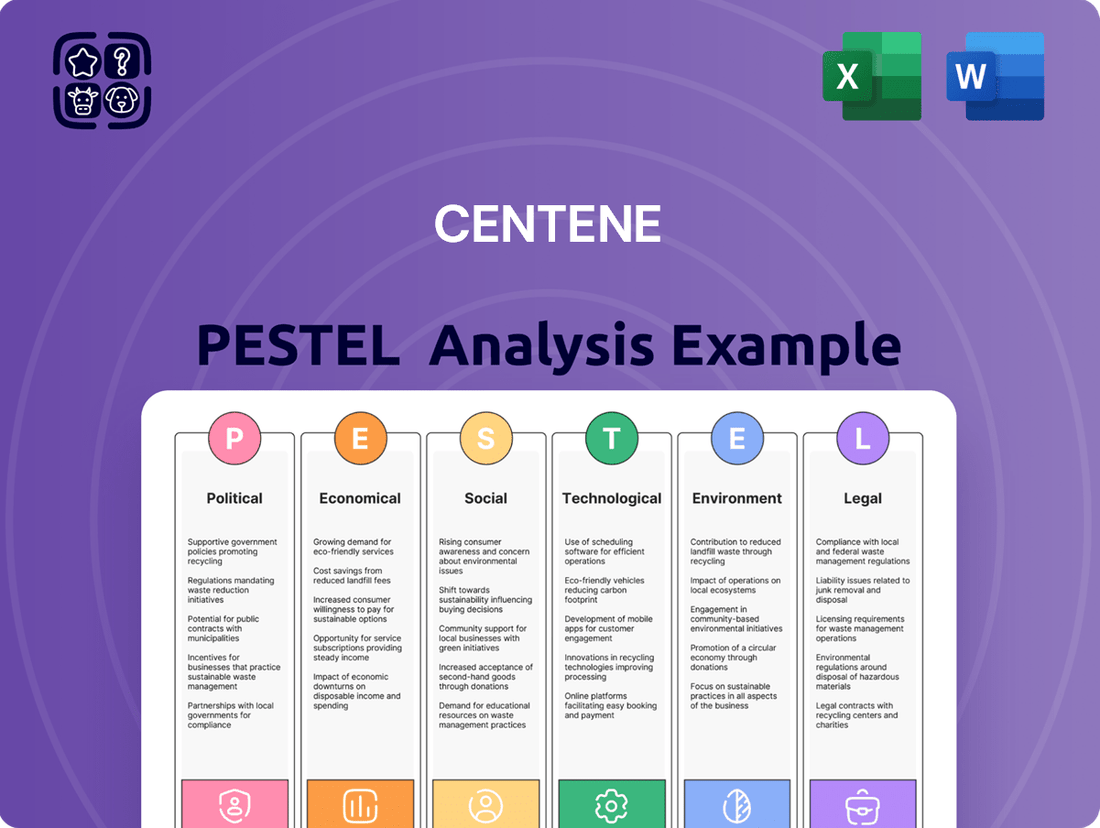

Centene PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centene Bundle

Centene operates within a dynamic healthcare landscape heavily influenced by political shifts, economic volatility, and evolving social demographics. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to navigate Centene's complex operating environment. Download the full version now to gain a competitive edge and make informed decisions.

Political factors

Centene's financial performance is intrinsically linked to the stability of government healthcare programs, particularly Medicaid and Medicare. These programs formed a substantial portion of Centene's revenue, with government contracts accounting for over 90% of its total revenue in recent years, underscoring its dependence on public sector funding and policy.

Policy shifts from the U.S. administration or Congress can significantly alter Centene's operational environment and profitability. For instance, proposed changes to Medicaid reimbursement rates or adjustments to Affordable Care Act (ACA) subsidies can directly impact the company's revenue streams and member enrollment numbers.

The political landscape surrounding healthcare reform, including debates on expanding or contracting eligibility for government programs, presents both opportunities and risks. Centene must continuously adapt to evolving regulations and funding mechanisms to maintain its competitive edge.

The resumption of Medicaid redeterminations following the COVID-19 public health emergency has significantly impacted Centene, as evidenced by a notable decline in its Medicaid membership. This political shift, moving back to pre-pandemic eligibility verification, directly affects Centene's core business, which relies heavily on this segment.

