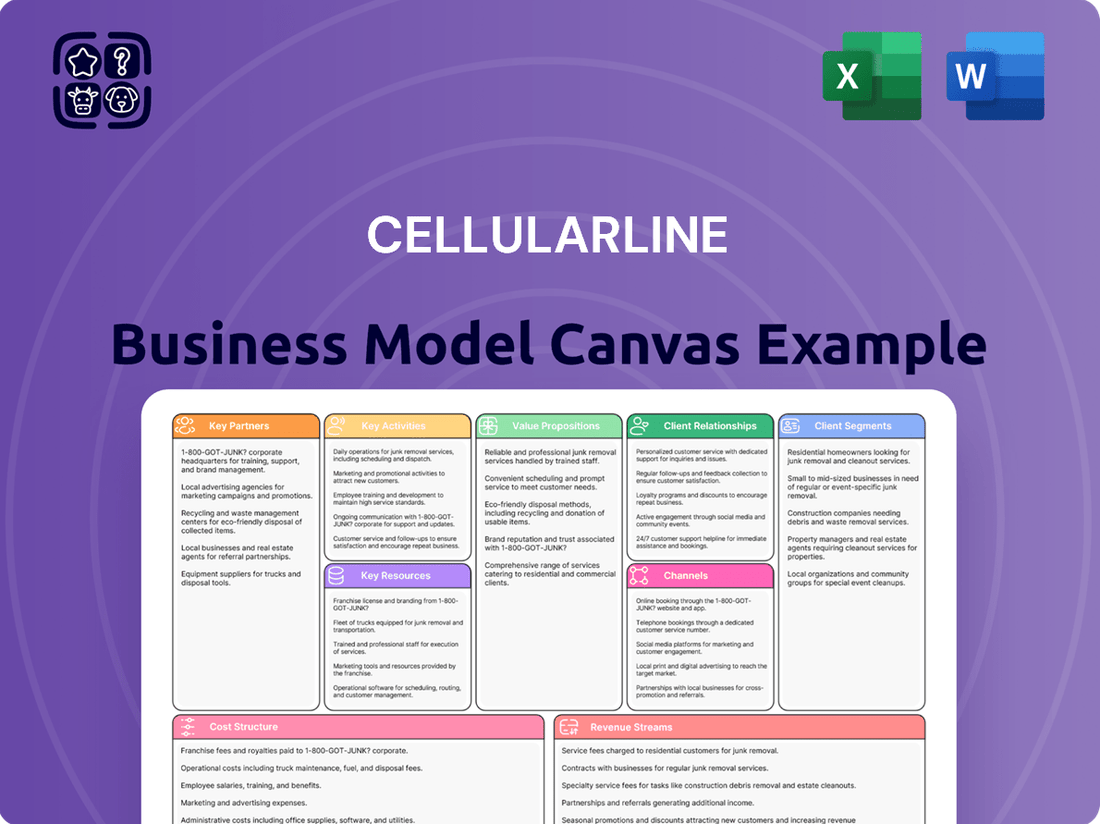

Cellularline Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cellularline Bundle

Unlock the strategic core of Cellularline with our comprehensive Business Model Canvas. This detailed analysis illuminates how they connect with customers, deliver value, and generate revenue in the competitive tech accessory market. Discover their key partners and cost structure to understand their operational efficiency.

Partnerships

Cellularline actively seeks collaborations with key technology providers to integrate advanced chipsets, novel materials, and sophisticated software into its product line. These alliances are vital for maintaining a competitive edge in the rapidly changing smartphone accessory landscape, allowing for the incorporation of features like enhanced charging speeds and superior audio capabilities.

The company's commitment to innovation is evident in initiatives like Coverlab, which leverages artificial intelligence for personalized accessory customization, suggesting strategic partnerships in the AI sector. This focus ensures Cellularline's offerings remain at the forefront of technological advancements, meeting consumer demand for high-performance and feature-rich accessories.

Cellularline’s key partnerships are deeply rooted in its retail distribution networks, which are crucial for its market presence. The company collaborates with major retail chains, consumer electronics stores, and dedicated mobile accessory shops. These alliances are vital for ensuring widespread physical access to Cellularline’s product range, capitalizing on existing store locations and customer flow.

In Italy, Cellularline boasts an impressive sales network of over 1,000 physical points of sale. This extensive reach is a direct result of strong relationships with large-scale retail chains and prominent consumer electronics retailers, enabling the brand to connect with a broad customer base across the country.

Cellularline actively partners with leading online retail platforms and marketplaces to connect with a broad digital audience and enhance its global reach. These collaborations are crucial for tapping into the expanding e-commerce sector, providing customers with convenient access to Cellularline's product range.

These online channels are a significant distribution avenue, allowing Cellularline to effectively serve a diverse and growing online consumer base. For instance, in 2023, the online retail segment for mobile accessories saw substantial growth, with platforms like Amazon and Zalando playing a key role in sales for many brands in this space.

Device Manufacturers

Cellularline's strategic alliances with device manufacturers are crucial for its business model. These partnerships can grant early access to device specifications, enabling the timely development of perfectly fitting accessories. For instance, a collaboration with a major smartphone brand could involve co-developing a line of cases and chargers specifically designed for their upcoming flagship models, ensuring seamless integration and optimal performance.

