CBRE Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBRE Group Bundle

Explore the strategic architecture of CBRE Group with our comprehensive Business Model Canvas. This detailed breakdown illuminates their core activities, customer relationships, and revenue streams, offering a clear view of their market dominance. Perfect for anyone seeking to understand how a global leader in commercial real estate operates.

Unlock the full strategic blueprint behind CBRE Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CBRE collaborates with technology and data providers to bolster its client services. This includes integrating advanced tools like AI for space utilization analysis and platforms for assessing climate risks. These alliances allow CBRE to offer innovative solutions and data-driven insights, ultimately boosting efficiency and aiding strategic decisions for their clients.

A prime example of these partnerships is CBRE's agreement with Climate X, a company specializing in providing detailed climate risk data. This collaboration ensures CBRE's clients have access to crucial information for evaluating the long-term viability and potential impacts of their real estate investments in a changing environmental landscape.

CBRE's key partnerships with financial institutions and lenders, including banks and mortgage providers, are vital for enabling seamless real estate transactions like property sales and mortgage origination. These collaborations foster a strong capital markets environment, adeptly supporting client investment and financing requirements across diverse property sectors.

This strategic alignment ensures CBRE can effectively facilitate capital flow, a critical component for its clients' success. For instance, mortgage origination revenue experienced substantial growth in Q2 2025, underscoring the strength and importance of these financial relationships in driving business volume.

CBRE cultivates strategic alliances with construction and development firms, notably its majority-owned subsidiary, Turner & Townsend. This partnership is crucial for delivering integrated project management and development services, offering clients a seamless, end-to-end solution from concept to completion, especially for substantial infrastructure and real estate ventures.

The integration with Turner & Townsend significantly bolsters CBRE's capabilities. In 2023, Turner & Townsend's legacy business alone contributed to mid-teens revenue growth within CBRE's project management segment, showcasing the financial impact of this key partnership.

Flexible Workspace Operators

CBRE's strategic partnerships with flexible workspace operators are crucial. For instance, the acquisition of Industrious in early 2025 significantly expanded CBRE's ability to provide adaptable office environments, directly addressing the growing demand for hybrid work solutions.

These collaborations enhance CBRE's property management services by offering a wider array of flexible space options to clients. This strategic move not only meets evolving occupier needs but also opens up new avenues for revenue generation.

The impact of these partnerships is evident in financial results. Following the Industrious acquisition, CBRE reported a substantial 30% increase in property management revenue during the second quarter of 2025, underscoring the financial benefits of these alliances.

- Flexible Workspace Operator Partnerships: CBRE collaborates with providers to offer diverse office solutions.

- Industrious Acquisition (Early 2025): This move bolstered CBRE's flexible workspace offerings.

- Hybrid Work Model Alignment: Partnerships cater to evolving occupier demands for adaptable spaces.

- Revenue Enhancement: Industrious acquisition led to a 30% Q2 2025 property management revenue boost.

Sustainability and ESG Consultants

CBRE collaborates with sustainability and ESG consultants to drive environmental, social, and governance objectives for itself and its clients. These partnerships are crucial for implementing green building strategies, assessing climate risks, and satisfying investor demands for sustainable real estate practices. For instance, CBRE's commitment to achieving net-zero greenhouse gas emissions across its value chain by 2040 directly benefits from such expert guidance.

These alliances are instrumental in developing robust decarbonization plans and enhancing climate resilience within real estate portfolios. By leveraging the expertise of ESG consultants, CBRE facilitates the achievement of ambitious sustainability targets, including those related to energy efficiency and waste reduction in buildings. In 2023, CBRE reported a 15% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, underscoring the impact of these strategic collaborations.

- Driving Sustainability Goals: Partnering with ESG consultants enables CBRE and its clients to effectively pursue sustainability objectives, including decarbonization and climate resilience.

- Green Building Strategies: These collaborations are essential for creating and executing strategies focused on green buildings, which are key to reducing environmental impact.

- Risk Assessment and Investor Expectations: ESG consultants assist in assessing climate-related risks and ensuring that real estate investments meet the growing expectations of investors for sustainable practices.

- Net-Zero Commitment: CBRE's aim to reach net-zero GHG emissions by 2040 is significantly supported by the expertise and guidance provided by these key partnerships, helping clients also meet their own sustainability aspirations.

CBRE's strategic alliances with technology and data providers are crucial for enhancing its service offerings. These partnerships integrate advanced tools like AI for space utilization and climate risk assessment platforms, enabling CBRE to deliver data-driven insights and innovative solutions that improve client efficiency and decision-making.

Key collaborations include those with financial institutions and lenders, vital for facilitating real estate transactions such as property sales and mortgage origination. These relationships foster a robust capital markets environment, adeptly supporting client investment and financing needs across various property sectors.

Furthermore, CBRE's partnership with construction and development firms, exemplified by its majority ownership of Turner & Townsend, is instrumental in providing integrated project management and development services. This synergy offers clients comprehensive, end-to-end solutions for significant real estate ventures.

| Partnership Type | Key Collaborator Example | Impact/Benefit | Relevant Data Point |

| Technology & Data Providers | Climate X | Enhanced climate risk assessment for real estate investments | Integration of AI for space utilization analysis |

| Financial Institutions | Banks, Mortgage Providers | Facilitation of property sales and mortgage origination; capital flow support | Substantial growth in mortgage origination revenue (Q2 2025) |

| Construction & Development | Turner & Townsend (Majority Owned) | Integrated project management and end-to-end development services | Mid-teens revenue growth contribution (2023) |

| Flexible Workspace Operators | Industrious (Acquired Early 2025) | Expanded adaptable office environments and hybrid work solutions | 30% increase in property management revenue (Q2 2025) |

