Caterpillar PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caterpillar Bundle

Uncover the critical external factors shaping Caterpillar's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are impacting this global giant. Gain the strategic foresight you need to anticipate challenges and capitalize on opportunities. Download the full analysis now and empower your decision-making.

Political factors

Government policies on infrastructure development are a major driver for Caterpillar's business, especially for its construction equipment. When governments invest heavily in roads, bridges, and other public works, the demand for the machinery Caterpillar produces naturally increases.

A prime example is the United States' Infrastructure Investment and Jobs Act, passed in 2021. This legislation earmarks a substantial $1.2 trillion for infrastructure projects. This significant allocation is anticipated to directly boost Caterpillar's construction equipment segment, fostering greater demand and driving sales growth through 2025 and beyond as projects get underway.

Global trade tensions and tariffs present a significant hurdle for Caterpillar's machinery exports. These international trade policies directly impact the cost and competitiveness of its products sold across borders. For instance, U.S. tariffs on Chinese imports in 2023 contributed to a noticeable reduction in Caterpillar's global machinery exports.

Looking ahead, Caterpillar anticipates continued cost pressures in 2025 if these tariff structures persist. This ongoing trade friction creates uncertainty and can necessitate adjustments to supply chain strategies and pricing models to mitigate financial impact.

Political instability in emerging markets, a key concern for Caterpillar, directly impacts its international equipment sales. Regions like Latin America and the Middle East have experienced heightened political tensions, creating significant headwinds for the company's revenue streams in these vital areas.

For instance, ongoing political uncertainty in parts of Latin America during 2024 has led to cautious infrastructure spending, a sector heavily reliant on Caterpillar's machinery. Similarly, geopolitical shifts in the Middle East continue to create an unpredictable operating environment, potentially dampening demand for construction and mining equipment.

Regulatory Environment and Lobbying

Caterpillar actively participates in shaping public policy, focusing on creating a legislative and policy landscape that supports its operations. This includes advocating for robust transportation funding, addressing workforce development needs, and influencing tax policies. The company's commitment to transparency in its political engagement is evident in its public disclosures.

- Lobbying Efforts: Caterpillar engages in lobbying activities to influence legislation and regulations impacting its industry, particularly concerning infrastructure investment and trade policies.

- Political Contributions: The company makes political contributions to support candidates and organizations aligned with its business interests, as detailed in its sustainability and lobbying reports.

- Sustainability Report 2024: Caterpillar's 2024 Sustainability Report outlines its approach to political engagement, including its lobbying expenditures and political contributions, demonstrating a commitment to transparency.

Energy Policy and Decarbonization Initiatives

Government policies and incentives driving the energy transition directly shape Caterpillar's product development and market opportunities. For instance, the U.S. Inflation Reduction Act (IRA), enacted in 2022, provides significant tax credits for clean energy and emissions reduction technologies, potentially boosting demand for Caterpillar's renewable energy infrastructure solutions and low-emission equipment. This policy landscape encourages investment in areas like battery storage and hydrogen fuel cell technology, aligning with Caterpillar's strategic focus on expanding its offerings in these burgeoning sectors.

Caterpillar is actively investing in and advocating for policies that promote lower greenhouse gas emissions, energy flexibility, and innovation in power supply. This strategic alignment with global decarbonization efforts is evident in their investments in areas such as advanced battery technologies and alternative fuels. By supporting policies that foster a reduced-carbon future, Caterpillar aims to position itself as a key player in the evolving energy landscape, anticipating increased demand for its sustainable solutions.

The company's commitment to decarbonization is further underscored by its participation in industry collaborations and its stated goals for reducing its own operational emissions. For example, Caterpillar aims to reduce absolute Scope 1 and 2 greenhouse gas emissions by 30% by 2030 from a 2018 baseline. This proactive approach to policy and internal targets demonstrates a clear strategy to capitalize on the global shift towards cleaner energy sources.

