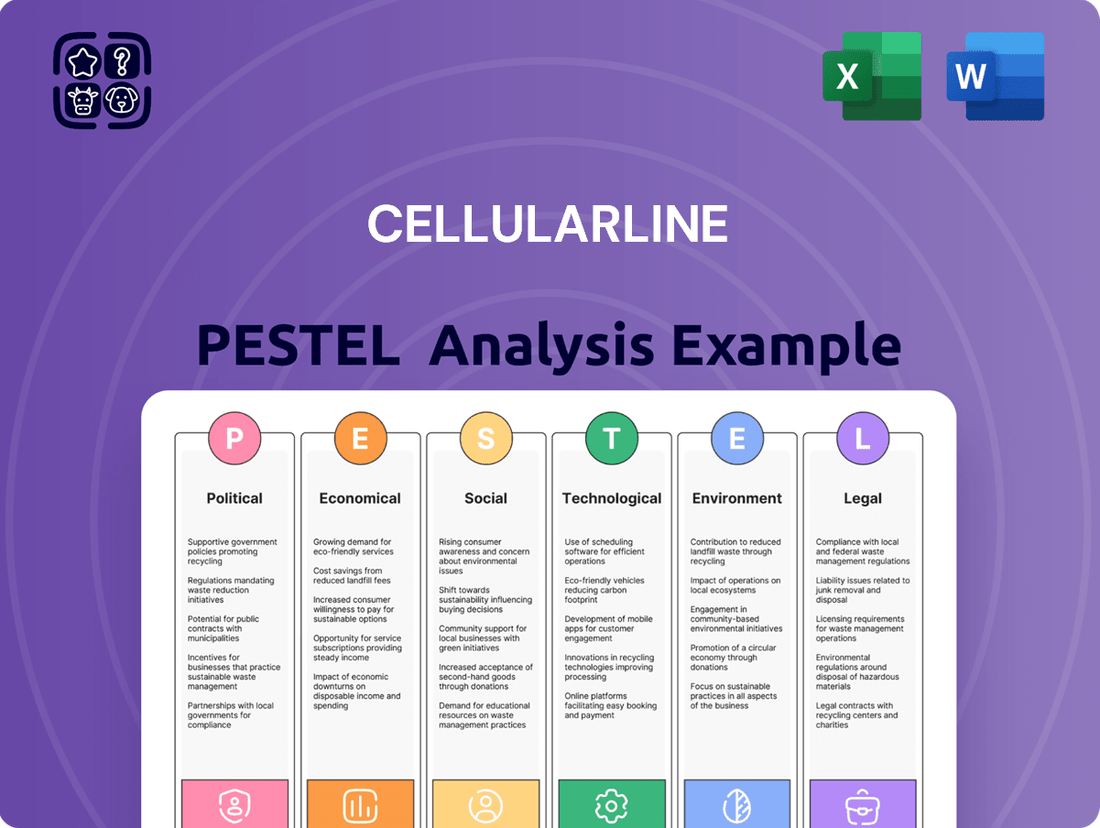

Cellularline PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cellularline Bundle

Uncover the hidden forces shaping Cellularline's market with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements create both opportunities and threats for the company. Equip yourself with actionable intelligence to refine your strategies and stay ahead of the curve. Download the full analysis now and gain a decisive competitive advantage.

Political factors

Government trade policies, including tariffs and international agreements, directly influence Cellularline's cost of goods. For instance, changes to the EU's trade relations with Asian manufacturing hubs could impact the import costs of their smartphone accessories. In 2024, ongoing discussions around digital trade agreements could also reshape how Cellularline operates across different regions.

Geopolitical stability is a significant concern for Cellularline. Disruptions in regions where they source components, like rare earth minerals from parts of Asia, or where they manufacture, such as in Vietnam or China, can severely impact their operations. For instance, escalating trade tensions or regional conflicts in 2024 could lead to increased tariffs or outright import bans, driving up costs and limiting access to essential materials.

Furthermore, the stability of Cellularline's key distribution markets, including major European economies like Italy, Germany, and France, is paramount. Political instability in these regions, evidenced by potential shifts in government policy or social unrest, could dampen consumer spending on accessories. In 2024, economic uncertainty in Europe, partly fueled by ongoing geopolitical events, has already shown a tendency to affect discretionary spending, which directly impacts sales volumes for companies like Cellularline.

