CF Industries Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CF Industries Holdings Bundle

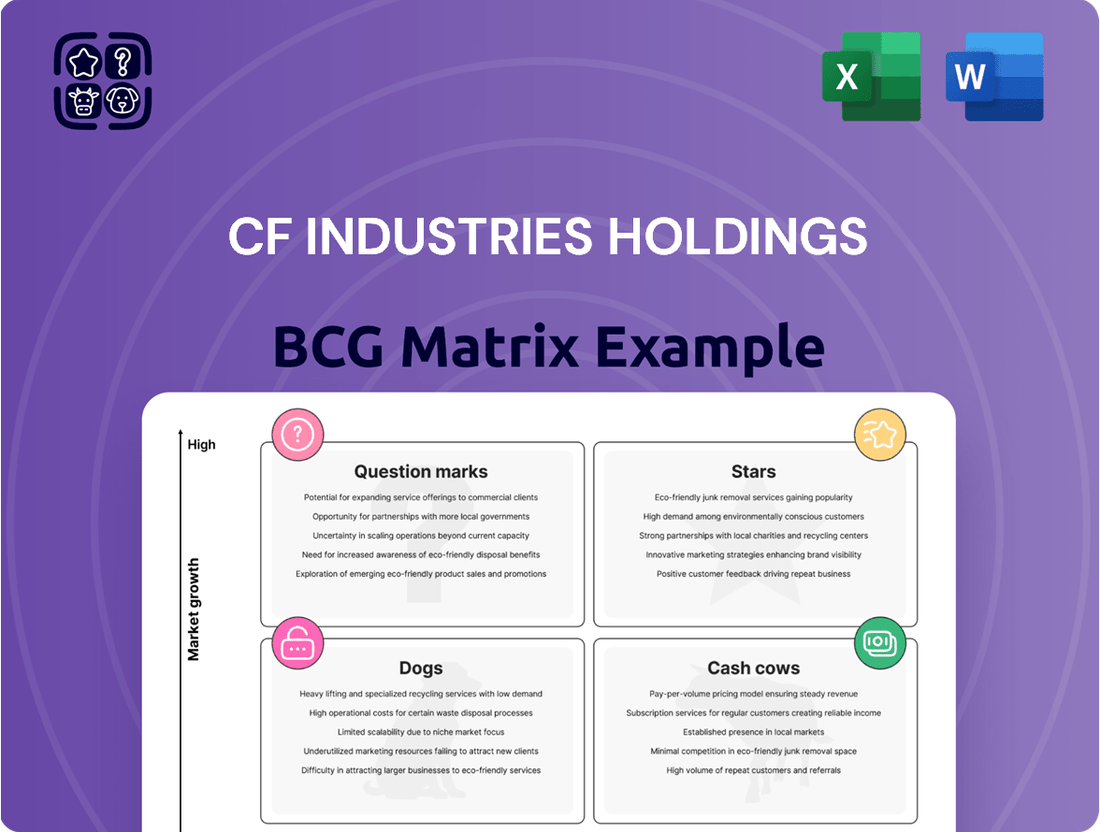

Discover the strategic positioning of CF Industries Holdings' product portfolio with our insightful BCG Matrix analysis. See which segments are driving growth and which may require a closer look.

This preview offers a glimpse into the potential Stars, Cash Cows, Dogs, and Question Marks within CF Industries. For a comprehensive understanding and actionable insights to optimize your investment strategy, purchase the full BCG Matrix report.

Stars

CF Industries is a dominant player in traditional nitrogen fertilizer production, leveraging its cost advantages from North American facilities powered by affordable natural gas. This strategic positioning allows them to capitalize on the growing global demand for fertilizers, which is fueled by the need for increased food production and modern agricultural practices. In 2024, the company's operational efficiency and high capacity utilization rates underscore its robust presence in this essential market.

CF Industries is actively pursuing low-carbon ammonia for agriculture, a strategic move positioning them for future growth. Their collaboration with POET for ethanol production exemplifies this commitment, aiming to reduce the carbon footprint in both food and biofuel sectors.

This focus on sustainability aligns with a growing global demand for environmentally friendly farming solutions. By offering lower-carbon alternatives, CF Industries is tapping into a market segment expected to expand significantly as the agricultural industry prioritizes decarbonization efforts.

