China Construction Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Construction Bank Bundle

Curious about China Construction Bank's strategic product positioning? Our BCG Matrix preview highlights key areas, but the real power lies in understanding the full picture. Discover which of their offerings are Stars, Cash Cows, Dogs, or Question Marks to inform your investment decisions.

Don't miss out on the granular details and actionable insights. Purchase the complete China Construction Bank BCG Matrix report to unlock a comprehensive breakdown of their portfolio, enabling you to strategize with confidence and identify future growth opportunities.

Stars

China Construction Bank (CCB) has aggressively pursued digital transformation, migrating its core systems to a distributed architecture by 2024. This modernization effort has successfully integrated more than 87 business scenarios into its enterprise-level application model, significantly boosting operational efficiency and customer experience.

This digital overhaul is a cornerstone of CCB's strategic growth, directly improving its customer-facing services. The bank is also a key enabler of digital transformation across various industries, demonstrating a commitment to fostering the growth of the digital economy.

China Construction Bank (CCB) demonstrates a robust commitment to green finance, evident in its expanding green loan portfolio. By the close of 2024, green loans reached an impressive RMB 4.70 trillion, marking a significant 17.95% year-over-year increase.

CCB is actively broadening its green credit offerings, aligning with China's national strategies to foster environmental sustainability. This expansion supports a wide array of eco-friendly projects, reflecting the bank's dedication to a greener economy.

The financial impact of these initiatives is notable, with net interest income derived from green loans contributing 3% to the Group's overall operating income by the end of 2024.

China Construction Bank (CCB) is actively channeling significant capital into strategic emerging industries, a move that underscores its commitment to fostering China's future economic drivers. By the first half of 2024, loans extended to these critical sectors had swelled to an impressive RMB 2.72 trillion, marking a substantial 21.19% increase. This aggressive lending strategy highlights CCB's role in powering sectors poised for high growth and technological advancement.

The bank's focus specifically targets areas like special-purpose electronic materials manufacturing and integrated circuit manufacturing. These industries are foundational to China's ambition of developing new quality productive forces, positioning CCB at the forefront of this national economic transformation. This strategic alignment is not just about lending; it's about investing in the nation's technological self-reliance and future competitiveness.

Wealth Management (Net Value Products)

China Construction Bank's (CCB) wealth management, specifically its net value products, is a strong performer, likely a star in its BCG matrix. In 2024, CCB saw personal customer assets under management (AUM) exceed RMB 20 trillion, a robust 8.7% increase year-on-year. The investment and wealth management segment alone reached RMB 4.36 trillion, with net value products making up over 85% of this, highlighting CCB's significant penetration in a growing and profitable market.

This success is underpinned by a comprehensive service ecosystem. CCB has built out a full 'research-investment-advice-products' system. This integrated approach strengthens its competitive position and allows it to effectively serve a broad range of customer needs in the wealth management space.

- Personal customer AUM surpassed RMB 20 trillion in 2024, an 8.7% year-on-year increase.

- Investment and wealth management reached RMB 4.36 trillion.

- Net value products constitute over 85% of the investment and wealth management segment.

- CCB has developed a complete 'research-investment-advice-products' service system.

Cross-border RMB Settlement

Cross-border RMB settlement represents a significant growth area for China Construction Bank (CCB). In 2024, CCB's Renminbi clearing business in the UK achieved a remarkable RMB 126 trillion, while its cross-border RMB settlement volume surpassed RMB 5 trillion, both marking new historical highs.

This performance underscores CCB's expanding influence in global RMB services, bolstered by its expertise in managing exchange rate risks.

- Market Dominance: CCB's 2024 UK clearing volume of RMB 126 trillion highlights its substantial market share in international RMB operations.

- Record Settlement: Exceeding RMB 5 trillion in cross-border RMB settlement in 2024 signifies a new benchmark for CCB's global reach.

- Risk Management Expertise: The bank's proficiency in exchange rate risk management is a key driver for its success in this sector.

- Economic Support: This business segment is vital for fostering China's economic relationships and facilitating international trade.

