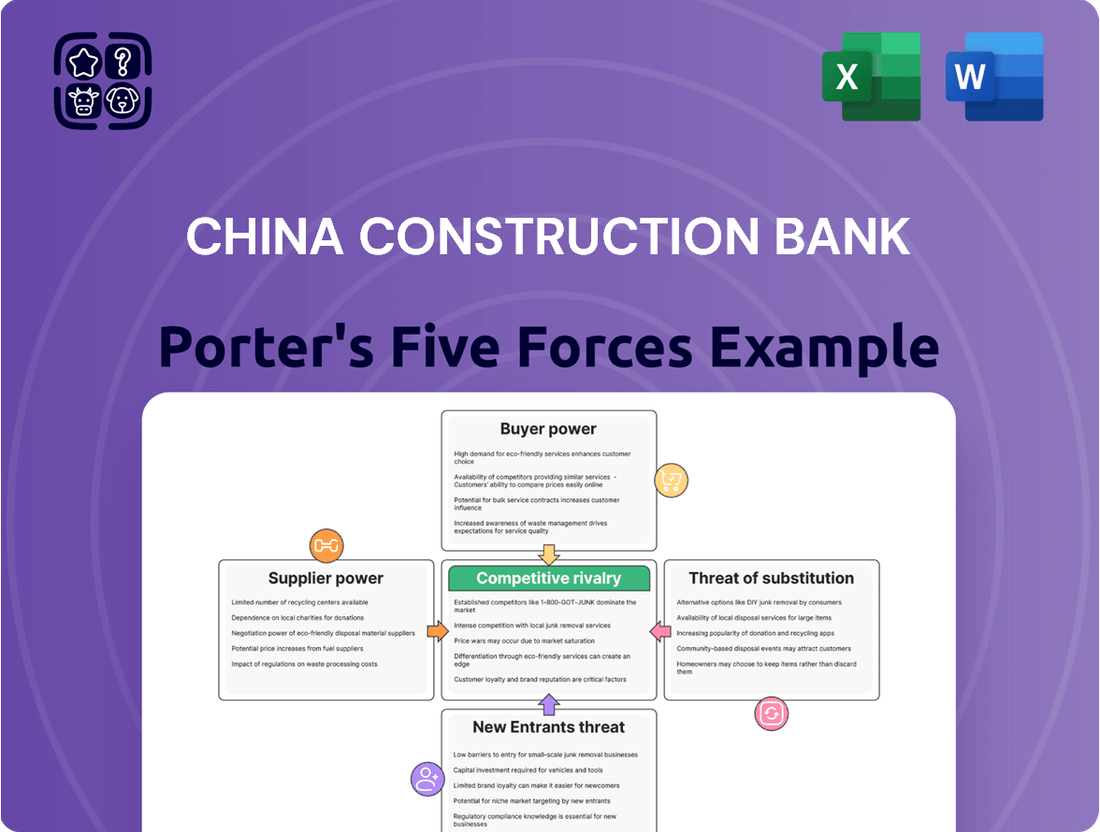

China Construction Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Construction Bank Bundle

China Construction Bank navigates a complex landscape shaped by intense rivalry and the growing threat of new digital entrants challenging traditional banking models. Understanding the power of its buyers and the potential impact of substitutes is crucial for its sustained success.

The complete report reveals the real forces shaping China Construction Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Construction Bank (CCB) depends on technology providers for its core operations, including IT infrastructure, software, and cybersecurity. While CCB's substantial size offers considerable negotiation leverage, specialized vendors for critical systems or advanced AI can still exert some influence due to unique or proprietary technologies. This necessitates a careful balance between managing costs and ensuring the bank has secure, reliable, and innovative technological capabilities.

China Construction Bank (CCB), like other major Chinese banks, relies on a skilled workforce in finance, technology, and risk management. The demand for specialized talent, particularly in fintech and data analytics, is high across the industry.

This competitive talent market can increase the bargaining power of individual employees or specialized recruitment agencies, potentially leading to higher salary demands and recruitment expenses for CCB. For instance, in 2023, average salaries for data scientists in China's financial sector saw significant increases, reflecting this trend.

However, CCB's established reputation and financial stability are significant draws for top talent, attracting a large volume of qualified applicants. This broad applicant pool helps to temper the bargaining power of individual suppliers of human capital, allowing CCB to manage its recruitment costs more effectively.

