Chargeurs Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chargeurs Bundle

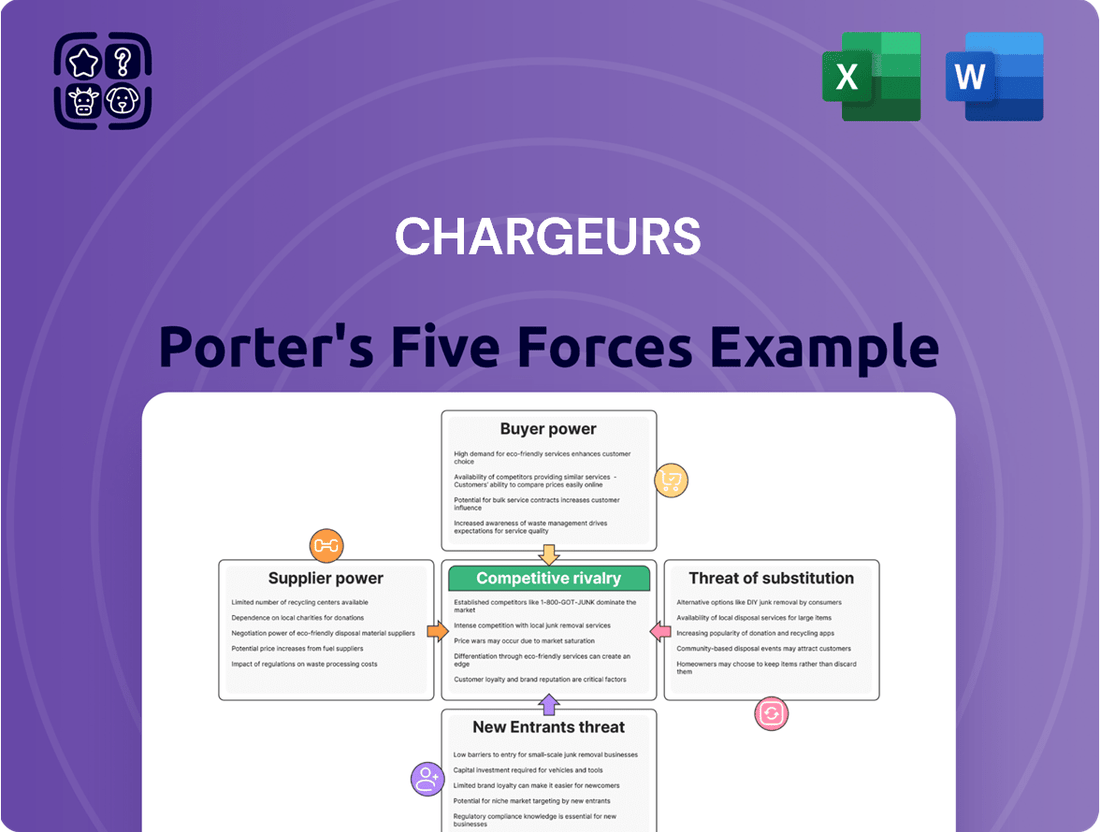

Chargeurs navigates a complex industrial landscape, where the bargaining power of buyers and the intensity of rivalry significantly shape its profitability. Understanding the threat of new entrants and the availability of substitutes is crucial for predicting market shifts.

The influence of suppliers, particularly for specialized materials, also presents a key dynamic that Chargeurs must manage effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Chargeurs’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Chargeurs operates in niche business-to-business markets, and the number of suppliers for its specialized products, like temporary protective films and technical interlinings, significantly influences supplier power. If there are only a handful of companies that can provide essential, high-quality materials, those suppliers gain leverage.

For instance, in 2024, the specialty chemical sector, which supplies raw materials for protective films, saw consolidation. A report indicated that the top three global suppliers controlled over 60% of the market for certain advanced polymers crucial for high-performance films, directly increasing their bargaining power over buyers like Chargeurs.

Chargeurs' strategic focus on high-value-added solutions often necessitates the use of unique or proprietary inputs. This reliance on specialized materials, which may not have readily available substitutes, further amplifies the bargaining power of the few suppliers capable of meeting these stringent quality and performance requirements.

The uniqueness of inputs is a critical factor in supplier bargaining power for Chargeurs. For instance, if suppliers provide highly specialized materials for Chargeurs' high-tech surface solutions or advanced interlinings, and these inputs are difficult to source elsewhere or require proprietary manufacturing processes, those suppliers gain considerable leverage. This limits Chargeurs' ability to negotiate favorable pricing or terms, as switching suppliers would be costly and time-consuming.