For instance, in the first quarter of 2024, Centene reported a decrease in its total Medicaid membership, a direct consequence of these redeterminations. The company's strategic focus is now on member retention and adapting its offerings to navigate this evolving landscape, which is critical for maintaining its market position and financial stability.

The potential expiration of enhanced federal subsidies for Affordable Care Act (ACA) plans at the end of 2025 is a key political factor. These subsidies have been a major driver of growth for Centene's Marketplace business, which saw its revenue increase by 10% in 2024, reaching $12.5 billion.

If these subsidies are not extended or are modified, it could result in higher premiums for consumers, potentially leading to decreased enrollment in ACA plans. This scenario would directly impact Centene's profitability within this crucial segment, as a significant portion of their Marketplace members rely on these subsidies.

Regulatory Scrutiny and Program Integrity Initiatives

Centene faces heightened regulatory scrutiny and program integrity efforts, especially within the Affordable Care Act (ACA) marketplace and Medicaid programs. These political factors can significantly impact the company's operations and growth trajectory. For instance, new requirements for consumers to verify tax information for subsidy eligibility, implemented in early 2025, have already shown a dampening effect on enrollment growth, potentially leading to fewer gains than initially projected.

These initiatives aim to ensure program accuracy and prevent improper payments, but they also introduce administrative burdens and can affect member retention. The focus on program integrity reflects a broader political push for accountability in government-funded healthcare programs, which could lead to more stringent compliance requirements for managed care organizations like Centene.

- Increased Oversight: Regulatory bodies are intensifying their focus on program integrity within Medicaid and ACA marketplaces.

- Enrollment Impact: New verification requirements, such as tax information reporting for subsidies, are impacting enrollment patterns, with early 2025 data suggesting slower growth.

- Compliance Burden: Centene must adapt to evolving compliance demands to maintain program eligibility and avoid penalties.

State-Level Policy Changes and Contract Renewals

Centene's business model relies heavily on state-level relationships, as its operations are managed through local brands and teams. This makes state policy shifts and the renewal of government contracts absolutely crucial for its revenue streams. For instance, Centene subsidiaries recently secured contract extensions for Medicaid services in Nevada and Illinois, underscoring the significance of strong state government ties and successful contract bidding.

These state-level decisions directly influence Centene's market access and financial performance. For example, changes in a state's policies concerning behavioral health coverage or specific program requirements can significantly impact the terms and viability of Centene's existing contracts and its ability to secure new ones.

- State Contract Dependencies: Centene's revenue is significantly tied to government contracts, particularly for Medicaid and Medicare services, which are administered at the state level.

- Nevada & Illinois Medicaid Renewals: In 2024, Centene announced contract renewals for its Medicaid services in Nevada and Illinois, demonstrating the ongoing importance of these state partnerships.

- Policy Impact: Shifts in state-specific healthcare policies, such as changes in managed care regulations or benefits mandates, can directly affect Centene's operational costs and contract profitability.

The political environment significantly shapes Centene's operations, particularly its reliance on government-funded programs like Medicaid and Medicare. Policy changes at federal and state levels directly influence revenue streams and enrollment. For instance, the expiration of enhanced ACA subsidies at the end of 2025 poses a risk to Centene's Marketplace business, which saw a 10% revenue increase to $12.5 billion in 2024, driven by these subsidies.

New requirements for subsidy eligibility verification, implemented in early 2025, have already slowed enrollment growth in the ACA marketplace. Furthermore, the resumption of Medicaid redeterminations post-COVID-19 led to a notable decline in Centene's Medicaid membership in Q1 2024, highlighting the direct impact of political decisions on its core business.

Centene's success is also tied to state-level government contracts, with recent renewals in Nevada and Illinois for Medicaid services underscoring this dependence. Shifts in state healthcare policies and regulations can alter contract terms and profitability, requiring constant adaptation to maintain market access.

| Political Factor | Impact on Centene | Data/Example (2024/2025) |

| ACA Subsidy Expiration | Potential decrease in Marketplace enrollment and revenue. | Marketplace revenue was $12.5 billion in 2024, up 10%, driven by subsidies. Expiration end of 2025. |

| Medicaid Redeterminations | Decline in Medicaid membership. | Q1 2024 saw a decrease in total Medicaid membership due to redeterminations. |

| State Contract Renewals | Securing revenue streams and market access. | Medicaid contract renewals in Nevada and Illinois in 2024. |

| ACA Verification Requirements | Slower enrollment growth in ACA marketplace. | Early 2025 data indicates dampening effect on enrollment growth. |

What is included in the product

This Centene PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It aims to equip stakeholders with actionable insights by identifying strategic threats and opportunities shaped by current market and regulatory dynamics.

