CES Energy Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

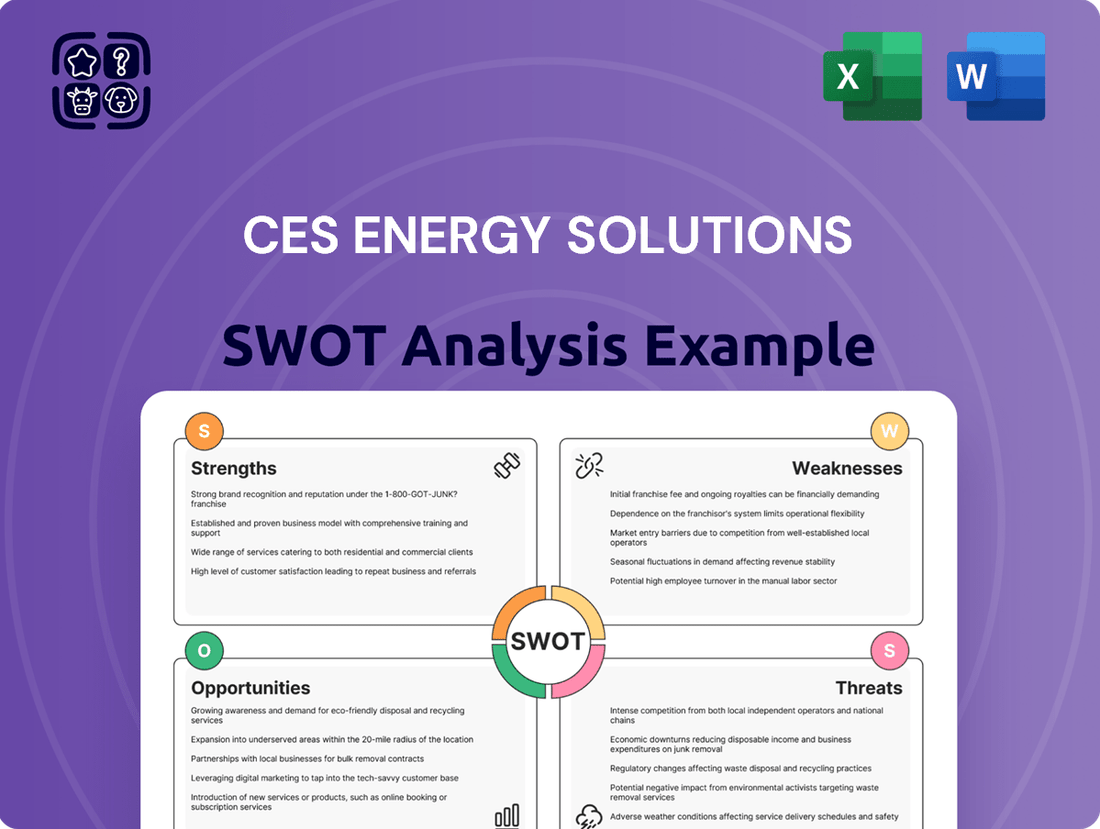

CES Energy Solutions leverages its strong operational capabilities and established market presence, but faces challenges from evolving industry regulations and competitive pressures. Our comprehensive SWOT analysis delves into these critical factors, providing a clear roadmap for strategic decision-making.

Want the full story behind CES Energy Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CES Energy Solutions holds a dominant position in the North American oil and gas chemical sector, a testament to its robust operational capabilities and strategic market penetration. Its leadership is particularly pronounced in Canada and the United States, where it commands a substantial market share in drilling fluids.

This leading market position, especially in key regions like Canada and the US, allows CES Energy Solutions to effectively leverage fluctuations in regional oil and gas activity. For instance, in 2023, the company reported significant revenue growth driven by increased demand for its chemical solutions in these core markets, underscoring its ability to capitalize on industry upswings.

CES Energy Solutions excels in providing technically advanced chemical solutions tailored for optimal performance throughout the well lifecycle. Their innovative offerings span drilling, completion, production, and midstream segments, demonstrating a commitment to addressing specific client needs and adapting to dynamic industry requirements.

CES Energy Solutions' asset-light business model is a significant strength, enabling robust free cash flow generation. This financial flexibility is particularly valuable in the often-volatile energy sector, allowing the company to maintain a strong balance sheet.

The company's financial health is underscored by its ability to return capital to shareholders. For instance, in 2023, CES Energy Solutions reported a record adjusted EBITDA of $469 million, a substantial increase from $300 million in 2022, demonstrating its capacity for growth and shareholder value creation through dividends and buybacks.

