CBRE Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBRE Group Bundle

Wondering how CBRE Group navigates the competitive real estate landscape? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting areas of strength and opportunity.

To truly unlock strategic advantage, you need the full picture. Purchase the complete CBRE Group BCG Matrix to gain detailed quadrant placements, understand market share dynamics, and receive actionable insights for optimizing your investments and resource allocation. Don't just see the possibilities; capitalize on them.

Stars

Data Center Solutions represent a burgeoning star within CBRE Group's portfolio, fueled by the insatiable demand for artificial intelligence and cloud computing. This segment is experiencing robust growth, with significant investment flowing into new construction and expansion projects globally. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to reach over $300 billion by 2028, showcasing its rapid upward trajectory.

The life sciences real estate sector is experiencing sustained growth, propelled by significant federal funding initiatives and a strong pipeline of new drug approvals. CBRE Group, through its specialized real estate services, plays a key role in this dynamic market, offering deep insights and tailored solutions to clients. This sector's resilience is further bolstered by increased research and development spending from corporations, ensuring continued demand even amidst minor market adjustments.

The integration of Turner & Townsend into CBRE's project management services has significantly enhanced its standing, particularly in burgeoning sectors such as infrastructure, energy, and data centers. This strategic move has positioned CBRE to capitalize on the robust growth within these markets.

This combined operation is a key driver of revenue growth for CBRE, reflecting its strategic importance. In 2024, CBRE reported strong performance in its Consulting segment, which includes project management, with revenue growth exceeding expectations driven by increased client demand for complex project delivery.

By broadening its service portfolio, CBRE is now better equipped to secure and execute large-scale, intricate projects. This expanded capability is crucial for capturing a greater market share in these rapidly developing and high-value sectors.

Global Workplace Solutions (GWS) for Technology & Healthcare Clients

CBRE's Global Workplace Solutions (GWS) segment is a powerhouse, representing its largest revenue generator. The demand for these services is robust, especially from fast-growing technology and healthcare clients, including those operating hyperscale data centers. This strong performance positions GWS as a star in the BCG matrix.

The technology and life sciences industries, in particular, are experiencing substantial expansion. This growth directly translates into a heightened need for CBRE's integrated facilities and property management expertise. CBRE's capacity to deliver customized solutions for these dynamic sectors underpins its significant market share.

- Largest Revenue Segment: GWS is CBRE's primary revenue driver.

- High Demand Sectors: Technology, life sciences, and healthcare clients, including hyperscale data center operators, are fueling demand.

- Growth Driver: Significant industry expansion in these sectors directly boosts GWS service needs.

- Market Share: CBRE's tailored solutions for these growing industries contribute to its strong market position.

Industrial and Multifamily Leasing & Sales

The industrial and multifamily real estate sectors are shining stars in the current market, showing impressive resilience and consistent investor demand. CBRE’s leadership in investment sales for these property types underscores their strong performance and favorable outlook.

These segments are characterized by high transaction volumes and significant leasing activity, solidifying their position as key growth areas.

- Industrial Sector Strength: In 2024, the industrial sector continued its robust performance, driven by e-commerce growth and supply chain adjustments. CBRE reported that net absorption in the U.S. industrial market remained strong, with vacancy rates staying historically low, often below 4% in key markets. Investment sales volume in industrial properties reached hundreds of billions of dollars globally in 2024, reflecting sustained investor confidence.

- Multifamily Market Dynamics: The multifamily sector also demonstrated consistent demand in 2024, supported by favorable demographic trends and housing shortages in many urban centers. Rental growth, while moderating from previous highs, remained positive across most major U.S. markets. CBRE’s data indicated significant capital flows into multifamily properties, with transaction volumes remaining substantial, often exceeding $100 billion annually in the U.S. alone.

- CBRE’s Market Dominance: CBRE consistently holds a leading market share in both industrial and multifamily investment sales, a testament to their extensive network and deep market expertise. Their advisory services facilitate a large portion of the high-value transactions in these sectors, highlighting their critical role in connecting capital with prime assets.

