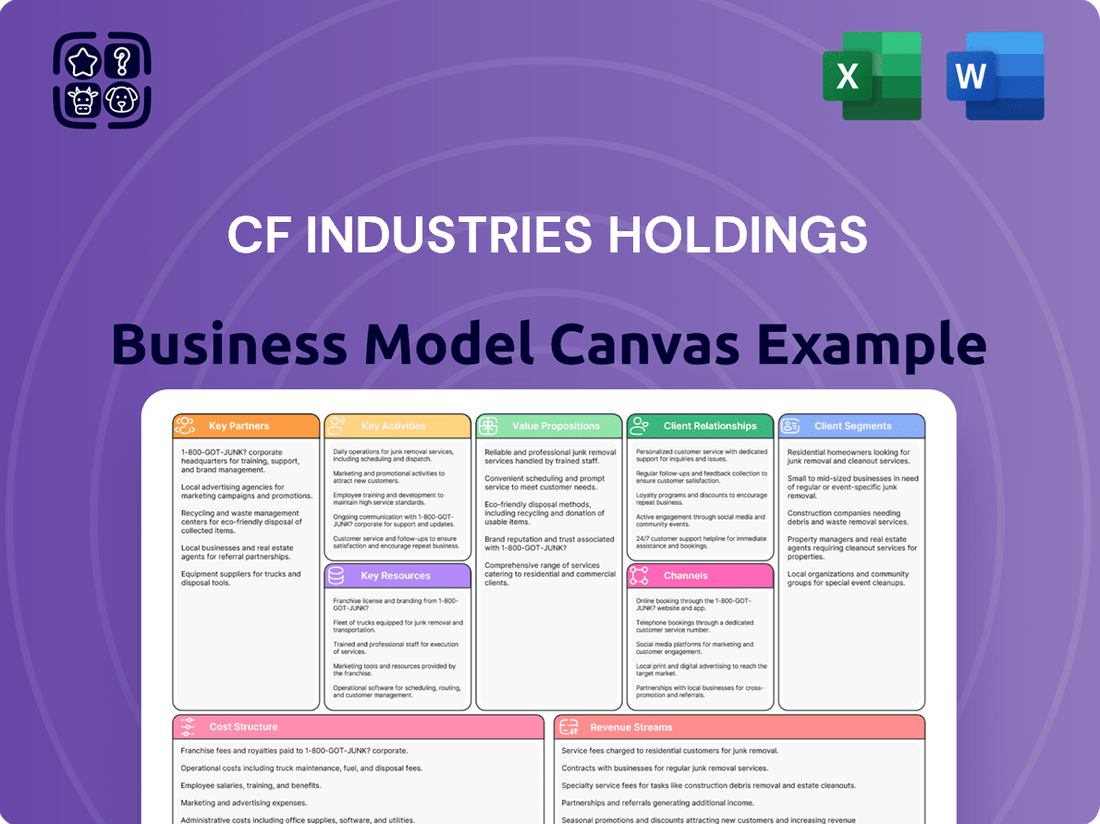

CF Industries Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CF Industries Holdings Bundle

Discover the strategic powerhouse behind CF Industries Holdings with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a unique glimpse into their market dominance.

Partnerships

CF Industries is forging key alliances with major players in the energy and trading sectors to drive the development of low-carbon ammonia production. These strategic partnerships are essential for accessing new clean energy markets and catering to the growing need for sustainable industrial solutions.

A prime example is CF Industries' joint venture with JERA Co., Inc. and Mitsui & Co., Inc., which underscores their commitment to this expansion. This collaboration is vital for building out the necessary infrastructure and expertise to capitalize on the burgeoning demand for green ammonia.

CF Industries actively engages in technology and infrastructure collaborations to advance its sustainability goals. A prime example is its partnership with ExxonMobil for carbon capture and sequestration (CCS) initiatives, aiming to reduce CO2 emissions from its nitrogen fertilizer production facilities.

Further strengthening its CCS capabilities, CF Industries has also partnered with 1PointFive, a subsidiary of Occidental Petroleum. This collaboration is crucial for the transportation and permanent underground storage of captured carbon dioxide, a key component in achieving significant emission reductions.

These strategic alliances are fundamental to CF Industries' strategy of decarbonizing its operations. By leveraging the expertise of technology and infrastructure leaders, the company is positioning itself to meet stringent environmental regulations and capitalize on the growing demand for low-carbon products.

CF Industries actively cultivates partnerships within the agricultural value chain, notably with entities like POET LLC. These collaborations are instrumental in showcasing and advocating for the adoption of low-carbon fertilizers across the industry.

The primary objective of these alliances is to significantly lower the carbon footprint associated with key agricultural commodities, such as corn and ethanol. This strategic focus directly addresses the escalating market demand for more sustainable and environmentally conscious farming methods.

For instance, CF Industries' commitment to sustainability is underscored by its role in initiatives that aim to reduce the carbon intensity of agricultural production, a critical factor for farmers and food producers alike in the current market landscape.

Research and Development Institutions

CF Industries Holdings likely collaborates with universities and specialized research centers to drive innovation in clean hydrogen production and advanced nitrogen fertilizer technologies. These partnerships are crucial for developing more efficient electrolysis methods, exploring novel carbon capture technologies, and creating next-generation nitrogen products with reduced environmental impact. Such collaborations would allow CF Industries to stay at the forefront of sustainable manufacturing practices.

These research endeavors could focus on:

- Developing advanced catalysts for green hydrogen production, aiming to reduce energy consumption and increase output efficiency.

- Investigating novel nitrogen fixation processes that require less energy and produce fewer greenhouse gas emissions.

- Exploring new applications for nitrogen products in emerging clean energy sectors, such as battery technology or advanced materials.

- Improving the efficiency and scalability of carbon capture and utilization (CCU) technologies for their existing and future production facilities.

Logistics and Distribution Network Partners

CF Industries leverages a robust network of logistics and distribution partners to ensure its products reach a global market efficiently. These partners are crucial for transporting anhydrous ammonia, urea, and other nitrogen-based fertilizers from CF's production facilities to agricultural and industrial customers across continents.