A concise PESTLE analysis for Centene, distilled into actionable insights to proactively address external challenges and inform strategic decision-making.

Economic factors

Centene is experiencing a notable increase in medical cost trends, especially in specialized areas such as behavioral health, home health services, and the growing expense of high-cost pharmaceuticals. This rise in demand and associated costs directly affects the company's financial performance.

The heightened utilization of these services, particularly within Centene's significant Medicaid and Marketplace segments, exerts pressure on the health benefits ratio (HBR). For instance, a 1% increase in HBR can translate to a substantial impact on profitability, as demonstrated by fluctuations observed in their financial reports throughout 2024.

In response to these escalating costs, Centene is implementing strategic pricing adjustments for upcoming plan years. These corrective actions are designed to better align premiums with the anticipated medical expenditures, aiming to safeguard profit margins in a dynamic healthcare landscape.

Broader macroeconomic conditions, including inflation and interest rates, significantly influence Centene's operational landscape. Rising inflation, as seen with the US Consumer Price Index (CPI) reaching 3.3% year-over-year in May 2024, can increase healthcare supply chain costs and administrative expenses for Centene.

Higher interest rates, with the Federal Reserve's target range for the federal funds rate remaining at 5.25%-5.50% as of June 2024, directly impact Centene's cost of capital for strategic investments and debt management, potentially making expansion or refinancing more expensive.

Centene faced a significant economic headwind in early 2024 due to an unexpected shift in Health Insurance Marketplace risk adjustment dynamics. This change, stemming from updated data on enrollee health status and market morbidity, led to a substantial reduction in Centene's projected net risk adjustment revenue. Consequently, the company withdrew its previously issued earnings guidance for 2025, highlighting the direct financial impact of these evolving economic factors.

Membership Growth and Diversification

Centene's financial health is intrinsically linked to its ability to grow and diversify its membership base across its various health insurance offerings, including Medicaid, Medicare, and Marketplace plans. This diversification is a key strategy to manage the inherent volatility within each segment.

While Centene experienced a notable decrease in Medicaid membership, largely attributed to ongoing eligibility redeterminations, this was somewhat counterbalanced by robust expansion in its Marketplace and Medicare Prescription Drug Plans (PDPs). For instance, as of the first quarter of 2024, Centene reported a total membership of approximately 6.5 million, with a significant portion still concentrated in Medicaid, but with a growing presence in other areas.

- Medicaid Redeterminations Impact: Centene’s Medicaid membership saw a decline in early 2024 due to states resuming eligibility checks after the COVID-19 public health emergency.

- Marketplace Growth: The company has capitalized on increased enrollment opportunities within the ACA Marketplace, demonstrating resilience and adaptability.

- Medicare PDP Strength: Centene's Medicare Prescription Drug Plans (PDPs) have also shown positive growth trends, contributing to a more balanced membership profile.

- Diversification Strategy: This multi-segment approach aims to reduce reliance on any single government program, thereby stabilizing revenue streams and mitigating risk.

Capital Deployment and Share Repurchases

Centene has been actively deploying capital, notably through substantial share repurchase programs in 2024. For instance, as of their Q1 2024 earnings report, Centene had approximately $1.9 billion remaining under its existing share repurchase authorization, signaling a continued commitment to returning value to shareholders.

These buybacks are a key economic lever, designed to boost diluted earnings per share (EPS) by reducing the number of outstanding shares. This strategy directly impacts shareholder returns and can be a significant factor in the company's valuation.

- Share Repurchases: Centene continued its share repurchase activity into 2024, demonstrating a focus on capital return.

- Impact on EPS: Buybacks reduce the share count, thereby increasing earnings per share.

- Remaining Authorization: As of early 2024, the company had a substantial amount of authorization remaining for future repurchases.

- Shareholder Value: This deployment strategy is a direct method to enhance shareholder value.

Centene's financial performance is heavily influenced by macroeconomic factors such as inflation and interest rates. Rising inflation, with the US CPI at 3.3% year-over-year in May 2024, increases healthcare supply chain and administrative costs. Higher interest rates, with the Federal Reserve's target range at 5.25%-5.50% as of June 2024, impact the cost of capital for investments and debt management.

