CES Energy Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CES Energy Solutions Bundle

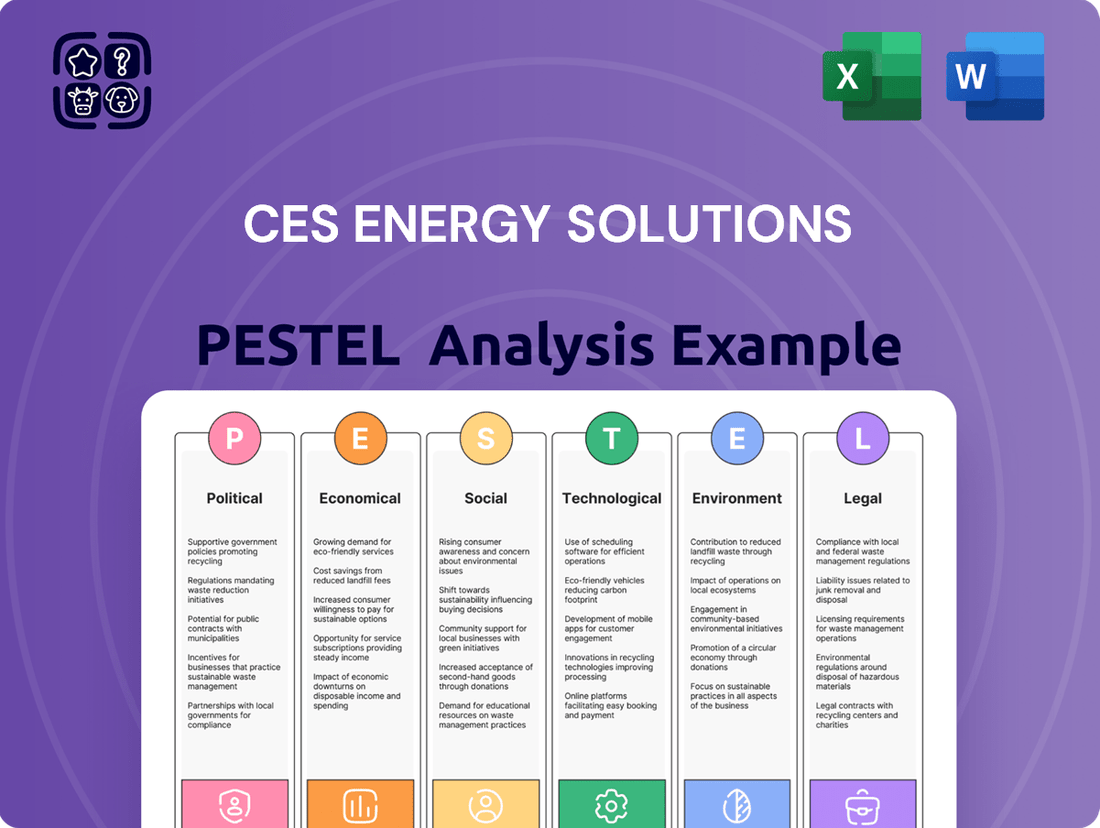

Unlock the secrets to CES Energy Solutions's market positioning with our comprehensive PESTLE analysis. We delve into the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Equip yourself with the knowledge to anticipate challenges and capitalize on emerging opportunities. Download the full report now for actionable intelligence.

Political factors

Government policies in Canada and the United States are pivotal for CES Energy Solutions, as they directly shape demand for its chemical products. For instance, in 2023, Canada's federal government continued to implement policies aimed at reducing greenhouse gas emissions, which could influence the pace of new oil and gas project approvals.

Shifts in energy policies, covering areas like drilling permits and resource extraction, directly impact the operational tempo of the oil and gas sector, thereby affecting CES Energy Solutions' market. In the U.S., the ongoing debate around energy independence and environmental regulations continues to shape the landscape for oil and gas producers.

The 2024 U.S. presidential election is a significant political factor. A potential shift in administration could bring about changes in energy policy, possibly favoring deregulation and lower oil prices, which would likely benefit the oil and gas industry and, by extension, demand for CES Energy Solutions' services.

Global geopolitical events significantly impact the energy sector. For instance, the ongoing conflict in Eastern Europe, which began in early 2022, has continued to create supply chain disruptions and price volatility in the oil and gas markets throughout 2024. This instability directly affects CES Energy Solutions by influencing the demand for their services and the cost of operations.