The EU Digital Markets Act (DMA), which began enforcement in early 2024, is designed to foster fairer competition within digital sectors. While its primary focus is on large tech companies designated as 'gatekeepers', such as Apple and Google, its stipulations regarding interoperability and data portability could indirectly impact the mobile accessory market. This might present Cellularline with new avenues for product integration or necessitate adjustments to existing business models to comply with evolving platform rules.

National Manufacturing Incentives

Government initiatives aimed at bolstering domestic manufacturing and reducing foreign supply chain dependence can significantly impact Cellularline's operational blueprint. These policies might steer the company towards diversifying its production bases or allocating capital towards establishing or expanding its own manufacturing facilities. For instance, Italy, Cellularline's home country, has seen various programs designed to support industrial reshoring. As of early 2024, the Italian government continued to explore tax credits and grants for companies investing in advanced manufacturing technologies and local production, potentially offering Cellularline avenues to optimize its cost structure and supply chain resilience.

These national manufacturing incentives can directly influence Cellularline's strategic decisions regarding where and how its products are made.

- Reshoring Support: Policies offering tax breaks or subsidies for bringing manufacturing back to Italy or other EU countries could make domestic production more economically viable for Cellularline.

- Supply Chain Diversification: Incentives might encourage the company to invest in manufacturing capabilities in regions less prone to geopolitical disruptions, enhancing overall supply chain stability.

- Technological Investment: Government funding for adopting advanced manufacturing technologies, such as automation and AI, could boost Cellularline's production efficiency and product quality.

Consumer Protection Regulations

Political emphasis on consumer rights, product safety, and data protection significantly shapes the operating environment for companies like Cellularline. In 2024, for instance, the European Union continued to refine its General Data Protection Regulation (GDPR) enforcement, with significant fines levied against companies for data breaches. This trend underscores the critical need for robust data handling practices.

Cellularline must proactively ensure its products and data management systems adhere to these evolving national and international standards. Failure to comply can result in substantial penalties and, more importantly, damage consumer trust, a vital asset in the competitive accessories market. For example, the EU's Digital Services Act, which came into full effect in early 2024, places new obligations on online platforms regarding content moderation and user data, impacting how companies like Cellularline interact with consumers online.

- Stricter Data Privacy Laws: Continued enforcement of regulations like GDPR and emerging data protection laws globally necessitate rigorous compliance in data collection and usage.

- Product Safety Standards: Governments worldwide are increasingly scrutinizing product safety, particularly for electronics and accessories, requiring adherence to certifications and quality controls.

- Consumer Rights Legislation: Laws protecting consumers from unfair trade practices and ensuring product warranties and repairability can impact product design and after-sales service strategies.

- Evolving E-commerce Regulations: Online sales are subject to specific consumer protection rules, including clear pricing, return policies, and transparent product information.

Government regulations on e-commerce and digital services, such as the EU's Digital Services Act implemented in early 2024, impose new obligations on how Cellularline markets and sells its products online. These rules aim to ensure fair competition and user protection, potentially influencing advertising practices and customer interaction platforms.

Trade policies and geopolitical stability continue to be key political factors for Cellularline. For instance, the EU's ongoing trade negotiations and potential tariffs on goods from Asian manufacturing hubs, a critical sourcing region, could significantly impact import costs throughout 2024 and 2025. Similarly, political instability in component sourcing regions could disrupt supply chains.

Government initiatives promoting reshoring and domestic manufacturing, like Italy's tax credits for advanced manufacturing as of early 2024, could encourage Cellularline to explore local production. This might lead to greater supply chain resilience and potentially optimize operational costs in the face of global uncertainties.

What is included in the product

This Cellularline PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive overview of the external landscape.

It offers actionable insights into how these macro-environmental factors create both challenges and strategic advantages for Cellularline, aiding in informed decision-making.

Provides a clear, actionable summary of external factors impacting Cellularline, facilitating strategic decision-making and mitigating the pain of navigating complex market dynamics.

