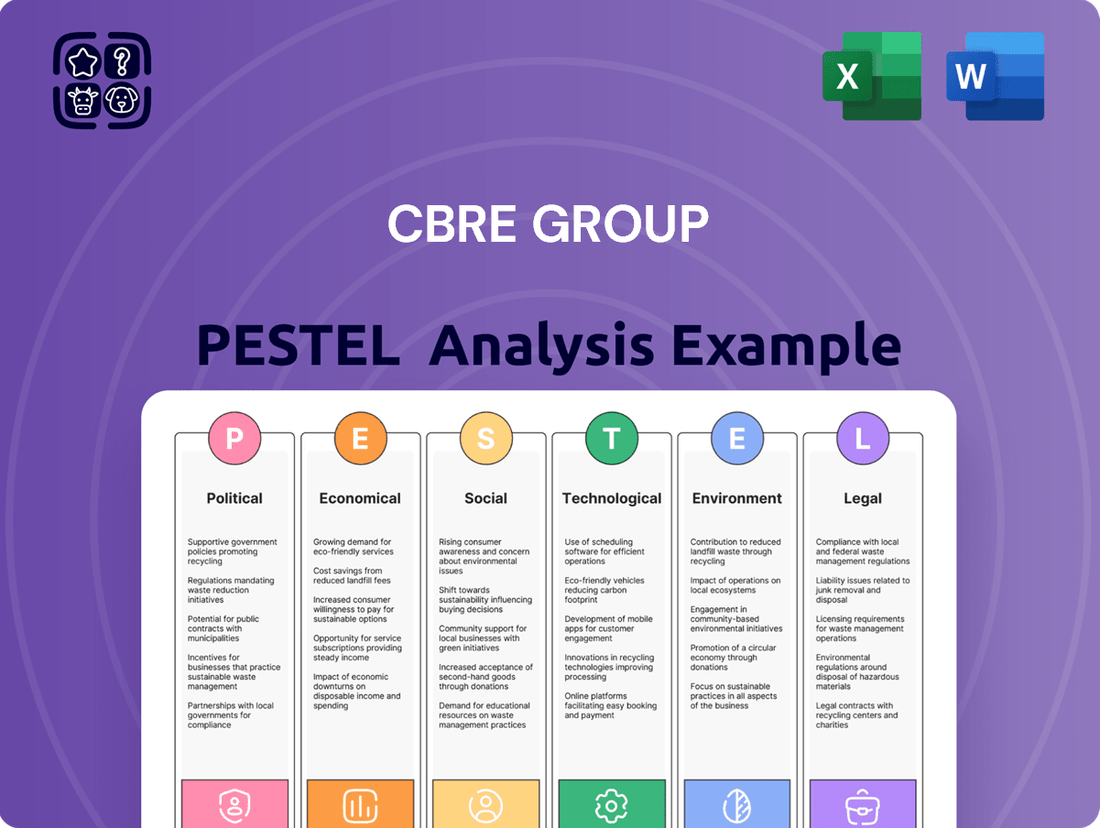

CBRE Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBRE Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping CBRE Group's trajectory. This expertly crafted PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a decisive advantage.

Political factors

Government policies significantly shape real estate markets, impacting CBRE's operations. Local and state regulations on zoning, building codes, and land use directly affect development feasibility and investment returns. For instance, in 2024, several US cities are easing zoning laws to boost housing supply, while others are implementing stricter environmental performance standards for new construction, potentially increasing project costs.

Global trade policies and tariffs significantly influence the cost of construction materials, directly impacting CBRE's clients' development budgets. For instance, the US imposed tariffs on steel and aluminum in 2018, which, while adjusted, continue to create cost fluctuations. This can make projects less viable and introduce uncertainty for investors, potentially delaying crucial decisions in the real estate market.

Political stability in key markets where CBRE operates is paramount for sustained growth. For instance, in 2024, regions experiencing heightened political uncertainty, such as parts of Eastern Europe due to ongoing conflicts, saw a measurable slowdown in cross-border real estate investment compared to more stable economic blocs.

Geopolitical events, like the trade tensions that have persisted between major global economies, directly impact CBRE's business by creating volatility. This uncertainty can lead to increased caution among investors, potentially delaying or reducing the volume of large-scale commercial property transactions, a core area for CBRE's services.