While there's a growing emphasis on energy security, which has somewhat eased pressure on the oil and gas industry to rapidly transition to cleaner alternatives, geopolitical tensions remain a primary driver of market fluctuations. As of mid-2025, the price of West Texas Intermediate (WTI) crude oil has seen significant swings, trading in a range influenced by these international relations, directly impacting CES Energy Solutions' revenue streams.

Trade policies and tariffs directly influence CES Energy Solutions' operational costs and market positioning. For example, tariffs imposed on specialized equipment or materials crucial for energy infrastructure projects can inflate expenses, potentially hindering the pace of development in the oil and gas industry. In 2024, global trade uncertainties, including potential new tariffs on manufactured goods, could add to these cost pressures.

Climate Policy and Decarbonization Efforts

Increasingly stringent climate policies and decarbonization efforts, especially in Europe, are impacting investment in the oil and gas sector and driving a move towards more sustainable practices. While the immediate effect on traditional business models is a subject of ongoing discussion, these regulations are compelling companies to enhance their reporting and decarbonization initiatives. This pressure is likely to accelerate a transition towards more environmentally friendly chemical solutions.

For instance, the European Union's Fit for 55 package aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. This legislative framework directly influences energy companies and their suppliers like CES Energy Solutions by creating both challenges and opportunities for those adapting to cleaner technologies and processes. The global push for net-zero emissions, with many countries setting targets for mid-century, further underscores the long-term trend towards decarbonization.

- Growing Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, carbon pricing mechanisms, and emissions standards.

- Investment Shifts: Capital is increasingly being diverted from fossil fuel projects towards renewable energy and decarbonization technologies.

- Demand for Sustainable Solutions: There is a rising market demand for chemicals and services that support reduced environmental impact and circular economy principles.

- Reporting and Transparency: Companies are facing greater scrutiny and requirements for transparent reporting on their environmental, social, and governance (ESG) performance.

Government Incentives and Subsidies

Government incentives and subsidies significantly shape the energy market, directly impacting companies like CES Energy Solutions. For instance, federal tax credits for carbon capture technologies, which saw extensions and modifications in recent years, can boost demand for CES's services in emissions reduction. The Inflation Reduction Act of 2022, for example, allocated substantial funding towards clean energy initiatives, potentially creating new revenue streams for CES by supporting projects aligned with these goals.

These financial supports can alter the economic viability of different energy production methods. Tax credits for renewable energy projects, such as wind and solar, can accelerate their development, indirectly influencing the demand for traditional energy infrastructure services that CES provides, potentially shifting focus towards maintenance and upgrades of existing assets or new infrastructure for renewables.

Furthermore, government support for lower-emission initiatives, like methane reduction programs in the oil and gas sector, presents direct opportunities. CES Energy Solutions, with its expertise in emissions management and environmental solutions, is well-positioned to capitalize on these policy-driven market shifts. For example, programs encouraging the reduction of fugitive emissions could lead to increased demand for CES's leak detection and repair services.

The landscape of government support is dynamic, with policy changes directly affecting investment decisions.

- Federal tax credits for carbon capture, utilization, and storage (CCUS) technologies offer financial incentives for emissions reduction.

- The Inflation Reduction Act of 2022 provides significant funding for clean energy projects, influencing investment in renewables.

- Government mandates for methane emission reductions in the oil and gas sector create demand for specialized services.

- Subsidies for energy efficiency upgrades can indirectly impact the need for related infrastructure and services.

Government policies significantly shape CES Energy Solutions' operating environment, influencing everything from drilling permits to environmental compliance. For instance, continued efforts in Canada and the U.S. to reduce greenhouse gas emissions directly impact the pace of new oil and gas project approvals, a key market for CES. The outcome of the 2024 U.S. presidential election, with potential policy shifts favoring deregulation, could boost demand for CES's services by stimulating oil and gas production.

What is included in the product

This PESTLE analysis meticulously examines the external macro-environmental factors influencing CES Energy Solutions, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the energy sector.

A clear, actionable PESTLE analysis for CES Energy Solutions that highlights key external factors, enabling proactive strategy development and mitigating potential business disruptions.

Economic factors

Fluctuations in global crude oil and natural gas prices directly impact the profitability and capital expenditure of CES Energy Solutions' clients. For instance, during 2024, West Texas Intermediate (WTI) crude oil prices generally traded within a range of $70 to $85 per barrel, reflecting a degree of stability that supports client investment in oilfield services.

Stable oil prices, such as those observed in 2024, can indicate a healthier environment for oilfield services, encouraging clients to maintain or increase their drilling and completion activity. Conversely, significant price drops, like the temporary dip below $70 per barrel seen in early 2024, can lead producers to curtail such activities, directly affecting demand for CES Energy Solutions' offerings.

