China Everbright Environment Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Everbright Environment Group Bundle

China Everbright Environment Group faces moderate bargaining power from buyers, as the need for environmental solutions is high but clients can switch providers. The threat of new entrants is significant due to the capital-intensive nature of the industry and evolving regulations. Intense rivalry among existing players, including state-owned enterprises and international firms, shapes competitive dynamics. Substitute products or services are limited, but technological advancements could offer alternative solutions. Supplier power is generally moderate, with specialized equipment and expertise driving some leverage.

The complete report reveals the real forces shaping China Everbright Environment Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Everbright Environment Group's reliance on specialized equipment and technology for its core operations in waste-to-energy and water treatment inherently grants significant bargaining power to its suppliers. These suppliers often possess proprietary or advanced technologies that are critical for the efficiency and effectiveness of Everbright's projects.

For instance, providers of advanced incineration systems or specialized filtration membranes hold considerable sway, as these components are not easily replicable and are essential for project success. The company's stated commitment to technological innovation in its 2024 reporting underscores its need for cutting-edge solutions, potentially increasing its dependence on a select group of niche technology providers.

The availability of alternative suppliers for China Everbright Environment Group's general components and services is typically high due to China's extensive manufacturing capabilities. However, for highly specialized or critical equipment, such as advanced waste-to-energy technology or specific pollution control systems, the number of qualified suppliers can be significantly limited. This scarcity grants those specialized providers greater bargaining power.

For instance, in 2024, the market for advanced environmental protection equipment in China saw a concentrated supply chain for certain niche technologies. Companies requiring these specialized inputs, like China Everbright Environment, might find their options fewer, allowing the few qualified suppliers to command higher prices or more favorable contract terms. This dynamic directly impacts the group's cost structure and operational flexibility.

China Everbright Environment Group faces considerable switching costs from its suppliers, particularly for its large-scale environmental infrastructure projects. For instance, the specialized equipment and integrated systems required for waste-to-energy plants and advanced water treatment facilities represent a significant upfront investment for clients. These complex systems often involve proprietary technologies and extensive customization, making it difficult and costly to switch providers mid-project or even for future upgrades.

Consider the intricate nature of waste-to-energy combustion chambers or sophisticated membrane bioreactor systems in water treatment. Replacing these core components from a different manufacturer could necessitate redesign, re-engineering, and extensive re-installation, leading to substantial financial outlays and operational downtime. In 2024, the ongoing global demand for advanced environmental solutions, coupled with supply chain complexities, further solidifies the bargaining power of established, technically proficient suppliers in these critical sectors.

Importance of China Everbright Environment Group to Suppliers

China Everbright Environment Group, as a major player in the environmental protection industry, exerts considerable influence over its suppliers. Its substantial demand for equipment, materials, and services can make it a critical revenue source for many businesses within the sector. For instance, the company's commitment to growth, demonstrated by its investment in 12 new projects totaling RMB 1.764 billion in 2024, signifies ongoing and significant purchasing power. This volume of business can reduce the bargaining power of suppliers who rely heavily on Everbright Environment Group for their sales.

The scale of China Everbright Environment Group's operations means that suppliers may be more inclined to offer favorable terms to secure and maintain its business. This dynamic can shift the power balance, giving the company an advantage in negotiations.

- Significant Customer Base: Everbright Environment Group's large project pipeline makes it a vital client for numerous suppliers.

- Volume of Business: The sheer quantity of goods and services procured by the company can reduce supplier leverage.

- Investment in Growth: With RMB 1.764 billion invested in 12 new projects in 2024, its demand is consistently strong.

- Favorable Terms: Suppliers may offer better pricing and conditions to retain Everbright Environment Group as a key customer.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into project development or operations for China Everbright Environment Group is generally low, but it's a factor to monitor. This would involve suppliers of specialized environmental technologies or equipment essentially becoming direct competitors by taking over the operational phase of projects.

This risk could escalate if suppliers see significant profit potential in the ongoing operation of environmental facilities, or if China Everbright itself decides to bring certain technological development in-house, potentially signaling a shift that suppliers might counter. For instance, in 2024, the global market for environmental technologies saw robust growth, with companies investing heavily in advanced solutions, which could incentivize some suppliers to explore higher-margin operational services.

- Specialized Technology Suppliers: Companies providing niche, high-value environmental solutions are most likely to consider forward integration.