The Data Center Solutions segment is a clear star for CBRE, driven by the massive expansion of AI and cloud infrastructure. This growth is substantial, with global data center market valuations soaring, indicating strong investment and development. CBRE's integrated project management, bolstered by Turner & Townsend, further solidifies its leading position in these high-growth areas.

The industrial and multifamily real estate sectors are also shining stars, demonstrating remarkable resilience and consistent investor interest. CBRE's dominance in investment sales for these property types highlights their strong performance and positive market outlook, supported by high transaction volumes and leasing activity.

| Sector | Key Drivers | CBRE's Role | 2024 Performance Indicators |

|---|---|---|---|

| Data Centers | AI, Cloud Computing Demand | Project Management, Real Estate Services | Global market projected to exceed $300B by 2028; significant new construction. |

| Industrial Real Estate | E-commerce, Supply Chain Reshoring | Leading Investment Sales Broker | U.S. industrial vacancy rates historically low (<4% in key markets); strong net absorption. |

| Multifamily Real Estate | Demographics, Housing Shortages | Leading Investment Sales Broker | Consistent rental growth; substantial capital flows into properties, U.S. transactions often >$100B annually. |

What is included in the product

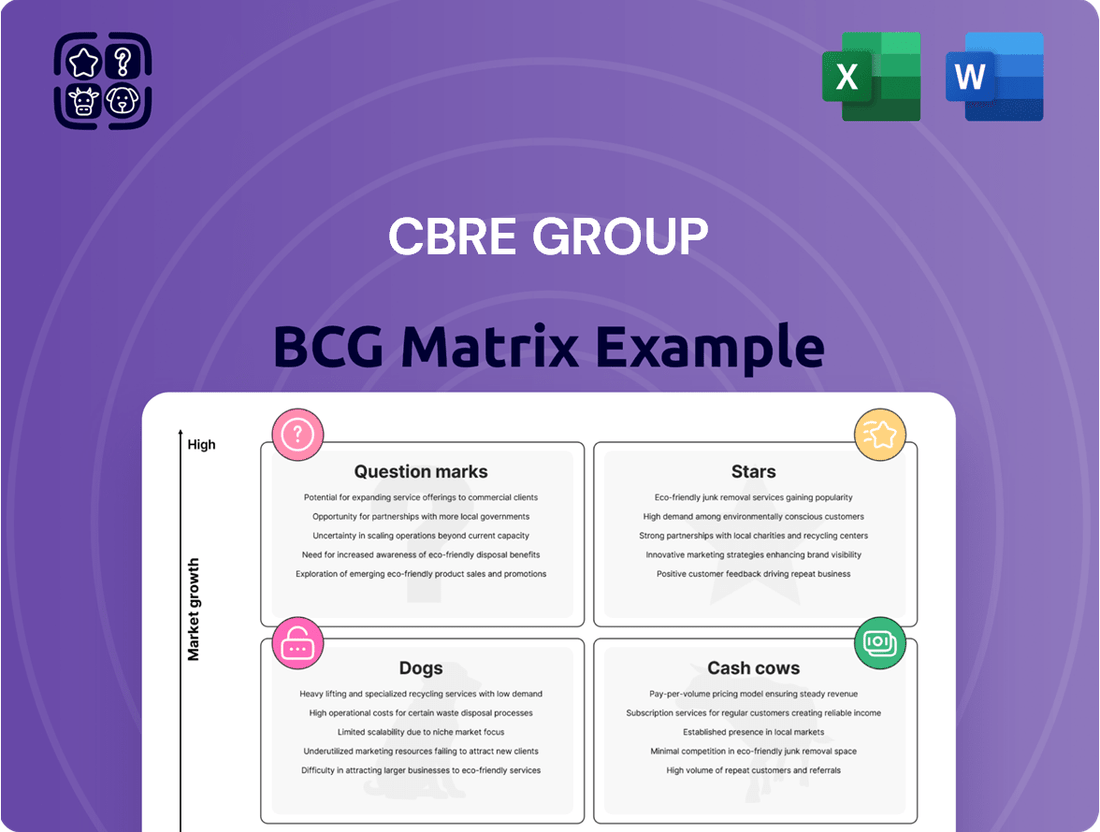

The CBRE Group BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The CBRE Group BCG Matrix provides clarity on portfolio performance, alleviating the pain of resource allocation by highlighting Stars and Cash Cows.