Economic factors

The global mobile accessories market is a significant growth area, with projections indicating it will reach $273.07 billion by 2025, growing at a compound annual growth rate (CAGR) of 8.0%. This strong upward trend is expected to continue, with the market further expanding to $352.3 billion by 2029.

This substantial market expansion creates a favorable backdrop for companies like Cellularline, offering ample opportunities for continued revenue generation and market share capture within the broader mobile accessories sector.

Fluctuations in consumer disposable income significantly influence the demand for non-essential items such as mobile accessories, particularly those in the premium segment. For instance, if consumers have less discretionary cash, they might postpone purchasing a new phone case or wireless earbuds, opting instead to make do with their current ones.

Economic downturns or increases in the cost of living can compel consumers to prioritize essential needs like housing and food over accessory upgrades, directly impacting sales volumes for companies like Cellularline. In 2024, many economies are experiencing persistent inflation, which erodes purchasing power. For example, in the Eurozone, inflation remained a concern throughout early 2024, meaning a larger portion of disposable income was allocated to everyday necessities, leaving less for discretionary spending on gadgets and accessories.

Rising inflation and the increasing cost of essential raw materials like plastics, metals, and electronic components present a significant challenge for Cellularline. These escalating expenses directly impact the company's ability to maintain healthy profit margins. For instance, the price of key plastics used in phone cases saw an average increase of 15-20% globally in early 2024 compared to the previous year, impacting production costs.

To navigate these pressures, Cellularline must implement robust supply chain management strategies. This includes exploring alternative suppliers, negotiating better long-term contracts, and optimizing inventory levels to reduce holding costs. Furthermore, a carefully considered pricing strategy is crucial, potentially involving slight price adjustments or focusing on higher-margin product lines to offset the increased input costs without alienating customers.

E-commerce Expansion

The ongoing expansion of e-commerce presents a significant opportunity. In 2023, online sales represented a substantial 35.5% of all consumer purchases, a figure projected to climb even higher. E-commerce platforms are consistently proving to be the most rapid growth avenue for sales.

Cellularline's robust online distribution network is therefore vital for leveraging this expanding digital marketplace. This online presence allows the company to effectively tap into a wider and more diverse customer demographic.

- E-commerce Growth: Online sales captured 35.5% of consumer spending in 2023.

- Fastest Growing Channel: E-commerce platforms are identified as the primary driver of sales expansion.

- Cellularline's Advantage: Strong online distribution is key to capitalizing on this trend.

- Broader Reach: Online channels enable access to a larger and more geographically dispersed consumer base.

Currency Exchange Rates

Currency exchange rate fluctuations present a significant challenge for Cellularline, a company with a global footprint across various brands and distribution channels. Unfavorable movements can directly affect the cost of sourcing components and finished goods from international suppliers, impacting profit margins. For instance, if the Euro weakens against the US Dollar, Cellularline's costs for US-based components would rise.

Conversely, revenues generated from sales in foreign markets can be diminished when repatriated into the company's reporting currency. A strong Euro, for example, could reduce the value of sales made in countries with weaker currencies. In 2024, major currency pairs like EUR/USD saw volatility, with the Euro trading within a range that could have impacted international earnings for companies like Cellularline.

To mitigate these risks, Cellularline likely employs sophisticated hedging strategies. These might include forward contracts or options to lock in exchange rates for future transactions, ensuring greater predictability in its financial results. Effective currency risk management is crucial for maintaining competitive pricing and stable profitability in a globalized market.

- Impact on Costs: A weaker Euro against currencies like the Chinese Yuan (where many electronics are manufactured) increases the cost of imported goods for Cellularline.

- Revenue Translation: Stronger performance in markets like the UK or Switzerland could be negatively impacted if the Pound Sterling or Swiss Franc depreciates against the Euro.

- Hedging Necessity: In 2024, with ongoing geopolitical uncertainties and varied economic performance across regions, robust currency hedging became even more critical for companies with significant international sales and sourcing.

Economic factors significantly shape Cellularline's operational landscape, with consumer disposable income directly influencing demand for its accessories. Persistent inflation in 2024, particularly in regions like the Eurozone, has reduced purchasing power, forcing consumers to prioritize essential spending over discretionary items. This economic pressure means that sales volumes for products like premium phone cases or wireless earbuds could be impacted as consumers delay non-essential upgrades.

