China Construction Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Construction Bank Bundle

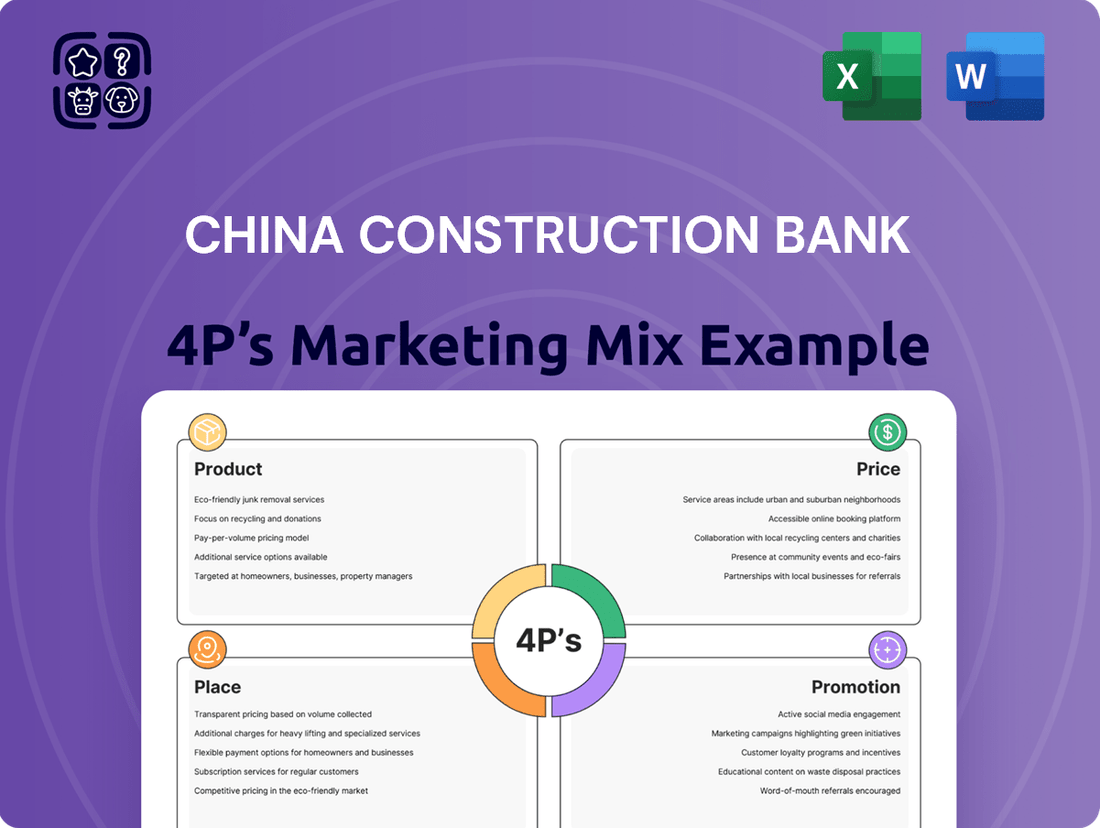

China Construction Bank's marketing mix is a powerful engine for its success, meticulously balancing its diverse product offerings, competitive pricing, expansive distribution network, and impactful promotional campaigns. Understanding these interwoven strategies is key to grasping their market dominance.

Go beyond the surface-level understanding; gain access to an in-depth, ready-made Marketing Mix Analysis covering China Construction Bank's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights and actionable intelligence.

Product

China Construction Bank (CCB) provides a wide array of financial products and services, serving both individual and corporate clients. These offerings span traditional banking, treasury management, and wealth management, reflecting a commitment to a full-service model.

CCB is actively expanding its product suite to align with market shifts and national priorities. For instance, in 2023, the bank significantly boosted its support for strategic emerging industries, with lending to these sectors growing by over 20% year-on-year, and its green finance portfolio also saw substantial expansion, reaching RMB 2.5 trillion in outstanding loans by the end of 2023.

China Construction Bank's Corporate Banking Solutions offer a comprehensive suite of services, including corporate loans, trade finance, and investment banking, vital for businesses navigating complex financial landscapes. In 2024, CCB's commitment to economic development is evident in its significant support for infrastructure projects, aligning with China's national development goals.