Key partners include major rail carriers, barge operators, and trucking companies, which collectively form the backbone of CF's supply chain. In 2024, the company continued to optimize its transportation costs, which are a significant component of its overall operating expenses. For instance, rail transportation remains a primary method for moving large volumes of product domestically, while barge access is vital for reaching coastal markets and international export terminals.

- Rail Transportation: Essential for bulk movement of products across North America, with significant volumes moved via Class I railroads.

- Barge and Waterway Systems: Critical for accessing major agricultural regions and international shipping routes, particularly along the Mississippi River and Gulf Coast.

- Trucking and Intermodal Solutions: Provide last-mile delivery and flexibility for reaching diverse customer locations.

- Storage and Terminal Facilities: Strategically located to hold inventory and facilitate efficient product transfer between different modes of transport.

CF Industries' key partnerships are vital for expanding its low-carbon ammonia production and accessing new markets. Collaborations with energy and trading giants like JERA and Mitsui are crucial for building infrastructure and expertise in green ammonia. These alliances are fundamental to decarbonizing operations and meeting environmental regulations.

What is included in the product

This Business Model Canvas provides a comprehensive overview of CF Industries' strategy, detailing its customer segments, value propositions, and revenue streams in the nitrogen fertilizer market.

It reflects CF Industries' operational focus on efficient production and distribution, outlining key resources and activities crucial for its competitive advantage in serving agricultural and industrial customers.

CF Industries' Business Model Canvas acts as a pain point reliever by visually mapping out how they deliver essential nitrogen fertilizers, addressing the critical need for food security and agricultural productivity.

It provides a clear, actionable framework for understanding how CF Industries alleviates the pain of farmers facing crop yield challenges and the global demand for food.

Activities

CF Industries' primary activities revolve around the large-scale manufacturing of essential nitrogen-based fertilizers and industrial products. This includes the production of ammonia, granular urea, and urea ammonium nitrate (UAN) solutions, which are critical for global agriculture and various industrial applications.

The company operates an extensive network of manufacturing complexes strategically located across North America and the United Kingdom. These facilities are designed for high-volume, efficient, and dependable production, ensuring a consistent supply to meet significant global demand.

In 2024, CF Industries continued to leverage its operational expertise to maintain high production levels. For instance, the company's total nitrogen fertilizer production capacity is a key indicator of its manufacturing prowess, with significant output across its ammonia, urea, and UAN product lines.

CF Industries Holdings actively invests in and executes clean energy initiatives. A key focus is on carbon capture and sequestration (CCS) projects, alongside developing low-carbon ammonia production. This strategy aims to shrink their environmental footprint and position their products for use in clean energy applications.

In 2024, CF Industries continued to advance its decarbonization efforts. The company is a leader in the development of low-carbon ammonia, a crucial component for hydrogen fuel and other clean energy technologies. Their investments in CCS are designed to capture CO2 emissions from their manufacturing processes, contributing to a more sustainable future for fertilizer production.

CF Industries actively manages a vast network of storage facilities, pipelines, and distribution terminals across North America and internationally. This extensive infrastructure is key to ensuring timely and cost-effective delivery of nitrogen products to a diverse customer base, including agricultural producers and industrial users.

In 2024, CF Industries continued to optimize its logistics operations, leveraging its integrated network to meet fluctuating market demands. The company's ability to efficiently move products from its manufacturing sites to end-users is a cornerstone of its operational strategy, contributing significantly to supply chain reliability.

Research, Development, and Innovation

CF Industries Holdings consistently invests in research and development to refine its existing product lines and pioneer new uses for hydrogen and nitrogen. This commitment extends to optimizing manufacturing methods and exploring cutting-edge technologies for decarbonization and sustainable production. For instance, in 2023, the company reported $120 million in R&D expenses, a slight increase from $115 million in 2022, reflecting this strategic focus.

Their innovation efforts are geared towards enhancing efficiency and environmental performance across their operations. This includes developing advanced catalysts and exploring novel production pathways that reduce energy consumption and greenhouse gas emissions. The company's strategic investments aim to solidify its position as a leader in nitrogen fertilizer and hydrogen production.

- Product Enhancement: Improving the nutrient efficiency and application methods of nitrogen fertilizers.

- New Applications: Investigating the use of hydrogen in emerging sectors like clean energy and advanced materials.

- Process Optimization: Developing more energy-efficient and environmentally friendly manufacturing techniques.

- Decarbonization Technologies: Researching and implementing solutions for carbon capture, utilization, and storage (CCUS).

Sales, Marketing, and Customer Relationship Management

CF Industries actively engages in comprehensive sales and marketing efforts, showcasing its extensive range of nitrogen fertilizer products and industrial chemicals to a global customer base. In 2024, the company continued to focus on direct sales channels and strategic distribution partnerships to reach agricultural producers and industrial clients effectively.

Building enduring customer relationships is paramount, achieved through consistent product availability, expert technical assistance, and highly responsive customer service. This commitment ensures reliability for their partners, a crucial factor in the agricultural and industrial sectors.

- Global Reach: CF Industries serves customers across North America, South America, Europe, and Asia, leveraging a robust distribution network.

- Product Focus: Key offerings include ammonia, urea, urea ammonium nitrate (UAN), and other nitrogen-based products essential for agriculture and various industrial applications.

- Customer Support: The company provides agronomic expertise and application support to help customers optimize fertilizer use and achieve better yields.

- Market Presence: In 2024, CF Industries maintained a strong market presence, adapting to evolving agricultural practices and industrial demands by emphasizing efficiency and sustainability in their product offerings.

CF Industries' key activities center on the efficient, large-scale production of nitrogen-based fertilizers and industrial products, including ammonia and urea. They also actively invest in and develop clean energy initiatives, particularly carbon capture and sequestration (CCS) and low-carbon ammonia production. Furthermore, the company manages an extensive logistics network for product distribution and engages in continuous research and development to enhance products and processes.