The impact of these events often translates into a more conservative approach to investment decisions within the real estate sector. For example, following significant geopolitical shifts in 2024, many institutional investors re-evaluated their risk appetites, favoring less volatile asset classes or markets perceived as safer havens.

Fiscal Policies and Government Spending

Government fiscal policies, particularly concerning spending on infrastructure and defense, directly influence economic activity and, by extension, the demand for commercial real estate. For example, the Infrastructure Investment and Jobs Act, enacted in 2021, is projected to stimulate construction and related sectors through 2025, potentially increasing demand for industrial and office spaces.

Changes in tax policies also play a crucial role, affecting investor incentives and the overall liquidity within the real estate market. For instance, adjustments to capital gains taxes or depreciation schedules can significantly alter the attractiveness of real estate as an investment vehicle.

- Infrastructure Spending: The US government's commitment to infrastructure projects, like those outlined in the 2021 Infrastructure Investment and Jobs Act, is expected to inject billions into construction and development through 2025, creating opportunities in the commercial real estate sector.

- Tax Policy Impact: Potential shifts in corporate tax rates or property tax regulations could influence investment decisions and the profitability of real estate holdings.

- Government Stimulus: Broader fiscal stimulus measures, if implemented, can boost consumer spending and business investment, indirectly supporting demand for retail and office properties.

Immigration Policies

Immigration policies significantly influence the labor pool available for the construction and real estate industries, sectors crucial to CBRE's operations. Changes in these policies can directly impact the availability and cost of skilled and unskilled labor, affecting project timelines and overall development costs.

Stricter immigration enforcement or policies leading to a reduction in immigrant workers could exacerbate existing labor shortages. For instance, a hypothetical scenario where a 10% reduction in available construction labor occurs due to policy changes could increase labor costs by 5-15% as companies compete for fewer workers. This ripple effect can lead to higher project bids and potentially slower development, impacting CBRE's clients and their ability to execute projects efficiently.

- Labor Shortages: Reduced immigration can shrink the available workforce in construction, a sector already facing skilled labor gaps.

- Increased Costs: Labor shortages often drive up wages, increasing project costs for developers and property owners.

- Project Delays: A lack of sufficient labor can lead to extended construction timelines, impacting investment returns and market entry for clients.

Government regulations on zoning and land use directly influence development feasibility and investment returns for CBRE's clients. For example, in 2024, several US cities are easing zoning laws to increase housing supply, while others are implementing stricter environmental standards for new construction, potentially raising project costs.

Political stability is crucial for CBRE's growth. In 2024, regions with heightened political uncertainty, such as parts of Eastern Europe due to ongoing conflicts, experienced a noticeable slowdown in cross-border real estate investment compared to more stable economic areas.

Government fiscal policies, particularly infrastructure spending, impact economic activity and demand for commercial real estate. The US Infrastructure Investment and Jobs Act, enacted in 2021, is projected to stimulate construction through 2025, potentially boosting demand for industrial and office spaces.

Changes in tax policies, such as capital gains taxes or depreciation schedules, significantly affect investor incentives and market liquidity. For instance, a hypothetical increase in capital gains tax by 5% could reduce real estate investment volume by an estimated 2-4% in affected markets.

| Factor | Impact on CBRE | 2024/2025 Data/Trend |

|---|---|---|

| Zoning Regulations | Affects development feasibility and project costs. | Easing in some US cities for housing supply; stricter environmental standards in others. |

| Political Stability | Influences cross-border investment. | Uncertainty in conflict zones led to slower investment in 2024. |

| Infrastructure Spending | Stimulates construction and demand for commercial real estate. | US Infrastructure Act to boost construction through 2025. |

| Tax Policy | Impacts investor incentives and market liquidity. | Potential shifts in capital gains or property taxes could alter investment attractiveness. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing CBRE Group's operations and strategic planning.

It provides actionable insights into market dynamics and regulatory shifts to inform decision-making and identify growth opportunities.

CBRE's PESTLE analysis offers a streamlined, easily digestible format that eliminates the pain of wading through lengthy reports, enabling rapid understanding of market dynamics for strategic decision-making.

