Cellularline Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cellularline Bundle

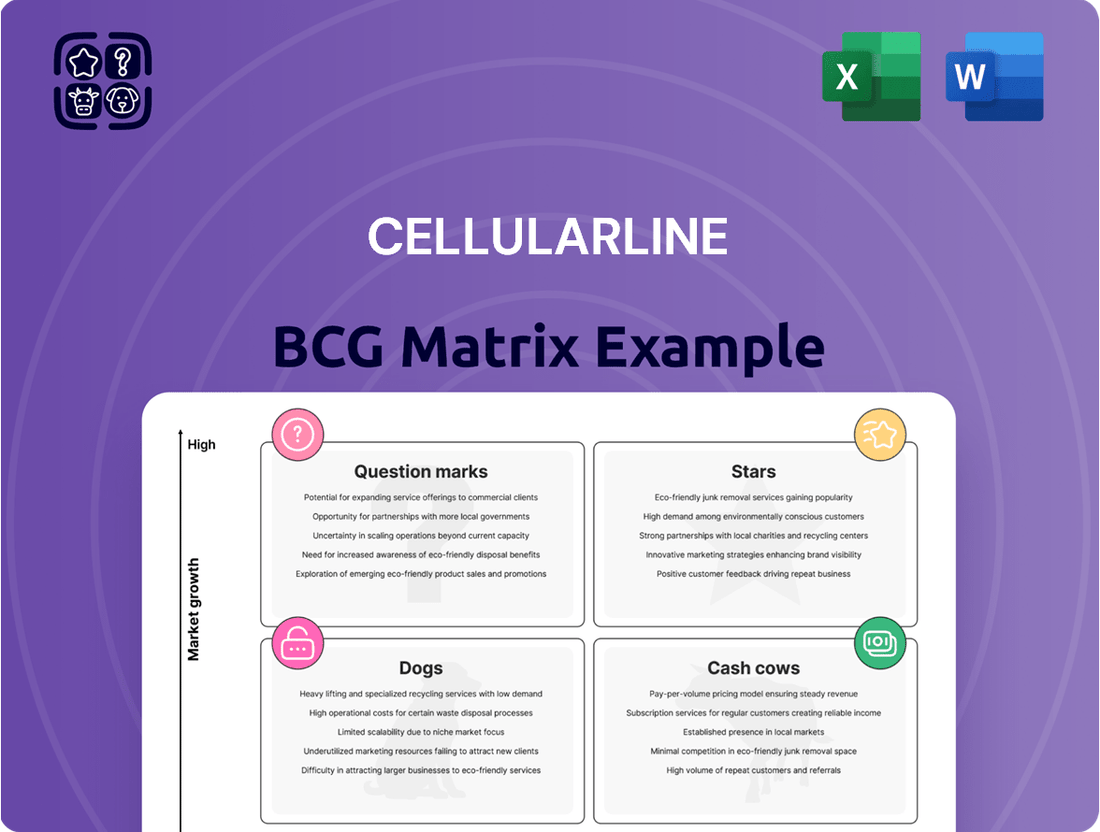

Curious about Cellularline's product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the actionable strategies that lie within the complete report.

Unlock the full potential of Cellularline's strategic positioning by purchasing the complete BCG Matrix. Gain in-depth analysis of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Ready to transform your understanding of Cellularline's market dynamics? The full BCG Matrix provides a comprehensive roadmap, detailing each quadrant's implications and offering clear pathways to optimize your product strategy. Invest in clarity and drive growth.

Stars

The Red Line, representing Cellularline's core business in smartphone, tablet accessories, and audio products, showed strong performance in 2024. This segment achieved a 5.2% year-on-year growth, bringing in €135.2 million.

This core segment accounts for a significant 82.3% of Cellularline's total revenue, highlighting its dominant position in the expanding mobile accessories market. The company's strategy of onboarding new, high-potential clients and forging key partnerships continues to solidify its Star status.

Sustained investment is crucial for the Red Line to maintain its market leadership and leverage opportunities for further expansion in this dynamic sector.