The company's operational focus in 2024 included maintaining high production levels across its nitrogen fertilizer portfolio. For instance, CF Industries' total nitrogen fertilizer production capacity is substantial, ensuring a consistent supply to meet global demand. Their commitment to clean energy is evident through ongoing CCS projects and the development of low-carbon ammonia, positioning them for future energy markets.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing | Large-scale production of nitrogen fertilizers (ammonia, urea, UAN) and industrial products. | Maintaining high production levels and operational efficiency. |

| Clean Energy Initiatives | Developing low-carbon ammonia and implementing carbon capture and sequestration (CCS). | Advancing decarbonization efforts and exploring hydrogen applications. |

| Logistics & Distribution | Managing storage, pipelines, and terminals for timely product delivery. | Optimizing the integrated network for efficient supply chain management. |

| Research & Development | Improving fertilizer efficiency, exploring new hydrogen uses, and optimizing production processes. | Focus on decarbonization technologies and sustainable production methods. |

Preview Before You Purchase

Business Model Canvas

The CF Industries Holdings Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Upon completing your order, you'll gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately analyze and leverage CF Industries' strategic framework.

Resources

CF Industries operates a robust network of large-scale manufacturing complexes strategically located across the United States, Canada, and the United Kingdom. This extensive infrastructure is a cornerstone of their business, enabling efficient production and distribution of essential nitrogen-based products.

The company's production capacity is substantial, with facilities designed for high-volume output of ammonia and other nitrogen fertilizers. For instance, their Donaldsonville, Louisiana complex is one of the largest ammonia production sites globally, highlighting their scale. The recent acquisition of the Waggaman ammonia production facility further bolsters this capacity, adding significant production capability in a key market.

These manufacturing assets are not just about volume; they are also technologically advanced, allowing for efficient conversion of natural gas into hydrogen and nitrogen products. This operational efficiency is crucial for maintaining competitive pricing and meeting the growing global demand for agricultural and industrial inputs. In 2023, CF Industries reported total ammonia production capacity of approximately 21.7 million tons.

Natural gas is the lifeblood of nitrogen fertilizer production, making access to cost-advantaged reserves and robust supply contracts absolutely essential for CF Industries. This directly influences their ability to manage production costs and maintain a competitive edge in the global market.

In 2024, CF Industries continues to leverage its strategic locations in North America, which benefit from abundant and relatively low-cost natural gas supplies. This access is a cornerstone of their operational efficiency and cost structure.

CF Industries Holdings' intellectual property and proprietary technologies are cornerstones of its business model, particularly in the manufacturing of ammonia and nitrogen products. These innovations are crucial for maintaining a competitive edge in the industry.

The company holds patents and trade secrets related to advanced production processes, including those designed for enhanced efficiency and reduced environmental impact. This focus on proprietary technology allows CF Industries to optimize its operations and develop next-generation products.

Specifically, CF Industries is investing heavily in proprietary advancements for carbon capture and low-carbon ammonia production. For example, by the end of 2023, the company had secured agreements for approximately 1.7 million tons per year of low-carbon ammonia offtake, highlighting the market's demand for these innovations.

Extensive Distribution and Logistics Infrastructure

CF Industries Holdings boasts an extensive distribution and logistics infrastructure, a critical asset in its business model. This network includes an unparalleled storage, transportation, and distribution system across North America, complemented by robust global logistics capabilities. This infrastructure is fundamental to efficiently delivering its nitrogen fertilizer products to a diverse customer base, spanning agricultural and industrial sectors, across the globe.

This vast network is not just about moving products; it's about ensuring timely and cost-effective delivery, which is paramount in the agricultural supply chain. For instance, CF Industries operates a significant network of terminals and distribution points, allowing them to serve customers in key agricultural regions efficiently. Their 2023 financial reports highlight the importance of this infrastructure in maintaining market leadership and operational efficiency.

- North American Network: Extensive owned and leased assets including terminals, pipelines, and barges for efficient product movement.

- Global Reach: Capabilities to export products, leveraging international shipping and port infrastructure.

- Customer Proximity: Strategically located facilities to minimize transportation costs and delivery times for agricultural customers.

- Operational Efficiency: The infrastructure supports optimized inventory management and responsive order fulfillment, crucial for seasonal demand.

Skilled Workforce and Management Expertise

CF Industries relies heavily on its highly skilled workforce, comprising engineers, plant operators, and a robust management team. This expertise is crucial for maintaining safe, reliable, and efficient production of nitrogen fertilizers and other industrial products. In 2024, the company continued to invest in training and development to keep its workforce at the forefront of industry best practices.

The management team's seasoned expertise is particularly vital for navigating the complexities of strategic growth, especially in emerging areas like clean energy and decarbonization. Their ability to identify opportunities and execute plans, such as exploring low-carbon ammonia production, directly impacts the company's long-term competitive advantage and financial performance.

Key resources in this category include:

- Specialized Engineering Talent: Expertise in chemical process design, plant optimization, and new technology implementation.

- Experienced Operations Personnel: Skilled operators ensuring continuous and safe plant functioning, minimizing downtime and maximizing yield.

- Strategic Leadership: A management team adept at market analysis, capital allocation, and driving innovation, particularly in sustainability initiatives.

- Human Capital Development Programs: Ongoing training and development to maintain and enhance the skills of the entire workforce.