CF Industries is making significant strides in carbon capture and sequestration (CCS), notably with substantial investments in its Donaldsonville and Yazoo City facilities. These large-scale projects are designed to capture millions of metric tons of CO2 each year, a crucial step in producing low-carbon ammonia. This positions CF Industries as a frontrunner in industrial decarbonization efforts, aligning with stringent environmental regulations and ambitious global sustainability targets.

Strategic Partnerships for Clean Energy

CF Industries Holdings actively pursues strategic partnerships to solidify its position in the expanding clean energy market. A prime example is their collaboration with JERA and Mitsui for a low-carbon ammonia facility at Blue Point. This joint venture underscores CF's commitment to capturing significant market share in this high-growth sector.

These alliances are crucial for leveraging established expertise and infrastructure to meet the projected surge in global demand for low-carbon ammonia. Such initiatives are vital as new applications for ammonia, including power generation and maritime fuel, continue to emerge and gain traction.

- Joint Venture with JERA and Mitsui: Focused on developing a low-carbon ammonia facility at Blue Point, highlighting CF's strategic move into clean energy.

- Market Share Capture: These partnerships are designed to secure a substantial position in the rapidly growing clean energy sector, particularly in low-carbon ammonia.

- Leveraging Expertise and Infrastructure: Collaborations allow CF to tap into existing capabilities and networks, accelerating its entry and competitiveness in new markets.

- Meeting Robust Global Demand: The initiative directly addresses the anticipated strong demand for low-carbon ammonia in emerging applications like power generation and maritime fuel.

North American Production Network

CF Industries' North American production network is a significant asset, underpinning its market dominance. This network boasts a cost advantage due to its strategic location and efficient operations. In 2024, CF Industries continued to leverage this advantage, with its integrated network of manufacturing complexes, storage facilities, and distribution channels enabling competitive pricing and reliable supply.

- Cost Advantage: Proximity to low-cost natural gas, a key feedstock, in North America.

- Integrated Logistics: Extensive storage and transportation infrastructure ensures efficient product movement.

- Market Leadership: Supports competitive pricing and reliable delivery, crucial for market share.

- Operational Scale: Large-scale production facilities contribute to economies of scale.

CF Industries' ventures into low-carbon ammonia and clean energy initiatives are clearly positioned as its Stars in the BCG Matrix. These are high-growth, high-market-share areas where the company is investing heavily and forging strategic partnerships, such as the one with JERA and Mitsui for a low-carbon ammonia facility at Blue Point. This strategic focus is designed to capture significant market share in a rapidly expanding sector driven by global decarbonization efforts and emerging applications for ammonia.

What is included in the product

CF Industries' BCG Matrix analysis provides clear strategic insights for its Stars, Cash Cows, Question Marks, and Dogs.

It highlights which business units to invest in, hold, or divest based on market growth and share.

The CF Industries BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Its export-ready design for PowerPoint eliminates the struggle of manually creating visual strategy summaries.

Cash Cows

Urea and Urea Ammonium Nitrate (UAN) are considered CF Industries' cash cows. These nitrogen fertilizers are staples in global agriculture, and CF Industries enjoys a significant market share in this mature segment.

These products consistently generate robust cash flow for CF Industries. Their established market presence and essential nature mean they require relatively low promotional investment, contributing to their strong cash-generating ability.

In 2023, CF Industries reported net sales of $7.1 billion for its ammonia and nitrogen products segment, with urea and UAN being key contributors. The steady, predictable demand for these fertilizers underpins their role as reliable cash generators for the company.

CF Industries' traditional ammonia production is a dominant cash cow, as the company is the world's largest producer. This segment leverages high operational efficiency and significant economies of scale. In 2023, CF Industries reported ammonia sales volumes of 16.8 million tons, contributing substantially to their overall revenue.

CF Industries' established distribution channels are a significant cash cow, particularly their extensive networks across North America and the UK. These robust systems ensure products reach customers efficiently, which helps keep logistical costs down and maximizes market penetration.

This logistical strength directly translates into consistent cash flow for CF Industries. For instance, in 2023, the company reported strong earnings driven by its ability to reliably supply essential agricultural and industrial products through these well-oiled channels.

Dividend Policy and Share Repurchase Programs

CF Industries Holdings' robust cash flow from its established operations fuels its shareholder return initiatives, including consistent dividend payments and ongoing share repurchase programs. These actions underscore the profitability of its core business segments, which generate surplus cash beyond reinvestment needs.

For instance, in the first quarter of 2024, CF Industries returned approximately $200 million to shareholders through dividends and share repurchases, a testament to its strong financial performance.