What is included in the product

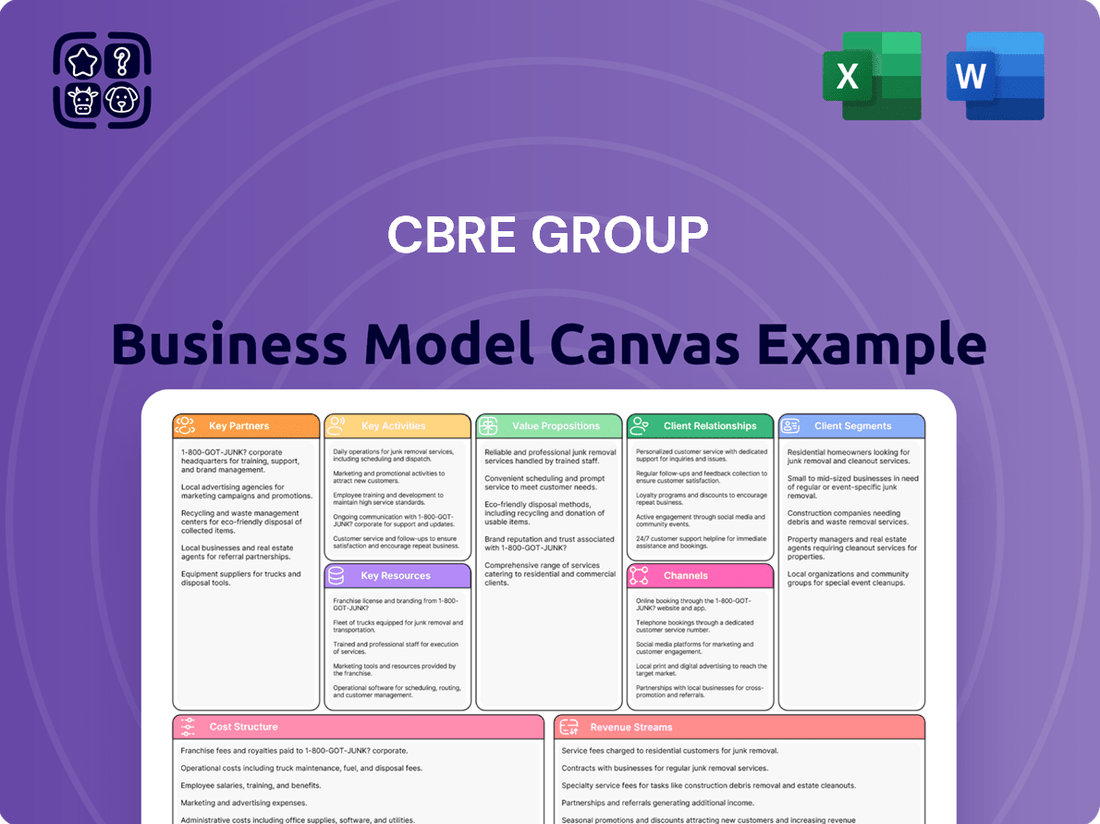

A comprehensive overview of CBRE Group's business model, detailing its diverse client segments, extensive service channels, and multifaceted value propositions in the commercial real estate sector.

This model reflects CBRE's global operations and strategic focus on providing integrated real estate services, making it ideal for understanding their market position and future growth potential.

CBRE's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling rapid understanding and identification of inefficiencies.

This visual tool streamlines strategic discussions and problem-solving for CBRE, transforming abstract concepts into actionable insights for improved service delivery.

Activities

CBRE's property leasing and sales activities are central to its business, focusing on brokering deals for commercial properties. This includes everything from office spaces and retail locations to industrial facilities and apartment buildings. They connect property owners with potential buyers and tenants, utilizing their extensive global reach and deep market knowledge to facilitate these transactions.

This core function is a significant revenue driver for CBRE. In fact, the company reported its highest-ever global leasing revenue for a second quarter in 2025. Furthermore, their global property sales revenue saw a healthy increase of 20% during the same period, underscoring the strength and demand within their brokerage services.

CBRE's key activities in Property and Facilities Management encompass the comprehensive operational oversight and maintenance of commercial real estate portfolios. This includes managing day-to-day building functions, ensuring tenant satisfaction through responsive service, and optimizing asset performance.

The group also delivers integrated facilities management (IFM) solutions, a critical service for large corporate occupiers seeking streamlined and efficient building operations. These IFM services cover a broad spectrum of needs, from space planning to complex technical services.

Demonstrating robust demand, CBRE's facilities management segment saw a significant 17% revenue increase in the second quarter of 2025. This growth was particularly strong within high-demand sectors such as data centers, technology, healthcare, and industrial properties.

CBRE's Project Management and Advisory Services are crucial for guiding clients through the complexities of real estate development. This includes everything from initial planning and design stages to overseeing construction and providing cost consulting. For instance, in 2024, CBRE's Project Management segment likely managed a significant volume of development projects globally, contributing to its overall revenue streams.

The advisory arm offers strategic consulting, valuation, and appraisal expertise, ensuring clients receive expert guidance on optimizing their real estate portfolios. These services are vital for informed decision-making in a dynamic market. The strategic combination of CBRE's project management capabilities with Turner & Townsend in early 2025 is expected to create a formidable new segment, enhancing service delivery and market reach.

Investment Management

CBRE Investment Management is a cornerstone of the group's operations, providing comprehensive global investment management services. They cater to a wide array of institutional investors, such as pension funds and sovereign wealth funds, by strategically managing real estate assets and entire portfolios with the goal of generating strong returns.

