China Everbright Environment Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Everbright Environment Group Bundle

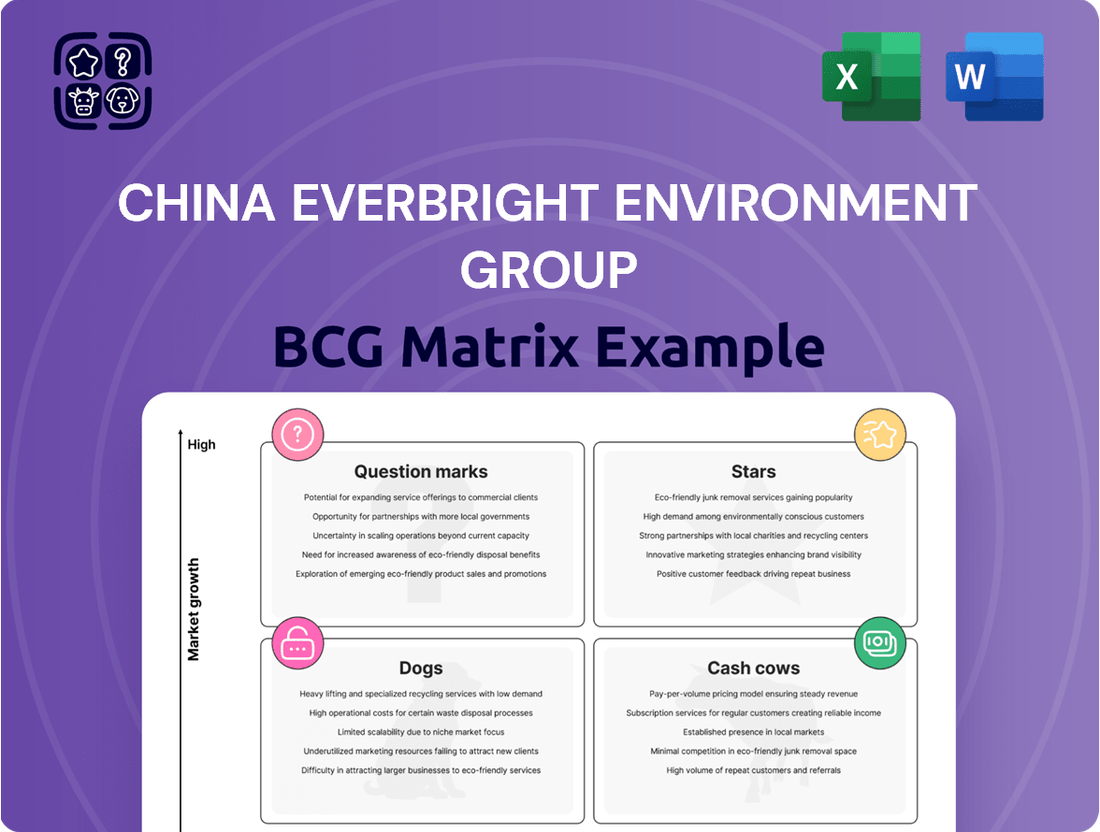

China Everbright Environment Group's BCG Matrix offers a fascinating glimpse into its diverse portfolio. Are its waste management solutions Stars, poised for rapid growth, or are its renewable energy projects Cash Cows, generating steady profits? Understanding these dynamics is crucial for any investor keen on this environmental giant.

This preview hints at the strategic positioning of China Everbright Environment Group's various business units. To truly grasp where its investments should be focused and which segments might require revitalization, a deep dive into the complete BCG Matrix is essential. Don't miss out on the detailed quadrant placements and actionable insights.

Unlock the full potential of your investment strategy by purchasing the complete BCG Matrix for China Everbright Environment Group. This comprehensive report will reveal which of its ventures are market leaders, which are resource drains, and where to strategically allocate capital next. Equip yourself with a ready-to-use strategic tool for informed decision-making.

