Centene Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Centene Bundle

Centene's current product portfolio is a complex landscape of opportunities and challenges, and understanding its position within the BCG Matrix is crucial for strategic growth. This glimpse into their Stars, Cash Cows, Dogs, and Question Marks is just the beginning of unlocking actionable insights.

Dive deeper into Centene's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Centene's Health Insurance Marketplace segment has experienced remarkable expansion, with enrollment figures hitting an all-time high of 24.3 million individuals in 2025. This represents a more than doubling of their marketplace enrollment since 2020.

This substantial growth is directly linked to the extended premium subsidies through 2025, which have significantly improved affordability for consumers. Centene's position as the leading carrier in this rapidly expanding market underscores its strategic importance and contribution to the company's financial health.

Centene's Medicare Part D (PDP) offerings are experiencing significant expansion, a key factor in its overall business strategy. The company saw a notable 22% increase in Medicare PDP membership in the first quarter of 2025 when compared to the first quarter of 2024. This upward trend continued robustly, with a 50% membership surge in the fourth quarter of 2024 against the prior year's fourth quarter.

Centene's strategic product positioning in the Health Insurance Marketplace has been a key driver of its success. By focusing on well-designed plans and effective execution, the company has seen substantial membership growth, outperforming competitors in risk adjustment. This has allowed Centene to secure a larger slice of the growing individual health insurance market.

Investment in Core Growth Areas

Centene is strategically channeling resources into its high-growth segments, notably the Marketplace and Medicare Prescription Drug Plans (PDP). This focus is designed to maintain Centene's market leadership and capitalize on expanding opportunities within these key government-sponsored programs.

The company's investment strategy is geared towards improving the overall member experience, making it easier for individuals to access necessary healthcare services, and reinforcing its competitive edge. This approach is directly responsive to observable market trends indicating sustained and growing demand for these types of health insurance offerings.

- Marketplace Growth: Centene reported a significant increase in its Marketplace membership, reaching approximately 2.9 million members by the end of 2023, up from roughly 2.5 million in 2022.

- Medicare PDP Expansion: The Medicare PDP business saw continued enrollment growth, with the company serving over 1.1 million members in 2023.

- Strategic Investments: Centene allocated substantial capital towards technology and service enhancements in these areas, aiming to improve customer retention and acquisition.

- Industry Trends: Projections for 2024 indicate continued expansion in the ACA Marketplace, with an estimated 17 million individuals expected to enroll, and stable growth anticipated in the Medicare Part D market.

Leveraging Enhanced Premium Subsidies

The extension of enhanced premium subsidies under the Inflation Reduction Act has been a game-changer for Centene. These subsidies make health insurance plans on the ACA Marketplace significantly more affordable for individuals and families. For instance, in 2024, the average subsidy amount is expected to remain substantial, helping to keep premiums manageable for millions of Americans.

Centene has capitalized on this favorable environment by effectively marketing its Marketplace plans, attracting a surge of new members. This has directly contributed to record enrollment figures for the company. The increased affordability translates into higher retention rates as well, as members are more likely to maintain coverage when it's financially accessible.

The robust performance of Centene's Marketplace segment in 2024 is a direct beneficiary of these enhanced subsidies. This external support acts as a significant tailwind, driving growth and reinforcing Centene's market position.

- Record Enrollment: Centene's Marketplace enrollment reached new highs in early 2024, buoyed by the extended subsidies.

- Affordability Impact: The subsidies have made ACA plans more accessible, leading to increased demand for Centene's offerings.

- Marketplace Growth: The company's Marketplace segment experienced substantial year-over-year growth in 2024, directly linked to subsidy support.

- Strategic Advantage: Centene's ability to leverage these subsidies provides a competitive edge in attracting and retaining members.