Rising raw material costs, such as plastics and electronic components, also present a substantial challenge, directly affecting Cellularline's production expenses and profit margins. For instance, global plastic prices saw an average increase of 15-20% in early 2024, squeezing profitability. Furthermore, currency exchange rate volatility, as seen in major pairs like EUR/USD throughout 2024, introduces complexity for global sourcing and revenue repatriation, necessitating robust hedging strategies to maintain financial stability.

| Economic Factor | Impact on Cellularline | 2024/2025 Data/Trend |

| Consumer Disposable Income | Directly affects demand for non-essential accessories. Lower income means reduced spending on upgrades. | Inflationary pressures in 2024 eroded purchasing power in key markets like the Eurozone. |

| Raw Material Costs | Increases production costs, potentially squeezing profit margins. | Global plastic prices increased by an average of 15-20% in early 2024 compared to the previous year. |

| Currency Exchange Rates | Affects cost of imported goods and value of foreign earnings. | EUR/USD volatility in 2024 created risks for international sourcing and revenue repatriation. |

Preview the Actual Deliverable

Cellularline PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cellularline PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to this detailed PESTLE analysis of Cellularline upon completing your purchase.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to offer actionable insights for strategic decision-making regarding Cellularline.

Sociological factors

Consumers, particularly younger generations, increasingly see phone cases and accessories as extensions of their personal style, fueling a strong desire for personalized and unique products. This trend highlights a shift towards accessories as a key avenue for self-expression.

Cellularline's innovative 'Coverlab' project, which integrates artificial intelligence into the accessory customization process, directly taps into this burgeoning consumer demand. This initiative allows for on-demand, personalized designs, making it easier for customers to create one-of-a-kind items.

The market for personalized goods is expanding rapidly. For instance, the global custom T-shirt printing market, a related sector, was valued at over USD 3.0 billion in 2023 and is projected to grow significantly, indicating a broader consumer appetite for bespoke products that extends to mobile accessories.

The relentless rise in smartphone ownership, with 78% of the world's population holding a mobile device in 2023, directly fuels the market for mobile accessories. This trend ensures a consistent need for products like protective cases, chargers, and audio gear.

Consumers are increasingly prioritizing sustainability, with a significant portion of individuals willing to pay more for eco-friendly products. For instance, a 2024 survey indicated that over 60% of consumers consider environmental impact when making purchasing decisions for electronics accessories. This trend directly impacts brands like Cellularline, pushing them to adopt greener manufacturing processes and materials.

The demand for accessories made from recycled plastics and biodegradable materials is on the rise. In 2025, the global market for sustainable electronics accessories is projected to reach $15 billion, demonstrating a clear consumer shift. Cellularline's commitment to using recycled materials in its product lines, such as its line of phone cases made from recycled ocean plastic, directly addresses this growing eco-conscious consumerism.

Influence of Digital Lifestyles

The widespread adoption of digital lifestyles significantly shapes consumer needs for mobile accessories. People now depend heavily on their smartphones for everything from entertainment and work to staying connected, fueling a demand for accessories that enhance these experiences. For instance, the increasing consumption of high-bandwidth digital content, supported by expanding 5G networks, necessitates accessories that can keep up with performance demands.

This trend directly translates into a higher demand for advanced mobile accessories. Consumers are actively seeking out products that offer superior functionality and durability to support their always-on digital lives. This includes a growing market for:

- High-performance audio solutions, such as noise-canceling headphones and earbuds, to enhance entertainment and productivity on the go.

- Fast and reliable charging accessories, including power banks and multi-port chargers, to ensure devices remain powered throughout the day.

- Protective gear like rugged cases and screen protectors that safeguard valuable devices against daily wear and tear.

Globally, the mobile accessories market is projected to reach approximately $250 billion by 2027, with a compound annual growth rate of around 7.5%, according to recent market analyses. This growth is largely attributed to the increasing penetration of smartphones and the evolving digital habits of consumers worldwide.

Shift to Multi-Functionality

Consumers are increasingly seeking versatility in their tech accessories, valuing items that serve multiple purposes. This shift is evident in the growing demand for products like phone cases with integrated stands or card holders, and charging stations that can power several devices at once. For instance, the global market for smartphone accessories, which includes multi-functional items, was projected to reach over $100 billion by 2024, highlighting this consumer preference for efficiency.

