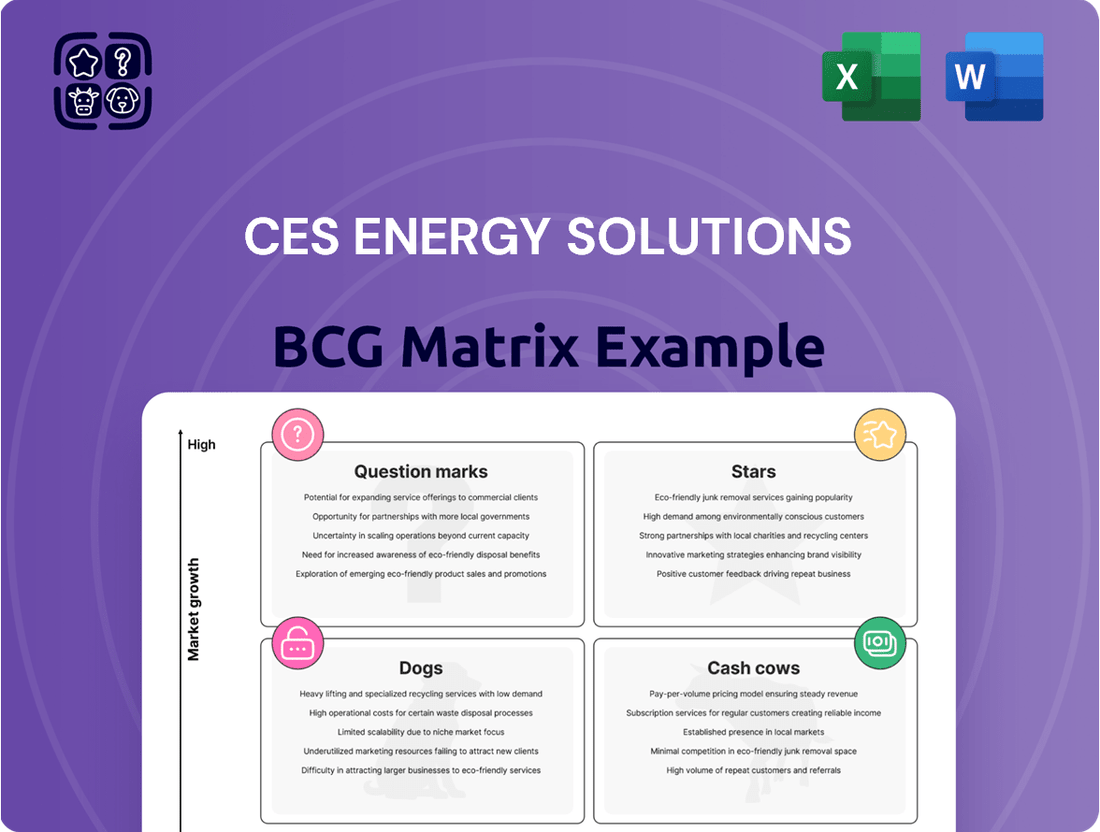

CES Energy Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

Curious about CES Energy Solutions' strategic product portfolio? This glimpse into their BCG Matrix reveals the core of their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't just wonder where their investments should flow next; gain the actionable intelligence you need.

Unlock the full potential of CES Energy Solutions' strategic positioning by purchasing the complete BCG Matrix. This comprehensive report provides detailed quadrant analysis, critical insights into market share and growth, and a clear roadmap for optimizing your product investments and resource allocation.

Ready to make informed decisions about CES Energy Solutions' product lines? The full BCG Matrix is your essential guide, offering a data-driven breakdown of each product's market standing and strategic implications. Invest in clarity and drive your business forward with this powerful analytical tool.

Stars

North American Drilling Fluids, a key component of CES Energy Solutions, demonstrates a robust market position with a significant 23% share in the US and an impressive 42% in Canada as of the first quarter of 2025. This strong standing is fueled by the persistent demand for high-service intensity and intricate drilling operations that necessitate sophisticated chemical solutions.

