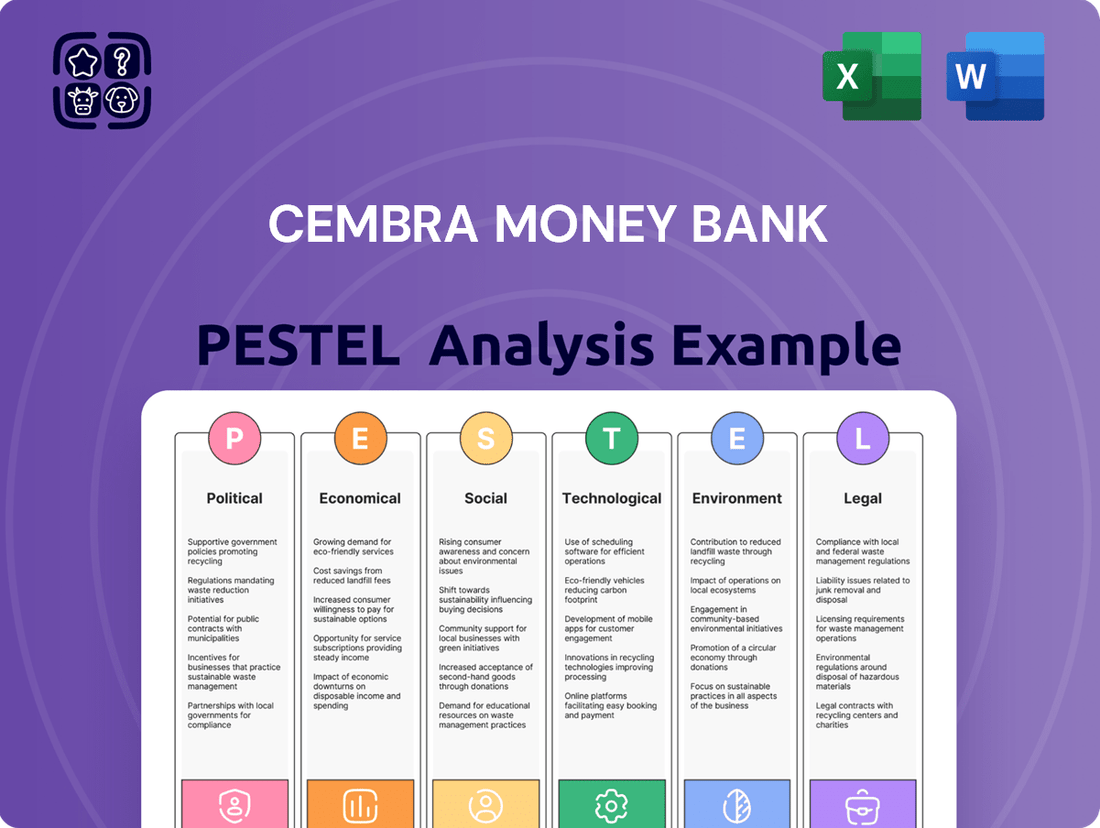

Cembra Money Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cembra Money Bank Bundle

Unlock the critical external factors influencing Cembra Money Bank's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends are shaping its market. Equip yourself with actionable intelligence to navigate these dynamics. Download the full PESTLE analysis now and gain a strategic advantage.

Political factors

Switzerland's enduring political stability and its rigorous financial oversight, spearheaded by the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss National Bank (SNB), create a predictable operating landscape for Cembra Money Bank. This stability is crucial for long-term planning and investment.

Anticipated adjustments to banking legislation and capital requirements, such as the ongoing implementation of Basel III standards which will see further refinements in 2025, directly affect Cembra's compliance burdens and its capacity for strategic maneuverability. These regulatory shifts are a constant consideration for the bank's management.

FINMA's mandate to foster market stability and safeguard customer interests, as demonstrated by its proactive approach to supervising the financial sector, contributes to a secure environment for institutions like Cembra. This regulatory certainty underpins investor confidence and facilitates sound business practices.

The Swiss government's commitment to sustainable finance, with initiatives planned through 2025, aims to solidify Switzerland's position as a global hub. This political momentum could translate into tangible benefits for companies like Cembra, potentially through tax advantages or subsidies for green financial products.

These government efforts are likely to foster an environment where ESG (Environmental, Social, and Governance) considerations become increasingly integrated into financial services. For Cembra, this means a potential shift in product development and investment strategies to align with these evolving political priorities and market expectations.