China Construction Bank's wealth management services, particularly its net value products, are a clear standout. By the end of 2024, personal customer assets under management surpassed RMB 20 trillion, showing an 8.7% year-on-year growth. The investment and wealth management segment alone reached RMB 4.36 trillion, with net value products dominating this, making up over 85% of the total. This segment's success stems from CCB's integrated 'research-investment-advice-products' system, solidifying its strong market position.

| Segment | 2024 AUM (RMB Trillion) | Growth (YoY) | Key Product Focus | Notes |

| Wealth Management (Personal) | > 20 | 8.7% | Net Value Products | Dominant in Investment & Wealth Management (85%+) |

| Investment & Wealth Management | 4.36 | N/A | Net Value Products | Represents a significant portion of Personal AUM |

What is included in the product

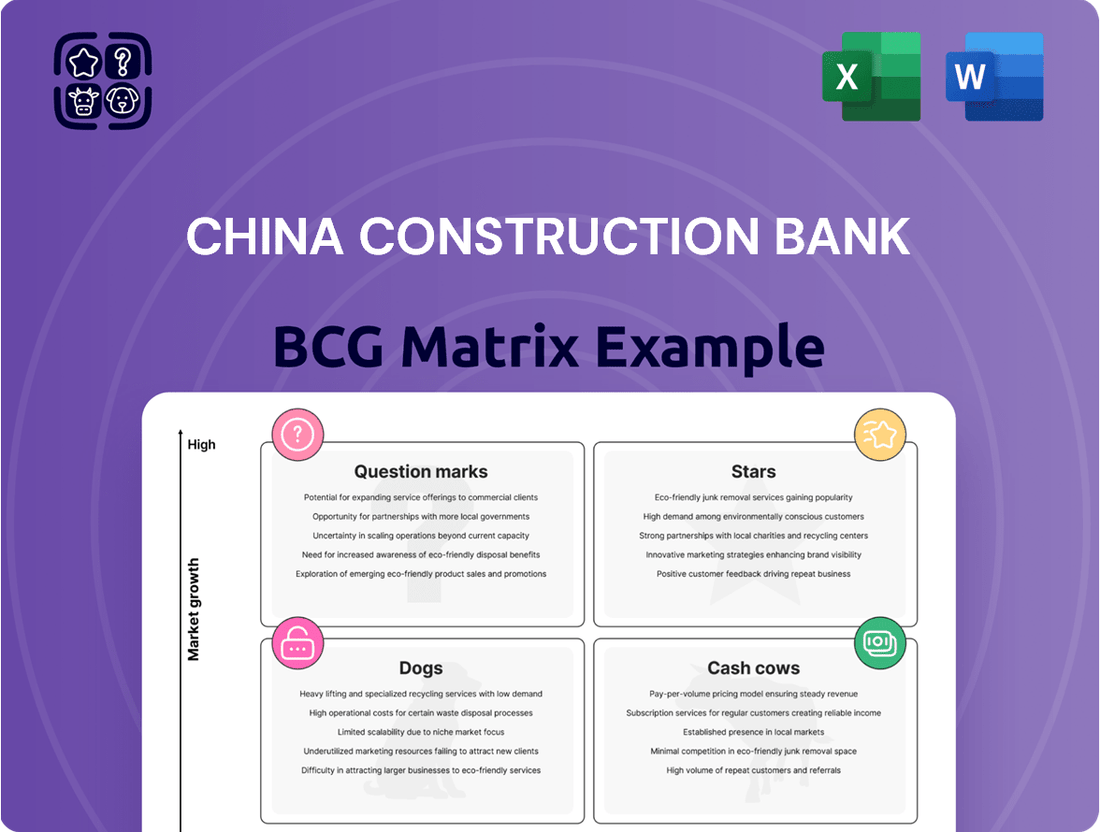

The China Construction Bank BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic guidance on investment, holding, or divesting units based on market share and growth.

The China Construction Bank BCG Matrix offers a clear, one-page overview of business units, simplifying strategic decisions and relieving the pain of complex portfolio analysis.

Cash Cows

China Construction Bank's traditional corporate banking services are a prime example of a Cash Cow within its BCG Matrix. As one of China's 'Big Four' banks and recognized as the world's strongest B2B brand for 2025, CCB commands a significant market share in this sector.

By the close of 2024, CCB served an impressive 11.68 million corporate customers, solidifying its industry-leading position. These established services benefit from a deep client base and high market penetration in a mature market, ensuring a consistent and substantial cash flow for the bank.

China Construction Bank's core personal banking deposits are a clear cash cow. With an impressive 771 million individual customers by the end of 2024, managing over RMB 20 trillion in financial assets, CCB has a massive and loyal customer base.

The growth in retail deposits, up 9.2% in the first half of 2024, with current deposits making up a significant 42% of the total, highlights the stability and low-cost nature of this funding. This substantial and steady deposit base is a reliable engine for consistent net interest income.

