CF Industries Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CF Industries Holdings Bundle

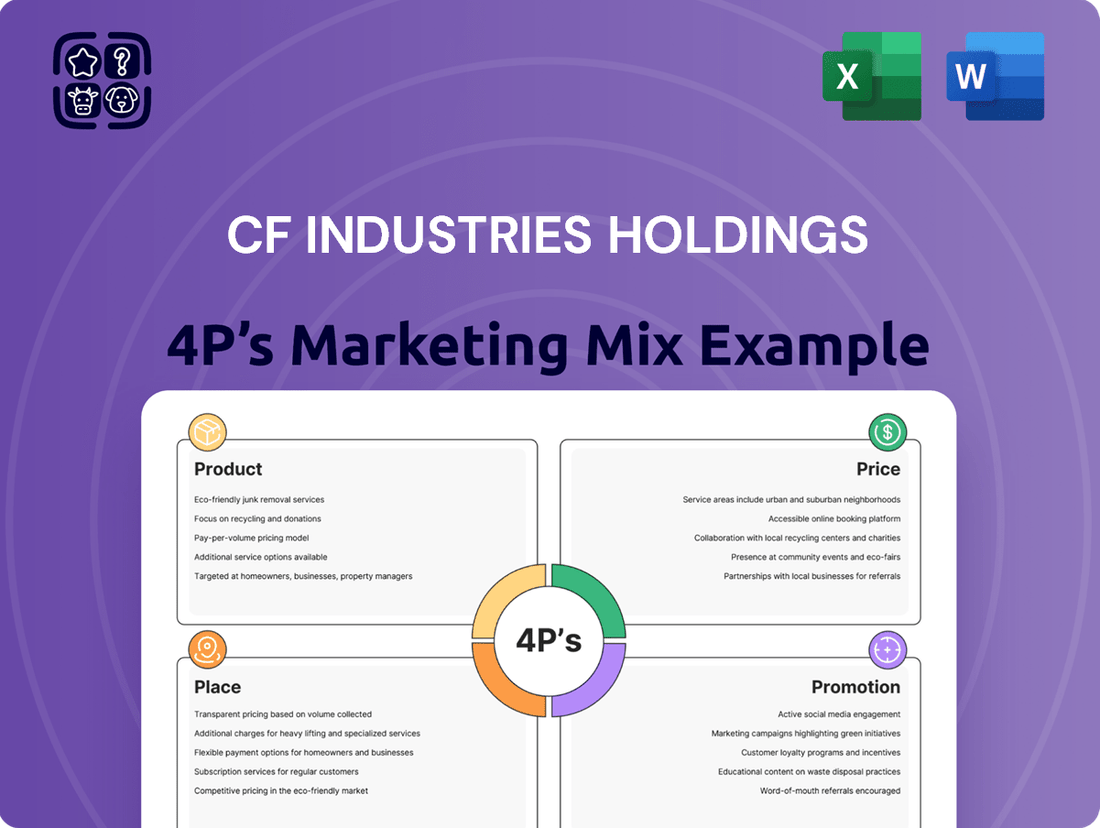

CF Industries Holdings' marketing strategy is built on a robust foundation of essential elements. Their product offerings, primarily nitrogen fertilizers, are crucial for global agriculture, while their pricing reflects market dynamics and value. Discover how their distribution network ensures widespread availability and how their promotional efforts target key stakeholders.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering CF Industries Holdings' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into this vital industry player.

Product

CF Industries Holdings' core products, anhydrous ammonia, granular urea, urea ammonium nitrate (UAN), and ammonium nitrate, are fundamental nitrogen and hydrogen-based compounds. These products are the bedrock of their operations, primarily fueling global agriculture by boosting crop yields. In 2024, the demand for these fertilizers remained robust, with global fertilizer consumption projected to increase, driven by the need to feed a growing population.

CF Industries is actively pursuing clean energy solutions, moving beyond its core fertilizer business. This strategic pivot includes substantial investment in low-carbon and green ammonia production. These innovations are vital for decarbonizing heavy industry and power generation, with projections suggesting the global ammonia market could reach $300 billion by 2030, with green ammonia playing an increasingly significant role.

CF Industries Holdings offers emissions abatement solutions, primarily through its nitrogen-based products. These products are crucial for industries aiming to reduce their environmental impact.

Diesel exhaust fluid (DEF) and nitric acid are key components of CF Industries' emissions abatement strategy. DEF is used in selective catalytic reduction (SCR) systems to convert harmful nitrogen oxides (NOx) into harmless nitrogen and water. Nitric acid can also be used in certain industrial processes to manage emissions.