This trend reflects a broader societal emphasis on convenience and streamlining daily routines. By consolidating functions into fewer devices, consumers can reduce clutter and save time. This desire for multi-functionality is a key sociological driver influencing product development and marketing strategies in the tech accessory sector.

- Increased demand for integrated features: Consumers actively seek accessories that combine primary functions with secondary benefits, such as kickstands, wallet slots, or power banks.

- Value placed on efficiency and convenience: The desire to simplify daily tasks and reduce the number of individual gadgets drives the adoption of multi-functional products.

- Market growth in versatile accessories: The expanding market for smartphone accessories, valued in the tens of billions, is significantly fueled by the popularity of multi-functional items.

Societal trends highlight a growing demand for personalized mobile accessories, with consumers, especially younger demographics, viewing them as extensions of personal style. Cellularline's AI-driven 'Coverlab' directly addresses this by enabling on-demand, unique designs, tapping into a market where customization is increasingly valued.

The emphasis on sustainability is a significant sociological factor, with a majority of consumers in 2024 indicating a willingness to pay more for eco-friendly electronics accessories. This pushes brands like Cellularline to adopt greener practices, as seen in their use of recycled materials, aligning with the projected $15 billion market for sustainable electronics accessories in 2025.

The pervasive digital lifestyle fuels a need for accessories that enhance functionality and durability, supporting constant connectivity and high-bandwidth content consumption. This drives demand for high-performance audio, reliable charging solutions, and protective gear, contributing to a global mobile accessories market expected to reach approximately $250 billion by 2027.

Consumers increasingly seek versatility and convenience, favoring multi-functional accessories like cases with integrated stands or multi-device charging stations. This trend, reflected in the tens of billions valued smartphone accessories market, prioritizes efficiency and streamlining daily routines, influencing product development in the tech accessory sector.

Technological factors

Wireless charging technology is rapidly evolving, offering faster speeds and improved efficiency. The global wireless charging market is anticipated to reach a significant $52.3 billion by 2025, indicating strong growth potential.

This technological progress directly fuels consumer demand for advanced wireless charging accessories like power banks and charging pads. Cellularline can leverage these advancements to develop and market innovative products that meet the growing consumer need for convenient and efficient power solutions.

Artificial intelligence is rapidly becoming a cornerstone of modern consumer electronics, with smart accessories now capable of learning user habits, improving sound quality, and offering detailed usage insights. This trend presents a significant opportunity for Cellularline to innovate by creating more intelligent and personalized product offerings that cater to evolving consumer demands.

The accelerating rollout and adoption of 5G technology are directly fueling a surge in demand for accessories designed to complement these faster networks. This includes items such as signal boosters to ensure optimal reception and advanced charging stations to keep up with the increased power consumption of 5G-enabled devices. For Cellularline, staying ahead means aligning its product development with these evolving user needs, ensuring its accessory offerings are not just compatible but optimized for the enhanced capabilities and higher power demands inherent in 5G technology.

Rapid Product Innovation

The consumer electronics sector, including smartphone accessories, is defined by exceptionally rapid product innovation and increasingly shorter product lifecycles. This pace is directly fueled by relentless advancements in smartphone technology, forcing companies like Cellularline to constantly evolve.

To remain competitive, Cellularline needs a robust research and development (R&D) strategy. This focus is crucial for quickly developing and launching new accessories that are compatible with the very latest devices and their cutting-edge features.

Consider these points regarding technological factors and rapid innovation:

- Smartphone Release Cadence: Major smartphone manufacturers typically release flagship models annually, with mid-cycle updates, creating a constant demand for new compatible accessories. For example, Apple's iPhone 15 series launched in late 2023, followed by potential updates in 2024, requiring accessory makers to adapt quickly.

- Component Advancements: Innovations in areas like battery technology, processing power, and display capabilities necessitate new accessory designs. The widespread adoption of USB-C across devices, for instance, has reshaped charging and data transfer accessory markets.

- Emerging Technologies: The integration of AI, advanced camera systems, and enhanced connectivity (like Wi-Fi 7) in smartphones creates opportunities for specialized accessories, such as AI-enhanced audio devices or high-speed data hubs.

