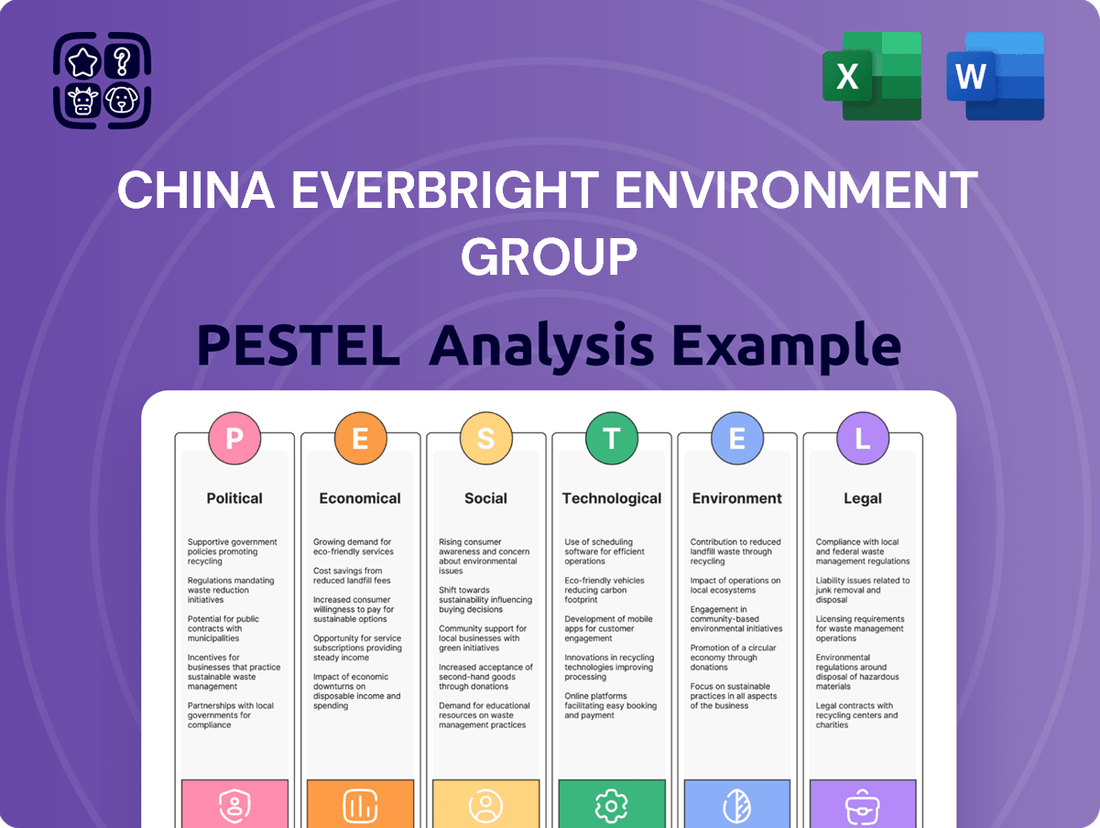

China Everbright Environment Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Everbright Environment Group Bundle

Navigate the complex landscape surrounding China Everbright Environment Group with our comprehensive PESTLE analysis. Understand how evolving political stability, economic growth, technological advancements, social shifts, environmental regulations, and legal frameworks are shaping its operations. Gain a critical advantage by anticipating market dynamics and identifying strategic opportunities. Download the full version now to unlock actionable intelligence and drive informed decision-making for your business.

Political factors

The Chinese government's unwavering focus on ecological civilization and green development provides substantial backing for companies like China Everbright Environment. This commitment materializes as supportive policies, financial subsidies, and favorable treatment for environmental protection enterprises.

Key national strategies such as the 14th Five-Year Plan (2021-2025) and numerous energy-saving and carbon reduction action plans directly fuel the company's operations. For instance, targets for increasing non-fossil energy consumption, which aims for around 20% by 2025, and reducing carbon intensity create a robust demand for China Everbright Environment's services.

China's evolving environmental policies are a major political factor for China Everbright Environment Group. For example, the government's ongoing push for cleaner energy and stricter waste management regulations, like those emphasizing waste reduction and improved treatment standards, directly influences the company's strategic direction and investment priorities. These policy shifts can either accelerate project development or necessitate adjustments to existing operational frameworks.

The nation's renewable energy targets, particularly for solar and wind power, are crucial. In 2024, China continued to lead global renewable energy deployment, with significant capacity additions expected to continue through 2025. This creates a favorable environment for Everbright's renewable energy segment, potentially boosting its project pipeline and revenue streams, provided it can align with evolving grid integration policies and market-based pricing mechanisms.