Capital expenditures by oil and gas exploration and production (E&P) companies are crucial for CES Energy Solutions' business. Global upstream capital spending is anticipated to increase, signaling a positive trend for service providers. For instance, Rystad Energy projected global upstream capex to reach $530 billion in 2024, a 4% increase from 2023.

However, the U.S. E&P sector presents a mixed outlook. While global spending is up, U.S. E&P capital expenditures are forecast to see a dip in 2025. This shift indicates a strategic move by U.S. producers to prioritize maintaining existing production levels, particularly in shale, rather than aggressive expansion.

Overall economic expansion and the health of industrial sectors directly impact the demand for CES Energy Solutions' products. Sectors like manufacturing and construction, which are key consumers of chemical products, are crucial indicators.

The chemical industry is projected for moderate growth in 2025, fueled by a rebound in demand across a wide array of chemical products. This anticipated recovery suggests a more favorable market environment for CES Energy Solutions.

Interest Rates and Access to Capital

Fluctuations in interest rates and the ease of obtaining financing significantly influence the investment strategies of oil and gas companies, directly impacting CES Energy Solutions' operations. For instance, a projected dip in interest rates by mid-2025 could stimulate greater capital expenditure within the industrial chemical sector, potentially boosting demand for CES's services.

The cost of borrowing is a critical determinant for capital-intensive industries like oil and gas. As of early 2025, the Federal Reserve's benchmark interest rate remains a key indicator. Analysts anticipate a potential reduction in rates later in the year, which would lower the cost of capital for exploration and production companies, encouraging them to greenlight new projects and expand operations.

- Interest Rate Environment: Central banks globally are navigating inflation, with many indicating a cautious approach to rate cuts in early 2025. However, market consensus suggests a possibility of 2-3 rate cuts by the US Federal Reserve in the latter half of 2025, potentially bringing the federal funds rate closer to 4.75%-5.00%.

- Impact on Capital Spending: Lower borrowing costs typically correlate with increased capital investment. For CES Energy Solutions, this could translate to more opportunities as clients finance new drilling, infrastructure, and chemical processing projects.

- Financing Availability: Beyond interest rates, the overall availability of credit is crucial. In 2024, many energy companies successfully refinanced debt at favorable terms, and this trend is expected to continue into 2025, ensuring access to necessary funds for growth.

- Sector-Specific Trends: The industrial chemical segment, a key market for CES, is particularly sensitive to interest rate movements. A more accommodative monetary policy in 2025 could spur significant investment in new chemical plants and upgrades, directly benefiting service providers like CES.

Currency Exchange Rates

Fluctuations in the Canadian Dollar (CAD) against the US Dollar (USD) directly affect CES Energy Solutions. As the company operates significantly in both Canada and the United States, a weaker Canadian dollar generally benefits its financial performance by making its services and products more competitive in the U.S. market and increasing the value of U.S. dollar-denominated revenues when converted back to CAD. For instance, in early 2024, the CAD/USD exchange rate hovered around 0.73-0.74, meaning a stronger USD translated to higher reported revenues for CES in Canadian dollar terms.

A weaker CAD/USD exchange rate can provide a significant tailwind for CES Energy Solutions' industrial chemistry exports. This is because Canadian-made chemicals become cheaper for U.S. buyers, potentially boosting sales volume and market share. Conversely, a stronger Canadian dollar can make exports more expensive, potentially dampening demand. For example, if the CAD strengthens to 0.80 against the USD, the cost of Canadian chemicals for U.S. customers effectively increases, impacting competitiveness.

The impact of currency exchange rates on CES Energy Solutions' costs is also noteworthy. While revenues might be bolstered by a weaker CAD, the cost of imported materials or equipment priced in USD would increase. This creates a balancing act for the company, where strategic hedging or pricing adjustments become crucial to mitigate potential negative impacts on profitability. For example, if CES imports a significant portion of its specialized drilling fluids components from the U.S., a depreciating CAD would directly raise these operational expenses.

- CAD/USD Exchange Rate Impact: A sustained weaker Canadian dollar (e.g., below 0.75 in 2024) generally enhances CES Energy Solutions' competitiveness in the U.S. market and increases the CAD value of its U.S. dollar earnings.

- Export Competitiveness: A depreciating CAD makes CES's industrial chemistry products more affordable for U.S. customers, potentially driving higher sales volumes and market penetration.