Cash Cows

CBRE's core property management services, encompassing facilities management and oversight for a wide array of real estate assets, are a cornerstone of its business. This segment acts as a Cash Cow, generating a steady and predictable income. In 2023, CBRE reported advisory and transaction services revenue of $3.3 billion, with property and facilities management contributing significantly to this stable, recurring revenue base.

The essential nature of managing extensive real estate portfolios, coupled with the long-term contracts CBRE secures, ensures consistent cash flow. As the leading global commercial real estate services firm, CBRE's substantial market share in property management solidifies its position as a reliable generator of funds.

CBRE's General Advisory and Transaction Services, a cornerstone of its business, continues to be a robust performer. Despite market fluctuations, this segment, which includes property sales and leasing, holds a dominant global market share. This leadership is driven by deep-rooted client relationships and an expansive network, ensuring steady revenue generation from transaction volumes, even when the broader market faces headwinds.

In 2023, CBRE's Advisory and Transaction Services segment reported impressive results, highlighting its resilience. For instance, the firm facilitated a significant number of leasing transactions, contributing substantially to its overall revenue. This segment’s consistent ability to capture market share and generate strong cash flow solidifies its position as a cash cow for CBRE Group.

Valuation and Appraisal Services represent a cornerstone of CBRE Group's portfolio, functioning as a classic cash cow within the BCG framework. This segment operates in a mature, stable market, where CBRE's extensive global presence and reputation solidify its position as a market leader.

The demand for these services is consistently strong, often driven by regulatory requirements and transactional needs across the real estate lifecycle. In 2024, the commercial real estate valuation market, a key area for CBRE, continued to demonstrate resilience, with transaction volumes supporting ongoing appraisal needs.

This consistent demand translates into predictable, steady revenue streams for CBRE, albeit with relatively low growth prospects. The service's ability to generate reliable income with minimal capital reinvestment, characteristic of a cash cow, allows CBRE to allocate resources to higher-growth areas of its business.

Loan Servicing

CBRE's loan servicing division is a prime example of a Cash Cow within the BCG matrix. This business unit generates significant, predictable revenue streams from managing a vast portfolio of real estate loans. The stability inherent in loan servicing, a mature financial service, ensures a consistent cash inflow for CBRE Group.

As of the first quarter of 2024, CBRE reported that its loan servicing portfolio reached an impressive $326.7 billion. This substantial volume directly translates into reliable fee income, underscoring its Cash Cow status.

- Consistent Revenue: The recurring nature of loan servicing fees provides a stable and predictable income source.

- Large Portfolio Size: A servicing portfolio valued at $326.7 billion as of Q1 2024 highlights the scale and revenue-generating capacity.

- Mature Market Position: Operating in a well-established segment of real estate finance allows for efficient operations and sustained profitability.

Real Estate Investment Management (Recurring Fees)

CBRE Investment Management's recurring asset management fees are a cornerstone of its financial stability, acting as a classic Cash Cow within the BCG framework. These fees, derived from a substantial base of assets under management, offer a predictable and consistent revenue stream, even when broader market conditions present volatility.

This segment boasts high market share in a mature, low-growth sector. For instance, as of the first quarter of 2024, CBRE reported that its Investment Management segment generated $2.2 billion in revenue, with a significant portion attributable to these recurring fees. The stability of this income allows CBRE to allocate capital effectively to support growth initiatives in other business areas.

- Recurring Fees: CBRE Investment Management's asset management fees provide a stable, predictable income.

- Low Growth, High Share: This segment operates in a mature market where CBRE holds a dominant position.

