CF Industries Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CF Industries Holdings Bundle

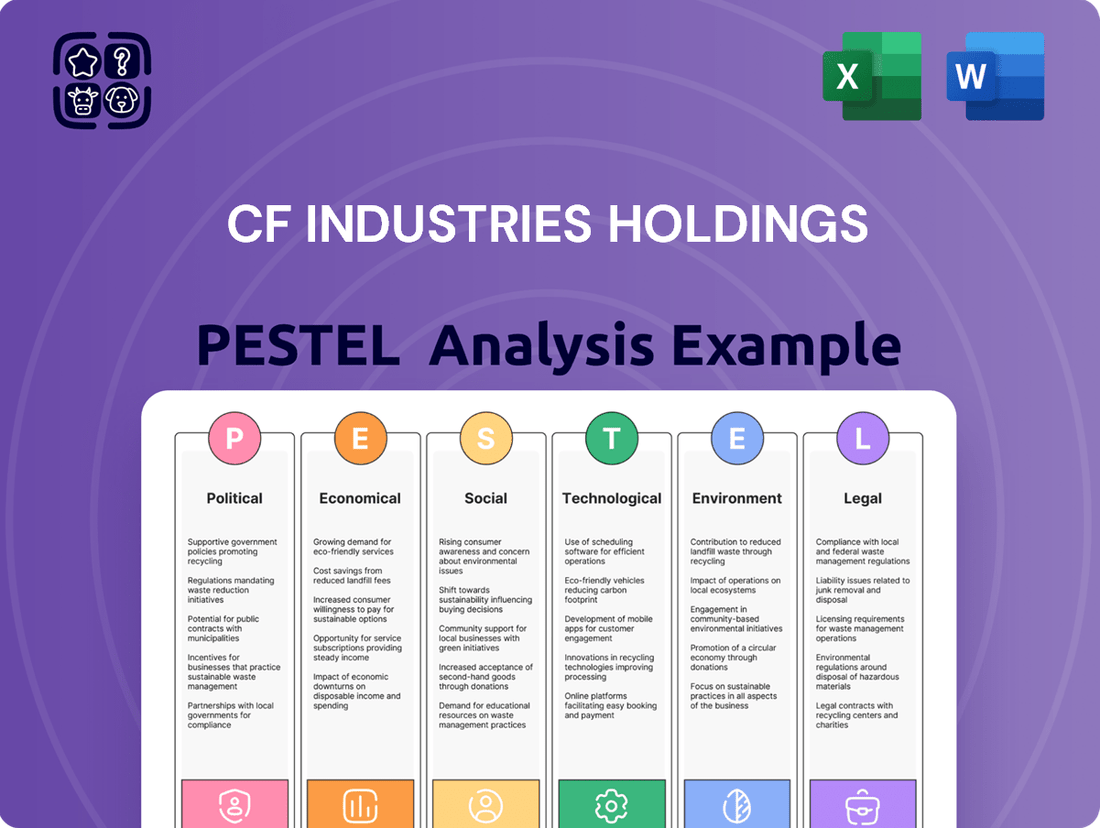

Unlock the strategic advantages of CF Industries Holdings by understanding the intricate web of external forces. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are actively shaping the company's trajectory. Gain a competitive edge by leveraging these critical insights.

Don't get left behind in the dynamic agricultural and industrial landscape. Our comprehensive PESTLE analysis for CF Industries Holdings provides actionable intelligence to navigate regulatory shifts, economic volatilities, and technological advancements. Download the full version now to empower your strategic decision-making.

Political factors

Governmental agricultural policies, such as subsidies and import/export regulations, significantly shape the demand for fertilizers and overall agricultural output, directly impacting CF Industries' sales and market potential. For instance, anticipated increases in US corn planted acreage for 2025 are projected to boost nitrogen demand, a key product for CF Industries.

International trade policies, such as tariffs and quotas, directly influence CF Industries' global market access and competitive positioning. For example, changes in trade agreements or the imposition of new tariffs can alter the cost of importing raw materials or exporting finished fertilizer products, impacting profitability and market share.

China's continued restrictions on urea exports, a significant global supply factor, have demonstrably tightened worldwide availability. This has contributed to price volatility and supply chain challenges for CF Industries, affecting its ability to secure raw materials and meet international demand efficiently in 2024 and into 2025.

Government energy policies and regulations significantly impact CF Industries, especially concerning natural gas, their primary feedstock. Policies in North America that aim to keep energy costs low can boost CF's competitive edge. For instance, the U.S. Department of Energy's initiatives to enhance natural gas production and infrastructure, as seen in ongoing investments through 2024, directly benefit CF's cost structure.

