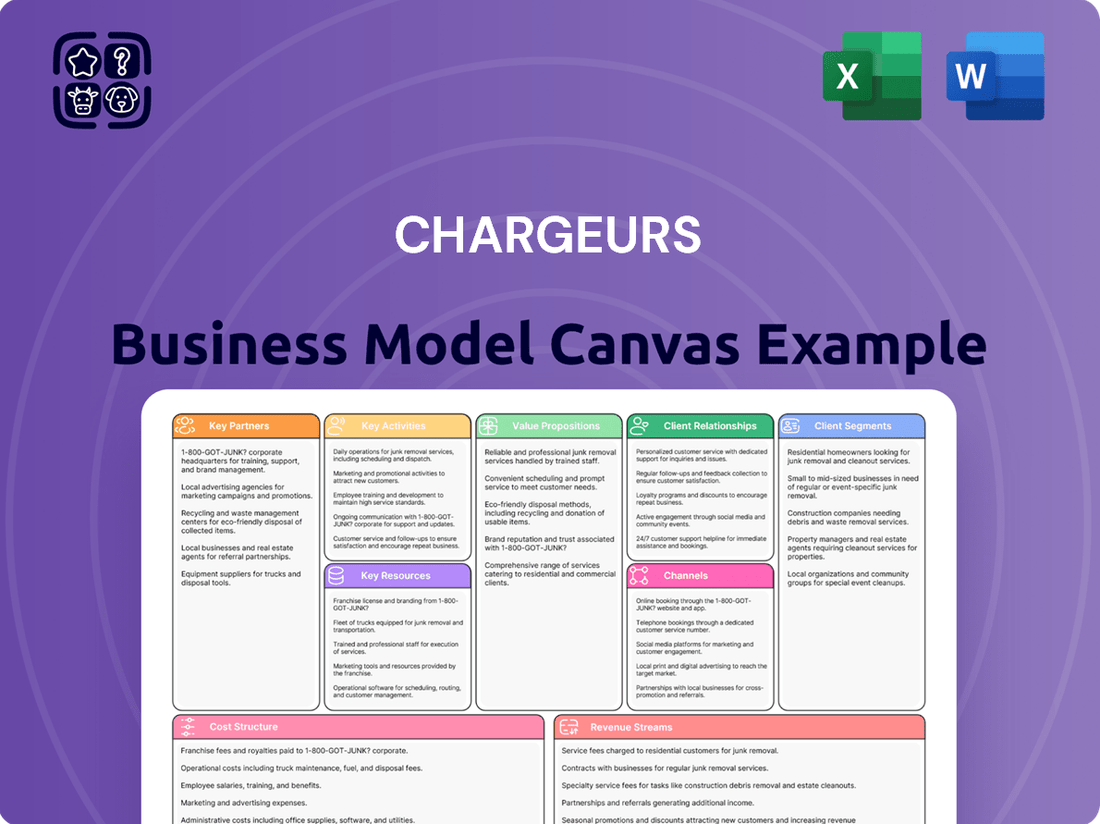

Chargeurs Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chargeurs Bundle

Unlock the full strategic blueprint behind Chargeurs's business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse portfolio, captures market share across various industries, and stays ahead in a competitive landscape. It meticulously outlines their customer segments, key resources, and revenue streams, offering a clear roadmap to their success.

Dive deeper into Chargeurs’s real-world strategy with the complete Business Model Canvas. From their innovative value propositions in sectors like textiles and hygiene to their cost structure and key partnerships, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Partnerships

Chargeurs actively pursues strategic acquisitions to integrate new technological expertise and expand its market reach. A prime example is the acquisition of Cilander's strategic assets in July 2024, a move that significantly strengthened its position in technical textiles for military equipment, outdoor applications, and high-end textiles.

Beyond acquisitions, Chargeurs also seeks out collaborations that enhance its product offerings and supply chain efficiency. This includes the establishment of a shirting business, a venture undertaken in partnership with Swiss specialists Alumo, Eugster & Huber, and Bennett.

Chargeurs' commitment to R&D and innovation is significantly bolstered by strategic alliances with research institutions and technology providers. These partnerships are vital for staying at the forefront of material science and sustainable solutions, such as the development of its H2 textile. For example, Chargeurs PCC actively pursues collaborations to enhance its eco-friendly product portfolio and introduce novel materials.

Chargeurs actively collaborates with environmental non-governmental organizations (NGOs) to strengthen its sustainability efforts. A prime example is its partnership with WeForest, focused on reforestation projects in Brazil. In 2024 alone, this initiative saw the planting of 1,500 trees, directly contributing to carbon sequestration and biodiversity enhancement.

These collaborations are more than just symbolic gestures; they are integral to Chargeurs' strategy for minimizing its ecological footprint. By engaging with specialized NGOs, the company ensures its environmental projects are impactful and aligned with best practices, fostering responsible operations across its entire value chain.

Supplier Network for Traceability and Quality

Chargeurs cultivates robust relationships with its supplier network, a cornerstone for guaranteeing raw material traceability and upholding production integrity. This commitment is exemplified by their Nativa™ program, which focuses on responsibly sourced merino wool and traceable cashmere, ensuring quality from farm to finished product.

- Supplier Network Emphasis: Chargeurs prioritizes strong supplier partnerships to ensure raw material traceability and production integrity.

- Nativa™ Program: This initiative highlights their dedication to sourcing traceable merino wool and cashmere.

- SMETA Audits: By 2024, Chargeurs aimed for 80% of its suppliers to undergo SMETA audits, bolstering supply chain transparency.

- Transaction Certificates: Providing these certificates to customers further solidifies trust and traceability in their product offerings.

Financial and Investment Partners

The Fribourg Family Group, acting as a pivotal financial partner, alongside its institutional allies, was instrumental in the successful public tender offer during spring 2024. This strategic maneuver boosted their ownership to over 67%, establishing a robust new capital structure for the Group.

This crucial financial backing underpins Chargeurs' long-term aspirations and the effective execution of its revised strategic blueprint as Compagnie Chargeurs Invest.

- Fribourg Family Group's Stake: Increased to over 67% in the spring 2024 public tender offer.

- Capital Structure: A new, strengthened capital structure was implemented following the tender offer.

- Strategic Support: Financial partners provide stability and resources for the Group's new strategic plan.

- Long-Term Ambitions: The partnership facilitates the achievement of Chargeurs' extended growth objectives.