Chargeurs' NATIVA™ program, which focuses on traceable natural fibers, exemplifies this. While it adds significant value and brand appeal, it also potentially binds the company to specific, certified suppliers who meet stringent traceability and quality standards. This dependency can strengthen the bargaining power of these select suppliers, especially if the certification process is complex and creates high switching costs for Chargeurs.

The bargaining power of suppliers for Chargeurs is significantly influenced by switching costs. For instance, if a key component supplier for Chargeurs' specialized B2B solutions changes, the process of re-tooling production lines or re-certifying new products can be extensive and costly. These costs directly translate into increased leverage for the incumbent supplier.

These switching costs can include not only direct financial outlays but also the time and resources dedicated to integrating a new supplier's materials and ensuring they meet Chargeurs' stringent quality standards. Such complexities make it less practical for Chargeurs to frequently change suppliers for critical inputs, thereby bolstering supplier power.

In 2024, the trend towards more specialized and integrated B2B supply chains means that the effort required to onboard a new supplier for critical components can extend for months, involving extensive testing and validation. This operational inertia means suppliers of highly specialized components for Chargeurs often hold considerable sway.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Chargeurs' operations significantly enhances their bargaining power. If a supplier possesses critical technology or a unique market position, they might consider directly engaging in Chargeurs' manufacturing or even reaching out to Chargeurs' end customers. This prospect forces Chargeurs to consider the supplier's potential competitive actions when negotiating terms.

For instance, if a key supplier of specialized materials for Chargeurs' textile divisions found the profit margins in direct garment manufacturing attractive, they could pose a credible threat. This leverage is particularly potent when the supplier's components are highly specialized and difficult for Chargeurs to source elsewhere. The supplier's ability to potentially capture more of the value chain makes them a more formidable negotiating party.

Consider the global textile market. In 2024, specialized fabric manufacturers often hold considerable sway. For example, a supplier of advanced, waterproof membranes for outdoor apparel could, in theory, begin producing their own branded waterproof jackets. This would directly compete with brands like those Chargeurs might supply, thereby increasing the supplier's leverage over existing customers.

- Increased Supplier Leverage: Suppliers capable of forward integration gain substantial bargaining power, influencing pricing and terms.

- Strategic Threat: For Chargeurs, this means managing relationships with suppliers who could become direct competitors.

- Industry Example: In sectors where component specialization is high, suppliers might explore moving into the manufacturing of finished goods.

- Impact on Margins: Suppliers may be motivated by attractive profit margins within the buyer's industry, driving integration decisions.

Importance of Chargeurs to Supplier

The bargaining power of suppliers for Chargeurs is significantly influenced by how crucial Chargeurs is to a supplier's business. If Chargeurs represents a substantial portion of a supplier's revenue, that supplier might be more inclined to offer competitive pricing and favorable terms to maintain the relationship. This dependency on Chargeurs can thus diminish the supplier's leverage.

For instance, if a key raw material supplier for Chargeurs' packaging division experiences a significant portion of its sales coming from Chargeurs, it might be hesitant to implement aggressive price hikes. This is particularly true if Chargeurs has the ability to switch to alternative suppliers, even if those alternatives are slightly less ideal. In 2023, the global packaging market saw various material cost fluctuations, making supplier relationships critical for cost management.

- Supplier Dependence: If a supplier's revenue is heavily reliant on Chargeurs, their bargaining power is reduced.

- Chargeurs' Purchasing Volume: Large order volumes for Chargeurs can give it more negotiating power.

- Availability of Alternatives: The presence of many alternative suppliers weakens the power of any single supplier.

- Switching Costs for Chargeurs: High costs to switch suppliers would increase supplier power.

The bargaining power of suppliers for Chargeurs is amplified when they offer highly specialized or differentiated inputs that are critical to Chargeurs' product performance. For example, in 2024, the market for advanced polymer films used in Chargeurs' protective solutions saw a limited number of suppliers capable of meeting stringent UV resistance and adhesion requirements, giving them significant pricing leverage.

High switching costs further bolster supplier power. If Chargeurs must invest heavily in re-tooling or re-qualifying materials when changing suppliers for its technical interlinings, incumbent suppliers gain considerable influence. This was evident in early 2024 as companies faced lengthy validation processes for new material integrations.