- Cost Considerations: Conversely, a weaker CAD increases the cost of USD-denominated imports for raw materials and equipment, requiring careful cost management and potential hedging strategies.

- Revenue Translation: For the fiscal year ending December 31, 2023, CES reported a significant portion of its revenue in USD. A CAD/USD rate of approximately 0.73 for the year meant that USD revenues were translated into a lower CAD equivalent, highlighting the sensitivity to exchange rate movements.

Economic growth and inflation directly influence the demand for oilfield services and chemical products. Global GDP growth projections for 2024 and 2025, hovering around 2.5-3%, suggest a moderate but steady demand environment. Inflationary pressures, while potentially increasing operating costs, can also lead to higher commodity prices, benefiting CES Energy Solutions' clients.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on CES Energy Solutions |

|---|---|---|---|

| Global GDP Growth | ~2.6% | ~2.7% | Supports steady demand for oilfield services and chemicals. |

| Inflation Rate (Global Average) | ~4.5% | ~3.5% | May increase operating costs but can also support higher commodity prices for clients. |

| U.S. Industrial Production | ~1.5% increase | ~1.8% increase | Positive for demand in industrial chemical segments. |

Preview the Actual Deliverable

CES Energy Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CES Energy Solutions covers all critical external factors impacting the company's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to CES Energy Solutions.

The content and structure shown in the preview is the same document you’ll download after payment. You’ll gain actionable insights into market dynamics and potential challenges and opportunities for CES Energy Solutions.

Sociological factors

Public perception of fossil fuels significantly shapes the regulatory landscape and investment patterns within the oil and gas sector. Growing environmental consciousness, amplified by events like the 2024 UN Climate Change Conference (COP29) discussions on fossil fuel phase-out, increasingly pressures companies like CES Energy Solutions to adopt and showcase sustainable practices. For instance, by 2024, over 60% of global consumers expressed a preference for brands demonstrating strong environmental responsibility, impacting corporate reputation and access to capital.

The availability of skilled labor in the oil, gas, and chemical sectors directly influences CES Energy Solutions' operational efficiency and expansion capabilities. A tight labor market, particularly for specialized roles like experienced field technicians and engineers, can lead to project delays and increased labor costs.

Attracting and retaining top talent remains a significant challenge for CES Energy Solutions, especially given the industry's inherent cyclicality. For instance, in 2024, the U.S. oil and gas sector continued to face competition for skilled workers, with some reports indicating shortages in specific engineering and operational disciplines, impacting project timelines and execution.

CES Energy Solutions prioritizes robust community relations to maintain its social license to operate, a critical factor in the energy sector. In 2024, the company continued to engage with stakeholders, addressing environmental concerns and promoting responsible operational practices across its North American footprint. This commitment is crucial for sustained operations and avoiding project delays or cancellations due to public opposition.

Health and Safety Standards

Societal expectations for worker well-being are increasingly stringent, influencing how companies like CES Energy Solutions manage their operations. This means a constant focus on improving safety protocols and investing in training to meet evolving standards. For instance, in 2024, the oil and gas sector saw a continued emphasis on reducing lost-time injury frequency rates, with many companies aiming for rates below 1.0 per 200,000 hours worked.

Compliance with these health and safety regulations directly affects CES Energy Solutions' operational costs, from equipment upgrades to specialized personnel. Failure to meet these standards can lead to significant fines and reputational damage. In 2023, workplace safety violations in the industrial sector resulted in over $1.5 billion in penalties across various industries, highlighting the financial implications of non-compliance.

- Enhanced Safety Training: CES Energy Solutions likely invests heavily in continuous training programs to ensure all employees are up-to-date on the latest safety procedures and equipment.

- Investment in Safety Technology: The company may be adopting advanced technologies like AI-powered monitoring systems or improved personal protective equipment (PPE) to proactively identify and mitigate risks.

- Regulatory Adherence: Maintaining a strong record of compliance with bodies like OSHA (Occupational Safety and Health Administration) or equivalent international organizations is crucial for operational continuity and market trust.

- Reputational Impact: A commitment to high safety standards is a key differentiator, positively impacting CES Energy Solutions' brand image and its ability to attract and retain talent and clients.

Consumer Demand for Energy and Products

Consumer demand for energy is a significant sociological factor impacting CES Energy Solutions. Shifts towards renewable energy sources and the increasing adoption of electric vehicles (EVs) are gradually altering the energy landscape. While this might suggest a long-term decline in demand for traditional oil and gas, global liquids consumption is still projected to rise in 2025. This indicates a nuanced transition where conventional energy sources will remain relevant for the foreseeable future, impacting the demand for oilfield chemical solutions.