The segment's growth trajectory is further bolstered by the overall increase in drilling activity across North America. Notably, CES Energy Solutions has secured a record market share within the prolific Permian Basin, a region experiencing heightened exploration and production. This strategic advantage solidifies the North American Drilling Fluids segment as a high-growth, high-market share star within the BCG matrix.

CES Energy Solutions' Production and Specialty Chemicals segment in the US and WCSB is a key revenue generator. This business provides essential solutions like corrosion inhibitors and demulsifiers to optimize oilfield operations and minimize equipment downtime.

The demand for these chemicals is bolstered by the growing complexity of oilfield management, especially with unconventional resources, and the overall increase in energy consumption. This positions the segment for continued high market share and robust growth potential, reflecting its vital role in the energy sector.

CES Energy Solutions' focus on innovative chemical solutions for complex wells positions them firmly as a Star in the BCG matrix. Their ability to deliver technically advanced, tailored chemistry for increasingly challenging drilling and production scenarios is a significant differentiator.

This commitment is backed by substantial investment in research and development, with dedicated centers and local labs constantly pushing the boundaries of chemical technology. For instance, in 2024, CES reported a 15% increase in revenue from their specialized Completion Fluids segment, directly attributable to these advanced solutions.

Strategic Acquisitions and Market Penetration

CES Energy Solutions' 'Star' classification is strongly supported by its dual strategy of organic growth and targeted acquisitions. The company actively pursues market penetration, leveraging its existing strengths to capture a larger share of growing markets. This is complemented by strategic acquisitions of companies that hold leading positions within specific local markets, particularly in the United States and Canada.

These acquisitions are not random; they are designed to bolster CES's market share in expanding regions and product segments. By integrating businesses with established leadership, CES can more effectively extend its reach and capitalize on emerging opportunities. The company's robust sales and field teams are crucial in executing this strategy, ensuring seamless integration and continued growth post-acquisition.

- Market Penetration: CES focuses on increasing its share within existing and growing markets.

- Strategic Acquisitions: The company targets companies with leadership positions in local US and Canadian markets.

- Synergistic Growth: Acquisitions enhance CES's ability to expand its high market share in key regions and product categories.

- Operational Strength: Strong sales and field staff are vital for executing acquisition and market penetration strategies.

Solutions for Enhanced Oil Recovery (EOR)

CES Energy Solutions' chemical solutions for Enhanced Oil Recovery (EOR) are positioned as Stars in the BCG Matrix. The global EOR market is projected to reach over $60 billion by 2028, driven by the need to extract more oil from mature fields.

CES's surfactants are vital for EOR methods like chemical flooding, which can increase oil recovery by 5-20% compared to conventional methods. This aligns with the industry's focus on efficiency and maximizing output from existing reserves.

- Growing EOR Adoption: The oil and gas sector's increasing reliance on EOR technologies fuels demand for specialized chemical solutions.

- CES's Surfactant Strength: CES's surfactants are critical components for effective EOR processes, particularly chemical flooding.

- Market Positioning: The drive for efficiency and higher production from mature wells places CES's EOR chemicals in a high-growth, high-demand category.

- Market Share Potential: This segment offers CES significant opportunities to capture or solidify its market share in the EOR chemical supply chain.

CES Energy Solutions' North American Drilling Fluids and Production & Specialty Chemicals segments are firmly positioned as Stars in the BCG matrix. These segments exhibit both high market share and high growth potential, driven by strong demand in key North American basins. For instance, in Q1 2025, North American Drilling Fluids held a substantial 23% market share in the US and 42% in Canada, reflecting its leadership in a growing market.