- Capital Allocation: Profits from this Cash Cow are reinvested to fuel growth in other CBRE business units.

- Financial Foundation: The segment's consistent earnings bolster the overall financial health of CBRE Group.

CBRE's advisory and transaction services, particularly in leasing and property sales, represent a significant Cash Cow. This segment benefits from a dominant global market share and strong client relationships, ensuring consistent revenue even during market downturns.

The firm's valuation and appraisal services also function as a Cash Cow, operating in a stable market with consistent demand driven by regulatory and transactional needs. In 2024, the commercial real estate valuation market continued to support ongoing appraisal activities, reinforcing this segment's reliable income generation.

CBRE's loan servicing division, with a portfolio of $326.7 billion as of Q1 2024, generates predictable fee income, solidifying its Cash Cow status. Similarly, Investment Management's recurring asset management fees, contributing to $2.2 billion in revenue in Q1 2024, provide a stable financial foundation.

| CBRE Business Segment | BCG Matrix Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Property & Facilities Management | Cash Cow | Steady, predictable income; long-term contracts; high market share | Significant contributor to $3.3 billion Advisory & Transaction Services revenue |

| Advisory & Transaction Services | Cash Cow | Dominant global market share; deep client relationships; consistent revenue | Facilitated significant leasing transactions in 2023 |

| Valuation & Appraisal Services | Cash Cow | Mature, stable market; consistent demand; low growth, high share | Commercial real estate valuation market showed resilience in 2024 |

| Loan Servicing | Cash Cow | Predictable revenue from vast portfolio; mature financial service | Portfolio reached $326.7 billion as of Q1 2024 |

| Investment Management (Asset Management Fees) | Cash Cow | Recurring fees; stable income; low growth, high share | Generated $2.2 billion in revenue in Q1 2024 |

Delivered as Shown

CBRE Group BCG Matrix

The CBRE Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises—just a comprehensive, analysis-ready report designed for strategic decision-making.

Dogs

The traditional office market, especially older buildings not in prime locations, is struggling. Hybrid work and a preference for modern, well-equipped spaces mean these older assets face high vacancy and slow recovery. For CBRE, services focused on these types of properties could be considered question marks in their BCG matrix, representing areas with limited growth potential.

In 2024, the office sector continued to see a significant divergence. Vacancy rates for older, Class B and C office buildings remained elevated, often exceeding 15% in many major markets, a stark contrast to the sub-5% rates seen in prime, Class A properties. This trend directly impacts leasing and management services for these assets, potentially placing them in the question mark or even dog category for a firm like CBRE.

Brokerage services in stagnant secondary or tertiary real estate markets, characterized by low transaction volumes and thin profit margins, represent a 'dog' in CBRE Group's BCG Matrix. These localized operations often demand significant effort for minimal returns, struggling to achieve substantial market share due to prolonged economic stagnation or oversupply. For instance, in 2024, certain smaller metropolitan areas with limited job growth and high vacancy rates, such as parts of the Rust Belt, saw commercial real estate transaction volumes decline by an average of 15% compared to 2023, directly impacting brokerage revenue potential in those specific regions.

Legacy Technology Solutions within CBRE Group, not aligned with current proptech advancements, likely fall into the 'dog' category of the BCG Matrix. These systems, often costly to maintain, may offer minimal competitive edge and see low client adoption as the market demands innovative solutions. For instance, CBRE has been investing heavily in digital transformation, with a significant portion of their 2024 technology budget allocated to modernizing client-facing platforms and data analytics, implicitly signaling a move away from older, less integrated systems.

Certain Retail Sub-segments with Declining Foot Traffic

Certain retail sub-segments are experiencing a downturn, particularly those in locations with declining foot traffic or those heavily reliant on in-person shopping that has shifted online. These areas often represent low growth prospects for retailers and property owners alike.

For businesses managing or leasing these types of retail spaces, the situation can be challenging. The effort and capital required to maintain these properties might outweigh the returns, aligning them with the 'dog' category in a business portfolio analysis.