The International Energy Agency (IEA) reported in its 2024 outlook that global oil demand is expected to reach 103.2 million barrels per day in 2025, an increase from 101.7 million barrels per day in 2024. This growth is largely driven by developing economies, particularly in Asia, where energy needs are expanding.

- Shifting Energy Preferences: Growing consumer preference for sustainable and cleaner energy alternatives influences investment and infrastructure development in the energy sector.

- EV Adoption Rates: The accelerating adoption of electric vehicles, while impacting road transport fuel demand, also creates new opportunities in related supply chains and technologies.

- Global Liquids Demand: Despite EV growth, global demand for oil and other liquids is still anticipated to increase through 2025, supporting the continued need for oilfield services and chemicals.

- Economic Growth Correlation: Energy demand is closely tied to global economic growth, with developing nations often exhibiting higher consumption increases.

Public sentiment towards the energy industry significantly influences regulatory frameworks and investment decisions. Growing environmental awareness, highlighted by discussions at COP29 in late 2024, pushes companies like CES Energy Solutions towards demonstrating sustainable operations. By 2024, over 60% of consumers favored environmentally responsible brands, impacting corporate reputation and capital access.

The availability of skilled labor is crucial for CES Energy Solutions' operational efficiency and growth. In 2024, the oil and gas sector faced a competitive labor market, with shortages in specialized engineering and operational roles impacting project timelines and costs.

CES Energy Solutions prioritizes strong community relations to maintain its social license to operate. In 2024, the company continued stakeholder engagement to address environmental concerns and promote responsible practices across North America, vital for sustained operations and avoiding project disruptions.

Societal expectations for worker well-being are increasingly stringent, driving CES Energy Solutions to enhance safety protocols and invest in training. The oil and gas sector in 2024 continued to focus on reducing lost-time injury rates, with many aiming for rates below 1.0 per 200,000 hours worked.

| Sociological Factor | Impact on CES Energy Solutions | 2024/2025 Data/Trend |

| Public Perception of Fossil Fuels | Influences regulatory environment and investment. | Growing environmental consciousness, COP29 discussions on fossil fuel phase-out. Over 60% of global consumers prefer environmentally responsible brands (2024). |

| Skilled Labor Availability | Affects operational efficiency and expansion. | Tight labor market for specialized roles (technicians, engineers) leading to project delays and increased costs. |

| Worker Well-being & Safety Standards | Impacts operational costs and reputation. | Emphasis on reducing lost-time injury rates; target rates below 1.0 per 200,000 hours worked in the oil and gas sector (2024). |

| Consumer Energy Preferences | Shapes demand for traditional vs. renewable energy. | While EV adoption grows, global oil demand projected to reach 103.2 million bpd in 2025 (IEA 2024 outlook), driven by developing economies. |

Technological factors

Technological leaps in drilling and completion methods, like hydraulic fracturing and extended-reach drilling, are creating a growing demand for sophisticated chemical solutions from companies like CES Energy Solutions. These advanced techniques often encounter challenging geological structures and extreme operational environments, necessitating specialized fluids to ensure efficiency and success.

The oil and gas industry's embrace of these technologies, such as the increasing use of multi-stage fracturing in North American unconventional plays, directly translates to a need for CES Energy Solutions' expertise in developing and supplying high-performance drilling fluids, completion fluids, and stimulation chemicals. For instance, the average number of hydraulic fracture stages per well has continued to climb, requiring more complex fluid chemistries to optimize hydrocarbon recovery.

The oil and gas industry is seeing a significant push towards greener chemical solutions. This trend is fueled by stricter environmental regulations and a growing industry commitment to reducing its ecological footprint. For CES Energy Solutions, this translates into a prime opportunity to lead in developing biodegradable chemicals, water-based drilling fluids, and innovative waste management strategies, aligning with the global shift towards sustainability.

Digitalization is transforming oilfield services, with companies like CES Energy Solutions leveraging advanced technologies. The integration of real-time monitoring and data analytics in drilling and fluid management is a prime example, directly boosting efficiency and optimizing how operations perform. This allows for better, quicker decisions and finer control over critical drilling fluid characteristics.

For instance, in 2024, the oil and gas industry saw significant investment in digital transformation initiatives aimed at improving operational uptime and reducing costs. CES Energy Solutions' focus on these areas means they are well-positioned to capitalize on the demand for more intelligent, data-driven solutions that deliver measurable performance improvements in the field.