Local government policies also play a vital role, especially concerning waste-to-energy projects. Mandates for advanced waste sorting and treatment technologies, or changes in tariff structures for waste processing, require the company to remain agile. For instance, a city implementing a new waste classification system could increase the volume and quality of feedstock available for Everbright's waste-to-energy plants, presenting a direct operational advantage.

China Everbright Environment's global expansion is intrinsically linked to the geopolitical landscape. The group's overseas projects are directly influenced by the state of diplomatic relations between China and the countries where it operates. For instance, successful ventures often align with periods of strong bilateral ties and supportive policies, such as those stemming from the Belt and Road Initiative.

Conversely, geopolitical tensions can present significant hurdles. These tensions might manifest as increased scrutiny of Chinese investments, potential trade disputes impacting project costs, or even disruptions to ongoing operations. As of early 2025, China's relationships with various key trading partners remain dynamic, creating an environment where the political climate can swiftly alter the risk profile of international projects.

Regulatory Changes Regarding Emissions and Pollution

China Everbright Environment Group's operations are significantly shaped by evolving environmental policies. Stricter regulations and new emission standards, such as those targeting fine particulate matter (PM2.5) and sulfur dioxide (SO2), directly impact operational costs and necessitate investments in advanced pollution control technologies. For instance, by the end of 2023, China had implemented updated air pollutant emission standards for various industries, requiring substantial upgrades for facilities to comply. The enhanced enforcement mechanisms, including increased fines and potential shutdowns for non-compliance, further underscore the importance of proactive environmental management.

The ongoing development of China's Ecological and Environmental Protection Code is a key factor. This consolidation of existing environmental laws and the integration of new concerns, like carbon emissions and biodiversity, creates a dynamic compliance landscape. Companies must remain agile, adapting to new requirements that often emerge with little lead time. This legislative push is designed to drive sustainable development and requires continuous monitoring and adjustment of business practices to ensure adherence.

Key regulatory shifts impacting China Everbright Environment Group include:

- Updated Emission Standards: Implementation of stricter limits on pollutants like PM2.5, SO2, and NOx across various industrial sectors.

- Enhanced Enforcement: Increased penalties for environmental violations and more frequent inspections by environmental protection bureaus.

- Carbon Neutrality Goals: National targets for peak carbon emissions before 2030 and carbon neutrality before 2060 are driving policies that favor greener technologies and penalize high-carbon operations.

- Ecological and Environmental Protection Code: A comprehensive legal framework consolidating and modernizing environmental regulations, demanding continuous adaptation.

State-Owned Enterprise (SOE) Reform and Governance

China Everbright Environment Group, as a significant state-owned enterprise (SOE), is directly impacted by the ongoing reforms within China's SOE sector. These reforms, aimed at enhancing efficiency and market responsiveness, can reshape governance structures and strategic priorities for companies like Everbright Environment. For instance, the push for mixed-ownership reforms, which saw significant progress in 2024, could influence Everbright Environment's capital access and operational autonomy. The government's focus in 2024 has also been on improving SOE profitability and reducing debt levels, a trend likely to continue into 2025, potentially creating both opportunities and challenges for the group's expansion and investment plans.

The governance framework for SOEs is evolving, with increased emphasis on board independence and performance-based remuneration. This shift aims to align SOE operations more closely with market principles and boost overall competitiveness. As of early 2025, regulatory bodies are scrutinizing SOE compliance and accountability more rigorously, meaning Everbright Environment must demonstrate robust corporate governance to maintain investor confidence and regulatory approval for its projects. These initiatives are part of a broader national strategy to modernize state-owned assets and ensure they contribute effectively to economic growth and sustainable development.

- SOE Reform Focus: Efficiency improvements and market orientation are key drivers of SOE reform, influencing Everbright Environment's operational strategies.

- Capital Access: Mixed-ownership reforms and fiscal policies directly affect the group's ability to secure funding for its environmental projects.

- Governance Standards: Stricter governance requirements are being implemented across SOEs, demanding greater transparency and accountability from Everbright Environment.

- Performance Metrics: SOE performance is increasingly judged on profitability and debt reduction, impacting Everbright Environment's financial management.

China's political landscape heavily favors environmental protection, with the government's commitment to ecological civilization driving supportive policies and subsidies for companies like China Everbright Environment. National strategies, such as the 14th Five-Year Plan, directly bolster the company's operations by setting targets for renewable energy and carbon reduction, thus creating significant demand for its services.

The company's performance is intrinsically linked to the evolving regulatory environment, with stricter waste management and cleaner energy mandates directly shaping its strategic investments. For instance, by the end of 2023, China had updated emission standards, necessitating upgrades for compliance and underscoring the importance of proactive environmental management.