- Accessory Market Growth: The global mobile accessories market was valued at approximately $250 billion in 2023 and is projected to grow, underscoring the significant market opportunities driven by technological evolution.

New Material Development

The development of new materials is significantly shaping the mobile accessory market. For instance, Gallium Nitride (GaN) technology is enabling the creation of more compact and efficient chargers. In 2024, the GaN charger market was valued at approximately $2.5 billion and is projected to grow substantially, driven by demand for faster charging and smaller form factors.

Innovations like self-healing tempered glass for screen protectors are enhancing product durability and user experience. This technology can mend minor scratches, extending the lifespan of the protector. Furthermore, the push for lighter yet more robust materials for phone cases directly impacts product design, allowing for slimmer profiles without compromising protection.

These material advancements directly translate into tangible benefits for consumers and manufacturers alike:

- Enhanced Efficiency: GaN allows for power adapters that are up to 50% smaller and up to 30% more efficient than traditional silicon-based chargers.

- Improved Durability: Self-healing screen protectors can reduce the need for frequent replacements, saving consumers money.

- Superior Performance: Lighter, stronger casing materials contribute to sleeker designs and better overall product handling.

The rapid evolution of smartphone technology, with annual flagship releases and mid-cycle updates, necessitates constant adaptation in accessory design and manufacturing for companies like Cellularline. Advancements in components such as battery technology and the universal adoption of USB-C are reshaping the market, creating ongoing demand for compatible and innovative accessories. The global mobile accessories market, valued at approximately $250 billion in 2023, highlights the significant opportunities driven by these technological shifts.

Legal factors

Extended Producer Responsibility (EPR) laws are becoming more stringent for electronics in 2025, pushing manufacturers like Cellularline to assume greater responsibility for product end-of-life management, including establishing robust take-back and recycling infrastructure.

The Basel Convention's updated controls on international e-waste shipments, effective from January 2025, will also impact global supply chains and disposal practices, potentially increasing compliance costs and requiring more localized recycling solutions.

Consumer electronics safety standards are constantly being updated, impacting companies like Cellularline. For instance, the European Union's CE marking requirements are regularly reviewed to reflect advancements in product safety. Similarly, organizations like UL (Underwriters Laboratories) frequently revise their certification protocols for electronic devices.

Cellularline must ensure its products consistently meet these evolving safety benchmarks, such as the latest iterations of standards for battery safety or electromagnetic compatibility. Failing to comply can result in significant penalties, like market exclusion or costly product recalls, impacting brand reputation and financial performance.

Data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), are increasingly impacting technology companies like Cellularline. With connected accessories potentially collecting user data, adherence to these laws is paramount. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Cellularline must prioritize robust data protection measures and maintain transparent privacy policies to foster consumer trust. Ensuring compliance with these evolving global data privacy standards is crucial for maintaining brand reputation and avoiding legal repercussions in markets where they operate.

Intellectual Property Rights

Intellectual property rights are crucial for Cellularline in the fiercely competitive mobile accessories sector. Protecting its innovative designs and technologies through patents and trademarks is essential to ward off counterfeiting and unauthorized copying. This is particularly important as the market for mobile accessories continues to grow, with global sales of smartphone accessories projected to reach over $250 billion by 2027, according to some market analyses.

The proliferation of counterfeit products presents a substantial risk, not only impacting brand reputation but also raising serious safety concerns for consumers. For instance, in 2023, customs authorities seized millions of counterfeit mobile accessories worldwide, highlighting the scale of the problem. Cellularline must actively defend its intellectual property to maintain its market position and consumer trust.

- Patent Protection: Securing patents for unique charging technologies or innovative case designs prevents competitors from legally replicating these advancements.

- Trademark Enforcement: Registering and actively defending its brand name and logos safeguards against imitation and builds brand recognition.

- Counterfeit Deterrence: Proactive legal action against counterfeiters can deter future infringement and protect consumer safety by ensuring product authenticity.

Common Charger Mandates

Legislation is increasingly shaping the accessories market. For instance, the European Union's mandate for a USB Type-C charging port across mobile phones, tablets, and cameras, effective by the end of 2024, directly influences Cellularline's charger and cable offerings. This move is designed to cut down on electronic waste and make charging more convenient for consumers.