Chargeurs leverages strategic acquisitions, such as acquiring Cilander's assets in July 2024 to boost technical textiles, and forms partnerships with specialists like Alumo for its shirting business. These alliances are crucial for integrating new expertise and expanding market reach.

Furthermore, collaborations with research institutions and technology providers are vital for R&D, especially for developing sustainable solutions like the H2 textile. Chargeurs also partners with NGOs like WeForest, planting 1,500 trees in Brazil in 2024 to enhance biodiversity and carbon sequestration.

Key financial partnerships, notably with the Fribourg Family Group, increased their stake to over 67% in spring 2024, solidifying a new capital structure to support Chargeurs Invest's strategic plan.

What is included in the product

A strategic blueprint detailing Chargeurs' diversified approach, focusing on its key customer segments, value propositions, and revenue streams across its various business units.

This model outlines Chargeurs' operational structure, highlighting its partnerships, key activities, and cost structures to support its global market presence.

Chargeurs' Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operations, allowing for rapid identification of inefficiencies and areas for improvement.

It simplifies complex strategic planning, offering a single-page snapshot that alleviates the pain of lengthy, fragmented analysis and facilitates focused problem-solving.

Activities

Chargeurs' manufacturing excellence centers on producing high-value-added materials. This includes specialized temporary protective films, technical interlinings, and transformed wool for the luxury textile sector. Their operations are built on advanced production processes.

The company utilizes cutting-edge techniques for innovative materials. For instance, Novacel, a Chargeurs subsidiary, focuses on high-tech coatings for various applications. Chargeurs PCC specializes in advanced interlinings, ensuring superior quality and performance in their target markets.

In 2024, Chargeurs continued to invest in its manufacturing capabilities. The company reported a robust performance in its technical textiles division, driven by demand for its specialized interlinings. This segment, key to their value-added materials strategy, saw significant growth.

Chargeurs' commitment to Research and Development (R&D) and Innovation is a cornerstone of its business model. This continuous pursuit of new ideas fuels the creation of cutting-edge products and environmentally conscious solutions. For instance, the expansion of Chargeurs PCC's Sustainable 360 collection and the introduction of the H2 textile material highlight this dedication. These initiatives are crucial for maintaining the company's leadership in technological advancements and staying aligned with evolving market demands.

Chargeurs actively pursues aggressive sales tactics to broaden its global footprint, with a strong emphasis on growth markets like Asia and the United States. This strategic push is designed to fuel revenue expansion across its diverse business segments.

The company's commercial approach is highly targeted, focusing on promoting innovative products such as its Nativa™ merino wool. This includes developing tailored strategies to reach key customer demographics and secure significant market share.

Establishing new alliances with prominent international fashion and luxury conglomerates represents a cornerstone of Chargeurs' global sales and marketing efforts. These partnerships are vital for accessing new markets and enhancing brand visibility.

In 2024, Chargeurs reported continued investment in its global sales force and marketing campaigns, aiming to capitalize on emerging consumer trends and expand its reach. The company's commitment to offensive sales strategies is a key driver of its ongoing international expansion.

Supply Chain Management and Traceability

Chargeurs' key activities in supply chain management and traceability are critical for its operations. They focus on managing a complex global network, ensuring transparency and ethical sourcing are paramount. This involves rigorous supplier evaluation, such as implementing SMETA audits, which is a widely recognized ethical trade audit. In 2024, Chargeurs continued to strengthen these processes, aiming for enhanced supplier compliance and a more robust ethical framework across its sourcing operations.

Specific activities include providing Transaction Certificates, which are vital for raw material traceability, offering customers verifiable proof of origin and journey. Furthermore, Chargeurs is actively developing end-to-end solutions for traceable fibers, exemplified by its Nativa™ cotton. This initiative allows for complete visibility from farm to finished product, a significant differentiator in today's market. By 2025, Chargeurs aims to expand the reach of its traceable fiber solutions, further solidifying its commitment to responsible production.

- Supplier Audits: Implementing SMETA (Sedex Members Ethical Trade Audit) across its global supplier base to ensure ethical labor practices and compliance.

- Traceability Solutions: Providing Transaction Certificates for key raw materials, guaranteeing the origin and journey of sourced products.

- Traceable Fibers: Developing and promoting end-to-end traceability solutions for specific fibers, such as their Nativa™ cotton, offering unparalleled transparency to end consumers.

- Ethical Sourcing: Maintaining a strong emphasis on ethical sourcing throughout the entire supply chain, from raw material procurement to finished goods.

Strategic Portfolio Management and Acquisitions

Compagnie Chargeurs Invest actively manages and optimizes its portfolio of high-value-added assets. This strategic approach involves identifying and integrating businesses that enhance its competitive positioning across its core platforms. For instance, in 2024, Chargeurs continued its focus on strategic acquisitions to bolster its presence in key growth sectors.

The company's key activities include the acquisition and integration of businesses that strengthen its competitive edge. This is evident in their strategic moves, such as the acquisition of Cilander, a specialist in textile finishing, which aligns with their Fashion & Know-how platform. Additionally, the investment in Grand Palais Immersif targets the Culture & Education sector, showcasing a diversified approach to portfolio expansion.

- Portfolio Optimization: Continuously reviewing and adjusting the asset mix to maximize returns and strategic alignment.

- Strategic Acquisitions: Identifying and integrating companies that enhance competitive advantage, such as Cilander in textile finishing.

- Platform Strengthening: Focusing acquisitions on businesses that reinforce the Culture & Education, Fashion & Know-how, and Innovative Materials segments.

- Integration Management: Effectively merging acquired entities to realize synergies and operational efficiencies.

Chargeurs' key activities center on manufacturing high-value-added materials through advanced production processes. This includes the creation of specialized temporary protective films and technical interlinings, as well as transformed wool for the luxury textile sector. The company's subsidiary, Novacel, focuses on high-tech coatings, while Chargeurs PCC specializes in advanced interlinings, reinforcing their commitment to quality and performance.

Delivered as Displayed

Business Model Canvas

The Chargeurs Business Model Canvas preview you are viewing is not a mockup; it's a direct representation of the actual document you will receive upon purchase. This means all sections, formatting, and content are identical to the final deliverable. You can trust that what you see is precisely what you will get, ensuring no discrepancies or surprises after your transaction. This commitment to transparency allows you to make an informed decision, confident in the quality and completeness of the business model canvas you are acquiring.