Key policy areas influencing Caterpillar include:

- Government incentives for renewable energy deployment

- Regulations on emissions standards for heavy machinery

- Support for infrastructure development related to alternative fuels

- Policies promoting energy efficiency and grid modernization

Government spending on infrastructure remains a critical driver for Caterpillar, with significant legislative actions in 2024 and projected continued investment through 2025. The ongoing implementation of the U.S. Infrastructure Investment and Jobs Act, allocating $1.2 trillion, directly fuels demand for construction equipment. Similarly, global trade dynamics, including tariffs and trade agreements, continue to influence Caterpillar's export competitiveness, with potential cost pressures persisting into 2025 if current trade policies remain unchanged.

Political stability in key markets significantly impacts Caterpillar's international sales performance. For instance, in 2024, political uncertainty in regions like Latin America led to more cautious infrastructure spending, affecting demand for the company's machinery. Geopolitical developments in other regions also create an unpredictable operating environment, underscoring the sensitivity of Caterpillar's revenue streams to global political landscapes.

Caterpillar actively engages in policy advocacy to support its business objectives, focusing on areas such as infrastructure funding and trade policies. The company's commitment to transparency in its political engagement is demonstrated through its public disclosures regarding lobbying expenditures and political contributions, as highlighted in its 2024 Sustainability Report.

The global energy transition, driven by government policies and incentives, is reshaping demand for Caterpillar's products. The U.S. Inflation Reduction Act, for example, offers substantial tax credits for clean energy technologies, potentially increasing demand for Caterpillar's renewable energy infrastructure solutions and low-emission equipment through 2025. Caterpillar's strategic investments in battery technologies and alternative fuels align with these policy trends, aiming to capitalize on the shift towards a reduced-carbon future.