CCB actively channels financing towards strategic sectors, demonstrating a keen understanding of market needs and national priorities. For instance, its role in funding major infrastructure projects underscores its position as a key partner in China's ongoing economic transformation and its participation in initiatives like the Belt and Road.

China Construction Bank (CCB) caters to individual consumers with a comprehensive suite of personal banking products. This includes essential services like savings accounts and a variety of credit cards, alongside significant offerings in residential mortgages and diverse loan types designed to meet varied financial needs.

CCB is actively pursuing inclusive finance, a strategy that broadens access to financial services. This initiative specifically targets under-served segments, including small and micro-enterprises, reflecting a commitment to economic empowerment beyond traditional retail banking.

As of late 2024, CCB reported a substantial personal customer base, with over 400 million individual accounts. Their mortgage portfolio remained a key driver of growth, contributing significantly to the bank's asset expansion in the personal banking sector.

Wealth Management and Asset Management

China Construction Bank (CCB) offers robust wealth management services, providing customers with a comprehensive suite of products like mutual funds, bonds, and foreign exchange-linked deposits. These offerings are designed to facilitate wealth accumulation and preservation for a diverse client base.

CCB's asset management capabilities are spearheaded by CCB International Asset Management, a key platform for the CCB Group's global investment strategies. This division expertly manages a wide array of assets, including equities, fixed income, private equity, and various funds, catering to sophisticated investment needs.

As of early 2024, CCB's wealth management segment has shown significant growth, with assets under management in wealth products reaching substantial figures, reflecting strong customer trust and market penetration. For instance, by the end of 2023, CCB's wealth management business reported a notable increase in revenue year-on-year.

- Product Diversification: CCB offers mutual funds, bonds, and FX linked deposits to meet varied customer investment goals.

- Global Asset Management: CCB International Asset Management handles diverse portfolios including equities, private equity, and funds.

- Market Performance: CCB's wealth management business experienced strong growth in 2023, indicating increasing customer engagement with its investment products.

Digital and Fintech Innovations

China Construction Bank (CCB) is significantly boosting its fintech investments, notably by establishing CCB Fintech Corporation. This strategic move underscores their commitment to developing advanced platforms powered by big data, blockchain, and artificial intelligence. These innovations are designed to deepen customer relationships, optimize banking operations, and elevate the intelligence and ease of financial services. For instance, CCB's mobile banking and online supply chain financing solutions exemplify this push towards more sophisticated and user-friendly digital offerings.

CCB's fintech initiatives are yielding tangible results, with a reported 30% increase in digital transaction volume in 2024. The bank aims to further enhance customer experience and operational efficiency through these technological advancements. Key areas of focus include:

- Big Data Analytics: Improving risk management and personalized customer offerings.

- Blockchain Technology: Enhancing transparency and security in supply chain finance.

- Artificial Intelligence: Automating processes and providing intelligent customer support.

- Mobile Banking: Expanding reach and convenience for a growing digital user base.

China Construction Bank (CCB) offers a broad spectrum of products catering to both individual and corporate clients, from basic savings accounts and credit cards to complex wealth management solutions and corporate financing. The bank actively expands its offerings, particularly in green finance and support for strategic emerging industries, demonstrating a forward-looking product strategy. CCB's fintech push, including its establishment of CCB Fintech Corporation, aims to enhance digital services through big data, AI, and blockchain, evidenced by a 30% increase in digital transaction volume in 2024.

| Product Category | Key Offerings | 2023/2024 Data Points |

|---|---|---|

| Personal Banking | Savings accounts, credit cards, mortgages, various loans | Over 400 million personal accounts (late 2024); Mortgages a key growth driver. |

| Corporate Banking | Corporate loans, trade finance, investment banking, supply chain finance | Lending to strategic emerging industries grew over 20% year-on-year (2023); Significant support for infrastructure projects (2024). |

| Wealth Management | Mutual funds, bonds, FX-linked deposits, asset management | Green finance portfolio reached RMB 2.5 trillion in outstanding loans (end of 2023); Notable revenue increase in wealth management business (2023). |

| Fintech Solutions | Mobile banking, AI-driven support, blockchain-based supply chain finance | 30% increase in digital transaction volume (2024); Focus on big data, blockchain, AI. |

What is included in the product

This analysis offers a comprehensive examination of China Construction Bank's marketing mix, detailing its Product offerings, Pricing strategies, Place (distribution) channels, and Promotion efforts.