- Profitability in Operations: A perceived gap between the cost of technology provision and the long-term revenue from operating projects could drive this threat.

- In-House Development by China Everbright: If China Everbright develops critical technologies internally, it might prompt suppliers to secure their market share by offering integrated services.

The bargaining power of suppliers for China Everbright Environment Group is moderate to high, primarily driven by the specialized nature of the equipment and technology required for waste-to-energy and water treatment projects. While general components have many suppliers, critical systems like advanced incineration or filtration membranes are often controlled by a limited number of highly capable providers. This scarcity, coupled with significant switching costs for Everbright, allows these specialized suppliers to exert considerable influence.

China Everbright Environment Group's substantial purchasing volume and investment in new projects, such as RMB 1.764 billion across 12 ventures in 2024, do provide some leverage. However, the threat of suppliers integrating forward remains low, though it's a factor to monitor in a growing environmental technology market. This balance means Everbright must carefully manage supplier relationships to mitigate cost pressures and ensure operational continuity.

| Factor | Impact on Everbright | Supporting Data/Observation |

|---|---|---|

| Supplier Specialization | Increases supplier bargaining power | Reliance on proprietary waste-to-energy and water treatment technologies. |

| Switching Costs | Increases supplier bargaining power | High costs associated with replacing specialized, integrated systems. |

| Customer Dependence | Decreases supplier bargaining power | Everbright's large procurement volume and RMB 1.764 billion investment in 12 projects in 2024. |

| Forward Integration Threat | Low, but monitorable | Potential for suppliers to offer operational services in a growing environmental tech market. |

What is included in the product

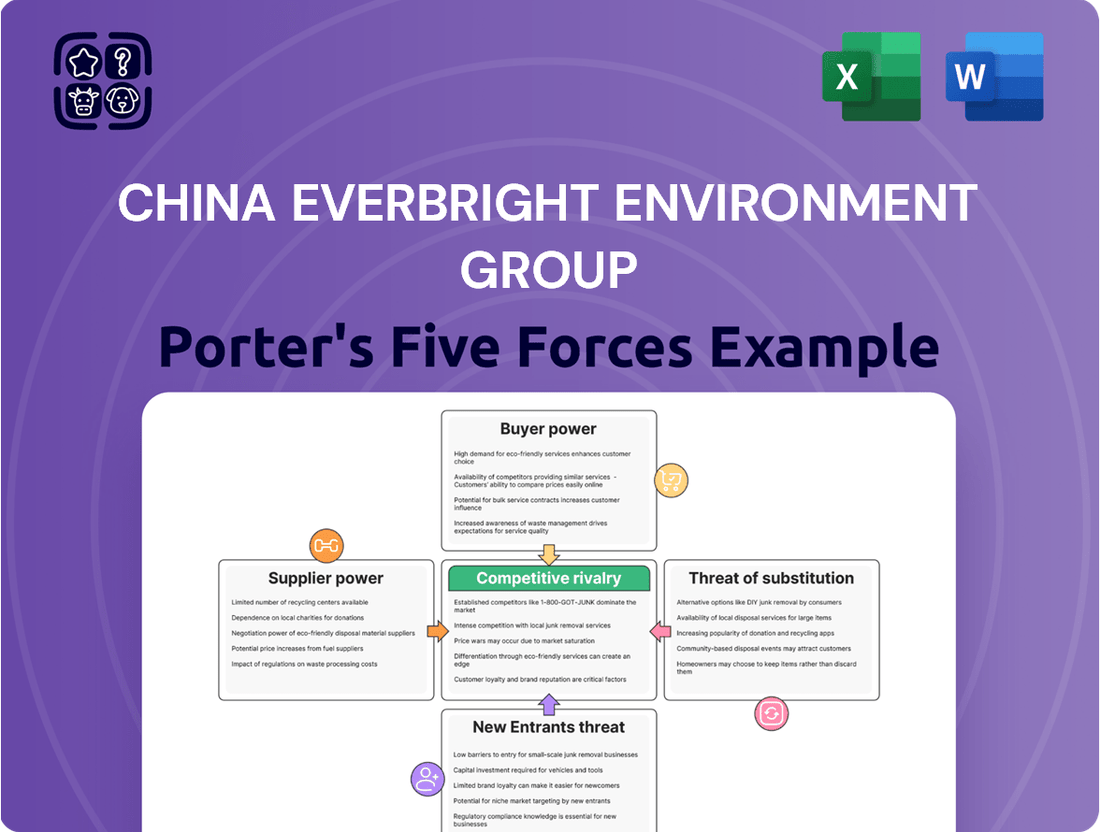

This analysis dissects the competitive forces impacting China Everbright Environment Group, revealing the intensity of rivalry, buyer and supplier power, threats of new entrants and substitutes within the environmental services sector.

