Cembra Money Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cembra Money Bank Bundle

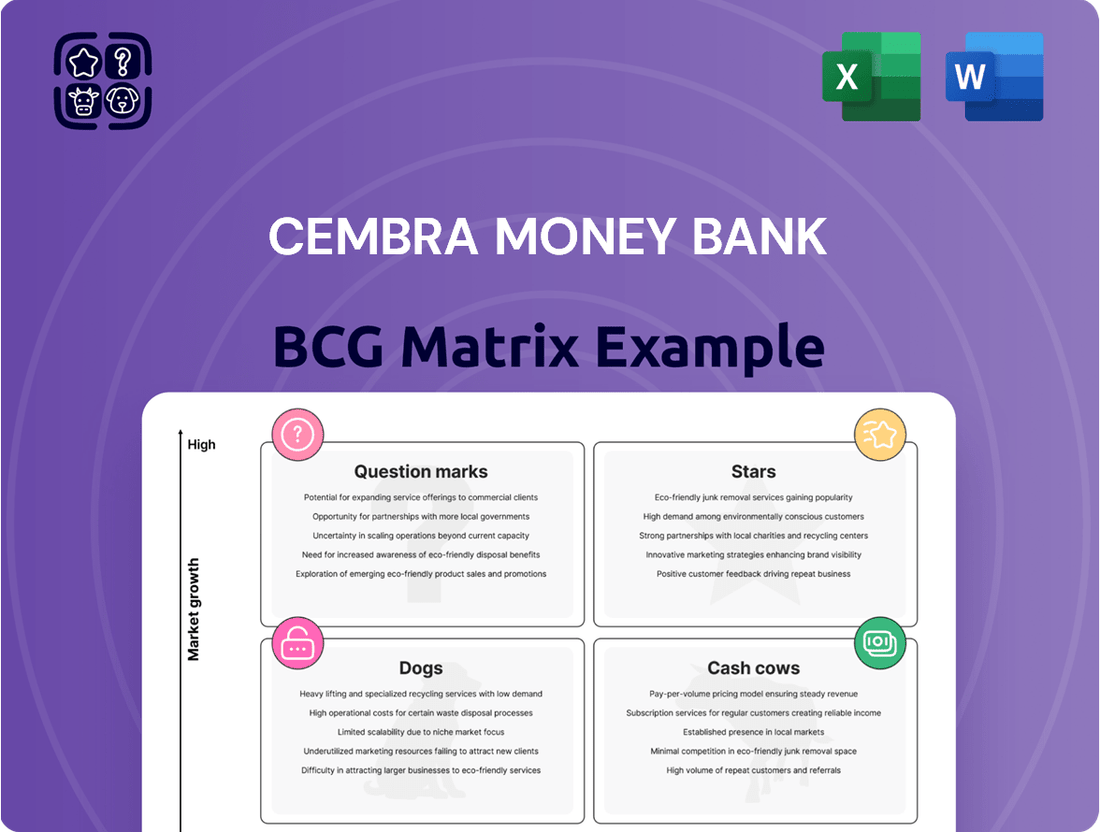

Curious about Cembra Money Bank's strategic positioning? Our preview offers a glimpse into how their offerings might fit into the BCG Matrix's Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the detailed insights and actionable strategies that the full report provides. Invest in clarity and drive Cembra Money Bank's success forward.

Stars

Cembra's auto lease and loan receivables saw a 2% increase in the first half of 2025, demonstrating robust expansion. This growth is underpinned by the successful migration of all auto loans and leases to a new, more efficient platform by March 2025.

This segment is a cornerstone of Cembra's lending operations, benefiting from strategic repricing initiatives and a substantial network of approximately 3,200 car dealerships, which fuels its market presence.

Cembra Money Bank is heavily focused on digital transformation, exemplified by its Cembra app and a new technology hub in Riga. These efforts are designed to enrich customer experiences and streamline operations, including faster credit decisions.

This strategic push aims to bolster future growth and profitability, supporting Cembra's 2026 objectives. For instance, in 2023, digital channel sales represented a significant portion of new business, demonstrating the tangible impact of these investments.