Diversified Revenue Streams and Vertical Integration

CES Energy Solutions benefits from a robust mix of revenue sources across the entire oilfield lifecycle, from initial drilling and completion to ongoing production and midstream operations. This diversification helps cushion the company against downturns in any single segment of the energy market.

The company's vertically integrated structure in both the United States and Canada is a significant strength. This integration, combined with adaptable supply chain management, offers a substantial layer of resilience and stability within the often-volatile energy industry.

- Diversified Operations: Revenue generated from drilling, completion, production, and midstream services.

- Vertical Integration: Control over multiple stages of the oilfield value chain in key North American markets.

- Supply Chain Flexibility: Ability to adapt and manage resources efficiently across its operations.

- Market Stability: Reduced reliance on any single product or service due to operational breadth.

Strategic Capital Allocation and Shareholder Returns

CES Energy Solutions has showcased a disciplined strategy for allocating capital, notably through its share buyback initiatives and consistent dividend payouts. This approach, underpinned by a solid financial position and strong cash flow, is designed to boost shareholder value and signals the company's belief in its underlying worth. For instance, in 2023, CES returned approximately $160 million to shareholders through dividends and repurchases, demonstrating a tangible commitment to enhancing returns.

The company's robust cash flow generation, a key enabler of this capital allocation strategy, provides the flexibility to pursue both growth opportunities and shareholder returns. This financial strength allows CES to maintain its dividend payments, which stood at $0.40 per share annually in early 2024, while also engaging in opportunistic share repurchases, further solidifying its commitment to shareholder value.

- Disciplined Capital Allocation: CES prioritizes returning capital to shareholders through buybacks and dividends.

- Shareholder Returns: In 2023, the company returned roughly $160 million to shareholders.

- Financial Strength: A strong balance sheet and consistent cash flow generation support these shareholder-friendly actions.

- Confidence in Intrinsic Value: The strategy reflects management's belief in the company's underlying worth.

CES Energy Solutions benefits from a significant market leadership in North America's oil and gas chemical sector, particularly in Canada and the US. This strong position allows it to effectively capitalize on market dynamics, as seen in its 2023 revenue growth driven by increased demand in these core regions.

The company's asset-light model is a key strength, facilitating robust free cash flow generation and maintaining a healthy balance sheet, which is crucial in the volatile energy industry. This financial flexibility supports its commitment to shareholder value, evidenced by a record adjusted EBITDA of $469 million in 2023, up from $300 million in 2022.

CES Energy Solutions' vertically integrated structure across the US and Canada, coupled with adaptable supply chain management, provides resilience and stability. Its operations span the entire oilfield lifecycle, from drilling to midstream, diversifying revenue and mitigating risks associated with any single segment.

The company demonstrates disciplined capital allocation, prioritizing shareholder returns through consistent dividends and share buybacks. In 2023, CES returned approximately $160 million to shareholders, reflecting confidence in its intrinsic value and strong cash flow generation, which supported a 2024 annual dividend of $0.40 per share.

| Metric | 2022 | 2023 | Growth (YoY) |

|---|---|---|---|

| Adjusted EBITDA ($M) | 300 | 469 | 56.3% |

| Shareholder Returns ($M) | N/A | 160 | N/A |

| Annual Dividend Per Share ($) | N/A | 0.40 (as of early 2024) | N/A |

What is included in the product

Delivers a strategic overview of CES Energy Solutions’s internal and external business factors, examining its strengths in service offerings and market position against potential threats from industry volatility and competition.

Offers a clear, actionable framework to address CES Energy Solutions' market challenges and capitalize on emerging opportunities.

Weaknesses

CES Energy Solutions' business is intrinsically tied to the oil and gas sector's performance. Even with its asset-light approach and varied services, the company's revenue and profits are directly influenced by oil and gas prices and drilling volumes. For instance, in the first quarter of 2024, the average West Texas Intermediate (WTI) crude oil price hovered around $77 per barrel, a level that supports industry activity but remains susceptible to global supply and demand shifts.

CES Energy Solutions' reliance on North America means it's vulnerable to regional market changes. A slowdown in drilling in a key basin, like the Permian or Montney, could directly impact demand for their specialized chemical services. For example, if rig counts in a specific area drop significantly, it translates to fewer opportunities for CES to deploy their solutions, potentially affecting revenue in that region.

CES Energy Solutions operates in a highly competitive oilfield services and chemical solutions sector. The market features a wide array of competitors, from global giants to niche providers, intensifying pressure on pricing and market share. For instance, in 2023, the North American oilfield services market saw significant activity with companies like Schlumberger and Halliburton reporting strong revenues, illustrating the scale of established players CES must contend with.

