Cembra Money Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cembra Money Bank Bundle

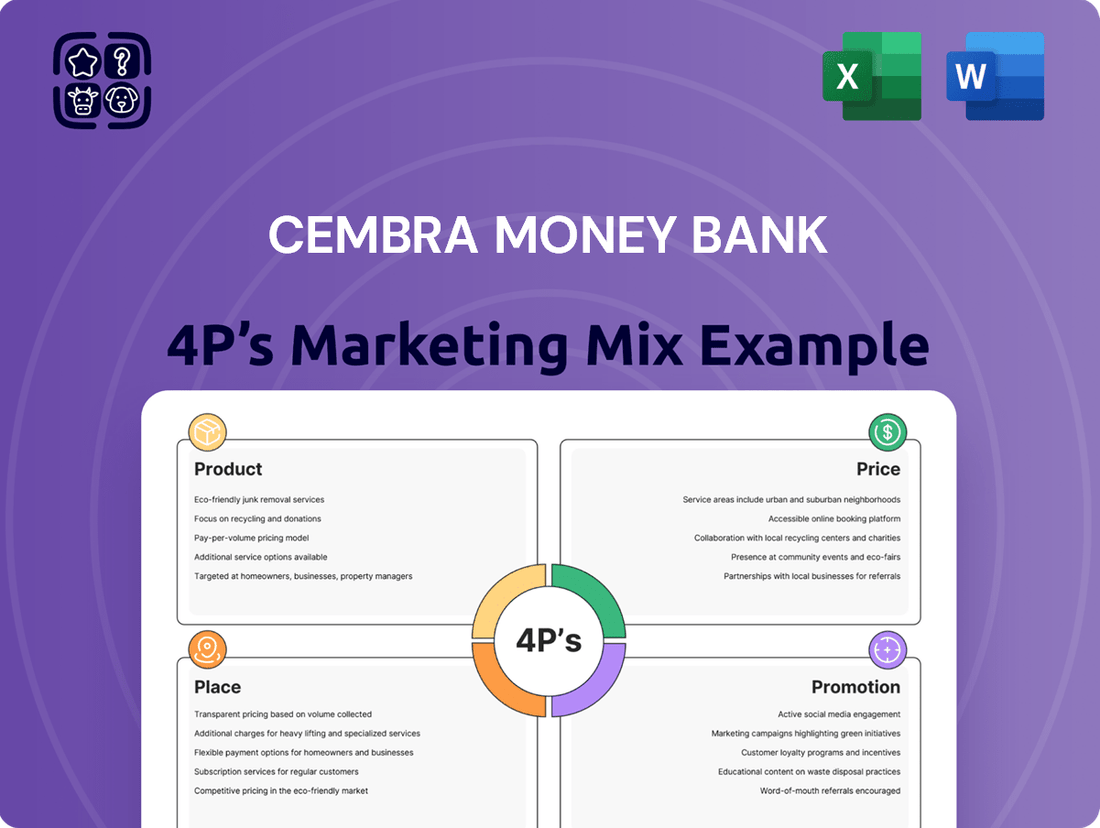

Discover how Cembra Money Bank strategically leverages its product offerings, competitive pricing, accessible distribution channels, and targeted promotional activities to capture market share and foster customer loyalty.

This comprehensive 4Ps analysis delves into the core of Cembra Money Bank's marketing engine, revealing the intricate interplay between what they offer, how they price it, where customers can access it, and how they communicate its value.

Unlock actionable insights and a ready-to-use framework by accessing the full Cembra Money Bank 4P's Marketing Mix Analysis, perfect for students, professionals, and anyone seeking a competitive edge in financial services marketing.

Product

Cembra Money Bank's consumer credit offerings are central to its marketing mix, featuring personal loans and auto financing solutions. These products are crafted to provide Swiss individuals and small businesses with adaptable financial tools for diverse needs, from everyday purchases to significant vehicle investments. The bank's strategy focuses on aligning these offerings with customer desires and effectively addressing their financial challenges.

In 2024, Cembra Money Bank reported a significant portion of its loan portfolio dedicated to consumer finance, demonstrating the importance of these products. For instance, personal loans alone accounted for a substantial percentage of their total lending, reflecting strong market demand. This emphasis allows Cembra to cater to a wide range of consumer financial requirements, solidifying its position in the Swiss market.