Centene's Health Insurance Marketplace and Medicare Part D (PDP) segments are positioned as Stars in the BCG Matrix due to their high growth and strong market share. The Marketplace experienced a significant surge, with enrollment reaching 24.3 million by 2025, more than double the 2020 figures, fueled by extended premium subsidies through 2025. Similarly, Medicare PDP saw a 22% membership increase in Q1 2025 compared to the previous year, demonstrating robust expansion. These segments represent Centene's strategic focus, with substantial investments in member experience and technology to maintain leadership in these expanding government-sponsored programs.

| Segment | Market Share | Growth Rate | Centene's Position |

| Health Insurance Marketplace | Leading | High (24.3M members by 2025) | Star |

| Medicare Part D (PDP) | Strong | High (22% YoY Q1 2025) | Star |

What is included in the product

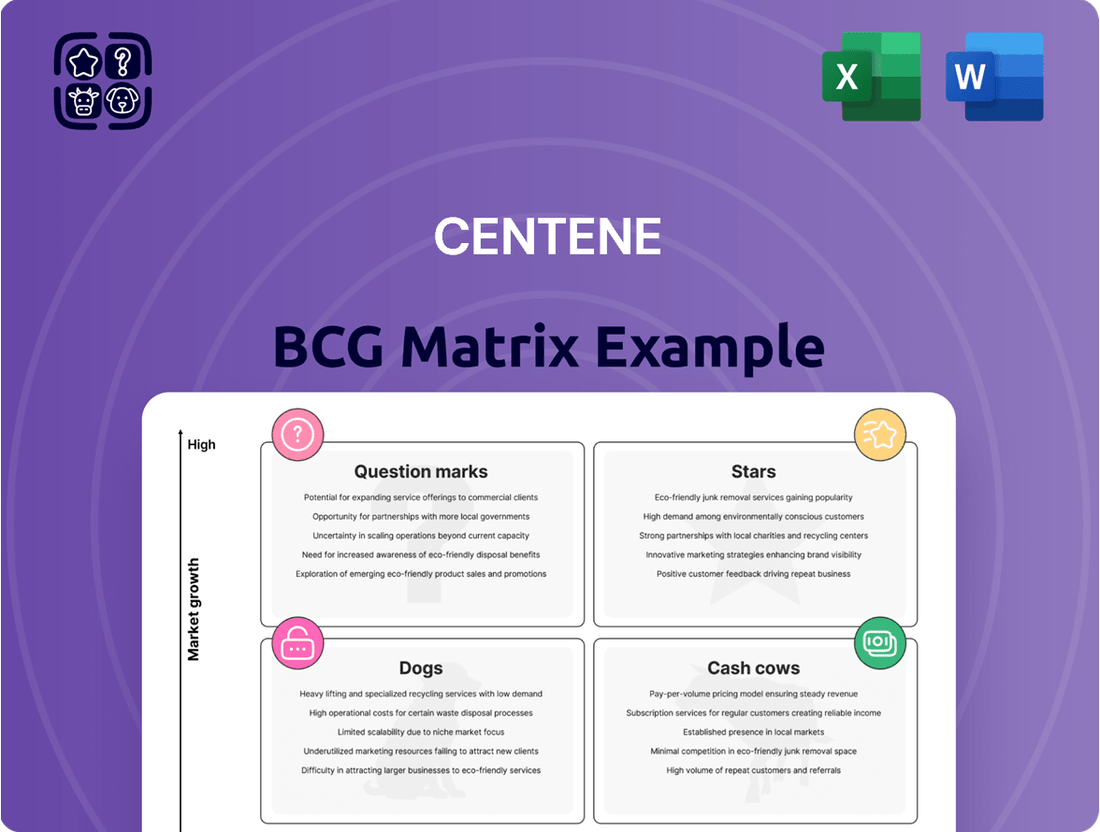

The Centene BCG Matrix categorizes its business units by market share and growth rate, guiding strategic decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Centene BCG Matrix offers a clear, visual way to identify underperforming units, easing the pain of resource allocation by highlighting areas needing strategic attention.

Cash Cows

Centene's Medicaid managed care business is a clear Cash Cow, boasting a dominant 17.7% national market share as of March 2025. This segment represents a substantial 60% of Centene's total medical membership, underscoring its foundational importance to the company's revenue generation. Even with market headwinds from redeterminations, Centene's immense scale ensures a consistent and significant revenue stream from this core operation.

Centene's Medicaid segment acts as a significant cash cow, consistently contributing a large chunk of its premium and service revenues. For the full year 2024, this segment saw an increase in premium and service revenues, bolstered by favorable Medicaid rate adjustments.

