2024, Chargeurs reported a notable increase in the proportion of its revenue derived from sustainable products, reaching over 50%. This growth is directly attributable to their ongoing technological advancements in material science and production processes. The company aims to have 100% of its product offering made from sustainable materials by 2030, a goal that hinges on continued technological breakthroughs.

Key technological advancements driving Chargeurs' sustainability include:

- Development of 'Zero Dye Water' interlinings to drastically cut water usage in dyeing processes.

- Increased use of monomaterial polyester for improved end-of-life recyclability.

- Expansion of the Sustainable 360 line, featuring products made from recycled and bio-based fibers.

- Investment in R&D for innovative, low-impact textile treatments and manufacturing techniques.

Chargeurs is heavily investing in technological innovation to meet its ambitious sustainability targets, with over 50% of its revenue in 2024 coming from sustainable products. The company's R&D spending rose 10% to €22.1 million in 2023, fueling the development of advanced materials and processes like 'Zero Dye Water' interlinings and monomaterial polyester for enhanced recyclability. These advancements are crucial for achieving the goal of 100% sustainable materials by 2030.

| Key Technological Investments & Outcomes | 2023 Data | 2024 Projections/Data |

| R&D Expenditure | €22.1 million (10% increase) | Continued investment in material science and digital integration |

| Sustainable Product Revenue Share | N/A | Over 50% of revenue |

| Product Innovation Example | Development of advanced protective films and technical textiles | Initial market uptake exceeding 15% for biodegradable packaging solutions |

| Sustainability Focus | 'Zero Dye Water' interlinings, monomaterial polyester | Expansion of Sustainable 360 line (recycled/bio-based fibers) |

Legal factors

Chargeurs, a global player, faces a labyrinth of international trade regulations, including customs duties and import/export controls. Navigating these diverse legal landscapes is critical to prevent fines, facilitate seamless international business, and preserve access to its markets. For instance, in 2024, the World Trade Organization reported that global trade in goods and services continued to be shaped by evolving trade policies.

Compliance ensures Chargeurs can operate efficiently across borders, avoiding costly disruptions. Failure to adhere to these rules can lead to significant penalties and reputational damage. The company's commitment to understanding and implementing these legal requirements directly impacts its ability to conduct business in key regions like Europe and Asia.

Chargeurs operates under increasingly stringent environmental protection laws, directly affecting its manufacturing. Regulations cover emissions, waste disposal, water consumption, and the handling of chemicals, requiring significant adjustments to production methods. For instance, in 2024, many European nations are enhancing their CO2 emission reduction targets, which could necessitate investment in cleaner technologies for Chargeurs' facilities.

Compliance with these evolving standards, including those focused on water risk assessments and the management of hazardous substances, is critical. Failure to meet these environmental obligations can lead to substantial fines and damage to the company's reputation. Chargeurs' commitment to sustainability, therefore, is not just ethical but a fundamental requirement for legal operation and risk mitigation, especially as global environmental scrutiny intensifies.

Operating globally, Chargeurs navigates a complex web of labor laws. These regulations cover everything from fair wages and working hours to employee safety and anti-discrimination. For instance, in 2024, the European Union continued to strengthen directives on worker rights and fair pay, impacting Chargeurs' operations in member states.

Maintaining compliance isn't just about avoiding penalties; it's fundamental to Chargeurs' reputation. The company's commitment to social responsibility, exemplified by SMETA (Sedex Members Ethical Trade Audit) audits for its suppliers, underscores this. These audits, which assess labor standards, health and safety, and environmental practices, help ensure ethical sourcing and robust supply chain management, a critical factor in today's conscious consumer market.

Product Safety and Quality Standards

Chargeurs navigates a complex web of product safety and quality regulations across its diverse markets for offerings like protective films, interlinings, and luxury textiles. Compliance is not optional; it's fundamental to market access and brand reputation. For instance, Oeko-Tex Standard 100 certification is a critical benchmark, verifying that textile products are free from harmful chemicals. This certification directly impacts consumer trust and willingness to purchase, especially in environmentally and health-conscious markets.