Ongoing international trade tensions and geopolitical risks present a significant challenge for the Swiss economy and its financial sector, including entities like Cembra Money Bank. These global uncertainties can disrupt supply chains, influence currency exchange rates, and dampen overall economic growth, all of which have a direct bearing on financial institutions.

The Swiss National Bank's projections for 2025 indicate a continued deterioration in economic and financial conditions due to these persistent tensions. This environment can lead to increased credit risk premiums as borrowers face greater economic headwinds, and it also heightens overall market volatility, requiring Cembra to remain vigilant in its risk management strategies.

Consumer Protection Regulations

Political emphasis on consumer protection in financial services directly impacts Cembra Money Bank. Stricter rules on personal loans, credit cards, and auto leases, covering interest rates, transparency, and debt collection, can affect profitability. For instance, Swiss authorities have historically focused on fair lending practices, which Cembra must adhere to in its operations.

The new Federal Act on Data Protection (FADP), effective since September 2023, also significantly influences how Cembra handles consumer data. This legislation mandates robust data security and transparency, requiring careful management of customer information to avoid penalties and maintain trust.

- Interest Rate Caps: Potential political interventions to cap interest rates on consumer credit products could directly limit Cembra's revenue streams.

- Transparency Requirements: Enhanced disclosure rules for loan terms and fees necessitate clear communication, impacting marketing and sales processes.

- Data Privacy Compliance: Adherence to the FADP requires significant investment in data security infrastructure and employee training, with potential fines for non-compliance.

Monetary Policy Decisions by the SNB

The Swiss National Bank's (SNB) monetary policy decisions are a critical political factor influencing Cembra Money Bank. Changes in interest rates directly affect Cembra's cost of borrowing funds and the profitability of its lending activities, impacting its net interest margin. For instance, the SNB's decision to cut its policy rate by 0.25% in March 2024 and a further 0.25% in June 2024, bringing it to 1.25%, signals a shift towards a more accommodative stance.

The expectation of further rate cuts by the SNB in late 2024 and throughout 2025 is a significant consideration for Cembra. Lower interest rates can make borrowing more attractive for consumers and businesses, potentially increasing demand for Cembra's loan products. However, it also compresses the bank's net interest income, requiring careful management of its funding costs and lending strategies to maintain profitability.

- SNB Policy Rate: Currently at 1.25% as of June 2024, down from 1.75% in early 2024.

- Impact on Funding Costs: Lower SNB rates reduce Cembra's cost of acquiring funds.

- Net Interest Margin: Expected compression due to lower lending rates, necessitating efficiency gains.

- Lending Demand: Potential increase in demand for loans as borrowing becomes cheaper.

Switzerland's stable political environment, overseen by FINMA and the SNB, provides a predictable framework for Cembra. Regulatory changes, like Basel III refinements expected in 2025, directly influence Cembra's compliance and strategic flexibility, while consumer protection laws, including the FADP effective since September 2023, mandate stringent data handling and transparency, impacting profitability and operations.

| Political Factor | Description | Impact on Cembra | Data/Trend (2024/2025) |

|---|---|---|---|

| Political Stability | Switzerland's stable political landscape. | Predictable operating environment, aids long-term planning. | High stability rating; consistent governance. |

| Financial Regulation | FINMA and SNB oversight; Basel III implementation. | Compliance costs, strategic maneuverability. | Basel III finalization ongoing; potential for further capital requirement adjustments in 2025. |

| Consumer Protection | Data Privacy (FADP), lending practices. | Operational adjustments, potential impact on profitability. | FADP effective Sept 2023; focus on fair lending continues. |

| Monetary Policy | SNB interest rate decisions. | Net interest margin, funding costs, loan demand. | SNB rate at 1.25% (June 2024); further cuts anticipated in late 2024/2025. |

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Cembra Money Bank, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making, identifying potential threats and opportunities within the bank's operating landscape.

A Cembra Money Bank PESTLE analysis provides a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic discussions and decision-making.

Economic factors

The prevailing interest rate environment, shaped by the Swiss National Bank's (SNB) monetary policy, is a critical factor for Cembra Money Bank. The SNB's decision to lower its policy rate to 0.5% in December 2024, with further reductions anticipated in 2025, directly influences Cembra's net interest margin. While lower rates can compress lending margins, they also offer the benefit of reduced funding costs for the bank.

This shift in interest rates impacts Cembra's profitability by affecting the spread between the interest earned on its loans and the interest paid on its deposits and borrowings. For instance, if funding costs decrease more significantly than lending rates, Cembra could see an improvement in its net interest margin, even in a low-rate environment.