CF Industries' key resources are its extensive manufacturing facilities, proprietary technologies, and a robust distribution network. These are supported by a skilled workforce and advantageous access to natural gas. The company’s substantial production capacity, exemplified by its Donaldsonville complex, and its ongoing investments in areas like low-carbon ammonia production, underscore the importance of these tangible and intangible assets. The company's 2023 ammonia production capacity stood at approximately 21.7 million tons.

| Resource Category | Key Components | Significance |

|---|---|---|

| Manufacturing Assets | Large-scale production complexes (US, Canada, UK), Donaldsonville, Waggaman facility | High-volume output, operational efficiency, cost competitiveness |

| Intellectual Property & Technology | Patents, trade secrets, advanced production processes, carbon capture tech | Competitive edge, operational optimization, development of next-gen products |

| Distribution & Logistics | North American network (terminals, pipelines, barges), global export capabilities | Efficient and cost-effective product delivery, customer proximity, market leadership |

| Human Capital | Skilled engineers, operators, management team, training programs | Safe and reliable production, strategic growth, innovation in sustainability |

| Natural Gas Access | Cost-advantaged reserves, supply contracts | Core to production costs, competitive pricing, operational efficiency |

Value Propositions

CF Industries is a cornerstone in global food security, offering a dependable stream of vital nitrogen fertilizers. This consistent supply is absolutely critical for farmers worldwide, directly impacting their ability to nourish crops and achieve robust yields, thereby supporting the entire agricultural value chain.

In 2024, CF Industries' commitment to reliability is underscored by its significant production capacity, enabling it to meet the escalating demand for fertilizers. This ensures that the essential nutrients farmers need are readily available, contributing to higher agricultural output and more stable food prices.

CF Industries Holdings provides solutions that are crucial for the clean energy transition and reducing emissions. They offer low-carbon hydrogen and nitrogen products, which are essential for various industrial applications aimed at sustainability.

These products, particularly low-carbon ammonia, are being developed for use in power generation and as a maritime fuel. This directly supports industries looking to lower their carbon footprint.

In 2024, the demand for low-carbon solutions is accelerating. CF Industries' focus on these areas positions them to capitalize on the growing market for emissions abatement technologies and clean energy alternatives.

CF Industries leverages its North American production network, a significant advantage stemming from abundant and affordable natural gas. This cost structure allows them to offer competitive pricing, directly benefiting customers seeking value.

In 2024, natural gas prices in North America remained significantly lower than in many other regions, providing CF Industries with a substantial cost advantage in ammonia and nitrogen fertilizer production. This efficiency translates into more attractive pricing for their agricultural and industrial customers.

Commitment to Environmental Stewardship

CF Industries Holdings demonstrates a strong commitment to environmental stewardship, directly appealing to customers and stakeholders prioritizing sustainability. This dedication is evident in their significant investments in carbon capture and sequestration (CCS) projects, aiming to drastically reduce their operational carbon footprint. For instance, in 2024, the company continued to advance its low-carbon ammonia initiatives, a key component of its strategy to decarbonize fertilizer production and related industries.

These initiatives not only align with global sustainability goals but also create tangible value by offering lower-emission products. CF Industries' focus on sustainable practices positions them as a leader in an increasingly environmentally aware market. Their proactive approach to environmental responsibility is a core element of their business model, fostering trust and long-term relationships with a broad range of stakeholders.

- Carbon Capture and Sequestration (CCS) Investments: CF Industries is actively developing and implementing CCS technologies to mitigate greenhouse gas emissions from its manufacturing processes.

- Sustainable Practices: The company integrates sustainable operational methods across its facilities to minimize environmental impact and promote resource efficiency.

- Low-Carbon Ammonia Production: A key focus is the development of low-carbon ammonia, a critical input for agriculture and a potential clean energy carrier, appealing to environmentally conscious consumers and industries.

- Alignment with Global Goals: CF Industries' environmental efforts contribute to broader international objectives for climate change mitigation and sustainable development.

Global Reach and Logistical Efficiency

CF Industries leverages its vast manufacturing footprint and sophisticated distribution system to provide unparalleled global reach. This extensive network ensures that essential hydrogen and nitrogen products are delivered efficiently and on time to customers worldwide, supporting diverse agricultural and industrial needs.

The company's logistical prowess is a cornerstone of its value proposition, enabling it to serve a broad international customer base. For instance, in 2024, CF Industries continued to optimize its supply chain, facilitating the movement of millions of tons of products to key markets. This global accessibility is crucial for industries reliant on consistent supply.

- Extensive Manufacturing Network: CF Industries operates numerous production facilities strategically located to serve major agricultural and industrial hubs globally.

- Efficient Distribution Channels: The company utilizes a combination of rail, barge, and truck transportation, alongside terminal operations, to ensure timely delivery.

- Global Customer Base: CF Industries serves customers in North America, South America, Europe, and Asia, demonstrating its broad international market penetration.

- Product Availability: This robust infrastructure guarantees consistent access to critical products like ammonia, urea, and urea ammonium nitrate (UAN) for a wide array of applications.

CF Industries offers a reliable supply of nitrogen fertilizers, a fundamental component for global food security. Their consistent production ensures farmers have the essential nutrients needed for optimal crop yields, supporting the entire agricultural sector.

The company is a key player in the clean energy transition, providing low-carbon hydrogen and nitrogen products. These are vital for industries aiming to reduce their environmental impact, particularly in areas like clean power generation and maritime fuel.

Leveraging abundant North American natural gas, CF Industries benefits from a significant cost advantage. This allows them to offer competitive pricing for their products, delivering value to both agricultural and industrial customers.

CF Industries' commitment to sustainability is demonstrated through substantial investments in carbon capture and sequestration (CCS) projects. This focus on reducing their operational footprint appeals to environmentally conscious stakeholders and positions them as a leader in sustainable practices.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Dependable Fertilizer Supply | Ensures global food security through consistent production of vital nitrogen fertilizers. | In 2024, CF Industries' robust production capacity met rising global demand for fertilizers, critical for stable food prices and agricultural output. |

| Low-Carbon Solutions | Provides essential products for the clean energy transition and emissions reduction. | The accelerating demand for low-carbon solutions in 2024 positions CF to capitalize on growing markets for emissions abatement and clean energy. |

| Cost Competitiveness | Offers competitive pricing due to access to affordable North American natural gas. | In 2024, North American natural gas prices remained significantly lower, giving CF a cost advantage that translates into attractive pricing for customers. |

| Environmental Stewardship | Demonstrates commitment to sustainability through CCS investments and low-carbon initiatives. | In 2024, CF advanced its low-carbon ammonia initiatives, supporting decarbonization efforts in agriculture and industry. |

Customer Relationships

CF Industries cultivates direct sales channels, engaging with major agricultural cooperatives, independent fertilizer distributors, and industrial clients. This approach ensures a deep understanding of market dynamics and customer requirements.