Working Capital Requirements

CES Energy Solutions' ability to support record revenue levels and increased operational activity in 2024 and into 2025 presents a potential challenge in managing its working capital. Higher sales volumes and expanded service offerings naturally necessitate greater investment in accounts receivable and inventory.

While the company actively manages these needs, the significant increases required to fuel this growth can temporarily strain free cash flow. For instance, a substantial rise in receivables means more cash is tied up in outstanding customer payments, impacting immediate cash availability for other uses.

- Increased Accounts Receivable: As revenue grows, so does the amount owed by customers, potentially delaying cash inflow.

- Higher Inventory Levels: To meet demand, CES Energy Solutions may need to hold more inventory, tying up capital.

- Impact on Free Cash Flow: These elevated working capital needs can reduce the cash available for debt repayment, dividends, or reinvestment in the short term.

Environmental and Regulatory Scrutiny

CES Energy Solutions operates within an industry facing heightened environmental and regulatory oversight. As a supplier of chemicals to the oil and gas sector, the company must navigate evolving rules concerning emissions, waste disposal, and the use of sustainable materials. This scrutiny can translate into increased compliance costs and the need for adaptable business practices.

The growing global emphasis on sustainability and the development of greener alternatives to traditional oil and gas operations present a significant challenge. CES Energy Solutions may need to invest heavily in research and development to create more environmentally benign chemical solutions. For instance, by 2024, many jurisdictions are implementing stricter mandates on the biodegradability and toxicity of industrial chemicals used in energy extraction.

- Increased Compliance Costs: Adhering to new environmental regulations, such as those concerning water usage and chemical runoff, can lead to higher operational expenses.

- R&D Investment: Developing and testing new, eco-friendly chemical formulations requires substantial financial commitment and time.

- Market Shift: A potential shift in customer demand towards greener solutions could necessitate a strategic pivot in product offerings.

CES Energy Solutions' dependence on the volatile oil and gas market creates inherent revenue instability. Fluctuations in commodity prices, like the WTI crude oil price which averaged approximately $77 per barrel in Q1 2024, directly impact drilling activity and, consequently, demand for CES's services.

The company's concentrated North American operational base makes it susceptible to regional economic downturns or shifts in drilling activity. A decline in rig counts, for example, in the Permian Basin, could significantly reduce service opportunities for CES in that area.

Intense competition within the oilfield services sector, with major players like Schlumberger and Halliburton reporting robust 2023 revenues, puts pressure on CES's pricing power and market share.

CES Energy Solutions faces challenges in managing increased working capital requirements driven by higher sales volumes. This can lead to greater accounts receivable and inventory levels, potentially straining free cash flow in the short term, impacting funds available for debt repayment or reinvestment.

Preview the Actual Deliverable

CES Energy Solutions SWOT Analysis

This is the actual CES Energy Solutions SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats. You can trust that the detailed insights presented here are exactly what you'll download.

Opportunities

The global oil and gas chemicals market is anticipated to see significant expansion, with projections indicating a compound annual growth rate (CAGR) of around 5.5% from 2023 to 2028, reaching an estimated value of over $50 billion by the end of that period. This upward trend is fueled by rising global energy consumption and continued upstream exploration and production activities, creating a favorable environment for CES Energy Solutions to leverage its expertise and product offerings.

The fluid solutions sector is rapidly evolving, with a notable trend towards advanced technologies like eco-friendly formulations, smart fluids equipped for real-time data transmission, and the integration of nanotechnology. CES Energy Solutions, with its established research and development strengths, is well-positioned to capitalize on this shift.

By focusing on these next-generation fluid solutions, CES can not only meet growing environmental demands but also offer enhanced performance and operational insights to its clients. This strategic direction could lead to significant market share gains and a stronger competitive edge.

The industry's push for more intricate well designs, featuring extended lateral sections and a focus on unconventional resource extraction, directly fuels the need for sophisticated drilling and completion fluids. CES Energy Solutions is well-positioned to capitalize on this trend, as its advanced chemical solutions are specifically engineered to meet these demanding operational requirements, driving demand for their specialized offerings.

Strategic Acquisitions and Market Consolidation

The oilfield services industry continues to see significant consolidation, as companies seek greater scale and more efficient cost structures to navigate market volatility. CES Energy Solutions, with a proven track record of successful acquisitions, is well-positioned to capitalize on this trend. By strategically acquiring complementary businesses, CES can broaden its service offerings and geographic footprint, enhancing its competitive edge.