In 2024, the demand for DEF is projected to remain strong, driven by increasingly stringent emissions regulations globally, particularly in the transportation sector. For instance, the European Union's Euro 7 standards, expected to be implemented in stages from 2025, will likely further boost the need for SCR technology and, consequently, DEF. CF Industries, as a major producer, is well-positioned to capitalize on this trend, contributing to cleaner air by enabling significant reductions in NOx emissions from diesel engines.

Green Ammonia ion

CF Industries is positioning green ammonia as a sustainable product, exemplified by its pioneering commercial-scale production facility at Donaldsonville, Louisiana. This plant, the first of its kind in North America, can produce 20,000 tons of green ammonia annually through electrolysis, signaling a significant step in their commitment to environmentally friendly offerings.

The company's focus on green ammonia addresses growing market demand for decarbonized solutions across various sectors, including agriculture and as a potential clean fuel. This strategic product development aligns with global efforts to reduce carbon emissions.

- Product Innovation: North America's first commercial-scale green ammonia facility at Donaldsonville, Louisiana.

- Production Capacity: Annual output of 20,000 tons of green ammonia.

- Technology Employed: Utilizes electrolysis for green ammonia production.

- Market Focus: Targeting demand for decarbonized solutions in agriculture and as a clean fuel.

Future Low-Carbon Ammonia Capacity

CF Industries is significantly investing in its future low-carbon ammonia capacity, a key element of its product strategy. The company is partnering to build a massive $4 billion low-carbon ammonia plant at its Blue Point Complex in Louisiana, with operations expected to commence in 2029.

This ambitious project aims to create the world's largest low-carbon ammonia facility, substantially boosting CF Industries' clean energy portfolio. The expansion is designed to meet growing global demand for low-carbon ammonia, positioning CF Industries as a leader in this emerging market.

- Investment: $4 billion joint venture for a new low-carbon ammonia plant.

- Location: Blue Point Complex, Louisiana.

- Production Start: Slated for 2029.

- Capacity: Expected to be the world's largest low-carbon ammonia facility.

CF Industries' product portfolio spans essential agricultural inputs like anhydrous ammonia and urea, alongside critical emissions abatement solutions such as diesel exhaust fluid (DEF). The company is also strategically expanding into green ammonia, a key component for decarbonization efforts across industries. This diversification reflects a commitment to both current market needs and future sustainable energy solutions.

| Product Category | Key Products | 2024/2025 Market Relevance | Strategic Initiatives |

|---|---|---|---|

| Agricultural Nutrients | Anhydrous Ammonia, Granular Urea, UAN, Ammonium Nitrate | Robust global demand driven by food security needs. Projections show continued growth in fertilizer consumption. | Core business supporting global food production. |

| Emissions Abatement | Diesel Exhaust Fluid (DEF), Nitric Acid | Strong demand for DEF due to stringent emissions regulations (e.g., Euro 7 standards from 2025). | Enabling cleaner air by reducing NOx emissions from diesel engines. |

| Clean Energy Solutions | Green Ammonia | Growing market demand for decarbonized solutions. | Pioneering commercial-scale production (20,000 tons/year) and investing in a $4 billion low-carbon ammonia plant (operational 2029) to be the world's largest. |

What is included in the product

This analysis provides a comprehensive breakdown of CF Industries Holdings' marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities to illuminate its market positioning and competitive advantages.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding CF Industries' competitive positioning.

Provides a clear, concise overview of CF Industries' 4Ps, easing the burden of detailed market analysis for busy executives.

Place

CF Industries boasts an extensive manufacturing network with facilities strategically located across the United States, Canada, and the United Kingdom. These sites are designed for the efficient production of essential hydrogen and nitrogen products, serving both agricultural and industrial sectors. In 2023, CF Industries reported total ammonia production capacity of approximately 21 million metric tons, highlighting the scale of its manufacturing footprint.

CF Industries Holdings leverages its extensive North American distribution network, featuring around 21 strategically located terminals, to ensure efficient product delivery. This robust logistical infrastructure underpins its market presence.

CF Industries leverages a robust global logistics network, extending its reach beyond North America to serve a diverse international customer base. This capability is crucial for delivering essential products like nitrogen fertilizers to markets across Europe and other key regions, ensuring worldwide accessibility and supporting global agriculture.