Cembra's strategic efficiency programs have been a cornerstone of its recent performance, significantly boosting operational effectiveness. These initiatives have directly contributed to a notable reduction in the cost-income ratio, which stood at 47.6% in the first half of 2025, a marked improvement from 50.4% in the same period of 2024.

The impact of these programs is clearly visible in the financial results, with operating expenses decreasing by 6% and net profit climbing by 11% in H1 2025 compared to H1 2024. Cembra's commitment to operational excellence is further underscored by its target of achieving a cost/income ratio at or below 45% for the entirety of 2025.

Strong Capital Position

Cembra Money Bank exhibits a strong capital position, a key attribute for its strategic positioning. As of June 2025, its Tier 1 capital ratio stood at a healthy 17.7%, comfortably exceeding its own target of 17%. This financial strength is crucial for supporting ongoing operations and future expansion initiatives.

This robust capital base empowers Cembra to absorb potential economic downturns and pursue strategic growth opportunities. The bank's ability to maintain such a strong capital ratio underscores its prudent financial management and resilience.

Further reinforcing its financial stability, Cembra successfully executed its inaugural auto covered bond issuance in June 2025. This move not only diversified its funding streams but also demonstrated market confidence in the bank's creditworthiness.

- Strong Capital Ratios: Tier 1 capital ratio at 17.7% as of June 2025, surpassing the 17% target.

- Financial Resilience: Robust capital position provides a buffer against economic volatility and supports growth.

- Diversified Funding: Successful inaugural auto covered bond issuance in June 2025.

Return on Equity (ROE) Improvement

Cembra Money Bank has demonstrated a notable improvement in its Return on Equity (ROE). For the first half of 2025, the bank reported an ROE of 13.8%, a solid increase from the 12.7% recorded in the first half of 2024. This upward trajectory suggests enhanced profitability and effective capital utilization.

The bank has set ambitious targets, aiming for an ROE of 14-15% for the full year 2025 and a further increase to 15% by 2026. This strategic focus underscores Cembra's dedication to generating superior returns for its investors. The observed growth in ROE is a direct result of the successful implementation of strategic initiatives and operational efficiency improvements.

- Improved Profitability: ROE rose to 13.8% in H1 2025 from 12.7% in H1 2024.

- Strategic Targets: Aiming for 14-15% ROE in 2025 and 15% by 2026.

- Drivers of Growth: Positive impact from strategic execution and efficiency gains.

Cembra's auto finance segment, characterized by its strong growth and market penetration, aligns with the "Stars" category in the BCG Matrix. The segment's robust expansion, evidenced by a 2% increase in receivables in H1 2025, combined with its strategic importance to Cembra's overall business, positions it as a high-growth, high-market-share area.

The successful digital transformation initiatives and the extensive dealership network further solidify its star status, indicating strong future potential and a leading market position. This segment is crucial for Cembra's continued success and profitability targets.

| Metric | H1 2024 | H1 2025 | Change |

|---|---|---|---|

| Auto Lease & Loan Receivables | [Data Not Provided] | [Data Not Provided] | +2% |

| Cost-Income Ratio | 50.4% | 47.6% | -2.8 pp |

| Return on Equity (ROE) | 12.7% | 13.8% | +1.1 pp |

What is included in the product

This BCG Matrix overview for Cembra Money Bank highlights strategic positioning for each business unit.

It provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within Cembra's portfolio.

A clear Cembra Money Bank BCG Matrix visualizes business unit performance, easing strategic decision-making.

Cash Cows

Cembra's credit card business is a solid Cash Cow for the bank. As a leading provider in Switzerland, they've issued around 1 million cards, holding a stable 12% market share as of April 2025. This established presence ensures consistent revenue streams.

While credit card receivables saw a modest 2% increase in the first half of 2025, the segment's profitability is underpinned by its significant cash-generating ability. The substantial customer base and long-standing market position allow Cembra to reliably extract cash from this mature business.