The threat of forward integration by suppliers also increases their leverage. A supplier of unique natural fibers for Chargeurs’ NATIVA™ program could potentially move into producing finished textile goods, directly competing with Chargeurs’ clients and strengthening their negotiating position.

Conversely, if Chargeurs represents a substantial portion of a supplier's revenue, that supplier's bargaining power is diminished. For instance, a supplier heavily reliant on Chargeurs’ packaging film orders in 2023 might be more flexible on pricing to retain that significant business.

| Factor | Impact on Supplier Bargaining Power for Chargeurs | Example/Data Point (2024) |

|---|---|---|

| Supplier Specialization & Differentiation | Increases Power | Limited suppliers for high-performance polymer films (e.g., UV resistance) |

| Switching Costs for Chargeurs | Increases Power | Lengthy re-tooling/re-qualification for new materials |

| Threat of Forward Integration | Increases Power | Textile fiber suppliers potentially entering finished goods production |

| Chargeurs' Importance to Supplier Revenue | Decreases Power | Supplier reliant on Chargeurs' packaging film orders |

What is included in the product

This analysis dissects the competitive landscape for Chargeurs, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its markets.

Effortlessly visualize competitive intensity across all five forces with a dynamic, interactive dashboard, instantly highlighting areas of strategic vulnerability.

Customers Bargaining Power

Customer concentration can significantly impact bargaining power. If Chargeurs relies heavily on a few major clients, these large buyers can leverage their importance to negotiate lower prices or more favorable contract terms. This is particularly relevant in B2B markets where relationships with key industrial clients, fashion houses, or luxury brands are crucial.

For instance, Chargeurs' recent success in securing substantial orders from prominent American fashion brands in its PCC division demonstrates the potential influence of these significant customers. Such concentrated demand means these key clients hold considerable sway over pricing and service expectations, directly affecting Chargeurs' profitability and operational flexibility.

The bargaining power of customers for Chargeurs hinges significantly on switching costs. If customers find it difficult and expensive to move to a competitor, their power to demand lower prices or better terms diminishes.

For Chargeurs' specialized products, such as advanced temporary protective films used in demanding industrial applications or technical interlinings in high-performance textiles, switching costs can be substantial. These costs can include the expense of re-qualifying new suppliers, potential disruptions to production lines, or the loss of specific product performance characteristics that Chargeurs' offerings provide. In 2024, many B2B clients in the automotive and aerospace sectors, for instance, operate with tightly integrated supply chains where substituting a critical component like a specialized film requires extensive testing and certification, often costing tens of thousands of dollars and months of development time.

Conversely, if Chargeurs' products are more commoditized or if there are many easily accessible alternatives that meet similar performance standards, customers will possess greater bargaining power. This is because they can readily switch to a competitor with minimal disruption or cost, forcing Chargeurs to compete more aggressively on price and service to retain their business.

Customer price sensitivity for Chargeurs is a key factor. It hinges on how crucial Chargeurs' products are to a customer's overall expenses, their profit margins, and whether viable alternatives exist. If customers operate in intensely competitive markets, they are more likely to push for lower prices, directly impacting Chargeurs.

For example, the recent economic headwinds, including a slowdown in the European luxury market, have demonstrably affected Chargeurs PCC's revenue streams. This indicates that customers do indeed react to broader market conditions, and these reactions can translate into price pressures on suppliers like Chargeurs.

Threat of Backward Integration by Customers

Large manufacturers who are significant buyers of Chargeurs' products, such as films and interlinings, possess a notable threat of backward integration. This means they could potentially start producing these materials in-house, bypassing Chargeurs as a supplier. For instance, a major automotive manufacturer, a key customer for specialized films, might consider developing its own film production capabilities if the technical barriers are low and the volume of their purchases is substantial enough to warrant the capital expenditure.

The credibility of this threat is amplified when the underlying technology for producing these components is readily available or easily replicable. If customers can acquire the necessary machinery and expertise without excessive difficulty, their inclination to integrate backward increases. This capability directly enhances their bargaining power with Chargeurs, as they have a viable alternative to relying solely on Chargeurs for their supply needs.