A clear, one-sheet summary of all five forces—perfect for quick decision-making on competitive pressures facing China Everbright Environment Group.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing the interplay of competitive forces for China Everbright Environment Group.

Customers Bargaining Power

China Everbright Environment Group's reliance on government entities as primary customers, particularly for waste-to-energy and water treatment projects, grants these bodies significant leverage. Municipal governments and state-owned enterprises often act as consolidated buyers, enabling them to dictate terms, tariffs, and stringent performance benchmarks. This concentration of purchasing power means the group must carefully align its service offerings and pricing strategies with governmental priorities and financial capabilities.

China Everbright Environment Group's customer base presents a mixed picture regarding bargaining power. While government entities, a significant customer segment, are highly concentrated and thus wield considerable influence, the company also serves a more fragmented base within the industrial wastewater treatment and environmental remediation sectors. This fragmentation among industrial clients can dilute their individual bargaining power, especially for specialized or customized environmental solutions.

Environmental protection services, such as waste management and water treatment, are fundamental and frequently legally required for customers. For instance, cities rely on waste-to-energy facilities due to mounting waste and limited landfill space, highlighting the essential nature of these services.

This inherent criticality somewhat mitigates customer bargaining power, as discontinuing these vital services is not a feasible option for most clients.

China Everbright Environment Group's services directly address these critical needs, meaning customers have a high dependency on reliable provision.

Availability of Alternative Service Providers

The bargaining power of customers for China Everbright Environment Group is significantly influenced by the availability of alternative service providers. Large municipal clients, a key customer segment, often have choices among other substantial state-owned enterprises and major private companies operating in China's environmental services sector. This competition intensifies customer leverage, particularly during competitive bidding processes for projects.

In 2023, the environmental protection industry in China saw continued growth, with numerous players vying for market share. For instance, the total revenue for China's environmental protection industry reached approximately ¥1.5 trillion in 2023, indicating a robust market with multiple service providers. This competitive landscape directly empowers customers to negotiate better terms and pricing.

- Customer Choice: Municipal governments and large industrial clients can select from a growing number of environmental service providers, including those specializing in waste management, wastewater treatment, and air pollution control.

- Competitive Bidding: The prevalence of public tenders and competitive bidding mechanisms allows customers to solicit multiple proposals, driving down costs and improving service quality.

- Market Saturation: As more companies enter the environmental services market, the overall supply of services increases, further enhancing customer bargaining power.

Price Sensitivity and Contract Structures

Customers, particularly government bodies in China, demonstrate significant price sensitivity. This is driven by budget limitations and the need to secure cost-effective environmental solutions, often leading to intense bidding processes that can compress profit margins for service providers like China Everbright Environment Group.

The nature of contract structures plays a crucial role in shaping customer bargaining power. Concession agreements, common in the environmental sector, frequently involve long-term fixed tariffs or payments tied to performance metrics. This can grant customers leverage over time, especially if the company faces cost overruns or fails to meet agreed-upon service levels.

- Price Sensitivity: Government clients, a key customer base for China Everbright Environment Group, are highly attuned to pricing due to public budget constraints, fueling competitive tender processes.

- Contractual Influence: Long-term concession agreements often feature fixed tariffs or performance-based payments, giving customers a degree of control over revenue streams and service delivery.

- Competitive Landscape: The presence of numerous domestic and international players in China's environmental services market intensifies customer negotiation power, as clients can switch providers if terms are unfavorable.

- Regulatory Impact: Government regulations, while creating demand, can also impose pricing ceilings or specific service requirements that limit the company's pricing flexibility.