- Dividend Payout: The company has a history of increasing its dividend, reflecting confidence in sustained earnings. In 2023, CF Industries paid out $1.12 per share in dividends.

- Share Repurchases: CF Industries actively repurchases its own stock, reducing the number of outstanding shares and potentially boosting earnings per share. In 2023, the company repurchased $1.5 billion worth of its shares.

- Free Cash Flow Generation: The company's mature businesses consistently generate significant free cash flow, enabling these shareholder-friendly actions. CF Industries reported free cash flow of $2.5 billion in 2023.

Existing Industrial Applications of Nitrogen Products

Beyond its core fertilizer business, CF Industries Holdings' nitrogen products are integral to several stable industrial applications, acting as significant cash cows. These include emissions abatement technologies, particularly for reducing nitrogen oxides (NOx) in industrial processes and vehicle exhausts, and other chemical manufacturing applications. The demand in these sectors is generally consistent, reflecting mature market dynamics.

These established industrial uses provide a predictable and reliable revenue stream for CF Industries. For instance, in 2024, the demand for urea and ammonia in industrial applications remained robust, supporting the company's strong cash flow generation. This stability is a key characteristic of a cash cow, where investment needs are minimal, and returns are substantial and consistent.

- Emissions Abatement: Crucial for reducing NOx in power plants and diesel engines.

- Chemical Manufacturing: Used as a feedstock in various industrial chemical processes.

- Stable Demand: Mature markets ensure predictable revenue streams.

- Cash Flow Generation: Contributes significantly to CF Industries' overall financial health.

CF Industries' established ammonia production, where they are the world's largest producer, stands out as a prime cash cow. This segment benefits from exceptional operational efficiency and significant economies of scale, ensuring consistent profitability. In 2023, CF Industries' ammonia sales volume reached 16.8 million tons, underscoring its massive contribution to the company's revenue and cash flow.

| Product Segment | 2023 Sales (USD Billions) | Key Drivers | Cash Flow Contribution |

|---|---|---|---|

| Ammonia & Nitrogen Products | 7.1 | Global agricultural demand, industrial applications | High and stable |

| Ammonia Production Volumes | N/A (Volume metric) | World's largest producer, operational efficiency | Significant contributor to revenue and cash |

What You See Is What You Get

CF Industries Holdings BCG Matrix

The BCG Matrix analysis of CF Industries Holdings you are currently viewing is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final report, offering a detailed strategic breakdown of CF Industries' product portfolio according to market share and growth rate, ready for your immediate business planning needs.

Dogs

Legacy high-carbon production processes at CF Industries, characterized by older, less efficient methods, are increasingly viewed as potential 'dogs' in a BCG matrix analysis. These processes contribute significantly to greenhouse gas emissions, placing them under mounting regulatory scrutiny and facing higher operating expenses due to carbon pricing mechanisms and environmental mandates. For instance, while specific figures for CF Industries' older assets aren't publicly detailed in a way that directly maps to a BCG 'dog' category, the broader industry trend shows that facilities with higher emissions intensity are subject to greater compliance costs. In 2023, many industrial sectors globally saw increased costs associated with carbon taxes and emissions trading schemes, impacting profitability for less efficient operations.

Certain specialized nitrogen products, perhaps those tied to older agricultural techniques or specific industrial processes that are being phased out, could be considered dogs within CF Industries' portfolio. For instance, if a particular form of nitrogen fertilizer is no longer favored due to environmental regulations or the adoption of more efficient nutrient delivery systems, its demand would shrink significantly. These niche segments would typically exhibit both low market share and minimal growth, suggesting a need for careful management rather than aggressive expansion.

Underperforming or obsolete minor facilities within CF Industries Holdings' portfolio, such as smaller, less strategic manufacturing plants or distribution centers, can be categorized as Dogs in the BCG Matrix. These assets typically exhibit low market share within the company's overall operations and offer very limited prospects for future growth or profitability. For instance, a facility that has not been upgraded to meet current environmental standards or efficiency benchmarks would likely fall into this category, requiring significant investment to remain competitive or facing potential closure.

Commodity Products with High Price Volatility and Low Differentiation

Certain nitrogen products, like urea and ammonia, are highly commoditized and face significant price swings. For CF Industries, these could be considered 'dogs' if they consistently underperform. In 2024, urea prices saw considerable volatility, influenced by global supply and demand dynamics, with some periods showing sharp declines.