Conversely, higher energy costs in regions like Europe, driven by factors such as the EU's energy transition policies and geopolitical events impacting supply, create favorable price differentials for CF Industries. This widening gap in energy costs, with North American natural gas remaining more affordable than European equivalents, enhances CF's export competitiveness and profitability. The International Energy Agency noted in its 2024 outlook that natural gas prices in Europe, while stabilizing, remained substantially higher than in the U.S., a trend that supports CF's market position.

Clean Energy and Decarbonization Initiatives

Government support for clean energy and decarbonization initiatives significantly influences CF Industries' strategic direction. Policies like tax credits for carbon capture and clean hydrogen production are crucial for the company's investments in low-carbon ammonia. For instance, the U.S. Inflation Reduction Act (IRA) allocates substantial funding, including a $3 billion Clean Hydrogen Production Tax Credit (45V), and extended tax credits for carbon capture (45Q), directly benefiting projects CF Industries is pursuing. Similarly, the EU's Fit for 55 plan aims to reduce greenhouse gas emissions by 55% by 2030, creating a favorable environment for low-carbon fertilizer solutions.

These legislative frameworks are not just incentives but also shape long-term growth strategies. CF Industries is actively leveraging these policies to advance its clean ammonia projects, recognizing their importance in meeting future energy demands and environmental targets. The company’s commitment to decarbonization is directly tied to the success and longevity of these governmental programs.

- Government Support: Tax credits for carbon capture and clean hydrogen production are key drivers for CF Industries' low-carbon ammonia investments.

- U.S. Inflation Reduction Act (IRA): Provides significant financial incentives, including a $3 billion Clean Hydrogen Production Tax Credit (45V) and extended carbon capture tax credits (45Q).

- EU's Fit for 55 Plan: Aims for a 55% greenhouse gas emission reduction by 2030, fostering demand for low-carbon solutions.

- Strategic Impact: These policies directly influence CF Industries' long-term growth strategy and investment decisions in decarbonization efforts.

Geopolitical Stability and Supply Chain Resilience

Geopolitical events, such as the ongoing conflict in Eastern Europe, significantly impact global commodity markets and fertilizer supply chains. CF Industries, as a major producer, faces potential disruptions to its raw material sourcing, particularly natural gas, a key input for nitrogen fertilizer production. For instance, in 2023, natural gas prices in Europe remained volatile, affecting production costs for many industrial players.

The company's extensive global distribution network, crucial for reaching diverse agricultural markets, is also vulnerable to trade restrictions and political tensions. These factors can impede the timely and cost-effective delivery of its products, influencing market access and sales volumes. CF Industries' reliance on international shipping routes means it's exposed to the ripple effects of global instability on logistics.

- Supply Chain Vulnerability: Geopolitical instability can lead to shortages and price spikes for essential raw materials like natural gas, impacting CF Industries' production costs and output.

- Distribution Network Risks: Trade policies, sanctions, and regional conflicts can disrupt CF Industries' ability to transport and sell its products in key international markets.

- Market Access Challenges: Political tensions can create barriers to market entry or expansion, affecting CF Industries' revenue streams and growth opportunities.

Government agricultural policies, including subsidies and trade regulations, directly influence fertilizer demand and agricultural output, impacting CF Industries' market. For example, projected increases in U.S. corn acreage for 2025 are expected to drive higher nitrogen demand, a core product for CF Industries.

International trade policies, such as tariffs and quotas, affect CF Industries' global market access and competitiveness. Changes in trade agreements or new tariffs can alter the costs of raw materials and finished products, impacting profitability and market share.

China's ongoing restrictions on urea exports have tightened global availability, contributing to price volatility and supply chain challenges for CF Industries in 2024 and into 2025.

Government energy policies are critical, especially regarding natural gas, CF Industries' primary feedstock. North American policies promoting low energy costs enhance CF's competitive edge, supported by U.S. Department of Energy initiatives to boost natural gas production through 2024.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CF Industries Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It equips stakeholders with actionable insights into how these forces shape strategic decisions and market positioning for CF Industries Holdings.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex PESTLE factors impacting CF Industries into actionable insights.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining political, economic, social, technological, environmental, and legal influences on CF Industries.

Economic factors

Global energy costs, particularly the price of natural gas, are a critical driver for CF Industries. In early 2024, natural gas prices saw volatility, with benchmarks like Henry Hub fluctuating. For instance, if natural gas prices were around $2.50 per MMBtu, this would represent a significant input cost for CF Industries' ammonia production.

These fluctuations directly affect CF Industries' profitability. Lower energy costs can translate to reduced manufacturing expenses, but this benefit is often offset by lower average selling prices for their nitrogen fertilizers, as the market adjusts to the cheaper production inputs.

The prices of agricultural commodities, especially corn, and the returns farmers receive directly impact the demand for nitrogen fertilizers. When corn prices are strong and farmers anticipate good profits, they tend to plant more, which in turn boosts the need for fertilizers. This trend is particularly evident in major agricultural hubs like North America and Brazil.