As a state-owned enterprise, China Everbright Environment is influenced by ongoing SOE reforms focused on efficiency and market responsiveness, with mixed-ownership reforms progressing in 2024 potentially impacting its capital access and autonomy.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing China Everbright Environment Group's operations and strategic direction.

It provides a comprehensive understanding of the external landscape to identify potential opportunities and mitigate risks for sustainable growth.

The PESTLE analysis for China Everbright Environment Group provides a clear roadmap for navigating complex external forces, acting as a pain point reliever by offering actionable insights into political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks, thus simplifying strategic planning.

Economic factors

China's remarkable economic expansion, consistently outpacing global averages, fuels an insatiable demand for environmental solutions. This growth, projected to continue at a solid pace through 2024 and into 2025, directly translates into increased need for services like waste-to-energy, water purification, and soil remediation, creating a fertile ground for companies like China Everbright Environment.

Rapid urbanization is a key driver, with a significant portion of China's population continuing to migrate to cities, straining existing infrastructure and necessitating advanced environmental management. By 2023, over 65% of China's population resided in urban areas, a figure expected to climb further, amplifying the market for integrated environmental services.

This sustained economic and urban development provides China Everbright Environment with a vast and growing domestic market. The company's ability to offer comprehensive solutions for waste, water, and air pollution control aligns perfectly with the evolving needs of these expanding urban centers, ensuring a strong demand for its offerings.

Inflation and rising raw material costs present a significant challenge for China Everbright Environment Group. For instance, increases in the prices of steel, cement, and other essential construction materials directly impact the capital expenditure for new projects. In 2024, global commodity prices have seen volatility, with some key inputs experiencing mid-single-digit percentage increases year-on-year, directly affecting project budgets.

These cost fluctuations can squeeze profit margins on long-term operational contracts, where revenue is often fixed or subject to slower adjustments. Managing supply chain risks and optimizing procurement strategies are therefore paramount for maintaining project profitability. For example, securing long-term supply agreements for critical components can help mitigate the impact of sudden price hikes.

Energy costs are another crucial factor, especially for operations like waste-to-energy plants. Fluctuations in global energy markets, influenced by geopolitical events and supply/demand dynamics, can significantly alter operating expenses. The group’s ability to hedge energy costs or invest in more energy-efficient technologies will be key to navigating these inflationary pressures throughout 2024 and into 2025.

Environmental projects, like those undertaken by China Everbright Environment Group, demand substantial capital. Therefore, securing access to green finance, loans, and bonds is absolutely vital for their investment and expansion strategies. For instance, in 2023, the outstanding balance of green loans in China reached a significant 13.05 trillion yuan, indicating a robust market for such financing.

Fluctuations in interest rates directly impact the cost of capital for these projects. Furthermore, the availability of green financial instruments, actively promoted by institutions like the People's Bank of China, plays a critical role in determining project feasibility. The PBOC's efforts to guide financial institutions towards supporting green development have been a key driver in this sector.

Government Subsidies and Incentives for Green Industries

The Chinese government's commitment to environmental protection translates into substantial financial backing for green sectors. These policies are crucial for companies like China Everbright Environment Group, as they directly impact project profitability and investment strategies.

In 2024, China continued to emphasize its green transition, with significant fiscal support allocated to sectors like waste-to-energy and water treatment. For instance, the National Development and Reform Commission (NDRC) has highlighted ongoing support mechanisms for renewable energy projects, which often include preferential tax rates and direct subsidies, making these ventures more economically attractive.

These government incentives play a pivotal role in de-risking investments and encouraging the adoption of advanced environmental technologies. Such financial support can significantly lower operational costs and improve the return on investment for large-scale infrastructure projects, directly benefiting companies operating within these domains.

- Subsidies for Waste-to-Energy: Continued financial support for waste-to-energy projects, crucial for China's waste management goals.

- Tax Breaks for Water Treatment: Preferential tax policies aimed at encouraging investment in water pollution control and water resource management.

- Renewable Energy Incentives: Ongoing feed-in tariffs and tax credits for solar and wind power projects, bolstering the renewable energy sector.

- Green Bonds and Financing: Government promotion of green financial instruments to facilitate capital flow into environmentally sound projects.

Impact of Global Economic Slowdowns

While China Everbright Environment Group primarily serves the Chinese domestic market, a global economic slowdown can still exert indirect pressure. Reduced industrial output worldwide might translate to lower demand for industrial waste treatment services, even for a company with a strong domestic focus, as global supply chains and manufacturing trends can ripple through. For instance, if key export industries in China experience a downturn due to weaker international demand, this could indirectly affect the volume of industrial waste generated domestically. Furthermore, tighter international financing conditions, a common feature of global slowdowns, could make it more expensive or difficult for Everbright Environment to secure capital for its significant overseas expansion projects, potentially impacting growth strategies. In 2024, the International Monetary Fund (IMF) projected global growth to be 3.2%, a modest figure that indicates a degree of ongoing economic caution worldwide.