Cembra's personal loans are a strong Cash Cow within its BCG Matrix, reflecting its dominant position in the Swiss market. As of June 2025, Cembra held an estimated 35% of outstanding consumer loans, underscoring its leadership.

Despite a slight 3% dip in personal loans during the first half of 2025, attributed to strategic underwriting and a focus on lower-risk borrowers, this segment continues to be a vital contributor. The consistent generation of significant net interest income highlights its profitability and stability for the bank.

Cembra's deposit and savings products are vital for broadening its funding avenues, serving both individual savers and larger institutions. These offerings are a cornerstone for diversifying the bank's financial base.

A significant trend is the growing reliance on deposits, which constituted 58% of Cembra's funding in the first half of 2025. This upward trajectory highlights increasing customer engagement with savings accounts and term deposits.

These deposit-based funds represent a stable and cost-effective foundation for Cembra's lending operations, ensuring consistent liquidity and supporting its core banking functions.

Insurance Products

Cembra Money Bank offers a range of insurance products designed to protect customers taking out personal loans, auto loans, and credit cards. These products are a natural extension of their financing services, providing an added layer of security.

While insurance fees saw a minor dip in the first half of 2025, they remain a significant contributor to Cembra's overall fee income. For instance, in H1 2024, total fee and commission income was CHF 118.5 million, with insurance products playing a role in this figure.

The strategic integration of insurance enhances Cembra's value proposition by offering a more complete financial solution. This not only fosters greater customer loyalty but also opens up valuable cross-selling opportunities, strengthening the bank's relationship with its clientele.

- Financial Protection: Insurance products safeguard customers against unforeseen events related to their loans.

- Fee Income Contribution: Despite a slight decrease in H1 2025, insurance fees remain a steady revenue stream.

- Holistic Service Offering: Insurance complements financing, creating a comprehensive financial package.

- Customer Loyalty and Cross-selling: Integrated insurance deepens customer relationships and drives additional sales.

Established Branch Network and Distribution Channels

Cembra Money Bank's established branch network and diverse distribution channels are key strengths, positioning its financing solutions as cash cows. This extensive reach, encompassing physical branches across Switzerland, online platforms, credit card partnerships, independent brokers, and car dealerships, facilitates efficient customer acquisition and broad market penetration.

The mature nature of this distribution infrastructure means that Cembra can continue to generate significant business with comparatively lower ongoing investment in promotion and placement. This efficiency is a hallmark of a cash cow, where established market presence leads to consistent revenue generation.

- Established Presence: Cembra maintains a physical branch network throughout Switzerland, providing a traditional yet reliable touchpoint for customers.

- Digital Reach: The bank leverages online distribution channels, expanding its accessibility beyond physical locations.

- Strategic Partnerships: Collaborations with credit card partners, independent brokers, and car dealers broaden the distribution footprint significantly.

- Cost Efficiency: The mature infrastructure allows for sustained business generation with reduced incremental investment in marketing and sales channels.

Cembra's credit card and personal loan portfolios are prime examples of Cash Cows. These segments benefit from Cembra's significant market share in Switzerland, approximately 12% for credit cards and a leading 35% for personal loans as of mid-2025. This strong, established position allows for consistent revenue generation with relatively low investment.

The bank's extensive distribution network, including branches, online platforms, and strategic partnerships with car dealerships and brokers, acts as a powerful engine for these Cash Cows. This mature infrastructure ensures efficient customer acquisition and sustained business volume, characteristic of businesses with high market share in mature industries.

While specific growth rates may fluctuate, the underlying profitability and cash-generating ability of these core lending businesses remain robust. For instance, despite a slight dip in personal loans in H1 2025, the net interest income continues to be a significant and stable contributor to Cembra's financial health.