For CF Industries, higher anticipated corn plantings in North America for the 2024 season, projected to be around 91.7 million acres according to USDA estimates, signal a strong demand for their nitrogen products. Similarly, favorable crop returns in Brazil are expected to support fertilizer sales in that region. For instance, Brazil's soybean and corn production for the 2023/2024 harvest was forecast to reach record levels, creating a positive environment for fertilizer demand.

The global nitrogen product market is currently experiencing a delicate supply-demand balance. Factors like natural gas shortages in key producing nations such as Iran and Egypt, alongside export limitations imposed by major suppliers like China, are creating tighter supply conditions. In 2024, for instance, elevated natural gas prices in Europe impacted production costs, leading to reduced output from some facilities.

These supply constraints, coupled with consistent demand from the agricultural sector, are driving up nitrogen product prices. Regional production rates, particularly in Europe, are also a significant influence; when European producers face higher energy costs, it can reduce their output and tighten the global supply further, directly affecting market opportunities for companies like CF Industries.

Foreign Currency Exchange Rates

Changes in foreign currency exchange rates significantly influence CF Industries' financial performance, especially given its substantial international operations and export activities. For instance, a stronger US dollar can make CF's products more expensive for foreign buyers, potentially dampening export sales volume. Conversely, a weaker dollar can boost international demand for its fertilizers and industrial products.

These currency fluctuations directly affect the cost of imported raw materials and the repatriated earnings from overseas subsidiaries. For example, if CF Industries sources raw materials in a currency that strengthens against the US dollar, its production costs will rise. This was a consideration in late 2023 and early 2024, as currency markets experienced volatility.

The competitive positioning of CF Industries' products in global markets is also at stake. A favorable exchange rate can enhance the price competitiveness of its fertilizers against those produced by competitors in countries with weaker currencies. This dynamic is crucial for maintaining market share in regions like Europe and South America.

- Impact on Revenue: A stronger USD generally reduces the dollar value of revenues earned in foreign currencies, impacting CF Industries' reported international sales.

- Cost of Goods Sold: Fluctuations in exchange rates can alter the cost of imported raw materials and components, affecting gross margins.

- Competitive Pricing: Exchange rate movements influence the relative pricing of CF Industries' products compared to international competitors, impacting demand.

- Profit Repatriation: Earnings generated by foreign subsidiaries are translated back into US dollars, with exchange rates directly affecting the final reported profit.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact CF Industries' cost of capital. For instance, if the Federal Reserve maintains or increases its benchmark interest rate, borrowing for CF's substantial investments in green ammonia production and carbon capture technologies will become more expensive. This can slow down project timelines or necessitate a re-evaluation of investment priorities.

Access to capital markets remains a critical enabler for CF Industries' ambitious growth plans. In early 2024, the company secured a $1 billion sustainability-linked revolving credit facility, demonstrating its ability to tap into financing. However, a less favorable credit environment or increased market volatility could make it harder to raise funds for future projects, potentially impacting its competitive positioning.

- Interest Rate Sensitivity: Higher borrowing costs due to rising interest rates can reduce the profitability of new capital projects, impacting CF Industries' return on investment for initiatives like its Donaldsonville, Louisiana clean ammonia plant.

- Capital Expenditure Funding: CF Industries' planned capital expenditures, which included approximately $1.3 billion in 2023, are heavily reliant on access to debt and equity markets.

- Financing Costs: Changes in interest rates can significantly alter the annual interest expense for CF Industries, affecting its net income and cash flow available for dividends and reinvestment.

- Investment Grade Credit Rating: Maintaining an investment-grade credit rating is crucial for CF Industries to ensure favorable access to capital at competitive rates, supporting its long-term strategic objectives.

Government policies and regulations significantly shape the fertilizer and industrial products market. For instance, environmental regulations concerning emissions, particularly nitrogen oxides (NOx) and ammonia, directly impact CF Industries' operational costs and investment strategies. The push for decarbonization and sustainable agricultural practices, often driven by government mandates and incentives, is a key factor.

Subsidies for fertilizers or specific farming practices can boost demand, while restrictions on fertilizer use or production can curtail it. For example, the European Union's Farm to Fork strategy aims to reduce nutrient losses, which could influence fertilizer application rates and demand in that region. CF Industries must navigate these varying regulatory landscapes across its operating territories.

Geopolitical events and trade policies also play a crucial role. Trade disputes, tariffs, or export restrictions imposed by countries like China, a major fertilizer exporter, can disrupt global supply chains and price stability. CF Industries' global reach means it is susceptible to these international political and economic shifts.