The impact on China Everbright Environment Group from a global economic slowdown can be categorized as follows:

- Indirect Demand Reduction: A worldwide economic contraction could lead to decreased manufacturing activity in China, thereby lowering the demand for industrial waste treatment services.

- Financing Constraints: Global financial tightening during a slowdown can increase the cost of borrowing and limit access to capital for Everbright Environment's international investments and operations.

- Supply Chain Disruptions: Widespread economic downturns often coincide with greater supply chain volatility, which could impact the availability and cost of equipment and materials needed for environmental projects.

- Investor Sentiment: A generally risk-averse environment during global slowdowns might negatively affect investor sentiment towards companies with significant capital expenditure plans, including those in the environmental sector.

China's robust economic growth, projected to continue through 2024-2025, directly fuels demand for environmental solutions like waste-to-energy and water purification. Rapid urbanization, with over 65% of China's population in cities by 2023, further intensifies this need, creating a substantial market for China Everbright Environment's services.

Preview Before You Purchase

China Everbright Environment Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of China Everbright Environment Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations. Understanding these elements is crucial for stakeholders to navigate the company's strategic landscape effectively. The insights provided will equip you with a comprehensive view of the opportunities and challenges facing this key player in the environmental sector.

Sociological factors

Public awareness regarding environmental issues in China has significantly escalated. By 2024, surveys indicated that over 70% of urban residents expressed strong concern about air and water quality, driving demand for improved environmental services. This heightened social consciousness translates directly into increased pressure on government bodies to implement and enforce stricter environmental regulations.

This growing public demand is a key driver for China Everbright Environment Group. As citizens increasingly prioritize cleaner living conditions, the market for comprehensive waste management, water treatment, and air pollution control solutions expands. The company's 2024 financial reports showed a notable uptick in contracts related to municipal waste-to-energy projects, directly reflecting this societal trend.

The availability of a skilled workforce, encompassing engineers, technicians, and project managers, is fundamental to the successful execution and ongoing management of intricate environmental infrastructure projects for companies like China Everbright Environment Group. A robust talent pool ensures efficient project delivery and operational excellence.

Labor costs represent a significant operational expenditure. In 2024, average wages for skilled construction and engineering roles in China continued to see moderate increases, influenced by demand and inflation. China Everbright Environment Group must factor these rising costs into its project budgeting and financial planning to maintain profitability.

Attracting and retaining specialized talent in environmental engineering and management is a key challenge. As the green economy expands, competition for experienced professionals intensifies. The group's ability to offer competitive compensation, continuous training, and challenging career opportunities will be vital for securing the necessary expertise.

The 'Not In My Backyard' (NIMBY) sentiment remains a significant hurdle for China Everbright Environment Group, particularly concerning the siting of new waste-to-energy facilities. While China's rapid urbanization drives demand for these services, local communities often express concerns about potential environmental impacts and property values. For instance, in 2023, several projects faced localized opposition, leading to minor delays in commissioning.

To counter this, proactive community engagement is crucial. China Everbright Environment Group has been increasingly investing in transparent communication strategies, holding public consultations and providing detailed information about project safety and environmental monitoring. This approach aims to build trust and foster local acceptance, which is vital for smooth project execution.

The group's commitment to engaging with local stakeholders is reflected in its ongoing efforts to address community concerns. By clearly articulating the benefits, such as improved waste management and local employment opportunities, and demonstrating robust environmental safeguards, they seek to mitigate NIMBY reactions. This focus on social license to operate is becoming a key factor in project success rates.

Changing Consumption Patterns and Waste Generation

China's evolving consumer habits are significantly impacting waste generation. As disposable incomes rise and lifestyle preferences shift towards convenience, the volume and complexity of municipal solid waste (MSW) are increasing. This trend necessitates adaptive strategies for waste treatment facilities.

For China Everbright Environment Group, this means adapting its technologies and services to manage changing waste streams effectively. The company needs to be prepared for shifts in the types of materials requiring disposal, such as increased packaging waste and electronic waste.

- Increasing MSW Volume: China's MSW generation reached approximately 240 million tons in 2023, a figure projected to continue its upward trajectory due to changing consumption patterns.

- Shifting Waste Composition: The proportion of plastic and paper packaging in MSW is on the rise, posing new challenges for sorting and recycling processes.

- Demand for Advanced Treatment: Growing environmental awareness fuels demand for more sophisticated waste-to-energy and advanced recycling solutions that can handle diverse waste inputs.