Innovation in Chemical Formulations

Innovation in chemical formulations is a key technological driver for CES Energy Solutions. Companies are heavily investing in research and development to create advanced chemical solutions that boost performance metrics such as rheology, filtration control, and lubricity. This ongoing effort aims to deliver superior operational efficiency for clients.

A significant trend is the dual focus on enhancing product performance while simultaneously reducing environmental impact. For instance, the development of biodegradable drilling fluid additives is gaining traction, reflecting a market demand for sustainability. In 2024, the global market for specialty chemicals used in oil and gas exploration and production was estimated to be over $30 billion, with a growing segment dedicated to eco-friendly solutions.

- Enhanced Performance: Formulations are being engineered to withstand more extreme downhole conditions, improving drilling speeds and well productivity.

- Environmental Stewardship: A push towards less toxic and more biodegradable chemical components is evident, driven by regulatory pressures and corporate sustainability goals.

- Cost Efficiency: Innovations often lead to reduced chemical usage or longer fluid life, offering clients significant cost savings over time.

- Digital Integration: The development of smart chemical delivery systems, which monitor and adjust formulation properties in real-time, is an emerging area of technological advancement.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

The increasing focus on carbon capture, utilization, and storage (CCUS) technologies presents a significant technological factor for CES Energy Solutions. The development and wider adoption of CCUS can directly impact the demand for specialized chemicals and services that CES Energy Solutions provides, potentially creating new revenue streams and market opportunities.

The U.S. Energy Information Administration (EIA) is actively incorporating modules related to carbon capture, allocation, transportation, and sequestration into its outlooks, with a dedicated module expected in their 2025 projections. This signifies a growing governmental and industry emphasis on these carbon management solutions.

- Growing CCUS Investment: Global investment in CCUS projects is projected to reach hundreds of billions of dollars by 2030, driving demand for associated technologies and services.

- Chemical Demand: CCUS processes often require specific chemicals for capture, purification, and transport, creating a direct market for chemical suppliers like CES Energy Solutions.

- Technological Advancements: Innovations in capture efficiency and storage methods could accelerate CCUS deployment, further boosting the need for integrated energy services.

Technological advancements are reshaping the energy sector, directly influencing demand for CES Energy Solutions' offerings. Innovations in drilling, like multi-stage hydraulic fracturing, necessitate advanced chemical formulations for optimal performance in challenging geological conditions.

The industry's push for digitalization, exemplified by real-time data analytics in fluid management, enhances operational efficiency and decision-making, areas where CES Energy Solutions is actively investing. Furthermore, the growing emphasis on environmentally friendly chemical solutions, such as biodegradable additives, presents a significant opportunity for CES to lead in sustainable product development.

The increasing adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies is also a key technological factor, potentially creating new markets for specialized chemicals and services. The U.S. Energy Information Administration's focus on CCUS in its future projections underscores the growing importance of this sector.

| Technology Area | Impact on CES Energy Solutions | Market Trend/Data (2024-2025) |

|---|---|---|

| Advanced Drilling & Completion | Increased demand for sophisticated chemical solutions (fluids, additives) | Growing use of multi-stage fracturing; average stages per well continue to rise. |

| Digitalization & Data Analytics | Enhanced efficiency and optimization of fluid management; demand for intelligent solutions | Significant investment in digital transformation initiatives in oil and gas to improve uptime and reduce costs. |

| Green Chemistry & Sustainability | Opportunity for biodegradable and less toxic chemical development | Global market for specialty chemicals in E&P over $30 billion, with a growing segment for eco-friendly solutions. |

| Carbon Capture, Utilization, & Storage (CCUS) | New market opportunities for specialized chemicals and services | Projected global investment in CCUS reaching hundreds of billions by 2030. |

Legal factors

Environmental regulations are a major factor for CES Energy Solutions. Strict rules on drilling fluid discharge, toxic additives, and waste disposal directly shape how CES develops products and runs its operations. For instance, in 2024, the U.S. Environmental Protection Agency continued to emphasize stricter oversight on wastewater management in the oil and gas sector, impacting disposal costs and methods.

To meet these evolving standards, companies like CES are increasingly shifting to more environmentally friendly fluid systems. This includes a greater adoption of water-based and synthetic-based fluid technologies, which are designed to minimize environmental impact compared to traditional oil-based muds. The global market for environmentally friendly drilling fluids was projected to reach over $10 billion by 2025, reflecting this industry-wide trend.