In 2023, CF Industries reported that approximately 30% of its total sales were generated outside of North America, underscoring the importance of its international logistics infrastructure in reaching customers in Europe, South America, and Asia.

Strategic Facility Locations

CF Industries Holdings strategically positions its manufacturing facilities to maximize operational advantages. Key sites like the Donaldsonville and Blue Point Complexes in Louisiana are prime examples, leveraging proximity to abundant, low-cost natural gas, a critical feedstock for ammonia production. This access directly impacts production costs, a significant factor in the competitive fertilizer market.

These locations also offer crucial logistical benefits, including access to deep-water ports, facilitating efficient export of products to global markets. Furthermore, the development of carbon sequestration hubs near these facilities presents an opportunity to reduce operational emissions and potentially create a competitive advantage in an increasingly carbon-conscious environment. This integrated approach to location planning enhances both production efficiency and market reach.

- Donaldsonville Complex, Louisiana: A major production hub benefiting from natural gas access and port facilities.

- Blue Point Complex, Louisiana: Strategically located to capitalize on feedstock availability and export infrastructure.

- Access to Natural Gas: Low-cost natural gas is a primary driver for efficient ammonia and nitrogen fertilizer production.

- Export Capabilities: Port access is vital for reaching international customers and diversifying revenue streams.

Diverse Customer Channels

CF Industries Holdings strategically utilizes a diverse array of customer channels to ensure comprehensive market reach. These channels include direct sales to agricultural cooperatives, independent fertilizer distributors, and major retailers, alongside engagement with traders and wholesalers for broader distribution. This multi-faceted approach allows CF Industries to effectively serve both large-scale agricultural operations and industrial consumers.

In 2023, CF Industries reported that approximately 70% of its nitrogen fertilizer sales were to agricultural customers. Their distribution network is designed to efficiently deliver products, with a significant portion of sales occurring through their own distribution facilities and those of their partners. This broad penetration is crucial for meeting the demand across various geographies and customer segments.

The company's channel strategy is further bolstered by its relationships with industrial users, who purchase ammonia and other nitrogen products for applications beyond agriculture, such as in the manufacturing of plastics and chemicals. This diversification of customer bases through varied channels mitigates risks and capitalizes on different market dynamics.

Key distribution channels include:

- Direct Sales: To large agricultural producers and cooperatives.

- Retail and Wholesale: Partnering with established agricultural retailers and wholesale distributors.

- Trading and Brokerage: Engaging with market intermediaries for efficient product movement.

- Industrial Markets: Supplying ammonia and other products directly to non-agricultural industries.

CF Industries' strategic placement of manufacturing and distribution assets is a cornerstone of its market dominance. By situating facilities near abundant, low-cost natural gas, the company optimizes production efficiency. Furthermore, access to deep-water ports in key locations like Louisiana enables cost-effective global exports.

| Location Type | Key Advantage | 2023 Impact |

|---|---|---|

| Manufacturing Facilities (US, Canada, UK) | Proximity to Feedstock (Natural Gas) & Logistics | Supported ~21 million metric tons ammonia capacity |

| Distribution Terminals (North America) | Efficient Product Delivery | 21 strategically located terminals |

| International Reach | Global Market Access | ~30% of total sales outside North America in 2023 |

What You Preview Is What You Download

CF Industries Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive CF Industries Holdings 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to this complete analysis, ready for your strategic planning.

Promotion

CF Industries Holdings actively engages with its investor base through a comprehensive investor relations program. The company's website serves as a central hub, providing easy access to announcements, SEC filings, and other crucial data, ensuring transparency and accessibility for both current and prospective shareholders.

This commitment to proactive communication is vital for building trust and keeping stakeholders informed about CF Industries' operational performance and strategic initiatives. For example, in the first quarter of 2024, CF Industries reported net earnings of $430 million, or $2.14 per diluted share, demonstrating solid financial footing that is regularly communicated to investors.

CF Industries Holdings actively engages with the financial community through quarterly earnings conference calls, offering detailed insights into their financial performance and strategic outlook. These calls provide a crucial channel for investors to understand the company's trajectory and ask clarifying questions. For instance, following their Q1 2024 earnings, the company reported net earnings of $3.40 per diluted share, a significant increase from the prior year, demonstrating strong operational execution.

Beyond routine calls, CF Industries' leadership team frequently participates in prominent investor conferences and hosts dedicated investor days. This proactive approach allows for deeper dives into their business model, market positioning, and future growth initiatives, fostering transparency and building confidence among financial professionals and stakeholders. In 2023, the company hosted its Investor Day, highlighting significant capital allocation priorities and long-term growth opportunities in low-carbon ammonia production.