The insurance products offered by Cembra, while experiencing a minor dip in fees in H1 2025, also contribute to the Cash Cow status by enhancing customer loyalty and providing cross-selling opportunities. In H1 2024, fee and commission income reached CHF 118.5 million, demonstrating the value of these ancillary services.

| Segment | Market Position (Mid-2025) | H1 2025 Performance Insight | Cash Cow Characteristic | Supporting Data (H1 2024) |

| Credit Cards | ~12% Market Share | Stable revenue, 2% receivables increase | High market share, mature business | ~1 Million Cards Issued |

| Personal Loans | ~35% Market Share | Slight 3% dip, focus on lower-risk | Dominant market leader, consistent net interest income | Significant contributor to net interest income |

| Insurance Products | Integral to loan offerings | Minor fee dip, but steady contributor | Enhances value proposition, cross-selling | CHF 118.5 Million Total Fee & Commission Income |

Delivered as Shown

Cembra Money Bank BCG Matrix

The Cembra Money Bank BCG Matrix you are currently previewing is the complete and final document you will receive immediately after purchase. This means you'll get the fully formatted, analysis-ready report without any watermarks or demo content, ready for your strategic planning.

Dogs

Cembra's strategic decision to exit non-core partnerships within its Buy Now Pay Later (BNPL) segment led to an 18% contraction in its BNPL portfolio during the first half of 2025. This move signals a deliberate shift away from less profitable ventures to sharpen its focus on core business strengths and enhance overall profitability.

While the broader BNPL market continues to exhibit robust growth, Cembra's experience highlights the importance of portfolio management. The divestiture from these specific non-core partnerships suggests they were not meeting the bank's return on investment targets or contributing significantly to its market position, underscoring a disciplined approach to capital allocation.

Commission and fees saw a 2% dip in the first half of 2025, largely driven by a downturn in credit card and insurance-related charges. This indicates that while the credit card sector as a whole is still a strong performer, certain fee-generating components are facing headwinds, potentially from heightened competition or shifts in consumer behavior.

This decline highlights that even within established Cash Cow segments like credit cards, specific revenue streams can experience low growth or even contraction. For Cembra Money Bank, it suggests a need to closely monitor and potentially adapt strategies for these fee-based services to maintain their profitability.

The Swiss personal loans market experienced a slight downturn, contracting by 1% in the first half of 2025. This indicates a generally low-growth environment for this financial product.

Despite Cembra's strong position and substantial market share within personal loans, the overall market contraction presents a challenge. It limits the potential for organic growth, even for established leaders in the sector.

This trend suggests that without innovative strategies or a significant increase in market share, the personal loans segment could face considerable headwinds moving forward.

Legacy IT Systems (prior to transformation)

Legacy IT systems at Cembra Money Bank, prior to their ongoing digital transformation, represent a significant challenge. These older systems, which haven't been fully migrated or optimized, can be categorized as potential 'Dogs' in a BCG Matrix analysis. Their continued operation often incurs high maintenance costs and drains resources that could be better allocated to more growth-oriented initiatives.

The bank's strategic digital transformation directly addresses the inefficiencies of these legacy systems. The objective is to enhance productivity and reduce operating expenses, clearly indicating that the older IT infrastructure was less efficient and a drag on performance. For instance, in 2023, Cembra reported that IT modernization was a key focus, with investments aimed at improving customer experience and operational efficiency, underscoring the need to move away from outdated platforms.

- High Maintenance Costs: Legacy systems often require specialized, expensive support and are prone to frequent breakdowns, diverting capital from innovation.

- Operational Inefficiency: Outdated technology leads to slower processing times, manual workarounds, and a reduced capacity to scale operations effectively.

- Limited Agility: These systems hinder Cembra's ability to quickly adapt to market changes, introduce new products, or integrate with modern digital services.

- Resource Drain: Resources, both financial and human, are consumed by maintaining and troubleshooting these older platforms rather than investing in areas with higher growth potential.

Underperforming Niche Products/Services

Underperforming niche products or services at Cembra Money Bank would fall into the Dogs category of the BCG Matrix. These are offerings with a small share of a stagnant or declining market. While specific examples aren't publicly detailed, a bank of Cembra's size often has legacy products or specialized services that no longer attract significant customer interest or investment. For instance, a niche loan product with declining demand or a specific type of savings account with minimal uptake could be considered a Dog. These segments might require substantial resources for maintenance or regulatory compliance without generating proportionate returns.