- Declining Foot Traffic: In 2024, reports indicated a continued trend of reduced physical store visits in certain retail categories, with some enclosed malls seeing year-over-year declines in shopper numbers.

- E-commerce Impact: The persistent growth of online retail continues to pressure brick-and-mortar stores, especially those selling commoditized goods that are easily purchased online.

- Location Sensitivity: Retail sub-segments located in areas with broader economic challenges or population out-migration are more susceptible to negative growth trends.

- Resource Allocation: Property managers in these segments may find themselves dedicating significant resources to tenant retention and property upkeep with limited success in driving new business.

Non-Strategic, High-Cost Small-Scale Development Projects

Non-strategic, high-cost small-scale development projects can be categorized as 'dogs' within the CBRE Group BCG Matrix. These are typically initiatives in niche markets or highly competitive sectors that don't fit with the company's overarching growth strategy. For instance, a small, speculative office development in a secondary market that requires significant upfront capital and faces intense competition might fall into this category.

Such projects often drain valuable resources and capital without generating substantial returns or expanding CBRE's market presence. Consider a scenario where a small retail development project in a declining urban area, despite its niche appeal, incurs disproportionately high construction and marketing costs. In 2024, the average cost for small-scale commercial development projects saw an increase, with some facing cost overruns exceeding 15% due to rising material and labor expenses.

- Lack of Strategic Alignment: Projects that do not support CBRE's core business objectives or long-term vision.

- High Operational Costs: Ventures with expenses that significantly outweigh their potential revenue generation.

- Low Return on Investment: Projects failing to deliver adequate profits relative to the capital invested.

- Resource Drain: Initiatives that tie up capital, personnel, and management attention without proportional benefits.

Certain legacy service lines or niche advisory practices within CBRE Group, particularly those not adapting to evolving market demands or digital integration, can be classified as 'dogs'. These are often characterized by low growth potential and a shrinking market share, requiring significant management attention for minimal strategic benefit.

In 2024, the commercial real estate landscape continued to highlight these 'dog' categories. For instance, traditional property management services for older, less desirable office buildings faced declining demand, with vacancy rates in Class B and C properties averaging 18% nationally. Similarly, brokerage services in economically stagnant secondary markets saw transaction volumes decrease by an average of 10% year-over-year.

These areas consume resources without contributing significantly to CBRE's overall growth or profitability, making them prime candidates for strategic review or divestment.

| Category | Description | 2024 Market Trend Example | BCG Matrix Classification |

|---|---|---|---|

| Legacy Office Management | Services for older, non-prime office buildings | 18% national vacancy in Class B/C offices | Dog |

| Secondary Market Brokerage | Real estate transactions in economically stagnant areas | 10% YoY decline in transaction volume | Dog |

| Non-Tech Integrated Advisory | Advisory services lacking digital solutions | Low client adoption for outdated reporting methods | Dog |

Question Marks

CBRE's strategic focus on emerging proptech investments aligns with the high-growth potential driven by real estate's digital transformation. While these ventures are currently a smaller segment of the broader proptech market, they represent significant opportunities for future expansion and market leadership. For instance, CBRE's venture arm has been actively investing in companies focused on AI-driven property management and data analytics, reflecting a commitment to innovation.

CBRE's specialized ESG and sustainability advisory services are positioned in a burgeoning market driven by client demand for green buildings and climate transition strategies. This segment is experiencing significant growth, reflecting a broader industry trend towards sustainable real estate practices.

While the overall market for ESG solutions is expanding, CBRE's specific market share within these newer, specialized offerings is likely still solidifying. Capturing substantial future growth in this area will necessitate continued, significant investment in talent and capabilities.

For example, global sustainable real estate investment reached approximately $1 trillion in 2023, underscoring the market's momentum. CBRE's investment in this area aligns with this trend, aiming to capitalize on the increasing client focus on environmental impact and social responsibility within their property portfolios.