Dedicated account managers are a cornerstone of this strategy, fostering strong relationships by offering personalized solutions and expert support. For instance, in 2023, CF Industries reported net sales of $7.7 billion, reflecting the success of these direct customer engagements and their ability to meet diverse market demands.

CF Industries Holdings secures its revenue streams through long-term supply agreements, especially with industrial clients and those in nascent clean energy sectors. These contracts, often spanning multiple years, offer predictable demand for CF's products and reliable supply for its customers.

These agreements are crucial for fostering stable relationships, providing CF Industries with a consistent demand base and its customers with assured access to essential products like ammonia. For instance, in 2024, CF announced a significant agreement to supply low-carbon ammonia to a major industrial consumer, highlighting the strategic importance of these long-term commitments.

CF Industries offers robust technical support and agronomic expertise, a key element in their customer relationships. This support helps farmers and agricultural businesses maximize the effectiveness of CF's fertilizer products, leading to better yields and more efficient operations.

By sharing valuable agronomic insights, CF Industries positions itself not just as a supplier, but as a trusted partner in agricultural success. This value-added service is crucial for building lasting relationships and fostering customer loyalty in a competitive market.

In 2024, CF Industries continued to emphasize these customer-centric services, understanding that providing expert guidance is as important as delivering high-quality fertilizer. This approach directly contributes to customer retention and the overall strength of their business model.

Sustainability Collaboration and Reporting

CF Industries actively engages customers in sustainability efforts, fostering partnerships to develop lower-carbon fertilizer solutions. This collaboration is crucial as businesses increasingly scrutinize their supply chains for environmental impact.

Transparent reporting on environmental performance, including carbon footprint reduction, is a cornerstone of these relationships. For instance, CF Industries' commitment to reducing greenhouse gas emissions aligns with customer needs for verifiable sustainability data.

- Customer Engagement: Partnering with customers on developing and adopting low-carbon fertilizers.

- Transparency: Providing clear data on environmental performance, such as Scope 1, 2, and 3 emissions.

- Market Demand: Responding to the growing customer requirement for sustainable and traceable agricultural inputs.

Digital Platforms and Customer Service

CF Industries is enhancing customer relationships through robust digital platforms. These platforms streamline order management, providing real-time updates and easy access to product information. For instance, in 2024, CF Industries continued to invest in its digital infrastructure to improve the efficiency of transactions and communication with its diverse customer base. This focus on digital engagement aims to create a more seamless and responsive experience for clients across various sectors.

- Digital Order Management: Online portals allow customers to place and track orders efficiently.

- Product Information Access: Customers can easily find detailed product specifications and application guidance.

- Integrated Customer Support: Digital channels offer prompt assistance for inquiries and issue resolution.

- Enhanced Communication: Platforms facilitate direct and transparent communication between CF Industries and its customers.

CF Industries prioritizes strong customer relationships through direct engagement with agricultural cooperatives, distributors, and industrial clients, supported by dedicated account managers. These relationships are solidified by long-term supply agreements, ensuring predictable demand and reliable product access for customers, a strategy highlighted by a significant 2024 agreement to supply low-carbon ammonia.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Sales & Account Management | Engaging directly with key clients and providing personalized support. | Net sales of $7.7 billion in 2023 underscore the effectiveness of these direct engagements. |

| Long-Term Supply Agreements | Securing predictable demand through multi-year contracts. | A 2024 agreement for low-carbon ammonia demonstrates strategic importance. |

| Technical & Agronomic Support | Offering expertise to maximize product effectiveness and foster partnerships. | Continued emphasis in 2024 on guidance as a key differentiator. |

| Sustainability Collaboration | Partnering on low-carbon solutions and transparent environmental reporting. | Responding to growing customer demand for verifiable sustainability data. |

| Digital Engagement | Utilizing digital platforms for streamlined order management and communication. | Ongoing investment in digital infrastructure for improved customer experience in 2024. |

Channels

CF Industries relies on its dedicated direct sales force to cultivate relationships with major agricultural and industrial clients. This direct engagement ensures tailored solutions and a nuanced understanding of each customer's specific needs, facilitating the negotiation of substantial supply agreements.

In 2024, CF Industries' direct sales strategy was instrumental in securing key partnerships, reflecting a commitment to personalized customer service. This approach allows for proactive identification of evolving market demands and the development of customized product offerings, strengthening customer loyalty and market position.

CF Industries Holdings operates a robust distribution network across North America, utilizing its extensive storage and transportation infrastructure. This includes strategically located terminals and warehouses, ensuring efficient product delivery to a wide range of regional distributors and end-users.

The company's logistical capabilities are a key component of its business model, allowing for reliable and timely supply of nitrogen fertilizer products. In 2024, CF Industries continued to optimize this network, aiming to reduce lead times and enhance customer service.

CF Industries leverages its global export and trading operations to serve customers outside of North America and the UK, effectively expanding its market reach. This involves strategic partnerships with international trading firms and the meticulous management of complex global shipping and logistics.

In 2023, CF Industries reported that its international sales represented a significant portion of its overall business, underscoring the importance of these export channels. For instance, the company's ability to efficiently move products via ocean freight is critical for meeting demand in regions like South America and Asia.

Third-Party Distributors and Retailers

CF Industries strategically partners with a vast network of third-party distributors and agricultural retailers. These relationships are crucial for extending their market reach, particularly to smaller, independent farms that might otherwise be difficult to access directly. These partners serve as vital intermediaries, offering localized sales, agronomic support, and product delivery.

This distribution channel is fundamental to CF Industries' ability to serve the diverse needs of the agricultural sector. In 2023, for instance, CF Industries reported that approximately 60% of its nitrogen fertilizer sales were made through these distribution partners, highlighting their significant role in the company's go-to-market strategy.