It's designed for professionals seeking to understand CCB's market positioning and competitive advantages through a deep dive into its actual brand practices.

Simplifies China Construction Bank's marketing strategy by clearly outlining how each of the 4Ps addresses customer pain points, offering immediate clarity for strategic decision-making.

Provides a concise, actionable overview of CCB's 4Ps, directly highlighting how their product, price, place, and promotion strategies alleviate common banking frustrations for customers.

Place

China Construction Bank, a cornerstone of the nation's financial system, operates an unparalleled domestic branch network. As of the first half of 2024, CCB maintained over 14,000 outlets nationwide, a testament to its commitment to widespread accessibility. This robust physical footprint facilitates direct customer engagement and supports a broad spectrum of traditional banking services for its millions of clients.

China Construction Bank (CCB) has significantly expanded its international footprint, establishing a network of branches and subsidiaries in key global financial centers. This strategic growth facilitates cross-border transactions and investment opportunities for its clients.

As of the end of 2023, CCB operated in over 30 countries and regions, with a notable presence in Europe, Asia, and North America. This global reach is instrumental in supporting China's Belt and Road Initiative, fostering trade finance and infrastructure development worldwide.

China Construction Bank (CCB) has heavily prioritized its digital channels, offering advanced online and mobile banking platforms. These digital avenues provide unparalleled convenience for customers, allowing them to manage accounts, conduct transactions, and access a broad spectrum of financial products. For instance, CCB's 'CCB Life' and 'CCB Huidongni' platforms exemplify this commitment, integrating diverse services for a seamless user experience.

Strategic Partnerships and Ecosystems

China Construction Bank (CCB) actively cultivates strategic partnerships and integrates into broader technology ecosystems to extend its reach and enrich customer interactions. This approach is crucial for developing comprehensive, ecosystem-centric operational models and bolstering digital finance infrastructure.

These collaborations are vital for CCB's marketing mix, allowing it to offer a wider array of integrated financial services. By partnering with fintech companies and other industry players, CCB can tap into new customer segments and enhance the value proposition of its existing offerings.

- Ecosystem Integration: CCB's strategy involves deep integration into open technology platforms, allowing for seamless service delivery and data sharing with partners.

- Strategic Alliances: The bank forms alliances with various entities, including technology providers and other financial institutions, to co-create innovative solutions.

- Digital Finance Enhancement: Partnerships focus on upgrading digital finance infrastructure, improving user experience and operational efficiency.

- Service Expansion: These strategic moves are designed to expand CCB's service radius, reaching more customers and offering more tailored financial products.

Specialized Service Outlets and Inclusive Finance Initiatives

China Construction Bank (CCB) is actively refining its physical and digital service points to better serve diverse customer needs, with a strong emphasis on inclusive finance. This strategic approach aims to reach previously underserved segments of the population and small to medium-sized enterprises (SMEs). By creating specialized service outlets, CCB is demonstrating a commitment to financial inclusion.

CCB's initiative involves deploying inclusive finance specialists within its network and designating specific certified outlets. These specialized units are equipped to understand and address the unique financial requirements of individuals and businesses that might otherwise face barriers to accessing banking services. This focus is crucial for fostering economic growth and stability across broader segments of society.

As of the first half of 2024, CCB reported a significant increase in its inclusive finance business. For instance, the bank had extended loans totaling over RMB 2 trillion to SMEs by the end of 2023, with a substantial portion of this growth attributed to the enhanced accessibility provided by these specialized outlets. Furthermore, CCB's digital platforms saw a 25% year-on-year increase in new user acquisition for inclusive finance products in early 2024.