In 2023, the global market for technical films, a segment relevant to Chargeurs' offerings, saw continued investment in advanced manufacturing techniques. Companies with high consumption volumes are increasingly evaluating the cost-benefit of in-house production versus outsourcing. For example, a large textile manufacturer consuming significant quantities of interlinings might assess the economics of establishing its own processing lines, especially if Chargeurs’ pricing or delivery terms become less competitive.

- Customer Integration Risk: Large clients, particularly those in sectors like automotive or high-volume apparel, could vertically integrate by producing films or interlinings themselves.

- Technological Accessibility: The threat is heightened if the technology required for film or interlining production is not proprietary and can be acquired or developed by customers.

- Volume Justification: A customer's substantial consumption volume acts as a key driver for considering backward integration, making the investment economically feasible.

- Increased Bargaining Leverage: The potential for backward integration significantly strengthens customers' negotiating position, allowing them to demand more favorable terms from Chargeurs.

Product Differentiation and Importance to Customer

When Chargeurs' products are highly unique and essential for a customer's end product's quality or performance, it significantly weakens the customer's ability to negotiate lower prices. Chargeurs actively pursues this strategy through innovation, as seen with their H2 textile material designed for technical apparel, which offers distinct performance advantages. This focus on unique features directly reduces the leverage customers have in bargaining.

The company's commitment to developing differentiated offerings, such as the Sustainable 360 collection, further solidifies its position. By providing products that are difficult for competitors to replicate and are vital to customer success, Chargeurs can command better terms and lessen the impact of customer price pressures. This differentiation is a key tool in managing customer bargaining power.

- Chargeurs' H2 textile material for technical apparel showcases product uniqueness.

- The Sustainable 360 collection further enhances product differentiation.

- Highly differentiated products reduce customer ability to negotiate lower prices.

- Chargeurs' innovation directly counters customer bargaining leverage.

When customers have numerous alternatives or can easily switch to competitors, their bargaining power increases. This is particularly true if Chargeurs’ products are perceived as less differentiated or if switching costs are low.

Conversely, if Chargeurs offers highly specialized or unique products that are critical to a customer's operations, this significantly diminishes customer bargaining power. For example, Chargeurs' advanced temporary protective films for sensitive industrial applications, like those used in the automotive sector, often involve substantial switching costs for clients in 2024 due to integration into complex production lines.

The threat of backward integration by large customers also plays a role. If customers can produce the required films or interlinings in-house, they gain considerable leverage. This is more feasible if the technology is accessible and the customer's purchase volume justifies the investment, as seen with large textile manufacturers evaluating in-house interlining production.

| Factor | Impact on Customer Bargaining Power | Relevance to Chargeurs |

|---|---|---|

| Customer Concentration | High power with few large clients | Key fashion brands in PCC influence pricing |

| Switching Costs | Low power with high switching costs | High for specialized films in industrial applications |

| Product Differentiation | Low power with unique, essential products | H2 textile material, Sustainable 360 collection reduce leverage |

| Backward Integration Threat | High power if customers can produce in-house | Considered by high-volume clients if technology is accessible |

Same Document Delivered

Chargeurs Porter's Five Forces Analysis

This preview provides a comprehensive Chargeurs Porter's Five Forces Analysis, detailing the competitive landscape of the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency. It covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning.

Rivalry Among Competitors

Chargeurs competes in niche global B2B markets, meaning the sheer number of direct rivals might not be overwhelming, but the ones that exist are often substantial and well-entrenched. The intensity of competition hinges significantly on the market dominance held by these larger entities and their overarching strategic goals. For instance, in 2023, the global textile industry, a key area for Chargeurs, was valued at over $1 trillion, demonstrating the scale of the market and the potential impact of major players.

The strategic maneuvers of these competitors, such as their investment in new technologies or their expansion into emerging markets, directly shape the competitive landscape. Chargeurs' own strategy of bolstering its standing within the textile value chain and entering new territories via acquisitions underscores the dynamic and competitive nature of these sectors. This approach suggests a recognition of the significant market share and strategic influence wielded by existing competitors.

The growth rate of the industries Chargeurs operates within directly influences how intensely its competitors battle for business. In sectors experiencing slower growth, or those that are already mature, companies often resort to more aggressive tactics to capture existing market share, thereby intensifying rivalry. This dynamic is evident as Chargeurs reported an 11.9% revenue increase in 2024, indicating some positive momentum across its diverse markets. However, specific segments, such as the European luxury textile market, have seen a noticeable slowdown, which can heighten competitive pressures within those particular niches.