Despite a slight dip in membership due to the ongoing unwinding process, the Medicaid business remains a dependable generator of cash flow for Centene, underpinning its financial stability.

Centene's Medicaid segment, despite facing a low-growth environment following the unwinding of continuous enrollment, demonstrates high profitability. This is largely due to its established market leadership, which allows for strong profit margins.

The company is actively engaged with states to align reimbursement rates with patient acuity, a move expected to bring its Medicaid business into equilibrium by 2025. This strategic focus on operational efficiency is key to sustaining profitability.

Efficiency Improvements in Medicaid Operations

Centene is actively enhancing the efficiency of its Medicaid operations, a key driver for robust cash flow. This focus is crucial for maximizing returns from a well-established, large-scale business segment.

These efforts include optimizing the health benefits ratio, aiming to keep medical costs in check relative to revenue. For instance, in 2024, Centene reported a health benefits ratio of 88.7%, demonstrating a commitment to managing medical expenditures.

- Optimizing Health Benefits Ratio: Efforts to control medical costs directly impact profitability.

- Managing Administrative Expenses: Streamlining operations reduces overhead, boosting cash flow.

- Mature Business Scale: These efficiency gains are vital for extracting maximum value from a large, stable segment.

Funding for Other Business Segments

Centene's Medicaid segment is a prime example of a cash cow, consistently generating substantial profits. In 2024, Centene reported a significant portion of its revenue derived from government-sponsored health plans, with Medicaid forming a core component. This reliable cash flow is essential for fueling the company's expansion into other business areas.

This robust cash generation from Medicaid allows Centene to strategically invest in its Marketplace business and explore new growth avenues. For instance, the company has been actively pursuing opportunities in higher-growth segments, leveraging the financial stability provided by its established Medicaid operations. This approach minimizes the need for external debt or equity financing.

- Medicaid's Role: Centene's Medicaid business acts as a stable revenue generator, providing consistent cash flow.

- Funding Growth: These funds are critical for investing in Centene's Marketplace segment and other strategic initiatives.

- Diversification Strategy: This 'milking' of the cash cow enables portfolio diversification and pursuit of new opportunities.

- Reduced Financing Needs: It allows Centene to fund growth internally, reducing reliance on external capital.

Centene's Medicaid business is the quintessential cash cow, consistently generating substantial profits and revenue. As of March 2025, it holds a commanding 17.7% national market share in Medicaid managed care, representing a significant 60% of Centene's total membership. This segment's scale and established market position ensure a reliable and robust cash flow, even amidst the ongoing redetermination process.

The company's focus on optimizing its health benefits ratio, targeting 88.7% in 2024, and managing administrative expenses directly contributes to the strong profitability of this segment. These operational efficiencies allow Centene to effectively leverage its mature business scale.

This dependable cash generation from Medicaid is crucial for funding Centene's investments in its Marketplace business and other strategic growth initiatives, reducing the need for external financing.

| Segment | Market Share (Medicaid) | Membership % | 2024 HBR | Role |

|---|---|---|---|---|

| Medicaid Managed Care | 17.7% (as of Mar 2025) | 60% | 88.7% | Cash Cow |

What You See Is What You Get

Centene BCG Matrix

The Centene BCG Matrix preview you see is the exact, fully formatted report you will receive immediately after purchase, offering a clear strategic overview of Centene's business units. This comprehensive document, designed for professional application, will be delivered without any watermarks or demo content, ensuring you get a ready-to-use analysis. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the purchased file. This means no surprises, just the polished, data-driven BCG Matrix ready for your strategic planning needs.

Dogs

Centene's strategic divestiture of non-core assets, including Circle Health Group, Magellan Specialty Health, Apixio, and its European operations, signals a focused approach to profitability. These moves are designed to shed underperforming or non-strategic units that may have been acting as cash drains.

Centene's Medicare Advantage (MA) individual non-SNP market share is shrinking, even as the broader MA market expands. This decline is evident in Centene's reduced state presence and fewer plan options for 2025 compared to 2024. The company saw a significant loss of 87,000 MA members in 2024, with projections indicating a further dip in Medicare enrollment by the close of 2025.