China Construction Bank's (CCB) infrastructure lending is a classic Cash Cow. Historically, CCB has been deeply involved in financing China's massive infrastructure development, a sector that consistently generates stable, predictable income. This focus aligns perfectly with national economic strategies, ensuring ongoing demand and government support for these vital projects.

In 2023, CCB reported significant growth in its infrastructure loan portfolio, with outstanding loans reaching approximately RMB 7.7 trillion (USD 1.07 trillion). This robust lending activity underscores the maturity and essential nature of this sector, providing CCB with reliable revenue streams and reinforcing its role as a key financial pillar in China's ongoing development.

Interbank Business and Custody Services

China Construction Bank's Interbank Business and Custody Services are a clear cash cow. The bank has significantly enhanced its management of these operations, with total assets under custody surpassing RMB 23 trillion. This strong performance positions CCB as an industry leader in both business volume and fund management within this segment.

These services are a reliable source of fee and commission income for CCB. They contribute substantially to the bank's non-interest revenue and overall profitability. The stability of the market segment where these services operate further solidifies their cash cow status.

- Assets Under Custody: Exceeding RMB 23 trillion.

- Industry Position: Leading in business number and fund volume.

- Revenue Generation: Consistent fee and commission income.

- Profitability Impact: Significant contribution to non-interest revenue.

Established Domestic Branch Network

China Construction Bank's (CCB) established domestic branch network is a significant Cash Cow. By the close of 2024, CCB operated an impressive 14,750 branches across China. This vast physical footprint allows for extensive customer reach and ensures accessibility to traditional banking services, underpinning stable customer acquisition and retention.

This extensive network, while experiencing low growth, provides a reliable revenue stream from established banking activities. It acts as a bedrock for CCB's operations, supporting a broad customer base that continues to engage in core banking transactions.

- Extensive Reach: CCB's 14,750 operating entities by end-2024 offer unparalleled physical access to customers nationwide.

- Stable Revenue: The network generates consistent income from traditional banking services, despite slower growth in this segment.

- Customer Foundation: It serves as a crucial touchpoint for customer acquisition and retention, particularly for those preferring in-person banking.

China Construction Bank's (CCB) wealth management services represent a significant Cash Cow. By the end of 2024, CCB managed RMB 7.07 trillion in wealth management assets, demonstrating its strong market position and customer trust in this mature segment.

The bank's focus on expanding its wealth management offerings, including private banking and cross-border services, ensures a steady stream of fee-based income. This segment benefits from CCB's extensive customer base and its reputation for reliability, contributing consistently to overall profitability.

| Segment | Assets Under Management (End 2024) | Market Position | Revenue Contribution |

| Wealth Management | RMB 7.07 trillion | Strong, mature market presence | Consistent fee and commission income |

Full Transparency, Always

China Construction Bank BCG Matrix

The China Construction Bank BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professionally designed and analysis-ready report ready for immediate strategic application.

Dogs

China Construction Bank's (CCB) legacy financial products, those not yet digitized or updated for modern platforms, are likely candidates for the Dogs quadrant in the BCG Matrix. These offerings, such as older savings accounts or basic fixed-term deposits that haven't seen innovation, often struggle to attract new customers in an era where digital convenience is paramount. For instance, while CCB reported a significant increase in its digital banking penetration, reaching over 90% of its retail customers by the end of 2023, products that remain solely in the physical realm or lack robust online features are inherently disadvantaged.

Despite China Construction Bank's (CCB) considerable strides in digital banking, certain legacy processes still rely heavily on paper and manual handling. These areas, though perhaps diminishing, can be considered CCB's Dogs in the BCG Matrix. For instance, some complex loan origination or specific types of corporate account management might still involve substantial paperwork, slowing down turnaround times.

These traditional workflows directly translate to higher operational costs due to manual labor and increased risk of errors compared to streamlined digital alternatives. In 2023, while CCB reported significant growth in its digital customer base, the persistence of these paper-heavy processes would have capped efficiency gains in those specific segments, potentially leading to lower net interest margins for those operations.

Consequently, these less efficient, paper-based segments likely exhibit minimal market share growth, especially as competitors rapidly adopt fully digital solutions. This stagnation, coupled with higher costs, would result in lower profitability for these specific business units within CCB, reinforcing their position as Dogs that require careful management or eventual phasing out.

Certain niche lending segments within China Construction Bank (CCB), those not directly supporting major national strategies or emerging industries, may be exhibiting low returns. These could be characterized by small-scale operations that consume significant administrative resources without offering substantial growth potential. For instance, if a specific niche market segment saw only a 1.5% year-over-year loan growth in 2024, while CCB’s overall loan portfolio grew by 8.2%, it signals a potential underperformance.