When these products offer little to no competitive advantage and struggle to generate consistent profits, their strategic value diminishes. This lack of differentiation means CF Industries might not command premium pricing.

The 'dog' category implies low market share and low growth potential for these specific products within CF Industries' portfolio.

- Low Profitability: Products consistently earning below the company's cost of capital.

- High Price Volatility: Subject to sharp price fluctuations due to global market forces.

- Lack of Differentiation: Offer little unique value compared to competitors' offerings.

- Limited Growth Prospects: Expected to show minimal expansion in market demand.

Investments in Failed or Stalled Pilot Projects

Pilot projects within CF Industries that have failed to gain market traction or have stalled indefinitely represent potential 'dogs' in a BCG Matrix analysis. These initiatives, often exploring new technologies or markets, consume valuable resources like capital and personnel without a clear trajectory toward profitability or significant market share. For instance, a pilot for a novel fertilizer additive that showed initial promise but faced regulatory hurdles or poor farmer adoption would fall into this category. Such projects, if they continue to drain funds without a viable path forward, become a drag on the company's overall performance.

These 'dog' investments are characterized by sunk costs and a lack of future potential. Consider a hypothetical scenario where CF Industries invested $50 million in a pilot for a bio-based fertilizer production method. If, by mid-2024, this project had not achieved its projected yield targets or secured any significant off-take agreements, and there were no clear plans to overcome these issues, it would be classified as a dog. The company must carefully evaluate these stalled ventures to decide whether to divest, restructure, or write them off to reallocate resources to more promising areas.

- Resource Drain: Pilot projects that fail to progress consume capital, R&D staff time, and management attention, diverting these from potentially profitable ventures.

- Opportunity Cost: Resources tied up in stalled pilots cannot be invested in current cash cows or promising question marks, leading to missed growth opportunities.

- Example Scenario: A pilot for a specialty nitrogen product targeting a niche agricultural market might have incurred $20 million in development costs by the end of 2023 but failed to achieve the necessary market penetration due to competitor pricing, classifying it as a dog.

Legacy high-carbon production processes at CF Industries, marked by older, less efficient methods, are increasingly viewed as potential 'dogs' in a BCG matrix analysis. These processes contribute significantly to greenhouse gas emissions, placing them under mounting regulatory scrutiny and facing higher operating expenses. For instance, while specific figures for CF Industries' older assets aren't publicly detailed in a way that directly maps to a BCG 'dog' category, the broader industry trend shows that facilities with higher emissions intensity are subject to greater compliance costs.

Certain specialized nitrogen products, perhaps those tied to older agricultural techniques or specific industrial processes that are being phased out, could be considered dogs within CF Industries' portfolio. These niche segments would typically exhibit both low market share and minimal growth, suggesting a need for careful management rather than aggressive expansion.

Underperforming or obsolete minor facilities within CF Industries Holdings' portfolio, such as smaller, less strategic manufacturing plants, can be categorized as Dogs. These assets typically exhibit low market share and offer very limited prospects for future growth or profitability. For example, a facility that has not been upgraded to meet current environmental standards would likely fall into this category.

Pilot projects within CF Industries that have failed to gain market traction or have stalled indefinitely represent potential 'dogs'. These initiatives consume valuable resources without a clear trajectory toward profitability or significant market share. For instance, a pilot for a novel fertilizer additive that faced regulatory hurdles or poor farmer adoption would fall into this category.

Question Marks

CF Industries' early-stage green ammonia production, exemplified by its 20,000 tons per year facility at Donaldsonville, Louisiana, represents a classic question mark in the BCG matrix. This venture targets the burgeoning market for decarbonized energy and sustainable agriculture, sectors with substantial long-term growth potential.

Despite the promising market outlook, the current market share for CF Industries' green ammonia is minimal. The company is still in the process of scaling up operations and establishing a significant presence in this nascent industry, requiring considerable ongoing investment to achieve commercial viability and market leadership.

CF Industries is making significant moves into hydrogen production, especially green hydrogen via electrolysis. This is a promising area for growth, though the company's current market share is small. This strategic pivot positions CF Industries to capitalize on the increasing demand for clean energy solutions.

The key to success for CF Industries' hydrogen ventures lies in their ability to ramp up production efficiently and bring down costs. Developing strong demand from industries looking to decarbonize will also be crucial. For instance, the global green hydrogen market was valued at approximately $10.7 billion in 2023 and is projected to grow substantially, indicating a robust future market.