Cellularline's innovative audio devices, like their wireless headphones and speakers, are firmly positioned as Stars in the BCG matrix. This segment of the audio accessories market is experiencing robust growth, driven by consumer demand for high-quality, portable sound solutions. The company's strong brand and established distribution channels further bolster these products' success.

Cellularline's extensive range of protective cases for the newest smartphones, such as the iPhone 16 and Samsung Galaxy S25/S24, firmly places them in the Star category. This segment thrives due to the constant release of new phone models, ensuring a sustained demand for protective accessories in a rapidly expanding market. In 2024, the global smartphone accessory market was valued at approximately $250 billion and is projected to grow at a CAGR of over 7% through 2030, highlighting the robust growth of this sub-market.

AI-Powered Customization (Coverlab)

Coverlab's AI-powered customizer, launched in July 2025, is positioned as a Star in the BCG matrix. This innovative tool allows for real-time, AI-driven personalization of accessories, tapping into the burgeoning demand for bespoke products. The high-growth potential of AI-driven personalization suggests that with substantial investment, Coverlab could capture significant market share.

The market for personalized consumer electronics accessories is experiencing robust growth. For instance, the global market for custom phone cases alone was projected to reach over $2.5 billion by 2024, indicating a strong appetite for unique products. Coverlab's AI configurator directly addresses this trend by offering an unprecedented level of customization.

- AI-Driven Personalization: Coverlab's July 2025 launch of its AI-to-product configurator enables real-time, AI-driven customization of accessories like phone cases.

- Market Demand: This technology caters to the increasing consumer desire for personalized products, a segment showing significant expansion.

- Investment Potential: The innovative nature and high-growth potential of AI-driven personalization position Coverlab for rapid market share expansion with strategic investment.

Strategic Partnerships for New Devices

Cellularline's strategic alliance with Telepass, inked in July 2025, marks a significant move into the burgeoning electronic toll collection market with their 'Grab & Go' device. This partnership is poised to capitalize on a high-growth opportunity, leveraging Cellularline's established distribution channels.

The agreement grants Cellularline the responsibility for distributing the 'Grab & Go' device across more than 1,000 retail locations throughout Italy and broader European markets. This expansion into integrated travel solutions taps into a rapidly expanding sector, aiming to secure substantial market share.

- Market Entry: Partnership with Telepass for 'Grab & Go' electronic toll collection devices, initiated July 2025.

- Distribution Reach: Over 1,000 physical points of sale in Italy and Europe.

- Growth Potential: Targeting the expanding market for integrated travel and mobility solutions.

- Strategic Value: Leverages existing distribution network to capture share in a new product category.

Cellularline's Stars represent its most promising product lines with high market share in high-growth industries. These are the segments poised for significant future expansion and revenue generation. Continuous investment is key to maintaining their market leadership and capitalizing on emerging opportunities.

The Red Line, encompassing smartphone, tablet accessories, and audio products, achieved €135.2 million in 2024, a 5.2% year-on-year increase. This segment, representing 82.3% of total revenue, benefits from new client acquisitions and strategic partnerships, solidifying its Star status.

Cellularline's wireless audio devices are Stars due to robust market growth driven by demand for portable, high-quality sound. The company's strong brand and established distribution further enhance their competitive edge.

Protective cases for new smartphone models, like the iPhone 16 and Samsung Galaxy S25/S24, are Stars. The global smartphone accessory market, valued at approximately $250 billion in 2024 and projected to grow at over 7% CAGR through 2030, underscores the strong potential of this segment.

Coverlab's AI-powered customizer, launched in July 2025, is a Star, tapping into the demand for bespoke products. The personalized consumer electronics accessories market, with custom phone cases alone projected to exceed $2.5 billion by 2024, offers substantial growth prospects.