China Construction Bank (CCB), while boasting a substantial domestic deposit base, also taps into wholesale funding markets. This includes borrowing from other banks, institutional investors, and issuing bonds to fuel its extensive lending operations. The cost and availability of this wholesale funding are directly influenced by the terms set by these large-scale providers, acting as a significant source of supplier power.

The bargaining power of these wholesale funders is shaped by broader market dynamics. Factors such as the overall liquidity in the interbank market, prevailing interest rate policies set by regulatory bodies, and the general state of the global economy all play a role. When market liquidity is tight or interest rates are rising, these funders can command more favorable terms, increasing CCB's cost of funds.

CCB's strong financial standing, evidenced by its robust credit rating and its designation as a systemically important financial institution, generally grants it an advantage. This allows CCB to access wholesale funding more readily and often on more favorable terms compared to smaller or less stable institutions. For instance, as of early 2024, major Chinese banks like CCB continued to benefit from relatively stable funding costs due to their perceived safety and government backing.

Regulatory Compliance Service Providers

The bargaining power of suppliers for China Construction Bank (CCB) in the regulatory compliance service sector is influenced by the specialized knowledge required to navigate China's intricate and frequently updated financial regulations. Services such as anti-money laundering (AML), data privacy, and capital adequacy demand expert external consultants, legal firms, and audit specialists. These providers can exert some leverage due to their unique expertise, which is crucial for CCB to maintain compliance.

CCB's internal legal and compliance departments play a significant role in mitigating this supplier power. By developing robust in-house capabilities, CCB can reduce its dependence on external consultants, thereby strengthening its negotiating position. This internal strength is vital for managing costs and ensuring the quality of compliance efforts.

- Specialized Expertise: Providers of AML, data privacy, and capital adequacy services possess niche knowledge essential for CCB's regulatory adherence.

- Dependency Mitigation: CCB's investment in internal legal and compliance teams lessens reliance on external service providers.

- Market Dynamics: The evolving regulatory landscape in China means demand for these specialized services remains consistently high, influencing supplier pricing.

Infrastructure and Utility Providers

China Construction Bank's vast physical infrastructure, encompassing numerous branches and data centers nationwide, creates a significant demand for utilities and real estate services. While many of these services are largely commoditized, providers of critical infrastructure, especially in geographically concentrated areas or for highly specialized facilities, can exert some degree of localized bargaining power. For instance, a single provider of high-speed fiber optic internet in a remote region where CCB operates a key data center might have more leverage than a utility provider in a densely populated urban area with multiple options.

Despite this, CCB's extensive national footprint and diversified operational presence significantly mitigate the bargaining power of individual infrastructure and utility providers. The bank can leverage its scale to negotiate favorable terms by spreading its business across various regional suppliers and by having the option to switch providers in many locations. As of 2024, China's utility sector is undergoing significant reforms aimed at increasing competition and efficiency, which further reduces the inherent bargaining power of individual suppliers.

- Infrastructure Dependency: CCB's extensive network of branches and data centers relies heavily on consistent and reliable utility services (electricity, internet) and real estate for its operations.

- Localized Power: Certain critical infrastructure providers, particularly in specialized or less competitive regions, may hold localized bargaining power due to the essential nature of their services for CCB's operations.

- Mitigation through Scale: CCB's national presence allows for diversified sourcing and negotiation leverage, enabling it to secure competitive pricing and terms by playing regional suppliers against each other.

- Market Reforms: Ongoing reforms in China's utility sector are generally aimed at fostering greater competition, which tends to diminish the bargaining power of individual utility providers.

China Construction Bank (CCB) faces supplier power primarily from technology providers and wholesale funding markets. Specialized IT vendors for critical systems can exert influence, while the demand for skilled fintech professionals in 2023 saw salary increases. Wholesale funders gain leverage during periods of tight liquidity or rising interest rates, although CCB's strong financial standing as of early 2024 generally provides a stable funding cost advantage.

| Supplier Category | Source of Power | CCB's Mitigation Strategy | 2023-2024 Impact/Trend |

|---|---|---|---|

| Technology Providers | Unique/proprietary tech, specialized systems | Leveraging scale, diversifying vendors | High demand for AI/fintech talent increased costs. |

| Wholesale Funders | Market liquidity, interest rate policies | Strong credit rating, systemic importance | Stable funding costs due to perceived safety. |

| Human Capital | Demand for specialized skills (fintech, data) | Reputation, financial stability attracts talent | Average data scientist salaries rose in finance. |

What is included in the product

This analysis delves into the competitive forces shaping China Construction Bank's operating environment, examining the intensity of rivalry, the bargaining power of customers and suppliers, and the threats posed by new entrants and substitutes.

