China Everbright Environment Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Everbright Environment Group Bundle

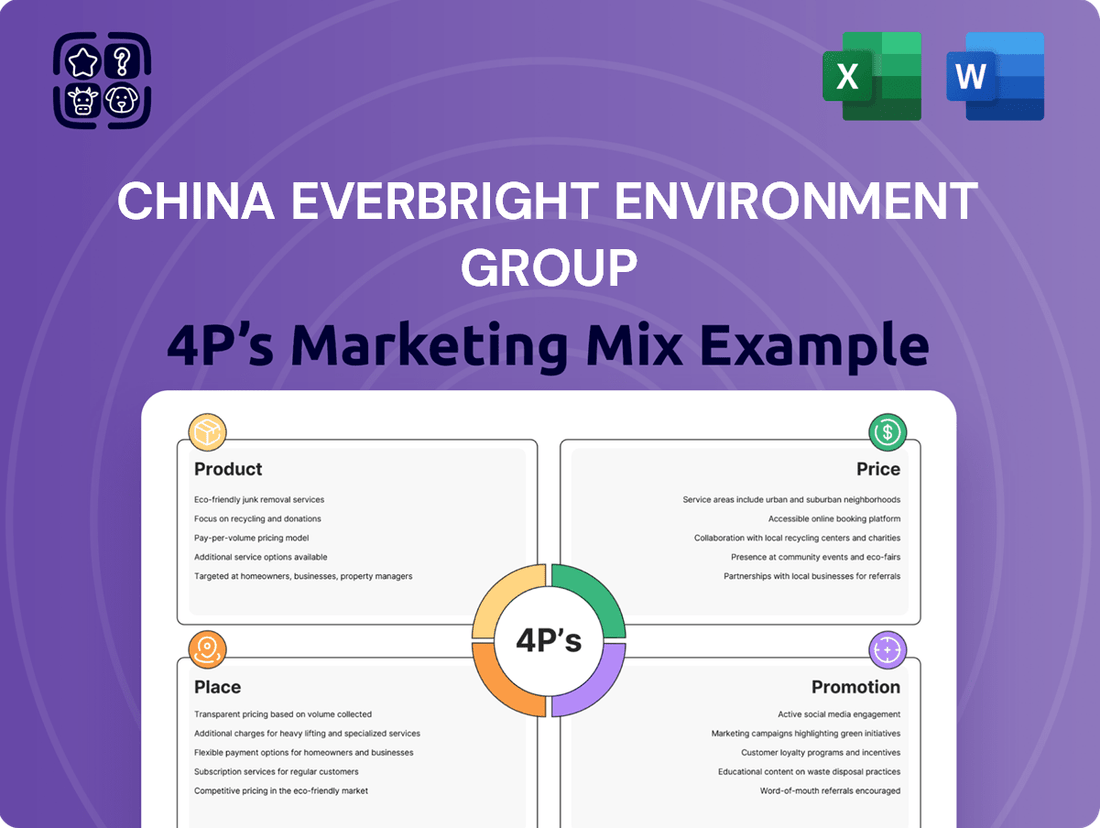

Discover how China Everbright Environment Group leverages its comprehensive service offerings, competitive pricing models, extensive operational footprint, and impactful promotional campaigns to dominate the environmental services sector. This analysis delves into the strategic integration of their Product, Price, Place, and Promotion.

Unpack the specifics of their diverse environmental solutions, from waste management to renewable energy, and understand the value proposition embedded in their pricing strategies. Explore how their extensive network of facilities and project sites ensures widespread accessibility and efficient service delivery.

Gain insights into their targeted communication efforts, including stakeholder engagement and public awareness initiatives, that solidify their market leadership. This detailed examination provides a clear roadmap of their marketing effectiveness.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

Integrated Environmental Solutions by China Everbright Environment Group represent a core component of their Product strategy, positioning them as a comprehensive, one-stop provider for diverse ecological needs. This offering goes beyond individual services, aiming for holistic environmental management by tackling complex challenges through synergistic approaches across their business segments.

In 2023, China Everbright Environment Group reported a substantial revenue of RMB 35.06 billion, underscoring the market demand for their wide array of environmental services. This integrated approach allows them to address multiple client requirements simultaneously, from waste management to water treatment and renewable energy, fostering deeper client relationships and a stronger market presence.

China Everbright Environment Group's Waste-to-Energy (WTE) and Waste Treatment services form a cornerstone of their offerings. These facilities transform municipal solid waste into electricity, contributing to renewable energy generation. In 2024, the company actively pursued investments in WTE infrastructure and focused on boosting operational efficiency across its sites.