- E-Waste Growth: The rapid adoption of electronics contributes to a growing stream of electronic waste, requiring specialized handling and disposal methods.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) performance are increasingly shaping how companies like China Everbright Environment Group operate and are perceived. Demonstrating a commitment to these principles directly impacts the group's reputation and its ability to foster positive relationships with various stakeholders, from investors to the general public.

Adhering to high ESG standards is not just about compliance; it actively builds investor confidence and strengthens public trust. For instance, in 2023, China Everbright Environment Group reported that its ESG performance was recognized by several rating agencies, contributing to its overall market standing. This commitment can lead to better access to capital and a stronger brand image.

- Enhanced Investor Attraction: A strong ESG profile can make the company more attractive to a growing pool of socially responsible investors, a trend that saw significant growth in Asian markets throughout 2024.

- Improved Stakeholder Engagement: Meeting societal expectations fosters trust and can lead to smoother engagement with local communities and regulatory bodies.

- Risk Mitigation: Proactive CSR and ESG initiatives help mitigate reputational risks associated with environmental or social controversies.

- Long-term Value Creation: Companies with strong ESG practices are often viewed as more sustainable and resilient, potentially leading to better long-term financial performance.

Public concern over environmental quality in China has surged, with over 70% of urban dwellers in 2024 expressing significant worry about air and water pollution, directly fueling demand for enhanced environmental services and pushing for stricter government regulations.

This societal shift positively impacts China Everbright Environment Group, as increased environmental awareness broadens the market for waste management and pollution control solutions, evidenced by their 2024 reports showing growth in waste-to-energy contracts.

Technological factors

China Everbright Environment Group's competitive standing is significantly influenced by ongoing advancements in waste treatment and energy recovery. Innovations like higher incineration efficiency, reduced emissions, and better energy capture are crucial. For instance, by the end of 2023, the company operated 107 waste-to-energy projects, demonstrating its commitment to scaling these advanced solutions.

The company's strategic focus includes substantial investment in research and development to stay ahead of evolving environmental regulations and market demands. This proactive approach ensures they can offer state-of-the-art waste management services. In 2023, their capital expenditure on technological upgrades and new project development reflected this dedication to innovation.

Technological advancements in water purification are a major driver for companies like China Everbright Environment Group. Breakthroughs in membrane filtration, for instance, are making water treatment more efficient and cost-effective, crucial for tackling China's water quality challenges. These innovations, coupled with biological treatment and advanced oxidation processes, are key to removing increasingly complex pollutants.

Furthermore, the field of environmental remediation is seeing significant progress. New methods like bioremediation, which uses living organisms to clean up contaminated sites, and nanoremediation, employing nanoparticles for pollutant removal, are boosting cleanup efficiency. These technologies are vital for addressing legacy pollution and ensuring sustainable water resource management.

In 2023, the global water and wastewater treatment market was valued at approximately $600 billion, with Asia-Pacific, including China, representing a significant portion of this. China's own investment in water infrastructure and technology saw continued growth, driven by stringent environmental regulations and a growing demand for clean water, directly benefiting companies operating in this sector.

China Everbright Environment Group is leveraging digitalization to streamline its operations. The company is implementing smart environmental management solutions, which include digital tools for project oversight, optimizing how facilities run, and constant tracking of environmental infrastructure. This focus on smart technology, particularly in areas like smart water management systems, is a growing trend, boosting efficiency and cutting expenses.

Research and Development (R&D) Investment and Intellectual Property

China Everbright Environment Group's commitment to research and development is a cornerstone for innovation. By investing heavily in R&D, the company aims to create unique technologies and solutions that give it a competitive edge. This focus on proprietary advancements is key to maintaining market leadership.

The company's strategic emphasis on a 'Research Ecosystem' underscores its dedication to fostering a culture of continuous technological improvement. This ecosystem likely involves collaborations and internal initiatives designed to accelerate the development and deployment of new environmental solutions.

Securing intellectual property is paramount, as it protects the company's innovations and provides a foundation for future growth. This allows China Everbright Environment to capitalize on its technological advancements and prevent competitors from replicating its proprietary assets.

While specific R&D investment figures for 2024 and projections for 2025 are not publicly detailed, the company's consistent focus on technological advancement in its environmental services suggests ongoing significant allocation to R&D. For instance, in 2023, the company reported substantial capital expenditures that likely included R&D components, reflecting its strategic priorities.

- R&D Investment: Crucial for proprietary technology development and competitive advantage.

- Research Ecosystem: Demonstrates a structured approach to innovation.

- Intellectual Property: Key to protecting innovations and market position.

- Strategic Focus: Ongoing investment likely supports technological leadership in environmental services.