Chargeurs actively pursues product differentiation through innovation, exemplified by its H2 materials and the NATIVA™ program, which offers traceable fibers. This focus on high-value-added solutions aims to make its offerings distinct from competitors.

By developing unique product features and quality, Chargeurs seeks to increase customer loyalty and create barriers to switching. For instance, its commitment to sustainability through programs like NATIVA™ can resonate with environmentally conscious clients, making them less inclined to switch to less sustainable alternatives.

These efforts to build strong differentiation and customer relationships directly address and can help to soften the intensity of competitive rivalry within its operating markets.

Exit Barriers

High exit barriers can trap competitors in a market, even when they are not performing well, which in turn fuels more intense rivalry. This situation arises when leaving the market is costly or impractical.

For Chargeurs, while specific exit barrier data isn't publicly itemized for all its diverse segments, the nature of specialized manufacturing often implies significant investments in fixed assets. These assets, such as dedicated machinery or unique production lines, are not easily converted to other uses. This inflexibility makes it difficult for companies to divest or shut down operations without substantial financial loss, effectively keeping them in the competitive landscape.

Consider the textile and technical fabrics sectors where Chargeurs operates. Specialized looms, dyeing equipment, and finishing machinery represent substantial capital outlays. The cost of decommissioning or selling these specialized assets at a loss can be a major deterrent to exiting. Furthermore, long-term supply contracts or commitments to employees can also act as exit barriers, increasing the financial and social costs associated with leaving the market.

These factors contribute to a scenario where even underperforming players may continue to operate, potentially leading to price wars or increased competitive pressure on more successful firms within the industry.

- Specialized Assets: High capital investment in unique manufacturing equipment can prevent easy exit.

- Long-Term Contracts: Existing agreements with suppliers or customers can bind companies to operations.

- Social Costs: Obligations to employees, such as severance packages or retraining, can increase exit expenses.

- Industry Structure: Mature industries with established players may have higher barriers to exit due to sunk costs.

Diversity of Competitors

The competitive landscape for businesses is often characterized by a wide array of players with differing approaches. This diversity in strategies, origins, and ultimate goals can significantly fuel rivalry. For instance, some companies might prioritize being the lowest-cost provider, while others focus on creating unique, premium products. This divergence means competitors might not always be directly vying for the same customer segment or employing similar tactics, leading to more complex and unpredictable market dynamics.

Consider the automotive industry in 2024. We see established giants like Toyota, known for its reliability and cost-efficiency, competing with newer entrants like Tesla, which emphasizes innovation and electric vehicle technology. Furthermore, state-owned enterprises in some markets may operate with different profit motives and capital structures compared to publicly traded companies, adding another layer of complexity. This mix of business models and strategic objectives means that competitive responses can be varied and sometimes surprising, intensifying the overall competitive rivalry.

- Varying Strategic Focus: Competitors might pursue cost leadership, differentiation, or niche market strategies, leading to unpredictable competitive actions.

- Diverse Origins: Companies with different national origins or ownership structures (e.g., state-owned vs. private) can have distinct objectives and operational philosophies.

- Differing Objectives: A company aiming for market share dominance might act differently than one focused purely on short-term profit maximization.

- Unpredictable Behavior: The combination of diverse strategies and objectives makes it harder for businesses to anticipate and counter rivals' moves, thus increasing rivalry intensity.

Chargeurs operates in niche global B2B markets where substantial, well-entrenched competitors exist, driving intense rivalry. The company's focus on product differentiation, such as its H2 materials and NATIVA™ traceable fibers, aims to set it apart. However, high exit barriers, stemming from significant investments in specialized manufacturing assets and long-term contracts within sectors like textiles, can keep underperforming players in the market, further intensifying competition.

The diverse strategic objectives of competitors, ranging from cost leadership to premium differentiation, coupled with differing ownership structures (e.g., private versus state-owned enterprises), create a complex and often unpredictable competitive environment. Chargeurs' reported 11.9% revenue increase in 2024 highlights positive momentum, yet market-specific slowdowns, like in European luxury textiles, can escalate competitive pressures.