The company's commitment extends beyond general municipal waste, encompassing specialized treatment for food waste, kitchen waste, sludge, leachate, and medical waste. This diversified approach addresses a broader spectrum of environmental challenges. Evidence of this strategic focus includes approvals for increased waste treatment fees in certain projects during 2024, signaling growing recognition and demand for these essential services.

China Everbright Environment Group's Water Environment Management segment offers comprehensive solutions, encompassing the construction, upgrading, and operation of wastewater treatment plants, water supply, and reusable water treatment facilities. This integrated approach addresses critical infrastructure needs for sustainable water resource utilization.

In 2024, China Everbright Water, a key subsidiary, demonstrated robust growth by securing new projects and focusing on asset-light business models. This strategic expansion significantly increased its daily water treatment capacity and reusable water supply capabilities, reflecting a commitment to scaling operations efficiently.

The segment's scope extends beyond traditional treatment, including vital ecological restoration of river basins and advanced sludge treatment solutions. These services are crucial for improving overall water quality and environmental health, addressing complex ecological challenges.

By year-end 2023, China Everbright Water's total water treatment capacity reached approximately 12.7 million cubic meters per day, with a substantial portion dedicated to reusable water. This highlights the company's significant contribution to water conservation and circular economy principles within China.

Greentech and Renewable Energy

China Everbright Environment Group's Greentech and Renewable Energy segment is a significant driver of its diversified business. This division is heavily invested in integrated biomass utilization, advanced hazardous and solid waste treatment facilities, and the development of renewable energy sources, specifically solar photovoltaic and wind power projects.

In 2024, the group demonstrated continued commitment to this sector by initiating substantial investments in new biomass capacity, expanding its solar power generation footprint, and bolstering its energy storage capabilities. This strategic expansion aims to capture growing demand for sustainable energy solutions.

Furthermore, Everbright Greentech is actively innovating by exploring novel energy paradigms. A prime example is their focus on 'Solar Power +', an initiative that synergistically combines new energy generation with integrated environmental protection scenarios, creating a more holistic approach to sustainability.

- Biomass Utilization: Integrated solutions for converting organic waste into energy and valuable products.

- Waste Treatment: Comprehensive services for hazardous and solid waste, including incineration and landfill management.

- Renewable Energy Generation: Development and operation of solar photovoltaic and wind power farms.

- Energy Storage: Investments in battery storage systems to enhance grid stability and renewable energy integration.

- 'Solar Power +': Innovative models linking solar energy with environmental protection projects.

Environmental Remediation and Technology Services

China Everbright Environment Group's product offering extends to comprehensive environmental remediation and technology services, directly addressing the Product element of the 4Ps. This segment focuses on tackling pollution and revitalizing contaminated land. For instance, in 2023, the company actively participated in various remediation projects, contributing to China's ongoing environmental cleanup efforts.

Beyond direct remediation, the group is deeply invested in environmental protection technology research and development. This commitment translates into providing related technological services, alongside the construction and installation of specialized environmental equipment. Their expertise is evident in the manufacturing and supply of critical components for waste-to-energy (WTE) projects, such as advanced leachate treatment systems and efficient grate furnaces.

The company's technological prowess is a key differentiator. In 2024, China Everbright Environment Group continued to innovate in areas like hazardous waste treatment and soil remediation technologies. They reported a significant portion of their revenue derived from these technology-driven service offerings, highlighting their strategic focus on high-value environmental solutions.

Key aspects of their product and service portfolio include:

- Environmental Remediation Services: Addressing soil and water contamination.

- Environmental Technology R&D: Developing advanced pollution control solutions.

- Technological Services: Offering expertise and support for environmental projects.

- Specialized Equipment Manufacturing: Producing key components like leachate treatment systems and grate furnaces for WTE plants.

China Everbright Environment Group's product strategy is defined by its comprehensive and integrated environmental solutions, covering waste management, water treatment, and renewable energy. Their offerings aim to provide holistic environmental management, addressing complex challenges through synergistic approaches across their various business segments.

In 2024, the company continued to expand its Waste-to-Energy (WTE) capacity and enhance operational efficiency, with a focus on specialized waste streams like food and kitchen waste, reflecting growing demand for these essential services, as evidenced by approved fee increases in some projects.

The Water Environment Management segment, particularly through China Everbright Water, saw robust growth in 2024, increasing daily water treatment capacity and reusable water supply, underscoring their commitment to sustainable water resource utilization and scaling operations efficiently.