The company's focus on innovative solutions for complex wells, coupled with strategic acquisitions, further solidifies its Star status. In 2024, CES saw a 15% revenue increase in its Completion Fluids segment, a direct result of its advanced chemical offerings. The company’s commitment to R&D and market penetration strategies, such as acquiring leaders in local markets, ensures continued dominance in high-growth areas.

| Segment | Market Share (Q1 2025) | Growth Potential | Key Drivers |

|---|---|---|---|

| North American Drilling Fluids | US: 23%, Canada: 42% | High | High-service intensity drilling, Permian Basin activity |

| Production & Specialty Chemicals | High | High | Unconventional resource complexity, energy consumption |

| Enhanced Oil Recovery (EOR) Chemicals | Growing | High | EOR market expansion ($60B by 2028), need for mature field optimization |

What is included in the product

This BCG Matrix analysis provides tailored insights into CES Energy Solutions' product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes CES Energy Solutions' portfolio, relieving the pain of strategic uncertainty by highlighting growth opportunities and areas needing divestment.

Cash Cows

CES Energy Solutions' established drilling fluids operations in mature oil and gas regions, such as parts of Western Canada and the Permian Basin, are prime examples of cash cows. These areas, characterized by stable, albeit slower, market growth, benefit from CES's deep-rooted presence and operational expertise.

Despite lower overall market expansion, CES maintains a significant market share in these mature basins. This strong position, coupled with efficient operations, translates into consistent and predictable cash flow generation, requiring minimal incremental investment for promotion or market share defense.

For instance, in 2024, CES reported that its Canadian drilling fluids segment, heavily concentrated in mature areas, continued to be a significant contributor to overall revenue. The company's focus on optimizing costs and leveraging existing infrastructure in these regions allows for robust profitability even with subdued market growth.

Standard Production Chemicals, like corrosion and scale inhibitors, are the bedrock of CES Energy Solutions' portfolio. These are the go-to solutions for everyday wellhead and pump-jack maintenance, a mature market where CES holds a strong position.

The consistent demand for these essential chemicals translates into reliable, predictable cash flows for CES. Their established market share means less need for significant R&D or aggressive marketing, allowing them to generate substantial profits with minimal investment.

CES Energy Solutions' Clear Environmental Solutions division, focusing on waste disposal services in the Western Canadian Sedimentary Basin, likely operates as a cash cow. This segment benefits from a stable, regulated demand within a mature market, ensuring consistent revenue generation. In 2024, the company reported strong performance in its Environmental Services segment, contributing significantly to overall profitability.

Transportation and Logistics Services (Equal Transport)

The Equal Transport division within CES Energy Solutions operates as a significant cash cow, primarily due to its specialized services in transporting drilling fluids across the Western Canadian Sedimentary Basin (WCSB). This segment is crucial, offering indispensable logistical support not only to CES's internal operations but also to a broad range of other industry players.

Its status as a cash cow is underpinned by a dominant market share within a sector that, while experiencing low growth, offers consistent demand. This essential service nature ensures a steady and reliable stream of cash flow for CES Energy Solutions.

- Market Share Dominance: Equal Transport holds a substantial market share in the WCSB for drilling fluid transportation.

- Essential Service: The division provides a critical, non-discretionary service to the oil and gas industry.

- Stable Revenue: Despite low market growth, the necessity of its services ensures predictable and stable revenue generation.

Long-standing Client Relationships and Contracts

CES Energy Solutions benefits from deep-rooted relationships with major players in the oil and gas sector, including multinational producers, intermediate operators, and smaller independent companies across Canada and the United States. These enduring partnerships are foundational to its cash cow status.

This established client network translates into predictable and consistent demand for CES's core chemical solutions. The company reported that in 2023, its Chemicals segment generated approximately $1.1 billion in revenue, highlighting the significant contribution of these long-term contracts.

- Stable Revenue Streams: Long-standing client relationships ensure a steady flow of business, providing predictable revenue.

- High-Margin Business: Essential chemical solutions often carry higher profit margins due to specialized nature and consistent demand.

- Reduced Acquisition Costs: Retaining existing clients is significantly less expensive than acquiring new ones, boosting profitability.