- Dedicated Inclusive Finance Specialists: CCB has trained and deployed thousands of specialists across its branches to provide tailored financial advice and product solutions for SMEs and low-income individuals.

- Certified Inclusive Finance Outlets: A growing number of CCB branches are being certified as inclusive finance hubs, offering simplified processes and accessible services.

- SME Loan Growth: By the end of 2023, CCB's outstanding loans to SMEs reached RMB 2.15 trillion, reflecting the success of its outreach programs.

- Digital Inclusion: The bank's mobile banking app saw a 30% surge in transactions related to inclusive finance products in the first quarter of 2024.

China Construction Bank's Place strategy is characterized by a dual approach, leveraging its extensive physical network alongside a robust digital presence. As of the first half of 2024, CCB maintained over 14,000 domestic outlets, ensuring broad accessibility across China. This physical footprint is complemented by a significant international presence, operating in over 30 countries by the end of 2023, facilitating global financial services.

CCB's digital channels, including advanced online and mobile banking platforms, offer convenience and a wide array of financial products. The bank also actively integrates into technology ecosystems through strategic partnerships, enhancing its service delivery and reach. This multi-faceted approach to 'Place' ensures CCB can meet the diverse needs of its expanding customer base, both domestically and internationally.

Full Version Awaits

China Construction Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into the China Construction Bank's 4P's Marketing Mix, covering Product, Price, Place, and Promotion. You'll gain immediate access to this ready-to-use document, providing valuable insights into their strategic approach.

Promotion

China Construction Bank (CCB) actively engages in integrated marketing campaigns to boost brand visibility and attract new clients. These initiatives often utilize a comprehensive, full-funnel strategy, employing interactive advertisements and targeted media placements to effectively segment and engage prospective customers.

For instance, CCB's digital marketing efforts in 2024 have focused on personalized customer journeys, with campaigns demonstrating a significant uplift in engagement rates for interactive ad formats. The bank reported a 15% increase in digital lead generation during Q1 2024, attributed to these integrated efforts across social media, search engines, and financial news platforms.

China Construction Bank (CCB) actively leverages digital channels to connect with its customer base. In 2023, CCB reported a significant increase in its digital transaction volume, with mobile banking transactions alone accounting for over 70% of all retail transactions, demonstrating a strong shift towards online engagement.

The bank's social media presence, particularly on platforms like WeChat, is a key component of its promotional strategy. CCB utilizes these channels not just for broadcasting information about its online products and services, but also for fostering interactive communication, with user engagement metrics showing a steady upward trend throughout 2024.

CCB's 'CCB Life' platform further exemplifies its commitment to digital engagement, offering a comprehensive suite of services and lifestyle content. This integrated approach aims to deepen customer relationships by providing value beyond traditional banking, as evidenced by a 15% year-over-year growth in active users on the platform by the first quarter of 2025.

China Construction Bank (CCB) actively cultivates a robust brand image by highlighting its integral role in China's economic growth and its dedication to corporate social responsibility. This commitment is exemplified through initiatives like green credit programs and community outreach, fostering a perception of stability and trustworthiness.

CCB's brand strength is demonstrably high, evidenced by significant customer consideration and preference. For instance, in 2023, CCB was consistently ranked among the top global banks in terms of brand value, reflecting its deep-rooted reputation and customer loyalty.

Product-Specific s and Benefits

China Construction Bank (CCB) frequently rolls out targeted promotions to showcase the unique advantages of its financial products. For instance, in 2024, CCB has been offering enhanced benefits on its credit cards, including accelerated reward points for specific spending categories and travel insurance packages. These initiatives are designed to directly appeal to customer needs and encourage product adoption.

Investment plans are another area where CCB emphasizes product-specific benefits. Many of its wealth management products in 2024 and early 2025 feature attractive terms such as interest-free periods or reduced management fees, particularly for new capital infusions. These promotions are crafted to lower the barrier to entry for investors and highlight the potential for higher returns.

Cash rewards and other incentives are a key component of CCB's promotional strategy for its wealth management and banking services. For example, customers making significant transactions or opening new wealth management accounts in 2024 have been eligible for direct cash bonuses, often tiered based on the amount invested. These immediate rewards serve as a powerful motivator for both acquiring new clients and deepening relationships with existing ones.