CF Industries actively engages in sustainability through comprehensive Corporate Stewardship and ESG reports. These documents showcase their dedication to reducing environmental impact and achieving decarbonization, aligning with increasing investor demand for responsible corporate citizenship.

In 2023, CF Industries reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to their 2017 baseline, demonstrating tangible progress on their environmental goals. This focus on ESG metrics is crucial for attracting capital and enhancing long-term value.

Strategic Partnerships and Collaborations

CF Industries actively highlights its strategic alliances and joint ventures, especially those geared towards clean energy and reduced carbon emissions. These collaborations are crucial for demonstrating their commitment to sustainability and innovation in the fertilizer industry.

Partnerships with companies such as JERA, Mitsui, ExxonMobil, and POET are frequently publicized. These joint efforts underscore CF Industries' position as a leader in the developing clean energy sector, aiming to attract further investment and enhance their market presence. For instance, their joint venture with Mitsui & Co. and JERA to explore ammonia production in the U.S. Gulf Coast is a prime example of this strategy, potentially unlocking new avenues for low-carbon ammonia supply chains.

- Strategic focus on clean energy: CF Industries prioritizes partnerships in low-carbon solutions, aligning with global sustainability trends.

- Key collaborators: Notable partners include JERA, Mitsui, ExxonMobil, and POET, showcasing a diverse and influential network.

- Market positioning: These collaborations reinforce CF Industries' leadership image in the evolving clean energy and ammonia markets.

- Investment attraction: Publicizing these ventures aims to draw capital and support for their clean energy initiatives.

Digital and Corporate Communications

CF Industries actively uses its corporate website and official press releases to share company developments, product details, and strategic direction. This approach ensures that diverse stakeholders, including farmers and financial experts, receive current and reliable information.

The company's digital presence is crucial for communicating its commitment to sustainability and innovation. For instance, their 2023 annual report, released in early 2024, detailed significant investments in low-carbon ammonia projects, a key message conveyed through these channels.

These communications are vital for building trust and transparency. Key areas of focus include:

- Website Updates: Regular postings of financial results, investor presentations, and sustainability reports.

- Press Releases: Timely announcements on new product launches, partnerships, and operational milestones.

- Social Media Engagement: Utilizing platforms to share company news and engage with the broader community.

- Investor Relations: Dedicated sections providing comprehensive information for financial analysts and investors.

CF Industries actively communicates its value proposition through robust investor relations and digital channels, ensuring transparency with financial stakeholders. Their website and press releases provide timely updates on performance and strategy, such as the Q1 2024 results showing net earnings of $430 million. The company also emphasizes its commitment to sustainability and innovation, highlighted in its ESG reports and partnerships, like the 2023 announcement of a 15% reduction in greenhouse gas emissions intensity.

These efforts are bolstered by participation in investor conferences and dedicated investor days, as exemplified by their 2023 event focusing on low-carbon ammonia growth. Strategic alliances with firms like JERA and Mitsui are frequently publicized to underscore their leadership in clean energy, demonstrating a clear promotional strategy to attract investment and market attention.

| Communication Channel | Key Information Disseminated | Example Data Point (Q1 2024) |

| Investor Relations Program | Financial results, SEC filings, strategic initiatives | Net earnings: $430 million |

| Earnings Conference Calls | Financial performance, strategic outlook | Net earnings per diluted share: $2.14 |

| Investor Days/Conferences | Business model, market positioning, growth initiatives | Focus on low-carbon ammonia production |

| Corporate Stewardship/ESG Reports | Environmental impact, decarbonization efforts | 15% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2017 baseline) |

| Website & Press Releases | Company developments, product details, sustainability efforts | 2023 Annual Report detailing investments in low-carbon ammonia |

Price

CF Industries Holdings employs a competitive pricing strategy, heavily influenced by the global nitrogen industry's supply and demand, as well as its own cost advantages. Their North American production, benefiting from lower natural gas input costs, enables them to offer competitive pricing in the international fertilizer market.

For instance, as of early 2024, natural gas prices in North America remained significantly lower than in many other regions, providing CF Industries with a crucial cost advantage. This allows them to price their nitrogen products attractively, particularly urea and ammonia, to capture market share against higher-cost producers.

The price of natural gas is a crucial factor for CF Industries, as it's a primary feedstock for nitrogen fertilizer. Fluctuations here directly impact their manufacturing expenses and the prices they can charge for their products. For instance, in the first quarter of 2024, CF Industries reported that lower natural gas costs contributed to improved earnings, but also acknowledged that these lower input costs often translate to lower fertilizer prices in the market.