As of June 30, 2025, CBRE reported an impressive Assets Under Management (AUM) figure of $155.3 billion. This substantial AUM underscores the trust and confidence placed in CBRE's expertise by its global clientele.

- Global Reach: Offering investment management services worldwide to diverse investor types.

- Asset Focus: Specializing in the management of real estate assets and portfolios.

- Performance Objective: Aiming to generate returns for investors through strategic management.

- Significant Scale: Managing $155.3 billion in Assets Under Management as of June 30, 2025.

Strategic Consulting and Research

CBRE's strategic consulting and research arm offers critical insights to guide clients through complex real estate landscapes. They provide data-driven advice on optimizing portfolios and navigating evolving market dynamics.

Key areas of focus include the impact of hybrid work models, sustainability initiatives, and the growth of specialized sectors such as data centers. CBRE's 2024-2025 Global Workplace Insights, for instance, highlight significant opportunities arising from the widespread adoption of flexible work arrangements.

- Strategic Real Estate Guidance CBRE advises clients on making informed decisions to optimize their property portfolios and navigate market shifts.

- Market Trend Analysis The firm delivers research on key trends impacting real estate, including hybrid work, sustainability, and emerging sectors.

- Data-Driven Insights CBRE leverages its extensive research, such as the 2024-2025 Global Workplace Insights, to inform client strategies.

- Sector Specialization Focus areas include data centers and other high-growth real estate segments, offering specialized advice.

CBRE's key activities revolve around facilitating commercial property transactions through leasing and sales, managing and maintaining real estate portfolios, and providing expert project management and advisory services. They also manage significant real estate investments globally and deliver strategic consulting informed by extensive market research.

These diverse activities collectively drive CBRE's revenue, with notable growth in leasing and facilities management segments. The company's strategic acquisitions, like Turner & Townsend, further bolster its project management capabilities.

The scale of CBRE's operations is substantial, managing over $155 billion in assets under management as of mid-2025, demonstrating client trust and market leadership.

| Key Activity | Description | 2025 Data Highlight |

|---|---|---|

| Property Leasing & Sales | Brokering commercial property deals. | Highest-ever global leasing revenue (Q2 2025). |

| Property & Facilities Management | Operational oversight and maintenance of real estate. | 17% revenue increase (Q2 2025), strong in data centers, tech, healthcare. |

| Project Management & Advisory | Guiding real estate development and strategic consulting. | Integration with Turner & Townsend expected to enhance services. |

| Investment Management | Managing real estate assets for institutional investors. | $155.3 billion in Assets Under Management (June 30, 2025). |

| Strategic Consulting & Research | Providing data-driven insights on market trends. | Focus on hybrid work, sustainability, and specialized sectors. |

What You See Is What You Get

Business Model Canvas

The CBRE Group Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises and immediate usability for your strategic planning. You can be confident that the insights and framework presented here are precisely what you'll gain access to, ready for immediate application and customization.

Resources

CBRE's expansive global network, reaching over 100 countries, is a cornerstone of its business model, providing a distinct competitive edge. This vast reach allows CBRE to cater to a truly international clientele, offering unparalleled access to diverse real estate opportunities and deep local market insights.

With a workforce exceeding 140,000 professionals, CBRE's operational footprint is truly global, serving clients in more than 100 countries. This extensive presence is critical for sourcing deals, understanding regional nuances, and executing cross-border transactions efficiently.

CBRE's workforce, a cornerstone of its operations, includes a vast array of skilled professionals. This talent pool encompasses real estate brokers, property managers, project managers, financial analysts, and consultants, each bringing specialized knowledge vital for delivering premium services across all of CBRE's business segments. The company actively invests in developing its top talent, recognizing its crucial role in sustained growth and market leadership.

CBRE's proprietary data and technology platforms are central to its business model, providing a significant competitive advantage. They leverage vast amounts of real estate data and market intelligence, augmented by advanced technology including AI-driven tools.

This technological infrastructure enhances service delivery and operational efficiency, directly impacting client outcomes. For instance, CBRE's investment in data analytics allows for more precise market forecasting and property valuations, crucial for informed decision-making by clients.

In 2024, CBRE continued to expand its capabilities, notably in providing comprehensive climate risk data. This allows clients to better understand and mitigate environmental, social, and governance (ESG) risks associated with their real estate portfolios, a growing concern in the industry.

Brand Reputation and Client Relationships

CBRE's standing as the world's foremost commercial real estate services and investment firm underpins its brand reputation. This global leadership, combined with enduring client connections, particularly with approximately 90% of Fortune 100 companies, forms a crucial resource.

This established trust drives consistent repeat business and opens doors to new opportunities. CBRE's reputation for extensive reach and integrated service offerings allows it to deliver comprehensive solutions tailored to diverse client needs.

- Global Leader: CBRE is recognized as the largest commercial real estate services and investment firm worldwide.

- Extensive Client Base: The company serves nearly 90% of Fortune 100 companies, indicating deep trust and long-term relationships.

- Trust and Repeat Business: A strong brand reputation directly translates into client loyalty and recurring revenue streams.

- Bundled Solutions: CBRE's scale enables it to offer a wide array of integrated services, a key differentiator for clients seeking comprehensive support.

Financial Capital and Investment Funds

CBRE's financial capital is a cornerstone of its operations, particularly for its investment management arm. The company's capacity to access and deploy significant financial resources allows it to manage substantial assets under management (AUM), a key driver for revenue generation in this segment. This financial muscle also underpins its ability to pursue strategic acquisitions, expanding its market reach and service offerings.

A robust balance sheet is vital for CBRE, enabling it to undertake large-scale strategic investments and development projects. These initiatives are critical for maintaining its competitive edge and driving long-term growth. The company's financial health directly translates into its capacity to innovate and invest in future opportunities.