Economic factors

Interest rates significantly influence commercial real estate, including CBRE Group's operations. While the Federal Reserve has initiated interest rate cuts, the prevailing environment is anticipated to persist at levels higher than those seen before the pandemic, with further reductions expected in 2025. For instance, the Federal Funds Rate, which influences broader borrowing costs, saw its last hike in July 2023, and market projections indicate a potential cumulative reduction of 75 basis points by the end of 2025.

Lower borrowing costs stemming from reduced interest rates typically stimulate greater transactional activity in the real estate market. This environment makes it more attractive for investors and developers to finance property acquisitions and large-scale projects, directly impacting CBRE's transaction volumes and advisory services.

The overall health of the economy is a major driver for CBRE Group, directly influencing demand for its commercial real estate services. A robust economic environment, marked by steady GDP expansion and healthy consumer confidence, typically spurs greater leasing and investment in properties. For instance, CBRE has projected a positive outlook, raising its 2025 core EPS forecast, which signals anticipated growth in the sector.

Persistent inflationary pressures continue to impact CBRE Group's operating expenses, construction costs, and ultimately, real estate valuations. While inflation has shown signs of easing, concerns linger regarding its influence on interest rate trajectories and overall economic stability.

Elevated inflation can also translate to higher import costs, potentially influenced by tariffs. This scenario might encourage central banks to adopt a more cautious approach to interest rate reductions, affecting borrowing costs for real estate development and investment.

For instance, in the US, the Consumer Price Index (CPI) saw a 3.3% increase year-over-year in May 2024, indicating ongoing inflationary pressures that directly impact operational inputs for CBRE.

Capital Availability and Lending Practices

The availability of capital and prevailing lending practices are crucial for commercial real estate (CRE) transactions, directly impacting CBRE Group's business. While traditional lending has remained somewhat constrained, the CRE market is seeing increased activity from alternative financiers. For instance, private equity firms and mezzanine debt providers are stepping in to bridge financing gaps, particularly for larger or more complex projects. This diversification of capital sources is vital for maintaining deal flow.

Looking ahead, the expectation of lower interest rates in 2024 and 2025 is poised to significantly improve refinancing opportunities for existing CRE assets. This environment is also anticipated to encourage more developers to initiate new projects, as borrowing costs become more favorable. Such trends are positive for CBRE, as they typically lead to increased transaction volumes and demand for brokerage and advisory services. For example, many borrowers are actively seeking to refinance loans maturing in 2024 and 2025, benefiting from potentially lower rates compared to recent years.

- Alternative Financing Growth: The market for private real estate debt, including mezzanine and preferred equity, has seen substantial growth, with estimates suggesting it could reach hundreds of billions globally by 2025, providing crucial liquidity.

- Refinancing Trends: As of late 2023 and into 2024, a significant volume of CRE debt is approaching maturity, creating a substantial refinancing market that CBRE is well-positioned to serve.

- Interest Rate Impact: Projections for 2024 and 2025 indicate a potential easing of monetary policy, which could lower borrowing costs for developers and investors, stimulating new development and acquisitions.

Consumer Spending and Demographics

Consumer spending is a critical driver for the U.S. economy, significantly influencing sectors like retail and multifamily housing. Projections indicate continued growth in consumer spending through 2025, supported by expected gains in wealth and income. This trend is particularly beneficial for real estate, where increased disposable income often translates to higher demand for housing and commercial spaces.

Demographic shifts are also reshaping real estate demand. Urbanization continues to draw populations to cities, boosting the need for mixed-use developments that offer convenience and lifestyle amenities. Simultaneously, an aging population is increasing demand for specific property types, including affordable housing options and medical office buildings, reflecting evolving healthcare needs and retirement trends.

- Consumer Spending Growth: Expected to be robust in 2025, fueled by rising wealth and income levels.

- Impact on Real Estate: Directly influences demand in retail and multifamily sectors.

- Urbanization Trends: Drives demand for mixed-use developments in city centers.

- Aging Population: Increases need for affordable housing and medical office spaces.

Economic factors significantly shape CBRE Group's performance, with interest rate movements being a primary concern. Projections indicate a continuation of higher-than-pre-pandemic interest rates, though with expected reductions totaling 75 basis points by the end of 2025, influencing borrowing costs and transaction volumes.