Instantly assess competitive intensity with a visual breakdown of threats and opportunities for China Construction Bank, simplifying complex market dynamics.

Customers Bargaining Power

China Construction Bank (CCB) serves a vast retail customer base, encompassing millions of depositors, borrowers, and wealth management clients. While individual retail customers generally possess limited bargaining power due to their small transaction sizes and the inconvenience of switching financial institutions, their collective influence, amplified by digital channels and consumer advocacy groups, can shape service expectations and product development.

China Construction Bank's (CCB) significant focus on corporate banking, particularly with large state-owned enterprises (SOEs) and major infrastructure clients, grants these entities substantial bargaining power. Their sheer size and the critical nature of their projects mean they can negotiate highly favorable terms, including competitive interest rates and bespoke financial products. For instance, in 2023, CCB's corporate loan portfolio continued to be a dominant segment, reflecting the strategic importance of these relationships.

As one of China's 'Big Four' state-owned commercial banks, China Construction Bank (CCB) experiences significant influence from government policies. This governmental role as a major stakeholder or 'customer' allows it to shape CCB's lending priorities and investment strategies, effectively wielding considerable bargaining power over the bank's operational focus and financial outcomes.

For instance, in 2024, government directives continued to steer lending towards strategic sectors like infrastructure and green finance. CCB's total assets reached approximately RMB 33.5 trillion by the end of 2023, demonstrating the scale at which these policy influences can impact the bank's vast operations and its role in supporting national economic development goals.

Increasing Financial Literacy and Digital Adoption

Chinese customers are increasingly savvy about their finances and comfortable with digital banking. This heightened financial literacy means they actively compare offerings, pushing banks like China Construction Bank to offer competitive rates and superior service. By 2024, a significant portion of the Chinese population actively uses mobile banking, making it easier than ever to switch providers for better deals.

The widespread adoption of digital financial services, including mobile payment systems and online investment platforms, has dramatically lowered the cost for customers to research and switch banks. This increased transparency and ease of access directly translates into greater bargaining power for consumers. For instance, the growth in fintech adoption means customers can readily access information on interest rates and fees across multiple institutions.

- Growing Digital Penetration: By the end of 2023, China's internet penetration rate reached 75.6%, with mobile internet users accounting for the vast majority, facilitating easy access to financial comparison tools.

- Increased Financial Literacy: Surveys indicate a rising trend in financial knowledge among Chinese consumers, enabling them to make more informed decisions about banking products and services.

- Platform Transparency: The proliferation of online financial marketplaces and comparison websites allows customers to easily view and contrast the offerings from various banks, including China Construction Bank.

- Demand for Convenience: Customers increasingly expect seamless, user-friendly digital experiences, pushing banks to innovate and improve their online and mobile service offerings to retain business.

Availability of Multiple Banking Options

The bargaining power of customers in China's banking sector, even with the presence of major players like China Construction Bank, is influenced by the sheer number of available banking options. Despite the prominence of the 'Big Four' state-owned banks, customers can choose from a diverse landscape including other large state-owned banks, numerous joint-stock commercial banks, and a growing number of city commercial banks. This competitive environment, further amplified by advancements in fintech, allows customers to readily switch providers if they find better pricing, superior service, or a more suitable product range, thus exerting a moderate degree of influence.

In 2024, the Chinese banking sector continued to see a significant number of institutions operating. For instance, as of the end of 2023, China boasted over 4,000 banking institutions, including commercial banks, rural financial institutions, and policy banks. This broad availability of choices means that a customer dissatisfied with China Construction Bank’s offerings or fees can easily explore alternatives. The rise of digital banking and mobile payment platforms, such as Alipay and WeChat Pay, also provides customers with convenient ways to compare and switch services, reinforcing their bargaining power.

- Diverse Banking Landscape: China's banking sector is not solely dominated by the 'Big Four'; it includes hundreds of other commercial banks.

- Fintech Influence: Digital platforms offer customers easy comparison and switching capabilities, enhancing their bargaining power.