The Greentech and Renewable Energy segment is a key growth driver, with significant 2024 investments in biomass capacity, solar power, and energy storage, alongside innovative 'Solar Power +' initiatives that integrate new energy generation with environmental protection.

| Product/Service Segment | Key Offerings | 2023/2024 Highlights |

|---|---|---|

| Integrated Environmental Solutions | Waste Management, Water Treatment, Renewable Energy | RMB 35.06 billion revenue in 2023; focus on holistic management. |

| Waste-to-Energy & Treatment | Municipal solid waste to electricity, specialized waste treatment | Investment in WTE infrastructure; focus on operational efficiency in 2024. |

| Water Environment Management | Wastewater treatment, water supply, ecological restoration | China Everbright Water increased daily treatment capacity in 2024; 12.7 million m³/day capacity by end 2023. |

| Greentech & Renewable Energy | Biomass, solar, wind, energy storage, 'Solar Power +' | Substantial 2024 investments in biomass and solar; expanding energy storage capabilities. |

| Environmental Remediation & Technology | Pollution control, soil revitalization, technology R&D, equipment manufacturing | Active participation in remediation projects in 2023; innovation in hazardous waste treatment in 2024. |

What is included in the product

China Everbright Environment Group's marketing mix strategically leverages its comprehensive environmental solutions (Product) by offering competitive, value-based pricing (Price) across a wide network of municipal and industrial clients (Place), supported by extensive government relations and a strong brand reputation built through project success and industry leadership (Promotion).

Simplifies China Everbright Environment Group's 4Ps marketing mix into actionable strategies that directly address market challenges and customer pain points.

Provides a clear, concise overview of how the company's product, price, place, and promotion effectively alleviate environmental concerns and deliver value.

Place

China Everbright Environment Group boasts an extensive domestic presence, operating in 229 cities, counties, and districts across all 25 provinces, municipalities, and autonomous regions as of December 31, 2024. This deep penetration into the Chinese market enables the company to effectively cater to a broad and varied customer base nationwide.

China Everbright Environment Group is aggressively pursuing international market expansion, now operating in 16 countries worldwide. This global presence, which includes key markets like Vietnam, Poland, Uzbekistan, and Germany, signifies a strategic push to share its cutting-edge environmental technologies and comprehensive solutions on a broader scale.

The company's commitment to this international growth is evident in recent developments, such as planned investments in waste incineration plants in Uzbekistan. This move highlights their proactive approach to entering and developing new overseas markets, leveraging their expertise in environmental protection.

China Everbright Environment Group primarily distributes its environmental solutions through a direct project-based model. This involves substantial investment in, development, operation, and ongoing management of environmental protection facilities. This strategy allows for deep control over project quality and long-term service reliability.

This asset-heavy distribution approach directly aligns with the Group's core business of providing comprehensive environmental services. By owning and operating projects, they ensure consistent delivery and capture value across the entire project lifecycle. This direct engagement is key to their market presence.

The effectiveness of this model is evident in the Group's continued expansion. In 2024 alone, China Everbright Environment Group successfully invested in and secured a total of 12 new environmental protection projects, showcasing the ongoing success and scalability of their project-based distribution strategy.

Strategic Partnerships and Government Concessions

China Everbright Environment Group frequently leverages Public-Private Partnerships (PPPs) and secures long-term concession agreements with local governments. This strategic approach is fundamental to undertaking extensive infrastructure projects that demand substantial capital and sustained operational involvement. For instance, in 2023, the group continued to expand its portfolio of environmental infrastructure projects through these collaborative models, highlighting their importance for market penetration and consistent revenue generation from essential public services.

These partnerships are vital for China Everbright Environment Group, as they unlock access to markets that would otherwise be difficult to penetrate independently. The concession agreements provide a predictable revenue framework, often tied to the provision of public services like waste management or water treatment, ensuring financial stability over extended periods. This model is particularly effective for projects with high upfront costs and long payback horizons.

- Public-Private Partnerships (PPPs): Facilitate large-scale environmental infrastructure development by sharing risks and rewards with government entities.

- Concession Agreements: Grant long-term operational rights for public services, ensuring stable and predictable revenue streams for the company.

- Market Access: Crucial for entering and operating within municipal environmental service sectors, often requiring government collaboration.

- Revenue Stability: These agreements typically involve fixed service fees or performance-based payments, providing a secure income base.