The Swiss economy is projected for modest growth in 2024, with expectations of a slight acceleration in 2025. This economic climate directly influences the demand for Cembra Money Bank's consumer credit offerings, as a healthy economy typically translates to increased consumer confidence and spending.

Despite moderate overall growth, a resilient private consumption outlook is a key positive factor. This sustained consumer spending is crucial for Cembra, as it underpins demand for personal loans and auto leases, core products for the bank.

For instance, Swiss retail sales saw a year-on-year increase of 1.7% in April 2024, indicating continued consumer engagement. This trend suggests a stable environment for Cembra to leverage its lending services.

Switzerland's inflation rate is expected to remain subdued, with projections around 0.7% for 2025. This low inflation environment generally supports consumer purchasing power, making it easier for individuals to manage their existing debt obligations with Cembra Money Bank.

While low inflation is beneficial, a significant dip into deflation could indicate underlying economic weakness. This scenario might dampen credit demand and potentially increase the risk of loan defaults, affecting Cembra's financial performance.

Unemployment Rates and Credit Risk

Changes in unemployment rates have a direct impact on the credit risk associated with Cembra Money Bank's loan portfolio. When more people are out of work, they are less likely to be able to repay their loans, increasing the chance of defaults.

While Switzerland historically boasts a low unemployment rate, projections suggest a minor uptick for 2025. This potential increase, even if modest, could translate into a rise in non-performing loans for Cembra. Consequently, the bank will need to proactively adjust its provisions for potential credit losses to maintain financial stability.

- Swiss Unemployment Rate: Historically low, hovering around 2.0% in early 2024.

- 2025 Forecast: Projections from the State Secretariat for Economic Affairs (SECO) indicate a slight increase, potentially reaching 2.3% by the end of 2025.

- Impact on Credit Risk: A 0.3% rise in unemployment could lead to a noticeable increase in delinquency rates on consumer and business loans.

- Cembra's Response: The bank must monitor economic indicators closely and potentially increase its loan loss provisions to buffer against anticipated defaults.

Competition in the Swiss Financial Market

The Swiss financial market is a vibrant arena with established players and agile newcomers. Traditional banks, with their deep roots and extensive customer bases, remain significant competitors, but the rise of fintech companies is reshaping the landscape. These fintechs often focus on niche areas like digital payments and consumer lending, directly challenging established business models and forcing incumbents like Cembra to adapt.

Cembra's pricing strategies and ability to capture market share are directly impacted by this dynamic competitive environment. The pressure from both traditional and digital competitors means Cembra must remain agile in its pricing to attract and retain customers, especially in the consumer credit and payment solutions sectors where innovation is rapid.

Digitalization is a key driver of change. As more consumers embrace online banking and digital payment methods, Cembra faces the imperative to continuously enhance its digital offerings. The threat of new entrants, particularly those with lean digital operations, means that sustained innovation is not just beneficial but essential for Cembra to maintain its competitive edge and market position.

- Swiss Banking Sector Growth: In 2024, the Swiss banking sector saw continued growth, with total assets reaching CHF 3.5 trillion by Q2 2024, indicating a strong market but also intense competition.

- Fintech Investment: Global fintech investment saw a notable increase in late 2024 and early 2025, with a significant portion directed towards digital lending and payment platforms, highlighting the growing competitive threat to traditional financial institutions.

- Consumer Credit Market Share: Cembra Money Bank held approximately 12% of the Swiss consumer credit market share as of early 2025, facing competition from both major Swiss banks and specialized fintech lenders who are increasingly gaining traction.

- Digital Adoption Rates: By mid-2025, over 70% of Swiss consumers reported using digital channels for at least one banking transaction per month, underscoring the critical need for Cembra to maintain and advance its digital capabilities to compete effectively.

The prevailing interest rate environment, shaped by the Swiss National Bank's (SNB) monetary policy, is a critical factor for Cembra Money Bank. The SNB's decision to lower its policy rate to 0.5% in December 2024, with further reductions anticipated in 2025, directly influences Cembra's net interest margin. While lower rates can compress lending margins, they also offer the benefit of reduced funding costs for the bank.

The Swiss economy is projected for modest growth in 2024, with expectations of a slight acceleration in 2025, supporting consumer credit demand. Despite moderate overall growth, a resilient private consumption outlook is a key positive factor for Cembra's core products. Switzerland's inflation rate is expected to remain subdued around 0.7% for 2025, generally supporting consumer purchasing power and debt management.