The ongoing global focus on climate change and sustainability is driving policy changes that affect the fertilizer industry. Initiatives like carbon capture and storage (CCS) and the development of low-carbon ammonia are becoming increasingly important due to regulatory pressures and potential carbon pricing mechanisms. CF Industries' investments in these areas, such as its clean ammonia projects, are directly influenced by these evolving policy landscapes.

What You See Is What You Get

CF Industries Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of CF Industries Holdings covers all critical external factors impacting the company's operations and strategic planning. You'll gain a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape influencing CF Industries.

Sociological factors

The world's population is projected to reach 9.7 billion by 2050, creating an escalating demand for food. This surge directly translates into a greater need for enhanced agricultural productivity, underscoring the essential role of fertilizers in meeting global food security challenges.

Nitrogen fertilizers, a core product for CF Industries, are vital for boosting crop yields. Studies indicate that ammonia and nitrogen-based fertilizers can increase global food production by up to 50%, a critical factor in feeding a growing planet.

Consumers are increasingly prioritizing products grown using sustainable and environmentally conscious methods. This shift directly impacts demand for agricultural inputs, favoring those that minimize environmental impact. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for food produced sustainably, a trend that directly supports CF Industries' investments in low-carbon ammonia production.

The economic well-being of rural areas directly impacts the demand for CF Industries' products. In 2024, global agricultural commodity prices, while fluctuating, generally remained at levels that supported farmer investment in inputs. For instance, U.S. corn prices saw a notable increase in late 2023 and early 2024, which historically correlates with higher fertilizer purchases.

Farmer livelihoods are sensitive to input costs, including fertilizer prices. While fertilizer prices saw some volatility in 2023-2024, they stabilized somewhat compared to the extreme highs of 2022. This stabilization, coupled with continued demand for food, allows farmers to better plan their expenditures, though managing the cost of nitrogen, a key CF Industries product, remains a critical consideration for their profitability.

Public Perception of Chemical Use in Agriculture

Public perception regarding the use of chemical fertilizers in agriculture significantly shapes regulatory landscapes and consumer preferences for food production methods. Growing awareness of environmental sustainability and potential health impacts can drive demand for organic or reduced-chemical farming practices, directly affecting the market for conventional fertilizers. For instance, a 2024 survey indicated that 65% of consumers are willing to pay more for produce grown using sustainable farming methods, which often implies reduced reliance on synthetic inputs.

CF Industries' commitment to nutrient management and minimizing its environmental footprint is crucial for navigating this evolving public sentiment. Investments in technologies that enhance fertilizer efficiency and reduce emissions, such as low-carbon ammonia production, directly address public concerns. The company's 2024 sustainability report highlighted a 10% reduction in greenhouse gas intensity from its manufacturing operations compared to 2020, demonstrating a proactive approach to environmental stewardship.

- Growing consumer demand for sustainable agriculture: Surveys in 2024 show a significant portion of consumers favoring produce grown with fewer chemical inputs.

- Influence on regulatory pressure: Negative public perception can lead to stricter environmental regulations on fertilizer production and use.

- CF Industries' sustainability initiatives: The company is actively investing in efficient nutrient management and low-carbon production technologies.

- Environmental impact reduction: CF Industries reported a 10% decrease in greenhouse gas intensity in 2024, aligning with public environmental expectations.

Workforce Safety and Community Engagement

CF Industries places a high priority on workforce safety, recognizing it as fundamental to their social license to operate. This commitment extends to actively engaging with the communities surrounding their facilities.

Their initiatives focus on several key areas: community safety programs, contributing to local economic development through job creation and investment, and diligently managing environmental impacts. These efforts are often detailed in their comprehensive corporate stewardship reports, showcasing their dedication to responsible operations.

For instance, in 2023, CF Industries reported a Total Recordable Incident Rate (TRIR) of 0.47, significantly below the industry average, highlighting their robust safety protocols. Furthermore, their community investment programs in 2024 are projected to reach $5 million, supporting local infrastructure and educational initiatives.

- Workforce Safety: Maintaining a TRIR well below industry benchmarks through rigorous training and safety procedures.

- Community Engagement: Investing in local economic development and supporting community-based safety and environmental projects.

- Corporate Stewardship: Transparent reporting on social and environmental performance, demonstrating accountability to stakeholders.

- Economic Impact: Contributing to local economies through employment and procurement, fostering positive community relations.

Sociological factors significantly influence CF Industries' market position, driven by increasing global food demand and evolving consumer preferences for sustainable agriculture. As the world population grows, the need for efficient fertilizer use becomes paramount, with nitrogen fertilizers playing a crucial role in boosting crop yields by up to 50%.

Consumer demand for sustainably grown food is on the rise, with a 2024 survey indicating over 60% of consumers are willing to pay more for such products. This trend supports CF Industries' investments in low-carbon ammonia production, a key initiative to align with environmental expectations and reduce greenhouse gas intensity, which saw a 10% reduction in 2024 compared to 2020.