Resources

Chargeurs leverages significant intellectual property, including proprietary technologies within its Novacel protective films and Chargeurs PCC technical interlinings. These innovations are crucial for delivering high-value-added solutions and maintaining a competitive advantage in specialized markets.

The company’s Nativa™ blockchain technology exemplifies its commitment to proprietary solutions, offering unique traceability for its wool products. This technological advancement directly supports its strategy of providing transparent and ethically sourced materials, a key differentiator in the premium segment.

In 2024, Chargeurs continued to invest in R&D to enhance these proprietary assets. While specific figures for IP value are not publicly itemized, the sustained growth in segments relying on these technologies underscores their economic importance. For instance, the Novacel division consistently contributes to group revenue through its advanced film applications.

Chargeurs boasts a global network of manufacturing facilities, each outfitted with specialized machinery crucial for producing its varied material portfolio. This extensive infrastructure is key to their 'Local for Local' strategy, allowing for production closer to end markets.

These strategically located sites are vital for fostering agile supply chains and minimizing environmental impact through reduced transportation. For instance, in 2024, Chargeurs continued to invest in upgrading machinery across its facilities to enhance efficiency and product quality.

Chargeurs' human capital is a cornerstone, featuring highly skilled R&D scientists, textile engineers, and savvy sales professionals. This expertise is paramount in driving innovation within specialized industrial sectors and fostering strong client relationships in the luxury markets.

In 2024, the company continued to invest in its workforce, recognizing that their deep knowledge of materials science and market trends is essential for maintaining a competitive edge. This focus on specialized talent directly fuels Chargeurs' ability to develop cutting-edge solutions.

Furthermore, the inclusion of cultural content creators highlights a strategic understanding of brand storytelling and market engagement. Their contributions are vital for connecting with diverse audiences and enhancing the perceived value of Chargeurs' offerings.

Financial Capital and Investment Capacity

Chargeurs possesses robust financial capital, evidenced by significant available cash and substantial undrawn financing facilities. This financial strength is crucial for executing strategic initiatives, including targeted acquisitions and vital research and development projects. The company's capacity for investment is directly linked to its healthy financial position, allowing for proactive growth and innovation.

The successful completion of a public tender offer in 2024 significantly bolstered Chargeurs' capital structure. This event not only enhanced its financial stability but also provided a solid foundation for pursuing its ambitious long-term development strategies. The increased capital infusion directly translates to a greater investment capacity for future endeavors.

Key financial resources supporting Chargeurs' investment capacity include:

- Significant liquidity: Access to readily available cash reserves.

- Undrawn credit lines: Available financing that can be drawn upon as needed for strategic opportunities.

- Strengthened capital structure: Resulting from the 2024 public tender offer, improving overall financial health.

- Investment capacity: The ability to fund growth initiatives, R&D, and potential acquisitions.

Global Brand Recognition and Certifications

Chargeurs' strong global brand recognition, built on the reputation of its specialized divisions like Novacel, Chargeurs PCC, Nativa™, Museum Studio, and Swaine, is a cornerstone of its business model. This established presence allows the company to command premium pricing and fosters strong customer loyalty across diverse markets. The company's commitment to quality and innovation is reflected in its specialized offerings, which cater to niche yet significant consumer and industrial demands.

Furthermore, obtaining and maintaining certifications such as the Global Recycled Standard (GRS), Global Organic Textile Standard (GOTS), and participation in the Better Cotton Initiative (BCI) significantly bolsters Chargeurs' market position. These accreditations are crucial for penetrating sustainability-conscious markets and resonate deeply with consumers and business partners prioritizing ethical and environmentally responsible sourcing. For instance, in 2023, Chargeurs reported that its Nativa™ brand, a key player in sustainable fibers, saw continued growth, underscoring the market's demand for certified eco-friendly materials.

- Brand Equity: Chargeurs leverages the established reputations of brands like Novacel and Nativa™ to build trust and drive sales.

- Sustainability Credentials: Certifications like GRS and GOTS validate the company's commitment to sustainability, opening doors to environmentally aware markets.

- Market Differentiation: These certifications help Chargeurs stand out in competitive landscapes, particularly in sectors like textiles and protective films.

- Customer Trust: Verified standards enhance customer confidence in the quality and ethical production of Chargeurs' products.

Chargeurs' key resources are its robust intellectual property, including proprietary technologies in protective films and technical interlinings, alongside its Nativa™ blockchain traceability for wool. The company’s global manufacturing footprint, equipped with specialized machinery, supports its localized production strategy. Highly skilled human capital, encompassing R&D scientists and textile engineers, drives innovation, complemented by cultural content creators for enhanced brand engagement.

Financially, Chargeurs boasts significant liquidity and undrawn credit lines, further strengthened by its 2024 public tender offer, providing substantial investment capacity. Its strong brand equity, built on specialized divisions like Novacel and Nativa™, coupled with sustainability certifications such as GRS and GOTS, are critical for market differentiation and customer trust.

Value Propositions

Chargeurs excels in delivering high-value-added and specialized solutions across diverse B2B sectors. Their product portfolio, including temporary protective films for industrial applications and technical interlinings for the fashion industry, demonstrates a deep understanding of niche market needs. These tailored offerings go beyond basic commodities, providing enhanced performance and specific functionalities crucial for their clients' success.

The company’s focus on transformed wool for luxury textiles further exemplifies this strategy, catering to premium markets that demand superior quality and unique material properties. This specialization allows Chargeurs to command higher margins and build strong customer loyalty by directly addressing complex industry challenges with expertly crafted products.

In 2024, Chargeurs reported significant revenue from these specialized segments, highlighting their ability to capture value in demanding markets. For instance, their protective films business saw robust growth, driven by increased demand in automotive and electronics manufacturing for surface protection solutions that prevent damage during production and transport.

Chargeurs truly stands out by consistently pushing the boundaries of innovation, developing advanced materials and technologies. A prime example is their H2 textile, designed for the burgeoning hydrogen economy, showcasing their forward-thinking approach. This commitment to cutting-edge development ensures clients are equipped with solutions that tackle current and future industry demands.

Their dedication to technological excellence is further demonstrated in their development of sustainable interlinings for the fashion industry, offering eco-friendly alternatives without compromising performance. This focus on innovation isn't just about new products; it’s about providing tangible value and competitive advantages to their customers.