- Customer Mobility: The ability to switch banks due to dissatisfaction with pricing or service quality is a key factor in customer bargaining power.

While individual retail customers at China Construction Bank (CCB) have limited power due to small transaction sizes, their collective voice, amplified by digital channels and consumer advocacy, significantly influences service expectations and product development. By 2024, China's high internet penetration, exceeding 75.6% by late 2023, and growing financial literacy empower customers to easily compare offerings, pushing CCB towards competitive rates and enhanced digital services.

The bargaining power of CCB's customers is also shaped by the diverse banking landscape in China, with over 4,000 banking institutions as of late 2023. This wide array of choices, coupled with the ease of switching facilitated by fintech platforms, allows customers to readily explore alternatives if dissatisfied with CCB's pricing or service, granting them a moderate yet impactful level of influence.

| Factor | Impact on CCB Customer Bargaining Power | 2023/2024 Data Point |

|---|---|---|

| Digital Adoption & Comparison Tools | Increases ability to find better deals | 75.6% Internet Penetration (end of 2023) |

| Financial Literacy | Enables more informed choices | Rising trend in consumer financial knowledge |

| Banking Sector Diversity | Provides ample alternatives | Over 4,000 banking institutions in China (end of 2023) |

| Fintech & Ease of Switching | Lowers switching costs | Widespread use of mobile banking and payment platforms |

What You See Is What You Get

China Construction Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for China Construction Bank, detailing the competitive landscape and strategic implications for the institution. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning needs.

Rivalry Among Competitors

China Construction Bank (CCB) faces intense rivalry from its domestic peers, the other 'Big Four' state-owned commercial banks: Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), and Bank of China (BOC). This concentrated market structure means these giants are constantly vying for dominance across all banking sectors.

The competition is particularly fierce in corporate, retail, and international banking, where product differentiation is often minimal. Banks frequently leverage their vast branch networks and similar service portfolios to attract and retain customers, driving down margins.

For instance, as of the first half of 2024, the 'Big Four' collectively held a substantial portion of China's total banking assets, underscoring their market power and the intensity of their competition. This rivalry compels CCB to continuously innovate its digital offerings and customer service to maintain its competitive edge.

Beyond the dominant 'Big Four,' China's banking landscape is increasingly shaped by a dynamic mix of joint-stock commercial banks and a proliferation of city and rural commercial banks. These institutions, such as China Merchants Bank and Industrial Bank, are not merely growing; they are actively challenging established players like CCB, especially within targeted market segments or geographical areas. Their agility and focus on specialized offerings or localized customer relationships provide a distinct competitive edge.

These regional and joint-stock banks are making significant strides in digital transformation, mirroring the investments of larger institutions. This strategic push allows them to offer more competitive digital services and innovative products, further intensifying the rivalry across the financial sector. For CCB, this translates to a more fragmented and competitive market where differentiation and customer-centricity are paramount for sustained market share.

The financial sector in China is experiencing a dramatic shift with the rise of fintech. Companies like Ant Group, operating Alipay, and Tencent, with WeChat Pay, have become dominant forces, handling a massive volume of transactions. In 2023, mobile payments in China were projected to reach over $3.5 trillion, demonstrating the sheer scale of these platforms.

These fintech innovators, while not traditional banks, are directly competing for customer engagement and valuable data, particularly in areas like online lending and wealth management. This forces established institutions such as China Construction Bank (CCB) to intensify their digital strategies and product development to remain competitive.

The dynamic between fintech giants and traditional banks is a complex dance of both collaboration and intense rivalry. CCB, like many of its peers, must adapt by integrating new technologies and offering seamless digital experiences to retain its market share and customer base in this rapidly evolving landscape.

Product and Service Homogeneity

China Construction Bank (CCB), like many large Chinese banks, faces intense competition due to the homogeneity of its traditional banking products and services. This similarity often forces competition into price wars rather than allowing for significant differentiation.

While CCB actively pursues service excellence and develops specialized offerings, particularly in infrastructure finance, its core banking products are readily replicable. This makes it difficult to build lasting competitive advantages solely on product innovation.

- Product Similarity: Many core banking products like savings accounts, current accounts, and standard loans are largely indistinguishable across major Chinese banks.

- Price-Based Competition: The lack of unique product features intensifies competition on interest rates and fees, impacting profit margins. For instance, in 2024, the benchmark lending rate for a one-year loan was around 3.45%, creating a tight margin for many institutions.