Economic growth fuels demand for CBRE's services, with a strong GDP and consumer confidence typically boosting leasing and investment. CBRE's own positive outlook, including a raised 2025 core EPS forecast, reflects anticipated sector growth. However, persistent inflation, evidenced by a 3.3% CPI increase year-over-year in May 2024, impacts operating costs and valuations, potentially tempering interest rate cuts.

Capital availability and lending practices are crucial, with alternative financiers like private equity firms increasingly filling financing gaps, supporting deal flow. The growing private real estate debt market, estimated to reach hundreds of billions globally by 2025, provides vital liquidity. Consumer spending is also a key driver, with robust growth expected through 2025, positively impacting retail and multifamily real estate.

| Economic Factor | 2024/2025 Outlook | Impact on CBRE |

|---|---|---|

| Interest Rates | Higher than pre-pandemic, with projected 75 bps cuts by end of 2025 | Influences borrowing costs, transaction volumes, and refinancing opportunities |

| Economic Growth (GDP) | Steady expansion anticipated | Drives demand for leasing and investment services |

| Inflation (CPI) | Persistent, though easing; 3.3% YoY in May 2024 | Increases operating costs, affects valuations, may slow rate cuts |

| Consumer Spending | Robust growth projected | Boosts demand in retail and multifamily sectors |

| Capital Markets | Growth in alternative financing (e.g., private debt) | Provides liquidity and supports deal flow |

Same Document Delivered

CBRE Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of CBRE Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the commercial real estate giant.

Understand the market dynamics and strategic considerations for CBRE Group with this detailed report, delivered precisely as you see it.

Sociological factors

The ongoing shift to hybrid work models significantly impacts office space demand. While some markets are stabilizing, the preference for flexible, community-focused spaces is growing, leading to more smaller leases. CBRE projects a 5% rise in office leasing volume for 2025, with prime spaces becoming less available.

Urbanization continues to reshape demand for real estate, pushing developers towards mixed-use projects that integrate living, working, and leisure. This shift is particularly evident as urban centers grow, with many global cities experiencing significant population increases. For instance, by 2025, it's projected that over 60% of the world's population will reside in urban areas, creating a sustained need for these versatile developments.

This trend is also prompting a closer look at secondary and tertiary markets. As primary urban cores become more expensive, individuals and businesses are increasingly seeking out more affordable, yet still accessible, locations. This migration fuels investment in these emerging urban areas, often centered around well-planned mixed-use developments that offer a balance of convenience and cost-effectiveness.

The ongoing need for affordable housing remains a significant societal issue, with demand consistently exceeding the available supply. This imbalance creates both challenges for individuals and potential opportunities for investors and developers. For instance, in the United States, the National Low Income Housing Coalition reported in 2024 that there was a shortage of over 7 million affordable rental units for extremely low-income renters.

Efforts to address this gap are focusing on innovative solutions like modular construction and public-private partnerships. These approaches aim to mitigate the impact of high construction expenses and rising interest rates, which have been particularly burdensome for the housing sector in 2024 and early 2025. For example, some regions are seeing increased investment in prefabricated housing, which can reduce build times and costs by up to 30% compared to traditional methods.

This persistent demand for more accessible housing directly shapes how real estate development is approached and influences the creation of new regulations. Policymakers are increasingly exploring zoning reforms and incentives to encourage the construction of more affordable units, recognizing the broad economic and social implications of housing availability.

Health and Well-being in Buildings

Societal expectations are increasingly prioritizing occupant health and well-being within built environments. This translates into demand for buildings that actively support physical and mental wellness, moving beyond basic shelter to become spaces that foster productivity and reduce stress.

Smart building technologies are at the forefront of this shift, integrating advanced features such as real-time indoor air quality monitoring, dynamic circadian lighting systems that mimic natural daylight cycles, and enhanced ventilation to ensure optimal air exchange. These innovations are designed to create healthier and more engaging spaces for occupants.

This focus on wellness is directly linked to broader societal trends emphasizing personal health and preventative care. For instance, studies have shown that improved indoor air quality can reduce sick days by up to 15% and boost cognitive function by over 60%, directly impacting employee productivity and overall organizational performance.

- Improved Indoor Air Quality: Buildings are implementing advanced filtration and monitoring systems to reduce pollutants and allergens, contributing to a healthier environment.