What is included in the product

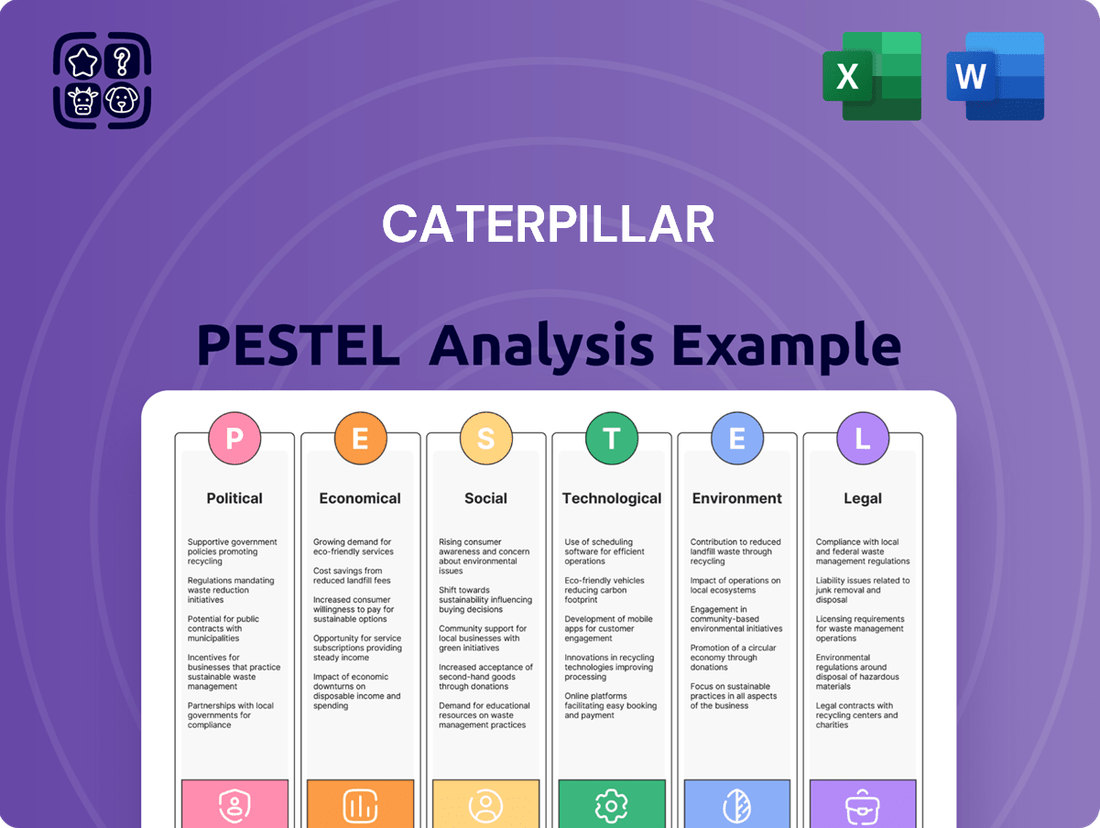

This Caterpillar PESTLE analysis examines the influence of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the company's operations and strategic positioning.

A clear, actionable framework that helps Caterpillar anticipate and navigate complex global shifts, reducing the pain of unexpected market disruptions and strategic uncertainty.

Economic factors

Caterpillar's performance is intrinsically linked to the ebb and flow of the global economy. When economies thrive, so does demand for the heavy machinery Caterpillar produces. Conversely, economic slowdowns directly translate to reduced orders for construction and mining equipment.

While Caterpillar posted robust results in 2024, the economic landscape for 2025 presents a more cautious outlook. Projections indicate a potential softening in demand and a decrease in sales volumes. This anticipated shift is largely attributed to prevailing macroeconomic uncertainties and the persistent impact of elevated interest rates, which can dampen capital expenditure across industries.

Global infrastructure investment remains a critical economic engine for Caterpillar. Regions like North America and parts of Asia continue to demonstrate robust demand for construction and infrastructure development, directly impacting sales of heavy machinery. For instance, the U.S. Infrastructure Investment and Jobs Act, passed in 2021, is projected to inject hundreds of billions of dollars into infrastructure projects through 2025, a significant tailwind for Caterpillar.

However, the overall pace of new infrastructure project commencements and the consistency of construction spending trends globally present a mixed economic picture. While some nations are accelerating their infrastructure build-outs, others face fiscal constraints or project delays, which can temper demand for Caterpillar's equipment and services. The World Bank's 2024 outlook suggests continued, albeit uneven, growth in infrastructure spending across emerging markets.

Commodity prices are a huge factor for Caterpillar, especially for its mining equipment. When prices for things like copper, iron ore, and coal go up, mining companies tend to invest more in new machinery, which is great news for Caterpillar's Resource Industries segment. For instance, as of late 2024, many key commodity prices have shown resilience, with copper reaching multi-year highs, signaling robust demand from infrastructure and EV sectors.

This increased demand for critical minerals, fueled by the global push towards electrification and renewable energy, creates a strong market for Caterpillar's advanced mining solutions. However, this also means Caterpillar needs to be agile, as sharp downturns in commodity prices can quickly lead to reduced capital expenditure by mining firms, impacting equipment sales.

Currency Exchange Rates and Inflation

Fluctuations in currency exchange rates present a significant challenge for Caterpillar, impacting its global revenue and cost structures. For instance, a stronger US dollar in 2023 made American-made machinery more expensive for international buyers, potentially dampening demand. This volatility directly affects the translation of foreign earnings back into US dollars, influencing overall profitability.

High inflation rates, particularly in key operating regions, can escalate Caterpillar's production costs. Increased prices for raw materials like steel and energy, coupled with rising labor expenses, squeeze profit margins if these costs cannot be fully passed on to customers. For example, persistent inflation in emerging markets could force Caterpillar to adjust pricing strategies, potentially impacting sales volume.

- Currency Volatility: In early 2024, the US dollar experienced moderate strength against major currencies, impacting Caterpillar's international sales competitiveness.