| Competitive Factor | Impact on Chargeurs | Example/Data Point |

|---|---|---|

| Number and Strength of Rivals | High rivalry due to few but powerful competitors | Global textile market over $1 trillion (2023) |

| Industry Growth Rate | Intensified rivalry in slower-growth segments | European luxury textile market slowdown noted |

| Product Differentiation | Chargeurs uses innovation (H2 materials, NATIVA™) to mitigate rivalry | Focus on traceable fibers for sustainability |

| Exit Barriers | High barriers (specialized assets) can prolong competitive pressure | Specialized machinery in textile manufacturing |

| Strategic Diversity | Varied competitor strategies increase unpredictability | Cost leadership vs. differentiation strategies |

SSubstitutes Threaten

The threat of substitutes for Chargeurs' product lines, including temporary protective films, technical interlinings, and luxury wool, hinges on the availability of alternative materials or technologies that can perform similar functions. For instance, new surface protection methods or different textile options for fashion could arise, offering comparable performance at a potentially different price.

Chargeurs is actively addressing this by innovating with sustainable materials, such as recycled synthetic fibers and cotton waste. This strategy aims to preemptively mitigate the impact of substitutes by offering eco-friendly alternatives that still meet performance requirements.

Customers constantly evaluate the price-performance trade-off when considering substitutes for Chargeurs' products. If an alternative offers comparable functionality or quality at a lower price point, or superior performance for a similar cost, the threat of substitution intensifies significantly.

For instance, in the textile sector where Chargeurs is active, a new synthetic fiber that offers similar breathability and durability as Chargeurs' premium natural fibers but at a 20% lower manufacturing cost presents a direct competitive threat. This forces Chargeurs to continually innovate and highlight the unique value proposition of its offerings.

Chargeurs' strategic emphasis on high-tech and value-added solutions, such as advanced technical textiles for aerospace and defense, is designed to command premium pricing. This focus aims to create a moat against lower-cost, less sophisticated alternatives that may not meet the stringent performance requirements of these demanding industries.

As of early 2024, the global market for technical textiles, a key segment for Chargeurs, was projected to reach over $250 billion by 2028, indicating strong demand but also intense competition from both established players and emerging material science innovators who might offer disruptive price-performance ratios.

Chargeurs' B2B customers consider switching to alternatives based on several factors. Their tolerance for risk plays a significant role; a customer less concerned about potential disruptions might explore new options more readily. The criticality of a component to the final product also matters; if it's a minor part, switching might be easier.

Industry shifts, particularly towards sustainability, can significantly boost customer willingness to adopt substitutes. For example, in the textile industry, a growing demand for recycled or biodegradable materials could push buyers towards suppliers offering these eco-friendly alternatives. Chargeurs is actively responding to this trend by investing in sustainable materials and processes, aiming to mitigate the threat of substitution.

In 2024, the global market for sustainable textiles, a key area for Chargeurs, continued its upward trajectory. Reports indicate growth exceeding 5% year-over-year, driven by consumer and regulatory pressure for environmentally responsible products. This presents a clear opportunity for Chargeurs to leverage its ESG initiatives to retain and attract customers who prioritize sustainability, thereby diminishing the appeal of less eco-conscious substitutes.

Technological Advancements

Technological advancements present a significant threat of substitutes for Chargeurs. Breakthroughs in material science or unrelated industries can introduce novel solutions that bypass existing offerings. For example, new synthetic materials might emerge with superior performance characteristics, directly competing with Chargeurs' current product lines.

Chargeurs' commitment to research and development is therefore paramount in mitigating this threat. The development of innovative materials, such as the H2 textile material by Chargeurs PCC, demonstrates a proactive approach to anticipating and countering potential substitutes. This continuous innovation helps maintain a competitive edge and adapt to evolving market demands.

Consider the impact of advancements in biodegradable or recyclable packaging materials. If such technologies mature rapidly, they could offer a compelling alternative to Chargeurs' current textile solutions in certain applications, especially for environmentally conscious consumers and businesses. Chargeurs' R&D efforts need to monitor and potentially integrate such sustainable innovations.

The pace of technological change means that even established product categories can be disrupted. Chargeurs must remain vigilant, monitoring not just direct competitors but also adjacent industries that might leverage new technologies to create substitute products. This requires a broad understanding of market trends and a flexible innovation pipeline.

- Rapid technological advancements in fields like advanced polymers or bio-engineered materials could yield novel substitutes for Chargeurs' textile and film products.

- Chargeurs' R&D investment, exemplified by innovations like the H2 textile material, is critical for developing proprietary solutions that outcompete emerging substitutes.

- **The emergence of high-performance, sustainable alternatives** in packaging or industrial textiles could significantly impact Chargeurs' market share if not met with comparable innovation.