Stars

China Everbright Environment Group's international waste-to-energy projects, such as their ventures in Uzbekistan, are positioned as Stars in the BCG matrix. These new markets represent significant growth opportunities as the company diversifies beyond its established domestic operations.

The planned waste incineration plants in Uzbekistan, for example, highlight a strategic push into regions with increasing demand for sustainable waste management solutions. This expansion into new territories is a testament to the group's ambition to capture emerging markets with high growth potential.

In 2023, China Everbright Environment Group reported a substantial increase in its international project pipeline, indicating strong momentum in this segment. Their commitment to these overseas ventures underscores their belief in the robust future of waste-to-energy solutions globally.

China Everbright Environment Group is strategically expanding its advanced environmental remediation services, a move signaling a strong commitment to a high-growth, specialized sector. The company is actively securing new contracts in this area, recognizing the increasing demand driven by stringent global environmental regulations and heightened public awareness.

This focus on complex pollution abatement presents substantial opportunities for market share growth. For instance, in 2023, the company reported a significant increase in its environmental protection segment revenue, demonstrating the commercial viability of these advanced services.

China Everbright Environment Group is aggressively pursuing its 'Solar Power +' strategy, a synergistic approach combining renewable energy generation with environmental protection services. This initiative involves significant investment in new solar and energy storage projects, reflecting a clear focus on the burgeoning renewable energy market.

The company's investment in solar and energy storage aligns with global trends towards decarbonization and energy independence. In 2024, China continued to be a dominant force in solar PV installations, with the National Energy Administration reporting over 210 GW of new solar capacity added by the end of the year, a substantial increase from previous years.

By integrating new energy solutions with its established environmental protection business, China Everbright Environment aims to create a robust ecosystem. This diversification allows them to capture opportunities across the entire value chain of the green economy, from generation to waste management and resource recovery.

Integrated Rural Environmental Management

Integrated Rural Environmental Management, falling under the Stars category for China Everbright Environment Group, signifies a strategic push into high-growth areas. The company is actively developing new business models focused on integrated sanitation solutions and new rural construction, directly addressing environmental challenges in less developed regions.

This segment offers significant untapped market opportunities by employing comprehensive approaches to waste management, water treatment, and agricultural pollution control. These integrated services are crucial for improving living conditions and fostering sustainable development in rural China.

- Market Potential: The rural environmental protection market in China is experiencing substantial growth, driven by government initiatives and increasing environmental awareness.

- Business Model Innovation: China Everbright is pioneering integrated solutions that combine waste disposal, wastewater treatment, and ecological restoration, creating a more holistic approach to rural environmental governance.

- Investment Focus: As a Star, this segment is expected to receive significant investment to capitalize on its high growth potential and establish market leadership.

- Revenue Growth: The company anticipates robust revenue expansion from these initiatives, reflecting the increasing demand for sophisticated environmental services in rural areas.

Waste Battery Recycling Technology

China Everbright Environment Group's foray into waste battery recycling technology positions it within a burgeoning market. This initiative, representing their first waste battery recycling project, taps into a sector experiencing rapid expansion, largely fueled by the escalating demand for electric vehicles and a proliferation of consumer electronics. As a pioneer in this specific domain within China, the company is strategically poised to secure a substantial portion of the market and establish itself as a frontrunner.

The environmental services sector in China is seeing considerable growth, with battery recycling being a key component. By 2024, the market for battery recycling in China was estimated to be worth billions of dollars, driven by government regulations and the sheer volume of batteries generated annually. China Everbright Environment's early investment allows them to build critical infrastructure and expertise.

- Market Growth: The global electric vehicle battery recycling market alone is projected to reach over $20 billion by 2030, indicating significant long-term potential for companies like China Everbright Environment.

- First-Mover Advantage: Being among the first to establish large-scale waste battery recycling operations in China provides a distinct competitive edge.

- Resource Recovery: These technologies focus on recovering valuable materials such as lithium, cobalt, and nickel, which are essential for new battery production, creating a circular economy.

- Regulatory Tailwinds: China's government has been increasingly emphasizing environmental protection and the responsible disposal of waste, including batteries, which supports the development of this industry.