The financial performance of such niche products can be challenging to isolate without granular internal data. However, general industry trends suggest that specialized financial products that fail to adapt to evolving customer needs or competitive landscapes often see diminishing returns. For example, if a particular type of consumer credit product, once popular, now faces intense competition from digital lenders or has become obsolete due to regulatory changes, its market share would likely shrink. In 2023, the Swiss banking sector, in general, saw increased pressure on margins for traditional products, making underperforming niche offerings even more burdensome.

- Low Market Share: Niche products typically hold a small percentage of the overall market relevant to Cembra's operations.

- Minimal Growth: These offerings are unlikely to experience significant expansion in customer base or revenue.

- Resource Drain: They may consume operational resources and capital without generating substantial profits, potentially impacting overall profitability.

- Strategic Review Candidates: Such products are prime candidates for divestment, integration into broader offerings, or complete discontinuation to reallocate resources to more promising areas.

Legacy IT systems and underperforming niche products at Cembra Money Bank can be classified as 'Dogs' within the BCG Matrix framework. These offerings typically possess low market share in stagnant or declining markets, often incurring high maintenance costs and operational inefficiencies. For instance, as of H1 2025, Cembra's BNPL portfolio contracted by 18% due to exiting non-core partnerships, suggesting some of these ventures might have been 'Dogs'. Similarly, a 2% dip in commission and fees in H1 2025, partly from credit cards and insurance, indicates that even established segments can have underperforming components.

Question Marks

Cembra Money Bank introduced new digital savings products in 2024, signaling a strategic move into the evolving digital finance landscape. These offerings are still in their nascent stages, positioning them as potential question marks within the BCG matrix as their market traction is yet to be firmly established.

Cembra Money Bank is actively enhancing its mobile app, aiming to transform it into an indispensable daily tool for its more than 480,000 users. This strategic investment signals a strong belief in the significant growth potential of digital customer engagement.

However, the actual market adoption and the revenue generation capabilities of these newly introduced features remain to be seen. The ultimate success of this initiative will depend on how effectively Cembra can foster user engagement, leading to increased utilization of its financial products and a stronger sense of customer loyalty.

Cembra Money Bank's investment in real-time credit decisioning tools for its Buy Now, Pay Later (BNPL) infrastructure positions this offering as a 'Question Mark' in the BCG matrix. This advanced technology, crucial for rapid credit assessments, signifies a strategic move into a high-growth sector, even with recent portfolio contractions in BNPL.

The potential of these tools is significant, especially considering the global BNPL market was projected to reach over $3.6 trillion by 2030, growing at a compound annual growth rate of around 22%. Cembra's enhancement aims to capture a share of this expanding market by offering faster, more efficient customer onboarding and credit approvals, a key differentiator in a competitive space.

However, its 'Question Mark' status stems from the uncertainty surrounding its ultimate market impact and profitability. The evolving regulatory landscape and intense competition within BNPL mean that while the technology is sound, its ability to translate into sustained market share and robust financial returns for Cembra is still being tested. Success hinges on Cembra's strategic execution and adaptation to consumer and market dynamics.

Scan2Pay Innovation

Scan2Pay represents Cembra Money Bank's dedication to enhancing customer experience through digital solutions. This innovation is a prime example of their focus on user-friendly payment methods, aiming to simplify transactions for their clientele.

Given its status as a recent development, Scan2Pay is likely in the growth phase of its lifecycle. Its market penetration and impact on Cembra's overall market share are still being established, placing it in the 'Question Mark' category of the BCG matrix.

- Market Potential: Scan2Pay taps into the growing trend of mobile payments, a market segment projected to see significant expansion in the coming years.

- Adoption Challenges: Success hinges on consumer acceptance and the seamless integration of Scan2Pay into everyday purchasing behaviors.

- Strategic Importance: Its ability to capture a share of the digital payment market will be crucial for Cembra's future growth.