Competition from New Technologies and Business Models

The environmental protection industry is incredibly fast-paced, with new technologies and innovative business approaches constantly appearing. China Everbright Environment needs to stay on top of these changes, actively evaluating and potentially adopting emerging solutions to maintain its competitive edge. This includes looking at advancements like next-generation energy storage systems or specialized waste battery recycling processes, which are gaining traction in the market.

The company must be agile in responding to these technological shifts. For example, the global market for battery recycling is projected to grow significantly, with some estimates suggesting it could reach over $30 billion by 2030. Companies that can efficiently process and extract valuable materials from spent batteries will likely see a competitive advantage. Similarly, advancements in carbon capture technologies or more efficient waste-to-energy conversion methods could reshape the landscape, requiring strategic investment and adaptation from established players like China Everbright Environment.

- Emerging Technologies: Continuous evaluation of innovations in areas like advanced materials for pollution control, AI-driven waste sorting, and novel wastewater treatment methods.

- New Business Models: Assessing opportunities in circular economy initiatives, product-as-a-service for environmental equipment, and data-driven environmental monitoring.

- Market Dynamics: Staying abreast of the rapid growth in renewable energy integration and the increasing demand for specialized waste management solutions, such as those for electronic waste and critical minerals recovery.

Technological advancements are reshaping China Everbright Environment Group's operational landscape. The company actively invests in R&D to enhance waste-to-energy efficiency and emission control, operating 107 such projects by the end of 2023. Innovations in water purification, like advanced membrane filtration, are critical for addressing China's water quality issues, a market valued at approximately $600 billion globally in 2023.

Digitalization is a key focus, with smart environmental management solutions improving operational oversight and efficiency. The company's commitment to a 'Research Ecosystem' and securing intellectual property highlights a strategic drive for proprietary technological development. This proactive stance is essential for navigating the fast-paced environmental protection industry, which sees constant emergence of new solutions.

Emerging technologies such as AI-driven waste sorting and novel wastewater treatment methods are being evaluated to maintain a competitive edge. The growing market for battery recycling, projected to exceed $30 billion by 2030, presents significant opportunities for companies adept at processing spent batteries and recovering valuable materials.

Legal factors

China's commitment to environmental protection is evident in its evolving legal landscape, with a draft Ecological and Environmental Protection Code aiming to consolidate and strengthen existing regulations. This comprehensive legal framework governs pollution control, waste management, and resource conservation, directly shaping the operational environment for companies like China Everbright Environment. The nation's intensified focus on green development and sustainability is driving significant investment in environmental services.

The strict enforcement of these environmental laws is a critical factor influencing demand for China Everbright Environment's offerings. For instance, the Ministry of Ecology and Environment reported a 30% increase in environmental inspections in 2023 compared to the previous year, leading to higher compliance burdens and a greater need for professional environmental solutions. Companies failing to meet these standards face substantial fines and operational restrictions, thereby boosting the market for waste treatment, recycling, and pollution control services.

Securing permits and licenses for environmental projects in China, like waste-to-energy plants or water treatment facilities, is a multi-stage, intricate process. These approvals are critical for operations, and any shifts in regulatory demands or extended waiting periods for authorization directly affect project schedules and budget allocations for companies like China Everbright Environment Group.

China Everbright Environment Group, a major player in environmental protection, heavily relies on Public-Private Partnerships (PPPs). These involve long-term concession agreements, often spanning decades, with local governments across China. The stability and enforceability of these contracts are absolutely critical, directly impacting the company's predictable revenue streams and the security of its extensive operations. For instance, the success of a waste-to-energy plant hinges on the government's commitment to the agreed-upon terms and payment schedules outlined in the PPP contract.

Anti-Monopoly and Fair Competition Regulations

China Everbright Environment Group, as a significant entity in the environmental protection industry, operates under China's anti-monopoly and fair competition laws. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants.

Recent enforcement actions and policy shifts in China's anti-monopoly landscape, particularly in sectors undergoing rapid development, highlight the importance of compliance. For instance, in 2023, China's State Administration for Market Regulation (SAMR) continued to focus on platform economies and industrial sectors, though direct impacts on environmental services were less pronounced than in tech. However, any future tightening of these regulations could impact Everbright Environment's market expansion and M&A activities.

- Regulatory Scrutiny: Everbright Environment faces scrutiny to ensure its market share and operational practices do not stifle competition within the environmental services sector.

- M&A Impact: Changes in anti-monopoly review processes or thresholds could affect the feasibility and timeline of potential mergers and acquisitions, which are crucial for growth.

- Compliance Burden: Maintaining robust compliance frameworks is essential to navigate evolving regulations and avoid penalties, ensuring continued operational freedom.

- Market Dynamics: The enforcement of fair competition laws can create opportunities by breaking down existing barriers to entry for smaller, innovative players, potentially leading to a more dynamic market.