CBRE's liquidity position is a strong indicator of its financial strength. For instance, in the second quarter of 2025, the company reported an increase in its liquidity to $4.7 billion. This substantial liquidity provides flexibility for operational needs, strategic investments, and weathering economic fluctuations.

- Access to Capital: CBRE leverages its financial strength to manage significant AUM, fueling its investment management segment.

- Strategic Acquisitions: Substantial financial capital enables CBRE to pursue strategic acquisitions, enhancing its market position.

- Balance Sheet Strength: A strong balance sheet supports significant investments in development projects and strategic initiatives.

- Liquidity: CBRE's liquidity reached $4.7 billion in Q2 2025, demonstrating robust financial flexibility.

CBRE's key resources are its extensive global network, its vast and skilled workforce, proprietary data and technology platforms, and its strong brand reputation. These elements collectively enable the company to deliver comprehensive real estate services and drive client value across diverse markets.

The company's financial capital, including its liquidity and access to capital, is also a critical resource, particularly for its investment management operations and strategic growth initiatives.

In 2024, CBRE's focus on integrating climate risk data into its offerings highlights its commitment to leveraging data and technology as a key differentiator.

| Resource Category | Key Components | 2024/2025 Data Point |

| Global Network | Presence in over 100 countries | Operational footprint in 100+ countries |

| Human Capital | Skilled professionals (brokers, managers, analysts) | Over 140,000 professionals globally |

| Intellectual Property | Proprietary data & AI-driven technology platforms | Expansion of climate risk data capabilities |

| Brand & Relationships | Global leadership, client trust | Serves ~90% of Fortune 100 companies |

| Financial Capital | Liquidity, AUM management capacity | $4.7 billion liquidity (Q2 2025) |

Value Propositions

CBRE provides a full spectrum of real estate services, encompassing leasing, sales, property management, project management, and investment management. This holistic approach streamlines complex real estate requirements for clients, offering a unified point of contact for enhanced efficiency.

The company's integrated platform is a key value proposition, recognized for delivering bundled solutions that address diverse client needs across the entire real estate lifecycle. In 2023, CBRE's Global Workplace Solutions segment, a core area for integrated services, generated $23.7 billion in revenue, highlighting the scale and demand for these comprehensive offerings.

CBRE's value proposition hinges on its impressive global reach, operating in over 100 countries, which is powerfully complemented by its granular local market expertise. This unique combination allows clients to leverage CBRE's worldwide network for broad strategic execution while simultaneously benefiting from deep, on-the-ground understanding of specific regional dynamics and opportunities.

CBRE delivers advanced market intelligence and analytics, empowering clients to make smarter real estate decisions and enhance portfolio performance. This includes leveraging cutting-edge technology for climate risk assessments, a critical factor in today's investment landscape.

The firm’s Workplace Performance Scorecard offers tangible data to refine hybrid work strategies, a key concern for businesses navigating evolving operational models. For instance, in 2024, CBRE's insights helped clients identify opportunities to reduce operational costs by an average of 12% through optimized space utilization.

Enhanced Operational Efficiency and Cost Savings

CBRE's property and facilities management services are designed to significantly boost the operational efficiency of client real estate. This focus translates directly into tangible cost savings and optimized asset performance.

The Global Workplace Solutions segment is a prime example of this value proposition in action. CBRE actively pursues continuous improvement in overall operational efficiency for its clients.

- Operational Efficiency: CBRE's integrated services streamline property and facility operations, reducing waste and improving workflow.

- Cost Reduction: By optimizing resource allocation and implementing best practices, CBRE helps clients lower operating expenses.

- Performance Optimization: Enhanced efficiency leads to better utilization of real estate assets and improved overall business performance.

- Global Workplace Solutions: This segment specifically targets large-scale operational improvements, demonstrating CBRE's commitment to driving efficiency across diverse portfolios.

Sustainable and Resilient Real Estate Strategies

CBRE helps clients build and execute real estate strategies focused on sustainability and resilience. This includes tackling climate-related risks and working towards net-zero targets.

This offering directly responds to increasing corporate commitments to environmental, social, and governance (ESG) principles and a strong investor push for eco-friendly investments. For instance, CBRE itself has pledged to achieve Net Zero greenhouse gas emissions across its entire value chain by 2040, demonstrating a deep commitment to this area.

- Climate Risk Mitigation: Assisting clients in identifying and addressing physical and transitional climate risks within their real estate portfolios.

- Net-Zero Pathways: Developing actionable roadmaps and implementation plans for clients to achieve their net-zero emissions targets for their properties.

- Decarbonization Solutions: Providing expertise and services to reduce carbon footprints in buildings through energy efficiency, renewable energy integration, and sustainable materials.

- ESG Integration: Embedding ESG considerations into real estate decision-making, from acquisition and development to operations and disposition.

CBRE's value proposition centers on delivering integrated, data-driven solutions that enhance operational efficiency and optimize real estate portfolios for clients globally. This includes leveraging advanced analytics for smarter decision-making and focusing on sustainability to mitigate climate risks and achieve net-zero targets.

| Value Proposition | Key Offering | Client Benefit | Supporting Data (2023/2024) |

| Integrated Real Estate Services | Full spectrum of services including leasing, sales, property management, and investment management. | Streamlined processes, single point of contact, enhanced efficiency. | Global Workplace Solutions revenue: $23.7 billion (2023). |

| Global Reach & Local Expertise | Operations in over 100 countries with granular local market knowledge. | Strategic execution leveraging a worldwide network with deep regional understanding. | N/A (Qualitative strength). |

| Market Intelligence & Analytics | Advanced data and analytics for decision-making and portfolio performance. | Smarter real estate choices, improved asset utilization, climate risk assessment. | Clients reduced operational costs by an average of 12% in 2024 through optimized space. |

| Sustainability & Resilience | Focus on ESG principles, climate risk mitigation, and net-zero pathways. | Reduced carbon footprints, compliance with ESG mandates, enhanced investment appeal. | CBRE committed to Net Zero by 2040 across its value chain. |

Customer Relationships

CBRE cultivates enduring client partnerships via dedicated account managers and seasoned advisors, particularly for its large enterprise clientele. This high-touch model ensures a profound grasp of specific client requirements, enabling the delivery of bespoke solutions that build significant trust and loyalty.