Centene's divestiture of its Spanish and Central European operations signals a strategic retreat from international markets where it likely held a minor market share and faced limited growth opportunities. This move aligns with the company's broader objective to streamline its corporate structure and concentrate its efforts on its core domestic government-sponsored healthcare programs.

Businesses with Limited Strategic Alignment

Centene’s divestment strategy specifically targets businesses that lack alignment with its core mission of serving government-sponsored healthcare programs for the under-insured and uninsured. These divested units often presented limited strategic value or synergy with Centene’s primary operations. For instance, in 2023, Centene completed the sale of its pharmacy benefits manager, Magellan Rx Management, for $1.5 billion, a move aimed at sharpening its focus on its core health plan offerings.

These businesses, falling under the 'Dogs' category in a BCG matrix context, are characterized by low market share and low market growth. Their divestment allows Centene to reallocate resources towards higher-growth, more strategically aligned segments of its business. This strategic pruning is crucial for optimizing capital allocation and enhancing overall profitability.

- Divestment Rationale: Focus on core government-sponsored healthcare programs.

- Strategic Alignment: Targeting units with limited synergy or value to core operations.

- Example: Sale of Magellan Rx Management in 2023 for $1.5 billion.

- BCG Matrix Classification: Identified as 'Dogs' due to low market share and growth.

Cash Flow Drains

Cash Flow Drains represent business segments within Centene that were likely consuming more capital than they were generating, or not yielding adequate returns. These were essentially 'cash traps' that, by their nature, hindered overall financial performance.

The strategic divestiture of these underperforming units in 2023, for instance, allowed Centene to shed these drains. This move is crucial for freeing up capital and improving the company's financial efficiency. By eliminating these drains, Centene can better allocate its resources towards areas with higher growth potential and better investment returns.

- Divested Businesses: Centene divested several non-core businesses in 2023, including its primary care clinics, which were reported to be a drag on earnings.

- Cash Consumption: These divested segments likely had high operational costs and were not generating sufficient revenue to cover their expenses, leading to negative cash flow.

- Resource Reallocation: The capital freed up from these divestitures can now be channeled into Centene's core managed care segments, which are expected to drive future growth and profitability.

- Financial Efficiency: By removing these cash drains, Centene aims to improve its overall financial health and boost shareholder value through a more optimized business portfolio.

Centene's strategic divestitures, including its European operations and Magellan Specialty Health, align with the 'Dogs' category of the BCG matrix. These were businesses with low market share and limited growth prospects, often acting as cash drains. The sale of Magellan Rx Management for $1.5 billion in 2023 exemplifies this strategy of shedding non-core, underperforming assets. By exiting these segments, Centene aims to reallocate capital to its more promising government-sponsored healthcare programs, thereby improving overall financial efficiency and profitability.

| Divested Segment | BCG Category | Rationale | Financial Impact Example |

|---|---|---|---|

| Circle Health Group | Dog | Low market share, limited growth | Resource reallocation |

| Magellan Specialty Health | Dog | Non-core, potential cash drain | Focus on core operations |

| European Operations | Dog | Limited growth opportunities | Streamlining corporate structure |

| Magellan Rx Management | Dog | Low synergy with core business | Sale for $1.5 billion (2023) |

Question Marks

Centene is strategically expanding its Medicaid services into new states, aiming to secure contracts with governments to broaden its market reach. Despite a national dip in Medicaid enrollment due to program unwinding, these new market entries represent significant growth opportunities for Centene in specific regions where it's building its presence.

These new ventures, while currently holding a small market share, possess substantial growth potential. For instance, in 2023, Centene successfully secured new Medicaid contracts in states like Georgia and Florida, which are expected to contribute to substantial membership growth in the coming years, even as overall national Medicaid rolls adjusted.

Centene places a significant emphasis on Dual Eligible Special Needs Plans (D-SNPs), with these plans constituting 29% of its Medicare Advantage (MA) offerings. This strategic focus is on a segment experiencing robust growth within the expanding MA market.