China Everbright Environment Group's international waste-to-energy projects and its advanced environmental remediation services are prime examples of Stars in the BCG matrix. The company's aggressive pursuit of its 'Solar Power +' strategy and integrated rural environmental management initiatives also represent significant Star opportunities. Furthermore, their early investment in waste battery recycling technology positions them as a leader in a rapidly expanding, high-potential market.

| Segment | BCG Category | Key Drivers | Growth Outlook | China Everbright's Position |

| International Waste-to-Energy | Star | Increasing global demand for sustainable waste management, expansion into new markets | High | Strategic push into emerging territories |

| Advanced Environmental Remediation | Star | Stringent global environmental regulations, rising public awareness | High | Securing new contracts, robust revenue growth |

| Integrated Rural Environmental Management | Star | Government initiatives for rural development, demand for comprehensive environmental solutions | High | Pioneering integrated models, investment focus |

| Waste Battery Recycling | Star | Growth of EVs and consumer electronics, regulatory support for battery recycling | Very High | First-mover advantage, building critical infrastructure |

What is included in the product

China Everbright Environment Group's BCG Matrix would analyze its diverse environmental services portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

The China Everbright Environment Group BCG Matrix provides a clear overview of its business units, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

China Everbright Environment Group's domestic waste-to-energy operations are robust cash cows, underpinned by an extensive network of operational plants across China. These facilities are the backbone of the company's revenue generation, consistently delivering substantial income.

While the pace of new plant development might be slowing in the domestic market, these existing operations are secured by long-term concession agreements. This stability, coupled with predictable waste volumes, ensures a reliable and high cash flow stream for the company.

In 2023, the company reported that its waste-to-energy segment treated over 73.8 million tons of municipal solid waste, a testament to the scale and maturity of these operations. This segment consistently contributes a significant portion to the group's overall profitability.

China Everbright Water's municipal wastewater treatment facilities are its established Cash Cows. This segment boasts a high market share within China's water industry, a sector characterized by stable, albeit mature, demand. These operations consistently generate robust cash flow, bolstered by ongoing tariff adjustments and improvements in operational efficiency.

In 2023, China Everbright Water operated 102 municipal wastewater treatment projects, treating approximately 1.5 billion cubic meters of wastewater. This large-scale operation underpins its strong market position and reliable revenue streams, even as the overall Chinese water market approaches saturation.

China Everbright Environment Group's integrated biomass power generation projects are indeed cash cows, consistently contributing a substantial portion to the company's earnings. In 2024, these operations demonstrated robust performance, reflecting their mature status and steady demand in the energy sector.

These projects, which transform agricultural and forestry waste into valuable energy, generated significant EBITDA and net profit for the group. This stable revenue stream is a testament to the well-established nature of these operations and the ongoing need for renewable energy solutions, particularly those utilizing waste resources.

Industrial Solid and Hazardous Waste Treatment

China Everbright Environment Group's Industrial Solid and Hazardous Waste Treatment segment, a clear cash cow, thrives on high profit margins. This is driven by the specialized expertise required and stringent environmental regulations that create a stable demand for its services. The company boasts a significant market share in this sector, particularly within China's established industrial zones, ensuring consistent cash flow.

These operations are a powerhouse for the group, benefiting from the continuous activity of industrial clients who rely on compliant waste disposal. In 2023, the revenue contribution from this segment remained robust, underscoring its importance as a reliable generator of funds for the company's strategic investments.

- Strong Profitability: High margins due to specialized services and regulatory necessity.

- Market Dominance: Significant share in established industrial regions fuels steady revenue.

- Consistent Cash Generation: Ongoing industrial activity ensures reliable cash flow.

- Strategic Importance: Key segment for funding group-wide initiatives and growth.

Equipment Manufacturing and Supply

China Everbright Environment Group’s equipment manufacturing and supply segment, particularly for specialized environmental protection equipment like leachate treatment systems and grate furnaces, acts as a significant cash cow. This area generates a steady flow of revenue by capitalizing on the company's established expertise and deep industry connections.