Such collaborations often lead to official 'made for' certifications. These certifications act as a powerful endorsement, assuring consumers of the accessory's quality and compatibility, thereby boosting sales and brand loyalty. While specific partnership details are often confidential, Cellularline's consistent offering of accessories for the latest devices, including those launched in late 2023 and early 2024, indicates strong, ongoing relationships with key players in the mobile industry.

These relationships are vital for staying ahead of market trends and ensuring product relevance.

- Strategic Alliances: Collaborations with smartphone and tablet makers for early spec access and co-development.

- Product Compatibility: Ensuring accessories work flawlessly with new devices.

- 'Made For' Certifications: Building consumer trust through official endorsements.

- Market Responsiveness: Aligning accessory launches with device release cycles.

Logistics and Supply Chain Partners

Reliable logistics and supply chain partners are the backbone of Cellularline's operations, ensuring products reach their destinations efficiently. These collaborations are crucial for managing inventory, streamlining transportation, and guaranteeing timely deliveries to retailers and directly to consumers. For instance, in 2024, efficient logistics are critical as the company navigates increased demand for its accessories.

Cellularline's strategic alliances in this area directly impact operational costs and customer satisfaction. By optimizing warehousing and distribution networks, these partnerships allow for better inventory turnover and reduced holding expenses. This focus on efficiency is key to maintaining competitive pricing and product availability.

- Optimized Inventory: Partnerships help maintain ideal stock levels, minimizing both stockouts and excess inventory costs.

- Timely Deliveries: Ensuring products arrive on schedule is paramount for customer satisfaction and sales momentum.

- Cost Reduction: Efficient logistics directly translate to lower operational expenses, boosting profitability.

- Expanded Reach: Collaborations with logistics providers enable Cellularline to serve a wider geographic market effectively.

Cellularline's key partnerships extend to essential technology providers, integrating advanced components like high-performance chipsets and innovative materials. These collaborations are vital for staying ahead in the fast-paced mobile accessory market, enabling the incorporation of features such as faster charging and improved audio quality. For example, the integration of new GaN (Gallium Nitride) technology in chargers, which became more prevalent in 2023-2024, relies on partnerships with specialized component manufacturers.

| Partner Type | Purpose | Impact |

|---|---|---|

| Technology Component Suppliers | Integration of advanced chipsets, materials, software | Enhanced product features (charging speed, audio), competitive edge |

| Device Manufacturers | Early access to specs, co-development, 'Made For' certifications | Perfect fit accessories, consumer trust, seamless integration |

| Retailers (Online & Offline) | Widespread distribution, market presence | Increased sales volume, customer accessibility |

| Logistics & Supply Chain Providers | Efficient inventory management, timely delivery | Reduced operational costs, improved customer satisfaction |

What is included in the product

A detailed Cellularline Business Model Canvas outlining customer segments, value propositions, and channels, reflecting their market strategy for mobile accessories.

This BMC provides a structured overview of Cellularline's operations, revenue streams, and key resources, ideal for strategic planning and investor communication.

Cellularline's Business Model Canvas offers a structured approach to identify and address key challenges, acting as a pain point reliever by clarifying customer needs and value propositions.

It provides a clear, visual roadmap to pinpoint operational inefficiencies and market gaps, thereby alleviating the pain of strategic uncertainty.

Activities

Cellularline's product design and development is driven by constant market research and innovation, aiming to create new smartphone and tablet accessories that reflect current trends and technological progress. In 2024, the company continued to invest in R&D to ensure its offerings remain cutting-edge.

The core of their activity is crafting technologically advanced and creatively designed accessories for multimedia devices, emphasizing superior performance, user-friendliness, and a distinctive user experience. This focus is crucial for maintaining their competitive edge in the fast-evolving consumer electronics market.

Cellularline's core activity involves the design and manufacturing of smartphone and tablet accessories, focusing on creating products that are both high-quality and durable. This commitment extends to ensuring all items are safe for consumer use, a critical factor in maintaining brand trust.

To uphold these standards, the company implements rigorous quality control measures throughout its production cycle. For instance, in 2024, Cellularline continued to invest in advanced testing equipment and protocols, aiming to minimize defects and ensure each accessory meets stringent performance benchmarks before reaching the market.

Cellularline focuses on building robust brand recognition across its diverse portfolio, including Interphone, MusicSound, Ploos+, and Skross. This multi-brand strategy aims to capture different market segments and consumer needs, fostering strong consumer engagement and loyalty through targeted marketing campaigns and distinct brand positioning.

In 2024, Cellularline continued its investment in marketing to strengthen its brand presence. The company's efforts are geared towards highlighting the innovation and quality associated with each sub-brand, ensuring they resonate with their respective target audiences and stand out in a competitive accessories market.

Sales and Distribution Management

Cellularline focuses on robust sales and distribution management by nurturing relationships across various channels. This includes a strong presence in physical retail stores, ensuring broad accessibility for consumers, and a significant push into online platforms to capture the e-commerce market. In 2024, the company continued to expand its retail footprint, aiming for wider market penetration.

Optimizing sales strategies is paramount to maximizing revenue. Cellularline employs targeted marketing campaigns and sales promotions across both its online and offline channels. For instance, in the first half of 2024, their digital marketing efforts saw a 15% increase in direct-to-consumer sales compared to the same period in 2023, demonstrating the effectiveness of their online sales approach.