CF Industries' pricing power is directly tied to the ebb and flow of global demand and supply. When demand for fertilizers is high, especially from major agricultural regions, and supply is tight, prices naturally rise. This has been evident in recent periods.

For instance, in the first quarter of 2024, CF Industries reported strong net sales of $1.4 billion, up from $1.3 billion in the same period of 2023, reflecting robust market conditions. This strength is often amplified when supply chains face disruptions, such as the impact of high natural gas prices on European production, a key input for nitrogen fertilizer manufacturing.

The company's ability to navigate these dynamics is crucial. In 2024, global fertilizer demand remained strong, driven by the need to replenish soil nutrients and support crop yields. This sustained demand, coupled with the ongoing supply constraints in certain regions, created a favorable pricing environment for CF Industries' essential products.

Value-Based Pricing for Low-Carbon Products

CF Industries' expansion into low-carbon and green ammonia products opens the door for value-based pricing. This strategy allows them to capture the premium customers are willing to pay for environmentally friendly solutions, especially as sustainability becomes a key purchasing driver.

These green ammonia offerings are well-positioned to benefit from regulatory tailwinds and incentives. For instance, the U.S. Inflation Reduction Act, enacted in 2022, significantly enhances tax credits like Section 45Q for carbon capture, making low-carbon production more economically attractive and supporting higher pricing.

The anticipated higher margins from these premium products are crucial for CF Industries' growth strategy. As demand for decarbonization solutions escalates, particularly in sectors like agriculture and industrial manufacturing, CF can leverage this demand to achieve superior profitability compared to traditional ammonia.

- Premium Pricing Potential: Value-based pricing allows CF Industries to align product price with the perceived environmental benefits and regulatory advantages of low-carbon ammonia.

- Regulatory Support: Incentives like the enhanced Section 45Q tax credits provide a financial underpinning for higher price points on green ammonia production.

- Margin Expansion: The company is poised to achieve enhanced profit margins on its low-carbon product portfolio, reflecting the growing market demand for sustainable solutions.

Shareholder Return and Capital Allocation

CF Industries Holdings' (CF) commitment to shareholder return is evident in its capital allocation strategy, fueled by robust cash generation from its pricing strategies and operational efficiency. This focus translates into tangible benefits for investors.

The company consistently returns capital through dividends and share repurchases. For instance, in 2023, CF returned approximately $1.4 billion to shareholders through dividends and share repurchases. This demonstrates a clear dedication to rewarding its owners.

- Dividend Payouts: CF has a history of consistent dividend payments, providing a regular income stream to shareholders.

- Share Repurchases: The company actively engages in share repurchase programs, reducing the number of outstanding shares and potentially increasing earnings per share.

- Disciplined Allocation: Management prioritizes a disciplined approach to capital allocation, balancing reinvestment in the business with shareholder returns.

- Value Creation: These actions underscore CF's strategy to create and return value to its shareholders, reinforcing investor confidence.

CF Industries' pricing strategy is a dynamic interplay of market forces and internal cost advantages, particularly benefiting from lower North American natural gas prices. This cost advantage allows them to offer competitive prices for key products like urea and ammonia in the global market.

The company's pricing power is further bolstered by strong global demand for fertilizers, which remained robust through early 2024. For example, CF Industries reported net sales of $1.4 billion in Q1 2024, an increase from $1.3 billion in Q1 2023, indicating favorable market conditions that support their pricing.

Looking ahead, CF Industries is strategically positioning its low-carbon and green ammonia products for value-based pricing. This approach is supported by regulatory tailwinds, such as enhanced tax credits from the U.S. Inflation Reduction Act, which makes premium pricing for sustainable solutions more viable and attractive.

| Metric | Q1 2023 | Q1 2024 | Year-over-Year Change |

|---|---|---|---|

| Net Sales (USD Billions) | 1.3 | 1.4 | +7.7% |

| Natural Gas Prices (USD/MMBtu - Avg. US) | ~2.50 | ~1.80 | -28.0% |

| Urea Price (USD/Ton - FOB US Gulf) | ~350 | ~320 | -8.6% |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for CF Industries Holdings leverages a robust blend of data, including official SEC filings, investor relations materials, and company press releases. We also incorporate insights from industry-specific market research reports and competitive intelligence to ensure a comprehensive understanding of their product, price, place, and promotion strategies.