Asset-Light Business Models

China Everbright Environment Group strategically complements its core asset-heavy operations with an asset-light business segment. This includes providing integrated sanitation solutions, managing industrial wastewater treatment, and supplying essential equipment. This dual approach enables wider market reach and revenue streams without the need for substantial initial capital outlay for each venture.

The company's commitment to this strategy is evident in its recent performance. In 2024, China Everbright Environment Group secured new contracts for its asset-light businesses totaling approximately RMB1.835 billion. This highlights the growing importance and success of these less capital-intensive revenue-generating activities within the group's overall portfolio.

- Integrated Sanitation Solutions

- Industrial Wastewater Treatment Services

- Equipment Supply and Leasing

- New Asset-Light Contracts in 2024: RMB1.835 billion

China Everbright Environment Group's place strategy centers on an expansive domestic footprint and a growing international presence. By December 31, 2024, the company was active in 229 cities across all 25 Chinese provinces, demonstrating deep market penetration. Simultaneously, it operates in 16 countries, including key markets like Vietnam and Poland, showcasing a global ambition to deploy its environmental solutions.

| Market Presence | Details | Year End 2024 Data |

|---|---|---|

| Domestic | Cities, Counties, Districts | 229 |

| Domestic | Provinces, Municipalities, Autonomous Regions | 25 |

| International | Countries of Operation | 16 |

What You See Is What You Get

China Everbright Environment Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive 4Ps Marketing Mix analysis of China Everbright Environment Group details their Product strategies, including their diverse environmental solutions. You'll also find an in-depth look at their Pricing tactics and Place (distribution) of services. Finally, the Promotion strategies employed by the group are thoroughly examined, providing a complete picture of their market approach.

Promotion

China Everbright Environment Group leverages Corporate Social Responsibility (CSR) and Sustainability Reporting as a key component of its marketing mix, demonstrating its dedication to environmental protection and sustainable development. Its 2024 Sustainability Report, for instance, details its environmental performance, social impact, and governance, directly attracting investors focused on Environmental, Social, and Governance (ESG) criteria.

These efforts are validated by tangible recognition; in 2024, the group secured multiple ESG awards, significantly bolstering its reputation as a leader in green practices. This proactive approach to transparent reporting and demonstrable ESG achievements strengthens its brand image and appeals to a growing segment of stakeholders prioritizing responsible corporate citizenship.

China Everbright Environment Group firmly establishes its position as a frontrunner in Asia's environmental protection sector. It's recognized globally as the largest investor and operator in waste-to-energy, a testament to its significant market influence and operational scale.

The group actively showcases its technological prowess and successful project execution, demonstrating a commitment to innovation. For instance, their advanced waste-to-energy facilities in Vietnam exemplify their capability in tackling intricate environmental issues through cutting-edge solutions.

This strategic emphasis on technology and project success, as seen in their Vietnam operations, reinforces their leadership narrative. It provides tangible proof of their expertise and their ability to deliver impactful environmental solutions, driving industry standards forward.

China Everbright Environment Group prioritizes clear communication with its stakeholders through dedicated investor relations and financial communications. This involves proactive engagement, such as hosting investor presentations and disseminating annual results, to ensure the investment community is well-informed about the company's financial health and future plans. This transparency fosters trust and encourages investment.

The Group's commitment to open dialogue is exemplified by its 2024 annual results, released in March 2025. These results showcased a revenue of RMB 30.5 billion for 2024, a 7.2% increase year-on-year, alongside a net profit attributable to shareholders of RMB 4.2 billion. Such detailed financial reporting is crucial for building and maintaining investor confidence.

Government Relations and Policy Alignment

Government relations and policy alignment are paramount for China Everbright Environment Group, given its core business in environmental protection. This strategic focus is a key promotional element, demonstrating the company's commitment to national development goals.

The group actively cultivates strong relationships with governmental authorities at various levels. This engagement is vital for securing project approvals, navigating regulatory landscapes, and accessing potential subsidies. For instance, China Everbright Environment Group’s strategic development is closely aligned with national plans, such as China's 15th Five-Year Plan (2026-2030), which emphasizes green development and ecological civilization. This alignment ensures that its business activities contribute directly to, and benefit from, the nation's environmental objectives.

This proactive approach to policy alignment is not merely about compliance; it's a strategic advantage that underpins the company's ability to secure large-scale projects and funding. By positioning itself as a key partner in achieving national environmental targets, the company enhances its reputation and market access.

- Strategic Alignment: Directly supports national environmental policies and initiatives, including those outlined in China's 15th Five-Year Plan.