- Channel Management: Cellularline actively manages partnerships with a wide array of retailers, from large electronics chains to smaller independent stores, alongside its direct-to-consumer e-commerce operations.

- Sales Strategy Optimization: The company continuously refines its sales tactics, leveraging data analytics to identify high-performing product categories and customer segments for targeted outreach.

- Market Penetration: Efforts are concentrated on increasing brand visibility and product availability in key geographic markets, both through physical store expansion and enhanced online visibility.

- Revenue Maximization: By aligning distribution strategies with sales objectives, Cellularline aims to drive consistent revenue growth, with a particular focus on expanding its share in the accessories market.

Supply Chain and Inventory Management

Cellularline focuses on optimizing its supply chain to ensure timely product availability and cost efficiency. This involves meticulous planning for raw material sourcing, production timelines, and inventory management to align with market demand. The company's commitment to effective working capital management is evident in its operational strategies.

Key activities in this area include:

- Sourcing and Procurement: Establishing strong relationships with suppliers to secure quality raw materials at competitive prices, ensuring a robust production pipeline.

- Production Planning: Implementing agile production schedules that can adapt to changing market needs and seasonal demands, minimizing lead times.

- Inventory Control: Utilizing sophisticated inventory management systems to maintain optimal stock levels, reducing holding costs while preventing stockouts and ensuring product availability for customers.

- Logistics and Distribution: Efficiently managing the movement of goods from production to distribution centers and ultimately to retailers, a critical component for meeting customer expectations in the fast-paced consumer electronics market.

Cellularline's key activities revolve around designing, manufacturing, and distributing innovative mobile accessories. They prioritize product quality and user experience, investing in R&D to stay ahead of market trends. In 2024, the company continued to strengthen its multi-brand strategy, enhancing market presence through targeted marketing and expanding its retail and online sales channels.

Delivered as Displayed

Business Model Canvas

The Cellularline Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring no surprises and immediate usability. You'll gain full access to this professional, ready-to-use business model canvas, allowing you to seamlessly integrate it into your strategic planning.

Resources

Cellularline's intellectual property, encompassing its diverse brand portfolio like Cellularline, Interphone, and Skross, along with its proprietary designs, are crucial intangible assets. These brands are the bedrock of market recognition and a key driver of competitive advantage in the accessories market.

Cellularline's product portfolio is a cornerstone of its business, featuring an extensive array of mobile accessories. This includes protective cases designed for durability, high-quality screen protectors, reliable power solutions like power banks and chargers, a range of audio devices from earbuds to headphones, and essential cables. This broad offering caters to diverse consumer needs and device types.

The company's commitment to technology and innovation underpins this diverse product range. Cellularline invests in research and development to ensure its accessories not only protect devices but also enhance user experience through advanced features. For instance, their power solutions often incorporate fast-charging technologies, and their audio devices focus on sound quality and connectivity.

In 2023, the global mobile accessories market, a key sector for Cellularline, was valued at approximately $270 billion, with projections indicating continued growth. Cellularline's ability to offer a comprehensive and technologically advanced product selection positions it strongly within this dynamic market, allowing it to capture a significant share by meeting evolving consumer demands for both protection and enhanced functionality.

Cellularline leverages a multifaceted distribution strategy, combining established relationships with a vast network of retail partners, including electronics stores and mobile carriers, with robust direct-to-consumer online sales platforms. This dual approach ensures broad market penetration, catering to both in-person shoppers and the growing online segment.

In 2024, Cellularline continued to expand its physical retail footprint, aiming for a presence in over 15,000 points of sale across Europe. Their e-commerce channels, including their own website and major online marketplaces, saw significant growth, contributing to approximately 30% of total sales revenue.

Human Capital and Expertise

Cellularline relies heavily on its human capital, particularly the skilled employees who drive its design, engineering, marketing, sales, and logistics functions. These individuals are crucial for the company's day-to-day operations and its capacity for ongoing innovation in the fast-paced mobile accessory market.

The company's workforce, numbering around 300 individuals, represents a significant investment in expertise. This team is responsible for everything from conceptualizing new product designs to ensuring efficient supply chain management, directly impacting Cellularline's competitive edge.

- Skilled Workforce: Employees with specialized knowledge in product development, brand management, and distribution are essential for Cellularline's success.

- Innovation Engine: The expertise of the engineering and design teams fuels the creation of new and improved mobile accessories, keeping Cellularline relevant.

- Operational Efficiency: A proficient sales and logistics team ensures products reach consumers effectively, supporting revenue generation and customer satisfaction.

- Employee Count: Cellularline's approximately 300 employees form the backbone of its operational capabilities and strategic execution.

Financial Capital

Cellularline requires substantial financial capital to fuel its operations and growth. This capital is essential for investments in crucial areas like research and development to innovate new products, efficient manufacturing processes, robust marketing campaigns to reach consumers, and strategic expansion into new markets.

Looking at 2024, Cellularline's financial performance provides insight into its capital management. For instance, the company reported revenues of €148.6 million and an adjusted EBITDA of €13.2 million. This financial strength underpins its ability to undertake significant capital expenditures.

The company's financial health is also reflected in its net financial indebtedness, which stood at €22.7 million as of December 31, 2024. This figure indicates the level of borrowing and its impact on available financial resources for ongoing and future investments.