Underperforming Older Overseas Branches

Underperforming older overseas branches for China Construction Bank (CCB) likely fall into the Dogs category of the BCG matrix. These are typically smaller, established operations in mature or declining markets where CCB has limited market share and faces slow growth prospects. For instance, CCB’s presence in certain European markets, while strategically important for global reach, might include branches that are not achieving significant revenue growth or profitability compared to their operational costs.

These older branches could be struggling due to intense competition from well-entrenched local banks, regulatory hurdles, or simply unfavorable economic conditions in their host countries. For example, as of the first half of 2024, while CCB’s overall international business saw growth, some of its older, smaller overseas subsidiaries might be experiencing stagnant asset growth or declining net interest margins. Such units often require substantial investment to maintain operations or achieve meaningful expansion, yielding disproportionately low returns.

- Stagnant Growth: Older overseas branches in less dynamic markets may exhibit single-digit or even negative revenue growth rates.

- Low Market Share: These units often hold a minor percentage of the local banking market, struggling to gain traction against established competitors.

- High Operational Costs: Maintaining these branches can be expensive, especially when factoring in compliance, staffing, and infrastructure, leading to low or negative profitability.

- Limited Strategic Value: Unless they serve a niche strategic purpose, their contribution to CCB’s overall global strategy might be minimal, making them candidates for restructuring or divestment.

Traditional Real Estate Developer Loans

Traditional Real Estate Developer Loans within China Construction Bank's (CCB) portfolio are likely positioned as Cash Cows or potentially Question Marks, given the current market dynamics. CCB's significant exposure to the property sector, even with a decrease in mortgage exposure, highlights the sector's ongoing challenges. The persistent weakness in demand and prolonged slump in China's real estate market directly impact the performance of these loans.

Loans extended to property developers, especially those experiencing financial difficulties, represent a considerable credit risk. This segment could indeed act as a drag on CCB's overall profitability. Despite some improvement, the bank's non-performing loan ratio specifically for real estate developer loans continues to underscore the inherent difficulties within this market segment.

- Exposure to Property Sector: CCB has a notably higher exposure to the property sector compared to some of its banking peers.

- Real Estate Market Challenges: China's overall real estate market is grappling with weak demand and a prolonged downturn, impacting developer loan performance.

- Credit Risk: Loans to property developers, particularly those in distress, carry significant credit risk and can negatively affect profitability.

- Non-Performing Loans: While showing improvement, the non-performing loan ratio for real estate developer loans at CCB still reflects ongoing challenges in this area.

Certain legacy financial products at China Construction Bank (CCB), those not yet digitized or updated for modern platforms, are likely candidates for the Dogs quadrant. These offerings, such as older savings accounts or basic fixed-term deposits that haven't seen innovation, often struggle to attract new customers in an era where digital convenience is paramount. For instance, while CCB reported over 90% digital banking penetration by the end of 2023, products remaining solely in the physical realm are disadvantaged.

Underperforming older overseas branches for CCB also fall into the Dogs category. These are typically smaller, established operations in mature or declining markets where CCB has limited market share and faces slow growth prospects. For example, some of CCB’s older, smaller overseas subsidiaries might be experiencing stagnant asset growth or declining net interest margins as of the first half of 2024.

These less efficient, paper-based segments and underperforming branches likely exhibit minimal market share growth, especially as competitors rapidly adopt fully digital solutions. This stagnation, coupled with higher costs, would result in lower profitability for these specific business units, reinforcing their position as Dogs that require careful management or eventual phasing out.

Question Marks

China Construction Bank's international expansion into new markets, such as its recent branch opening in Adelaide, Australia, positions these ventures as potential Stars within its BCG matrix. These new outposts represent significant investment and strategic focus, aiming to capture future growth in promising regions.

While these international efforts are geared towards high-growth potential, CCB's initial market share in these newly established markets is naturally low, characteristic of Question Marks. The bank must strategically nurture these operations, providing substantial investment and support to cultivate them into future market leaders.

China Construction Bank's specific niche digital financial products, such as specialized investment tools or advanced wealth management features within its mobile banking and CCB Life platforms, are likely positioned as Stars or Question Marks. These products target high-growth segments of the digital finance market, but their current market share might be relatively low as they are still gaining traction. For instance, CCB's push into digital RMB pilot programs in 2024 aims to capture a nascent but rapidly expanding market, demonstrating potential for significant future growth.