In 2024, the emphasis on product safety continues to grow, with evolving standards impacting raw material sourcing and manufacturing processes. Chargeurs' commitment to these standards, such as those mandated by REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, ensures their products meet the highest safety thresholds. Failure to comply can result in significant penalties and product recalls, impacting financial performance and market share.

Key legal factors influencing Chargeurs' operations include:

- Oeko-Tex Certifications: Ensuring textile products, like those used in their interlining and luxury textile divisions, are tested for harmful substances, a requirement for sales in many key global markets.

- REACH Compliance: Adhering to the European Union's regulations on chemical substances, which dictates strict requirements for the registration, evaluation, and authorization of chemicals used in products, including those manufactured by Chargeurs.

- Consumer Protection Laws: Meeting national and international consumer protection legislation that governs product labeling, safety claims, and liability for defective goods across all product lines.

- Industry-Specific Standards: Complying with sector-specific quality marks and safety standards relevant to protective films, automotive textiles, and medical applications, which can vary by region and application.

Intellectual Property Rights and Protection

Chargeurs places significant legal emphasis on protecting its high-value-added solutions, innovative materials, and proprietary processes. This protection is primarily achieved through intellectual property rights, including patents and trademarks, which are fundamental to its business model. For instance, the company actively seeks patent protection for its advanced textile technologies and specialized chemical formulations.

Safeguarding these intellectual assets is crucial for preventing direct imitation by competitors and maintaining Chargeurs' distinct competitive advantage in its specialized niche markets. Without robust IP protection, the significant investments made in research and development could be easily undermined, impacting future profitability and market share. In 2023, Chargeurs reported significant investment in R&D to fuel innovation, underscoring the importance of IP for its growth strategy.

- Patents: Securing patents for novel materials and manufacturing processes is a core legal strategy.

- Trademarks: Protecting brand names and logos ensures market recognition and prevents brand dilution.

- Trade Secrets: Confidentiality agreements and internal controls safeguard proprietary knowledge not suitable for patenting.

- Enforcement: Proactive legal measures are taken to address any infringement of its intellectual property rights.

Chargeurs must navigate evolving international trade laws, including tariffs and import/export restrictions, which significantly impact its global supply chain and market access. Compliance with these regulations, such as those monitored by the World Trade Organization, is vital to avoid penalties and ensure smooth cross-border operations. The company's 2024 strategy likely incorporates adjustments to trade agreements and tariffs affecting its key markets in Europe and Asia.

Environmental factors

Chargeurs faces growing pressure from global climate change regulations and an increasing demand for corporate responsibility in reducing its environmental impact. This trend is a significant environmental factor influencing the company's strategic planning and operational decisions.

In response, Chargeurs PCC has put forth a robust Environmental, Social, and Governance (ESG) plan. A key component of this plan is a commitment to slash CO2 emissions by 46% by the year 2030. This ambitious target requires substantial investment in energy efficiency across its operations and a thorough examination of emissions throughout its entire supply chain.

Water scarcity is a growing global challenge, and for industries like textile manufacturing, it presents significant operational and environmental hurdles. Chargeurs recognizes this, integrating water risk assessments across all its production facilities. This proactive approach helps the company understand and mitigate potential water-related disruptions.

In response to these environmental concerns and evolving regulations on industrial water usage, Chargeurs is innovating with product development. The company is actively developing 'Zero Dye Water' product lines. This initiative aims to drastically reduce water consumption in the dyeing process, a typically water-intensive stage in textile production, thereby demonstrating a commitment to responsible wastewater management.

The increasing global demand for sustainably sourced raw materials, especially for fibers like wool, is a significant environmental consideration. Certifications such as the Responsible Wool Standard (RWS) are becoming benchmarks for environmentally conscious production.