- Focus on Efficiency and Experience: Consequently, CCB's competitive strategy often hinges on operational efficiency and delivering a superior customer experience to attract and retain clients.

Regulatory Influence on Competition Dynamics

The Chinese banking sector operates under stringent government oversight, with policies directly influencing how banks compete. For instance, regulations on lending rates and capital adequacy ratios, like the tiered reserve requirement ratios that can vary based on bank size and asset quality, dictate operational parameters and profitability, thereby shaping competitive intensity.

These regulatory frameworks, while often providing a degree of protection for major state-owned entities such as China Construction Bank (CCB), also steer the industry towards consolidation. This consolidation can reduce the number of players but may also introduce new competitive pressures as larger, more capitalized banks emerge, potentially altering market share dynamics.

- Interest Rate Liberalization: Gradual liberalization of interest rates can intensify competition by allowing banks to price loans and deposits more dynamically, impacting net interest margins.

- Capital Requirements: Evolving capital adequacy ratios (e.g., Basel III implementation) force banks to manage their balance sheets more robustly, influencing lending capacity and strategic choices.

- Market Entry Restrictions: Historically, restrictions on foreign bank entry have shielded domestic players, but shifts in policy can open doors to new competitors with different business models.

- Government Directives: Policies promoting specific lending areas, such as green finance or support for small and medium-sized enterprises, can create new competitive battlegrounds and reward banks that align with national priorities.

China Construction Bank (CCB) contends with fierce rivalry from its domestic peers, particularly the other 'Big Four' state-owned banks: ICBC, ABC, and BOC. This intense competition is evident across corporate, retail, and international banking sectors where product differentiation is often limited, leading to a focus on leveraging extensive branch networks and similar service offerings. As of the first half of 2024, these 'Big Four' collectively controlled a dominant share of China's banking assets, highlighting the concentrated nature of the market and the constant drive for customer acquisition.

Beyond the major state-owned entities, CCB also faces increasing pressure from agile joint-stock and regional commercial banks. These institutions are actively innovating, particularly in digital banking, and are carving out market share through specialized offerings and localized customer engagement strategies. The rise of fintech platforms like Alipay and WeChat Pay further intensifies this rivalry, as they capture significant transaction volumes and customer data, forcing traditional banks like CCB to accelerate their digital transformation efforts to remain competitive.

| Competitor Type | Key Characteristics | Impact on CCB |

|---|---|---|

| Big Four State-Owned Banks (ICBC, ABC, BOC) | Vast branch networks, similar product portfolios, significant market share. | Intense competition for core banking customers, pressure on margins. |

| Joint-Stock & Regional Banks (e.g., China Merchants Bank) | Agility, digital innovation, specialized offerings, localized focus. | Challenging CCB in specific segments, demanding continuous service improvement. |

| Fintech Platforms (e.g., Ant Group, Tencent) | Dominant in mobile payments, data analytics, online lending, wealth management. | Disrupting traditional banking models, requiring significant digital investment. |

SSubstitutes Threaten

The rise of digital payment platforms like Alipay and WeChat Pay presents a significant threat of substitution for traditional banking services. These platforms have become deeply embedded in daily life in China, handling everything from retail purchases to bill payments, thereby diminishing the need for CCB's basic transaction services. By 2023, China's mobile payment market was valued at over $30 trillion, demonstrating the immense scale of this substitution.

Large corporations and government entities in China increasingly opt for direct financing via capital markets, bypassing traditional bank loans. In 2024, China's bond market saw substantial activity, with corporate bond issuance reaching trillions of yuan, offering a direct funding avenue that competes with bank lending for CCB.

The growing maturity of China's equity markets, evidenced by a steady stream of IPOs and secondary offerings throughout 2024, provides another powerful substitute. This allows companies to raise capital directly from investors, diminishing their reliance on CCB for corporate lending and pushing the bank towards more specialized financial services.

The rise of online wealth management products presents a significant threat of substitutes for China Construction Bank (CCB). Fintech platforms, asset managers, and other non-bank financial institutions are increasingly offering digital solutions that compete directly with traditional bank deposits and wealth management services. These alternatives often lure customers with the promise of higher yields or a broader array of investment choices, diverting capital that might otherwise remain with CCB.