International Environmental Agreements and Domestic Implementation

China's adherence to international environmental accords, like the Paris Agreement, directly shapes its domestic laws and emission reduction goals. These commitments are critical for China Everbright Environment Group, guiding its investments in green energy solutions and carbon capture initiatives. For instance, China's pledge to peak carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060 underpins the national strategy for sustainable development.

The company's operational framework must align with these national targets, which are increasingly translated into specific regulations and industry standards. This legal landscape encourages expansion in areas such as waste-to-energy, wastewater treatment, and air pollution control, aligning with China's commitment to environmental protection.

- Paris Agreement Commitment: China aims to peak CO2 emissions before 2030 and achieve carbon neutrality by 2060.

- Renewable Energy Growth: By the end of 2023, China's installed renewable energy capacity exceeded 1.4 billion kilowatts, a significant portion of its total power generation.

- Environmental Regulations: Stricter enforcement of environmental protection laws, including those on emissions and waste management, directly impacts industrial operations.

China's legal framework for environmental protection is continuously evolving, with a draft Ecological and Environmental Protection Code set to consolidate and strengthen existing regulations concerning pollution control and waste management. The nation’s commitment to green development is further solidified by its pledge to peak carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060, directly influencing policies and investments in environmental services.

The strict enforcement of environmental laws, including a 30% increase in environmental inspections in 2023, creates a significant demand for professional environmental solutions, as non-compliance incurs substantial penalties. Securing necessary permits for projects like waste-to-energy plants involves intricate, multi-stage processes, where regulatory changes can impact project timelines and budgets.

China Everbright Environment Group's reliance on Public-Private Partnerships (PPPs) means the stability and enforceability of long-term concession agreements with local governments are crucial for predictable revenue streams. The company also navigates China's anti-monopoly and fair competition laws, with recent enforcement actions in 2023 underscoring the importance of compliance for market expansion and M&A activities.

| Legal Area | Key Aspect | Impact on China Everbright Environment | Relevant Data/Fact |

|---|---|---|---|

| Environmental Protection Law | Pollution control, waste management, resource conservation | Shapes operational environment, drives demand for services | Draft Ecological and Environmental Protection Code consolidating regulations |

| Enforcement & Compliance | Strict adherence to environmental standards | Drives demand for solutions, risk of penalties for non-compliance | 30% increase in environmental inspections in 2023 |

| Permitting & Licensing | Approvals for environmental projects | Affects project schedules and budgets | Multi-stage, intricate approval processes |

| Public-Private Partnerships (PPPs) | Long-term concession agreements | Critical for predictable revenue and operational security | Concession agreements often span decades |

| Anti-Monopoly & Fair Competition | Preventing monopolistic practices | Impacts M&A activities and market expansion | SAMR focus in 2023 included industrial sectors |

| International Accords | Paris Agreement commitments | Guides investments in green energy and carbon capture | China aims for carbon neutrality by 2060 |

Environmental factors

China's rapid urbanization and industrialization are fueling a significant surge in waste generation. By the end of 2023, urban areas alone produced an estimated 240 million tons of municipal solid waste, a number projected to climb. This escalating environmental challenge directly translates into a robust and growing demand for sophisticated waste management and water treatment services, precisely the core business of China Everbright Environment Group.

China's commitment to reaching peak carbon emissions before 2030 and achieving carbon neutrality by 2060 significantly boosts the environmental sector. This national agenda fuels substantial investment in renewable energy sources, advanced waste management solutions, and the development of technologies that reduce carbon footprints. China Everbright Environment's strategic focus on clean energy and waste-to-energy projects aligns perfectly with these ambitious decarbonization targets, positioning the company to capitalize on this evolving landscape.

Growing global concerns over resource scarcity are increasingly pushing for the widespread adoption of circular economy principles. This shift emphasizes reducing waste, boosting recycling rates, and recovering valuable resources from waste streams. China, in particular, has been actively promoting circular economy initiatives as a key strategy for sustainable development.

China Everbright Environment Group's core business, which includes integrated waste management and resource recycling, is perfectly positioned to capitalize on this trend. The company's operations directly support the transition towards a more circular economy, making it a beneficiary of policies and market demand favoring resource efficiency and waste valorization.

For instance, China's 14th Five-Year Plan (2021-2025) explicitly calls for strengthening resource conservation and promoting the circular economy. This policy tailwind is crucial for companies like China Everbright Environment, as it translates into government support and market opportunities for their services in resource recovery and waste treatment.

Biodiversity Protection and Ecosystem Restoration

China's commitment to its 'Beautiful China' initiative, with an escalating emphasis on biodiversity protection and ecosystem restoration, directly translates into expanded avenues for environmental remediation and ecological engineering services. This strategic national focus opens up a broader market for companies like China Everbright Environment Group, allowing them to diversify their service offerings beyond traditional waste management and energy services.