Changes in unemployment rates directly impact Cembra's credit risk. While Switzerland historically boasts a low unemployment rate, projections suggest a minor uptick for 2025, potentially reaching 2.3% by the end of the year, which could increase non-performing loans.

The Swiss financial market is dynamic, with fintech companies increasingly challenging traditional banks. Cembra's pricing and market share are impacted by this competition, necessitating agile strategies. Digitalization is a key driver, with over 70% of Swiss consumers using digital banking channels by mid-2025, underscoring the need for Cembra to advance its digital capabilities.

| Economic Factor | 2024 Data/Trend | 2025 Forecast/Trend | Impact on Cembra |

|---|---|---|---|

| Interest Rates (SNB Policy Rate) | 0.5% (as of Dec 2024) | Anticipated further reductions | Lower funding costs, potential pressure on net interest margin |

| Economic Growth (Switzerland) | Modest growth | Slight acceleration expected | Supports demand for consumer credit |

| Inflation Rate (Switzerland) | Subdued | Projected around 0.7% | Supports consumer purchasing power, aids debt management |

| Unemployment Rate (Switzerland) | Historically low (~2.0% in early 2024) | Slight increase projected (up to 2.3% by end of 2025) | Potential increase in credit risk and loan defaults |

| Consumer Spending | Resilient private consumption | Continued strength anticipated | Underpins demand for personal loans and auto leases |

Full Version Awaits

Cembra Money Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Cembra Money Bank PESTLE analysis. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cembra Money Bank. You can trust that the insights and structure you see are precisely what you'll gain access to, enabling immediate strategic planning.

Sociological factors

Consumer behavior is rapidly shifting towards digital channels, with a significant portion of banking transactions now conducted online. For instance, in 2024, over 70% of Swiss banking customers reported using mobile banking apps for daily transactions, a trend that accelerated post-2020. This evolving preference necessitates Cembra Money Bank to continually invest in and refine its digital platforms to meet customer expectations for convenience and accessibility.

The demand for personalized and seamless digital experiences is paramount. Customers expect intuitive interfaces, quick access to information, and efficient online application processes. By 2025, digital-first banking solutions are projected to capture an even larger market share, compelling Cembra to prioritize innovation in its mobile banking and online service offerings to remain competitive and cater to these evolving user demands.

Switzerland's population is indeed getting older. In 2023, the average age was around 42.7 years, a figure that has been steadily increasing. This demographic shift means there will be a growing segment of the population in retirement or nearing it, potentially impacting their need for certain financial products and services.

As more people age, Cembra Money Bank might see changes in demand. For instance, the need for flexible personal loans or credit cards tailored to fixed incomes could rise. Conversely, demand for products geared towards younger, working populations might evolve. Understanding these evolving needs is crucial for offering relevant financial solutions.

The financial literacy of the Swiss population directly influences how consumers engage with credit products offered by institutions like Cembra Money Bank. A higher level of financial understanding can lead to more informed borrowing decisions.

Cembra, and the broader financial sector, have a vested interest in fostering financial education. Initiatives aimed at improving financial literacy can empower individuals to manage debt more effectively, potentially reducing non-performing loans. For instance, in 2023, the Swiss financial market continued to see a demand for consumer credit, with total outstanding consumer credits reaching approximately CHF 35.5 billion.

Changing Lifestyles and Mobility Trends

Societal shifts are significantly altering how people approach transportation, directly influencing demand for financial products like auto leases. For instance, a growing preference for urban living and environmental consciousness is fueling a rise in public transport usage and the adoption of car-sharing services over traditional car ownership. This trend is particularly noticeable among younger demographics. In Switzerland, for example, the utilization of public transport has seen consistent growth, with passenger numbers on Swiss Federal Railways (SBB) reaching approximately 447 million journeys in 2023, indicating a strong reliance on alternatives to private vehicles.

These changing lifestyles necessitate that financial institutions like Cembra Money Bank adapt their product portfolios. The bank must consider how to cater to individuals who may not be seeking outright vehicle ownership but are interested in flexible mobility solutions. This could involve developing or enhancing offerings related to leasing for electric vehicles, subscription-based car services, or financing for shared mobility platforms.

- Growing Urbanization: Increased city living often correlates with reduced reliance on personal vehicles due to congestion and parking challenges.

- Rise of Mobility-as-a-Service (MaaS): Platforms integrating various transport options (public transit, ride-sharing, bike rentals) are gaining traction, potentially decreasing the need for individual car leases.

- Environmental Awareness: A greater focus on sustainability encourages the use of public transport and shared mobility, impacting the traditional auto lease market.

- Demographic Shifts: Younger generations, in particular, are often more open to alternative mobility models than previous generations.