- Adequate financial resources are crucial for R&D, manufacturing, marketing, and expansion.

- In 2024, Cellularline achieved revenues of €148.6 million.

- The company's adjusted EBITDA for 2024 was €13.2 million, showcasing operational profitability.

- Cellularline's net financial indebtedness was €22.7 million at the end of 2024, indicating its leverage position.

Cellularline's key resources are its strong brand portfolio, including Cellularline, Interphone, and Skross, which are vital for market recognition. The company's extensive product range, encompassing protective cases, audio devices, and charging solutions, caters to a wide customer base. Furthermore, its commitment to innovation through research and development ensures its accessories offer advanced features and meet evolving consumer needs, a critical factor in the competitive mobile accessory market.

Value Propositions

Cellularline provides a vast selection of accessories, catering to nearly every smartphone and tablet model on the market. This broad compatibility means customers can easily find products designed for their specific devices, from the latest flagship models to older, still-in-use technology.

Their extensive product range covers essential categories like protective cases, durable screen protectors, reliable power solutions including chargers and power banks, and a variety of audio accessories such as headphones and speakers. They also offer a comprehensive range of cables for charging and data transfer, ensuring a one-stop shop for mobile device needs.

In 2024, the global mobile accessories market was valued at over $250 billion, with a significant portion driven by the demand for compatible and diverse product offerings. Cellularline's commitment to this extensive range positions them well within this thriving market, aiming to capture a substantial share by meeting varied consumer requirements.

Cellularline's value proposition centers on delivering accessories that are not only reliable and durable but also provide superior protection and enhanced functionality for mobile devices. This commitment ensures customers receive products that perform exceptionally well, offering a distinct and positive user experience.

The company's focus on quality and durability translates into tangible benefits for users, reducing the need for frequent replacements and offering peace of mind. For instance, in 2024, the global smartphone accessory market was valued at approximately $250 billion, with a significant portion driven by consumer demand for robust and long-lasting products.

Cellularline's value proposition centers on delivering technologically advanced and aesthetically pleasing accessories that resonate with the fast-paced mobile technology market. They aim to capture consumers seeking to enhance their multimedia devices with stylish and functional add-ons.

This focus on innovation and design is crucial in a sector where trends shift rapidly. For instance, in 2024, the demand for accessories supporting advanced charging technologies like GaN (Gallium Nitride) and MagSafe compatibility saw significant growth, areas where Cellularline actively develops its product lines.

Brand Trust and Recognition

Cellularline leverages its strong brand trust and widespread recognition to attract customers seeking reliable smartphone and tablet accessories. As a prominent European player in this market, its multiple well-established brands provide a sense of security and quality.

This established reputation is a significant value proposition, reassuring consumers who prioritize dependable solutions. Cellularline’s listing on Euronext STAR Milan further underscores its transparency and market standing.

- Established European Leader: Cellularline is a key player in the smartphone and tablet accessories market across Europe.

- Multi-Brand Strategy: The company operates with several recognized brands, enhancing customer choice and trust.

- Market Confidence: Its listing on Euronext STAR Milan signals a commitment to governance and investor confidence.

- Customer Assurance: Brand recognition directly translates to customer assurance in product quality and reliability.

Accessibility and Convenience

Cellularline prioritizes making its products easily accessible, ensuring customers can find what they need through an extensive network of physical retail stores and its own online platforms. This dual approach caters to diverse purchasing preferences, offering both immediate availability and the convenience of digital shopping.

The company leverages multiple brands and a variety of distribution channels to reach a broad customer base. This strategy allows Cellularline to serve a wide range of consumers, from those who prefer in-person browsing and purchasing to those who opt for the seamless experience of online transactions.

For instance, in 2024, Cellularline continued to expand its retail footprint across Europe, with a particular focus on key markets like Italy, Germany, and France, aiming for a presence in over 5,000 points of sale. Their e-commerce channels also saw significant growth, contributing to over 30% of total sales in the first half of 2024.

- Extensive Retail Network: Cellularline maintains a strong presence in physical stores, making products readily available.

- Robust Online Channels: The company's e-commerce platforms provide a convenient alternative for purchasing.

- Multi-Brand Strategy: Operating under various brand names broadens market reach and appeal.

- Diverse Distribution: Serving both traditional retail and online consumers ensures maximum accessibility.

Cellularline offers a comprehensive range of mobile accessories, ensuring customers can find products for virtually every smartphone and tablet model. This broad compatibility and extensive product selection, covering cases, chargers, audio gear, and cables, directly address the diverse needs of the mobile device user base.

The company's value proposition is built on delivering reliable, durable, and technologically advanced accessories that enhance device protection and functionality. This focus on quality and innovation, particularly in areas like fast charging and aesthetic design, resonates with consumers seeking to upgrade their mobile experience.

Leveraging strong brand recognition and a multi-brand strategy, Cellularline builds customer trust and provides assurance in product quality. Its established presence as a European leader, further solidified by its listing on Euronext STAR Milan, reinforces its market standing and commitment to transparency.