Farmer livelihoods, directly tied to agricultural commodity prices and input costs, also shape demand. While fertilizer prices experienced some volatility in 2023-2024, stabilization has allowed farmers to better manage expenditures, with U.S. corn prices in early 2024 supporting fertilizer purchases.

CF Industries prioritizes workforce safety, evidenced by a 2023 Total Recordable Incident Rate (TRIR) of 0.47, well below the industry average. The company also actively engages with communities, with projected community investments of $5 million in 2024 to support local development and safety initiatives.

| Factor | Trend | Impact on CF Industries | Data Point (2023-2024) |

|---|---|---|---|

| Global Population Growth | Increasing demand for food | Higher demand for fertilizers | Projected 9.7 billion by 2050 |

| Consumer Preference | Shift towards sustainable agriculture | Demand for low-carbon products | 60%+ willing to pay premium for sustainable food |

| Farmer Economics | Sensitivity to input costs and commodity prices | Influences fertilizer purchase decisions | U.S. corn prices supported fertilizer purchases in early 2024 |

| Workforce Safety & Community Relations | Focus on operational safety and local impact | Enhances social license to operate | TRIR of 0.47 (2023); $5M community investment projected (2024) |

Technological factors

Technological advancements in ammonia production are a cornerstone of CF Industries' strategic direction, especially those geared towards reducing carbon intensity. The company is actively pursuing innovations like autothermal reforming (ATR) coupled with carbon capture and sequestration (CCS), alongside electrolysis for green hydrogen production. These technologies are designed to boost operational efficiency and significantly lower greenhouse gas emissions.

CF Industries is heavily investing in Carbon Capture and Sequestration (CCS) technologies, recognizing their crucial role in achieving decarbonization targets and producing low-carbon ammonia. This strategic focus is evident in their significant commitments to projects at their Yazoo City and Donaldsonville facilities, aimed at capturing and permanently storing CO2 emissions.

The advancement in green and blue hydrogen production technologies is a significant technological factor for CF Industries. These methods allow for the creation of ammonia with substantially reduced or zero carbon emissions. For instance, green hydrogen, produced via water electrolysis powered by renewable energy, is key to producing green ammonia.

This capability opens up new markets for CF Industries, particularly in the burgeoning clean energy sector. By producing green and blue ammonia, the company can meet the growing demand for low-carbon fuels and feedstocks used in various industrial processes, positioning them as a supplier in the transition to cleaner energy solutions.

Precision Agriculture and Nutrient Management

The growing use of precision agriculture is significantly impacting fertilizer demand. By enabling more targeted application, these technologies can optimize the volume and type of fertilizers needed, potentially leading to shifts in market dynamics. CF Industries is well-positioned to capitalize on this trend through its focus on nutrient stewardship and the development of products that support efficient farming practices.

For instance, advancements in sensor technology and data analytics allow farmers to apply fertilizers precisely where and when they are needed, reducing waste and environmental impact. In 2023, the global precision agriculture market was valued at approximately $9.5 billion and is projected to reach over $20 billion by 2030, indicating a substantial growth trajectory. This increasing adoption directly influences the type of nutrient solutions that will be in demand.

CF Industries' commitment to developing enhanced efficiency fertilizers (EEFs) and providing agronomic support to farmers aligns with this technological shift. These products are designed to improve nutrient uptake by crops and minimize losses, directly addressing the core principles of precision agriculture. The company's strategy emphasizes providing value beyond the product itself, offering solutions that enhance farm productivity and sustainability.

- Precision agriculture adoption: Increasing use of GPS, sensors, and data analytics for optimized fertilizer application.

- Market impact: Potential shift in demand towards specialized and efficient nutrient formulations.

- CF Industries' alignment: Focus on nutrient stewardship and developing products supporting efficient farming.

- Growth projection: Precision agriculture market expected to grow significantly, creating opportunities for nutrient providers.

Digitalization and Automation in Manufacturing

CF Industries is leveraging digitalization and automation to boost efficiency and cut costs within its manufacturing operations. This strategic adoption directly supports its position as a low-cost producer in the fertilizer industry.

These advancements are crucial for enhancing operational reliability and streamlining production processes across CF Industries' extensive network. By integrating smart technologies, the company aims to optimize resource utilization and improve overall output quality.

- Increased Efficiency: Automation in production lines can lead to faster cycle times and reduced manual labor requirements.

- Cost Reduction: Digital tools for predictive maintenance and process optimization minimize downtime and energy consumption, lowering operational expenses.

- Enhanced Reliability: Automated quality control systems ensure consistent product standards, bolstering customer trust and reducing waste.

- Competitive Edge: By embracing these technologies, CF Industries solidifies its competitive advantage through improved cost structures and operational performance.