- Broadened Customer Access: Partnerships enable CF Industries to connect with a wider array of agricultural producers, including those in remote or smaller-scale operations.

- Local Expertise and Service: Distributors and retailers provide essential local market knowledge, customer service, and logistical support, enhancing the end-user experience.

- Market Penetration: These alliances are key to penetrating diverse agricultural regions and ensuring product availability where and when farmers need it.

- Sales Volume Contribution: In 2023, distribution partners were responsible for a substantial portion of CF Industries' overall sales volume, underscoring their importance.

Online and Digital Presence

CF Industries Holdings maintains a robust online presence, primarily through its corporate website. This digital platform acts as a crucial channel for communicating with a wide array of stakeholders, including investors, potential customers, and the general public. The site offers detailed investor relations information, the latest company news, and comprehensive product specifics.

The website serves as a central hub for information dissemination, ensuring transparency and accessibility. For instance, in 2024, CF Industries continued to update its investor relations section with quarterly earnings reports and presentations, making critical financial data readily available. This digital outreach is vital for building trust and facilitating informed decision-making among its audience.

- Corporate Website: A primary channel for stakeholder communication, offering investor relations, news, and product information.

- Information Dissemination: Facilitates access to financial reports, company updates, and product details for customers and investors.

- Digital Engagement: Supports transparency and accessibility in 2024 through updated financial data and news releases.

CF Industries' channels are multifaceted, encompassing direct sales to large clients, an extensive North American distribution network, global export operations, and strategic partnerships with third-party distributors and agricultural retailers. The company also maintains a strong online presence via its corporate website for stakeholder communication.

In 2023, approximately 60% of CF Industries' nitrogen fertilizer sales were channeled through these distribution partners, demonstrating their critical role in reaching a broad customer base. The direct sales force, meanwhile, focuses on cultivating relationships with major agricultural and industrial clients, securing substantial supply agreements.

CF Industries’ logistical capabilities, including strategically located terminals and warehouses, ensure efficient product delivery across its distribution network. In 2024, the company continued to optimize these operations to reduce lead times and improve customer service, while its export operations expanded market reach, particularly to South America and Asia.

The corporate website serves as a vital hub for information, providing investors and customers with access to financial reports and company news, with updated investor relations sections in 2024 enhancing transparency.

| Channel | Key Characteristic | 2023 Sales Relevance (Nitrogen Fertilizer) | 2024 Focus |

|---|---|---|---|

| Direct Sales Force | Cultivates relationships with major clients | Secures substantial supply agreements | Tailored solutions and understanding needs |

| North American Distribution Network | Extensive storage and transportation infrastructure | Ensures efficient regional product delivery | Network optimization for reduced lead times |

| Global Export & Trading | Serves customers outside North America/UK | Significant portion of overall business | Expanding market reach through partnerships |

| Third-Party Distributors & Retailers | Extends market reach to smaller farms | Approximately 60% of nitrogen fertilizer sales | Enhancing local market penetration and service |

| Corporate Website | Primary channel for stakeholder communication | Information dissemination and transparency | Updated investor relations and financial data |

Customer Segments

Agricultural cooperatives and independent distributors form a crucial customer segment for CF Industries. These entities act as intermediaries, purchasing large volumes of nitrogen fertilizers directly from CF Industries to then supply individual farmers. Their primary needs revolve around consistent availability of products, pricing that allows for profitable resale, and efficient delivery and storage solutions.

In 2024, the agricultural sector continued to be a significant driver for fertilizer demand. For example, the U.S. Department of Agriculture reported that corn planted acreage in 2024 was projected to be around 91.7 million acres, a key crop that heavily relies on nitrogen fertilization. This sustained demand underscores the importance of CF Industries’ ability to reliably serve these bulk purchasers.

Industrial users, including chemical manufacturers and energy producers, are key customers for CF Industries. These sectors rely heavily on hydrogen and nitrogen products for a wide array of applications, from fertilizer production to refining processes. In 2023, CF Industries reported significant sales to industrial customers, highlighting their critical role in the company's revenue streams.

The energy sector, particularly power generation and the growing field of emissions abatement, represents a substantial and expanding market. Companies in these areas utilize nitrogen-based products for pollution control technologies, such as selective catalytic reduction (SCR) systems, to meet increasingly stringent environmental regulations. The demand for cleaner energy solutions continues to drive growth in this segment.

The maritime industry also presents a growing opportunity, with a focus on cleaner fuels and emissions reduction. Hydrogen, as a potential clean fuel source, and nitrogen-based solutions for emissions control are becoming increasingly important for shipping companies aiming to comply with international environmental standards. CF Industries is well-positioned to serve these evolving needs.

Farmers and growers, while not directly purchasing from CF Industries, represent the crucial end-users of their nitrogen fertilizer products. Their purchasing decisions, influenced by crop cycles and market prices, ultimately dictate the demand for CF's offerings. For instance, the U.S. Department of Agriculture projected that in 2024, corn planted acreage would be around 91.7 million acres, a key crop heavily reliant on nitrogen fertilization.

Clean Energy Developers and Collaborators

This emerging customer segment includes companies actively engaged in clean energy initiatives, such as those pioneering low-carbon fuels or aiming to reduce their operational carbon footprint using low-carbon ammonia. These forward-thinking entities are crucial partners for CF Industries.

Key players within this segment are collaborating with CF Industries to advance sustainable energy solutions. For instance, partnerships with companies like JERA and Mitsui highlight the strategic importance of this group in driving the adoption of cleaner technologies. These collaborations are vital for scaling up the production and utilization of low-carbon ammonia.

- Emerging Clean Energy Focus: Companies dedicated to developing low-carbon fuels and decarbonizing operations through low-carbon ammonia.

- Strategic Partnerships: Collaborations with industry leaders like JERA and Mitsui to advance clean energy solutions.