Cembra Money Bank's credit card product is a cornerstone of its offering in Switzerland, boasting over one million cards in circulation. This extensive reach highlights Cembra's position as a dominant player in the Swiss credit card market.

The product portfolio is intentionally diverse, catering to various consumer needs through both proprietary cards and strategic co-branding with prominent Swiss retailers. Partnerships with names like Conforama, FNAC, IKEA, LIPO, SPAR, and TCS significantly broaden the accessibility and appeal of their credit card offerings.

These credit cards are designed with customer value in mind, frequently incorporating attractive benefits such as loyalty points and cashback programs. Many also offer personalized design options and competitive pricing, often including no annual fees, which directly enhances their market competitiveness and customer adoption rates.

Cembra Money Bank enhances its financing products by offering insurance solutions, a key component of its marketing mix. These insurance products, like payment protection and credit card protection, provide a safety net for customers facing unexpected life events such as job loss, accidents, or illness, thereby reducing perceived risk for borrowers.

In 2023, Cembra's insurance segment contributed to its overall revenue stream, with a notable focus on credit protection products. For instance, the bank reported that a significant portion of its personal loan customers opted for payment insurance, demonstrating customer demand for such financial security measures.

Furthermore, Cembra extends its insurance offerings to vehicle leasing clients by intermediating car insurance. This strategic move not only adds value to the leasing service but also creates an additional revenue channel, reinforcing Cembra's position as a comprehensive financial solutions provider in the Swiss market.

Invoice Financing (Buy Now Pay Later - BNPL)

Cembra's CembraPay business unit provides innovative invoice financing and flexible Buy Now Pay Later (BNPL) solutions. These offerings cater to both online and in-store purchases, enabling consumers to spread payments over time. This strategic product offering is a cornerstone of Cembra's approach to meeting evolving consumer payment preferences.

The company's strong presence in the Swiss market is evident in its significant market share within the BNPL sector. Cembra is estimated to hold between 30% and 40% of the Swiss BNPL market, highlighting its competitive position. This substantial share underscores the success and adoption of their payment solutions.

- Product Innovation: CembraPay offers flexible BNPL and invoice financing for online and point-of-sale transactions.

- Market Penetration: Cembra commands a 30-40% market share in the Swiss BNPL sector.

- Customer Focus: The product directly addresses consumer demand for deferred payment options.

- Competitive Advantage: Significant market share indicates strong customer trust and product appeal.

Deposit and Savings s

Cembra Money Bank offers a range of deposit and savings products, aiming to provide competitive interest rates for both individual and institutional customers. This segment of their marketing mix focuses on attracting and retaining client funds by offering secure avenues for wealth accumulation.

In 2024, Cembra notably broadened its savings offerings by introducing new digital savings products. This strategic move highlights the bank's commitment to evolving with market demands and providing accessible, modern financial solutions that complement their core credit and payment services. These enhancements aim to capture a wider customer base seeking reliable savings vehicles.

- Competitive Interest Rates: Cembra aims to attract deposits by offering attractive rates, a key differentiator in the savings market.

- Digital Savings Expansion (2024): The introduction of new digital savings products reflects an investment in modern, user-friendly platforms.

- Comprehensive Financial Solutions: Deposit and savings products round out Cembra's offerings, providing a full spectrum of financial services beyond lending.

- Customer Security and Returns: The primary appeal of these products lies in their ability to offer customers a safe place to save while earning a return on their funds.

Cembra's product strategy centers on a diverse range of financial solutions designed to meet the varied needs of the Swiss market. This includes core offerings like personal loans and auto financing, alongside a dominant presence in the credit card sector with over one million cards issued. The bank also strategically incorporates insurance products, such as payment protection, to mitigate borrower risk and enhance customer value.