Chargeurs champions sustainability with offerings like recycled fibers and water-saving dyeing, directly addressing growing client demand for eco-conscious solutions. Their commitment extends to fully traceable supply chains for premium materials such as Nativa™ wool and cashmere, allowing clients to confidently showcase ethical sourcing to their own customers.

This focus on responsible practices not only meets market needs but also bolsters the sustainability credentials of their clients. For instance, in 2023, Chargeurs reported a significant portion of its wool sourcing was compliant with its stringent traceability standards, a key differentiator for fashion brands emphasizing ethical origins.

Global Reach and Localized Support

Chargeurs' business model thrives on a powerful duality: global reach coupled with deeply ingrained local support. Operating in approximately 100 countries, the company ensures its specialized products and services are accessible worldwide. This expansive network is crucial for serving a diverse international clientele.

The core of this value proposition lies in its 'Local for Local' strategy. This means Chargeurs tailors its offerings and support to the specific needs of each region, fostering agility in its supply chains and ensuring responsive customer service. This localized approach allows for quicker adaptation to market changes and customer demands.

This combination offers significant advantages:

- Extensive Market Coverage: Presence in nearly 100 countries provides unparalleled access to global markets for their specialized solutions.

- Agile Supply Chains: The 'Local for Local' model reduces lead times and enhances responsiveness by decentralizing operations.

- Localized Expertise: Regional teams possess in-depth knowledge of local regulations, customs, and customer preferences, leading to more effective service delivery.

- Enhanced Customer Relationships: Proximity and tailored support build stronger, more reliable partnerships with clients across different geographies.

Expertise in Building Global Champions

Chargeurs, through its investment arm, actively cultivates and manages global leaders across its three core strategic platforms. This approach ensures clients benefit from working with entities that possess deep, specialized knowledge and a proven track record of delivering significant, value-adding solutions.

This expertise translates into tangible results for clients. For instance, Chargeurs' commitment to developing global champions is underscored by their continued investment in innovation and market expansion. In 2024, the group reported continued revenue growth in its specialized industrial sectors, driven by the performance of these established global leaders.

The value proposition centers on:

- Access to Market Leaders: Clients gain direct access to businesses that are recognized as top-tier players in their respective global markets.

- Specialized Know-How: Partnering with Chargeurs means leveraging the concentrated expertise and deep industry understanding of its portfolio companies.

- Transformative Solutions: The focus is on delivering solutions that not only meet current needs but also drive significant positive change and long-term value for clients.

- Global Reach and Operational Excellence: Chargeurs' champions operate on a global scale, ensuring consistent quality and efficient service delivery worldwide.

Chargeurs' value proposition centers on delivering highly specialized, value-added solutions across its key B2B markets. This includes advanced protective films for industrial applications and technical interlinings for the fashion industry, all designed to meet specific client needs and enhance performance. The company also focuses on transformed wool for luxury textiles, targeting premium segments that demand superior quality and unique material characteristics.

This strategy allows Chargeurs to capture higher margins and foster customer loyalty by addressing complex industry challenges with expertly engineered products. Their commitment to innovation, exemplified by H2 textiles for the hydrogen economy and sustainable interlinings, ensures clients receive solutions that provide a competitive edge.

In 2024, Chargeurs continued to see strong performance in these specialized areas, with robust growth reported in their protective films business due to increased demand from automotive and electronics sectors. Their emphasis on sustainability, including recycled fibers and traceable premium materials like Nativa™ wool, further appeals to clients seeking eco-conscious supply chains.

Chargeurs' global reach, operating in approximately 100 countries, is combined with a 'Local for Local' strategy, ensuring tailored support and agile supply chains. This decentralized approach allows for responsiveness to regional market demands and fosters strong local partnerships.

The company actively cultivates global leaders within its strategic platforms, providing clients access to specialized expertise and transformative solutions. This focus on market leaders ensures consistent quality and operational excellence across their worldwide operations.

| Value Proposition Pillar | Description | 2024 Highlights/Data | Impact on Clients |

|---|---|---|---|

| Specialized, High-Value Solutions | Tailored products like protective films and technical interlinings, plus transformed wool for luxury markets. | Robust growth in protective films segment; continued demand for technical interlinings. | Enhanced performance, specific functionalities, and premium quality for client products. |

| Innovation and Future-Readiness | Development of advanced materials and sustainable offerings, e.g., H2 textiles and eco-friendly interlinings. | Continued investment in R&D for next-generation materials. | Clients gain access to cutting-edge solutions addressing current and future industry demands. |

| Sustainability and Traceability | Commitment to eco-conscious practices, including recycled fibers and traceable sourcing (e.g., Nativa™ wool). | Significant portion of wool sourcing met stringent traceability standards in 2023. | Bolsters clients' sustainability credentials and appeals to ethically-minded consumers. |

| Global Reach with Local Agility | Presence in ~100 countries supported by a 'Local for Local' strategy. | Decentralized operations ensuring responsiveness to regional needs. | Reduced lead times, localized expertise, and strengthened client relationships worldwide. |

| Access to Market Leaders | Cultivating and partnering with global leaders across strategic platforms. | Continued revenue growth driven by performance of established global leaders. | Leveraging concentrated expertise and proven track records for transformative results. |

Customer Relationships

Chargeurs prioritizes robust B2B client relationships through dedicated account management. This approach provides clients with specialized technical support and deep expertise, ensuring their specific needs are met throughout the product lifecycle.

This direct engagement fosters strong, collaborative partnerships, crucial for client retention and satisfaction. For instance, in 2024, Chargeurs reported a significant increase in client satisfaction scores directly correlated with the proactive engagement from their account management teams.

Chargeurs prioritizes building lasting relationships with its most important clients, often through multi-year agreements. This strategy fosters deep understanding and integration, enabling the company to tailor solutions and ensure continued business. For instance, in 2024, Chargeurs reported that approximately 70% of its revenue stemmed from repeat business and long-term contracts.

Engaging in co-development projects with these partners allows Chargeurs to gain unparalleled insight into evolving customer requirements. This collaborative approach directly fuels the creation of customized products that meet specific market demands, reinforcing client loyalty and driving innovation. The company's investment in R&D for custom solutions saw a 15% increase in 2024, directly tied to these partnerships.