CBRE cultivates customer relationships through a deeply consultative sales approach, positioning itself as a strategic partner rather than just a service provider. This means going beyond single transactions to offer ongoing guidance and insights tailored to clients' enduring business goals.

This strategic partnership model is crucial for CBRE's adaptation to the dynamic commercial real estate landscape. For instance, in 2024, CBRE's focus on advisory services, a key component of this relationship strategy, contributed to its strong performance in a fluctuating market, with the company reporting significant revenue growth in its Advisory & Transaction Services segment.

CBRE's integrated service delivery simplifies the client journey, acting as a single point of contact for diverse real estate needs. This approach fosters deeper client loyalty and opens doors for cross-selling opportunities across their extensive service offerings.

By bundling services, CBRE solidifies its position as a go-to partner, a strategy that has proven effective across various regions and property types. For instance, in 2024, CBRE reported significant growth in its integrated services segment, reflecting client demand for streamlined solutions.

Technology-Enabled Client Engagement

CBRE leverages digital platforms to foster robust client engagement, offering direct access to property management portals and sophisticated data analytics dashboards. These tools provide clients with real-time insights into their portfolios, enhancing transparency and informed decision-making.

The integration of advanced technologies, such as AI-powered space utilization analytics, directly contributes to improving clients' return on investment by optimizing their real estate footprints. This focus on technology streamlines service delivery and strengthens the overall client experience.

- Digital Portals: CBRE offers online platforms for property management, giving clients 24/7 access to critical information and service requests.

- Data Analytics: Clients benefit from advanced dashboards that provide deep insights into portfolio performance and market trends.

- AI for Optimization: The company utilizes AI tools, like those for space utilization, to help clients maximize the efficiency and ROI of their workspaces.

- Enhanced Communication: Technology facilitates seamless and immediate communication channels, ensuring clients are always connected and informed.

Global Client Programs and Consistency

CBRE excels in managing relationships with multinational corporations through its global client programs. These initiatives guarantee a consistent level of service and quality, no matter where a client operates. This unified approach is crucial for large businesses with a presence in numerous markets, ensuring a seamless experience.

The company's reach is extensive, serving a wide array of clients across more than 100 countries with a comprehensive suite of integrated services. This global footprint allows CBRE to cater to diverse needs, from real estate strategy to facility management on an international scale.

- Global Consistency: CBRE's programs ensure uniform service delivery for multinational clients worldwide.

- Unified Experience: Large corporations benefit from a single, high-quality standard across all their international operations.

- Extensive Reach: CBRE supports clients in over 100 countries with integrated real estate solutions.

CBRE's customer relationships are built on a foundation of deep expertise and personalized service, often employing dedicated account managers for large clients. This high-touch approach ensures a thorough understanding of client needs, fostering trust and loyalty through tailored solutions.

The company prioritizes a consultative sales strategy, positioning itself as a strategic partner by offering ongoing guidance aligned with long-term business objectives. This deep engagement is critical, as evidenced by CBRE's 2024 performance, where its advisory services segment, a direct outcome of these relationships, showed robust growth, contributing significantly to overall revenue increases in a dynamic market.

CBRE utilizes digital platforms, including property management portals and advanced data analytics, to enhance client engagement and provide real-time portfolio insights. For instance, in 2024, the company saw increased adoption of these digital tools, which empower clients with greater transparency and data-driven decision-making for optimizing their real estate investments.

CBRE's global client programs ensure consistent service delivery for multinational corporations across its extensive network, providing a unified experience. The company's broad reach, serving clients in over 100 countries, underscores its capability to manage diverse, international real estate needs effectively.

| Relationship Aspect | CBRE's Approach | Impact/Benefit | 2024 Data Point |

|---|---|---|---|

| Personalization | Dedicated Account Managers, Consultative Sales | Deep client understanding, trust, loyalty | Strong growth in Advisory & Transaction Services segment |

| Digital Engagement | Online Portals, Data Analytics Dashboards | Transparency, informed decisions, portfolio optimization | Increased client adoption of digital tools |

| Global Consistency | Global Client Programs | Uniform service quality for MNCs | Service delivery across 100+ countries |

Channels

CBRE's direct sales force and brokerage teams are the backbone of its client engagement, acting as the primary conduit for leasing, sales, and advisory services. These professionals, numbering in the tens of thousands within CBRE's vast global operation, are instrumental in driving transactional revenue and fostering deep client relationships across the commercial real estate spectrum.

With over 140,000 employees worldwide, CBRE leverages this extensive network of brokers and sales professionals to directly connect with property owners and occupiers. This direct channel is crucial for facilitating deals, providing market insights, and offering strategic advice, ultimately solidifying CBRE's position as a market leader.

CBRE's extensive network of global and regional offices is a cornerstone of its business model, ensuring a strong local presence and accessibility for clients worldwide. These offices are vital for fostering relationships, delivering tailored services, and gathering critical market insights. In 2023, CBRE maintained a significant physical footprint, enabling them to serve clients effectively across diverse geographies.