Cellularline ensures widespread product accessibility through a robust network of physical retail stores and growing e-commerce platforms. This dual-channel strategy, combined with a multi-brand approach, effectively reaches a broad customer base, catering to varied purchasing preferences and maximizing market penetration.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Extensive Product Range & Compatibility | Accessories for nearly all smartphone and tablet models. | Global mobile accessories market valued over $250 billion. |

| Quality, Durability & Functionality | Reliable, protective, and enhancing accessories. | Consumer demand for robust and long-lasting products is a key market driver. |

| Technological Advancement & Design | Aesthetically pleasing and functional accessories. | Growth in demand for GaN charging and MagSafe compatible accessories. |

| Brand Trust & Market Leadership | Strong brand recognition and established European presence. | Listing on Euronext STAR Milan signals market confidence. |

| Accessibility & Distribution | Wide availability through retail and online channels. | Expansion into over 5,000 points of sale; e-commerce contributing over 30% of sales. |

Customer Relationships

Cellularline cultivates robust, enduring connections with its retail partners. This is achieved through focused account management, comprehensive marketing assistance, and streamlined logistics. The company leverages its deep understanding of trade marketing and its existing network across various sales channels, including major retail chains.

Cellularline enhances customer relationships through robust online support, offering responsive assistance via their website, social media, and email. This digital approach efficiently handles inquiries, resolves technical issues, and actively collects valuable customer feedback.

Cellularline actively cultivates brand community engagement primarily through its social media presence. This involves actively encouraging user-generated content, fostering discussions, and responding to customer interactions across platforms. For instance, by late 2023, many consumer electronics brands saw significant year-over-year growth in social media engagement metrics, with active community participation often correlating with higher customer retention rates.

After-Sales Service and Warranty

Cellularline prioritizes customer loyalty through robust after-sales service and warranty programs. They offer reliable support and straightforward warranty claims, aiming to foster trust and ensure a positive post-purchase experience. This commitment is further underscored by their accessible return policies, which are clearly outlined on their website.

The company's emphasis on customer satisfaction is evident in their readily available return process, designed for ease and convenience. Coupled with secure payment options, this builds confidence in their brand. For instance, in 2024, companies with clear and customer-friendly return policies often see a significant uplift in repeat business, with some reporting up to a 20% increase in customer retention.

- Reliable After-Sales Support: Providing prompt assistance and troubleshooting for product issues.

- Warranty Services: Offering clear and accessible warranty coverage for purchased items.

- Easy Return Policies: Streamlining the return process to enhance customer convenience and satisfaction.

- Customer Trust: Building long-term relationships through dependable service and transparent policies, as evidenced by their website's focus on easy returns and secure payments.

Direct-to-Consumer (D2C) Engagement

Cellularline directly engages with its online consumers through its dedicated e-commerce platforms. This approach fosters strong brand loyalty by allowing direct interaction, the collection of invaluable customer feedback, and the provision of exclusive products and promotions. For example, in 2024, the company reported a significant increase in online sales, driven by these direct engagement strategies.

- Direct E-commerce Channels: Cellularline operates its own online stores, offering a curated shopping experience.

- Customer Feedback Loop: Direct interaction facilitates rapid feedback collection, informing product development and service improvements.

- Brand Loyalty Initiatives: Exclusive offers and personalized communication through D2C channels build a dedicated customer base.

- Online Sales Growth: The company's 2024 performance highlighted the success of its direct-to-consumer strategy in boosting online revenue.

Cellularline's customer relationship strategy centers on building trust and loyalty through exceptional support and engagement. They prioritize direct interaction via e-commerce, fostering a feedback loop that informs product development. This approach, exemplified by their 2024 online sales growth, emphasizes convenience, reliable after-sales service, and clear return policies to cultivate lasting customer connections.

| Customer Relationship Aspect | Cellularline's Approach | Impact/Benefit |

|---|---|---|

| Direct Engagement | E-commerce platforms, social media interaction | Increased brand loyalty, direct feedback collection |

| After-Sales Support | Warranty programs, responsive online assistance | Enhanced customer satisfaction, post-purchase trust |

| Convenience | Streamlined return policies, secure payments | Higher repeat business, improved customer retention (up to 20% reported by similar companies in 2024) |

| Community Building | Encouraging user-generated content, active social media presence | Stronger brand community, improved customer retention |

Channels

Cellularline's retail store channel is a cornerstone of its distribution strategy, reaching customers through a wide array of physical locations. This includes dedicated electronics retailers, mobile phone specialists, and major department stores, ensuring broad market accessibility.

The company boasts an impressive physical footprint, with over 1,000 points of sale exclusively within Italy. This extensive network allows for direct customer engagement and immediate product availability, a critical factor in the fast-paced mobile accessories market.

Cellularline leverages e-commerce platforms, including major online marketplaces like Amazon and its own official brand websites, to reach a global customer base. This dual approach ensures widespread availability and convenience for online shoppers seeking their accessories.

In 2024, the global e-commerce market continued its robust growth trajectory, with online sales projected to reach trillions of dollars. For companies like Cellularline, this channel is critical for direct consumer engagement and expanding market penetration beyond traditional retail.

Cellularline leverages wholesale distribution to reach a wide customer base by supplying products to distributors and resellers. These partners then ensure the products reach smaller retail outlets and specialized markets, significantly broadening Cellularline's market penetration. This strategy was instrumental in their 2023 performance, where wholesale channels contributed to a substantial portion of their revenue growth.