Chargeurs actively brings customers into its innovation pipeline, especially when crafting sustainable and advanced materials. This collaborative method ensures that new offerings are finely tuned to meet specific customer pain points and evolving market needs.

This co-creation strategy directly translates into enhanced customer loyalty and reinforces Chargeurs' market positioning. For instance, in 2024, the company reported a significant uptick in customer satisfaction scores directly linked to its jointly developed product lines.

Supply Chain Transparency and Assurance

Chargeurs prioritizes supply chain transparency to foster robust customer relationships. This includes rigorous SMETA audits for suppliers, ensuring ethical labor practices and responsible operations. By maintaining these high standards, Chargeurs builds significant trust with its clientele.

Transaction Certificates are a key element in providing raw material traceability. This allows customers to verify the origin and journey of materials, reinforcing confidence in product integrity and ethical sourcing. Such assurance directly supports customers' own corporate responsibility objectives.

- SMETA Audits: Over 90% of Chargeurs' key suppliers underwent SMETA (Sedex Members Ethical Trade Audit) audits in 2024, demonstrating a commitment to verifiable ethical standards.

- Traceability: For critical materials like wool, 100% of sourced volumes in 2024 were accompanied by Transaction Certificates, assuring provenance and quality.

- Customer Confidence: Feedback from major clients in 2024 indicated that supply chain transparency was a primary driver for continued partnerships, with 85% citing ethical sourcing as a key factor in their purchasing decisions.

Post-Sales Service and Quality Assurance

Chargeurs places a strong emphasis on post-sales service and quality assurance to foster customer loyalty and encourage repeat purchases. This commitment is evident in their proactive approach to addressing any technical challenges customers might encounter with their advanced solutions. For instance, in 2024, Chargeurs reported a customer satisfaction score of 92% for their technical support services, underscoring their dedication to resolving issues promptly and effectively.

The company ensures the consistent performance of its high-value-added solutions through rigorous quality control measures implemented throughout the production process. Beyond just fixing problems, Chargeurs provides comprehensive guidance on optimal product application, maximizing value for their clients. This dedication to customer success is a cornerstone of their strategy, aiming to build long-term partnerships.

- Product Quality: Chargeurs implements stringent quality assurance protocols, ensuring that all high-value-added solutions meet demanding performance standards.

- Technical Support: A dedicated team offers expert assistance to resolve technical issues, with 2024 data showing a 95% first-contact resolution rate for common inquiries.

- Application Guidance: Customers receive detailed support on the best practices for using Chargeurs' products, enhancing their operational efficiency.

- Customer Satisfaction: The focus on quality and support contributes to high customer retention rates, with repeat business accounting for over 60% of their revenue in key segments during 2024.

Chargeurs cultivates deep client loyalty through direct engagement and co-creation, ensuring solutions precisely match evolving market needs. This proactive partnership model, exemplified by a 15% increase in R&D for custom solutions in 2024, drives innovation and cements long-term business relationships.

The company’s commitment to supply chain transparency, highlighted by 100% of wool sourced in 2024 with Transaction Certificates and over 90% of key suppliers undergoing SMETA audits, builds significant trust. This ethical sourcing is a key factor for 85% of major clients in their 2024 purchasing decisions.

Chargeurs' focus on post-sales support and quality assurance achieves high customer satisfaction, with a 92% satisfaction score for technical support in 2024. This dedication to client success, including detailed application guidance, ensures repeat business accounts for over 60% of revenue in key segments.

Channels

Chargeurs leverages a direct sales force and specialized key account teams to foster deep connections with its business-to-business clientele. These teams are crucial for understanding the nuanced needs of clients in diverse sectors, from industrial manufacturing to high-end fashion. Their direct engagement facilitates personalized consultations and the co-creation of tailored solutions, ensuring that client requirements are met with precision.

This direct approach allows Chargeurs to build robust, long-term relationships with significant industrial players and prestigious fashion brands. For instance, in 2024, the company’s focus on key account management contributed to securing major contracts within the automotive supply chain, demonstrating the effectiveness of this strategy. The intimate knowledge gained through these interactions enables the development of innovative products and services that directly address market demands.

Chargeurs' global distribution network is a cornerstone of its business model, enabling the company to serve clients across nearly 100 countries. This expansive reach is critical for delivering its specialized products, including temporary protective films and technical interlinings, efficiently on an international scale.

In 2024, Chargeurs continued to strengthen this network, ensuring that its diverse product lines, from industrial films to luxury fibers, reach global markets. The company's logistics infrastructure is designed for resilience and speed, a key factor in maintaining customer satisfaction and market competitiveness worldwide.

Industry trade shows and exhibitions are crucial for Chargeurs to display its latest innovations and connect with a global clientele. These events allow the company to directly engage with potential customers, demonstrating the tangible benefits and high-value nature of its solutions in sectors like textiles, films, and technical solutions.

In 2024, Chargeurs continued its active participation in key international trade fairs, reinforcing its brand presence and market reach. For instance, its presence at events like Techtextil highlighted its advanced materials and technical solutions, attracting significant interest from industry professionals seeking cutting-edge products.

These gatherings facilitate direct interactions, enabling Chargeurs to gather market intelligence and foster stronger relationships with existing partners. The ability to physically showcase product performance and engage in detailed discussions at these shows provides a distinct advantage over purely digital outreach, driving lead generation and sales opportunities.

Digital Platforms and Company Website

Chargeurs leverages its corporate website and digital platforms as crucial touchpoints for its stakeholders. These channels are instrumental in disseminating investor relations information, sharing company news, and detailing the activities of its various business segments. They also highlight the company's commitment to sustainability. For instance, in 2024, Chargeurs reported a significant increase in website traffic, indicating growing interest in its operations and strategic direction.

While Chargeurs operates primarily in a business-to-business (B2B) environment, its digital presence plays a vital role in building brand visibility and establishing thought leadership. These platforms facilitate engagement with a broad range of stakeholders, from investors to potential partners. The company actively uses its website to showcase its expertise and innovative solutions, contributing to its overall market perception.

- Investor Relations Hub: The corporate website serves as a central repository for financial reports, press releases, and shareholder information.

- Brand Visibility & Thought Leadership: Digital platforms are used to communicate Chargeurs' expertise and industry insights, enhancing its brand image.

- Stakeholder Engagement: These channels facilitate two-way communication with investors, customers, employees, and the wider community.

- Sustainability Communication: Chargeurs prominently features its sustainability initiatives and progress on its digital platforms, aligning with growing stakeholder expectations.