The Telepass partnership for 'Grab & Go' electronic toll collection devices, initiated in July 2025, positions Cellularline in a high-growth sector. Distribution across over 1,000 retail locations in Italy and Europe leverages existing channels to capture share in integrated travel solutions.

| Product Segment | BCG Category | 2024 Revenue (Millions €) | Growth Driver | Strategic Focus |

|---|---|---|---|---|

| Smartphone & Tablet Accessories | Star | 135.2 | New clients, key partnerships, constant new model releases | Maintain market leadership, expand distribution |

| Audio Devices (Wireless Headphones/Speakers) | Star | N/A (part of Red Line) | Consumer demand for quality, portable sound | Leverage brand, distribution |

| AI-Driven Personalization (Coverlab) | Star | N/A | Demand for bespoke products, AI innovation | Capture market share with investment |

| Electronic Toll Collection ('Grab & Go') | Star | N/A | Expanding mobility solutions market | Leverage distribution, expand reach |

What is included in the product

The Cellularline BCG Matrix analyzes product portfolio based on market growth and share.

Provides a clear, one-page overview of business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Cellularline's established power solutions, such as chargers and power banks, are prime examples of Cash Cows. These are indispensable accessories with a steady demand in a market that, while mature, remains quite stable.

These products hold a commanding market share and benefit from well-developed distribution networks. This combination allows Cellularline to generate significant and dependable cash flow, often with minimal need for extensive promotional spending, effectively leveraging their established position.

For instance, in 2023, the global market for mobile phone chargers was valued at approximately $25.5 billion, with power banks adding a substantial segment. Cellularline's strong presence in this area, particularly within its core European markets, contributes a consistent revenue stream that fuels other business ventures.

Screen protectors represent a significant Cash Cow for Cellularline within its product portfolio. This segment, characterized by a mature market, benefits from Cellularline's strong brand recognition and extensive distribution network, allowing it to maintain a substantial market share.

The consistent demand for device protection, driven by the ubiquity of smartphones and tablets, generates predictable and stable revenue for Cellularline. This mature market requires minimal marketing investment, contributing to healthy profit margins and reinforcing its Cash Cow status.

Basic connectivity cables, like USB-C and Lightning cords, are a prime example of Cellularline's Cash Cows. These are the everyday essentials for charging devices and moving data, and everyone needs them. The market for these cables is mature, meaning it's not growing rapidly, but demand remains consistently high.

Cellularline benefits from its widespread availability in both physical stores and online platforms. This broad reach allows them to sell a large volume of these necessary accessories. The result is a steady stream of income, providing reliable cash flow without the need for significant new investments to drive growth.

In 2024, the global market for mobile phone accessories, which includes charging cables, was projected to continue its steady performance. While specific figures for Cellularline's cable segment aren't publicly detailed, the overall accessory market demonstrated resilience, with charging solutions remaining a core component of consumer spending.

Interphone Motorcycle Accessories

The Interphone motorcycle accessories segment, operating under Cellularline's 'Black Line,' is a prime example of a Cash Cow. In 2024, this division achieved sales of €8.4 million, marking a substantial 14.8% year-over-year growth. This performance indicates a strong, stable revenue stream.

While the motorcycle accessory market might be more specialized and mature than broader consumer electronics, Cellularline's established brand recognition and market dominance within this niche allow for consistent profitability. The segment's ability to generate significant cash flow with relatively low investment is a hallmark of a Cash Cow.

- Sales in 2024: €8.4 million

- Year-over-year growth: 14.8%

- Market position: Niche, mature, but with established leadership

- Financial characteristic: Generates consistent profits and cash flow

Broad European Distribution Network

Cellularline's broad European distribution network, encompassing both physical retail and online channels, functions as a significant Cash Cow. This established infrastructure facilitates efficient market penetration for their diverse product range, leading to steady sales and strong market share in established categories. The network's maturity means it generates substantial cash flow with minimal need for new capital expenditure.

- European Reach: Cellularline boasts a presence in over 60,000 retail points of sale across Europe.

- Online Presence: The company also maintains a robust online sales channel, catering to a growing digital consumer base.

- Revenue Generation: This extensive network is a primary driver of Cellularline's consistent revenue, particularly for its established accessory lines.

- Cost Efficiency: Leveraging existing distribution agreements minimizes incremental costs for launching new, albeit related, products.