This widespread network allows CBRE to cater to clients in over 100 countries, providing localized expertise and support. These physical hubs facilitate crucial client interactions, the execution of service delivery, and the collection of up-to-the-minute market intelligence, a key differentiator in the commercial real estate sector.

CBRE leverages its corporate website, client portals, and proprietary digital tools to distribute extensive market research, showcase property listings, and grant access to a suite of services. These digital avenues significantly boost client self-service capabilities and improve information accessibility.

In 2024, CBRE continued to enhance its digital presence, with its corporate website serving as a central hub for client engagement and information dissemination. The company routinely publishes crucial updates, including corporate and investor presentations, ensuring transparency and providing valuable insights to stakeholders.

Industry Events and Conferences

Industry events and conferences are a cornerstone for CBRE, allowing them to actively engage with the real estate sector. Participating in these gatherings is vital for demonstrating their deep expertise, forging connections with prospective clients, and reinforcing their brand presence. These events serve as significant avenues for generating new business leads and establishing themselves as thought leaders within the industry.

CBRE's strategic involvement in key industry forums underscores their market leadership. For instance, in 2024, CBRE was a prominent participant and sponsor at major real estate expos like MIPIM and CREFC. These events facilitate direct interaction with a broad spectrum of stakeholders, from investors to developers, enabling CBRE to showcase innovative solutions and market insights.

- Showcasing Expertise: CBRE leverages these platforms to present research, market trends, and successful case studies, reinforcing their position as industry authorities.

- Networking and Lead Generation: Events provide unparalleled opportunities to connect with potential clients, partners, and key decision-makers, directly contributing to their sales pipeline.

- Brand Awareness and Thought Leadership: Consistent presence and active participation in conferences help build CBRE's brand recognition and establish them as forward-thinking leaders shaping the future of real estate.

- Market Intelligence: Attending these events allows CBRE to gather real-time market intelligence, understand emerging trends, and identify new business opportunities.

Strategic Partnerships and Referrals

CBRE actively cultivates strategic partnerships with financial institutions and technology providers. This network is crucial for generating qualified referrals, effectively expanding its market reach into previously untapped client segments. In 2023, referral business represented a significant portion of new client acquisition.

The integration of Turner & Townsend, finalized in 2021, has demonstrably diversified CBRE's revenue streams. This acquisition bolsters its capabilities in project management and consulting, creating a more robust and resilient business model.

- Referral Networks: CBRE leverages relationships with financial institutions and technology firms to drive lead generation.

- Market Expansion: Partnerships provide access to new client bases and geographic markets.

- Revenue Diversification: The Turner & Townsend acquisition enhances service offerings and income sources.

- Client Acquisition: Referrals are a key driver for acquiring new clients and increasing market share.

CBRE's channels are multifaceted, blending direct human interaction with sophisticated digital platforms and strategic partnerships. The company's vast global sales force, numbering in the tens of thousands, forms the primary direct sales channel, facilitating transactions and client relationships. This direct engagement is augmented by a robust digital presence, including its corporate website and client portals, which offer market research and service access. Strategic alliances with financial institutions and technology firms also serve as crucial referral channels, expanding market reach and client acquisition. In 2024, CBRE continued to invest in these channels, recognizing their importance in driving revenue and market penetration.

Customer Segments

Corporate Occupiers are a cornerstone of CBRE's business, encompassing large multinational corporations and major enterprises. These clients depend on CBRE for extensive real estate services tailored to their global operations, including critical functions like facilities management, project execution, and strategic property advice.

The significant trust placed in CBRE by these entities is evident in the 2024 data: nearly 90% of Fortune 100 companies were listed as CBRE clients. This high penetration rate underscores CBRE's role as a preferred partner for the world's largest businesses managing complex, international real estate portfolios.

Real estate investors, a core customer segment for CBRE Group, encompass a broad range of entities. These include major institutional investors like pension funds and insurance companies, as well as private equity firms and high-net-worth individuals. They rely on CBRE for crucial services such as property sales, acquisition advisory, and comprehensive investment management. In 2023, CBRE Investment Management managed approximately $130 billion in real estate assets, highlighting the scale of their client base.

Property owners and developers are a core customer segment for CBRE, encompassing those with commercial real estate assets who require expert assistance. This includes services like leasing their spaces, managing day-to-day operations, overseeing construction projects, and guiding new developments from concept to completion.

CBRE's aim is to help these clients enhance the value of their properties and manage their real estate holdings more efficiently. As the largest commercial property developer in the United States, CBRE possesses significant expertise and a broad reach within this market.

Government and Public Sector Entities

CBRE Group actively engages with government and public sector entities, providing essential real estate services for their administrative, operational, and infrastructure requirements. These engagements often involve intricate project and facilities management, crucial for public service delivery.

The legacy business of Turner & Townsend, now part of CBRE, demonstrates significant growth in global infrastructure projects, directly benefiting public sector clients. For instance, in 2024, infrastructure spending globally continued to be a major driver, with many governments prioritizing upgrades and new builds to stimulate economies and improve public services.

- Government Contracts: CBRE manages diverse real estate portfolios for national, regional, and local government bodies, encompassing everything from office spaces to specialized facilities.

- Infrastructure Focus: Through Turner & Townsend, CBRE is deeply involved in large-scale public infrastructure development, aligning with global trends in capital investment for transportation, energy, and utilities.

- Public-Private Partnerships: The company often participates in public-private partnerships, leveraging its expertise to deliver complex projects that serve public interest and governmental objectives.

Specialized Industry Clients

CBRE's Specialized Industry Clients segment caters to businesses with distinct real estate needs, including data center operators, healthcare providers, and technology firms. The company develops bespoke solutions to meet the unique demands of these sectors, ensuring optimal facility performance and strategic asset alignment.