Despite a slight dip in Centene's overall MA market share, its concentrated investment in D-SNPs signals a clear strategy to capture greater market penetration in this high-potential area. For instance, in 2024, the D-SNP market is projected to continue its upward trajectory, offering Centene a prime opportunity for expansion and revenue growth.

Centene is actively pursuing digital transformation, pouring resources into enhancing its platforms and member engagement. These investments are designed to streamline access to healthcare services and build future competitive advantages. For example, in 2023, Centene reported a 10% increase in digital engagement among its members, with a focus on telehealth and online portal usage.

These technology-driven efforts are positioned within a high-growth segment of healthcare innovation, aiming to unlock new efficiencies and potential revenue streams. While these initiatives are relatively new, their current market share contribution is minimal. However, the strategic importance of digital innovation for future growth is significant, mirroring trends across the broader health insurance industry where digital health solutions saw substantial investment in 2024.

Value-Based Care Partnerships

Centene is actively building strategic alliances with local healthcare providers and organizations. These collaborations are designed to create integrated care models focused on value-based care, a sector prioritizing improved patient outcomes and cost reduction. This strategic direction places these initiatives within a high-growth, evolving market segment.

Centene's market share within these specific integrated value-based care models is still in its formative stages. This positioning suggests a "Question Mark" in the BCG matrix, indicating areas with high potential for growth but currently requiring significant investment and development to capture substantial market share.

- Strategic Alliances: Centene forms partnerships with local healthcare providers and organizations.

- Value-Based Care Focus: These alliances aim to develop integrated care models that improve outcomes and reduce costs.

- Market Position: Centene's market share in these specific integrated models is developing, classifying them as Question Marks.

- Growth Potential: This segment represents a high-growth area with significant future potential for Centene.

Future Acquisitions in Emerging Healthcare Solutions

Centene is actively evaluating potential acquisitions in 2025, aiming to strengthen its position in emerging healthcare solutions. These targets are likely to be in high-growth sectors where Centene's current market share is modest, but the strategic intent is to establish or enhance its presence.

These strategic moves are designed to introduce new product lines and services, particularly those that complement Centene's established expertise in government-sponsored health plans. For instance, a company specializing in digital health platforms for chronic disease management or an innovative provider of behavioral health services could be attractive targets.

- Focus on High-Growth Markets: Centene seeks acquisitions in areas like telehealth, personalized medicine, or value-based care solutions, where market penetration is currently low but future potential is significant.

- Complementary Services: Potential targets will likely offer services that enhance Centene's existing government-sponsored program offerings, such as care coordination technology or specialized patient support programs.

- Strategic Market Entry: Acquisitions will serve as a faster route to market entry or expansion in nascent healthcare segments, allowing Centene to build scale and expertise rapidly.

- 2025 Outlook: Industry analysts project continued consolidation in the healthcare sector in 2025, with companies like Centene looking for strategic tuck-in acquisitions to drive growth and innovation.

Centene's ventures into new state Medicaid markets, while currently holding smaller market shares, represent significant growth potential. These new markets are being developed with substantial investment, aiming to capture a larger portion of the expanding government-sponsored healthcare landscape. For example, Centene's expansion into new Medicaid contracts in 2023 and 2024 is a clear indicator of its strategy to cultivate these "Question Mark" areas.

The company's focus on Dual Eligible Special Needs Plans (D-SNPs) also falls into this category. While D-SNPs constitute a significant 29% of Centene's Medicare Advantage offerings, the market itself is experiencing rapid growth, meaning Centene's current share, while substantial, still has considerable room to expand. The projected continued upward trajectory of the D-SNP market in 2024 provides a prime opportunity for increased penetration.

Centene's investments in digital transformation and strategic alliances for value-based care are also nascent efforts. These initiatives, while showing early signs of success such as a 10% increase in digital engagement in 2023, currently contribute minimally to overall market share. However, their strategic importance for future competitive advantage and revenue streams positions them as key "Question Marks" requiring continued investment.

Centene's pursuit of acquisitions in emerging healthcare solutions in 2025 further highlights its "Question Mark" strategy. By targeting companies in high-growth sectors where its current market share is modest, Centene aims to rapidly build scale and expertise, transforming these nascent areas into future revenue drivers.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.