The bargaining power of customers for China Everbright Environment Group is substantial, largely due to the concentrated nature of its key clients, primarily government entities. These bodies often operate as single, dominant buyers for essential environmental services like waste-to-energy and water treatment, allowing them to dictate terms and pricing. Furthermore, the environmental services sector in China is increasingly competitive, with numerous providers vying for contracts, which further empowers customers to negotiate favorable terms. In 2023, the Chinese environmental protection market generated approximately ¥1.5 trillion in revenue, reflecting a dynamic landscape where customer choice is amplified by the presence of many capable service providers.

| Customer Segment | Bargaining Power Drivers | Impact on China Everbright Environment Group |

|---|---|---|

| Government Entities (Municipalities, SOEs) | Consolidated buyer, budget constraints, regulatory influence | High leverage on pricing and contract terms, requires alignment with public policy |

| Industrial Clients | Fragmented base, but can be concentrated for specialized services; essential service need | Varies; generally lower for individual clients but can increase for large-scale or niche projects |

| General Public/Communities | Indirect influence through public opinion and policy advocacy | Shapes demand and regulatory environment, impacting service requirements and pricing indirectly |

Same Document Delivered

China Everbright Environment Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of China Everbright Environment Group, revealing the exact document you'll receive immediately after purchase—no surprises or placeholders. The analysis meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the environmental services sector. You're looking at the actual document, which offers actionable insights into the strategic positioning of China Everbright Environment Group, ready for download and use the moment you buy.

Rivalry Among Competitors

China's environmental protection sector is a dynamic landscape with numerous players. While China Everbright Environment Group stands out, it shares the stage with several large state-owned enterprises and an increasing number of private firms. This suggests a competitive environment where market share is actively contested.

The industry encompasses various segments, including waste-to-energy, water treatment, and environmental remediation. In these areas, China Everbright faces robust competition from other major entities. For instance, in the waste-to-energy market, companies like Beijing Enterprises Water Group and China Three Gorges Corporation are significant competitors, each managing substantial project portfolios.

By the end of 2023, China's installed waste-to-energy capacity reached over 670,000 tons per day, with numerous companies contributing to this growth. This expansion means more opportunities but also intensifies the competition for new projects and market dominance, requiring companies like China Everbright to continually innovate and optimize their operations to maintain their leading position.

China's environmental protection sector is experiencing robust growth, fueled by supportive government initiatives and rising waste volumes. However, this expansion also intensifies competition, especially in more established market segments. For instance, the renewable energy sub-sector, while still offering significant opportunities, saw a surge in new project bidding, leading to heightened rivalry among established players.

The overall market saturation varies across different environmental services. While areas like waste-to-energy incineration are relatively mature with established competition, segments such as advanced water treatment and hazardous waste disposal continue to present attractive growth prospects with less intense, though still present, rivalry. China Everbright Environment Group, therefore, navigates a landscape where strategic focus on high-growth niches is crucial to mitigate competitive pressures.

Environmental infrastructure projects like waste-to-energy plants and water treatment facilities demand substantial upfront capital, often running into hundreds of millions or even billions of dollars. For example, a large-scale waste-to-energy plant in China can cost upwards of 1 billion RMB to construct. This significant initial investment, along with ongoing operational expenses such as maintenance, staffing, and energy consumption, creates a high fixed cost base for companies like China Everbright Environment Group.

These high fixed costs, combined with long-term operating concession agreements, which can span 20 to 30 years, and the highly specialized nature of the assets involved, erect formidable exit barriers. Once a company commits to these projects, divesting or shutting them down becomes exceedingly difficult and financially punitive. This situation compels operators to fiercely compete to ensure their facilities operate at high utilization rates, thereby spreading the substantial fixed costs over a larger volume of services and maintaining profitability.

Product and Service Differentiation

China Everbright Environment Group focuses on differentiating its offerings through technological advancements and comprehensive service packages. This approach aims to create a distinct market position, especially in a sector where innovation and integrated solutions are increasingly valued by clients, including government bodies.

The company's emphasis on technological superiority in areas like waste-to-energy and water treatment provides a competitive advantage. For instance, their investments in advanced incineration technologies contribute to higher energy conversion rates and reduced emissions, setting them apart from competitors relying on older methods. By 2024, China Everbright Environment Group had secured numerous projects leveraging these advanced technologies.

- Technological Edge: China Everbright Environment Group's commitment to R&D in environmental protection technologies, such as advanced waste-to-energy solutions, offers a clear differentiator.

- Integrated Service Model: The group provides end-to-end solutions, from project development and financing to operation and maintenance, creating a comprehensive offering that is attractive to clients.