Chemical substance control laws significantly impact CES Energy Solutions, dictating how they handle everything from raw material sourcing to product disposal. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce stringent regulations under acts like the Toxic Substances Control Act (TSCA), which governs the introduction of new chemicals and the management of existing ones. Failure to comply can result in substantial fines and operational disruptions, making adherence non-negotiable for CES Energy Solutions' manufacturing and logistics.

Occupational health and safety laws are paramount in the oil and gas chemical services sector, directly influencing CES Energy Solutions' operations. These regulations, such as OSHA standards in the US, mandate rigorous protocols for worker protection and site safety, aiming to prevent accidents and injuries. For instance, in 2023, the oil and gas extraction industry reported a total recordable case rate of 1.0 per 100 full-time workers, underscoring the critical need for robust safety compliance.

CES Energy Solutions must adhere to these stringent health and safety requirements to ensure a secure working environment for its employees and to avoid significant legal penalties and reputational damage. Non-compliance can lead to substantial fines; for example, OSHA penalties can range from thousands to hundreds of thousands of dollars for serious or willful violations, directly impacting financial performance.

Trade and Competition Laws

Antitrust and competition laws are crucial for CES Energy Solutions, particularly given the consolidation trends in the oil and gas sector. For instance, in 2024, regulatory bodies like the U.S. Federal Trade Commission (FTC) and the Department of Justice (DOJ) have been actively scrutinizing major mergers, aiming to prevent market monopolization and ensure fair competition. These regulations directly impact CES Energy Solutions' ability to pursue strategic acquisitions or form partnerships that could alter the industry's competitive balance.

The enforcement of these laws dictates the permissible scope of market share and operational integration for companies like CES Energy Solutions. For example, a proposed merger in the energy services sector might be blocked or require significant divestitures if it's deemed to stifle competition. This regulatory environment necessitates careful planning and legal counsel to navigate potential antitrust challenges, ensuring compliance while pursuing growth opportunities.

- Regulatory Scrutiny: Increased focus by antitrust agencies on energy sector mergers and acquisitions in 2024-2025.

- Market Concentration: Laws aim to prevent excessive market share by any single entity, influencing CES Energy Solutions' growth strategies.

- Partnership Impact: Competition laws shape the terms and feasibility of joint ventures and strategic alliances within the industry.

- Compliance Costs: Navigating these regulations involves legal expenses and potential delays for significant corporate actions.

Intellectual Property Rights

Intellectual property rights are a cornerstone of CES Energy Solutions' competitive edge. The company's ability to protect its innovations, such as patents for advanced chemical formulations and unique service methodologies, directly impacts its ability to capitalize on research and development investments. This protection ensures that CES Energy Solutions can maintain exclusivity over its proprietary technologies, fostering continued innovation and market differentiation.

For instance, in the oil and gas sector, safeguarding patented technologies can prevent competitors from replicating costly R&D efforts, allowing CES Energy Solutions to command premium pricing and market share. The company's commitment to IP protection is evident in its ongoing efforts to secure and defend patents related to its specialized fluid systems and downhole tool designs.

Key aspects of CES Energy Solutions' intellectual property strategy include:

- Patent Protection: Securing patents for novel chemical compositions and service delivery processes used in oilfield operations.

- Trade Secrets: Maintaining confidentiality around proprietary operational procedures and customer data.

- Licensing Agreements: Potentially leveraging intellectual property through strategic licensing to expand market reach or generate revenue.

- Enforcement: Actively monitoring for and taking action against any infringement of its intellectual property rights.

Legal factors significantly shape CES Energy Solutions' operational landscape, particularly concerning environmental compliance and worker safety. Stringent regulations, such as those enforced by the EPA and OSHA, necessitate substantial investment in safe practices and environmentally sound technologies, impacting operational costs and product development. For example, the oil and gas extraction industry's recordable case rate of 1.0 per 100 full-time workers in 2023 highlights the critical importance of safety compliance, with OSHA penalties for violations potentially reaching hundreds of thousands of dollars.

Environmental factors

Global efforts to combat climate change are intensifying, pushing the oil and gas sector towards lower-carbon alternatives. This shift directly fuels demand for sustainable chemical solutions, impacting companies like CES Energy Solutions. For instance, in 2024, investments in renewable energy are projected to reach $2 trillion globally, signaling a significant move away from traditional fossil fuels.

The energy transition is not just about renewables; it also involves reducing emissions from existing operations. This creates opportunities for service providers offering eco-friendly chemical treatments and technologies. CES Energy Solutions' focus on environmentally conscious solutions aligns with this trend, as the demand for services that minimize methane emissions and improve water management in oil and gas extraction grows.