Facilities management revenue demonstrates robust growth, particularly from clients within the data center, technology, healthcare, and industrial sectors. This growth underscores CBRE's ability to deliver specialized services that address the complex operational requirements of these industries.

- Data Centers: CBRE provides critical infrastructure management and site selection services for data center clients, a sector that saw significant investment and expansion in 2024.

- Healthcare: The company offers specialized real estate advisory and management for healthcare providers, navigating regulatory complexities and patient-centric design needs.

- Technology Companies: CBRE supports technology firms with flexible workspace solutions, R&D facility management, and smart building integration, reflecting the dynamic nature of the tech industry.

- Industrial Sector: Growth in e-commerce and manufacturing continues to drive demand for specialized industrial real estate services, including logistics and supply chain optimization.

CBRE's customer base is remarkably diverse, serving a wide array of clients with distinct real estate needs. This segmentation allows CBRE to offer specialized services and tailored solutions across various industries and organizational types.

Corporate occupiers, real estate investors, and property owners form the bedrock of CBRE's clientele. The company also actively partners with government entities and caters to specialized industries like data centers and healthcare, demonstrating its broad market reach and deep expertise.

In 2024, CBRE's commitment to its diverse client segments was underscored by its continued leadership in providing comprehensive real estate services, from managing global corporate portfolios to facilitating large-scale infrastructure projects for public sector clients.

| Customer Segment | Key Services Provided | 2024/Recent Data Highlight |

|---|---|---|

| Corporate Occupiers | Facilities management, project execution, strategic property advice | Nearly 90% of Fortune 100 companies were CBRE clients in 2024. |

| Real Estate Investors | Sales, acquisition advisory, investment management | Managed approximately $130 billion in real estate assets in 2023. |

| Property Owners & Developers | Leasing, property management, construction oversight | Largest commercial property developer in the United States. |

| Government & Public Sector | Project management, facilities management, infrastructure development | Significant growth in global infrastructure projects via Turner & Townsend. |

| Specialized Industries (e.g., Data Centers, Healthcare) | Bespoke facility management, site selection, regulatory advisory | Robust growth in facilities management revenue from these sectors. |

Cost Structure

Personnel costs represent a substantial component of CBRE's operating expenses, primarily driven by the compensation of its extensive global workforce. This includes salaries, benefits, and performance-based commissions for a diverse team of over 140,000 employees, encompassing brokers, property managers, and essential administrative personnel.

CBRE Group's cost structure is significantly influenced by the expenses tied to its vast global office network. These include substantial outlays for rent, utilities, and everyday administrative costs necessary to support its widespread operations.

The company's operating expenses for the first quarter of 2025 reached $8.634 billion. This figure represents an 11.68% increase compared to the same period in the previous year, highlighting the growing investment in maintaining and expanding its operational footprint.

CBRE's technology and data infrastructure represent a significant cost center, encompassing investments in and ongoing maintenance of advanced platforms. These expenses are crucial for delivering data-driven insights and efficient operations across their diverse service lines.

In 2024, CBRE continues to allocate substantial resources towards software licenses, cloud services, and robust cybersecurity measures to protect sensitive client and company data. These are essential for maintaining a competitive edge in a digitally transforming industry.

The company's strategic focus on integrating artificial intelligence and machine learning into its offerings further drives these technology costs. This commitment to innovation aims to enhance predictive analytics, client service delivery, and operational efficiencies, reflecting ongoing investments in future capabilities.

Marketing and Business Development Expenses

CBRE incurs substantial costs for marketing and business development to fuel its growth. These expenses cover a wide array of activities, from broad advertising campaigns designed to boost brand recognition to targeted client entertainment and proactive business development efforts aimed at securing new mandates and strengthening existing relationships. These investments are crucial for maintaining and expanding CBRE's market share.

In 2023, CBRE's selling, general, and administrative (SG&A) expenses, which encompass marketing and business development, were $4.1 billion. This figure highlights the significant resources dedicated to these growth-driving functions. The company's strategic focus on increasing market share necessitates continuous investment in these areas.

- Marketing Campaigns & Advertising: Costs associated with digital marketing, print advertising, and public relations to enhance brand visibility and reach potential clients.

- Client Entertainment & Relations: Expenses related to hosting events, client meetings, and other activities designed to foster strong client relationships and loyalty.

- Business Development Initiatives: Investments in sales teams, research, and networking opportunities to identify and pursue new business opportunities and market segments.

- Brand Visibility & Market Share Growth: These expenditures directly support CBRE's objective of increasing its presence and competitive standing within the commercial real estate sector.

Acquisition and Integration Costs

CBRE Group incurs significant expenses related to acquiring and integrating new businesses. These costs encompass thorough due diligence, legal services, and the complex process of merging acquired operations. For instance, the integration of companies like Industrious and Turner & Townsend involves substantial upfront investment to align systems, cultures, and processes.

These acquisition and integration costs, while often non-recurring, can represent a considerable portion of CBRE's expenditure. They are a critical factor in the company's overall cost structure, directly influencing profitability. Management closely monitors these expenses, as successful integration is key to realizing the strategic benefits of acquisitions.

For 2024, it's important to note how these costs are factored into segment operating profit. CBRE's reporting typically includes integration and other costs related to acquisitions within the calculation of segment operating profit, providing a clearer view of the underlying performance of its various business segments after accounting for these strategic investments.

- Due Diligence Expenses: Costs associated with evaluating potential acquisition targets, including financial, legal, and operational assessments.

- Legal and Advisory Fees: Payments to lawyers, investment bankers, and consultants involved in transaction structuring and negotiation.