Cellularline's established power solutions, like chargers and power banks, are prime examples of Cash Cows. These are indispensable accessories with a steady demand in a market that, while mature, remains quite stable, generating significant and dependable cash flow with minimal promotional spending.

Screen protectors also represent a significant Cash Cow, benefiting from Cellularline's strong brand recognition and extensive distribution network, leading to predictable and stable revenue with healthy profit margins due to minimal marketing investment.

Basic connectivity cables, such as USB-C and Lightning cords, are another key Cash Cow. Their widespread availability and consistent high demand in a mature market provide a steady stream of income, offering reliable cash flow without the need for substantial new investments.

The Interphone motorcycle accessories segment, a part of Cellularline's Black Line, demonstrated strong performance in 2024, achieving €8.4 million in sales with 14.8% year-over-year growth, solidifying its position as a profitable Cash Cow within its niche market.

| Product Category | Market Status | Cellularline's Position | Financial Contribution |

| Chargers & Power Banks | Mature, Stable | High Market Share, Strong Distribution | Consistent Revenue, Low Investment |

| Screen Protectors | Mature | Strong Brand Recognition, Extensive Distribution | Predictable Revenue, Healthy Margins |

| Connectivity Cables | Mature, High Demand | Widespread Availability | Steady Income, Reliable Cash Flow |

| Interphone Motorcycle Accessories | Niche, Mature | Established Leadership | Significant Profitability, Strong Growth (2024: €8.4M sales, +14.8% YoY) |

Full Transparency, Always

Cellularline BCG Matrix

The preview you are currently viewing is the exact, fully formatted Cellularline BCG Matrix report you will receive upon purchase. This comprehensive document, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis. You can confidently expect the same high-quality, actionable information that will be delivered directly to you, allowing for immediate application in your business planning and decision-making processes.

Dogs

The Blue Line segment, representing Cellularline's third-party brand offerings in Italy, has unfortunately shown a significant downturn. Sales saw a notable drop in 2024, and the challenges continued into the first quarter of 2025.

Specifically, revenues within Italy for this segment plummeted by 44.6% in Q1 2025. This steep decline points to a low market share coupled with negative growth, firmly placing the Blue Line in the 'Dog' category of the BCG matrix.

Such a position suggests that this part of the business may be consuming valuable capital without generating adequate returns, potentially hindering overall company performance.

Obsolete or niche legacy accessories represent products that have fallen out of favor due to evolving technology or shifting consumer tastes. Think of older charging cables for devices no longer in widespread use or specialized phone cases for discontinued models. These items often occupy a small slice of a shrinking market, contributing little to overall revenue and potentially costing money to store.

In 2024, the market for accessories tied to technologies like 30-pin connectors or older Bluetooth standards has significantly diminished. Cellularline, like many in the industry, faces the challenge of managing inventory for such items. While precise figures for specific legacy accessory lines are proprietary, the broader trend shows a decline in demand for non-USB-C or non-MagSafe compatible products, impacting their market share and revenue contribution.

Certain basic, undifferentiated accessories, like generic charging cables or basic screen protectors, could be considered Dogs for Cellularline. The market for these items is incredibly saturated, with countless low-cost alternatives readily available, leaving little room for differentiation. In 2024, the global market for smartphone accessories, excluding smartphones themselves, was valued at approximately $250 billion, but the segment for these highly commoditized products likely saw single-digit growth and intense price competition.

Products from Unsuccessful Acquisitions

Products stemming from unsuccessful acquisitions by Cellularline would fall into the Dogs category of the BCG Matrix. These are typically acquired brands or product lines that have failed to gain significant market share or demonstrate growth potential within the company's broader offerings. For instance, if Cellularline acquired a smaller accessory brand that subsequently saw its market share decline, it would represent a Dog.

Such products are characterized by low growth and low market share, meaning they are not expanding rapidly and are not leaders in their respective segments. These underperforming assets can drain resources without generating substantial returns, making them prime candidates for divestment or strategic repositioning.

- Low Market Share: Acquired products that fail to capture a meaningful portion of their target market.