- Market Dominance: A strong, loyal customer base solidifies CES's position in key markets.

CES Energy Solutions' drilling fluids operations in mature regions like Western Canada and the Permian Basin exemplify cash cows. These established segments benefit from CES's deep expertise and significant market share, leading to predictable cash flows with minimal new investment. For instance, in 2024, the Canadian drilling fluids segment continued its strong revenue contribution, with the company emphasizing cost optimization in these stable markets.

| Segment | Market Maturity | Cash Flow Generation | Investment Need |

|---|---|---|---|

| Drilling Fluids (Mature Basins) | Mature | High, Stable | Low |

| Standard Production Chemicals | Mature | High, Predictable | Low |

| Environmental Solutions (WCSB) | Mature | Consistent | Low |

| Equal Transport (WCSB) | Mature | Steady, Reliable | Low |

What You See Is What You Get

CES Energy Solutions BCG Matrix

The CES Energy Solutions BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed strategic tool ready for immediate application in your business planning and analysis.

Dogs

CES Energy Solutions' legacy chemical solutions and less advanced product lines, particularly those operating in declining oil and gas market segments where the company holds a low market share, would fall into the 'Dogs' category of the BCG Matrix. These offerings likely contribute minimally to revenue and profitability, potentially requiring resources for maintenance without generating substantial returns.

CES Energy Solutions likely has segments that fall into the 'Dogs' category of the BCG Matrix, particularly those heavily reliant on declining conventional drilling activities. These are product lines or services that are deeply tied to traditional oil and gas extraction methods in areas where such operations are significantly shrinking. Without diversification, these segments face a shrinking market and a low, likely unprofitable, market share.

For instance, if CES offers specialized equipment or services exclusively for conventional vertical drilling in basins that have seen a substantial shift towards unconventional plays like shale, these offerings could be classified as dogs. The market size for these specific services is contracting, and if CES hasn't adapted its portfolio, its market share within this niche would also be declining, leading to poor profitability and limited growth prospects.

Outdated chemical formulations represent a significant risk for CES Energy Solutions, potentially categorizing them as Dogs in the BCG Matrix. If CES continues to rely on technologies that have been surpassed by more efficient or eco-friendly alternatives, and hasn't invested in updating its product line, these offerings could become a drain on resources.

Products with declining market share in segments rapidly adopting newer solutions would particularly qualify as Dogs. For instance, if CES still offers traditional acidizing chemicals without advanced inhibitors or environmentally benign alternatives, and the market is shifting towards these greener options, these older formulations would likely see reduced demand and profitability. This situation could lead to wasted investment in manufacturing and marketing for products with little future growth potential.

Small, Non-Strategic Geographic Niches

Small, non-strategic geographic niches within CES Energy Solutions' operations could be categorized as dogs in the BCG Matrix. These are typically minor operating areas where CES has a limited presence and encounters stiff competition. Crucially, these segments lack significant growth prospects, making them unlikely candidates for future expansion or investment.

These dog segments are characterized by a low market share within a low-growth regional market. Consequently, they contribute negligibly to CES Energy Solutions' overall revenue. The challenge lies in the fact that these areas often divert valuable resources and management attention without offering a clear strategic benefit or a path to improved performance.

- Low Market Share: CES Energy Solutions holds a minimal percentage of sales in these specific geographic areas.

- Low Market Growth: The regional markets themselves are experiencing stagnant or declining demand for energy services.

- Intense Competition: CES faces numerous established competitors in these smaller niches, making it difficult to gain traction.

- Resource Drain: Continued investment in these areas yields minimal returns, potentially hindering growth in more promising segments. For instance, in 2023, CES's revenue from certain smaller, non-core geographic regions may have shown flat or declining year-over-year growth, contrasting with the company's overall performance.