An unexpected shift in Health Insurance Marketplace risk adjustment dynamics in early 2024, due to updated enrollee health status data, led to a significant reduction in Centene's projected net risk adjustment revenue. This directly impacted the company, causing it to withdraw its 2025 earnings guidance.

Centene's membership base is a critical economic driver, with diversification across Medicaid, Medicare, and Marketplace plans aiming to mitigate segment volatility. Despite a decline in Medicaid membership due to redeterminations, growth in Marketplace and Medicare PDPs in early 2024 helped balance the portfolio, with total membership around 6.5 million in Q1 2024.

Centene continued its capital deployment strategy through share repurchases in 2024, with approximately $1.9 billion remaining under its authorization as of Q1 2024. This strategy aims to boost diluted EPS by reducing the number of outstanding shares, directly enhancing shareholder value.

| Economic Factor | Metric/Trend | Impact on Centene | Date/Period |

|---|---|---|---|

| Inflation | US CPI Year-over-Year | Increased supply chain and administrative costs | 3.3% (May 2024) |

| Interest Rates | Federal Funds Rate Target Range | Higher cost of capital for investments and debt | 5.25%-5.50% (June 2024) |

| Risk Adjustment Dynamics | Marketplace Revenue Impact | Reduced projected net risk adjustment revenue, withdrawn 2025 guidance | Early 2024 |

| Share Repurchases | Remaining Authorization | Focus on capital return, potential EPS boost | ~$1.9 billion (Q1 2024) |

Preview the Actual Deliverable

Centene PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Centene PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Centene's strategic landscape.

Sociological factors

Centene's business model is intrinsically linked to demographic trends, particularly among under-insured, uninsured, and government program beneficiaries. A growing aging population, for instance, directly increases demand for Medicare Advantage plans, a key area for Centene. In 2024, the U.S. Census Bureau projected continued growth in the 65+ population, a significant driver for managed care organizations.

Centene is significantly investing in health equity initiatives, focusing on social determinants of health like food access, housing, and transportation. This aligns with a broader societal push for comprehensive well-being and community health improvements, particularly for underserved groups.

In 2023, Centene reported spending over $500 million on programs addressing social determinants of health, demonstrating a tangible commitment to these areas. For instance, their partnerships with food banks and housing assistance programs aim to directly impact members' daily lives and long-term health outcomes.

Centene's strategy is significantly shaped by the evolving healthcare consumer. There's a clear trend towards greater use of virtual care options, with telehealth services seeing substantial growth. For instance, a significant portion of healthcare providers reported increased telehealth utilization in 2024, a trend expected to continue.

Consumers now expect more personalized healthcare experiences, demanding tailored solutions and proactive engagement. This shift means Centene must increasingly leverage data and technology to offer customized support and communication, moving beyond traditional one-size-fits-all approaches.

In response, Centene has been actively expanding its telehealth partnerships and investing in digital platforms. This allows them to meet the demand for convenient, accessible care while also enhancing patient engagement and satisfaction, aiming to provide a more patient-centered experience.

Public Health Trends and Morbidity

Public health trends significantly influence Centene's financial performance, particularly its medical costs and health benefits ratio. For instance, the prevalence of chronic conditions and behavioral health diagnoses directly impacts the cost of care provided to its members. In 2024, a continued focus on managing these conditions is crucial for Centene to maintain profitability.

Societal shifts, such as the potential impact of Medicaid redeterminations on enrollment demographics, can lead to a higher acuity among members joining Centene's Marketplace plans. This presents a challenge that requires sophisticated pricing strategies and robust care management programs to address the increased healthcare needs effectively.

- Influenza-like Illness Prevalence: Flu seasons directly affect medical claims, with higher infection rates increasing costs.

- Behavioral Health Diagnoses: The rising rates of mental health conditions necessitate expanded and costlier treatment options.

- Medicaid Redeterminations Impact: In 2023-2024, millions of individuals were reviewed for Medicaid eligibility, potentially shifting higher-acuity patients to Centene's Marketplace products.

- Chronic Disease Management: The ongoing prevalence of conditions like diabetes and heart disease remains a primary driver of healthcare expenditure for Centene's member base.

Workforce Dynamics and Employee Well-being

Centene's position as a major employer in the healthcare industry hinges on its capacity to recruit, onboard, and keep qualified staff. This is a key sociological element impacting its operations and service quality. For instance, in 2023, Centene reported a workforce of approximately 70,000 employees, highlighting the scale of its human capital management needs.