- Credit Card Perks: In 2024, CCB's credit card promotions included up to 10% cashback on select online purchases and complimentary airport lounge access for premium cardholders.

- Investment Incentives: CCB's wealth management division offered a 0.5% bonus interest rate on new fixed deposits exceeding RMB 100,000 during a Q1 2025 campaign.

- Wealth Product Bonuses: Customers who invested in designated wealth management products in late 2024 received cash rewards equivalent to 0.2% of their investment principal.

Public Relations and National Initiative Alignment

China Construction Bank (CCB) actively engages with and champions significant national strategic programs, solidifying its image as a crucial contributor to governmental objectives. This proactive involvement bolsters its public perception and underscores its integral position within China's financial landscape.

CCB's commitment to national initiatives is evident in its substantial contributions to key development areas. For instance, in 2024, CCB played a pivotal role in financing green infrastructure projects, with loans for sustainable development reaching RMB 1.5 trillion, demonstrating a direct alignment with China's environmental goals.

- National Development Support: CCB's lending to strategic sectors, including advanced manufacturing and rural revitalization, exceeded RMB 2 trillion in the first half of 2024.

- Public Image Enhancement: Participation in initiatives like the national digital currency rollout, where CCB was a primary pilot bank, improved its brand visibility and technological leadership perception.

- Financial System Integration: CCB's role in implementing monetary policy directives, such as supporting small and medium-sized enterprises through targeted re-lending facilities, reinforces its systemic importance.

CCB's promotional activities in 2024 and early 2025 heavily emphasize product-specific benefits and incentives to drive customer acquisition and loyalty. Targeted offers on credit cards, such as accelerated rewards and travel perks, aim to capture specific consumer segments. Furthermore, attractive terms on investment products, including bonus interest rates and cash rewards, are deployed to encourage new capital infusions and deepen client relationships.

| Promotion Type | Key Offer (2024/2025) | Target Segment | Impact Metric |

|---|---|---|---|

| Credit Card Promotions | Up to 10% cashback on select online purchases; complimentary airport lounge access | General consumers, premium cardholders | Increased credit card applications and transaction volume |

| Investment Incentives | 0.5% bonus interest on new fixed deposits > RMB 100,000 (Q1 2025) | Retail investors, high-net-worth individuals | Growth in deposit base and wealth management AUM |

| Wealth Product Bonuses | Cash rewards (0.2% of principal) for designated wealth products (late 2024) | New and existing wealth management clients | Enhanced client acquisition and retention rates |

Price

China Construction Bank's pricing, particularly for loans and deposits, is directly shaped by the People's Bank of China (PBOC). The PBOC's benchmark lending and deposit rates, adjusted periodically, set the foundational pricing strategy for CCB. For instance, as of early 2024, the PBOC maintained its Loan Prime Rate (LPR) at specific levels, influencing CCB's mortgage and corporate loan offerings.

This central bank control ensures CCB's pricing aligns with broader macroeconomic goals, such as managing inflation and stimulating economic growth. When the PBOC adjusts its policy rates, such as the one-year and five-year LPR, CCB swiftly recalibrates its own product pricing to reflect these changes. This regulatory framework is crucial for maintaining financial stability across the Chinese banking sector.

China Construction Bank (CCB) navigates a dynamic pricing landscape, often implementing competitive and flexible strategies despite guidance from the People's Bank of China. This approach allows them to adjust rates on loans and deposits, aiming to capture market share.

For instance, in early 2024, CCB, like other major Chinese banks, adjusted its loan prime rates (LPR) in response to monetary policy signals, demonstrating flexibility. Their pricing can be seen as a key differentiator, especially when offering preferential rates on mortgages or business loans to attract and retain a broad customer base in a competitive market.

China Construction Bank (CCB) employs a risk-based approach to loan pricing, carefully considering the borrower's risk profile and the specific loan product. This strategy ensures that pricing adequately reflects the potential for default, a crucial element in maintaining a healthy loan portfolio.