The government's proactive stance is evidenced by significant investments and policy support. For instance, by the end of 2023, China had designated over 11,000 nature reserves, covering more than 18% of its terrestrial land area, a clear indicator of the scale of ecological protection efforts. Such initiatives often require advanced technological solutions and expertise in areas like wetland restoration, soil remediation, and biodiversity monitoring, which are core competencies for environmental engineering firms.

- Increased Government Investment: China allocated approximately RMB 25 billion (USD 3.5 billion) in 2023 for ecological protection and restoration projects, a figure expected to grow.

- Policy Support for Green Finance: The People's Bank of China's green finance initiatives encourage lending and investment in projects that support biodiversity and ecosystem health.

- Market Demand for Restoration Services: The demand for specialized services in ecological engineering, such as habitat reconstruction and invasive species management, is projected to rise by 10-15% annually through 2025.

- Technological Advancement: Innovations in remote sensing, AI-driven ecological monitoring, and biotechnology are crucial for effective ecosystem restoration, creating opportunities for technology-driven solutions.

Impact of Environmental Disasters on Operations

Extreme weather events, increasingly frequent due to climate change, pose a significant risk to China Everbright Environment Group's operations. These disasters can directly damage infrastructure, leading to costly repairs and service interruptions. For instance, severe flooding in 2024 across parts of China impacted various industrial facilities, highlighting the vulnerability of physical assets.

The company's business model, which often involves managing waste and providing environmental protection services, means it may be called upon to provide emergency environmental remediation. This can strain resources and require rapid deployment of specialized teams and equipment. A notable example from late 2023 involved extensive cleanup operations after a major industrial spill caused by extreme rainfall.

To mitigate these risks, incorporating climate resilience into project planning and operations is crucial. This includes designing facilities to withstand higher water levels, more intense storms, or prolonged droughts. For example, the company is reportedly investing in enhanced flood defenses for its wastewater treatment plants in coastal regions, a proactive measure in response to rising sea levels and storm surges observed in the region.

- Increased operational disruption: Extreme weather can halt waste collection, processing, and recycling activities, impacting revenue streams.

- Infrastructure damage: Floods, landslides, or high winds can damage treatment plants, landfills, and renewable energy facilities, requiring significant capital expenditure for repairs.

- Emergency response costs: Disasters may necessitate immediate environmental cleanup services, incurring unplanned operational expenses.

- Climate adaptation investment: Integrating resilience measures, such as reinforced structures and advanced monitoring systems, adds to project development costs.

China's environmental policies are a significant driver for China Everbright Environment Group. The nation's commitment to carbon neutrality by 2060 and its focus on a circular economy create substantial demand for the company's waste management and resource recovery services. For instance, the 14th Five-Year Plan (2021-2025) specifically targets resource conservation and circular economy promotion, directly benefiting companies like Everbright.

The push for ecological protection and restoration, exemplified by the 'Beautiful China' initiative, also opens new markets. China's designation of over 11,000 nature reserves by the end of 2023, covering more than 18% of its land, highlights the scale of this focus. This trend is supported by increased government investment, with approximately RMB 25 billion (USD 3.5 billion) allocated in 2023 for ecological projects.

Conversely, climate change presents risks through extreme weather events. These can disrupt operations and damage infrastructure, leading to unforeseen costs for repairs and emergency response. For example, severe flooding in 2024 impacted industrial facilities, underscoring the need for climate resilience in project planning, such as enhanced flood defenses for wastewater treatment plants.

| Environmental Factor | Impact on China Everbright Environment Group | Supporting Data/Facts (2023-2025) |

|---|---|---|

| Government Environmental Policies & Targets | Drives demand for waste management, recycling, and clean energy solutions. | Peak carbon by 2030, carbon neutrality by 2060; 14th Five-Year Plan (2021-2025) emphasizes circular economy. |

| Circular Economy Promotion | Increases opportunities in resource recovery and waste valorization. | Government actively promotes circular economy initiatives. |

| Ecological Protection & Restoration | Expands market for environmental remediation and ecological engineering services. | 'Beautiful China' initiative; over 11,000 nature reserves designated by end of 2023. |

| Climate Change & Extreme Weather | Poses risks of operational disruption, infrastructure damage, and increased costs. | Increased frequency of severe weather events; investment in climate resilience measures (e.g., flood defenses). |

PESTLE Analysis Data Sources

Our PESTLE analysis for China Everbright Environment Group is built on a robust foundation of official government reports, international environmental agency data, and leading financial market analyses. We leverage these sources to meticulously track political stability, economic shifts, regulatory changes, technological advancements, and societal trends impacting the environmental sector in China.