The segment benefits from relatively lower ongoing investment needs when compared to the capital-intensive nature of project operations. This efficiency contributes to its strong cash-generating capabilities. For instance, in 2023, the company reported revenue from its environmental protection equipment segment, highlighting its consistent contribution to overall financial performance.

- Consistent Revenue: The manufacturing and supply of specialized environmental protection equipment provides a stable income source for China Everbright Environment Group.

- Leverages Expertise: This segment effectively utilizes the company's deep technical knowledge and long-standing industry relationships.

- Lower Investment Needs: Compared to project development and operations, this business unit requires less capital for ongoing investment, boosting its cash generation.

- Industry Demand: The ongoing need for advanced environmental solutions in China supports the sustained demand for the equipment manufactured.

China Everbright Environment Group's integrated biomass power generation projects are indeed cash cows, consistently contributing a substantial portion to the company's earnings. In 2024, these operations demonstrated robust performance, reflecting their mature status and steady demand in the energy sector.

These projects, which transform agricultural and forestry waste into valuable energy, generated significant EBITDA and net profit for the group. This stable revenue stream is a testament to the well-established nature of these operations and the ongoing need for renewable energy solutions, particularly those utilizing waste resources.

The company's commitment to biomass energy, a mature and reliable segment, ensures consistent cash flow generation, allowing for strategic reinvestment in other growth areas.

China Everbright Environment Group's Industrial Solid and Hazardous Waste Treatment segment is a clear cash cow, thriving on high profit margins due to specialized expertise and stringent environmental regulations. The company boasts a significant market share in this sector, particularly within China's established industrial zones, ensuring consistent cash flow.

These operations are a powerhouse for the group, benefiting from the continuous activity of industrial clients who rely on compliant waste disposal. In 2023, the revenue contribution from this segment remained robust, underscoring its importance as a reliable generator of funds for the company's strategic investments.

The segment's ability to command premium pricing for its specialized services, coupled with its essential role in industrial operations, solidifies its position as a consistent and significant cash generator.

China Everbright Environment Group’s equipment manufacturing and supply segment, particularly for specialized environmental protection equipment like leachate treatment systems and grate furnaces, acts as a significant cash cow. This area generates a steady flow of revenue by capitalizing on the company's established expertise and deep industry connections.

The segment benefits from relatively lower ongoing investment needs when compared to the capital-intensive nature of project operations. This efficiency contributes to its strong cash-generating capabilities. In 2023, the company reported revenue from its environmental protection equipment segment, highlighting its consistent contribution to overall financial performance.

The sustained demand for advanced environmental solutions in China supports the ongoing need for the specialized equipment manufactured by this segment, ensuring its continued role as a dependable cash contributor.

China Everbright Environment Group's domestic waste-to-energy operations are robust cash cows, underpinned by an extensive network of operational plants across China. These facilities are the backbone of the company's revenue generation, consistently delivering substantial income.

While the pace of new plant development might be slowing in the domestic market, these existing operations are secured by long-term concession agreements. This stability, coupled with predictable waste volumes, ensures a reliable and high cash flow stream for the company.

In 2023, the company reported that its waste-to-energy segment treated over 73.8 million tons of municipal solid waste, a testament to the scale and maturity of these operations.

China Everbright Water's municipal wastewater treatment facilities are its established Cash Cows. This segment boasts a high market share within China's water industry, a sector characterized by stable, albeit mature, demand. These operations consistently generate robust cash flow, bolstered by ongoing tariff adjustments and improvements in operational efficiency.

In 2023, China Everbright Water operated 102 municipal wastewater treatment projects, treating approximately 1.5 billion cubic meters of wastewater. This large-scale operation underpins its strong market position and reliable revenue streams, even as the overall Chinese water market approaches saturation.