In 2023, China's fintech sector continued its rapid expansion, with digital wealth management platforms attracting substantial assets. For instance, some estimates suggest that the total assets under management for online wealth management platforms in China reached trillions of yuan, demonstrating the scale of this competitive force. CCB, therefore, faces pressure to enhance its digital offerings and product innovation to retain its customer base and market share against these agile substitutes.

Peer-to-Peer (P2P) Lending and Other Alternative Financing

Peer-to-peer (P2P) lending and other online financing methods have presented a significant threat of substitutes to traditional banking services, including those offered by China Construction Bank. These platforms historically provided an alternative avenue for credit, especially for small and medium-sized enterprises (SMEs) and individuals facing challenges with conventional bank loan approvals. For instance, by 2020, China's P2P lending market, though shrinking, had facilitated trillions of yuan in transactions, showcasing its past appeal.

While regulatory crackdowns have reduced the prevalence of P2P lending, the underlying demand for more accessible and flexible credit solutions persists. This enduring need could fuel the emergence of new digital finance models that directly compete with bank loans. The continued innovation in fintech suggests that alternative financing will remain a viable substitute, potentially impacting traditional banks by diverting customers seeking quicker or less stringent lending processes.

- P2P Lending's Past Impact: Historically, P2P platforms offered an alternative to bank loans, particularly for SMEs and individuals.

- Regulatory Shifts: Increased regulation has led to a contraction in the P2P lending market, but the demand for alternative finance remains.

- Fintech Innovation: New digital finance models continue to emerge, posing an ongoing threat of substitution for traditional banking services.

Insurance and Investment Products

Insurance products like annuities and investment-linked policies, alongside direct investments in public or private funds, present viable substitutes for traditional bank savings and certain investment offerings. Customers aiming for superior returns or tailored risk management may opt for these alternatives over standard bank deposits or less lucrative wealth management products. For instance, by July 2024, the global insurance market was projected to reach over $6.5 trillion, indicating a significant pool of capital seeking alternatives to traditional banking.

China Construction Bank (CCB) actively addresses this threat by leveraging its subsidiaries to offer a comprehensive suite of its own insurance and investment banking services. This integrated approach allows CCB to retain customer assets by providing competitive products that directly compete with external substitutes. In 2023, CCB’s wealth management business saw significant growth, with assets under management reaching approximately RMB 11.6 trillion, demonstrating its capacity to compete in these alternative product categories.

- Annuities and investment-linked insurance offer diversification beyond traditional savings accounts.

- Direct investment in funds provides access to broader market opportunities and potentially higher returns.

- CCB's strategy involves cross-selling these financial products through its banking channels.

- The bank's extensive branch network and digital platforms facilitate the promotion of its insurance and investment arms.

The increasing sophistication of fintech platforms offering digital payment solutions, like Alipay and WeChat Pay, poses a significant substitute threat to traditional banking services. These platforms have captured a substantial share of transaction volumes, with China's mobile payment market exceeding $30 trillion in 2023. This shift diverts essential fee-based income from CCB's core transaction processing.

Direct access to capital markets for corporations, bypassing traditional bank lending, is another key substitute. In 2024, substantial corporate bond issuance in China, reaching trillions of yuan, highlights this trend. Similarly, the robust growth of China's equity markets provides an alternative funding source for businesses, reducing their reliance on CCB for financing.

Online wealth management products and alternative investment vehicles are also strong substitutes for CCB's savings and investment services. Assets under management for digital wealth platforms in China reached trillions of yuan by 2023, indicating a significant migration of customer funds. This necessitates CCB's continuous innovation in its digital offerings to remain competitive.

Entrants Threaten

The banking sector in China presents formidable regulatory barriers, including rigorous licensing processes and substantial capital requirements. For instance, as of early 2024, establishing a new commercial bank in China typically necessitates a registered capital of at least RMB 1 billion, with many requiring significantly more depending on their scope. These high entry costs and complex compliance frameworks, such as those mandated by the China Banking and Insurance Regulatory Commission (CBIRC), effectively deter most new, independent banking entrants, thus diminishing the threat of new competitors for established players like China Construction Bank.

China Construction Bank (CCB) benefits from decades of established brand recognition and deep trust among its vast customer base, a significant barrier for new entrants.

Its extensive physical branch network across China, comprising over 15,000 outlets as of the end of 2023, further solidifies this advantage.