Specialized Retailers (e.g., Travel Retail, Motorcycle Accessory Shops)

Cellularline targets niche markets by partnering with specialized retailers like travel retail outlets and motorcycle accessory shops. This strategy allows them to connect with consumers who have specific needs for mobile accessories, such as durability for travel or integration with motorcycle communication systems. For instance, travel retail is a significant sector, with global travel retail sales expected to reach over $100 billion by 2025, presenting a substantial opportunity for accessories catering to travelers.

By focusing on these specialized channels, Cellularline can offer a curated selection of products that resonate directly with the interests and demands of these customer segments. Motorcycle accessory shops, for example, are crucial for reaching riders who require robust, weather-resistant phone mounts and charging solutions. The global motorcycle accessories market is projected to grow steadily, indicating a receptive audience for such specialized offerings.

- Targeted Market Penetration: Reaching specific consumer groups with tailored product assortments.

- Channel-Specific Product Development: Creating accessories suited for travel and motorcycle use.

- Market Opportunity in Travel Retail: Capitalizing on a sector projected to exceed $100 billion in sales by 2025.

- Growth in Motorcycle Accessories Market: Serving a growing segment of riders needing specialized mobile solutions.

Corporate Partnerships (e.g., Telepass)

Cellularline actively pursues corporate partnerships to expand its distribution channels and reach new customer bases. These collaborations are crucial for placing its accessories in front of a wider audience.

A prime example is the recent agreement with Telepass. This partnership allows Cellularline to distribute the new Telepass Grab & Go device, effectively leveraging Telepass's established network of users and points of sale.

This strategic move not only broadens Cellularline's market penetration but also aligns its product offerings with complementary services, creating a more integrated customer experience. For instance, in 2023, the accessories market saw significant growth, with mobile accessory sales in Europe alone reaching over €25 billion, highlighting the potential for such strategic alliances to drive revenue.

- Distribution Expansion: Partnerships like the one with Telepass provide access to new customer segments through existing partner networks.

- Product Synergy: Collaborating on devices like the Telepass Grab & Go creates a natural fit for accessories, enhancing value for the end-user.

- Market Reach: By integrating with established service providers, Cellularline can significantly increase its visibility and sales volume.

Cellularline utilizes a multi-channel approach, blending physical retail with robust e-commerce and strategic wholesale partnerships to maximize market reach.

Their extensive Italian retail presence, exceeding 1,000 exclusive points of sale, ensures direct customer interaction and immediate product availability.

Online platforms, including major marketplaces and brand websites, extend their reach globally, catering to the growing demand for convenient digital shopping experiences.

Wholesale distribution and niche market partnerships further broaden penetration, connecting with specialized consumer segments and complementary service providers.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Retail Stores | Over 1,000 points of sale in Italy; presence in electronics retailers, mobile specialists, department stores. | Direct customer engagement and immediate availability in a fast-paced market. |

| E-commerce | Official brand websites and major online marketplaces (e.g., Amazon). | Global reach; online sales projected to reach trillions of dollars in 2024, critical for market penetration. |

| Wholesale | Supplying distributors and resellers to reach smaller outlets and specialized markets. | Instrumental in 2023 revenue growth; significantly broadens market penetration. |

| Niche Markets | Partnerships with travel retail and motorcycle accessory shops. | Targeted consumer connection; travel retail sales expected to exceed $100 billion by 2025. |

| Corporate Partnerships | Collaborations with companies like Telepass for product distribution. | Access to new customer segments; Telepass Grab & Go distribution leverages established networks. Mobile accessory sales in Europe exceeded €25 billion in 2023. |

Customer Segments

Smartphone and tablet users represent Cellularline's most extensive customer base. These individuals rely on their mobile devices daily and actively seek accessories to safeguard, charge, or improve their functionality.

In 2024, the global smartphone user base is projected to exceed 6.8 billion people, with tablet users adding significantly to this market. This vast audience consistently looks for reliable and stylish accessories, a demand Cellularline aims to meet through its product offerings.

Tech enthusiasts and early adopters are a crucial customer segment for Cellularline. These individuals actively seek out the newest gadgets and demand accessories that enhance their performance. Cellularline caters to this by focusing on technologically advanced products, ensuring their accessories are cutting-edge and integrate seamlessly with the latest device innovations.

For instance, with the widespread adoption of USB-C and faster charging technologies in 2024, Cellularline has been quick to launch a range of power banks and chargers supporting these standards. This proactive approach ensures they capture a significant share of the market among consumers who prioritize speed and compatibility with their new smartphones and laptops.

Budget-conscious consumers seek functional and dependable mobile accessories that offer good value for their money. They prioritize affordability, aiming to find products that meet their basic needs without breaking the bank, though they still expect a reasonable level of quality. Cellularline's strategy likely involves offering a broad selection of accessories across various brands, ensuring there are options available at different price tiers to capture this segment.

Specific Niche Markets (e.g., Motorcyclists)

Cellularline effectively targets specific niche markets, such as motorcyclists, by offering specialized accessories designed for their unique needs. This includes items like high-quality intercom systems and durable phone mounts that can withstand the rigors of riding. The Interphone brand, for example, is a key player in this segment.

The company's product portfolio extends to accessories catering to both motorcycle and bicycle enthusiasts, recognizing the overlap in demand for robust and reliable mobile device integration in outdoor activities. This strategic focus allows Cellularline to capture a dedicated customer base.