- Minimal Growth: These products exhibit little to no sales expansion, indicating a lack of market demand or effective strategy.

- Resource Drain: They tie up capital and management attention that could be better allocated to more promising ventures.

- Potential Divestment: Often considered for sale or discontinuation to streamline the product portfolio.

Niche Products with Declining Demand

Niche products with declining demand, often categorized as Dogs in the BCG Matrix, represent items that cater to specific, often outdated, mobile device models or technologies. For instance, accessories designed exclusively for older smartphone generations like the iPhone 6 or specific flip phones would fall into this category. As the mobile technology landscape rapidly evolves, these products face a natural contraction in their market share and growth potential.

The demand for these niche accessories is diminishing because consumers are consistently upgrading to newer devices with different specifications and connectivity standards. For example, the market for 30-pin iPhone connectors has significantly shrunk as Apple transitioned to the Lightning and then USB-C ports. By 2024, the global market for accessories specifically for devices older than five years is projected to be a fraction of its peak, with many manufacturers ceasing production.

- Shrinking Market Share: Products tied to fading mobile trends, such as cases for discontinued feature phones, see their market share dwindle as user bases migrate to smartphones.

- Low Growth Potential: The inherent nature of catering to outdated technology limits any significant future growth prospects for these items.

- Reduced Investment Appeal: Companies often divest or discontinue production of these "Dog" products to reallocate resources towards more promising ventures in their portfolio.

- Example: Accessories for devices like the Samsung Galaxy S5, released in 2014, are now considered niche "Dog" products with very limited demand in 2024.

The Blue Line segment, representing Cellularline's third-party brand offerings in Italy, has unfortunately shown a significant downturn. Sales saw a notable drop in 2024, and the challenges continued into the first quarter of 2025. Revenues within Italy for this segment plummeted by 44.6% in Q1 2025, firmly placing it in the 'Dog' category of the BCG matrix due to low market share and negative growth.

This means the Blue Line may be consuming valuable capital without generating adequate returns, potentially hindering overall company performance. Products like obsolete or niche legacy accessories, such as older charging cables or cases for discontinued models, fit this description. The market for these items has significantly diminished by 2024, with many manufacturers ceasing production.

Generic, undifferentiated accessories, like basic charging cables, also fall into the Dog category due to an incredibly saturated market and intense price competition. In 2024, this segment likely saw only single-digit growth within the broader $250 billion global smartphone accessory market.

Products from unsuccessful acquisitions or niche items tied to fading mobile trends, like accessories for the Samsung Galaxy S5 (released in 2014), are also considered Dogs. These underperforming assets drain resources and are often candidates for divestment.

Question Marks

Emerging smart home integrations represent a classic Question Mark for Cellularline. While the smart home market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 10% through 2028, Cellularline's current presence in this highly competitive and rapidly evolving sector is likely minimal.

This necessitates significant investment in research, development, and marketing to build brand recognition and secure market share against established tech giants and specialized smart home providers. Without a clear strategy and substantial capital allocation, these ventures risk remaining niche or failing to gain traction.

Advanced wearable technology accessories, like AR glasses or advanced health trackers, represent a nascent but rapidly expanding market. Cellularline's position in this segment would likely be that of a new entrant with significant growth potential. For instance, the global AR glasses market was valued at approximately $3.2 billion in 2023 and is projected to reach $68.7 billion by 2030, indicating a substantial opportunity.

Cellularline's dedication to sustainability, as detailed in their 2023 ESG report, positions them to potentially launch eco-friendly accessory lines. These would likely be considered question marks in the BCG matrix, as they represent a new venture into a growing market for sustainable products.

The challenge for these new eco-friendly lines lies in capturing market share. The global market for sustainable electronics accessories was valued at approximately $10 billion in 2023 and is projected to grow significantly. Cellularline would need to compete with established eco-conscious brands and larger players, necessitating substantial investment in marketing and product development to gain traction.