In 2024, the industry's drive for efficiency and scale is a key theme. For CES, this translates into opportunities to acquire companies that either expand its existing service lines or introduce new, synergistic capabilities. For example, a potential acquisition could bolster CES's position in specialized well stimulation services, a segment that has shown resilience and growth potential. This inorganic growth strategy allows CES to gain market share and operational efficiencies more rapidly than organic expansion alone.

- Market Consolidation: The oilfield services sector is actively consolidating, with a focus on achieving economies of scale and improving cost competitiveness.

- Inorganic Growth: CES Energy Solutions has a history of strategic acquisitions and can leverage this expertise to pursue further inorganic growth.

- Capability Expansion: Acquisitions can enhance CES's service portfolio and operational capabilities, strengthening its market position.

- Market Reach: Through strategic M&A, CES can expand its geographic presence and customer base.

Focus on ESG and Sustainable Solutions

The increasing focus on ESG principles within the energy sector presents a significant opportunity for CES Energy Solutions. Companies are actively seeking chemical solutions that minimize environmental impact and adhere to stricter governance standards. CES is well-positioned to capitalize on this trend by expanding its portfolio of sustainable and lower-carbon offerings.

CES can strategically invest in the research and development of biodegradable and low-toxicity chemical products. This aligns with evolving environmental regulations and growing customer demand for eco-friendly solutions. For instance, the global ESG investing market reached an estimated $35.3 trillion in 2021, with a significant portion directed towards sustainable energy solutions, indicating a strong market pull for CES's potential offerings.

Key opportunities for CES include:

- Developing and marketing advanced biodegradable chemicals for oilfield services, reducing environmental persistence.

- Innovating low-toxicity chemical formulations to minimize harm to ecosystems and personnel.

- Highlighting the reduced carbon footprint of their sustainable product lines to attract environmentally conscious clients.

- Securing certifications and partnerships that validate their commitment to ESG principles, enhancing market credibility.

The global demand for specialized chemicals in oil and gas exploration, particularly for complex well designs, is a significant opportunity. CES Energy Solutions can leverage its advanced chemical formulations to meet the needs of extended lateral sections and unconventional resource extraction, a trend that is expected to continue driving demand.

Market consolidation within the oilfield services sector presents a chance for CES to grow through strategic acquisitions. By acquiring complementary businesses, CES can expand its service offerings and geographic reach, enhancing its competitive stance in the market. This inorganic growth strategy aligns with the industry’s drive for efficiency and scale observed in 2024.

The increasing emphasis on Environmental, Social, and Governance (ESG) principles creates a strong market pull for sustainable chemical solutions. CES is well-positioned to capitalize on this by developing and marketing biodegradable and low-toxicity products, appealing to environmentally conscious clients and aligning with evolving regulations.

| Opportunity Area | Market Trend | CES Energy Solutions' Advantage | Potential Impact |

|---|---|---|---|

| Advanced Fluid Solutions | Growing demand for eco-friendly and smart fluids | R&D strengths and ability to innovate | Increased market share, competitive edge |

| Market Consolidation | Industry focus on scale and cost efficiency | History of successful acquisitions | Expanded service offerings, broader geographic footprint |

| ESG Integration | Client demand for sustainable chemical products | Portfolio of sustainable and lower-carbon offerings | Attract environmentally conscious clients, enhanced market credibility |

Threats

Volatile commodity prices represent a significant threat to CES Energy Solutions. Fluctuations in global oil and natural gas prices directly impact drilling and production activity, which in turn affects demand for CES's services. For instance, a sustained drop in crude oil prices, like the 2020 downturn, can drastically reduce exploration and development budgets, leading to lower service utilization for companies like CES.

Prolonged periods of low commodity prices can lead to reduced demand for CES Energy Solutions' services and products, directly impacting revenue and profitability. In 2023, while prices saw some recovery, the energy sector remained sensitive to geopolitical events and supply/demand imbalances, creating an environment of uncertainty for service providers.

Increasingly stringent environmental regulations worldwide pose a significant threat to CES Energy Solutions. For instance, the International Energy Agency reported in 2024 that over 100 countries have committed to net-zero emissions targets, directly impacting the fossil fuel industry where CES primarily operates. This global push for decarbonization could lead to a substantial decline in demand for traditional oil and gas services.

The ongoing global energy transition, shifting towards renewable energy sources, presents another major challenge. By 2025, renewable energy capacity is projected to grow significantly, potentially displacing fossil fuels. CES will need to adapt by investing in new technologies or diversifying its service offerings to remain competitive in this evolving energy landscape.