Water scarcity is becoming a critical concern for the oil and gas industry, especially in arid regions. CES Energy Solutions' chemical products play a vital role in enabling efficient water recycling and minimizing the use of freshwater in operations.

The demand for advanced water treatment chemicals is rising as companies seek to comply with stricter regulations and improve their environmental footprint. For instance, by 2024, the global produced water treatment market, which includes solutions CES offers, was projected to reach over $25 billion, highlighting the significant market opportunity.

Growing concerns over the impact of oil and gas operations on biodiversity and delicate ecosystems are driving demand for more stringent operational rules. This trend favors companies like CES Energy Solutions that offer environmentally responsible products and services, aligning with a global push for sustainability.

For instance, the International Union for Conservation of Nature (IUCN) Red List continues to highlight species threatened by habitat disruption, a direct concern for energy extraction activities. In 2024, many regions are implementing or reinforcing regulations that mandate biodiversity impact assessments and mitigation strategies, pushing CES Energy Solutions to innovate in areas like biodegradable drilling fluids and spill containment solutions.

Waste Management and Disposal Regulations

Stricter regulations on drilling and production waste, like spent chemicals and produced water, are driving CES Energy Solutions to develop advanced management techniques. For instance, the Environmental Protection Agency (EPA) continues to refine rules around wastewater discharge, impacting how companies handle byproducts. This regulatory landscape encourages innovative solutions, such as repurposing produced water for valuable resource extraction.

This push for better waste management is evident in the industry's focus on sustainability. CES Energy Solutions is actively exploring and implementing methods to reduce its environmental footprint. The company's efforts align with broader industry trends toward circular economy principles, where waste streams are viewed as potential resources.

- Regulatory Focus: Evolving EPA guidelines on produced water disposal and treatment are a key driver for innovation in waste management.

- Innovative Solutions: Repurposing produced water for lithium extraction exemplifies the industry's move towards resource recovery.

- Industry Trend: CES Energy Solutions' waste management strategies reflect a growing industry commitment to sustainability and circular economy practices.

Emissions Reduction Targets

Industry and governmental targets for reducing greenhouse gas emissions, particularly methane, are significantly reshaping operational practices within the energy sector. CES Energy Solutions, like its peers, faces mounting pressure to adopt cleaner technologies and chemicals that minimize environmental impact. For instance, by the end of 2024, many jurisdictions are expected to have finalized stricter methane emission regulations, impacting how companies like CES operate and report their environmental performance.

Companies are increasingly prioritizing climate risk mitigation, which translates into tangible investments in emissions reduction initiatives. This focus is driven by both regulatory mandates and growing investor demand for robust environmental, social, and governance (ESG) reporting. CES Energy Solutions' 2024 and 2025 strategic planning will undoubtedly incorporate enhanced emissions monitoring and reduction strategies to meet these evolving expectations, potentially influencing capital allocation towards greener solutions.

- Governmental Targets: Many countries are setting ambitious net-zero targets, with specific interim goals for emissions reductions by 2030 and 2035.

- Industry Initiatives: Several major oil and gas producers have committed to reducing methane intensity to below 0.20% by 2025.

- Investor Pressure: ESG funds, which manage trillions of dollars globally, are increasingly screening companies based on their emissions performance and climate strategies.

- Technological Adoption: Investments in technologies like advanced leak detection and repair (LDAR) systems are becoming standard practice to meet new standards.

Environmental regulations are increasingly shaping the energy sector, pushing for reduced emissions and better resource management. CES Energy Solutions' business is directly influenced by these evolving standards, particularly concerning water usage and waste disposal.

The growing emphasis on sustainability and climate change mitigation is leading to stricter rules on methane emissions and overall environmental impact. CES Energy Solutions must adapt its chemical solutions and operational practices to meet these demands, which also present opportunities for innovative, eco-friendly offerings.

Water scarcity and the need for efficient water treatment are critical environmental factors impacting oil and gas operations. CES Energy Solutions' role in providing solutions for water recycling and management is becoming more vital, especially as regulatory bodies tighten controls on water usage and discharge.

The push for responsible waste management and resource recovery, such as extracting valuable materials from produced water, is a significant trend. CES Energy Solutions' development of advanced chemical treatments and technologies directly addresses these environmental pressures and market opportunities.

PESTLE Analysis Data Sources

Our PESTLE Analysis for CES Energy Solutions is meticulously crafted using data from reputable government energy departments, international financial institutions, and leading industry market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.