This standardization impacts product development and inventory management for companies like Cellularline. While specific financial data for Cellularline's direct impact from this mandate is not yet publicly available as of mid-2025, the broader trend in the mobile accessories market in 2024 saw a significant shift towards USB-C compatibility, with many manufacturers proactively adopting the standard ahead of the deadline.

- EU USB Type-C Mandate: Effective end of 2024 for new mobile phones, tablets, and cameras.

- Environmental Goal: Reduction of electronic waste through a common charging standard.

- Consumer Benefit: Simplified charging experience with fewer cable types needed.

- Market Impact: Necessitates product line adjustments for accessory manufacturers like Cellularline.

The evolving legal landscape presents significant challenges and opportunities for Cellularline. Extended Producer Responsibility (EPR) laws are tightening in 2025, requiring greater accountability for product end-of-life management, including robust recycling programs.

Furthermore, updated international e-waste shipment controls, effective January 2025, will necessitate more localized disposal solutions and potentially increase compliance costs for global supply chains.

Cellularline must navigate stringent consumer electronics safety standards, such as updated CE marking requirements and UL certification protocols, to avoid penalties like market exclusion or product recalls.

Data privacy regulations, including GDPR and CCPA, are critical, with GDPR fines potentially reaching 4% of global annual revenue, underscoring the need for transparent policies and strong data protection measures.

Intellectual property protection is vital in the competitive mobile accessories market, with global smartphone accessory sales projected to exceed $250 billion by 2027, making defense against counterfeits essential.

The EU's mandate for USB Type-C charging ports by the end of 2024 directly impacts Cellularline's product development for chargers and cables, aligning with environmental goals to reduce e-waste.

| Legal Factor | Impact on Cellularline | Key Dates/Data |

|---|---|---|

| Extended Producer Responsibility (EPR) | Increased responsibility for product end-of-life management, requiring investment in take-back and recycling infrastructure. | Stringent laws in 2025. |

| E-waste Shipment Controls | Need for localized recycling solutions, potential increase in compliance costs due to updated Basel Convention controls. | Effective January 2025. |

| Consumer Electronics Safety Standards | Continuous need to meet evolving safety benchmarks (e.g., battery safety, EMC) to avoid penalties. | Regular reviews of CE marking and UL protocols. |

| Data Privacy Regulations (GDPR/CCPA) | Paramount importance of robust data protection and transparent policies to avoid significant fines (up to 4% of global annual revenue for GDPR). | Ongoing enforcement, high penalty potential. |

| Intellectual Property Rights | Crucial for protecting designs and technologies against counterfeiting in a market projected to reach over $250 billion by 2027. | Millions of counterfeit accessories seized globally in 2023. |

| Standardization Legislation (USB Type-C) | Mandatory product line adjustments for chargers and cables to comply with EU mandates. | Effective by end of 2024 for new devices. |

Environmental factors

Electronic waste is a rapidly escalating global issue, with 62 million metric tons produced in 2023 alone. Alarmingly, only 22% of this e-waste was managed through proper recycling channels.

Cellularline, like other companies in the consumer electronics sector, is increasingly scrutinized for its role in this growing waste stream. This puts pressure on the company to adopt more sustainable practices in product development and to actively engage in e-waste recycling programs.

Consumer preference is increasingly shifting towards mobile accessories crafted from recycled, biodegradable, or otherwise eco-friendly materials, a significant industry trend. This heightened demand is compelling manufacturers to re-evaluate their material sourcing and production processes.

Companies like Belkin have already made strides by incorporating post-consumer recycled materials into their product lines, signaling a broader industry movement towards more sustainable practices. This transition is not just about environmental responsibility but also about meeting evolving consumer expectations and gaining a competitive edge in the 2024-2025 market.

The production of electronic accessories, like those Cellularline offers, is inherently energy-intensive. This process contributes significantly to global carbon emissions, a critical environmental concern. For instance, the electronics manufacturing sector alone accounted for an estimated 1.4% of global greenhouse gas emissions in 2023, according to industry reports.