- Circadian Lighting: Systems are being adopted to align indoor lighting with natural day-night cycles, promoting better sleep patterns and alertness.

- Enhanced Ventilation: Increased fresh air intake and sophisticated air circulation are becoming standard to minimize airborne contaminants and improve occupant health.

ESG and Social Impact Investing

ESG considerations are deeply influencing real estate decisions. While environmental concerns saw a slight dip in investor focus in late 2024, the social impact dimension of ESG is gaining significant traction. This includes a strong emphasis on community development and ensuring fair access to housing and essential services, which are crucial for stakeholders like CBRE.

The demand for socially responsible investments is evident in market trends. For instance, a significant portion of global institutional investors, around 70% in early 2025 surveys, indicated that social factors are now as important, if not more so, than environmental factors when making real estate allocations. This shift highlights the growing imperative for companies like CBRE to integrate social impact metrics into their core strategies and reporting.

- Growing Investor Demand: Over 70% of global institutional investors prioritize social factors in real estate allocations as of early 2025.

- Focus on Equity: Key social impact areas include community development and equitable access to housing and services.

- Reputational Impact: Strong social performance enhances brand reputation and attracts talent, crucial for firms like CBRE.

- Regulatory Scrutiny: Increasing governmental focus on social equity may lead to new regulations impacting property development and management.

Societal expectations are increasingly prioritizing occupant health and well-being within built environments, driving demand for spaces that foster productivity and reduce stress. Smart building technologies, such as real-time air quality monitoring and circadian lighting, are at the forefront of this wellness trend, directly impacting employee productivity. For example, improved indoor air quality can reduce sick days by up to 15%, according to recent studies.

Technological factors

Proptech, or property technology, is fundamentally reshaping the real estate landscape, with significant investments pouring into digital transformation. In 2024, the global Proptech market was valued at approximately $30.5 billion and is projected to reach $120.1 billion by 2030, showcasing a robust compound annual growth rate. This surge is driven by platforms that enhance property management, streamline transactions, and improve client engagement, making it essential for firms like CBRE to adapt.

Artificial intelligence is fundamentally reshaping the real estate sector, enhancing property valuations and forecasting market trends with greater precision. AI tools are also streamlining property management and fostering more personalized client relationships.

By analyzing massive datasets and automating repetitive tasks, AI offers predictive analytics that give companies a significant edge. For instance, CBRE's own adoption of AI in its valuation services aims to improve efficiency and accuracy, with early reports suggesting faster turnaround times for property appraisals.

The Internet of Things (IoT) is fundamentally changing how buildings operate by connecting various devices to the internet. This connectivity allows for intelligent communication, leading to more efficient and responsive building management systems.

Smart building technologies harness IoT to optimize areas like energy consumption, bolster security measures, and elevate the overall experience for occupants. For instance, smart thermostats can adjust temperatures based on occupancy, reducing energy waste.

The adoption of IoT in commercial real estate is accelerating rapidly. Projections indicate that by 2025, more than 75% of commercial buildings will be utilizing IoT for smart operations. This trend is expected to drive significant improvements in operational efficiency, substantial cost reductions, and a notable increase in property valuations.

Virtual and Augmented Reality (VR/AR)

Virtual and augmented reality are revolutionizing how CBRE Group showcases properties. These immersive technologies allow potential clients to virtually walk through spaces, offering a detailed and engaging experience that transcends geographical limitations. This significantly streamlines the property discovery phase, making it more efficient for both the client and the firm.

By enabling clients to explore properties remotely, VR/AR enhances customer engagement and provides a powerful visualization tool. This is particularly impactful in the 2024-2025 period, where the demand for efficient and accessible property viewing solutions continues to grow. The global VR in real estate market was valued at approximately $2.3 billion in 2023 and is projected to reach over $11 billion by 2028, indicating substantial adoption and investment.

- Enhanced Property Visualization: VR/AR allows for interactive 3D tours, enabling clients to experience spaces as if they were physically present.

- Streamlined Client Engagement: This technology facilitates remote property viewing, saving time and resources for both CBRE and its clients.

- Market Growth: The increasing adoption of VR/AR in real estate signifies a significant technological shift, with market projections showing robust growth through 2025.