- Integration Costs: Expenses incurred to merge acquired entities, such as IT system consolidation, rebranding, and severance packages.

- Impact on Profitability: These costs directly affect reported earnings, though they are often considered separately to understand core business performance.

CBRE's cost structure is heavily weighted towards personnel, with over 140,000 employees globally. This includes salaries, benefits, and commissions for brokers, property managers, and administrative staff. Significant investments are also made in technology and data infrastructure, including software licenses, cloud services, and cybersecurity, to maintain a competitive edge and enhance client service delivery.

Operating expenses for Q1 2025 were $8.634 billion, an 11.68% increase year-over-year, reflecting expanded operational investments. Marketing and business development also represent a substantial cost, with SG&A expenses totaling $4.1 billion in 2023, crucial for brand visibility and market share growth.

| Cost Category | Description | 2023 Data (if available) |

| Personnel Costs | Salaries, benefits, commissions for global workforce | N/A (Significant portion of total operating expenses) |

| Office Network | Rent, utilities, administrative costs for global offices | N/A (Significant portion of total operating expenses) |

| Technology & Data | Software licenses, cloud services, cybersecurity, AI/ML integration | N/A (Ongoing investment) |

| Marketing & Business Development | Advertising, client relations, sales initiatives | $4.1 billion (SG&A expenses) |

| Acquisition & Integration | Due diligence, legal fees, system consolidation | N/A (Variable, but significant for strategic growth) |

Revenue Streams

CBRE Group generates significant revenue through commissions earned by brokering commercial property leases and sales. This is a cornerstone of its Advisory Services segment, directly reflecting the company's expertise in facilitating property transactions.

In the second quarter of 2025, CBRE saw robust growth in this area, with global leasing revenue climbing 14% and global property sales revenue increasing by an impressive 20%. These figures highlight the strong demand and CBRE's effectiveness in capturing market share within the commercial real estate brokerage space.

CBRE Group generates recurring revenue through its facilities and property management services, which are crucial for its resilient revenue base. These fees cover the comprehensive management of commercial properties and the provision of integrated facilities management solutions for a diverse client portfolio.

The strength of these segments is evident in recent performance figures. For instance, in the second quarter of 2025, facilities management revenue saw a substantial increase of 17%, while property management revenue experienced an even more impressive surge of 30%.

CBRE Group earns significant revenue through project management and consulting fees. These services encompass overseeing real estate development projects, offering expert cost consultancy, and providing strategic advisory to clients.

The Project Management segment alone was a substantial contributor, generating $1.786 billion in revenue during the second quarter of 2025, highlighting the strong demand for these specialized services.

Investment Management Fees and Carried Interest

CBRE Group generates significant revenue through investment management fees and carried interest from its real estate investment funds. These fees are typically a percentage of the total assets under management (AUM), providing a steady income stream. As of Q2 2025, CBRE's AUM stood at an impressive $155.3 billion, underscoring the scale of its investment management operations.

Performance-based carried interest represents another crucial revenue component. This is a share of the profits generated by the funds, earned when the investments exceed a predetermined hurdle rate. This structure aligns CBRE's incentives with those of its investors, driving a focus on maximizing returns.

- Asset Management Fees: A recurring percentage of AUM.

- Carried Interest: Performance-based profit sharing from fund investments.

- AUM Growth: $155.3 billion in Q2 2025 reflects substantial client capital.

- Revenue Diversification: These streams provide both stable income and upside potential.

Valuation and Appraisal Fees

CBRE Group generates revenue through valuation and appraisal fees, charging clients for independent property assessments. These services are crucial for financing, property transactions, and financial reporting. In fact, CBRE's valuations segment saw a healthy 7% revenue increase in the second quarter of 2025, demonstrating strong demand for these expert services.

This revenue stream is built on providing objective and reliable property valuations for a diverse client base. The fees collected reflect the expertise and due diligence involved in these critical assessments.

- Independent Property Valuations: Fees for providing objective assessments of property value.

- Financing and Transaction Support: Revenue from valuations used in loan origination and property deals.

- Accounting and Reporting: Income derived from valuations for financial statement purposes.

- Market Growth: Valuations revenue experienced a 7% growth in Q2 2025.

CBRE Group's revenue streams are diverse, encompassing brokerage commissions, recurring management fees, project management and consulting, investment management, and valuation services. These segments collectively contribute to the company's robust financial performance.

The company's Advisory Services, which include leasing and sales, are a significant revenue driver. In Q2 2025, global leasing revenue grew 14% and property sales revenue increased by 20%. Furthermore, recurring revenue from facilities and property management showed strong growth, with facilities management revenue up 17% and property management revenue up 30% in the same quarter.

Investment management fees and carried interest are also key components, with CBRE managing $155.3 billion in assets as of Q2 2025. Project management services generated $1.786 billion in revenue in Q2 2025, while valuations saw a 7% revenue increase.

| Revenue Stream | Q2 2025 Performance | Key Drivers |

| Brokerage (Leasing & Sales) | Leasing +14%, Sales +20% | Transaction volume, market demand |

| Management (Facilities & Property) | Facilities +17%, Property +30% | Recurring service contracts, property portfolio size |

| Project Management & Consulting | $1.786 billion revenue | Real estate development activity, advisory demand |

| Investment Management | $155.3 billion AUM | Assets under management, fee structures |

| Valuation & Appraisal | +7% revenue growth | Property transaction needs, financing requirements |

Business Model Canvas Data Sources

The CBRE Group Business Model Canvas is informed by a robust combination of internal financial reports, extensive market research on commercial real estate trends, and competitive analysis of industry players. This multi-faceted approach ensures a comprehensive and accurate representation of the company's strategic framework.