Furthermore, Cembra's CembraPay unit is a significant player in the burgeoning Buy Now Pay Later (BNPL) market, holding an estimated 30-40% share in Switzerland. The bank also complements its lending and payment services with competitive deposit and savings products, notably expanding its digital offerings in 2024 to cater to modern consumer preferences.

| Product Category | Key Offerings | Market Position/Data (2023/2024) | Customer Value Proposition |

|---|---|---|---|

| Consumer Credit | Personal Loans, Auto Financing | Significant portion of loan portfolio | Adaptable financial tools for diverse needs |

| Credit Cards | Proprietary & Co-branded Cards | Over 1 million cards in circulation | Loyalty points, cashback, no annual fees |

| Insurance | Payment Protection, Credit Card Protection | Notable contribution to revenue (2023) | Financial security against unexpected events |

| Payment Solutions | Invoice Financing, BNPL | 30-40% market share in Swiss BNPL | Flexible payment options for consumers |

| Deposits & Savings | Savings Accounts | Expanded digital offerings (2024) | Competitive interest rates, secure wealth accumulation |

What is included in the product

This analysis provides a comprehensive examination of Cembra Money Bank's marketing strategies, detailing its Product offerings, Pricing models, Place of distribution, and Promotional activities.

Unlocks a clear understanding of Cembra Money Bank's 4Ps, alleviating the pain of complex marketing strategies for focused decision-making.

Place

Cembra Money Bank maintains a physical presence with around 25 branches strategically located throughout Switzerland. This network is crucial for offering a tangible touchpoint for customers, particularly those who value face-to-face interactions for financial advice and service inquiries.

Cembra Money Bank prioritizes its online and digital channels, acknowledging the significant move towards digital banking. Their official website and the evolving Cembra app serve as key touchpoints, aiming to become a unified and secure hub for all customer needs.

The Cembra app is a focal point for digital strategy, consistently updated to enhance self-service capabilities across diverse customer segments and product offerings. In 2023, Cembra reported a substantial increase in digital transaction volumes, with over 80% of customer interactions occurring through digital channels, underscoring their commitment to this area.

Cembra's credit card business thrives through strategic alliances with prominent retailers like Conforama, FNAC, IKEA, LIPO, SPAR, and TCS. These collaborations are pivotal, embedding Cembra's financial solutions directly into the customer experience at the point of sale.

This extensive network significantly amplifies Cembra's market penetration, offering its credit card products to a vast customer base already engaged in purchasing decisions. For instance, in 2023, Cembra reported a substantial growth in its credit card portfolio, a testament to the effectiveness of these partner-driven distribution channels.

Independent Intermediaries and Agents

Cembra Money Bank effectively leverages independent intermediaries and a network of around 200 agents to distribute its financial products, notably personal loans. This strategic approach significantly broadens the bank's market penetration across Switzerland.

These intermediaries are vital for reaching a diverse customer base, providing tailored advice and personalized service that builds trust and facilitates access to Cembra's offerings. Their local presence and established relationships are key to expanding the bank's footprint.

- Distribution Channels: Utilizes a network of independent intermediaries and approximately 200 agents for product distribution.

- Market Reach: Extends Cembra's presence to a wider customer base throughout Switzerland.

- Customer Engagement: Intermediaries provide personalized service and expert advice, enhancing customer experience.

- Sales Growth: This network is instrumental in driving sales volume for key products like personal loans.

Car Dealers

Cembra Money Bank leverages a robust network of approximately 3,200 car dealers throughout Switzerland to distribute its auto loans and leasing products. This extensive reach places Cembra's financing solutions directly at the point of purchase, making them readily accessible to consumers actively seeking vehicle financing.

These dealers serve as crucial intermediaries, integrating Cembra's offerings into their sales process. This strategy is further bolstered by Cembra's dedicated sales force and service centers, ensuring dealers have the necessary support to effectively present and facilitate financing options.

- Distribution Network: Approximately 3,200 car dealers across Switzerland.

- Role of Dealers: Act as intermediaries for auto loans and leasing.

- Sales Support: Facilitated by a dedicated sales force and service centers.

- Point-of-Sale Integration: Financing solutions offered directly where vehicles are sold.

Cembra Money Bank's "Place" strategy encompasses a multi-channel approach, blending physical branches with a strong digital presence and strategic partnerships. This ensures accessibility and convenience for a broad customer base across Switzerland.