Technological advancements are reshaping fertilizer production and application, directly impacting CF Industries. The company is heavily invested in developing low-carbon ammonia through technologies like carbon capture and sequestration (CCS) and green hydrogen production via electrolysis. These innovations are crucial for meeting environmental regulations and capitalizing on the growing demand for sustainable agricultural inputs and clean energy solutions.

Precision agriculture, driven by sensor and data analytics, is optimizing fertilizer use, leading to shifts in market demand toward specialized, efficient nutrient formulations. CF Industries’ focus on nutrient stewardship and enhanced efficiency fertilizers (EEFs) directly addresses this trend, aiming to provide value beyond the product itself by improving farm productivity and sustainability.

Digitalization and automation are key to CF Industries' operational strategy, enhancing efficiency, reducing costs, and improving reliability across its production network. These investments are critical for maintaining its position as a low-cost producer and securing a competitive edge in the evolving fertilizer market.

| Technology Area | CF Industries' Focus | Market Impact/Opportunity | 2024/2025 Relevance |

|---|---|---|---|

| Low-Carbon Ammonia Production | CCS, Green Hydrogen (Electrolysis) | Meeting decarbonization targets, access to clean energy markets | Continued investment in projects like Yazoo City and Donaldsonville |

| Precision Agriculture | Enhanced Efficiency Fertilizers (EEFs), Agronomic Support | Optimized nutrient application, reduced waste, increased farm productivity | Growing adoption of precision ag, projected market growth to over $20 billion by 2030 |

| Digitalization & Automation | Process optimization, predictive maintenance | Increased operational efficiency, cost reduction, enhanced reliability | Streamlining production, improving output quality, maintaining cost leadership |

Legal factors

CF Industries operates under a complex web of environmental laws, including stringent standards for air and water emissions, hazardous waste management, and greenhouse gas output. For instance, the U.S. Environmental Protection Agency (EPA) sets limits on pollutants like nitrogen oxides and sulfur dioxide, which are critical for CF's manufacturing processes.

Meeting these compliance mandates necessitates substantial capital expenditures. In 2023, the company reported significant investments in environmental controls and upgrades to its facilities to adhere to evolving regulations, underscoring the financial impact of environmental stewardship.

However, proactive adoption of sustainable practices can also unlock opportunities. CF Industries' focus on developing low-carbon ammonia production technologies, for example, positions it to benefit from growing global demand for cleaner energy solutions and potentially leverage government incentives for green initiatives.

CF Industries operates within a stringent regulatory environment, particularly concerning health and safety. In the United States, agencies like the Occupational Safety and Health Administration (OSHA) mandate strict protocols for the handling, storage, and transportation of hazardous materials common in fertilizer production.

Compliance is not merely a matter of good practice; it's a critical operational necessity. Failure to adhere to these health and safety laws can result in severe consequences, including significant fines, operational shutdowns, and substantial legal liabilities, impacting CF Industries' financial performance and reputation.

Changes in tax laws, especially those providing credits for carbon sequestration like Section 45Q of the Internal Revenue Code, and for clean hydrogen production, directly influence the financial feasibility of CF Industries' clean energy initiatives. For instance, the Inflation Reduction Act of 2022 significantly enhanced these credits, making projects more attractive. Uncertainty or changes in these government incentives can sway investment decisions for CF Industries, impacting the profitability of their low-carbon ammonia and hydrogen ventures.

International Trade Laws and Anti-Dumping Duties

International trade laws are a significant consideration for CF Industries. These regulations, including potential anti-dumping duties or import restrictions, can directly impact the company's global competitiveness and the movement of its products across different markets. For instance, in 2023, the United States International Trade Commission (USITC) continued to review anti-dumping and countervailing duty orders on certain nitrogen fertilizer products from various countries, which could affect import volumes and pricing relevant to CF Industries.

These legal frameworks can create barriers or advantages for CF Industries. For example, if a country imposes tariffs on imported fertilizers, it might make CF Industries' domestically produced products more attractive to local buyers. Conversely, if CF Industries exports to a market that implements strict import quotas or high duties, its market access and sales volume could be negatively impacted. The evolving nature of these trade policies necessitates constant monitoring and strategic adaptation by the company.

The imposition of anti-dumping duties is particularly relevant. These duties are levied when foreign producers are found to be selling goods in an export market at a price below their normal value, causing injury to domestic industry. CF Industries, as a major producer of nitrogen fertilizers, is sensitive to such measures, which can alter the cost dynamics of international fertilizer trade. For example, in early 2024, investigations into alleged dumping of urea ammonium nitrate solutions from certain countries were ongoing, highlighting the dynamic trade environment.

- Trade Policy Impact: Changes in international trade laws, such as tariffs or quotas, can alter the cost and availability of raw materials and finished products for CF Industries.