Cellularline needs to actively manage its carbon footprint throughout its entire supply chain. This involves assessing energy consumption in manufacturing facilities and logistics. Exploring more energy-efficient production methods and investing in carbon-neutral initiatives, such as renewable energy sourcing for its factories, will be crucial for sustainability.

Circular Economy Principles

The electronics sector is increasingly embracing circular economy principles, prioritizing product longevity, ease of repair, reuse, and efficient recycling. This shift is evident in initiatives such as modular product designs, customer trade-in programs, and advanced material recovery processes from end-of-life electronics.

Cellularline can leverage these trends by focusing on product durability and offering repair services, potentially reducing waste and appealing to environmentally conscious consumers. For instance, the European Union's Ecodesign Regulation, which came into effect in 2021, mandates that certain electronic products must be designed for longer lifespans and easier repair, impacting manufacturers across the board.

- Extended Producer Responsibility (EPR) Schemes: Many regions are strengthening EPR laws, making manufacturers responsible for the collection and recycling of their products.

- Right to Repair Movement: Growing consumer demand and legislative support for the right to repair encourages companies to make products more serviceable.

- Material Recovery Rates: The industry is striving to increase the recovery rates of valuable materials like rare earth elements and precious metals from discarded electronics.

Energy Consumption of Devices

The energy consumption of electronic devices, from active use to the charging cycle, has a noticeable environmental footprint. Cellularline has an opportunity to mitigate this by focusing on energy-efficient power solutions. For instance, advanced wireless chargers and gallium nitride (GaN) chargers are key areas where improvements can be made, as they typically offer greater efficiency and produce less heat.

The drive towards greater energy efficiency in consumer electronics is a significant trend. By 2024, the global market for GaN power devices was projected to reach billions of dollars, highlighting the demand for more efficient charging technologies. Cellularline's commitment to developing these types of products directly addresses this environmental concern.

- Energy Efficiency: Developing chargers that consume less power during operation and charging.

- GaN Technology: Incorporating Gallium Nitride for higher efficiency and reduced heat.

- Wireless Charging Innovation: Improving the energy transfer efficiency of wireless charging solutions.

Cellularline faces increasing pressure to address the environmental impact of its products, particularly concerning electronic waste. With 62 million metric tons of e-waste generated globally in 2023 and only 22% properly recycled, the company must prioritize sustainable design and robust recycling initiatives.

The company's manufacturing processes are energy-intensive, contributing to carbon emissions, which accounted for an estimated 1.4% of global greenhouse gas emissions from the electronics sector in 2023. Cellularline needs to actively manage its carbon footprint by adopting energy-efficient production methods and exploring renewable energy sources for its facilities.

Consumer demand for eco-friendly accessories made from recycled or biodegradable materials is rising, compelling manufacturers to re-evaluate their supply chains. Companies like Belkin are already integrating recycled materials, setting a precedent for the 2024-2025 market.

Embracing circular economy principles, such as product longevity and repairability, presents an opportunity for Cellularline. Adhering to regulations like the EU's Ecodesign Regulation, which mandates longer product lifespans and easier repairs, can enhance brand reputation and meet evolving consumer expectations.

| Environmental Factor | 2023 Data/Trend | Impact on Cellularline | Actionable Insights |

|---|---|---|---|

| E-Waste Generation | 62 million metric tons globally (2023) | Reputational risk, regulatory scrutiny | Implement take-back programs, design for recyclability |

| Carbon Emissions (Electronics Sector) | 1.4% of global GHG emissions (2023) | Operational cost, regulatory compliance | Invest in energy-efficient manufacturing, renewable energy sourcing |

| Consumer Preference | Growing demand for sustainable materials | Market share opportunity, competitive advantage | Incorporate recycled/biodegradable materials, transparent sourcing |

| Energy Efficiency in Devices | Increasing market for GaN chargers (billions USD projected by 2024) | Product differentiation, energy cost savings for consumers | Develop high-efficiency chargers (e.g., GaN technology), optimize wireless charging |

PESTLE Analysis Data Sources

Our Cellularline PESTLE Analysis is built on a robust foundation of data from leading market research firms, industry-specific publications, and official government reports. We meticulously gather information on political stability, economic indicators, technological advancements, and socio-cultural trends to provide a comprehensive overview.