- Government Relationships: Strong ties with government entities, often fostered through reliable and innovative service delivery, are a key differentiating factor in securing large-scale environmental projects.

- Operational Efficiency: Continuous improvements in operational efficiency, driven by technology and management practices, translate to cost advantages and better service delivery, further enhancing differentiation.

Government Policy and Support

Government policies significantly influence the competitive environment for companies like China Everbright Environment Group. Often, these policies tend to favor state-owned enterprises or businesses that align with national strategic objectives, thereby intensifying competition for government-backed projects.

China's commitment to its 'dual-carbon' goals and the directives within the 14th Five-Year Plan are major drivers. These create substantial opportunities for environmental companies but also lead to fiercer competition among those vying for projects that support these national priorities. For instance, the government has set targets for renewable energy installation, which directly impacts companies in the sector.

- Government's 'dual-carbon' goals and the 14th Five-Year Plan create a policy-driven market.

- Policies can favor state-owned enterprises or strategically aligned companies, impacting competition.

- Intensified competition arises for projects aligned with national environmental and energy targets.

- Government support, such as subsidies or tax incentives, can attract new entrants and existing players, escalating rivalry.

China Everbright Environment Group faces intense competition from numerous large state-owned enterprises and a growing number of private firms within China's expanding environmental protection sector. This rivalry is particularly pronounced in established segments like waste-to-energy, where companies such as Beijing Enterprises Water Group and China Three Gorges Corporation are significant players. The sector's overall growth, driven by government initiatives, means companies must continuously innovate and optimize to secure market share, especially as new project bidding intensifies.

SSubstitutes Threaten

The threat of substitutes for waste-to-energy services offered by China Everbright Environment Group is a significant consideration. Alternatives such as landfilling, recycling, and composting directly compete for the same waste streams. Despite China's push towards waste-to-energy due to land constraints, these other methods remain viable, particularly if waste-to-energy projects face economic challenges or public disapproval.

While landfilling is becoming less attractive in China, with the country aiming to reduce landfill waste significantly, it still represents a baseline substitute. Recycling and composting are increasingly supported by government policies and public awareness campaigns, diverting valuable materials and organic matter from incineration. For instance, China's target to reduce the proportion of waste disposed of by landfilling in key cities by 2025 underscores the shift away from this traditional method, but it also highlights its continued presence as an alternative.

The threat of substitutes in China's water treatment sector is significant. Decentralized solutions, like on-site filtration and purification systems for industrial facilities or even individual buildings, can bypass the need for large-scale, centralized treatment plants operated by companies like China Everbright Environment Group. Improved industrial processes that minimize wastewater generation at the source also reduce the overall demand for treatment services.

Furthermore, a growing emphasis on water reuse and conservation, driven by both environmental concerns and potential cost savings, presents another substitution pathway. Instead of treating water to a high standard for discharge and then abstracting new water, industries might invest in technologies that allow for direct reuse of their process water, thereby circumventing traditional treatment providers. For instance, advancements in membrane technology and advanced oxidation processes are making on-site recycling more economically viable. In 2023, China's Ministry of Water Resources reported that the country's water reuse rate reached 23.5%, a figure expected to climb further as technologies mature and regulations encourage circular economy principles.

Other renewable energy sources pose a significant threat. For instance, large-scale solar and wind power projects, often supported by substantial government subsidies, can directly compete with China Everbright Environment Group's biomass and waste-to-energy operations by offering alternative clean energy solutions. As of early 2024, China's installed solar capacity exceeded 600 GW, and wind power capacity surpassed 400 GW, demonstrating the immense scale of these competing sectors.

Emerging technologies like green hydrogen also represent a growing substitute threat. While still in developmental stages, advancements in green hydrogen production could eventually offer a cleaner and potentially more efficient energy source, especially for industrial applications where China Everbright Environment Group's waste-to-energy solutions are currently deployed. The global push for decarbonization is accelerating investment in these alternative clean energy pathways.

Cost-Effectiveness and Regulatory Environment of Substitutes

The cost-effectiveness of substitutes for China Everbright Environment Group’s services, such as advanced waste treatment technologies versus traditional landfilling, is significantly shaped by evolving regulatory landscapes. Stricter environmental mandates, particularly in China, are making less sustainable options increasingly expensive and less viable. For instance, the push towards a circular economy and stricter emissions standards directly benefits solutions like waste-to-energy, making them more competitive against older, polluting methods.