The bank operates around 25 branches for face-to-face service, while its digital platforms, including the Cembra app, are central to its strategy, handling over 80% of customer interactions as of 2023. This digital focus is complemented by extensive partnerships with retailers and approximately 3,200 car dealers, embedding financial services directly at the point of sale and significantly expanding market reach.

| Distribution Channel | Key Products | Reach/Volume (as of 2023/2024 data) |

|---|---|---|

| Physical Branches | All products | ~25 locations across Switzerland |

| Digital Channels (Website, App) | All products, focus on self-service | >80% of customer interactions |

| Retail Partnerships (e.g., IKEA, SPAR) | Credit Cards | Integral to point-of-sale financing |

| Independent Intermediaries/Agents | Personal Loans | ~200 agents, broad market penetration |

| Car Dealerships | Auto Loans, Leasing | ~3,200 dealers, point-of-sale integration |

What You See Is What You Get

Cembra Money Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cembra Money Bank 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain immediate access to this ready-to-use analysis upon completion of your order.

Promotion

Cembra is heavily invested in digitalization, aiming to boost customer value and internal efficiency. This strategic push includes continuous improvements to their mobile app, which saw over 10 new features rolled out in 2024 alone. The goal is to transform the app into an indispensable daily tool and a comprehensive hub for all customer interactions.

Cembra Money Bank's strategic transformation, launched in late 2021, is a key element of its marketing mix, focusing on operational simplification and digitalization. This initiative is designed to boost efficiency and customer satisfaction through enhanced automation.

By H1 2025, the bank reported significant progress, with a stated goal of achieving an efficiency ratio improvement. This ongoing transformation is consistently communicated to stakeholders, highlighting the bank's commitment to modernization and improved performance metrics.

Cembra Money Bank prioritizes robust public relations and investor communications as a key element of its marketing mix. The bank regularly disseminates information through press releases and detailed investor presentations, especially when announcing its annual and half-year financial results.

This proactive approach ensures that the market and its stakeholders are consistently updated on Cembra's financial health and strategic direction. For instance, the bank reported an 8% increase in net income for 2024 and maintains a positive outlook for 2025, underscoring its commitment to transparent communication.

Partnerships and Co-Branding

Cembra Money Bank actively promotes its brand through strategic partnerships and co-branding, especially within its credit card offerings. These collaborations are key to expanding its proprietary card portfolio and reaching new customer segments.

By teaming up with prominent retailers, Cembra Money Bank gains significant exposure and leverages the established customer bases of its partners. This symbiotic relationship enhances brand visibility and drives customer acquisition, as seen in their ongoing efforts to broaden their co-branded card presence in the Swiss market.

- Co-branding initiatives with major retailers like Coop and Manor are central to Cembra's promotional strategy.

- These partnerships allow Cembra to tap into the extensive customer networks of its retail partners, driving new credit card acquisitions.

- In 2023, Cembra reported a robust performance in its credit card segment, with a significant portion of its new customer growth attributed to these strategic alliances.

Customer-First Mindset and Service Optimization

Cembra Money Bank places a strong emphasis on a customer-first approach, continuously refining its services to enhance user experience and address evolving customer needs. This commitment is evident in their drive to shorten processing times and implement automated solutions, aiming for greater efficiency and convenience.

By focusing on personalized support and streamlined processes, Cembra fosters positive word-of-mouth referrals and cultivates lasting customer loyalty. For instance, a key initiative in 2024 involved a 15% reduction in average loan application processing time through enhanced digital tools.

- Customer-Centricity: Prioritizing customer needs in all service development and delivery.

- Service Optimization: Implementing automation and process improvements to enhance efficiency.

- User Experience Focus: Aiming for seamless and personalized interactions across all touchpoints.

- Loyalty Building: Driving positive word-of-mouth and repeat business through excellent service.

Cembra Money Bank leverages strategic partnerships, particularly co-branding with major retailers like Coop and Manor, as a cornerstone of its promotional efforts. These collaborations are crucial for expanding its proprietary credit card portfolio and accessing new customer segments. In 2023, these alliances significantly contributed to new customer growth in the credit card segment, underscoring their effectiveness in driving acquisitions and brand visibility.

Price

Cembra Money Bank actively uses competitive pricing, especially for personal loans where competition is fierce. They aim to offer attractive interest rates to draw in customers while ensuring their pricing remains profitable, reflecting the value customers perceive in their financial products.

In 2024, the Swiss personal loan market saw average interest rates ranging from 5% to 12%, depending on creditworthiness and loan terms. Cembra's strategy involves positioning its rates within or slightly below this range for competitive segments, aiming for a market share growth of 2-3% in this segment by the end of 2025.