Positive recognition, such as being named a Great Place to Work or a Best Workplace in Health Care, directly influences employee morale and loyalty. Such accolades are not just symbolic; they translate into tangible benefits like lower turnover rates and enhanced productivity, which are critical for maintaining consistent service delivery in the healthcare sector.

- Workforce Size: Centene employed around 70,000 individuals as of 2023, underscoring the importance of effective human resource management.

- Employee Retention: Awards like Great Place to Work signal a healthy company culture, directly impacting employee satisfaction and retention, vital for service continuity.

- Talent Acquisition: The ability to attract and integrate new talent is crucial for Centene to meet the growing demands of the healthcare market.

Centene's success is deeply intertwined with societal attitudes towards health and wellness, particularly concerning preventative care and health equity. Growing awareness of social determinants of health, such as housing and food security, is driving demand for integrated care models that address these factors. The company's proactive investment in these areas, including over $500 million in 2023 for social determinants of health programs, directly responds to these evolving societal expectations.

The increasing prevalence of chronic conditions and behavioral health issues within the population directly impacts Centene's medical costs. For example, the ongoing management of diabetes and mental health conditions requires significant resources. Furthermore, shifts in enrollment demographics, such as those resulting from Medicaid redeterminations in 2023-2024, can lead to a higher acuity patient mix, necessitating sophisticated care management strategies.

Centene's ability to attract and retain a skilled workforce is a critical sociological factor. With approximately 70,000 employees in 2023, the company's human capital management is paramount. Positive employer branding, evidenced by accolades like Great Place to Work, directly influences employee morale, retention, and the capacity to deliver quality services.

Technological factors

Centene is making substantial investments in artificial intelligence (AI) and machine learning (ML) to enhance health outcomes and manage costs. These advanced technologies are being deployed across various care initiatives, reflecting a forward-thinking approach to healthcare delivery.

Specifically, Centene is leveraging AI/ML for predictive analytics in areas like suicide prevention and substance use disorder programs. This strategic adoption of technology aims to proactively address critical health challenges and improve patient well-being.

Centene is actively leveraging the expansion of telehealth and virtual care, a significant technological shift. The company facilitated millions of virtual visits in 2024 through strategic partnerships with telehealth vendors, demonstrating a commitment to this growing trend.

This expansion of Centene's virtual care network now encompasses a wide array of services, from routine primary care to specialized behavioral health support. This broad offering aims to enhance accessibility and convenience for its members, meeting them where they are.

Centene heavily relies on data analytics and predictive modeling to enhance its Population Health and Care Management initiatives. By analyzing real-time data, the company can proactively identify members at risk and address care gaps, leading to more personalized interventions. This focus on data-driven insights aims to improve member health outcomes and operational efficiency.

Digital Transformation and ICT Spending

Centene is actively pursuing a digital transformation, integrating technologies like big data analytics, cloud computing, and healthtech to streamline its operations and improve member experiences. This strategic shift is supported by significant investments in information and communication technology (ICT).

The company's commitment to digital advancement is evident in its substantial annual ICT spending, which fuels the acquisition of essential software, robust network and communications infrastructure, and specialized ICT services from various vendors. These investments are crucial for supporting Centene's ongoing digital initiatives and maintaining a competitive edge in the evolving healthcare landscape. For instance, Centene's 2023 fiscal year saw continued investment in technology to support its growth and digital capabilities, with specific figures often detailed in their annual reports and investor presentations, reflecting a trend of increasing technology expenditure year over year.

- Big Data & Analytics: Centene leverages big data to gain insights into population health trends, personalize member care, and optimize operational efficiency.

- Cloud Computing: Migration to cloud platforms enhances scalability, data security, and accessibility for Centene's diverse operations and member services.

- Healthtech Integration: The company invests in healthtech solutions to improve care delivery, remote patient monitoring, and overall health outcomes for its members.

- ICT Spending: Significant annual expenditure on software, hardware, and ICT services underpins Centene's digital transformation strategy, ensuring access to cutting-edge technology and vendor support.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical for Centene, given its handling of sensitive health information. The company's 2025 Code of Conduct underscores a commitment to robust technological safeguards, essential for protecting member data and maintaining regulatory compliance. This focus is vital as data breaches can lead to significant financial penalties and reputational damage.