- Inflationary Pressures: Global inflation remained a concern throughout 2023, with the IMF projecting an average inflation rate of 6.8% for advanced economies in 2023, impacting input costs for manufacturers like Caterpillar.

- Material Costs: Prices for key commodities such as iron ore and copper saw upward trends in late 2023 and early 2024, directly increasing Caterpillar's manufacturing expenses.

Dealer Inventory Management

Caterpillar's approach to dealer inventory management is a key economic indicator, reflecting their reading of end-user demand. They closely track these levels to fine-tune production and avoid overstocking or shortages.

For 2025, Caterpillar anticipates dealer inventory levels will largely mirror those seen in 2024. This stability suggests a deliberate, cautious strategy, aiming to match output with anticipated market consumption rather than aggressive expansion.

- Cautious Outlook: The expectation of stable 2025 dealer inventory levels signals a conservative stance on future demand.

- Demand Alignment: Caterpillar uses inventory data to ensure production schedules are closely aligned with actual market needs.

- Economic Sensitivity: Dealer inventory levels are sensitive to broader economic conditions, impacting Caterpillar's operational planning.

The global economic outlook for 2025 suggests a potential slowdown, with projections indicating softer demand and reduced sales volumes for Caterpillar. This anticipated shift is driven by ongoing macroeconomic uncertainties and the persistent effect of higher interest rates, which tend to curb capital expenditures across various industries.

Infrastructure spending remains a vital economic driver for Caterpillar, with North America and parts of Asia showing strong demand for construction and development projects. The U.S. Infrastructure Investment and Jobs Act, for example, is expected to significantly boost infrastructure investments through 2025, providing a considerable advantage for the company.

Commodity prices directly influence Caterpillar's mining equipment sales; resilient prices for key materials like copper in late 2024 signal strong demand for mining machinery, especially with the global push towards electrification.

| Economic Factor | 2024 Trend/Outlook | 2025 Outlook | Impact on Caterpillar |

|---|---|---|---|

| Global Economic Growth | Mixed; some regions robust, others cautious | Potential softening, reduced demand | Lower sales volumes, especially for construction equipment |

| Infrastructure Investment | Strong in North America and Asia; uneven globally | Continued, but pace may vary by region | Directly supports demand for construction machinery |

| Commodity Prices | Resilient, with key metals showing strength | Expected to remain supportive for mining sector | Drives investment in mining equipment |

| Interest Rates | Elevated | Likely to remain a factor | Can dampen capital expenditure |

Preview the Actual Deliverable

Caterpillar PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Caterpillar PESTLE analysis covers all key external factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this detailed PESTLE analysis, providing actionable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This in-depth PESTLE analysis for Caterpillar is designed to equip you with a thorough understanding of its operating environment.

Sociological factors

The availability of a skilled workforce in manufacturing and construction is a critical sociological factor impacting Caterpillar. The company actively addresses this through its foundation and advocacy, investing in skills development and workforce readiness programs. This focus is essential for maintaining operational excellence and ensuring robust customer support across its global operations.

Caterpillar places significant emphasis on employee health and safety, a commitment underscored in its 2024 Sustainability Report. The company's 2023 safety performance data shows a 12% reduction in recordable injuries compared to 2022, demonstrating a tangible commitment to improving workplace safety across its diverse global operations. Maintaining these high standards is not only vital for the well-being of its workforce but also instrumental in cultivating a strong and responsible corporate reputation.

Caterpillar's dedication to community betterment is evident through the Caterpillar Foundation, which actively funds projects focused on sustainable infrastructure and disaster relief. This aligns with growing public demand for businesses to demonstrate tangible social responsibility, a trend likely to intensify in 2024 and 2025.

In 2023, the Caterpillar Foundation continued its robust support, contributing to numerous global initiatives aimed at improving livelihoods and building resilient communities. This commitment reflects a strategic understanding that strong social impact enhances brand reputation and fosters long-term stakeholder trust.