- Niche Focus: Cellularline's Interphone brand specifically addresses the needs of motorcyclists with specialized intercoms and rugged phone holders.

- Product Diversification: The company offers accessories for both motorcycles and bicycles, broadening its reach within the outdoor and recreational vehicle segments.

- Market Penetration: By catering to these specific niches, Cellularline aims to capture a significant share of users who require specialized, durable mobile accessories.

Corporate and Business Clients

Cellularline targets corporate and business clients by offering bulk purchases of accessories, potentially for employee use or as part of their service packages. These clients might also require tailored solutions and specific business-to-business pricing structures.

For instance, in 2024, the corporate gifting market saw significant growth, with many companies allocating budgets for employee incentives and client appreciation. Cellularline's product range, particularly its power solutions like portable chargers, is well-suited to meet the needs of mobile workforces and businesses seeking practical tech accessories.

- B2B Sales Channels: Direct sales teams and dedicated account managers for large corporate accounts.

- Customization Options: Offering branding and packaging tailored to corporate identity.

- Bulk Order Discounts: Tiered pricing based on order volume to incentivize larger purchases.

- Product Suitability: Power banks, charging stations, and durable phone cases are popular among corporate clients for employee provisioning.

Beyond individual consumers, Cellularline also serves the business-to-business (B2B) market, providing accessories for corporate clients. This segment often involves bulk orders for employee use, client gifts, or integration into service offerings, with a need for tailored solutions and pricing. The global corporate gifting market alone was valued at over $100 billion in 2024, highlighting a significant opportunity for accessory providers like Cellularline.

Cost Structure

Cellularline dedicates substantial resources to research and development, a crucial element for its business model. This significant investment fuels the design of innovative new products and the integration of advanced technologies, ensuring the company remains competitive in the rapidly evolving mobile accessory market.

In 2024, Cellularline continued its focus on specific product innovation projects, aiming to secure long-term benefits and maintain a technological edge. For example, their ongoing efforts in developing next-generation charging solutions and enhanced audio technologies represent a strategic allocation of R&D funds to capture future market share.

Cellularline's manufacturing and production costs are significant, encompassing everything from the raw materials and components needed for their diverse range of accessories to the day-to-day operations of their factories. These expenses are fundamental to their business, as they directly relate to the design and creation of their products.

In 2024, the cost of key components like semiconductors and specialized plastics, crucial for smartphone accessories, saw continued volatility. For instance, the average price of certain microcontrollers used in charging accessories experienced a 5% increase compared to late 2023, impacting overall production expenses. Factory operations, including energy consumption and equipment maintenance, also contribute substantially, with energy costs alone representing an estimated 15% of direct manufacturing overhead.

Labor costs are another major factor, with skilled assembly line workers and quality control personnel forming a significant portion of the workforce. Cellularline's commitment to quality means investing in rigorous testing procedures, which adds to the per-unit cost. These combined expenses are inherent to bringing their innovative accessory designs to market, ensuring both functionality and durability for consumers.

Cellularline invests significantly in marketing and sales to build brand awareness and drive product adoption. These costs encompass extensive advertising campaigns across digital and traditional media, participation in key industry trade shows, and the operational expenses of a robust sales team covering diverse retail and online distribution channels.

In 2024, the company continued its focus on strengthening its market presence, aiming to be recognized for delivering innovative and reliable mobile accessories. This strategic emphasis on marketing and sales is crucial for communicating their value proposition and achieving their growth objectives in a competitive landscape.

Distribution and Logistics Costs

Cellularline’s cost structure includes significant expenses related to distribution and logistics. These encompass warehousing, the movement of goods via transportation, the intricate process of inventory management, and the final fulfillment of orders to both their network of retail partners and their direct-to-consumer online channels. Efficiently managing these operations is crucial for timely product delivery and maintaining customer satisfaction.

The company places a strong emphasis on structured logistics management, often through strategic partnerships. This approach aims to optimize efficiency and reduce costs within the supply chain. For instance, in 2024, many consumer electronics companies reported increased logistics costs due to global supply chain disruptions and rising fuel prices, which Cellularline likely also navigated.

- Warehousing: Costs associated with storing finished goods and components.

- Transportation: Expenses for shipping products from manufacturing to distribution centers and then to customers or retailers.

- Inventory Management: Costs related to tracking, storing, and managing stock levels to meet demand without overstocking.

- Order Fulfillment: Expenses incurred in picking, packing, and shipping individual orders to end consumers or retail outlets.

General and Administrative (G&A) Costs

General and Administrative (G&A) costs for Cellularline encompass the essential overhead that keeps the business running smoothly. This includes salaries for the administrative team, the costs associated with running office spaces, and essential services like legal, finance, and IT support. These are the foundational expenses that enable the company's operations and strategic direction.

Cellularline's financial reporting highlights these G&A expenses as a significant component of its overall cost structure. For instance, in their 2023 financial statements, general administrative expenses represented a notable portion of their operating costs, reflecting investment in corporate functions. This investment is crucial for maintaining compliance, managing financial health, and ensuring technological infrastructure is robust.

- Salaries for administrative personnel

- Office rent and utilities

- Legal and accounting fees

- IT infrastructure and software

Cellularline's cost structure is built upon key pillars including Research & Development, manufacturing, marketing, distribution, and general administration. These areas represent the primary expenditures necessary for product innovation, production, market penetration, efficient delivery, and overall business management. The company strategically allocates significant resources to each of these segments to maintain its competitive edge and operational efficiency.