- **Monitoring adjacent industries** for disruptive technologies is essential to proactively address the threat of substitutes before they become widespread.

Regulatory or Environmental Shifts

Changes in regulations or growing environmental consciousness can certainly push customers towards substitutes. For instance, if materials historically used by Chargeurs face tougher environmental rules, or if clients increasingly seek greener choices, then eco-friendly alternatives, even if initially less effective or more expensive, could pose a greater threat. Chargeurs PCC's commitment to its ESG strategy and its Sustainable 360 product line are direct responses to these evolving market demands.

The company actively addresses these potential shifts through its robust ESG framework. In 2023, Chargeurs reported a 20% reduction in CO2 emissions compared to its 2019 baseline, demonstrating tangible progress in sustainability. This proactive approach aims to mitigate the threat of substitutes driven by regulatory pressures and consumer preference for environmentally responsible products.

- Regulatory Impact: Stricter environmental laws can make traditional materials less viable, increasing the appeal of substitutes.

- Consumer Demand: A heightened focus on sustainability by customers can drive adoption of eco-friendly alternatives, even at a premium.

- Chargeurs' Response: The company's ESG plan and Sustainable 360 collection are designed to meet these evolving demands.

- Performance Data: Chargeurs achieved a 20% reduction in CO2 emissions by the end of 2023 against a 2019 benchmark.

The threat of substitutes for Chargeurs' offerings is influenced by technological advancements and changing consumer preferences, particularly towards sustainability. Chargeurs' investment in R&D, like its H2 textile material, and its focus on ESG initiatives, such as the Sustainable 360 product line, are strategic responses to mitigate these threats.

For example, the growing demand for eco-friendly packaging materials could present a substitute threat to some of Chargeurs' protective films. Similarly, in the textile sector, advancements in biodegradable or recycled fibers might offer alternatives to traditional materials.

Chargeurs' commitment to sustainability is demonstrated by its 20% reduction in CO2 emissions by the end of 2023, compared to a 2019 baseline. This proactive approach aims to align with increasing regulatory pressures and consumer demand for environmentally responsible products, thereby lessening the appeal of less sustainable substitutes.

| Factor | Impact on Chargeurs | Mitigation Strategy | Example |

|---|---|---|---|

| Technological Advancements | Emergence of novel materials or processes that perform similar functions. | Continuous R&D investment, development of proprietary solutions. | New bio-engineered fibers competing with technical textiles. |

| Sustainability Push | Increased customer preference for eco-friendly alternatives. | ESG framework, Sustainable 360 product line, reduced carbon footprint. | Demand for recycled materials in packaging films. |

| Price-Performance Trade-off | Lower-cost substitutes with comparable quality. | Focus on high-tech, value-added solutions, emphasizing unique value proposition. | Synthetic fibers offering similar performance at a lower cost than premium natural fibers. |

Entrants Threaten

The substantial capital needed to enter Chargeurs' specialized manufacturing segments presents a considerable hurdle for potential new competitors. Setting up advanced production lines for high-technology films, sophisticated textile interlinings, or efficient wool processing demands significant upfront investment in cutting-edge machinery, ongoing research and development, and robust supply chain networks. This financial barrier naturally discourages many smaller or less capitalized firms from entering the market.

Chargeurs' strategic acquisitions, such as the integration of Cilander, further solidify its existing asset base and operational scale. This consolidation can increase the already high capital requirements for new entrants, as they would need to compete not only with established technology and infrastructure but also with a larger, more integrated entity. For instance, in 2023, Chargeurs continued its investment in capacity expansion and modernization, underscoring the ongoing capital intensity of its operations.

Chargeurs likely benefits from significant economies of scale across its global operations, particularly in areas like raw material procurement and manufacturing. This allows the company to achieve lower per-unit production costs compared to potential new entrants who would struggle to match this efficiency without substantial upfront investment. For instance, Chargeurs' extensive global footprint, serving customers in nearly 100 countries, facilitates bulk purchasing and optimized logistics, further solidifying its cost advantage.

Chargeurs' commitment to innovation and sustainability fosters strong product differentiation, making it difficult for new companies to enter. Their focus on high-value-added solutions cultivates deep customer loyalty, especially within demanding B2B segments like luxury goods. For instance, in 2024, the company continued to highlight its advancements in bio-based materials and circular economy initiatives, key differentiators in a competitive landscape.