Diversity and Inclusion Initiatives

Caterpillar's commitment to Diversity and Inclusion (D&I) is evident in its integration of D&I reporting into its 2024 Sustainability Report. This strategic move reflects growing societal pressure for businesses to champion equitable employment and diverse representation, aligning with Caterpillar's goal of fostering an inclusive workplace.

Societal expectations continue to push for greater accountability in corporate D&I efforts. Caterpillar's proactive reporting demonstrates an understanding of this trend, aiming to build trust and enhance its brand reputation among stakeholders who value social responsibility.

- Workforce Diversity: Caterpillar aims to increase representation of underrepresented groups across all levels of the organization.

- Inclusive Culture: Initiatives focus on creating an environment where all employees feel valued, respected, and empowered to contribute.

- Supplier Diversity: The company is also focused on expanding its partnerships with diverse suppliers, contributing to economic inclusion within its supply chain.

- Reporting Transparency: The inclusion of D&I metrics in the 2024 Sustainability Report signifies a commitment to transparently tracking and communicating progress.

Customer Expectations for Sustainable Solutions

Societal pressure for sustainability is significantly shaping the construction and equipment sectors. Customers are actively seeking products and services that align with environmental responsibility, pushing companies like Caterpillar to prioritize eco-friendly innovations.

This demand translates into a clear expectation for solutions that reduce greenhouse gas emissions and offer greater energy flexibility. For instance, Caterpillar's commitment to developing battery electric and hydrogen fuel cell technologies directly addresses this growing customer need, reflecting a broader shift in consumer values toward environmental stewardship.

Key customer expectations include:

- Reduced operational emissions: Demand for machinery that minimizes its carbon footprint during use.

- Energy source versatility: A preference for equipment that can utilize alternative fuels or electric power.

- Lifecycle sustainability: Consideration for the environmental impact of products from manufacturing to disposal.

Societal shifts towards greater corporate responsibility significantly influence Caterpillar's operations and strategy. Growing expectations for ethical labor practices and community engagement are paramount. The company's investments in workforce development and its foundation's philanthropic efforts directly address these evolving societal demands, aiming to foster positive social impact and enhance brand reputation.

Technological factors

Caterpillar is significantly boosting its investment in electrification and alternative fuel technologies to align with shifting energy needs and sustainability targets. This strategic focus involves creating more fuel-efficient, fuel-flexible, and entirely electric product offerings. Evidence of this commitment was visible with new electric models and hybrid retrofit options presented at CES 2025, signaling a clear direction for the company's future product development.

Caterpillar is heavily invested in automation and autonomy, recognizing their transformative potential in construction and mining. The company is a leader in this space, offering autonomous versions of key equipment like haul trucks, dozers, drills, wheel loaders, and compactors. These technologies are designed to significantly boost safety and operational efficiency for Caterpillar's customers.

By 2024, Caterpillar's autonomous haulage systems (AHS) were already operational at multiple mine sites globally, demonstrating proven productivity gains. For instance, sites using AHS have reported increases in truck utilization and overall material moved. This trend is expected to accelerate through 2025 as more companies adopt these advanced solutions to reduce labor costs and improve site safety.

Caterpillar is deeply invested in digitalization, exemplified by its VisionLink® platform. This cloud-based solution offers customers real-time, actionable insights into fleet performance, helping them optimize operations and reduce unexpected downtime. For instance, in 2023, Caterpillar reported significant growth in its digital services adoption, with over 70% of its new equipment sold being connected, a key driver for its aftermarket revenue streams.

Research and Development Investment

Caterpillar's sustained investment in research and development is a cornerstone of its technological advancement. Over the last twenty years, the company has allocated more than $30 billion to R&D, underscoring a deep commitment to innovation and staying ahead in the competitive heavy equipment sector.

This substantial financial commitment directly fuels the development of cutting-edge technologies. These advancements are vital for Caterpillar to maintain its industry leadership and offer superior products and solutions to its global customer base.