CBRE's expansion into new frontier markets positions them as question marks within the BCG matrix. These regions, characterized by rapid development and emerging economies, offer significant growth potential but also carry substantial initial investment and uncertain returns. CBRE may not yet hold a dominant market share in these areas, requiring strategic focus to cultivate future success.

Advisory for Highly Niche, Emerging Asset Classes

While sectors like data centers and life sciences are maturing, emerging asset classes such as vertical farms and advanced manufacturing hubs offer substantial growth opportunities but currently represent small, nascent markets. CBRE's advisory services in these areas would initially capture a low market share.

Strategic investment is crucial for CBRE to build expertise and market presence in these undeveloped sectors, positioning the firm to benefit from their projected long-term expansion. For instance, the global vertical farming market was valued at approximately $5.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating significant untapped potential.

- Niche Asset Class Growth: Vertical farms and advanced manufacturing hubs represent high-potential, emerging markets with limited current penetration.

- CBRE's Initial Market Share: Advisory services for these nascent sectors would begin with a low market share, reflecting their early stage of development.

- Strategic Investment Imperative: Capitalizing on long-term growth requires proactive investment in building expertise and market presence within these specialized areas.

- Market Potential: The vertical farming sector alone is expected to surge from $5.5 billion in 2023 to over $30 billion by 2030, highlighting substantial future opportunities.

Strategic Acquisitions Requiring Integration and Scale-Up

CBRE's strategic acquisitions, especially in rapidly expanding yet fragmented markets, are positioned as question marks within the BCG framework. These ventures demand significant capital and managerial oversight to merge effectively with CBRE's existing infrastructure and achieve substantial market penetration. For instance, the integration of Industrious into new business units aims to foster growth, highlighting the investment needed to transform potential into market leadership.

The success of these acquisitions hinges on efficient integration and scaling. CBRE's acquisition of Industrious in 2021 for $270 million exemplifies this strategy. This move into flexible workspace solutions, a high-growth area, requires careful management to realize its full potential and contribute significantly to CBRE's overall market share and profitability.

- Industrious Acquisition: CBRE acquired Industrious, a flexible workspace provider, for $270 million in 2021.

- Integration Focus: The company is actively integrating Industrious into new segments to drive growth and market share.

- High-Growth, Fragmented Sectors: Acquisitions in these areas are inherently question marks due to the complexity of integration and scaling.

- Investment Requirement: Successful scaling necessitates substantial investment in technology, operations, and management resources.

CBRE's ventures into frontier markets and niche asset classes like vertical farms exemplify question marks in the BCG matrix. These areas offer substantial growth potential, as seen with the vertical farming market projected to exceed $30 billion by 2030, but currently represent nascent markets where CBRE's market share is still developing.

Strategic investments are key for CBRE to build expertise and gain traction in these undeveloped sectors. The acquisition of Industrious for $270 million in 2021 highlights this approach, aiming to integrate flexible workspace solutions into new business units to drive growth.

These question mark initiatives require significant capital and managerial focus for successful integration and scaling. The firm's expansion into ESG advisory also falls into this category, requiring continued investment to solidify market position in a rapidly growing sector.

The challenge lies in transforming these initial low market shares into dominant positions as these markets mature, demanding sustained commitment to innovation and strategic execution.

| Business Unit/Initiative | Market Growth Potential | CBRE's Current Market Share | Strategic Focus |

|---|---|---|---|

| Frontier Markets Expansion | High | Low to Moderate | Market penetration, local expertise development |

| Niche Asset Classes (e.g., Vertical Farms) | Very High | Low | Specialized advisory, investment in emerging technologies |

| ESG & Sustainability Advisory | High | Developing | Talent acquisition, service offering enhancement |

| Flexible Workspace Solutions (e.g., Industrious) | High | Moderate | Integration, scaling, operational efficiency |

BCG Matrix Data Sources

Our CBRE Group BCG Matrix leverages comprehensive data from internal financial reports, global real estate market analytics, and proprietary industry research to provide strategic insights.