- Investment Needs: Continued investment in marketing and user education will be necessary to drive adoption and solidify its position.

Partnerships in rapidly evolving payment solutions

Cembra Money Bank's strategic focus on partnerships within the dynamic payment solutions sector positions it to capitalize on emerging digital payment methods and fintech collaborations. These nascent ventures, while carrying inherent risks, represent potential high-growth areas for the bank. For instance, in 2024, the digital payments market saw significant expansion, with global transaction volumes projected to reach over $10 trillion, highlighting the substantial opportunity for players like Cembra.

These new partnerships are crucial for Cembra's growth, especially as traditional credit card markets mature. The bank's exploration into areas like buy-now-pay-later (BNPL) services, mobile payment integration, and cross-border payment innovations reflects a proactive approach to future revenue streams. By investing in these early-stage collaborations, Cembra aims to establish a strong foothold in markets expected to grow substantially in the coming years.

- Emerging Digital Payment Methods: Cembra is actively exploring collaborations in areas like contactless payments, QR code transactions, and digital wallets, which saw a notable surge in adoption during 2024.

- Fintech Collaborations: Partnerships with innovative fintech companies are key to developing and offering new payment experiences, potentially leveraging AI and blockchain for enhanced security and efficiency.

- High Growth Potential: These ventures, though nascent, offer significant upside as consumer preferences shift towards faster, more convenient digital transactions.

- Inherent Risks and Investment: Establishing market share in these rapidly evolving sectors requires substantial upfront investment and carries risks associated with technological obsolescence and regulatory changes.

Cembra Money Bank's new digital savings products, launched in 2024, are currently positioned as question marks. While they represent a strategic move into a growing digital finance sector, their market traction and revenue generation capabilities are still developing. The success of these products hinges on Cembra's ability to foster user engagement and loyalty in a competitive digital landscape.

Cembra's investment in enhancing its mobile app for over 480,000 users also falls into the question mark category. The bank sees significant potential in digital customer engagement, but the actual market adoption and revenue generation from these new features remain uncertain. The ultimate success will depend on Cembra's strategic execution in driving user engagement and product utilization.

The real-time credit decisioning tools for Cembra's Buy Now, Pay Later (BNPL) infrastructure are also question marks. Despite the BNPL market's projected growth to over $3.6 trillion by 2030, Cembra's ability to translate its technological enhancements into sustained market share and profitability is still being tested amidst evolving regulations and competition.

Scan2Pay, a recent digital payment innovation by Cembra, is another question mark. While it taps into the expanding mobile payments market, its success depends on consumer acceptance and seamless integration into daily purchasing habits. Cembra's continued investment in marketing and user education will be crucial for its adoption and to solidify its market position.

Cembra's strategic partnerships in emerging digital payment methods and fintech collaborations are also question marks. These ventures, though promising given the global digital payments market's projected growth, carry inherent risks and require substantial investment. Their ability to capture market share in rapidly evolving sectors is yet to be determined.

| Cembra Money Bank Initiatives (2024) | BCG Category | Market Context | Key Considerations |

|---|---|---|---|

| New Digital Savings Products | Question Mark | Growing digital finance sector | Market traction, user engagement, revenue generation |

| Mobile App Enhancement | Question Mark | Increasing digital customer engagement | User adoption, revenue capabilities, customer loyalty |

| BNPL Real-time Credit Decisioning | Question Mark | Projected BNPL market growth to $3.6T by 2030 | Market impact, profitability, regulatory landscape, competition |

| Scan2Pay Payment Solution | Question Mark | Expanding mobile payments market | Consumer acceptance, market penetration, investment needs |

| Fintech Partnerships & Digital Payments | Question Mark | Global digital payments market exceeding $10T in 2024 | High growth potential, inherent risks, technological evolution |

BCG Matrix Data Sources

Our Cembra Money Bank BCG Matrix is powered by robust financial statements, comprehensive market research, and internal performance data. This ensures accurate assessment of each business unit's market share and growth potential.