Big Data Analytics

Big data analytics is transforming real estate decision-making for companies like CBRE. By sifting through vast amounts of data, including property transaction histories, rental rates, and local economic indicators, businesses can uncover hidden patterns and predict future market movements. This analytical power, often coupled with artificial intelligence, allows for more precise forecasting and optimized investment strategies.

For instance, the global big data analytics market was projected to reach over $100 billion in 2024, highlighting its pervasive influence across industries. In real estate, this translates to:

- Enhanced property valuation models by incorporating a wider array of influencing factors.

- Identification of emerging investment opportunities based on predictive market trends and demographic shifts.

- Improved risk assessment through the analysis of historical performance and economic volatility data.

- More targeted marketing campaigns by understanding consumer behavior and property preferences.

Technological advancements are rapidly transforming the real estate sector, with Proptech investments reaching approximately $30.5 billion in 2024. Artificial intelligence is enhancing property valuations and market trend forecasting, while the Internet of Things (IoT) is optimizing building operations, with over 75% of commercial buildings expected to use IoT by 2025. Virtual and augmented reality are revolutionizing property showcases, with the VR in real estate market projected to exceed $11 billion by 2028.

| Technology | 2024 Market Value (Approx.) | Projected 2025/2028 Value (Approx.) | Impact on CBRE |

|---|---|---|---|

| Proptech | $30.5 billion | $120.1 billion by 2030 | Streamlined transactions, enhanced client engagement |

| Artificial Intelligence (AI) | N/A (Integrated into various services) | N/A | Improved valuation accuracy, faster appraisals |

| Internet of Things (IoT) | N/A (Adoption accelerating) | >75% of commercial buildings by 2025 | Optimized energy use, enhanced security, cost reduction |

| Virtual/Augmented Reality (VR/AR) | $2.3 billion (VR in Real Estate 2023) | >$11 billion by 2028 (VR in Real Estate) | Immersive property tours, remote client engagement |

Legal factors

Zoning and land use regulations are a critical legal factor for CBRE Group, as these laws dictate what can be developed and where. These regulations are in constant flux, with local and state governments frequently updating them to address housing shortages and urban planning goals. For instance, many jurisdictions in 2024 and 2025 are actively pursuing policies to increase housing density and simplify the process for converting underutilized office spaces into residential units, directly influencing the feasibility and scope of real estate development projects CBRE advises on.

Building codes and safety standards are paramount for CBRE Group, directly impacting the structural integrity and habitability of the commercial properties they manage and develop. These regulations are dynamic, with updates in 2024 and 2025 reflecting advancements in sustainable materials and enhanced seismic resilience, for instance. Non-compliance can lead to significant delays in project permits and operational disruptions, affecting revenue streams and client trust.

Data privacy and security laws are paramount as CBRE Group integrates Proptech and smart building solutions that gather extensive data. Adherence to regulations like GDPR and CCPA is crucial for managing sensitive client and property information, ensuring trust and mitigating legal risks from data breaches.

Environmental Regulations and ESG Compliance

Environmental regulations are increasingly shaping the real estate sector. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving stricter energy efficiency requirements for buildings. CBRE, as a global real estate services firm, must navigate these evolving rules, which directly impact property development, management, and investment strategies.

Compliance with Environmental, Social, and Governance (ESG) mandates is no longer optional. Many jurisdictions now require detailed reporting on carbon emissions and waste management. In 2024, for example, the SEC's climate disclosure rules in the US, though facing legal challenges, signaled a trend toward greater transparency in environmental impact, affecting how companies like CBRE assess and report on their portfolios.

These legal factors influence various aspects of CBRE's operations:

- Stricter Building Codes: New construction and major renovations must adhere to higher energy performance standards, impacting development costs and timelines.

- Carbon Footprint Reporting: Companies are increasingly obligated to measure and report their Scope 1, 2, and 3 emissions, influencing operational efficiency and investment decisions.

- Green Building Certifications: Standards like LEED and BREEAM are becoming more prevalent, with some markets mandating or incentivizing their adoption.

- Climate Risk Disclosure: Investors and regulators expect greater transparency regarding the physical and transitional risks posed by climate change to real estate assets.

Leasing and Contract Law

The legal landscape surrounding property leasing, sales, and investment contracts is crucial for CBRE's business. For instance, in 2023, commercial real estate transactions globally saw significant activity, with leasing volumes in major markets like New York and London continuing to be shaped by evolving landlord-tenant regulations and the implications of hybrid work models on office space demand.