- Anti-Dumping Duties: The threat or imposition of anti-dumping duties on fertilizers by key importing nations can significantly affect CF Industries' export opportunities and competitive pricing.

- Market Access: Import restrictions can limit CF Industries' ability to sell its products in certain international markets, necessitating a focus on domestic or less restricted export regions.

- Regulatory Compliance: CF Industries must navigate a complex web of international trade regulations, ensuring compliance to avoid penalties and maintain smooth cross-border operations.

Product Liability and Regulatory Compliance

CF Industries operates under strict regulations concerning the formulation, packaging, and safe application of its fertilizer products. These rules are designed to protect consumers and the environment from potential harm. Failure to comply can lead to significant penalties and reputational damage.

The company faces potential legal challenges stemming from product defects or adverse environmental impacts attributed to its fertilizers. To mitigate these risks, CF Industries invests heavily in robust quality assurance processes and adheres diligently to all applicable regulatory mandates.

- Product Safety Standards: CF Industries must meet stringent standards for nutrient content, purity, and the absence of harmful contaminants in its fertilizers.

- Labeling Requirements: Accurate and comprehensive labeling regarding product use, safety precautions, and environmental impact is legally mandated.

- Environmental Regulations: Compliance with regulations on manufacturing emissions, waste disposal, and the potential runoff of fertilizer components into waterways is critical.

- Potential Liabilities: Lawsuits related to crop damage, health issues, or environmental degradation caused by product misuse or unforeseen product effects can result in substantial financial liabilities.

Legal factors significantly shape CF Industries' operations, from environmental compliance to trade policies. The company must navigate a complex landscape of regulations governing emissions, hazardous materials, and product safety, with substantial investments made to ensure adherence. For instance, in 2023, CF Industries continued to invest in facility upgrades to meet evolving environmental standards, a trend expected to persist as regulations tighten.

Changes in tax legislation, particularly those offering incentives for carbon capture and clean energy production, directly influence the financial viability of CF Industries' strategic initiatives, such as low-carbon ammonia production. The Inflation Reduction Act of 2022, for example, enhanced these credits, making such projects more attractive, though the long-term stability of these incentives remains a key consideration for investment decisions.

International trade laws and the potential for anti-dumping duties present both challenges and opportunities. In early 2024, investigations into urea ammonium nitrate solutions from certain countries highlighted the dynamic trade environment, impacting CF Industries' global market access and competitive pricing strategies.

| Regulatory Area | Key Regulations/Agencies | Impact on CF Industries | Recent/Projected Data/Trends |

|---|---|---|---|

| Environmental | EPA (Air/Water Emissions, GHGs) | Requires capital investment for compliance; proactive adoption can create opportunities (e.g., low-carbon ammonia). | Continued investment in environmental controls in 2023; growing demand for cleaner energy solutions. |

| Health & Safety | OSHA (Hazardous Materials Handling) | Mandates strict protocols; non-compliance leads to fines, shutdowns, and liabilities. | Ongoing focus on robust safety measures to prevent incidents and ensure operational continuity. |

| Tax & Incentives | IRS (e.g., Section 45Q, Clean Hydrogen Credits) | Influences financial feasibility of clean energy projects; changes in incentives impact investment decisions. | Inflation Reduction Act of 2022 enhanced credits, making projects more attractive; long-term stability of incentives is key. |

| Trade Policy | USITC, WTO (Tariffs, Anti-Dumping Duties) | Affects global competitiveness, market access, and pricing; requires constant monitoring and adaptation. | Ongoing investigations into fertilizer dumping in early 2024; potential impact on import volumes and pricing. |

Environmental factors

Climate change concerns are a significant driver for CF Industries' strategic direction, particularly in its focus on decarbonization efforts. The company is actively pursuing strategies to reduce its environmental footprint.

CF Industries has set ambitious goals, committing to substantial reductions in CO2-equivalent emissions. A key target is achieving net-zero greenhouse gas emissions by 2050, a commitment influenced by both increasing regulatory pressures and a genuine dedication to sustainable business practices.

In 2023, CF Industries reported a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to its 2017 baseline, demonstrating tangible progress towards its long-term decarbonization objectives.

The success of CF Industries' large-scale carbon capture and sequestration (CCS) projects hinges significantly on the availability of suitable geological storage sites, with estimates suggesting billions of tons of CO2 storage capacity in the US alone. A robust and clear regulatory framework is also paramount, providing the necessary certainty for these multi-billion dollar investments. These CCS initiatives are vital for CF Industries to achieve its goal of reducing the carbon intensity of its ammonia production, a key component in its sustainability strategy.

CF Industries' manufacturing processes, particularly for hydrogen and nitrogen-based fertilizers, are water-intensive. In 2023, global freshwater availability faced increasing pressure, with reports indicating that over 2 billion people live in countries experiencing high water stress. This trend is projected to worsen, directly impacting industries reliant on substantial water inputs.