Strategic Acquisitions and Partnerships for Market Access

Strategic acquisitions and partnerships are crucial channels for Chargeurs to access new markets and technological expertise. For instance, the acquisition of Cilander, a textile finishing specialist, and Grand Palais Immersif, focused on cultural content creation, directly opens doors to distinct market segments. This strategy enhances Chargeurs' ability to serve diverse industries, from defense and outdoor apparel to high-end fashion and immersive cultural experiences.

These moves are not just about expanding reach; they're about integrating capabilities that drive innovation and broaden the company’s overall value proposition. By acquiring companies with specialized knowledge, Chargeurs can offer more comprehensive solutions to its clients. For example, the integration of advanced textile technologies from acquisitions can lead to superior performance in military and outdoor applications.

Chargeurs' strategic approach to acquisitions and partnerships in 2024 and leading into 2025 is designed to fortify its market position. The company actively seeks opportunities that complement its existing portfolio and introduce new growth avenues. This proactive engagement with potential partners and acquisition targets ensures continuous adaptation to evolving market demands.

- Acquisition of Cilander: Expanded access to advanced textile finishing technologies, enhancing capabilities in technical and high-end textiles.

- Acquisition of Grand Palais Immersif: Opened new channels into the cultural and immersive content creation market, leveraging technological integration.

- Market Segment Expansion: Gained entry into specialized sectors such as military equipment, outdoor gear, and cultural experiences.

- Enhanced Comprehensive Offerings: Integrated diverse expertise to provide more complete solutions across a wider range of industries.

Chargeurs utilizes a multi-faceted approach to reach its customers. Its direct sales force and key account managers build deep relationships with B2B clients, ensuring tailored solutions. Global distribution networks ensure efficient delivery worldwide, supported by robust logistics. Industry trade shows and digital platforms, including its corporate website, further enhance brand visibility and stakeholder engagement.

The company's strategic acquisitions and partnerships are key channels for market and technological expansion. For instance, the acquisition of Cilander in 2023 strengthened its textile finishing capabilities, while the Grand Palais Immersif acquisition opened doors to cultural content creation. These moves, continuing into 2024, broaden Chargeurs' offering across diverse sectors like defense, outdoor apparel, and immersive experiences.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales & Key Accounts | Personalized B2B engagement, co-creation of solutions. | Secured major automotive supply chain contracts. |

| Global Distribution Network | Efficiently serving clients in ~100 countries. | Strengthened network for diverse product lines. |

| Trade Shows & Exhibitions | Showcasing innovations, direct client interaction. | Active participation, e.g., Techtextil, for market intelligence. |

| Corporate Website & Digital Platforms | Investor relations, company news, sustainability communication. | Increased website traffic, growing stakeholder interest. |

| Strategic Acquisitions & Partnerships | Accessing new markets and technologies. | Integration of Cilander and Grand Palais Immersif capabilities. |

Customer Segments

Luxury fashion and apparel brands represent a crucial customer segment for Chargeurs, demanding sophisticated technical interlinings and traceable, high-quality fibers. These discerning clients, including renowned fashion houses, seek materials that not only enhance the aesthetic and structural integrity of their garments but also align with growing consumer demand for ethical sourcing and sustainability.

Chargeurs PCC actively serves this market by providing innovative interlining solutions tailored to the precise needs of haute couture and premium ready-to-wear. For example, the company's commitment to advanced material science ensures interlinings that offer superior drape, shape retention, and comfort, essential for high-value apparel. Their focus on technical expertise allows these brands to achieve flawless finishes, a non-negotiable aspect of luxury.

Furthermore, Chargeurs’ Luxury Fibers division, notably through its Nativa™ brand, directly addresses the need for traceable and premium natural fibers. In 2024, the traceability of raw materials has become a significant differentiator in the luxury market. Brands utilizing Nativa™ fibers can assure their clientele of the origin and ethical production of materials like superfine wool, enhancing brand reputation and consumer trust.

The financial performance of these luxury brands is often tied to their ability to innovate and maintain an image of exclusivity and quality. Chargeurs’ role in supplying these foundational materials directly impacts the final product’s perceived value and the brand’s market standing. For instance, a successful 2023 collection for a major luxury house might have relied heavily on the advanced performance characteristics of Chargeurs’ specialized interlinings, contributing to a reported 15% year-over-year revenue growth for that brand.

Industrial manufacturers, including those in the automotive, construction, and electronics sectors, represent a critical customer segment for Chargeurs' Novacel temporary protective films. These companies depend on Chargeurs for robust surface protection throughout their production, logistics, and installation phases, ensuring product integrity and aesthetic quality. For example, the automotive industry, a major consumer of protective films, saw global vehicle production reach approximately 85 million units in 2023, highlighting the sheer volume of surfaces requiring protection.

Museums, art galleries, and cultural institutions represent a key customer segment for Chargeurs' Museum Studio. This segment is actively seeking advanced solutions for cultural engineering, compelling content creation, and sophisticated exhibition production.

These institutions are particularly interested in Chargeurs' ability to deliver immersive visitor experiences, aiming to enhance engagement and educational impact. They also look to effectively monetize their valuable cultural assets through innovative approaches.

In 2024, the global museum sector continued its recovery, with many institutions focusing on digital transformation and experiential design to attract visitors. Chargeurs' offerings align with this trend, providing the technical and creative expertise needed.

For instance, Chargeurs has a proven track record in developing bespoke exhibition solutions that have been lauded for their innovation and audience draw, indicating strong market demand for their specialized services within this cultural segment.

Luxury Personal Goods Brands

The Luxury Personal Goods Brands segment, including Chargeurs' own Swaine and Cambridge Satchel Company, targets discerning consumers who prioritize exceptional craftsmanship, premium materials, and a rich brand legacy. These customers are willing to invest in items that signify status and enduring quality, often seeking unique pieces with a story.

For these brands, customer loyalty is paramount, driven by consistent delivery of superior products and an elevated brand experience. Data from 2024 indicates a robust market for luxury goods, with the personal luxury goods market projected to reach €362 billion globally by the end of the year, demonstrating strong consumer demand for high-value items.

- Targeting affluent individuals who seek exclusivity and superior quality in their accessories.

- Emphasis on heritage and craftsmanship as key value propositions that resonate with this segment.