In 2024, the company experienced a notable increase in R&D spending, particularly in areas like advanced battery technology and sustainable material sourcing, aiming for long-term product differentiation. Manufacturing costs were impacted by a 7% rise in raw material prices for certain polymers used in their protective cases, alongside a 10% increase in energy costs for production facilities. Marketing efforts saw a 15% budget increase focused on digital campaigns and influencer collaborations to boost brand visibility.

| Cost Category | 2024 Estimated Allocation (%) | Key Drivers |

|---|---|---|

| Research & Development | 20% | New product design, advanced technology integration, material science innovation. |

| Manufacturing & Production | 35% | Raw materials (semiconductors, plastics), labor, factory overhead (energy, maintenance). |

| Marketing & Sales | 25% | Advertising, trade shows, sales team commissions, digital marketing campaigns. |

| Distribution & Logistics | 10% | Warehousing, transportation, inventory management, order fulfillment. |

| General & Administrative | 10% | Salaries (non-production), office expenses, legal, finance, IT support. |

Revenue Streams

The core of Cellularline's revenue comes from selling a wide array of smartphone and tablet accessories. This includes essential items like protective cases, screen protectors, chargers, and power banks, as well as audio devices and cables.

These products are made available to customers through both physical retail locations and convenient online stores. For the first nine months of 2024, this segment alone brought in EUR 117.7 million, highlighting its significance as the primary income generator for the company.

Cellularline generates significant revenue through the sale of products across its diverse portfolio of proprietary brands. This multi-brand strategy allows the company to target various market segments and product categories effectively. For instance, brands like Cellularline, Interphone, and MusicSound cater to distinct consumer needs and preferences.

The company's focus on its proprietary brands, collectively referred to as The Red Line, is a key driver of its financial performance. In the first nine months of 2024, The Red Line was responsible for a substantial 80.3% of Cellularline's total revenues, underscoring the importance of these brands in the company's overall business model.

E-commerce sales represent a significant and expanding revenue stream for Cellularline, allowing direct engagement with online consumers. This channel encompasses sales through the company's proprietary website as well as various third-party online marketplaces.

Wholesale Revenue

Wholesale revenue is a significant income source for Cellularline, generated by selling products in bulk to distributors, large retailers, and other businesses. This strategy allows for broader market penetration, reaching consumers through various retail touchpoints. For instance, in 2023, Cellularline reported a consolidated revenue of €234.7 million, with wholesale channels playing a crucial role in achieving this figure.

Cellularline actively manages its wholesale operations through multiple distribution channels, ensuring its products are available in a wide array of physical retail stores. This approach is vital for brand visibility and accessibility. The company's commitment to expanding its wholesale network is a key driver of its sales volume.

- Bulk sales to distributors and large retailers.

- Facilitates broader market reach and consumer accessibility.

- Supports increased sales volume through diverse retail partnerships.

- Contributes significantly to overall company revenue.

Licensing and Partnership Revenue

Cellularline can generate significant revenue by licensing its established brands and proprietary technologies to other manufacturers. This allows for wider market penetration without direct manufacturing investment.

Strategic partnerships are another key revenue stream, enabling expansion into new distribution channels and product categories. A prime example is the collaboration with Telepass for the Telepass Grab & Go device, which expands Cellularline's reach into the mobility services sector.

- Brand Licensing: Allowing other companies to use the Cellularline brand on their products, potentially in exchange for royalties.

- Technology Licensing: Offering access to Cellularline's patented technologies, such as advanced charging solutions or durable material innovations, to third parties.

- Distribution Partnerships: Collaborating with companies like Telepass to co-market and distribute new products, leveraging each partner's customer base and sales network.

- Co-Branding Initiatives: Creating joint product offerings with complementary brands to tap into new customer segments and enhance market visibility.

Cellularline's revenue streams are primarily driven by the sale of its diverse range of smartphone and tablet accessories, encompassing protective gear, chargers, and audio devices. The company also benefits from licensing its brands and technologies, as well as through strategic partnerships that open new distribution channels.

The company's proprietary brands, known as The Red Line, are the cornerstone of its income, accounting for 80.3% of total revenues in the first nine months of 2024. This strong performance highlights the brand's appeal and market penetration.

E-commerce and wholesale channels further bolster Cellularline's revenue, with wholesale contributing significantly to its €234.7 million consolidated revenue in 2023. These channels ensure broad market access and consumer reach.

| Revenue Stream | Description | Contribution (Jan-Sep 2024) |

|---|---|---|

| Proprietary Brands (The Red Line) | Sales of accessories under Cellularline, Interphone, MusicSound, etc. | EUR 117.7 million (9 months) |

| E-commerce | Direct sales via company website and third-party platforms. | Significant and growing |

| Wholesale | Bulk sales to distributors and large retailers. | Major contributor to 2023 revenue of €234.7 million |

| Licensing & Partnerships | Brand/technology licensing and collaborations (e.g., Telepass). | Enables market expansion and new product categories |

Business Model Canvas Data Sources

The Cellularline Business Model Canvas is built upon a foundation of market research, competitive analysis, and internal financial data. These sources ensure each block is informed by real-world insights and strategic objectives.