- Decarbonization Drive: A segment actively seeking to reduce their environmental impact by integrating low-carbon ammonia into their processes.

Government Agencies and International Organizations

Government agencies and international organizations are crucial stakeholders for CF Industries, particularly concerning food security and environmental policy. These entities often influence agricultural practices and sustainability mandates, indirectly shaping demand for nitrogen fertilizers. For instance, organizations like the Food and Agriculture Organization of the United Nations (FAO) promote sustainable agriculture, which can impact fertilizer usage patterns.

In 2024, global efforts to enhance food security remain a priority, with many governments investing in agricultural productivity. CF Industries' products are foundational to achieving these goals. Furthermore, evolving environmental regulations, such as those related to greenhouse gas emissions from fertilizer production and use, directly affect operational standards and product development for companies like CF Industries. For example, the European Union’s Farm to Fork Strategy aims to make food systems more sustainable, potentially influencing fertilizer application recommendations.

CF Industries' engagement with these bodies is strategic, as their policies can create both opportunities and challenges. The company must navigate varying regulatory landscapes and align its operations with global sustainability objectives. This includes adapting to potential carbon pricing mechanisms or incentives for more efficient nutrient management.

Key interactions and impacts include:

- Influence on agricultural policy: Government subsidies and agricultural support programs can directly impact fertilizer demand.

- Environmental regulations: Stricter emissions standards and water quality regulations can necessitate investments in cleaner production technologies.

- Food security initiatives: International organizations' focus on increasing crop yields can bolster demand for fertilizers.

- Sustainability mandates: Global agreements on climate change and sustainable development can shape long-term product innovation and market access.

CF Industries serves a diverse customer base, broadly categorized into agricultural distributors, industrial users, and emerging clean energy entities. Agricultural cooperatives and independent distributors are key intermediaries, purchasing fertilizers in bulk to supply farmers, with consistent availability and competitive pricing being paramount. Industrial clients, including chemical and energy producers, rely on CF Industries for essential products like hydrogen and nitrogen for refining and manufacturing processes.

The company also targets the growing clean energy sector, engaging with companies focused on low-carbon fuels and decarbonization through initiatives like low-carbon ammonia. For instance, in 2023, CF Industries reported significant sales to industrial customers, underscoring their importance. The agricultural sector's demand remains robust, with projections for 2024 indicating substantial acreage for nitrogen-intensive crops like corn, around 91.7 million acres in the U.S.

| Customer Segment | Key Needs | 2023/2024 Relevance |

| Agricultural Distributors | Product Availability, Resale Pricing, Logistics | Major volume purchasers; 2024 corn acreage projections highlight sustained demand. |

| Industrial Users | Hydrogen, Nitrogen for Manufacturing/Refining | Significant revenue driver; crucial for chemical and energy sectors. |

| Clean Energy Sector | Low-Carbon Ammonia, Decarbonization Solutions | Emerging growth area; strategic partnerships in development. |

Cost Structure

Natural gas is the single biggest expense for CF Industries, making up a substantial portion of their cost of sales. This is because natural gas is the key ingredient, the feedstock, for producing ammonia, which is a core product for the company.

Given this, any swings in natural gas prices directly affect how profitable CF Industries is. For instance, in the first quarter of 2024, CF Industries reported that the average cost of natural gas for their ammonia production was $2.40 per million British thermal units (MMBtu), a decrease from $2.75 per MMBtu in the same period of 2023, highlighting the direct impact of market prices on their cost structure.

Manufacturing and production expenses are a significant component of CF Industries' cost structure, encompassing labor, utilities other than natural gas, and the upkeep of their extensive manufacturing facilities and equipment. These costs are directly tied to the physical operations of producing nitrogen fertilizer.

For instance, in 2023, CF Industries reported total cost of goods sold of $6.5 billion, which includes these manufacturing and production expenses. Effective management of these costs hinges on achieving high asset utilization and maintaining operational efficiency across their plants.

Logistics and distribution form a significant component of CF Industries' cost structure. These expenses encompass the substantial freight, storage, and handling costs associated with moving their nitrogen fertilizer products across a vast network throughout North America and internationally.

In 2024, CF Industries continued to invest in optimizing its supply chain to manage these critical costs. For instance, the company's strategic focus on improving rail and barge efficiency directly impacts the freight component of these expenditures, aiming to mitigate the overall financial burden of distribution.

Capital Expenditures for Growth and Decarbonization

CF Industries Holdings is making significant capital investments to drive growth and support decarbonization efforts. These investments are crucial for their long-term strategy and directly influence their cost structure.

- Strategic Growth Investments: The company is allocating substantial capital to projects aimed at expanding its production capacity and market reach, particularly in areas like clean energy.

- Decarbonization Initiatives: A key focus is on developing and building new low-carbon ammonia production facilities and investing in carbon capture technologies, which represent considerable upfront costs.

- Impact on Cost Structure: These capital expenditures, while essential for future revenue streams and sustainability, will increase the company's depreciation and amortization expenses and may require significant financing, impacting operating costs in the near to medium term.

- 2024 Capital Expenditure Guidance: For 2024, CF Industries has guided for capital expenditures in the range of $1.1 billion to $1.3 billion, with a significant portion dedicated to clean energy projects.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for CF Industries Holdings represent the company's overhead, covering everything from sales and marketing efforts to the salaries of administrative staff and corporate functions. These costs are vital for maintaining operations and driving future growth, including investments in research and development.

Efficiently managing these expenditures is key to CF Industries' overall profitability. In 2023, SG&A expenses were reported at $704 million. This figure highlights the significant investment required to support the company's global reach and operational complexity.

- Sales and Marketing: Costs associated with promoting and selling CF Industries' products.

- General and Administrative: Includes executive salaries, legal, finance, and HR functions.

- Research and Development: Investments in innovation and improving existing products and processes.

- 2023 SG&A: Totaled $704 million, demonstrating the scale of these operational overheads.