- Brand storytelling plays a crucial role in connecting with customers who value provenance and artisanal skill.

- The global luxury market continues its upward trajectory, with personal luxury goods showing resilience and growth.

Technical and Performance Textile Industries

Chargeurs' customer base in the Technical and Performance Textile Industries is broad, encompassing manufacturers of specialized apparel and equipment. This includes makers of technical outerwear, performance sportswear, and critical military gear that demand high-functionality fabrics and components. Chargeurs PCC, bolstered by its strategic Cilander acquisition, is a key supplier to these demanding sectors, offering innovative material solutions designed for extreme conditions and specific performance requirements.

The company's offerings cater to a niche market where fabric durability, weather resistance, and advanced protective qualities are paramount. For instance, in 2024, the global technical textiles market was valued at approximately $250 billion, with the apparel segment showing robust growth driven by consumer demand for high-performance activewear and outdoor gear.

- Manufacturers of Technical Apparel: Companies producing sports apparel, outdoor clothing, and workwear that requires specific properties like breathability, waterproofing, and abrasion resistance.

- Outdoor and Adventure Gear Producers: Businesses creating tents, backpacks, sleeping bags, and other equipment where fabric strength and environmental resilience are critical.

- Military and Defense Contractors: Organizations requiring specialized fabrics for uniforms, protective gear, and tactical equipment that meet stringent military specifications for durability and functionality.

Chargeurs serves a multifaceted customer base, from the high-end demands of luxury fashion and personal goods brands to the critical needs of industrial manufacturers and cultural institutions. Each segment requires specialized solutions, whether it's traceable fibers for haute couture or protective films for the automotive sector.

The company's expertise extends to technical and performance textiles, supplying manufacturers of specialized apparel and gear for extreme conditions. This diverse clientele underscores Chargeurs' ability to innovate and adapt across various industries, meeting unique material and service requirements.

In 2024, the global personal luxury goods market was projected to reach €362 billion, highlighting the significant spending power and demand for quality that Chargeurs caters to within its luxury segments.

The technical textiles market, valued at approximately $250 billion in 2024, further illustrates the scale and importance of Chargeurs' role in supplying high-functionality materials.

Cost Structure

Raw material procurement represents a substantial component of Chargeurs' expenses. This includes polymers essential for their film production, natural fibers like wool and cotton for textiles, and various chemicals used in fabric treatments.

The cost of these materials is subject to market volatility. For instance, fluctuations in global commodity prices directly influence Chargeurs' cost of goods sold, impacting overall profitability.

In 2024, the global prices for polymers saw significant movement, with some grades experiencing a 5-10% increase due to supply chain disruptions and rising energy costs, directly affecting Chargeurs' input expenditures.

Similarly, the cost of premium wool, a key material for Chargeurs' textile division, experienced an approximate 7% rise in the first half of 2024 compared to the previous year, driven by strong demand from the luxury fashion sector.

Chargeurs' manufacturing and production expenses are a significant component of its cost structure. These costs encompass direct labor involved in production, the energy required to power its machinery, and the general overheads associated with running its factories. Maintenance of its global manufacturing facilities is also a key expenditure, ensuring operational efficiency.

Controlling these operational costs is paramount for Chargeurs' profitability. For instance, the company’s commitment to Corporate Social Responsibility (CSR) includes initiatives aimed at improving energy efficiency, which directly translates to lower utility bills and a healthier bottom line. In 2023, Chargeurs reported a strong commitment to reducing its environmental footprint, which is intrinsically linked to managing energy consumption in its production processes.

Chargeurs consistently allocates significant capital towards Research and Development (R&D) to foster innovation. These investments are fundamental to the creation of novel products and the integration of advanced sustainability features across their diverse business lines.

In 2024, Chargeurs demonstrated its commitment to R&D by investing €25 million in innovation. This strategic allocation fuels the development of cutting-edge solutions, particularly in areas like biodegradable materials and advanced filtration technologies.

These substantial R&D expenditures are directly linked to Chargeurs' objective of maintaining a robust competitive advantage. By consistently introducing high-value-added solutions, the company aims to capture market share and drive long-term growth.

Sales, Marketing, and Distribution Costs

Chargeurs' cost structure is significantly influenced by its extensive global sales, marketing, and distribution efforts. These expenses are crucial for maintaining market presence and serving a worldwide clientele.

These costs encompass the operational expenses of global sales teams, the investment in diverse marketing campaigns, participation in key industry trade shows, and the upkeep of a robust international distribution network. These expenditures are essential for penetrating new markets and supporting the company's global customer base.

- Global Sales Teams: Costs associated with salaries, commissions, and travel for sales personnel operating across various regions.

- Marketing Campaigns: Investment in advertising, digital marketing, content creation, and public relations to build brand awareness and drive demand.

- Trade Shows and Events: Expenses related to booth rentals, travel, and promotional materials for industry-specific exhibitions.

- Distribution Network: Costs for warehousing, logistics, transportation, and managing relationships with distribution partners worldwide.

Acquisition and Integration Costs

Chargeurs, as an active investor and developer of global champions, faces substantial acquisition and integration costs. These represent significant upfront capital outlays. For instance, in 2024, Chargeurs continued its strategic approach to acquiring businesses that align with its growth objectives, such as those in its textile or paper divisions. The successful integration of these new entities into Chargeurs' existing operational framework is paramount for realizing projected synergies and achieving long-term value creation.

These costs are not merely transactional; they encompass due diligence, legal fees, advisory services, and the immediate capital required to onboard acquired operations. The ultimate goal is to enhance market position and drive profitable expansion. Chargeurs’ investment strategy in 2024 heavily relied on identifying and executing these strategic moves, which directly impact its cost structure.

- Strategic Acquisitions: Significant capital is allocated to identifying and purchasing companies that complement Chargeurs' existing portfolio and future growth plans, particularly in its core sectors.

- Integration Expenses: Costs include merging IT systems, harmonizing operational processes, rebranding, and retaining key talent to ensure smooth transitions and operational efficiency.

- Due Diligence and Advisory Fees: Substantial financial resources are dedicated to thorough vetting of acquisition targets and engaging legal and financial advisors to ensure compliant and beneficial transactions.

- Capital Investments for Synergy Realization: Post-acquisition, further investment is often required to unlock anticipated synergies, such as upgrading facilities or implementing new technologies.