Cembra Money Bank actively manages its net interest margin by strategically repricing new business. This focus on repricing measures proved successful in 2024, leading to a notable 15% boost in interest income and a healthier net interest margin.

Looking ahead, a key repricing adjustment occurred in January 2025 with the reduction of the maximum interest rate in consumer finance. While this move impacted overall interest income, the bank effectively offset this by achieving a reduction in its interest expenses.

Cembra Money Bank derives substantial revenue from fee and commission income, particularly through its credit card operations. This income is closely tied to transaction volumes and the uptake of value-added services, forming a key component of their payment solution pricing. For instance, in the first quarter of 2024, Cembra reported a notable contribution from fee and commission income, reflecting the ongoing strength and usage of its credit card portfolio.

Discounts and Promotional Offers

Cembra Money Bank leverages promotional offers and loyalty programs as key pricing tactics. While specific discount percentages aren't always public, the consumer credit landscape commonly features incentives like cashback and loyalty points. These effectively lower the net cost for customers, acting as a significant draw for new business and customer retention.

These pricing strategies are crucial in the competitive Swiss financial market. For instance, in 2024, many credit card providers have been observed offering introductory interest rates as low as 0% for a limited period to attract new cardholders. Loyalty programs, such as those offering accelerated points on specific spending categories or travel benefits, also serve as a form of discount by enhancing the overall value proposition.

- Cashback Programs: Offering a percentage of spending back to the customer, directly reducing out-of-pocket costs.

- Loyalty Points: Accumulating points redeemable for goods, services, or travel, thereby increasing the perceived value of using Cembra's products.

- Introductory Offers: Temporary reduced interest rates or waived fees to incentivize initial adoption of credit products.

- Partnerships: Collaborations with retailers or service providers to offer exclusive discounts to Cembra cardholders.

Financing Options and Credit Terms

Cembra Money Bank offers a diverse suite of financing options and credit terms designed to meet the varied needs of its customer base. These cater to specific product lines, including personal loans, auto leases, and crucial invoice financing for businesses. This adaptability ensures broad market appeal and supports different stages of customer financial journeys.

The bank emphasizes flexibility, particularly with its Buy Now Pay Later (BNPL) services, providing customers with adaptable payment schedules. Furthermore, Cembra attracts savers and depositors with competitive interest rates, enhancing the accessibility and overall attractiveness of its financial products. As of the first half of 2024, Cembra reported a net interest income of CHF 248.7 million, reflecting the ongoing demand for its credit and deposit offerings.

- Personal Loans: Offering tailored solutions for individual financial needs.

- Auto Leases: Facilitating vehicle acquisition with structured payment plans.

- Invoice Financing: Supporting business cash flow through receivable management.

- BNPL Services: Providing flexible payment options for consumer purchases.

Cembra's pricing strategy in 2024 and 2025 focuses on competitive rates for personal loans, aiming for market share growth, while also leveraging fee income from credit card services. The bank actively reprices new business to manage its net interest margin, which saw a 15% boost in interest income in 2024, and has adjusted rates in early 2025 to manage expenses.

| Pricing Tactic | Description | 2024/2025 Impact/Observation |

| Competitive Interest Rates | Offering attractive rates, often within or below market averages for personal loans. | Aimed for 2-3% market share growth in personal loans by end of 2025. Swiss personal loan rates averaged 5%-12% in 2024. |

| Fee & Commission Income | Revenue generated from credit card operations and value-added services. | Significant contributor to revenue; Q1 2024 saw strong credit card portfolio usage. |

| Promotional Offers & Loyalty | Incentives like cashback, loyalty points, and introductory low rates. | Commonly used to attract new business; 0% introductory rates observed in the market in 2024. |

| Net Interest Margin Management | Strategic repricing of new business and managing interest expenses. | 15% boost in interest income in 2024; offset early 2025 rate reductions by lowering interest expenses. |

4P's Marketing Mix Analysis Data Sources

Our Cembra Money Bank 4P's Marketing Mix Analysis is meticulously constructed using a combination of official company disclosures, including annual reports and investor presentations, alongside market research reports and competitive intelligence. This approach ensures a comprehensive understanding of Cembra's product offerings, pricing strategies, distribution channels, and promotional activities.