Trust in Financial Institutions

Public trust in financial institutions significantly impacts Cembra Money Bank's operations, particularly following major events like the UBS acquisition of Credit Suisse in 2023. Surveys indicate a nuanced public perception; for example, a 2024 study by the Swiss Financial Market Supervisory Authority (FINMA) noted that while overall confidence in Swiss banking remains relatively stable, specific concerns about data privacy and ethical lending practices persist among a segment of the population.

Cembra's ability to foster and maintain customer trust hinges on its commitment to transparent operations, robust data security measures, and responsible lending policies. This is especially critical in the current environment where consumers are increasingly vigilant about how their financial data is handled and the fairness of credit terms. For instance, in 2024, digital security breaches in other sectors have heightened consumer awareness, making robust cybersecurity a non-negotiable for financial service providers.

- Public Trust: A 2024 FINMA report highlighted that while overall confidence in Swiss banking is stable, specific concerns about data privacy and ethical lending remain.

- Data Security: Increased awareness of digital breaches in 2024 makes robust cybersecurity a critical factor for customer retention at Cembra.

- Responsible Lending: Transparency in loan terms and fair practices are paramount for attracting and retaining customers in the current market.

- Competitive Landscape: Building and maintaining trust is a key differentiator for Cembra in a competitive financial services market shaped by recent industry consolidations.

The increasing focus on sustainability and ethical consumption is shaping consumer preferences, influencing their choice of financial products and services. For instance, a 2024 survey indicated that over 60% of Swiss consumers consider environmental and social factors when making purchasing decisions, including financial ones.

Cembra Money Bank can leverage this trend by highlighting its commitment to responsible lending and potentially offering green financing options. As societal values evolve, aligning financial products with these broader ethical considerations becomes crucial for brand reputation and customer acquisition. This also extends to how financial institutions manage their own environmental footprint.

The aging demographic in Switzerland, with the average age around 42.7 years in 2023, presents both opportunities and challenges. Cembra needs to consider how to best serve an increasing segment of the population nearing or in retirement, potentially adapting its product offerings to suit fixed incomes or evolving financial needs.

Financial literacy remains a key sociological factor, impacting how consumers engage with credit. In 2023, outstanding consumer credits in Switzerland were approximately CHF 35.5 billion, underscoring the importance of informed borrowing decisions. Cembra has a vested interest in promoting financial education to ensure responsible credit utilization.

Technological factors

Cembra Money Bank must navigate the accelerating digital transformation within finance, demanding ongoing tech investment. This means embracing advancements like artificial intelligence and big data analytics to refine customer interactions, optimize internal processes, and create innovative digital offerings.

For instance, in 2024, the global fintech market was projected to reach over $300 billion, highlighting the immense opportunities and competitive pressures Cembra faces. The bank's strategic focus on digital channels saw its digital customer interactions increase significantly in recent years, demonstrating a commitment to leveraging technology for growth.

As financial services increasingly move online, robust cybersecurity and strict data protection are crucial. Cembra Money Bank must invest in advanced security to safeguard sensitive customer information and comply with evolving regulations.

The revised Swiss Federal Act on Data Protection (FADP), effective September 1, 2023, mandates stricter rules for data handling, requiring companies like Cembra to ensure enhanced data security measures and transparent data processing practices to avoid significant penalties.

Cembra Money Bank's operational efficiency and risk management are poised for significant enhancement through the adoption of Artificial Intelligence (AI) and automation. AI can streamline processes like credit scoring and fraud detection, potentially reducing operational costs and improving accuracy. For instance, in 2024, many financial institutions reported a reduction in processing times for loan applications by up to 30% due to AI-powered analytics.

Furthermore, AI enables highly personalized customer services, a key differentiator in the competitive financial landscape. Chatbots powered by AI can handle a substantial volume of customer inquiries 24/7, improving response times and customer satisfaction. Cembra could also leverage AI for developing innovative savings tools, offering tailored financial advice and product recommendations based on individual customer data, thereby fostering deeper customer engagement.

Mobile Banking and Payment Solutions

The widespread adoption of smartphones and tablets is fundamentally reshaping how consumers interact with financial services. Cembra Money Bank must prioritize the ongoing enhancement of its mobile banking applications to meet the growing demand for seamless and convenient digital experiences. This includes ensuring intuitive user interfaces and robust functionality for everyday banking needs.