- $30 Billion+ Invested in R&D over 20 years

- Focus on developing best-in-class technologies

- Maintaining industry leadership through innovation

- Driving advancements in machinery and digital solutions

Advanced Manufacturing and Remanufacturing

Caterpillar actively integrates advanced manufacturing and remanufacturing into its operations, focusing on designing products for longevity, ease of rebuilding, and eventual remanufacturing. This strategy underscores their commitment to efficient resource utilization throughout a product's lifecycle.

The company has experienced a notable surge in sales derived from its remanufactured products, a clear indicator of their successful circular economy model. This approach not only extends product life but also significantly curtails energy consumption compared to new manufacturing processes.

- Increased Sales from Remanufactured Parts: Caterpillar's Reman business saw robust growth, contributing significantly to overall revenue. For instance, in 2023, the Reman segment continued its positive trajectory, reflecting strong customer adoption of sustainable solutions.

- Resource Efficiency: Remanufacturing processes typically consume 80-90% less energy than producing new components, aligning with Caterpillar's sustainability goals and reducing its environmental footprint.

- Circular Economy Leadership: Caterpillar's commitment to remanufacturing positions them as a leader in the circular economy within the heavy equipment sector, offering customers cost-effective and environmentally sound alternatives.

Caterpillar's technological strategy heavily emphasizes electrification and alternative fuels, aiming to offer more fuel-efficient and electric equipment. This focus was evident at CES 2025 with new electric and hybrid models, demonstrating a clear path toward sustainable machinery. The company's significant R&D investment, exceeding $30 billion over two decades, directly supports these advancements, ensuring industry leadership and superior customer solutions.

| Technology Focus | Key Initiatives | Impact/Data |

|---|---|---|

| Electrification & Alternative Fuels | New electric and hybrid models (CES 2025) | Aligning with shifting energy needs and sustainability targets |

| Automation & Autonomy | Autonomous haul trucks, dozers, etc. | Operational at multiple mine sites by 2024, improving safety and efficiency |

| Digitalization | VisionLink® platform | Over 70% of new equipment connected in 2023, driving aftermarket revenue |

| Advanced Manufacturing & Remanufacturing | Designing for longevity and rebuilding | Increased sales from remanufactured products, 80-90% less energy than new production |

Legal factors

Caterpillar must navigate a complex web of global emissions regulations, including stringent standards from bodies like the California Air Resources Board (CARB). For instance, CARB's Advanced Clean Cars II regulation aims for 100% zero-emission vehicle sales by 2035, impacting engine manufacturers. Failure to comply can result in significant penalties and restrict market access for Caterpillar's engines and equipment.

Caterpillar, as a major manufacturer of heavy machinery, operates under stringent product safety and liability laws globally. These regulations mandate that their equipment, from excavators to dozers, must meet rigorous safety standards to prevent accidents and injuries. Failure to comply can result in significant legal repercussions, including costly lawsuits and damage to the company's reputation.

In 2024, the landscape of product liability continues to evolve, with increased scrutiny on manufacturers to demonstrate robust safety protocols throughout the product lifecycle. Caterpillar's commitment to safety is not just a regulatory necessity but a core business principle, aiming to minimize potential legal exposure and protect its customers. For instance, the company invests heavily in research and development to incorporate advanced safety features, such as improved operator visibility and automated hazard detection systems.

Caterpillar's global operations are significantly shaped by international trade laws and sanctions. Navigating these complex regulations, including export controls and trade embargoes, is critical for maintaining market access and avoiding costly penalties. For instance, the ongoing geopolitical tensions in 2024 continue to influence trade flows and necessitate rigorous compliance efforts.

Failure to adhere to these international trade frameworks can lead to substantial fines and reputational damage. Caterpillar's commitment to compliance ensures it can continue to operate in diverse global markets. In 2023, the U.S. Department of Commerce reported over $1.5 billion in penalties for export control violations, highlighting the financial risks involved.