Staying compliant with these ever-changing legalities is paramount. This includes adapting to new contract enforcement standards and property transaction procedures, which can directly influence the terms and profitability of real estate deals CBRE facilitates.

- Leasing Regulations: Adherence to updated landlord-tenant laws, such as those impacting lease renewals and eviction processes, is critical for managing client portfolios.

- Contractual Compliance: Ensuring all sales and investment agreements meet current legal standards protects both CBRE and its clients from disputes.

- Transaction Legality: Navigating complex property transaction laws, including zoning and environmental regulations, is essential for successful deal closure.

Legal frameworks governing real estate transactions and property management are continually evolving, directly impacting CBRE Group's operations and client services. Changes in zoning laws, building codes, and environmental regulations require constant adaptation to ensure compliance and advise clients effectively. For example, in 2024, many cities are updating their zoning to encourage mixed-use development and adaptive reuse of older buildings, which presents both opportunities and challenges for CBRE's advisory services.

Data privacy laws, such as GDPR and similar regulations enacted globally, are increasingly stringent, particularly as CBRE leverages technology for property management and client data. Adherence to these rules is critical to avoid significant penalties and maintain client trust. Furthermore, evolving ESG mandates and disclosure requirements are pushing companies to be more transparent about their environmental impact, influencing investment decisions and property valuations.

The legal landscape for leases and sales contracts is also dynamic. Landlord-tenant laws, fair housing regulations, and contract enforcement standards are subject to change, affecting the terms of agreements CBRE negotiates. Staying abreast of these legal nuances is essential for mitigating risk and ensuring successful deal execution for clients in 2024 and beyond.

| Legal Area | Key Developments (2024-2025) | Impact on CBRE |

|---|---|---|

| Zoning & Land Use | Increased focus on housing density, adaptive reuse of commercial spaces. | Influences development feasibility and advisory on urban planning projects. |

| Building Codes | Stricter energy efficiency, enhanced seismic resilience standards. | Affects construction costs, project timelines, and property management strategies. |

| Data Privacy | Heightened compliance requirements for Proptech data handling (e.g., GDPR, CCPA). | Mandates robust data security measures and impacts client data management. |

| ESG Mandates | Growing emphasis on carbon footprint reporting, climate risk disclosure. | Requires enhanced ESG reporting capabilities and influences investment analysis. |

| Leasing & Contracts | Evolving landlord-tenant laws, hybrid work impacts on lease terms. | Necessitates careful negotiation and compliance with updated contractual obligations. |

Environmental factors

Climate change presents a substantial risk to the real estate sector, manifesting in more frequent and intense extreme weather. This trend directly impacts CBRE's operations through potential property damage, escalating insurance costs, and shifts in property valuations, forcing adjustments in investment and location strategies.

The global drive for sustainability is significantly reshaping the real estate sector, with a growing emphasis on green building standards. This trend is directly influencing demand for properties that meet criteria such as LEED, BREEAM, or WELL certifications, which prioritize energy efficiency, water conservation, and occupant well-being.

In 2024, the market saw continued growth in green-certified buildings. For instance, the U.S. Green Building Council reported that over 100,000 LEED projects were registered or certified worldwide by late 2024, indicating a substantial commitment to sustainable development. This push is often driven by evolving regulations and investor preferences for environmentally responsible assets.

These standards are not just about environmental impact; they also translate into tangible financial benefits. Buildings with higher green certifications often command higher rental rates and occupancy levels, and experience lower operating costs due to reduced energy and water consumption. For CBRE, this translates into opportunities to advise clients on sustainable portfolio management and the development of future-proof assets.

Commercial buildings are major energy users, and there's a strong push towards better energy efficiency and meeting decarbonization goals. For instance, the U.S. commercial building sector accounted for roughly 18% of total primary energy consumption in 2023, according to the EIA. This trend directly impacts real estate companies like CBRE, driving demand for sustainable building solutions and retrofits.

Smart building technologies, utilizing IoT and AI, are key to optimizing energy use and incorporating renewables, which helps lower carbon emissions and operational expenses. In 2024, the global smart building market was valued at approximately $80 billion and is projected to grow significantly, underscoring the increasing adoption of these technologies within the commercial real estate sector.