The segment's substantial operational scale and essential service provision ensure a predictable and consistent inflow of cash, reinforcing its cash cow status.

| Segment | BCG Category | Key Characteristics | 2023 Data Highlight |

| Waste-to-Energy (Domestic) | Cash Cow | Extensive operational network, long-term concession agreements, stable waste volumes. | Treated over 73.8 million tons of municipal solid waste. |

| Municipal Wastewater Treatment | Cash Cow | High market share, stable demand, ongoing tariff adjustments, operational efficiency. | Operated 102 projects, treating ~1.5 billion cubic meters of wastewater. |

| Industrial Solid & Hazardous Waste Treatment | Cash Cow | High profit margins, specialized expertise, stringent regulations, significant market share in industrial zones. | Robust revenue contribution, underscoring reliability. |

| Integrated Biomass Power Generation | Cash Cow | Mature operations, steady demand, utilizes waste resources. | Generated significant EBITDA and net profit. |

| Environmental Protection Equipment Manufacturing & Supply | Cash Cow | Leverages expertise, lower investment needs, deep industry connections. | Consistent revenue contribution reported. |

Delivered as Shown

China Everbright Environment Group BCG Matrix

The China Everbright Environment Group BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, meticulously prepared by industry experts, will be delivered to you without any watermarks or demo content, ready for immediate strategic application.

Dogs

Some older waste-to-energy (WTE) projects within China Everbright Environment Group's portfolio may be experiencing underperformance. This is often due to less efficient technology or a decrease in waste volumes in their operating regions. For instance, older plants might struggle to meet current environmental standards or achieve optimal energy conversion rates compared to newer facilities.

These underperforming assets can become a financial burden, often referred to as cash traps. They may necessitate substantial capital investment for upgrades or modernization to remain competitive and compliant. However, the anticipated returns on these investments might not justify the expenditure, potentially diluting the overall profitability of the group.

In 2023, China Everbright Environment Group reported that while its overall WTE segment showed resilience, certain older facilities required ongoing operational adjustments. The company has been actively reviewing its asset base to identify and address such underperforming projects, focusing on efficiency improvements and strategic divestments where appropriate to optimize its capital allocation.

Minority stakes in stagnant environmental ventures, perhaps in sub-sectors like mature waste management or established water treatment technologies with limited innovation, would likely be categorized as Dogs within China Everbright Environment Group's BCG Matrix. These investments, by their nature, are not dominant in their respective markets and operate within low-growth environments. For instance, if a particular segment of the environmental services market saw only a 2% compound annual growth rate (CAGR) in 2024, and the group held only a small percentage in several companies within that segment, these would fit the Dog profile.

Such holdings often represent capital that isn't generating substantial returns or offering significant strategic leverage. The lack of control inherent in minority stakes further complicates their repositioning or revitalization. If these ventures are not showing signs of market share expansion or improved profitability, they are essentially draining resources without a clear upside. The group's focus would likely be on divesting or minimizing exposure to these types of assets to free up capital for more promising areas.

Certain legacy wastewater treatment facilities within China Everbright Environment Group's portfolio might be classified as Dogs. These older plants, particularly those that haven't seen recent tariff adjustments or significant efficiency overhauls, face challenges with escalating operational expenses and consequently, slim profit margins.

In a market where water infrastructure is becoming more mature, these less-efficient assets may yield only modest returns relative to the capital outlay, diminishing their appeal for further investment. For instance, while specific figures for individual legacy plants are proprietary, the broader Chinese municipal wastewater treatment sector experienced an average revenue growth of around 5-7% in 2023, with older, non-upgraded facilities likely lagging behind this average due to fixed tariffs and rising energy costs.

Outdated Technology Offerings

China Everbright Environment Group's portfolio might include environmental technology solutions that are becoming outdated. This can happen quickly in the environmental sector due to fast-paced innovation and evolving regulations. For instance, older waste-to-energy incineration technologies, while functional, may not meet the stricter emission standards introduced in recent years, making them less competitive.

Investing further in these legacy systems offers diminishing returns and reduces the company's market standing. Companies that fail to adapt their technological offerings risk becoming irrelevant in a market that increasingly demands cutting-edge, efficient, and compliant solutions. This is particularly true in areas like advanced wastewater treatment or carbon capture technologies, where newer, more effective methods are constantly emerging.