Intellectual Property Rights

Protecting its vast array of innovative technologies and product designs is paramount for Caterpillar. Legal frameworks governing intellectual property rights are essential for the company to secure its substantial research and development expenditures, thereby preserving its competitive advantage in the heavy machinery sector.

Caterpillar actively leverages patents, trademarks, and copyrights to shield its proprietary innovations. For instance, in 2024, the company continued to invest heavily in R&D, with a significant portion allocated to developing and patenting new technologies for emissions reduction and autonomous operation, critical for maintaining market leadership.

- Patent Protection: Caterpillar holds thousands of active patents globally, covering everything from engine technology to advanced manufacturing processes.

- Trademark Enforcement: The iconic Caterpillar brand and its distinctive yellow color are rigorously protected through trademark laws, preventing counterfeiting and brand dilution.

- Copyright Safeguards: Software and design documentation associated with Caterpillar's sophisticated machinery are protected by copyright, ensuring the integrity of its digital assets.

- Global IP Strategy: The company maintains a robust international intellectual property strategy to address varying legal landscapes and enforce its rights across key markets.

Corporate Governance and Reporting Requirements

Caterpillar navigates a complex web of corporate governance and reporting mandates. These include stringent financial disclosure rules, evolving sustainability reporting standards, and regulations surrounding political engagement. The company's 2024 Annual Report, for instance, details its adherence to these frameworks, underscoring transparency in its operations and governance practices.

Key reporting areas for Caterpillar in 2024 and 2025 include:

- Financial Disclosures: Adherence to SEC regulations for quarterly and annual financial statements, including detailed revenue breakdowns by segment and geographic region, as reported in their 2024 filings.

- Sustainability Reporting: Comprehensive reporting on environmental, social, and governance (ESG) metrics, as exemplified by their 2024 Sustainability Report which outlines progress on emissions reduction targets and supply chain responsibility.

- Political Engagement Transparency: Disclosure of lobbying activities and political contributions in compliance with federal and state laws, ensuring accountability in their public policy advocacy efforts.

- Board Oversight and Ethics: Maintaining robust corporate governance structures, including independent board committees and codes of conduct, to ensure ethical decision-making and shareholder protection.

Legal factors significantly influence Caterpillar's operations, particularly concerning environmental regulations and product safety. The company must adhere to evolving emissions standards globally, with initiatives like CARB's Advanced Clean Cars II regulation impacting engine design. Furthermore, stringent product liability laws globally necessitate rigorous safety standards for all machinery, as failure to comply can lead to substantial legal penalties and reputational damage.

Navigating international trade laws and sanctions is also critical, with geopolitical tensions in 2024 continuing to shape trade flows and compliance requirements. Intellectual property protection is paramount, with Caterpillar investing heavily in securing patents for its innovations in emissions reduction and autonomous operation. Robust corporate governance and transparent financial and sustainability reporting, as detailed in their 2024 filings, are also key legal considerations.

Environmental factors

Caterpillar is actively addressing climate change by committing to substantial greenhouse gas (GHG) emissions reductions. The company has established ambitious 2030 sustainability targets, aiming for a 34% decrease in Scope 1 and 2 GHG emissions compared to a 2018 baseline.

Beyond its own operations, Caterpillar is focused on developing innovative product solutions that empower customers to achieve their own sustainability objectives and reduce their environmental impact.

Resource scarcity is a growing concern, pushing Caterpillar to embrace a circular economy model. This means a greater emphasis on remanufacturing existing components and recovering valuable materials from end-of-life equipment, reducing the need for virgin resources.

Caterpillar's remanufacturing efforts, for instance, aim to extend the life of parts and reduce waste. By 2024, the company reported significant progress in its sustainability initiatives, with remanufacturing and repair services contributing to reduced greenhouse gas emissions and material usage across its operations.

The global shift towards cleaner energy sources is a major environmental factor affecting Caterpillar. As demand for renewable energy, like solar and wind, grows, so does the need for specialized equipment to build and maintain these infrastructure projects. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that global renewable capacity additions would reach nearly 500 gigawatts in 2024, a significant increase from previous years.