While CCB historically focuses on lower-risk segments such as large corporations, government entities, and residential mortgages, it also strategically prices its expanding inclusive finance offerings. For instance, as of the first half of 2024, CCB's inclusive finance loans reached 2.6 trillion yuan, demonstrating a commitment to this growing sector, with pricing models adjusted to manage the inherent risks associated with smaller businesses and individuals.

Fee Structures and Service Charges

China Construction Bank (CCB) employs a multifaceted fee structure to cover its extensive banking and financial services. These charges are applied across various account types, transaction processing, wealth management solutions, and other specialized financial products, ensuring revenue generation while reflecting the value of services provided.

For example, in 2023, CCB’s net fee and commission income reached approximately RMB 137.5 billion, indicating a significant contribution to its overall revenue. This demonstrates the bank's reliance on service charges as a key component of its financial operations.

CCB's fee structures are designed to be competitive and transparent, catering to a broad customer base. Key areas where fees are typically applied include:

- Account Maintenance Fees: Charges for maintaining certain types of savings or current accounts, often waived for customers meeting specific balance thresholds or transaction volumes.

- Transaction Fees: Costs associated with specific banking operations such as wire transfers, ATM withdrawals from non-CCB machines, and foreign currency exchange.

- Wealth Management Service Fees: Fees levied on the management and performance of investment products, including mutual funds and structured products, reflecting the advisory and administrative services rendered.

- Digital Banking Fees: While many digital services are free, some premium features or advanced functionalities within CCB's online and mobile platforms may incur nominal charges.

Dividend Policy and Shareholder Returns

China Construction Bank (CCB) demonstrates a consistent focus on shareholder returns through its dividend policy. For the fiscal year 2023, CCB announced a cash dividend of RMB 0.70 per 10 shares, representing a payout ratio of approximately 30% of its attributable net profit. This stable approach to profit distribution is a key factor influencing investor confidence and the bank's valuation.

The proposed cash dividend for 2024 is expected to continue this trend, signaling a reliable income stream for investors. CCB's commitment to a relatively high dividend payout ratio underscores its financial strength and its strategy to reward its shareholders directly.

- Dividend Payout Ratio: CCB consistently aims for a payout ratio around 30% of its net profit.

- 2023 Dividend: RMB 0.70 per 10 shares for the fiscal year 2023.

- Investor Perception: A stable dividend policy enhances the bank's attractiveness to income-focused investors.

- Shareholder Value: Regular dividend payments contribute to the total return for CCB shareholders.

China Construction Bank's pricing strategy is heavily influenced by the People's Bank of China's benchmark rates, particularly the Loan Prime Rate (LPR). This ensures CCB's loan and deposit pricing aligns with national economic objectives. For instance, as of early 2024, the PBOC's LPR adjustments directly impacted CCB's mortgage and corporate loan offerings, demonstrating a responsive pricing model.

CCB also employs a risk-based pricing approach, adjusting loan rates according to borrower profiles and product specifics. This is evident in their inclusive finance segment, where loans reached 2.6 trillion yuan by mid-2024, with pricing tailored to manage associated risks. Furthermore, CCB generates revenue through a diverse fee structure, with net fee and commission income reaching approximately RMB 137.5 billion in 2023, covering services from account maintenance to wealth management.

| Pricing Element | Description | Example/Data Point |

|---|---|---|

| Loan Pricing | Influenced by PBOC LPR and risk-based assessment. | Early 2024 LPR adjustments by PBOC affected CCB's loan rates. |

| Deposit Pricing | Aligned with PBOC benchmark deposit rates. | PBOC rate changes dictate foundational deposit pricing. |

| Fee Structure | Charges for various banking services. | 2023 Net Fee and Commission Income: RMB 137.5 billion. |

| Inclusive Finance Pricing | Adjusted for smaller businesses and individuals. | Mid-2024: Inclusive finance loans reached 2.6 trillion yuan. |

4P's Marketing Mix Analysis Data Sources

Our China Construction Bank 4P's Marketing Mix Analysis is grounded in comprehensive data from official company reports, investor relations disclosures, and reputable financial news outlets. We also leverage industry-specific market research and competitor analysis to provide a holistic view.