Replicating such a widespread infrastructure and cultivating comparable customer loyalty requires immense time and capital, making it a formidable challenge for any new player seeking to compete on scale or trust.

Fintech companies, like Ant Group and Tencent's WeBank, are increasingly encroaching on traditional banking territory. While they may not hold full banking licenses initially, their expansion into payments and online lending, leveraging massive user bases and advanced data analytics, presents a growing threat. For instance, Ant Group's Alipay processed over $1.8 trillion in payment volume in 2023, showcasing its significant reach.

Limited Scope for Foreign Bank Expansion

The threat of new entrants for China Construction Bank (CCB) is relatively low, particularly from foreign banks. While China has been opening its financial sector, foreign institutions still encounter substantial hurdles. These include stringent regulations, cultural differences, and established domestic players with deep market penetration. For instance, foreign banks' share of China's banking assets remained modest, often below 2% in recent years, highlighting their limited ability to disrupt the market significantly as new entrants.

Key factors contributing to this limited threat include:

- Regulatory Barriers: Foreign banks face ongoing licensing requirements and operational restrictions that differ from those for domestic banks.

- Scale and Network Advantage: Established Chinese banks, like CCB, possess vast branch networks and a deep understanding of the local market, making it difficult for newcomers to compete on scale.

- Capital Requirements: Meeting capital adequacy ratios and other regulatory demands can be more challenging for new foreign entrants compared to well-capitalized domestic institutions.

Government Policy and Market Structure Protection

As one of China's 'Big Four' state-owned banks, China Construction Bank (CCB) enjoys significant implicit government backing and plays a crucial role in national economic development strategies. This government support acts as a powerful barrier to entry for potential new competitors. For instance, in 2024, the banking sector in China continued to be heavily influenced by state directives, with policies often reinforcing the stability of major financial institutions.

Government policies in China frequently prioritize financial system stability and the well-being of key state-owned enterprises like CCB. This regulatory environment makes it challenging for new, potentially disruptive players to enter the market and rapidly gain traction without facing significant hurdles. The established structure is often favored, limiting the scope for radical market shifts.

This inherent protection means that the threat of new entrants is relatively low for CCB. New entities would struggle to replicate the scale, regulatory advantages, and government trust that CCB possesses. For example, in 2023, while fintech innovations continued, their integration into the core banking system was often guided by state approval, reinforcing the dominance of established players.

- Government Support: CCB's status as a state-owned enterprise provides implicit guarantees and preferential treatment.

- Regulatory Environment: Policies often favor established banks, creating high barriers for new entrants.

- National Economic Planning: CCB's integral role in economic initiatives means its stability is a government priority.

- Market Structure: The existing banking landscape is dominated by large, state-backed institutions, making it difficult for newcomers to compete effectively.

The threat of new entrants for China Construction Bank (CCB) is generally considered low, primarily due to significant regulatory hurdles and high capital requirements. For instance, establishing a new commercial bank in China typically requires substantial registered capital, often exceeding RMB 1 billion as of early 2024, a figure that deters many potential new players.

CCB also benefits from its established brand reputation and extensive physical footprint, with over 15,000 branches nationwide by the end of 2023. Replicating this scale and customer loyalty presents a considerable challenge for any new domestic or foreign entrant, effectively limiting their ability to compete effectively.

While fintech firms are innovating, their expansion into core banking services is often managed within existing regulatory frameworks, reinforcing the dominance of established institutions like CCB. The inherent government backing and strategic importance of CCB further solidify its position, making market entry and disruption exceptionally difficult for newcomers.

| Factor | Impact on CCB | Key Data/Observation (as of early 2024/late 2023) |

|---|---|---|

| Regulatory Barriers | Lowers Threat | Minimum registered capital for new banks often RMB 1 billion+; rigorous licensing. |

| Brand & Network Scale | Lowers Threat | Over 15,000 branches; deep customer trust built over decades. |

| Fintech Competition | Moderate Threat (managed) | Ant Group's Alipay processed over $1.8 trillion in payments in 2023, but operates within evolving regulations. |

| Foreign Entry Barriers | Lowers Threat | Foreign banks' share of China's banking assets typically below 2%. |

| Government Support | Lowers Threat | Implicit guarantees and priority in national economic planning for state-owned banks like CCB. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Construction Bank leverages data from official company filings, financial news outlets, and industry-specific research reports. This approach ensures a comprehensive understanding of the banking sector's competitive landscape.