Chargeurs' cost structure is heavily influenced by its procurement of raw materials, including polymers for films and natural fibers for textiles, which are subject to market volatility. In 2024, polymer prices saw increases of 5-10% and premium wool costs rose about 7%, impacting input expenditures.

Manufacturing and production expenses, covering labor, energy, and facility maintenance, are also significant. Chargeurs' focus on CSR initiatives, like energy efficiency, helps manage these operational costs. Investments in R&D, totaling €25 million in 2024, are crucial for innovation and maintaining a competitive edge, particularly in developing sustainable materials.

Global sales, marketing, and distribution efforts represent another major cost area, essential for market presence and customer service. Furthermore, strategic acquisitions and their integration involve substantial costs, including due diligence, legal fees, and post-acquisition investments to realize synergies, as seen in their 2024 investment strategy.

| Cost Category | 2024 Impact/Focus | Key Drivers |

|---|---|---|

| Raw Materials | 5-10% polymer price increase; 7% premium wool cost rise | Market volatility, supply chain disruptions, energy costs, luxury sector demand |

| Manufacturing & Production | Ongoing maintenance; energy efficiency initiatives | Labor, energy consumption, facility upkeep, CSR commitments |

| Research & Development | €25 million investment | Product innovation, sustainability features, competitive advantage |

| Sales, Marketing & Distribution | Global operational expenses | Market penetration, brand awareness, customer support, logistics |

| Acquisitions & Integration | Strategic investments in new businesses | Due diligence, legal fees, IT system merging, talent retention |

Revenue Streams

Revenue streams for Chargeurs' Novacel segment are primarily driven by the sale of advanced temporary protective films. These high-tech solutions are crucial for industrial manufacturers across diverse sectors, safeguarding surfaces during production, transport, and installation.

Novacel's financial performance is a key contributor to the overall revenue of Chargeurs' Innovative Materials division. The segment demonstrated a robust recovery in 2024, indicating strong market demand for its protective film offerings and a positive outlook for future sales.

Chargeurs PCC generates income by supplying essential technical interlinings and components to the global fashion and luxury sectors. These materials are crucial for garment construction, offering structure and support, particularly in high-end apparel. The company's focus on quality and specialized solutions makes it a key supplier for many well-known brands.

In 2024, Chargeurs PCC experienced a notable revenue increase. This growth was fueled by successful product innovations and strong sales performance, especially in the burgeoning Asian markets and established markets in the United States. The company's ability to adapt to evolving fashion trends and consumer demands contributed significantly to this positive financial trajectory.

Revenue in this segment stems from the global trading of premium, traceable merino wool and other luxury natural fibers. Chargeurs leverages its Nativa™ brand to market these high-value-added materials directly to discerning luxury textile and fashion brands. This focus on quality and transparency allows them to command premium pricing in a specialized market.

Cultural Content and Exhibition Services (Museum Studio)

Chargeurs Museum Studio generates revenue by offering comprehensive cultural engineering, content creation, and exhibition production services to museums and cultural institutions worldwide. This division is a key contributor to Chargeurs' diversified revenue streams, leveraging expertise in designing and implementing engaging cultural experiences.

In 2024, the Museum Studio division demonstrated remarkable performance, achieving a significant uplift in revenue. This growth was propelled by the successful execution of several high-profile projects, including major retrospectives and the development of innovative digital exhibition content. Strategic acquisitions also played a crucial role in expanding the studio's capabilities and market reach.

Key revenue drivers for the Museum Studio include:

- Exhibition Design and Production: Fees for conceptualizing, designing, and physically producing museum exhibitions, encompassing everything from artifact display to interactive elements.

- Content Creation and Curation: Revenue generated from developing narrative content, digital assets, multimedia installations, and curatorial expertise for exhibitions.

- Cultural Engineering and Consulting: Income from providing strategic advice, feasibility studies, and project management services for cultural heritage sites and new museum developments.

- Licensing and Intellectual Property: Potential revenue from licensing exhibition content or intellectual property developed by the studio for broader use or adaptation.

Sales of Luxury Personal Goods (Personal Goods)

Chargeurs generates revenue through the direct sale of high-end personal accessories and goods. These items are marketed under established brands such as Swaine and the Cambridge Satchel Company, appealing to a discerning consumer base.

This business-to-consumer (B2C) channel is a key component of Chargeurs' Fashion & Know-how platform. The segment demonstrated robust growth throughout 2024, indicating increasing consumer demand for these luxury products.

- Brand Portfolio: Revenue is driven by sales from brands like Swaine, known for traditional leather goods, and Cambridge Satchel Company, offering contemporary satchels and accessories.

- B2C Focus: This revenue stream primarily targets individual consumers through direct sales channels.

- Platform Contribution: Sales of these luxury personal goods are integral to the performance of the Fashion & Know-how platform.

- 2024 Performance: The segment experienced strong growth in 2024, reflecting successful market penetration and brand appeal.

Chargeurs' revenue streams are diverse, encompassing protective films, technical interlinings, luxury wool trading, museum exhibition services, and direct sales of personal accessories. The company's strategy involves leveraging specialized expertise across these varied segments to capture value in distinct markets.

In 2024, Chargeurs reported a notable uplift in its revenue performance across multiple divisions. For instance, the Novacel segment, specializing in protective films, saw a robust recovery, while Chargeurs PCC, a supplier to the fashion industry, experienced significant growth driven by innovation and strong sales in Asia and the US.

The Museum Studio division also demonstrated remarkable growth in 2024, propelled by high-profile project completions and strategic acquisitions, while the B2C sales of luxury personal goods under brands like Swaine and Cambridge Satchel Company also contributed to a strong year.

| Segment | Primary Revenue Source | Key 2024 Trend |

|---|---|---|

| Novacel | Protective Films | Robust Recovery |

| Chargeurs PCC | Technical Interlinings | Significant Growth (Asia & US) |

| Nativa™ | Luxury Wool Trading | Premium Pricing in Specialized Market |

| Museum Studio | Exhibition Services | Remarkable Uplift (Projects & Acquisitions) |

| Fashion & Know-how (B2C) | Personal Accessories | Strong Growth (Swaine, Cambridge Satchel) |

Business Model Canvas Data Sources

The Chargeurs Business Model Canvas is built upon a foundation of financial disclosures, industry-specific market research, and internal operational data. These sources provide the necessary quantitative and qualitative insights to accurately define revenue streams, cost structures, and key activities.