New entrants face a significant hurdle in replicating Chargeurs' established brand recognition and the trust built through long-standing customer relationships. Overcoming these entrenched preferences, particularly in premium markets, requires substantial investment in research and development, aggressive marketing campaigns, and dedicated efforts to build new client connections. The strategic rebranding to Compagnie Chargeurs Invest in 2024 further solidifies their market presence and signals continued investment in brand strength.

Access to Distribution Channels

Access to distribution channels presents a significant barrier for new entrants looking to compete with Chargeurs. For instance, in the textile industry, securing shelf space or gaining access to established B2B networks often requires substantial upfront investment and proven track records, which newcomers typically lack.

Chargeurs has cultivated deep, long-standing relationships with a diverse global clientele, including major industrial clients, prominent fashion brands, and luxury textile manufacturers. These established connections are not easily replicated, making it difficult for new players to penetrate existing supply chains and gain significant market share.

Successfully entering these established networks would likely necessitate considerable sales and marketing expenditures for new entrants. In 2024, the average cost to acquire a new B2B customer in specialized manufacturing sectors often exceeds tens of thousands of dollars, reflecting the effort required to build trust and secure initial orders.

- Established Customer Loyalty: Chargeurs' existing customer base demonstrates high loyalty, making it challenging for new entrants to displace them.

- B2B Network Penetration: Gaining access to Chargeurs' established B2B distribution channels requires significant time and resources.

- High Initial Marketing Costs: Newcomers face substantial sales and marketing expenses to build brand awareness and secure initial client relationships.

- Limited Alternative Channels: The specialized nature of Chargeurs' markets often means fewer readily available alternative distribution avenues for new competitors.

Government Policy and Regulation

Government policies and regulations significantly shape the threat of new entrants for companies like Chargeurs. Stringent environmental regulations, for instance, can impose substantial compliance costs, making it harder for new players to enter the market. Similarly, trade barriers, such as tariffs or quotas on imported materials, can increase the operational expenses for any company, including potential new competitors. Industry-specific certifications are also crucial; obtaining and maintaining these can be both time-consuming and expensive.

Chargeurs PCC's commitment to various certifications underscores the importance of navigating this regulatory environment. For example, certifications like the Global Recycled Standard (GRS), Global Organic Textile Standard (GOTS), Responsible Wool Standard (RWS), and Oeko-Tex are not merely quality markers but also reflect adherence to complex and evolving environmental and social standards. These requirements act as significant barriers, elevating the cost and complexity for new entrants aiming to compete in markets where these certifications are expected or mandated.

- Environmental Regulations: Compliance costs for emissions, waste management, and sustainable sourcing can deter new entrants.

- Trade Barriers: Tariffs and import restrictions increase raw material costs, impacting profitability and market entry feasibility.

- Industry Certifications: Standards like GRS, GOTS, RWS, and Oeko-Tex require investment in processes and audits, creating a hurdle for newcomers.

- Safety Standards: Adherence to product safety regulations, particularly in sectors like protective films, necessitates rigorous testing and quality control.

The threat of new entrants for Chargeurs is mitigated by substantial capital requirements, the need for advanced technology, and the establishment of economies of scale, making it difficult for new players to compete on cost and efficiency.

Chargeurs' strong brand reputation, deep customer relationships, and established distribution networks create significant barriers, demanding high initial marketing costs and extensive sales efforts from potential competitors seeking to gain market access.

Government regulations, environmental standards, and mandatory industry certifications further deter new entrants by increasing compliance costs and the complexity of market entry, particularly in specialized manufacturing sectors.

| Barrier Type | Impact on New Entrants | Chargeurs' Advantage |

|---|---|---|

| Capital Requirements | High upfront investment in advanced machinery and R&D. | Established operational scale and ongoing investment in modernization. |

| Brand & Relationships | Difficulty replicating brand recognition and trust. | Long-standing customer loyalty and deep B2B network penetration. |

| Regulatory Environment | Costs associated with environmental compliance and industry certifications (e.g., GRS, Oeko-Tex). | Existing infrastructure and processes to meet stringent global standards. |

| Economies of Scale | Inability to match lower per-unit costs due to smaller production volumes. | Global procurement power and optimized logistics leading to cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a robust mix of data, including company annual reports, industry-specific market research, and government economic data, to provide a comprehensive view of competitive pressures.