- Obsolescence Risk: Technologies like older flue gas desulfurization (FGD) systems may struggle to meet the latest stringent air quality standards, impacting their operational viability and market appeal.

- Low ROI: Continued capital expenditure on outdated equipment, such as older landfill gas capture systems with low efficiency, yields minimal returns compared to investments in modern alternatives.

- Regulatory Pressure: As environmental regulations tighten globally, older technologies that cannot be easily upgraded to meet new standards become liabilities rather than assets. For example, China's updated environmental protection laws in 2023 have increased the pressure for cleaner technologies.

- Market Relevance Decline: The market is shifting towards smart environmental solutions and circular economy principles, leaving businesses reliant on obsolete technology with a significantly reduced competitive edge.

Geographically Isolated Projects with Limited Scale

Geographically isolated projects with limited scale, especially those undertaken by China Everbright Environment Group, often find themselves in the 'dogs' quadrant of the BCG matrix. These ventures, typically located in remote regions, face significant hurdles in achieving economies of scale. For instance, a small waste management facility in a sparsely populated area might struggle with high transportation costs for waste collection and processing, directly impacting profitability.

These isolated operations often require substantial upfront investment for infrastructure and ongoing maintenance, while generating only modest returns. This low profitability can tie up capital that could be better allocated to high-growth potential areas. In 2024, China Everbright Environment Group, like many in the environmental services sector, continued to balance its portfolio, likely divesting or restructuring such underperforming, geographically constrained assets to improve overall efficiency.

- Low Profitability: Projects in isolated areas often operate at or near break-even due to high logistical expenses and limited throughput.

- Resource Drain: These ventures can consume management attention and financial resources without delivering significant returns, hindering investment in more promising growth areas.

- Economies of Scale Challenge: The small scale and remote location prevent the realization of cost efficiencies typically seen in larger, more centralized operations.

- Strategic Re-evaluation: Companies like China Everbright Environment Group must continually assess these ‘dog’ assets, considering divestment or consolidation to optimize their portfolio.

Certain minority stakes in mature or stagnant environmental ventures within China Everbright Environment Group's portfolio would be classified as Dogs. These are typically investments in sub-sectors with low growth and limited market dominance, such as older waste management or water treatment technologies that haven't seen recent innovation. For example, if a segment of the environmental services market only grew by 2% in 2024, and the group held only a small percentage in companies within that segment, these would be considered Dogs.

| Asset Type Example | Market Growth (2024 Estimate) | China Everbright Environment Group's Position | BCG Classification |

|---|---|---|---|

| Legacy Wastewater Treatment Plants | 3-5% | Minority Stake, Low Efficiency | Dog |

| Outdated Waste Incineration Tech | 2-4% | Small Market Share, High Upgrade Costs | Dog |

| Geographically Isolated Waste Mgmt | 1-3% | Low Throughput, High Logistics Cost | Dog |

Question Marks

Emerging international markets, such as the initial waste incineration plant projects in Uzbekistan, are positioned as question marks for China Everbright Environment Group. These ventures offer substantial growth potential in less established regions, but currently command a low market share. For instance, in 2024, the group continued to explore opportunities in Central Asia, recognizing the nascent demand for advanced environmental solutions.

Such initiatives demand considerable upfront investment and focused strategic execution to cultivate market presence and demonstrate financial viability. The company's commitment to these markets in 2024 underscores a long-term vision, anticipating future returns from these developing economies as environmental regulations and public awareness evolve.

Developing and deploying highly specialized industrial wastewater treatment solutions for niche or emerging sectors positions China Everbright Environment Group in a question mark quadrant. The market for these advanced solutions is expanding, with global spending on industrial water treatment projected to reach over $100 billion by 2025. However, securing substantial contracts and proving the efficacy of these specialized treatments is crucial for market penetration.