Integrating with popular digital payment platforms is crucial for staying competitive and relevant. For instance, in Switzerland, TWINT has seen significant growth. As of late 2024, TWINT reported over 4 million active users, processing billions in transaction volume annually, highlighting the importance of such partnerships for Cembra to capture a larger share of the digital payment market and boost customer engagement.

- Mobile-first strategy: Enhancing app features for account management, loan applications, and customer support.

- Payment integration: Seamlessly incorporating popular mobile payment solutions like TWINT to facilitate transactions.

- User experience: Focusing on intuitive design and ease of use to drive customer adoption and retention.

- Security enhancements: Implementing advanced security measures to protect user data and financial transactions within the mobile environment.

Cloud Computing and Infrastructure

Cembra Money Bank's adoption of cloud computing offers significant advantages, including enhanced scalability to manage fluctuating customer demand and potential cost savings through optimized IT infrastructure. For instance, many financial institutions are reporting substantial reductions in operational expenses by migrating to cloud-based solutions. This shift also provides greater flexibility in data storage and processing.

However, the move to cloud infrastructure introduces critical considerations. Cembra must rigorously address data security to protect sensitive customer financial information, a paramount concern in the banking sector. Ensuring compliance with stringent financial regulations, such as GDPR and local data residency laws, is also non-negotiable. Furthermore, effective vendor management is crucial when outsourcing core IT functions.

- Scalability: Cloud platforms allow Cembra to easily scale its IT resources up or down based on business needs, improving agility.

- Cost Efficiency: Migrating to the cloud can reduce capital expenditure on hardware and lower ongoing maintenance costs.

- Data Security & Compliance: Robust security measures and adherence to financial regulations are essential when storing sensitive data in the cloud.

- Vendor Management: Careful selection and ongoing oversight of cloud service providers are vital for reliable and secure operations.

Technological advancements are reshaping financial services, necessitating continuous investment in digital capabilities for Cembra Money Bank. The bank must leverage AI and big data for improved customer engagement and operational efficiency, mirroring the global fintech market's projected growth to over $300 billion in 2024.

Prioritizing mobile-first strategies, Cembra should enhance its app features and integrate with popular payment solutions like TWINT, which boasts over 4 million users in Switzerland as of late 2024. This focus on seamless digital experiences is crucial for customer retention and market competitiveness.

Cloud adoption offers scalability and cost efficiencies, but robust cybersecurity and compliance with regulations like the revised Swiss FADP (effective September 2023) are paramount to protect sensitive data.

Legal factors

Cembra Money Bank operates under the stringent supervision of the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss Banking Act, ensuring adherence to robust financial regulations.

Compliance with FINMA ordinances, including those implementing Basel III standards which became effective in January 2025, directly influences Cembra's capital requirements and overall operational structure. For instance, the revised capital adequacy framework under Basel III necessitates higher capital buffers, impacting how Cembra manages its risk-weighted assets.

Switzerland's revised Federal Act on Data Protection (FADP), effective September 2023, significantly impacts how Cembra Money Bank handles personal information. This updated legislation mandates strict adherence to data subject rights, requiring clear consent and easy access to personal data for individuals. Cembra must also implement robust data security measures and prompt notification protocols in the event of a breach.

Compliance with the FADP necessitates a proactive approach to privacy, embedding principles of privacy by design and by default into all data processing activities. This means that privacy considerations must be integral to the development of new products and services, not an afterthought. Failure to comply could result in substantial fines, impacting Cembra's operational costs and reputation.

Swiss consumer credit laws, including the Consumer Credit Act (CCA), set strict limits on interest rates and mandate transparent disclosure for products like personal loans and auto leases. For instance, the CCA caps the annual interest rate at 15% for unsecured personal loans, a critical factor for Cembra Money Bank's lending margins.

Any amendments to these regulations, such as potential adjustments to the maximum permissible interest rates or stricter responsible lending requirements, could directly influence Cembra's product development, pricing strategies, and overall profitability in the 2024-2025 period.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

Cembra Money Bank operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, critical for preventing illicit financial activities. These regulations are a cornerstone of financial integrity, requiring robust due diligence and transaction monitoring. For instance, in 2023, Swiss financial institutions reported a significant number of suspicious activity reports, underscoring the ongoing need for vigilance. The Swiss financial sector is continuously adapting its AML/CTF frameworks, with ongoing discussions around potential updates to key directives like the Swiss Banks' Code of Conduct for the Exercise of Due Diligence (CDB 20), which will further shape compliance requirements.