The oilfield chemical and services sector is highly competitive, featuring both large international corporations and numerous regional players. This intense rivalry often forces companies like CES Energy Solutions into aggressive pricing strategies, which can significantly squeeze profit margins. For instance, in early 2024, reports indicated that pricing for some essential oilfield chemicals saw a decline of 5-10% due to oversupply and competitive bidding.

Maintaining market share in such an environment presents a constant challenge. Companies must innovate and offer superior service to differentiate themselves, but the pressure to offer lower prices can undermine these efforts. CES Energy Solutions, like its peers, faces the difficult task of balancing cost control with the need for investment in technology and talent to stay ahead.

Geopolitical Instability and Trade Policies

Geopolitical instability, such as the ongoing conflicts in Eastern Europe and the Middle East, directly impacts global energy markets. These events can disrupt supply chains and lead to volatile energy prices, affecting CES Energy Solutions' operational costs and demand for its services. For example, the price of West Texas Intermediate (WTI) crude oil, a key benchmark, experienced significant fluctuations throughout 2024 due to these tensions.

Shifting trade policies and protectionist measures implemented by major economies create further uncertainty. Tariffs or restrictions on cross-border trade can increase the cost of imported materials and equipment essential for CES Energy Solutions' operations, potentially squeezing profit margins. The ongoing trade disputes between major global powers continue to pose a risk to international business environments.

- Supply Chain Disruptions: Geopolitical events can sever critical links in the energy sector's supply chain, impacting the availability and cost of specialized equipment and materials.

- Price Volatility: Tensions in major energy-producing regions can cause sharp swings in oil and gas prices, making financial planning and project costing more challenging for CES Energy Solutions.

- Trade Policy Uncertainty: Evolving trade agreements and tariffs can affect the competitiveness of CES Energy Solutions' offerings in international markets and increase the cost of imported components.

Technological Disruption and Rapid Innovation by Competitors

CES Energy Solutions, while strong in innovation, faces a significant threat from competitors who might outpace them in adopting new technologies. This is particularly true in areas like digitalization and automation, which are rapidly transforming the energy services sector. For instance, advancements in AI-driven predictive maintenance or the development of more efficient, environmentally friendly chemical formulations by rivals could quickly erode CES's market share if they don't keep pace.

The pace of technological change means that what is cutting-edge today can be obsolete tomorrow. Competitors actively investing in R&D for areas such as advanced drilling fluids, digital well monitoring, or carbon capture technologies pose a direct challenge. A failure to integrate these innovations could see CES Energy Solutions lose its competitive edge and become less relevant in an increasingly tech-dependent market. For example, in 2023, the global oilfield chemicals market saw significant growth driven by demand for advanced solutions, a trend that highlights the competitive pressure to innovate.

- Digitalization: Competitors are enhancing efficiency and data analytics through digital platforms.

- Automation: Advanced automation in operations can lead to cost savings and improved safety, creating a competitive advantage.

- New Chemical Formulations: Rivals developing superior or more sustainable chemical solutions can capture market share.

- R&D Investment: Competitors with higher R&D spending, potentially exceeding CES's investment, can introduce disruptive technologies.

Intense competition within the oilfield services sector puts pressure on pricing, potentially squeezing CES Energy Solutions' profit margins. For example, early 2024 reports indicated a 5-10% price decline in some oilfield chemicals due to oversupply. This environment necessitates constant innovation and service differentiation to maintain market share, a difficult balance when cost pressures are high.

The global energy transition, with a projected significant growth in renewable energy capacity by 2025, poses a threat as it may displace fossil fuels, impacting demand for CES's core services. Furthermore, increasingly stringent environmental regulations worldwide, with over 100 countries targeting net-zero emissions by 2024, directly challenge the fossil fuel industry where CES primarily operates.

Geopolitical instability, such as ongoing conflicts, creates market volatility and disrupts supply chains, affecting CES's operational costs and service demand. For instance, West Texas Intermediate (WTI) crude oil prices saw significant fluctuations in 2024 due to these tensions. Shifting trade policies and protectionist measures also introduce uncertainty, potentially increasing the cost of essential imported materials and equipment.

CES faces a threat from competitors who may adopt new technologies, such as AI-driven predictive maintenance or advanced chemical formulations, more rapidly. The rapid pace of technological change means that failure to integrate innovations like digital well monitoring or carbon capture technologies could lead to a loss of competitive edge. The oilfield chemicals market's growth in 2023 was driven by demand for advanced solutions, highlighting this competitive pressure.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from CES Energy Solutions' official financial filings, comprehensive market research reports, and expert industry analyses to provide a thorough and actionable assessment.