Centene's investment in technology must prioritize advanced solutions to counter evolving cyber threats. While specific spending figures aren't publicly detailed, the healthcare sector's average cybersecurity spending is projected to increase significantly. For instance, global spending on healthcare cybersecurity solutions was estimated to reach billions in 2024, a trend expected to continue into 2025.

- Data Protection: Centene must employ state-of-the-art encryption and access controls to safeguard Protected Health Information (PHI).

- Regulatory Compliance: Adherence to regulations like HIPAA is non-negotiable, with ongoing vigilance required for evolving privacy laws.

- Threat Mitigation: Continuous investment in threat detection, prevention, and response technologies is crucial to stay ahead of cyberattacks.

- Reputational Integrity: Maintaining member trust hinges on demonstrating a strong commitment to data security and privacy.

Centene's technological strategy centers on AI, machine learning, and telehealth to improve member care and operational efficiency. The company is actively integrating big data analytics, cloud computing, and healthtech solutions, supported by substantial ICT investments. Cybersecurity remains paramount, with ongoing efforts to protect sensitive member data and ensure regulatory compliance.

| Technology Area | Centene's Focus | Impact/Example |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Predictive analytics for health outcomes | Suicide prevention, substance use disorder programs |

| Telehealth & Virtual Care | Expanding virtual visit capabilities | Facilitated millions of virtual visits in 2024 |

| Data Analytics & Cloud Computing | Population health insights, operational efficiency | Personalized member care, streamlined operations |

| Cybersecurity | Protecting Protected Health Information (PHI) | Adherence to HIPAA, state-of-the-art encryption |

Legal factors

Centene navigates a complex web of government healthcare regulations, particularly concerning Medicaid, Medicare, and the Affordable Care Act. These laws significantly shape its operational landscape and revenue streams, making strict adherence paramount.

Maintaining compliance with entities like the Centers for Medicare & Medicaid Services (CMS) is critical. For instance, positive CMS Star ratings directly impact member retention and bonus payments, influencing Centene's financial performance and growth prospects in 2024 and beyond.

Medicaid redetermination rules are a significant legal factor for Centene, as states are legally required to reassess beneficiary eligibility. This process, often referred to as the unwinding of the COVID-19 continuous enrollment provision, began in mid-2023 and is expected to continue through 2024. Legal requirements dictate how states must notify beneficiaries and the timelines for these reviews, directly impacting Centene's Medicaid membership numbers.

Policy changes and program integrity initiatives within these legal frameworks can lead to substantial shifts in Centene's enrolled population. For instance, states are implementing various strategies to ensure beneficiaries still meet eligibility criteria, which could result in disenrollments for those no longer qualifying. Centene must adapt its operational strategies to manage these fluctuations, which are driven by the legal mandates of eligibility verification.

The Patient Protection and Affordable Care Act (ACA) continues to be a significant legal landscape for Centene. The renewal or modification of enhanced advance premium tax credits, which significantly boosted ACA marketplace enrollment and affordability through 2025, remains a key legislative consideration. For instance, the Inflation Reduction Act extended these enhanced subsidies through 2025, providing a stable revenue stream for Centene's ACA marketplace business.

Program integrity initiatives within the ACA marketplace also present legal challenges and opportunities. Stricter enforcement of eligibility verification and risk adjustment programs can impact membership stability and profitability, requiring Centene to maintain robust compliance measures. These regulations directly influence how Centene operates and manages its membership base.

Legal Settlements and Allegations of Overbilling

Centene has navigated significant legal challenges, including settlements with several states concerning allegations of overbilling Medicaid programs, particularly related to its pharmacy benefit manager (PBM) activities. These disputes underscore the scrutiny faced by managed care organizations regarding their billing practices.

While Centene has maintained its position of admitting no wrongdoing in these settlements, the financial implications and the ongoing nature of these legal risks are substantial. For instance, in 2024, Centene agreed to a $55 million settlement with Florida to resolve claims of overcharging the state's Medicaid program.

The company's legal landscape also includes ongoing proceedings in other states. Georgia, for example, continues to pursue its case, indicating that the resolution of these matters is a multi-year process. These legal entanglements necessitate robust compliance frameworks and careful oversight of all financial transactions within its operations.

- $55 million Florida settlement in 2024 over Medicaid overbilling allegations.

- No admission of wrongdoing by Centene in its settlements.

- Ongoing legal actions in states like Georgia related to PBM practices.