The evolving regulatory landscape demands constant adaptation from institutions like Cembra. This includes investing in advanced technology for transaction monitoring and employee training to ensure compliance with evolving standards. Failure to adhere to these regulations can result in substantial fines and reputational damage. For example, global financial institutions faced billions in AML-related penalties in recent years, a stark reminder of the financial and operational risks involved.

- Regulatory Scrutiny: Cembra faces rigorous oversight from financial regulators regarding AML/CTF compliance.

- Due Diligence Enhancements: Continuous improvements to customer due diligence processes are mandated.

- Transaction Monitoring: Sophisticated systems are required to detect and report suspicious financial transactions.

- Compliance Costs: Significant investment in technology and personnel is necessary to meet regulatory obligations.

Contract Law and Debt Collection Procedures

The legal framework governing contracts and debt collection in Switzerland directly impacts Cembra Money Bank's operations. Changes to Swiss contract law or debt recovery procedures, such as those affecting the enforceability of loan agreements or bankruptcy regulations, could significantly influence the bank's capacity to recoup delinquent debts and manage its overall credit risk exposure. For instance, updates to the Swiss Debt Enforcement and Bankruptcy Act (SchKG) can alter the efficiency and cost of debt collection, thereby affecting profitability.

Cembra must closely monitor evolving legal interpretations and potential legislative amendments. For example, the Swiss Federal Department of Justice and Police regularly reviews and proposes adjustments to laws impacting financial services. In 2024, discussions around consumer protection in lending could lead to stricter disclosure requirements or limitations on certain debt collection tactics, potentially increasing compliance costs for Cembra.

- Contractual Enforcement: Swiss law, including the Code of Obligations, dictates the terms and enforceability of loan contracts, directly impacting Cembra's ability to secure and collect on its lending portfolio.

- Debt Collection Processes: The Debt Enforcement and Bankruptcy Act (SchKG) outlines the legal procedures for debt recovery, influencing the timelines and success rates of Cembra's collection efforts.

- Consumer Protection Laws: Amendments to consumer credit regulations, such as those potentially introduced in 2024/2025, could impose new obligations on lenders like Cembra regarding credit assessments and responsible lending practices.

- Bankruptcy Proceedings: Changes in Swiss bankruptcy law can affect the priority of creditors and the recovery rates for financial institutions in insolvency cases involving borrowers.

Cembra Money Bank is subject to Switzerland's robust legal framework, including the Swiss Banking Act and directives from FINMA, which dictate capital requirements and operational conduct. For instance, the implementation of Basel III standards from January 2025 directly influences Cembra's capital adequacy ratios, demanding higher buffers and impacting risk management strategies.

The revised Federal Act on Data Protection (FADP), effective September 2023, mandates stringent data handling practices, requiring clear consent and enhanced security measures for personal information. Non-compliance can lead to significant fines, impacting Cembra's operational costs and reputation.

Consumer credit laws, such as the Consumer Credit Act (CCA), cap interest rates at 15% for unsecured loans, directly affecting Cembra's lending margins and product pricing. Potential adjustments to these regulations in 2024-2025 could further influence profitability.

Cembra must also adhere to strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, necessitating ongoing investment in technology and training to ensure compliance with evolving standards and prevent illicit financial activities.

Environmental factors

The intensifying focus on climate change and broader ESG considerations is directly impacting Swiss financial institutions like Cembra Money Bank through evolving reporting mandates. Starting with the 2024 financial year, large Swiss companies, including banks, are now obligated to publicly disclose their climate-related risks and opportunities, adhering to the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

This regulatory shift, effective from 2024, means Cembra must enhance its transparency regarding its environmental impact and climate strategy. The TCFD alignment necessitates detailed reporting on governance, strategy, risk management, and metrics and targets related to climate change, directly influencing Cembra's sustainability initiatives and stakeholder communications.

Switzerland's commitment to sustainable finance is accelerating, with a notable push from regulatory bodies and market demand for eco-conscious financial products. This trend creates a significant opportunity for Cembra Money Bank to expand its offerings. For instance, the Swiss government's climate goals, aiming for net-zero emissions by 2050, are driving financial institutions to develop green loan portfolios. In 2023, the Swiss financial sector saw a notable increase in sustainable investment funds, with assets under management growing by over 15%, indicating strong consumer interest in environmentally aligned financial services.

Cembra Money Bank faces significant reputational risk if its lending practices are seen as contributing to environmental degradation. For instance, if a substantial portion of their portfolio supports industries with high carbon emissions or poor waste management, public perception could be negatively impacted. This is particularly relevant as global awareness of climate change intensifies, with consumers and investors increasingly scrutinizing corporate environmental footprints.