CF Industries' cost structure is heavily influenced by its reliance on natural gas as a primary feedstock, with fluctuations in gas prices directly impacting profitability. Manufacturing and production expenses, including labor and utilities, are also significant operational costs. Furthermore, logistics and distribution costs are substantial due to the extensive network required to move products.

Capital expenditures are a growing component, with substantial investments in 2024 for growth and decarbonization projects, such as low-carbon ammonia facilities. SG&A expenses, totaling $704 million in 2023, cover essential overheads like sales, marketing, and administrative functions.

| Cost Component | 2023 Data | 2024 Outlook/Notes |

|---|---|---|

| Natural Gas (Cost of Sales) | Average cost decreased from $2.75/MMBtu in Q1 2023 to $2.40/MMBtu in Q1 2024. | Key feedstock; price volatility directly impacts profitability. |

| Manufacturing & Production Expenses (part of Cost of Goods Sold) | Total Cost of Goods Sold: $6.5 billion in 2023. | Includes labor, utilities, facility upkeep; efficiency is crucial. |

| Logistics & Distribution | Ongoing investment in supply chain optimization (rail, barge efficiency). | Significant freight, storage, and handling costs. |

| Capital Expenditures | N/A (Focus on future investments) | Guidance of $1.1-$1.3 billion for 2024, heavily weighted towards clean energy projects. |

| Selling, General & Administrative (SG&A) | $704 million in 2023. | Covers sales, marketing, admin staff, R&D; essential for operations and growth. |

Revenue Streams

CF Industries Holdings' core revenue originates from selling essential nitrogen fertilizers like anhydrous ammonia, granular urea, and urea ammonium nitrate (UAN) solutions. These products are crucial for global agriculture, supporting crop yields and food production. In 2024, the demand for these fertilizers remained robust, driven by the need to feed a growing world population.

CF Industries Holdings generates significant revenue from selling industrial nitrogen products. These products are crucial for various sectors, including automotive and manufacturing, where they are used in applications like emissions abatement systems, particularly for diesel engines. In 2023, industrial products represented a substantial portion of their sales, demonstrating the ongoing demand for nitrogen-based solutions beyond agriculture.

CF Industries is increasingly focused on low-carbon ammonia sales as a significant emerging revenue stream. This clean energy application includes its use in power plant co-firing, as a maritime fuel, and for hydrogen storage, positioning the company for future growth in the green economy.

The company is actively investing in technologies to produce low-carbon ammonia, aiming to capture a growing market share. In 2024, CF Industries announced plans to develop a low-carbon ammonia production facility with an annual capacity of approximately 1.7 million metric tons, signaling a substantial commitment to this sector.

Services Revenue from Joint Ventures

CF Industries anticipates consistent revenue from its joint venture operations, particularly through services related to the Blue Point low-carbon ammonia facility. This includes income generated from the ongoing operation and maintenance of the plant, as well as the provision of essential supporting infrastructure.

This revenue stream is crucial for CF Industries' diversified business model. For instance, in 2023, CF Industries reported significant growth, with net sales reaching $7.48 billion, highlighting the importance of such service-based income streams in bolstering overall financial performance.

- Operational Services: Fees for managing and maintaining the joint venture's production facilities.

- Infrastructure Support: Revenue from providing shared or dedicated logistical and utility services.

- Long-Term Agreements: Securing ongoing revenue through multi-year service contracts with joint venture partners.

Carbon Capture and Sequestration Incentives

CF Industries can generate revenue or achieve cost savings through government incentives and tax credits specifically designed to encourage carbon capture and sequestration (CCS) initiatives. A prime example is the Section 45Q tax credit in the United States, which directly supports companies undertaking decarbonization projects. These credits can significantly improve the economic viability of CCS investments, making them a crucial component of CF Industries' revenue streams.

The financial impact of these incentives is substantial. For instance, the Inflation Reduction Act of 2022 enhanced Section 45Q, increasing the credit amount to $85 per metric ton of carbon dioxide captured and stored. This makes CCS projects more attractive and directly contributes to CF Industries' bottom line by reducing the net cost of implementing these technologies or providing a direct revenue stream if the captured carbon is sold.

- Government Incentives: Section 45Q tax credits in the U.S. provide financial support for CCS projects.

- Enhanced Credits: The Inflation Reduction Act of 2022 boosted 45Q credits to $85 per metric ton of captured and stored CO2.

- Economic Viability: These incentives improve the financial feasibility of decarbonization efforts for CF Industries.

- Revenue Generation/Cost Savings: Credits can either directly generate revenue or reduce operational costs associated with carbon capture.

CF Industries' primary revenue comes from selling nitrogen fertilizers like anhydrous ammonia and urea, vital for agriculture. In 2024, the demand for these fertilizers remained strong due to global food security needs.

Industrial nitrogen products, used in sectors like automotive for emissions control, also contribute significantly. In 2023, these industrial sales represented a substantial portion of the company's revenue, underscoring their broad applicability.

Low-carbon ammonia represents a key growth area, with applications in clean energy. CF Industries is investing heavily in this sector, with plans for a 1.7 million metric ton low-carbon ammonia facility announced in 2024.

Revenue is also generated through operational services and infrastructure support for joint ventures, such as the Blue Point low-carbon ammonia facility. These service agreements provide a stable income stream, as seen in the company's overall financial performance in 2023.

| Revenue Stream | Description | 2023 Relevance |

|---|---|---|

| Fertilizer Sales | Anhydrous ammonia, urea, UAN solutions for agriculture | Core business, robust demand |

| Industrial Products | Nitrogen for automotive, manufacturing (e.g., emissions abatement) | Substantial sales portion |

| Low-Carbon Ammonia | Clean energy applications (maritime fuel, hydrogen storage) | Emerging growth area, significant investment |

| Joint Venture Services | Operational and infrastructure support for facilities | Stable income stream |

Business Model Canvas Data Sources

The CF Industries Business Model Canvas is built using a combination of financial disclosures, industry analysis reports, and internal operational data. These sources provide a comprehensive view of market dynamics, competitive landscapes, and the company's strategic direction.