Government incentives and subsidies play a crucial role in tilting the balance. Policies promoting renewable energy or advanced pollution control technologies can artificially lower the cost of these substitutes, thereby enhancing their attractiveness relative to existing solutions. In 2023, China continued to emphasize green development, with significant policy support directed towards sectors like renewable energy and environmental protection, which directly impacts the comparative cost of substitutes.

- Regulatory Impact: Stricter environmental regulations in China, such as the updated Solid Waste Law, increase the operational costs and liabilities associated with landfilling, making advanced treatment more cost-competitive.

- Incentive Driven Adoption: Government subsidies and tax breaks for waste-to-energy projects and advanced recycling facilities in 2023 made these alternatives more financially appealing compared to conventional waste management methods.

- Cost Comparison: While landfilling might have lower initial capital costs, the long-term environmental remediation and compliance costs are rising, narrowing the cost advantage of this substitute.

- Market Shifts: The increasing consumer and corporate demand for sustainable practices is also driving down the perceived cost of environmentally friendly solutions, further pressuring less sustainable substitutes.

Technological Advancements and Innovation

Rapid technological advancements in waste management, water treatment, and renewable energy present a significant threat of substitutes for China Everbright Environment Group. New innovations could offer more efficient, cost-effective, or environmentally friendly alternatives to existing solutions. For instance, breakthroughs in anaerobic digestion or advanced oxidation processes might reduce reliance on traditional incineration or chemical treatments. In 2024, global investment in clean tech, including waste-to-energy and water purification, continued to surge, with significant venture capital flowing into startups developing novel approaches.

China Everbright Environment Group's commitment to research and development is paramount to counter this threat. By investing in and adopting new technologies, the company can maintain its competitive edge and adapt to evolving market demands. Their focus on technological transformation aims to not only improve existing operations but also to pioneer new service offerings. For example, the group has been actively exploring digital solutions for operational efficiency, which can be seen as a way to preemptively address potential substitute technologies that leverage automation and AI.

- Technological Disruption: Emerging technologies in waste-to-energy conversion and advanced water recycling could offer superior performance or lower operational costs compared to current methods.

- R&D Investment: China Everbright's strategic allocation of resources towards innovation is critical for developing proprietary technologies and staying ahead of potential substitutes.

- Market Adaptability: The group's ability to integrate and scale new, more efficient solutions will determine its resilience against substitute threats in the rapidly evolving environmental services sector.

The threat of substitutes for China Everbright Environment Group's waste-to-energy services is multifaceted, encompassing traditional landfilling, recycling, and composting. While landfilling's appeal is diminishing due to China's environmental goals, it remains a baseline alternative. Recycling and composting are gaining traction, supported by policy and public awareness, diverting waste streams. China's 2025 targets for reducing landfill waste highlight the ongoing competition from these methods.

Entrants Threaten

Entering China's environmental protection sector, especially for large-scale waste-to-energy and water treatment, requires substantial upfront capital. Companies need to fund expensive infrastructure, cutting-edge equipment, and advanced technologies, creating a significant hurdle for newcomers. For instance, a single modern waste-to-energy plant can cost hundreds of millions of dollars to construct, making it difficult for smaller firms to compete. This capital intensity effectively deters many potential entrants from challenging established players like China Everbright Environment Group.

The environmental sector in China operates under a stringent regulatory framework, demanding extensive permits, licenses, and rigorous compliance with environmental standards. Navigating this intricate web of regulations and securing the necessary approvals presents a formidable barrier for potential new entrants. For instance, as of late 2024, the Ministry of Ecology and Environment (MEE) continues to emphasize stricter enforcement of pollution control laws, making it more challenging for unestablished companies to meet the required operational benchmarks.

Established players like China Everbright Environment Group leverage significant economies of scale in project development, procurement, and ongoing operations. This allows them to spread fixed costs over a larger volume, reducing per-unit expenses.

Furthermore, China Everbright Environment Group benefits from an experience curve, meaning its operational efficiency and cost-effectiveness improve with cumulative output and learning. This accumulated expertise leads to better project execution and lower operational risks.