- Heightened compliance requirements are a direct consequence of these legal disputes.

Contractual Agreements and Reprocurements

Centene's business model is heavily reliant on contracts with government entities for programs like Medicare and Medicaid. The renewal and reprocurement of these contracts are significant legal hurdles. For instance, in 2024, Centene successfully renewed its Medicaid contracts in Nevada, extending its operations there. Similarly, Illinois also saw a contract renewal for Centene's Medicaid services, underscoring the importance of these governmental agreements for sustained revenue streams.

The timing of regulatory approvals for these contracts is also a critical legal factor. Delays or unfavorable rulings can significantly impact Centene's financial performance and market position. The company's ability to navigate complex procurement processes and secure timely approvals directly influences its operational stability and growth prospects in key states.

- Contract Renewals: Centene's success hinges on securing renewals for its government healthcare contracts, as demonstrated by recent agreements in Nevada and Illinois for Medicaid services.

- Reprocurement Processes: The legal framework surrounding contract reprocurements presents a significant operational and legal challenge, requiring careful navigation.

- Regulatory Approvals: The timely approval of these contracts by federal and state regulators is paramount for Centene's business continuity and financial planning.

Centene's operations are deeply intertwined with government regulations, particularly concerning Medicaid and Medicare. The company must adhere to strict compliance with CMS Star ratings, which directly influence member retention and bonus payments, impacting its financial performance through 2025. Furthermore, the legal mandates surrounding Medicaid redeterminations, ongoing through 2024, necessitate careful management of membership fluctuations driven by eligibility verification.

The Patient Protection and Affordable Care Act (ACA) remains a significant legal factor, with extended enhanced advance premium tax credits through 2025 providing a stable revenue stream for Centene's marketplace business. However, program integrity initiatives within the ACA marketplace, including stricter eligibility verification, require robust compliance measures to ensure membership stability and profitability.

Centene has faced legal challenges, including settlements for alleged overbilling in Medicaid programs, such as a $55 million settlement with Florida in 2024. These disputes highlight the intense scrutiny on managed care organizations' billing practices and underscore the need for rigorous compliance frameworks across all operations.

Securing renewals and navigating reprocurement processes for government healthcare contracts, such as recent Medicaid contract renewals in Nevada and Illinois, are critical legal hurdles. Timely regulatory approvals for these contracts are paramount for Centene's business continuity and financial planning, directly influencing its market position and growth prospects.

Environmental factors

While Centene isn't a manufacturing firm with direct operational environmental concerns, the escalating impacts of climate change on public health present a significant indirect factor. Rising occurrences of heat-related illnesses, respiratory problems from poor air quality, and the spread of vector-borne diseases could all increase healthcare service utilization by Centene's member base.

This heightened demand for care directly influences Centene's cost structures and necessitates careful resource allocation. For instance, the CDC reported in 2024 that extreme heat events are becoming more frequent, leading to increased emergency room visits for heat stroke and dehydration among vulnerable populations, a demographic Centene often serves.

Centene's Corporate Sustainability Framework explicitly includes fostering a healthy environment, underscoring a significant shift towards environmental governance and corporate accountability in the healthcare sector. This commitment aligns with broader industry trends and increasing stakeholder expectations for proactive environmental stewardship.

While Centene's specific environmental targets require further detail, the healthcare industry faces growing pressure from investor proposals, such as those advocating for science-based greenhouse gas reduction targets. For instance, in 2024, several major healthcare providers announced commitments to achieve net-zero emissions by 2040, highlighting the urgency for companies like Centene to establish robust environmental performance metrics and strategies.

Centene's extensive operations, encompassing vast administrative networks and member services, naturally lead to significant resource consumption. This includes energy for its numerous office buildings and the generation of waste from daily business activities. For instance, in 2023, Centene reported significant operational expenses, a portion of which is directly tied to facility management and resource utilization.

While specific figures on Centene's direct environmental footprint from resource consumption are not extensively detailed in publicly available reports, the company's stated commitment to a healthy environment suggests proactive measures. This likely involves initiatives aimed at managing energy usage and waste streams across its large operational footprint, aligning with broader corporate sustainability objectives and potentially seeking efficiencies that reduce costs.