Stricter water quality regulations, driven by environmental concerns, could also elevate operational costs for CF Industries. Companies may need to invest in advanced water treatment and recycling technologies to comply with evolving standards, potentially affecting capital expenditure plans and operational efficiency in the coming years.

Biodiversity and Land Use Impacts

CF Industries, as a major supplier of nitrogen fertilizers, plays a role in agricultural land use. Their products are essential for crop yields, impacting how much land is needed for food production. For instance, efficient fertilizer use can help reduce the need for expanding farmland, thereby preserving natural habitats.

The company's commitment to sustainable agriculture extends to promoting practices that minimize environmental impact. This includes educating farmers on best nutrient management techniques to prevent excess fertilizer runoff, which can harm aquatic ecosystems and biodiversity. CF Industries' focus on product stewardship aims to ensure their fertilizers are used effectively and responsibly.

- Land Use Efficiency: Optimized fertilizer application can increase crop yields per acre, potentially reducing the pressure to convert natural landscapes into agricultural land.

- Biodiversity Preservation: By supporting practices that limit nutrient runoff, CF Industries helps protect aquatic life and the biodiversity of surrounding ecosystems.

- Sustainable Farming Initiatives: The company actively engages in programs that promote soil health and responsible nutrient management, contributing to a lower environmental footprint in agriculture.

Natural Gas as a Feedstock and its Environmental Footprint

While North America's abundant natural gas provides a cost advantage for CF Industries, its extraction and utilization carry a significant environmental footprint, particularly concerning methane emissions. These emissions are a potent greenhouse gas, contributing to climate change.

CF Industries is actively addressing this by pursuing certified natural gas. For instance, in 2024, the company continued its focus on sourcing natural gas with verified lower methane intensity. This initiative aims to reduce the environmental impact associated with its primary feedstock, reflecting a growing industry trend towards sustainability.

- Methane's Potency: Methane is over 80 times more potent than carbon dioxide in the short term, making its reduction a key climate strategy.

- Industry Focus: Many industrial players, including those in the fertilizer sector, are increasingly prioritizing lower-emission energy sources.

- Certification Programs: Initiatives like the MiQ methane intensity standard are gaining traction, providing a framework for verifying reduced emissions.

Environmental regulations are increasingly shaping CF Industries' operational strategies, particularly concerning emissions and resource management. The company's commitment to net-zero greenhouse gas emissions by 2050 underscores the growing importance of sustainability in its long-term planning. Progress in 2023, with a 10% reduction in Scope 1 and 2 emissions intensity against a 2017 baseline, highlights the tangible impact of these environmental drivers.

Water scarcity and quality are critical environmental factors for CF Industries, given its water-intensive manufacturing processes. With over 2 billion people globally living in water-stressed regions in 2023, and projections indicating worsening conditions, the company must navigate potential operational challenges. Furthermore, evolving water quality regulations could necessitate additional investments in advanced treatment technologies.

CF Industries' role in agriculture means its products influence land use and biodiversity. By promoting efficient fertilizer application and responsible nutrient management, the company contributes to land use efficiency and helps preserve natural habitats by minimizing the need for agricultural expansion. This focus on sustainable farming practices is key to mitigating the environmental footprint of food production.

The sourcing of natural gas, a primary feedstock, presents environmental considerations, particularly methane emissions. CF Industries is actively addressing this by prioritizing certified natural gas with verified lower methane intensity, a trend seen across the industry in 2024. This strategic move aims to reduce the carbon impact of its operations and supply chain.

| Environmental Factor | Impact on CF Industries | Key Data/Trends (2023-2024) |

|---|---|---|

| Climate Change & Emissions | Drives decarbonization efforts, investment in CCS, and net-zero targets. | 10% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2017 baseline) in 2023. Net-zero by 2050 target. |

| Water Availability & Quality | Potential operational risks due to water-intensive processes; compliance with stricter regulations. | Over 2 billion people in water-stressed countries (2023). Potential need for advanced water treatment tech. |

| Land Use & Biodiversity | Influence on agricultural practices; opportunity to promote sustainable farming and habitat preservation. | Focus on efficient fertilizer use and nutrient management to minimize runoff and protect ecosystems. |

| Feedstock Emissions (Natural Gas) | Need to mitigate methane emissions from natural gas extraction and use. | Increased focus on sourcing certified natural gas with verified lower methane intensity (2024). Methane is over 80x more potent than CO2 short-term. |

PESTLE Analysis Data Sources

Our PESTLE analysis for CF Industries Holdings is grounded in data from reputable sources such as the U.S. Environmental Protection Agency, the International Fertilizer Association, and reports from leading financial institutions. We incorporate economic indicators from the Bureau of Labor Statistics and regulatory updates from government bodies to ensure a comprehensive view.