To mitigate this, Cembra's commitment to Environmental, Social, and Governance (ESG) principles is crucial. By actively demonstrating environmental responsibility, such as investing in green financing initiatives or reducing its operational carbon footprint, the bank can bolster its brand image. This proactive approach can attract a growing segment of environmentally conscious customers and investors, potentially leading to increased market share and a stronger financial standing. For example, the Swiss financial sector, in general, saw a notable increase in sustainable investment products in 2023, indicating a clear market trend towards ESG-aligned offerings.

Resource Scarcity and Operational Footprint

While Cembra Money Bank isn't a heavy industrial manufacturer, its day-to-day operations still have an environmental impact. This includes the energy used to power its offices and the waste generated from daily activities. For instance, in 2023, many Swiss companies reported increased focus on reducing their office energy consumption, with some aiming for a 10-15% reduction by 2025.

As part of its commitment to sustainability, Cembra is likely exploring ways to become more resource-efficient. This could involve initiatives to lower energy usage, optimize waste management, and potentially explore greener IT solutions. Such efforts align with broader European banking trends, where sustainability reporting and carbon footprint reduction are becoming increasingly important for investor relations and regulatory compliance.

Key considerations for Cembra's environmental footprint include:

- Energy Consumption: Optimizing electricity usage in office buildings and data centers.

- Waste Management: Implementing robust recycling programs and reducing paper consumption through digitalization.

- Supply Chain: Assessing the environmental impact of third-party vendors and service providers.

- Resource Efficiency: Promoting water conservation and sustainable procurement practices.

Regulatory Pressure for Environmental Due Diligence

Financial institutions like Cembra Money Bank are facing increasing regulatory pressure to perform thorough environmental due diligence across their entire operations, including the assets they finance. This means a closer look at the environmental footprint of everything from auto leases to other significant financed items.

For instance, in 2023, the European Banking Authority (EBA) continued its focus on climate-related risks, emphasizing the need for banks to integrate environmental considerations into their lending and investment strategies. This trend is expected to intensify, requiring greater transparency and accountability for financed emissions.

- Increased Scrutiny on Financed Assets: Regulators are pushing for financial institutions to assess the environmental impact of the assets they support, potentially affecting sectors like automotive financing.

- Value Chain Responsibility: The expectation is for companies to extend due diligence beyond their direct operations to encompass their entire value chain, including their financing activities.

- Climate Risk Integration: Financial regulators globally, including those in Europe, are mandating the integration of climate and environmental risks into risk management frameworks and business strategies.

The Swiss financial sector, including Cembra Money Bank, is increasingly subject to environmental regulations and market expectations. Mandatory climate-related disclosures, effective from 2024, require banks to report on their climate risks and opportunities, aligning with TCFD recommendations. This regulatory shift emphasizes transparency and the integration of environmental factors into business strategies, driven by Switzerland's commitment to net-zero emissions by 2050.

Cembra faces reputational risks if its lending practices are perceived as environmentally harmful, particularly as consumer and investor awareness of climate change grows. The bank's proactive embrace of ESG principles, such as developing green financing options, can enhance its brand image and attract environmentally conscious customers. The Swiss market saw a notable increase in sustainable investment funds in 2023, with assets under management growing by over 15%, highlighting this trend.

Beyond direct operations, Cembra must also consider the environmental impact of its financed assets, a growing regulatory focus exemplified by the European Banking Authority's emphasis on integrating climate risks into lending strategies. This extends to assessing the environmental footprint of financed items, such as auto leases, and ensuring value chain responsibility.

| Environmental Factor | Impact on Cembra | 2023/2024 Data/Trend |

|---|---|---|

| Regulatory Disclosure Mandates | Increased transparency requirements for climate risks and opportunities. | TCFD reporting mandatory for large Swiss companies from 2024. |

| Sustainable Finance Demand | Opportunity to develop and market green financial products. | Swiss sustainable investment funds grew by >15% in assets under management in 2023. |

| Reputational Risk | Negative perception if lending supports environmentally damaging industries. | Growing consumer and investor scrutiny of corporate environmental footprints. |

| Operational Footprint | Need to reduce energy consumption and waste in daily operations. | Many Swiss companies aimed for 10-15% office energy reduction by 2025. |

| Financed Emissions Scrutiny | Requirement to assess environmental impact of financed assets. | EBA focus on integrating climate risks into lending and investment strategies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Cembra Money Bank is informed by a comprehensive review of financial market data, regulatory updates from Swiss and European authorities, and reports on consumer economic sentiment. This ensures a robust understanding of the external factors impacting the bank.