- Government Engagement: Maintains robust relationships with government bodies to facilitate project execution and policy navigation.

- Subsidy & Project Access: Leverages policy alignment to secure government-backed projects and financial support.

- Reputational Enhancement: Reinforces its image as a key contributor to China's ecological civilization goals.

Public Relations and Media Engagement

China Everbright Environment Group actively manages its public relations and media engagement to shape its corporate narrative. The company leverages press releases and collaborates with financial news outlets to communicate key developments. This strategy aims to highlight new projects, technological innovations, and operational successes, thereby fostering a positive public image and underscoring its commitment to environmental stewardship.

Recent media engagement includes announcements about significant new projects, such as those underway in Uzbekistan, which demonstrate the group's international expansion and operational capabilities. Furthermore, the dissemination of timely financial results through various media channels keeps stakeholders informed about the company's performance. For instance, their financial reports for the first half of 2024 showcased a robust performance, with revenue reaching HKD 13.8 billion, a 12% increase year-on-year.

- Dissemination of Information Press releases and financial news outlet engagement inform the public about new projects, technological advancements, and operational achievements.

- Public Image Management This communication strategy is crucial for maintaining a positive public perception and highlighting the company's environmental contributions.

- Project Spotlights News regarding new environmental protection projects, like those in Uzbekistan, serves as a key element of their media outreach.

- Financial Transparency Regular updates on financial results are provided to stakeholders through targeted media engagement.

China Everbright Environment Group's promotional strategy centers on highlighting its market leadership and technological innovation. By showcasing successful projects, like its advanced waste-to-energy facilities, the group reinforces its expertise and commitment to solving complex environmental challenges.

The group actively communicates its financial performance, as evidenced by its 2024 results showing RMB 30.5 billion in revenue and RMB 4.2 billion in net profit. This transparency builds investor confidence and underscores its operational strength.

Furthermore, strong government relations and alignment with national policies, such as China's 15th Five-Year Plan, are key promotional tools. This strategic positioning enhances its reputation and market access, reinforcing its role in national green development.

Public relations efforts, including media engagement on new projects in Uzbekistan and financial updates, further solidify its brand. These communications emphasize its environmental stewardship and international expansion.

| Promotional Aspect | Key Activities & Data (2024/2025) | Impact |

|---|---|---|

| Market Leadership | Largest investor/operator in waste-to-energy globally. | Establishes authority and scale. |

| Technological Innovation | Advanced waste-to-energy facilities (e.g., Vietnam). | Demonstrates problem-solving capability. |

| Financial Transparency | 2024 Revenue: RMB 30.5 billion (+7.2% YoY) 2024 Net Profit: RMB 4.2 billion H1 2024 Revenue: HKD 13.8 billion (+12% YoY) |

Builds investor trust and confidence. |

| Policy Alignment | Alignment with China's 15th Five-Year Plan (2026-2030). | Enhances reputation and market access. |

| Public Relations | Media announcements on projects (e.g., Uzbekistan). | Shapes positive public image and highlights contributions. |

Price

Project-specific tariffs and fees are central to China Everbright Environment Group's (CEEG) pricing strategy, reflecting the tailored nature of its environmental solutions. For instance, waste-to-energy facilities operate on waste treatment fees, while wastewater treatment plants are priced based on water treatment tariffs. These rates are typically established through direct negotiation with local government entities or relevant regulatory authorities, ensuring alignment with public service mandates and economic viability.

In a notable development for 2024, several of CEEG's wastewater treatment facilities secured regulatory approval for tariff increases. This is a critical data point, suggesting a move towards more sustainable revenue streams that better reflect operational costs and the value delivered. Such adjustments are crucial for CEEG's ability to reinvest in advanced technologies and expand its service offerings across China.

China Everbright Environment Group's projects heavily rely on long-term concession and service agreements, often spanning decades. These contracts are the bedrock of their pricing strategy, providing a predictable revenue stream and a clear financial roadmap for years to come. For instance, many of their waste-to-energy facilities operate under such agreements, ensuring stable income. This long-term commitment is essential given the substantial upfront capital and ongoing operational dedication needed for environmental infrastructure development.

China Everbright Environment Group navigates new project acquisitions through competitive bidding, a process heavily influenced by pricing. The group actively engages in these auctions, recognizing price as a critical factor for securing contracts in the environmental sector.

A core strategy involves meticulously balancing competitive pricing with the need for sustained profitability and the long-term operational success of each project. This careful equilibrium ensures their bids are attractive to clients while safeguarding the company's financial health.