Specialized Gaming Accessories for Mobile

The burgeoning mobile gaming sector is fueling a significant demand for specialized accessories like advanced controllers and cooling systems. Cellularline's entry into this high-growth market with highly specialized gaming accessories would likely position them as a question mark in the BCG matrix, requiring substantial investment to gain traction.

The mobile gaming accessories market, projected to reach over $10 billion globally by 2025, presents a substantial opportunity. However, Cellularline would need to navigate intense competition from established players and innovative startups to carve out a significant market share. This necessitates a strategic approach focusing on distinct product features and targeted marketing campaigns.

- Market Growth: The global mobile gaming market is expected to continue its rapid expansion, with accessories playing a crucial role in enhancing the player experience.

- Competitive Landscape: Cellularline would face established brands and emerging innovators, demanding a clear differentiation strategy.

- Investment Needs: Significant R&D and marketing investment would be crucial for success in this niche.

- Potential for Stars: With the right strategy, these specialized accessories could transition from question marks to stars if market share is successfully captured.

International Expansion into Untapped Markets

Cellularline's aggressive expansion into new, high-growth geographical markets where its brand recognition and market share are currently minimal would place these ventures in the Question Marks category of the BCG Matrix. This strategic move necessitates substantial upfront investment in establishing distribution networks, marketing campaigns, and local partnerships to build brand awareness and capture market share. For instance, entering a market like India, which is projected to see a significant increase in smartphone accessory demand, would require careful planning and execution.

These new markets, while offering high growth potential, carry inherent risks due to the lack of established customer base and competitive landscape. Cellularline's success in these areas hinges on its ability to adapt its product offerings and marketing strategies to local preferences and economic conditions. The company's prior success in established European markets, such as Italy where it holds a significant share, provides a foundation, but replicating this in nascent markets presents a different challenge.

- High Growth Potential: Untapped markets often exhibit rapid economic development and increasing consumer disposable income, driving demand for mobile accessories.

- Low Market Share: Initial entry into these markets means Cellularline would have minimal existing customer base and brand loyalty.

- Significant Investment Required: substantial capital is needed for market research, product localization, distribution channel setup, and aggressive marketing to gain traction.

- Uncertain Future Success: The outcome of these expansion efforts is uncertain, with potential to become Stars if successful, or Dogs if unable to gain market share.

Cellularline's ventures into emerging smart home technology and advanced wearable accessories represent significant Question Marks. These areas, while experiencing rapid growth—the smart home market is projected to exceed $150 billion by 2028, and AR glasses are expected to reach $68.7 billion by 2030—require substantial investment for Cellularline to establish a foothold against established players.

Similarly, the company's potential new lines of eco-friendly accessories and specialized mobile gaming peripherals are also Question Marks. The sustainable electronics market, valued at around $10 billion in 2023, and the mobile gaming accessories market, projected to surpass $10 billion by 2025, offer considerable upside but demand significant R&D and marketing capital to compete effectively.

Geographical expansion into new, high-growth markets also falls into the Question Mark category. While markets like India show strong potential for smartphone accessory demand, Cellularline faces the challenge of building brand awareness and distribution networks from a low initial market share, necessitating considerable investment to overcome competitive hurdles and adapt to local preferences.

| Category | Market Trend | Cellularline's Position | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Smart Home Tech | High Growth (CAGR >10% through 2028) | Minimal Presence, New Entrant | High (R&D, Marketing) | Star or Dog |

| Advanced Wearables (AR Glasses) | Rapid Expansion ($3.2B in 2023 to $68.7B by 2030) | Nascent, High Potential | High (R&D, Brand Building) | Star or Dog |

| Eco-Friendly Accessories | Growing Demand ($10B in 2023) | New Venture, Competitive Landscape | High (Marketing, Product Dev) | Star or Dog |

| Mobile Gaming Accessories | High Growth (>$10B by 2025) | New Entrant, Niche Focus | High (R&D, Differentiation) | Star or Dog |

| New Geographical Markets | Increasing Demand (e.g., India) | Low Market Share, Untapped | High (Distribution, Marketing) | Star or Dog |

BCG Matrix Data Sources

Our Cellularline BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.