CF Industries Holdings' proposed $4 billion blue ammonia facility at its Blue Point Complex represents a significant question mark in their BCG matrix. This ambitious project targets the burgeoning market for low-carbon ammonia, a sector poised for substantial growth.

The substantial capital expenditure required for this facility, coupled with the unproven market share potential, places it firmly in the question mark category. Success hinges on efficient project execution and widespread market adoption of blue ammonia.

Advanced Fertilizer Technologies (e.g., Enhanced Efficiency Fertilizers)

Investments in advanced fertilizer technologies, such as enhanced efficiency fertilizers (EEFs), represent potential question marks for CF Industries within a BCG Matrix framework. These innovations, designed to boost nutrient uptake and minimize environmental losses, cater to the increasing global demand for sustainable agricultural practices. For example, urea with urease inhibitors, a type of EEF, can significantly reduce nitrogen volatilization, a key environmental concern.

While the market for EEFs is growing, driven by regulatory pressures and consumer preferences for eco-friendly food production, initial adoption rates can be slow. Significant capital expenditure for research, development, and manufacturing, coupled with the need for extensive farmer education and demonstration programs, characterizes these ventures. The global market for enhanced efficiency fertilizers was projected to reach over $30 billion by 2024, indicating substantial growth potential but also highlighting the investment required to capture market share.

- Market Potential: Growing demand for sustainable agriculture and improved crop yields.

- Investment Needs: High R&D costs, new manufacturing processes, and farmer education campaigns.

- Adoption Challenges: Requires time for farmers to understand benefits and integrate into existing practices.

- Environmental Benefits: Reduced nutrient runoff and greenhouse gas emissions, aligning with ESG goals.

New Geographic Market Expansions for Clean Energy Products

New geographic market expansions for clean energy products, like CF Industries' potential foray into low-carbon ammonia for maritime fuel in Asia, represent question marks within the BCG matrix. These regions, particularly Asia, are showing burgeoning demand for cleaner fuel alternatives. For instance, the global maritime industry is actively seeking solutions to meet IMO 2023 emissions targets, creating a significant opportunity for low-carbon ammonia.

These nascent markets, while holding substantial growth potential, necessitate considerable upfront investment. This includes developing the necessary infrastructure for production, distribution, and bunkering of low-carbon ammonia, alongside navigating complex and evolving regulatory environments in each target country. Establishing market share in these new territories requires a strategic approach to build brand recognition and secure early adoption.

- Asia's maritime sector is a key focus for clean energy adoption, with a projected growth in demand for alternative fuels.

- Significant capital expenditure will be required for infrastructure development, including production facilities and distribution networks for low-carbon ammonia.

- Navigating diverse international regulations and standards is crucial for successful market entry and expansion.

- Early investment in market development and partnerships will be essential to secure a competitive advantage in these emerging clean energy markets.

CF Industries' investments in green ammonia and hydrogen production, along with advanced fertilizer technologies and new geographic market expansions, are all prime examples of question marks in the BCG matrix. These ventures are characterized by high growth potential but currently hold a low market share, demanding significant investment to achieve success.

The company's strategic focus on decarbonization and sustainable agriculture positions these question marks to potentially become future stars. However, the path forward requires overcoming challenges related to scaling operations, reducing costs, and gaining market acceptance.

For instance, the global green hydrogen market was valued at approximately $10.7 billion in 2023 and is projected to grow substantially. Similarly, the market for enhanced efficiency fertilizers was projected to reach over $30 billion by 2024. These figures underscore the significant opportunities, but also the capital commitment needed to capture market share.

| Venture Area | Market Growth Potential | Current Market Share | Investment Needs | Key Challenges |

|---|---|---|---|---|

| Green Ammonia | High (Decarbonized Energy) | Minimal | Significant (Scaling Up) | Cost Reduction, Market Adoption |

| Green Hydrogen | High (Clean Energy Solutions) | Small | High (Production & Infrastructure) | Efficiency, Cost Competitiveness |

| Enhanced Efficiency Fertilizers (EEFs) | High (Sustainable Agriculture) | Growing but Low | High (R&D, Manufacturing, Education) | Farmer Adoption, Integration |

| New Geographic Markets (e.g., Asia Maritime) | High (Clean Fuels) | Nascent | Substantial (Infrastructure, Regulatory) | Market Development, Partnerships |

BCG Matrix Data Sources

Our CF Industries BCG Matrix is built on a foundation of robust data, incorporating financial disclosures, market share analysis, and industry growth projections.