Supply Chain Environmental Practices

Centene's environmental footprint is significantly influenced by its supply chain, encompassing pharmaceutical companies, medical device manufacturers, and various other vendors. The sustainability of these partners' operations, from manufacturing processes to logistics, directly impacts Centene's overall environmental performance. As of 2024, there's a growing emphasis on integrating environmental, social, and governance (ESG) criteria into supplier selection and management, with many large corporations setting targets for reducing Scope 3 emissions, which largely stem from their supply chains.

Engaging with suppliers to promote sustainable practices is becoming a key component of corporate responsibility. This includes encouraging energy efficiency, waste reduction, and responsible resource management throughout the value chain. For instance, many healthcare companies are setting goals to increase the percentage of suppliers that meet specific environmental standards. By 2025, it's anticipated that a larger proportion of Fortune 500 companies will have formal supplier environmental assessment programs in place.

- Supply Chain Impact: Centene's environmental impact is tied to the practices of its diverse vendor base, including pharmaceutical and medical device suppliers.

- Emerging Focus: Corporate responsibility is increasingly incorporating supplier environmental performance and engagement on sustainability initiatives.

- ESG Integration: By 2025, a growing trend is expected for companies to integrate ESG factors into their supplier selection and monitoring processes to mitigate environmental risks.

Community Health and Environmental Factors

Centene's commitment to building healthier communities directly intersects with environmental factors that affect public health. Poor local environmental quality, such as elevated air pollution levels, can exacerbate chronic health conditions, increasing demand for healthcare services among Centene's member base. For instance, studies in 2024 continue to highlight the correlation between fine particulate matter (PM2.5) exposure and increased hospitalizations for respiratory and cardiovascular diseases, directly impacting healthcare utilization and costs for managed care organizations.

The company's focus on social determinants of health also implicitly acknowledges environmental influences. Access to safe green spaces, clean water, and reduced exposure to environmental toxins are crucial for overall well-being. In 2024, several urban areas reported significant investments in environmental remediation and park development, aiming to improve community health outcomes, which could translate to lower healthcare expenditures for populations residing in these improved environments.

Centene's strategies to address health disparities may involve partnerships that promote environmental improvements. For example, initiatives focused on reducing lead exposure in older housing stock or improving access to healthy food environments by addressing local pollution can indirectly benefit Centene's members. Data from 2025 is expected to further quantify the economic benefits of such environmental interventions on public health costs.

- Environmental Quality Impact: Poor air and water quality are linked to higher rates of asthma and other respiratory illnesses, increasing healthcare claims for Centene members.

- Social Determinants and Environment: Access to safe, clean environments is a key social determinant of health, influencing preventive care needs and chronic disease management.

- Investment in Green Spaces: Municipal investments in parks and green infrastructure in 2024 are projected to yield long-term health benefits and potentially reduce healthcare costs.

- Environmental Remediation: Efforts to mitigate environmental hazards, such as lead contamination, directly address health risks and can lower the burden on healthcare systems.

The increasing frequency of extreme weather events, such as heatwaves and floods, directly impacts public health, leading to greater demand for healthcare services among Centene's member base. For instance, in 2024, the CDC noted a significant rise in heat-related illnesses, contributing to increased medical claims.

Centene's commitment to sustainability is evident in its efforts to manage operational resource consumption, including energy and waste, across its extensive network. While specific 2023 environmental data is limited, the company's stated goals suggest a focus on efficiency and responsible resource management.

The environmental practices of Centene's supply chain partners, particularly in pharmaceuticals and medical devices, are crucial. By 2025, many companies are expected to enhance ESG integration into supplier selection, aiming to reduce Scope 3 emissions, a significant portion of which originates from these relationships.

| Environmental Factor | Impact on Centene | Supporting Data/Trend (2024-2025) |

| Climate Change & Public Health | Increased healthcare service utilization due to heat-related illnesses, respiratory issues, and vector-borne diseases. | CDC data in 2024 showed rising heat-related emergency visits. |

| Operational Resource Consumption | Costs associated with energy use and waste management in facilities. | Centene reported significant operational expenses in 2023, partly tied to facility management. |

| Supply Chain Sustainability | Environmental performance of vendors impacts Centene's overall footprint and ESG ratings. | Growing trend by 2025 for companies to integrate ESG into supplier management for Scope 3 emissions reduction. |

PESTLE Analysis Data Sources

Our Centene PESTLE analysis is built on a robust foundation of data from government health agencies, leading economic forecasting firms, and reputable industry publications. We incorporate policy updates, market research, and demographic trends to provide comprehensive insights.