Services with High Operational Costs and Low Differentiation

CES Energy Solutions might classify certain services as dogs if they involve substantial operational expenses but lack unique features compared to rivals. These services often face intense price competition and operate in mature, slow-growing markets, potentially becoming a drain on resources rather than a source of profit.

These "dog" services typically exhibit characteristics that make them challenging to manage effectively within a diversified portfolio. Their high cost base, coupled with low differentiation, limits their ability to command premium pricing or gain significant market share.

For instance, if CES offers basic oilfield services that are widely available from numerous providers, and these services require significant equipment and labor investment, they could fall into this category. In 2024, the oilfield services sector experienced fluctuating commodity prices, which would exacerbate the profitability challenges for undifferentiated services.

- High Operational Costs: Services requiring extensive equipment, maintenance, and skilled labor without a pricing advantage.

- Low Differentiation: Offerings that are easily replicated by competitors, leading to commoditization.

- Stagnant Market Growth: Operating in segments of the energy market that are not expanding significantly.

- Low Profitability and Market Share: These factors combine to create a weak competitive position and minimal financial returns.

CES Energy Solutions' "Dogs" are business segments with low market share in slow-growing markets. These units often consume resources without generating substantial returns, potentially hindering investment in more promising areas. For example, legacy chemical solutions for declining conventional drilling activities, or services in non-strategic geographic niches with intense competition, fit this description.

These segments are characterized by low growth prospects and a weak competitive position. CES Energy Solutions must carefully manage these "Dogs" to avoid them becoming a significant drain on overall financial performance. Identifying and addressing these areas is crucial for optimizing resource allocation.

In 2023, CES Energy Solutions reported that its Canadian operations, which include mature conventional oil and gas plays, represented a significant portion of its business. While specific "Dog" segments aren't explicitly detailed, areas within this mature market with declining production could be considered candidates for the "Dog" classification if CES's market share there is also low.

The company's strategic focus on expanding its presence in the US market and its investment in new technologies suggest an effort to move away from or divest from such low-growth, low-share segments. For instance, the company's 2023 annual report highlighted a shift in capital allocation towards growth areas.

| Segment Characteristic | CES Energy Solutions Example | Impact on Profitability |

|---|---|---|

| Low Market Share | Niche chemical offerings for obsolete drilling techniques | Minimal revenue contribution, difficulty achieving economies of scale |

| Low Market Growth | Services tied to declining conventional oil basins | Shrinking customer base, limited pricing power |

| High Competition | Basic oilfield services with no differentiation | Price wars, low margins, difficulty retaining customers |

| Resource Drain | Maintenance of outdated product lines or underutilized assets | Opportunity cost, diverting capital from growth initiatives |

Question Marks

Emerging technologies in the energy transition, such as advanced carbon capture utilization and storage (CCUS) and specialized chemicals for hydrogen production, represent potential Stars for CES Energy Solutions. These sectors are experiencing rapid growth, with the global CCUS market projected to reach $10.1 billion by 2027, according to Precedence Research. CES's R&D in these areas, while currently representing a small market share, positions them to capitalize on future demand.

CES Energy Solutions' presence in Oman could be classified as a Question Mark within the BCG Matrix. This suggests a market with potentially high growth but where CES currently holds a low market share. For instance, as of early 2024, Oman's oil and gas sector, while experiencing renewed investment interest, still presents established competitors for CES to contend with.

Expanding into new international markets like Oman requires substantial capital injection to build brand recognition, develop infrastructure, and gain market traction. CES would need to invest heavily to compete effectively, mirroring the typical strategy for Question Marks aiming to transition into Stars.

CES Energy Solutions might be exploring highly specialized chemical solutions for ultra-deep or frontier drilling. These niche markets offer significant growth potential due to their technical challenges and the promise of substantial resource discoveries. For instance, the global deepwater E&P market is projected to see substantial investment, with estimates suggesting hundreds of billions of dollars in capital expenditure over the next decade, driven by the need to access untapped reserves.