For instance, in 2023, the company secured several waste-to-energy projects where pricing bids were instrumental. The group's ability to offer competitive rates, demonstrated in their financial reports, reflects a strategic approach to market penetration and growth, aiming for a market share that also ensures project sustainability.

Government Subsidies and Incentives

As a key player in environmental protection, China Everbright Environment Group (CEEG) significantly leverages government subsidies and incentives aimed at fostering green development. These financial aids directly impact project economics and CEEG's profitability. For instance, the company reported securing approximately RMB100 million in government subsidies during 2024.

These government programs are crucial for making environmentally sound projects more viable, influencing CEEG's pricing strategies.

- Government Support: CEEG benefits from policies designed to encourage environmental solutions.

- Financial Impact: Subsidies directly enhance project profitability and pricing flexibility.

- 2024 Subsidies: The company received around RMB100 million in government subsidies in 2024.

- Green Initiatives: Incentives are tied to national goals for environmental protection and sustainable growth.

Value-Based Pricing for Integrated Solutions

China Everbright Environment Group employs value-based pricing for its integrated environmental solutions, recognizing that customers are willing to pay for the comprehensive benefits provided. This strategy acknowledges the substantial value derived from enhanced environmental compliance, improved operational efficiencies, and the long-term sustainability benefits inherent in their advanced technologies. For instance, their waste-to-energy projects not only generate revenue from waste processing but also provide renewable energy, justifying a premium price point.

The company's commitment to technological innovation directly supports its pricing. By focusing on developing and implementing cutting-edge solutions, China Everbright Environment Group enhances both cost-effectiveness and operational safety for its clients. This technological edge allows them to offer solutions that are not only environmentally sound but also economically advantageous, underpinning their ability to command prices that reflect this superior value proposition.

Key aspects of their value-based pricing include:

- Quantifiable Environmental Improvements: Pricing reflects measurable reductions in pollution and carbon emissions achieved for clients.

- Operational Efficiency Gains: The cost savings and productivity boosts realized by clients through their integrated solutions are factored into pricing.

- Long-Term Sustainability Benefits: The enduring positive impact on environmental health and resource management supports premium pricing.

- Technological Superiority: Advanced, proprietary technologies that offer enhanced safety and cost-effectiveness justify higher price points compared to standard offerings.

China Everbright Environment Group's pricing strategy is a sophisticated blend of project-specific tariffs, competitive bidding, and value-based considerations, all underpinned by government support. The company's revenue streams are largely derived from long-term concession agreements, ensuring predictable income from waste treatment fees and water tariffs. For 2024, CEEG secured tariff increases for several wastewater treatment facilities, reflecting a move towards cost recovery and reinvestment in technology.

CEEG's pricing must balance competitiveness with profitability, particularly in securing new projects through competitive auctions. In 2023, the group successfully bid on waste-to-energy projects by offering attractive rates, demonstrating a strategic approach to market growth. Furthermore, government subsidies, with CEEG receiving approximately RMB100 million in 2024, play a crucial role in enhancing project economics and providing pricing flexibility.

The group employs value-based pricing, factoring in quantifiable environmental improvements, operational efficiencies for clients, and the long-term sustainability benefits of their advanced technologies. This approach is supported by technological innovation, allowing CEEG to offer economically advantageous and environmentally sound solutions, justifying premium pricing for their integrated services.

| Pricing Strategy Element | Description | 2023/2024 Data Point | Impact on CEEG |

|---|---|---|---|

| Project-Specific Tariffs/Fees | Waste treatment fees, water treatment tariffs negotiated with authorities. | Tariff increases approved for wastewater facilities in 2024. | Ensures revenue alignment with operational costs and value delivered. |

| Competitive Bidding | Pricing as a key factor in securing new project contracts. | Secured waste-to-energy projects in 2023 through competitive pricing. | Facilitates market penetration and strategic growth. |

| Value-Based Pricing | Pricing reflects environmental improvements, operational efficiency, and sustainability benefits. | Advanced technologies justify premium pricing for integrated solutions. | Enhances profitability and market positioning. |

| Government Subsidies/Incentives | Financial aids impacting project economics and profitability. | Received ~RMB100 million in government subsidies in 2024. | Improves project viability and pricing flexibility. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for China Everbright Environment Group is grounded in comprehensive data from official company reports, investor relations materials, and industry-specific publications. We meticulously examine their product and service offerings, pricing strategies, distribution networks, and promotional activities.