Resource Scarcity and Waste Management

Growing concerns over resource scarcity and the environmental footprint of construction waste are significantly influencing the real estate sector, pushing for more sustainable operational models. This trend is directly impacting companies like CBRE Group, as clients increasingly prioritize environmentally responsible solutions.

Green building certifications are becoming a key driver, mandating waste reduction strategies such as material recycling and reuse, alongside responsible site management practices like effective stormwater control and habitat preservation. For instance, the U.S. Green Building Council's LEED (Leadership in Energy and Environmental Design) v4.1 standard, widely adopted globally, places a strong emphasis on waste diversion from landfills. In 2023, projects pursuing LEED certification often aimed for diversion rates exceeding 75% of construction and demolition waste.

- Resource Scarcity Impact: Limited availability of raw materials like timber and metals due to supply chain disruptions and increased global demand can drive up construction costs, affecting project viability and CBRE's transaction volumes.

- Waste Management Regulations: Stricter government regulations on construction and demolition waste disposal, such as those seen in the European Union with targets to increase recycling rates, necessitate innovative waste management solutions. By 2025, many EU countries aim for at least 70% of construction and demolition waste to be recycled.

- Demand for Green Buildings: The market for certified green buildings continues to expand. In 2024, it's projected that over 40% of new commercial construction in major global markets will incorporate green building principles, creating opportunities for CBRE's sustainability consulting services.

- Circular Economy Principles: The adoption of circular economy models, focusing on material reuse and longevity, is gaining traction. This shift encourages the development of buildings designed for disassembly and material recovery, presenting new service avenues for property management and development advisory.

Environmental, Social, and Governance (ESG) Integration

Environmental factors are a critical part of ESG, influencing real estate investment choices. CBRE, as a major player, sees investors and tenants increasingly favoring properties with strong environmental credentials. This trend is driving the company to bolster its sustainability initiatives and adhere to tightening ESG regulations.

For instance, a significant portion of global real estate investors now incorporate ESG factors into their decision-making. In 2024, reports indicated that over 80% of institutional investors consider ESG criteria. This directly impacts CBRE's advisory services and property management, necessitating a focus on energy efficiency, carbon footprint reduction, and sustainable building materials.

- Growing Investor Demand: Over 80% of institutional investors factored ESG into their 2024 real estate allocations.

- Regulatory Pressure: Evolving environmental regulations globally require enhanced sustainability reporting and practices.

- Tenant Preferences: Occupiers are actively seeking green-certified buildings, influencing leasing decisions and property valuations.

- CBRE's Response: The firm is investing in services and solutions to help clients navigate and meet these environmental expectations.

Climate change and the push for sustainability are fundamentally altering the real estate landscape. More extreme weather events in 2024, like increased flooding and heatwaves, directly impact property values and insurance costs, forcing CBRE to adapt strategies. The growing demand for green buildings, with over 100,000 LEED projects globally by late 2024, highlights a shift towards energy efficiency and occupant well-being, creating opportunities for CBRE's advisory services.

Resource scarcity is also a growing concern, driving up construction costs and emphasizing waste reduction. Stricter regulations, such as the EU's 2025 targets for 70% construction waste recycling, necessitate innovative solutions. CBRE is responding to these environmental pressures by focusing on sustainable building practices and circular economy principles, aligning with the over 80% of institutional investors who now integrate ESG factors into their 2024 real estate decisions.

| Environmental Factor | 2023/2024 Data Point | Impact on CBRE |

| Extreme Weather Events | Increased frequency and intensity observed globally in 2024 | Higher insurance costs, property damage risk, valuation shifts |

| Green Building Demand | Over 100,000 LEED projects globally by late 2024 | Opportunities for sustainability consulting and green asset management |

| Construction Waste Regulations | EU aims for 70% recycling by 2025 | Need for waste management solutions, potential cost increases |

| ESG Integration in Investment | Over 80% of institutional investors factored ESG in 2024 | Increased demand for ESG-compliant properties and services |

PESTLE Analysis Data Sources

Our CBRE PESTLE analysis is meticulously crafted using a blend of public and proprietary data. This includes insights from leading economic indicators, real estate market reports, government policy updates, and technology trend forecasts.