Chargeurs actively addresses this by prioritizing responsible sourcing. Initiatives like their NATIVA™ wool program and traceable cashmere demonstrate a commitment to minimizing environmental impacts. This includes focusing on improved land management practices and enhanced animal welfare throughout their supply chain.

Waste Reduction and Circular Economy Initiatives

Chargeurs is actively pursuing waste reduction and circular economy initiatives as key environmental goals. A significant part of this involves transforming PET bottles into synthetic fibers, contributing to a more sustainable manufacturing cycle. This approach not only minimizes waste but also creates value from discarded materials.

Further demonstrating their commitment, Chargeurs is also focused on recycling cotton waste, a vital step in reducing textile industry landfill impact. By integrating these practices, the company aims to lessen its environmental footprint significantly, aligning with global sustainability trends.

The company's efforts extend to product design, with an emphasis on creating items that are easier to recycle at the end of their life cycle. This forward-thinking design strategy is crucial for closing the loop in material usage.

- PET Bottle Recycling: Chargeurs converts PET bottles into synthetic fibers, a key component in their circular economy model.

- Cotton Waste Recycling: The company actively recycles cotton waste to reduce landfill contributions and conserve resources.

- Design for Recyclability: Products are engineered with recyclability in mind to minimize end-of-life environmental impact.

Biodiversity Protection and Ecosystem Restoration

Chargeurs actively engages in biodiversity protection and ecosystem restoration, recognizing their importance for long-term sustainability. This commitment is evident in their management practices, which include the preservation of natural habitats at their operational sites. For instance, Chargeurs aims to maintain these sensitive areas, contributing to local ecological balance and species conservation.

Further demonstrating their dedication, Chargeurs collaborates with organizations focused on environmental regeneration. A key partnership is with WeForest, a non-profit dedicated to large-scale reforestation. Through this collaboration, Chargeurs supports tree-planting initiatives, notably in Brazil, which are crucial for combating deforestation and enhancing carbon sequestration.

These reforestation efforts are not merely symbolic; they directly contribute to ecosystem health by restoring degraded lands and supporting biodiversity. By investing in projects like those with WeForest, Chargeurs aligns its corporate responsibility with global environmental objectives, fostering healthier ecosystems for the future.

- Habitat Preservation: Chargeurs maintains protected natural habitats at its various operational sites.

- Reforestation Partnerships: Collaborates with WeForest on reforestation projects, particularly in Brazil.

- Ecosystem Health: Initiatives aim to improve the health and resilience of local and global ecosystems.

- Carbon Sequestration: Reforestation efforts contribute to the absorption of atmospheric carbon dioxide.

Chargeurs is actively addressing climate change by targeting a significant reduction in CO2 emissions, aiming for a 46% decrease by 2030, which necessitates substantial investments in operational energy efficiency and supply chain emission scrutiny.

The company is also innovating in water management, developing 'Zero Dye Water' product lines to drastically cut water usage in the dyeing process, a critical step given global water scarcity concerns.

Chargeurs prioritizes sustainable sourcing, as seen in its NATIVA™ wool and traceable cashmere programs, which focus on responsible land management and animal welfare, aligning with growing market demand for eco-certified materials.

Furthermore, the company champions circular economy principles through initiatives like converting PET bottles into synthetic fibers and recycling cotton waste, aiming to minimize landfill impact and enhance material value.

| Environmental Initiative | Target/Action | Impact |

|---|---|---|

| CO2 Emission Reduction | 46% by 2030 | Mitigates climate change impact, enhances operational efficiency |

| Water Usage in Dyeing | 'Zero Dye Water' product lines | Conserves water resources, reduces wastewater pollution |

| Raw Material Sourcing | NATIVA™ wool, traceable cashmere | Promotes sustainable land use, improved animal welfare |

| Waste Management & Circularity | PET bottle to fiber conversion, Cotton waste recycling | Reduces landfill waste, conserves natural resources |

PESTLE Analysis Data Sources

Our PESTLE analysis for Chargeurs is built on a robust foundation of data from reputable sources. This includes official government reports, global economic databases, and leading industry publications to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.