China Everbright Environment Group's investments in new digital and intelligent environmental solutions, like 'Intelligent Water' systems and IoT/AI analytics, place them in a high-growth technology market. These initiatives are crucial for optimizing environmental management, but their market adoption and revenue generation are still in early stages. For instance, as of 2024, the global smart water market was projected to reach $40.6 billion, indicating significant potential but also the nascent nature of widespread implementation.

The group's commitment to digitalization and intelligence-driven tools signifies a strategic pivot towards innovation, essential for navigating the evolving environmental services landscape. While these segments represent future growth engines, they demand considerable research and development expenditure and extensive implementation efforts to realize their full market potential and contribute meaningfully to revenue streams in the near term.

Waste Sorting and Renewable Resources Utilisation

China Everbright Environment Group is exploring new avenues in waste sorting and the broader utilization of renewable resources. These initiatives, which extend beyond traditional waste-to-energy, tap into rapidly expanding markets. For instance, the company is investing in technologies that facilitate advanced recycling and the recovery of valuable materials from waste streams.

Success in these nascent areas hinges on significant shifts in consumer behavior and the development of new infrastructure. This presents a degree of uncertainty, but the potential for high rewards is substantial. By 2024, China's waste management market was estimated to be worth over $100 billion, with a growing segment dedicated to resource recovery and circular economy principles.

- Market Growth: The demand for advanced waste sorting and resource utilization solutions is increasing as environmental regulations tighten and sustainability becomes a priority.

- Consumer Behavior: Public participation in waste sorting programs is crucial for the effectiveness of these new initiatives.

- Infrastructure Investment: Significant capital is required to build the necessary facilities for advanced recycling and material recovery.

- Potential Rewards: Early movers in these growing markets can capture substantial market share and establish a strong competitive advantage.

Carbon Capture and Storage Technologies

While China Everbright Environment Group’s current portfolio may not explicitly feature large-scale operational carbon capture and storage (CCS) or carbon capture, utilization, and storage (CCUS) projects, these emerging technologies represent a significant potential for future growth, aligning with the characteristics of a question mark in the BCG matrix. The company's expertise in environmental solutions provides a strong foundation for venturing into this high-risk, high-reward sector.

The global CCUS market is projected to experience substantial growth. For instance, analysts estimated the market to reach approximately USD 6.3 billion in 2023 and forecast a compound annual growth rate (CAGR) of over 14% through 2030. This rapid expansion highlights the potential for early movers like China Everbright Environment Group to capture significant market share.

- High Growth Potential: The increasing global focus on decarbonization and net-zero targets drives demand for CCUS solutions.

- Significant Investment Required: Developing and deploying CCUS technologies necessitates substantial capital outlays for research, development, and infrastructure.

- Technological Uncertainty: While advancements are being made, the long-term efficacy and cost-effectiveness of certain CCUS methods are still being proven.

- Regulatory and Policy Dependence: Market growth is heavily influenced by government incentives, carbon pricing mechanisms, and supportive regulations.

China Everbright Environment Group's ventures in emerging international markets, such as its initial waste incineration projects in Uzbekistan, represent question marks. These ventures have high growth potential in less developed regions but currently hold a small market share. The group continued exploring opportunities in Central Asia throughout 2024, acknowledging the developing need for sophisticated environmental services.

Investing in new digital and intelligent environmental solutions, like AI-powered water management systems, also places China Everbright Environment Group in a question mark category. These innovations are vital for better environmental management, but their widespread adoption and revenue generation are still in their early stages. The global smart water market was projected to reach $40.6 billion in 2024, indicating substantial potential alongside nascent implementation.

The company's exploration into advanced waste sorting and resource recovery beyond traditional waste-to-energy models falls into the question mark quadrant. These areas are experiencing rapid growth, with China's waste management market valued at over $100 billion in 2024, including a growing segment focused on resource recovery and circular economy principles.

BCG Matrix Data Sources

Our BCG Matrix for China Everbright Environment Group is built upon a foundation of comprehensive financial disclosures, detailed industry research, and official government reports to offer a robust strategic overview.