China Construction Bank (CCB) is actively shaping the future of transition finance, a critical component of sustainable finance. They are not just participating but leading in the development of industry standards for these green initiatives. CCB is also establishing practical demonstration sites to showcase effective low-carbon transition financial services, highlighting their commitment to this burgeoning sector.

Transition finance, focused on helping industries decarbonize, represents a significant growth opportunity within the broader sustainable finance landscape. CCB's involvement positions them to capitalize on this expansion. As of early 2024, the global sustainable finance market is valued in the trillions, with transition finance expected to be a major driver of future growth as regulatory pressures and investor demand for decarbonization increase.

While CCB is a pioneer, their current market share in the relatively nascent transition finance segment is still building. This area, though high-growth, requires ongoing investment and strategic development to solidify a leading position. The bank's proactive approach, however, suggests a strong intent to capture a substantial portion of this evolving market in the coming years.

AI and Financial Large Model Applications

China Construction Bank (CCB) is making significant strides in AI and financial large models, deploying these technologies across more than half of its workforce and in 46 distinct business areas, encompassing over 200 specific application scenarios. This extensive integration underscores CCB's commitment to leveraging advanced technology for operational enhancement.

While CCB's internal application of AI and large models is broad, the direct impact on its external market share for AI-driven customer products is still in its nascent stages. The bank is actively exploring how these innovations can translate into tangible competitive advantages and new service offerings for its clientele.

CCB's strategic focus on AI and large models positions it for future growth, with ongoing investments aimed at refining these capabilities. The bank's proactive approach suggests a clear intention to translate technological leadership into market leadership, particularly in areas where AI can redefine customer experiences and financial services.

- AI Deployment: CCB has applied AI and financial large models to over 50% of its employees and 46 business areas.

- Application Scenarios: The bank utilizes these technologies in more than 200 distinct application scenarios.

- Market Impact: Direct influence on external market share for AI-driven customer products is currently emerging.

- Future Strategy: Continued investment and innovation are key to translating AI capabilities into market leadership.

Individual 'Carbon Accounts' and Related Products

China Construction Bank (CCB) is venturing into the burgeoning green consumer finance market with innovative products like individual 'carbon accounts.' These accounts connect customers' eco-friendly actions to financial tools such as digital RMB, credit cards, and personal loans, creating a unique financial ecosystem that rewards sustainable behavior.

This initiative positions CCB at the forefront of a high-growth sector, tapping into increasing consumer demand for sustainable financial solutions. While the concept is novel and promising, its current market adoption and share are understandably low.

- Innovation: CCB's 'carbon accounts' are a first-mover advantage in linking personal carbon footprints to financial products.

- Market Potential: The green finance sector is experiencing rapid growth, with increasing consumer interest in sustainability.

- Current Status: As a new offering, market penetration and customer awareness require substantial investment in promotion and education.

- Strategic Importance: This product line represents a strategic move to capture a future market segment and enhance brand image as an environmentally conscious institution.

China Construction Bank's (CCB) new international ventures, such as its Adelaide branch, are classic examples of Question Marks. These operations are in high-growth potential markets but currently hold a low market share, requiring significant investment to develop into Stars. CCB's digital financial products, like those leveraging digital RMB in 2024, also fit this category, targeting a rapidly expanding but still developing segment where initial market penetration is modest.

The bank's pioneering efforts in transition finance, a key area within sustainable finance, also represent Question Marks. While the global sustainable finance market is valued in the trillions as of early 2024, CCB's share in the specific, nascent transition finance segment is still being built. Continued strategic development and investment are crucial for CCB to solidify its position and capture future growth in this environmentally focused financial sector.

CCB's deployment of AI and large models across over half its workforce and 46 business areas, with more than 200 application scenarios, is a testament to its technological advancement. However, the direct impact of these internal AI applications on CCB's external market share for AI-driven customer products is still emerging. This indicates a strategic focus on leveraging technology for future market leadership, requiring further investment to translate internal capabilities into external competitive advantage.

CCB's innovative green consumer finance products, such as individual 'carbon accounts,' are positioned as Question Marks. These initiatives tap into the growing demand for sustainable financial solutions, a sector experiencing rapid growth. Despite being a first-mover advantage, the current market adoption and share of these novel products are understandably low, necessitating substantial investment in promotion and customer education to capture this future market segment.

BCG Matrix Data Sources

Our China Construction Bank BCG Matrix leverages official financial statements, comprehensive industry research, and detailed market trend analyses to provide a robust strategic overview.