For instance, in 2023, China Everbright Environment Group's total revenue reached HK$27.85 billion, reflecting its substantial operational scale. This scale makes it challenging for new entrants to match the cost efficiencies and operational reliability that come with years of experience and a large installed base.

Access to Distribution Channels and Customer Relationships

New entrants in China's environmental services sector face significant hurdles in accessing crucial distribution channels and fostering strong customer relationships. Securing long-term contracts, particularly with government entities, is paramount. These agreements often hinge on an established reputation, a history of successful large-scale project delivery, and deep-rooted connections. For instance, in 2023, China Everbright Environment Group reported a robust order book, reflecting its strong existing relationships with municipal governments for waste management and water treatment projects. New players would struggle to replicate this level of trust and proven capability from the outset.

The challenge for new entrants is compounded by the need to build credibility and secure access to key project opportunities. Existing players like China Everbright Environment Group have cultivated these relationships over years, often through consistent performance and adherence to stringent environmental standards. This makes it difficult for newcomers to break into the market and gain a foothold. Consider that in the first half of 2024, the company secured several significant new projects, underscoring the continued reliance on established partnerships.

- Established Relationships: Government entities often prioritize suppliers with a track record and established rapport, making it hard for new entrants to secure initial contracts.

- Reputation and Trust: Proven ability to deliver complex, large-scale environmental projects builds trust, a critical factor for securing long-term agreements.

- Access to Key Projects: Existing players benefit from preferential access or bidding advantages on major infrastructure projects due to their established presence and expertise.

Proprietary Technology and Expertise

China Everbright Environment Group's substantial investments in research and development, particularly in advanced waste-to-energy and environmental remediation technologies, create a significant hurdle for potential new entrants. For instance, the company's focus on developing and patenting proprietary processes for industrial wastewater treatment and hazardous waste disposal requires considerable upfront capital and time to replicate.

The accumulation of specialized technical expertise within China Everbright Environment Group acts as another formidable barrier. New players would need to attract and retain highly skilled engineers, scientists, and project managers with proven track records in complex environmental engineering projects, a process that is both time-consuming and expensive. In 2023, the company reported a significant portion of its workforce dedicated to technical and R&D roles, underscoring this internal capability.

- High R&D Investment: Competitors must match significant capital expenditure on developing or acquiring advanced environmental technologies.

- Specialized Talent Acquisition: Securing and retaining highly skilled personnel in niche environmental engineering fields is crucial and costly for newcomers.

- Intellectual Property Protection: China Everbright Environment Group's portfolio of patents and proprietary knowledge presents a legal and technical barrier to entry.

- Operational Scale and Efficiency: New entrants would face challenges in achieving the same level of operational efficiency and cost-effectiveness built through years of experience.

The threat of new entrants in China's environmental protection sector, particularly for large-scale waste-to-energy and water treatment, is significantly mitigated by high capital requirements and stringent regulatory demands. Established players like China Everbright Environment Group benefit from economies of scale and accumulated experience, making it difficult for newcomers to compete on cost and efficiency. Furthermore, strong relationships with government entities and a proven track record are crucial for securing projects, creating a substantial barrier to entry for less-established firms.

| Barrier Type | Description | Impact on New Entrants | Example for China Everbright Environment Group |

| Capital Intensity | High upfront investment in infrastructure and technology. | Deters smaller firms. | Construction of a single waste-to-energy plant can cost hundreds of millions of dollars. |

| Regulatory Hurdles | Complex permits, licenses, and compliance with environmental standards. | Requires extensive knowledge and resources. | Stricter enforcement of pollution control laws by the Ministry of Ecology and Environment (MEE) as of late 2024. |

| Economies of Scale & Experience Curve | Lower per-unit costs due to high volume and learning. | Makes it hard to match cost-effectiveness. | 2023 revenue of HK$27.85 billion indicates significant operational scale. |

| Customer Relationships & Reputation | Need for established trust and access to government contracts. | Difficult to gain initial traction. | Robust order book in 2023 reflects strong existing municipal government partnerships. |

| R&D and Technical Expertise | Investment in advanced technologies and skilled personnel. | Requires matching innovation and talent. | Focus on proprietary processes for wastewater treatment and hazardous waste disposal; significant technical workforce in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Everbright Environment Group is built upon a foundation of official company disclosures, including annual reports and investor presentations, supplemented by industry-specific research from reputable market analysis firms and government environmental data.