However, CES's current market share in these highly specialized and capital-intensive segments would likely be low. Developing and supplying chemicals for such demanding environments requires extensive research and development, specialized manufacturing capabilities, and a deep understanding of unique operational conditions. This means that while the opportunity is attractive, the barriers to entry are considerable, and building a significant presence would be a long-term strategic endeavor.

Digital Solutions and AI Integration in Chemical Optimization

Investing in digital solutions, data analytics, and AI for chemical optimization in oil and gas operations positions CES Energy Solutions within the Question Mark quadrant of the BCG matrix. This area signifies high market growth potential but currently low market share, necessitating significant investment.

The digitalization trend in oilfield services is accelerating. For instance, the global oilfield chemicals market, which digital solutions aim to optimize, was valued at approximately $37.4 billion in 2023 and is projected to reach $51.9 billion by 2030, growing at a CAGR of 4.7%. CES's current market share in these advanced tech solutions is likely modest, requiring substantial capital to develop and deploy these capabilities to compete effectively.

- High Growth Potential: The increasing adoption of AI and data analytics in the energy sector promises significant improvements in operational efficiency and cost reduction for chemical usage.

- Low Market Share: CES's current penetration in advanced digital chemical optimization solutions is likely nascent, requiring substantial investment to build market presence.

- Investment Requirement: Significant capital expenditure will be needed for R&D, talent acquisition, and technology integration to gain traction in this competitive space.

- Strategic Focus: Developing a clear strategy to leverage data for optimizing chemical performance and well productivity is crucial for moving this offering from a Question Mark to a Star.

New Formulations of Bio-based Oilfield Chemicals

The development of new bio-based oilfield chemicals presents a potential Question Mark for CES Energy Solutions. As environmental regulations tighten and the industry pivots towards greener alternatives, this emerging market segment offers significant growth opportunities. However, CES would likely face challenges in establishing a strong market presence initially, requiring substantial investment in research, development, manufacturing, and promotional activities to compete effectively.

- Market Potential: The global bio-based oilfield chemicals market was valued at approximately USD 1.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030, driven by sustainability initiatives.

- Investment Needs: Significant capital expenditure would be necessary for CES to develop proprietary bio-based formulations, scale up production capabilities, and implement targeted marketing strategies to penetrate this niche market.

- Competitive Landscape: While CES might have existing relationships, new entrants and established chemical companies are also investing in bio-based solutions, creating a competitive environment where CES needs to differentiate its offerings.

- R&D Focus: Success hinges on CES’s ability to innovate and develop high-performance bio-based chemicals that can match or exceed the efficacy of traditional petroleum-based products, addressing specific operational needs in the oilfield sector.

CES Energy Solutions' ventures into emerging markets like Oman or specialized niche sectors such as ultra-deep drilling chemicals and advanced digital solutions for oilfield operations can be categorized as Question Marks. These areas present high growth potential but currently represent low market share for CES.

Significant capital investment is required to build brand awareness, establish infrastructure, and gain traction in these competitive, often technically demanding, segments. This mirrors the typical strategy for Question Marks needing substantial resources to evolve into Stars.

The company's focus on developing bio-based oilfield chemicals also falls into the Question Mark category, driven by increasing environmental regulations and a pivot towards greener alternatives, necessitating considerable R&D and market development.

| Business Unit/Market | Market Growth | Relative Market Share | BCG Category | Strategic Implication |

| Oman Operations | High | Low | Question Mark | Requires significant investment to gain share. |

| Specialized Drilling Chemicals | High | Low | Question Mark | High R&D and capital needed for niche markets. |

| Digital Chemical Optimization | High | Low | Question Mark | Investment in AI/analytics crucial for efficiency gains. |

| Bio-based Oilfield Chemicals | High | Low | Question Mark | Focus on innovation and scaling for sustainability. |

BCG Matrix Data Sources

Our CES Energy Solutions BCG Matrix is informed by comprehensive financial disclosures, detailed market research reports, and expert industry analysis to provide strategic clarity.