Caterpillar is responding by investing in and developing a wider range of products that cater to this transition. This includes more fuel-efficient diesel engines, equipment that can run on alternative fuels, and fully electric machinery. Their commitment to this area is evident in their ongoing product development, aiming to help customers reduce their own carbon footprints and meet sustainability targets.

Sustainable Construction Practices

The construction industry is increasingly prioritizing eco-friendly methods, directly shaping the equipment Caterpillar designs and offers. This shift mandates that machinery be more fuel-efficient, produce fewer emissions, and minimize material waste throughout its lifecycle.

Caterpillar has set a clear target: by 2030, all new products are intended to be more sustainable than their predecessors. This commitment involves meeting specific benchmarks such as enhanced operational efficiency and a significant reduction in waste generation.

- Focus on Energy Efficiency: New Caterpillar equipment is being engineered to consume less fuel per operational hour.

- Emissions Reduction: Compliance with stricter environmental regulations means developing engines and exhaust systems that lower harmful emissions.

- Waste Minimization: Design considerations include longer equipment lifespan and easier recyclability of components.

- Sustainable Material Sourcing: Exploration into using recycled or more environmentally benign materials in manufacturing is ongoing.

Environmental Stewardship in Operations

Caterpillar places a strong emphasis on environmental stewardship, adhering to rigorous Environmental, Health, and Safety (EHS) standards across its global operations. This commitment extends to actively minimizing the environmental footprint of its manufacturing processes and its extensive supply chain. For instance, in 2023, the company reported a 10% reduction in greenhouse gas emissions intensity compared to their 2018 baseline, a testament to their ongoing sustainability initiatives.

The company's strategy involves continuous improvement in resource efficiency and pollution prevention. Caterpillar invests in technologies and practices designed to reduce waste, conserve water, and manage emissions effectively. These efforts are crucial as regulatory pressures and customer expectations regarding environmental performance continue to escalate globally.

Key areas of focus for Caterpillar's environmental stewardship include:

- Reducing Scope 1 and Scope 2 greenhouse gas emissions: Targeting a 30% reduction by 2030 against a 2018 baseline.

- Improving energy efficiency: Implementing measures to decrease energy consumption in manufacturing facilities.

- Sustainable product design: Developing equipment that offers improved fuel efficiency and reduced emissions during operation.

- Supply chain engagement: Collaborating with suppliers to promote responsible environmental practices throughout the value chain.

Caterpillar is actively responding to the global push for decarbonization by developing equipment that supports the transition to cleaner energy sources. The company's investment in electric and alternative fuel machinery is a direct response to growing demand in sectors like renewable energy infrastructure development.

Resource scarcity is driving Caterpillar towards circular economy principles, emphasizing remanufacturing and recycling to reduce reliance on virgin materials. This approach not only conserves resources but also aligns with increasing regulatory and customer demands for sustainable practices.

The company's commitment to reducing its own environmental footprint is demonstrated through ambitious GHG emission reduction targets, aiming for a 30% decrease in Scope 1 and 2 emissions by 2030 against a 2018 baseline. This focus extends to its supply chain, encouraging responsible environmental practices among its partners.

Caterpillar's product development strategy prioritizes sustainability, with a goal for all new products to be more sustainable than their predecessors by 2030, focusing on enhanced efficiency and waste reduction.

| Environmental Focus | Target/Goal | Progress/Data Point |

| Scope 1 & 2 GHG Emissions Reduction | 30% by 2030 (vs. 2018 baseline) | 10% reduction achieved by 2023 (vs. 2018 baseline) |

| New Product Sustainability | More sustainable than predecessors by 2030 | Ongoing development of fuel-efficient and lower-emission machinery |

| Circular Economy | Increased emphasis on remanufacturing and recycling | Remanufacturing and repair services contribute to reduced GHG emissions and material usage |

| Renewable Energy Support | Develop equipment for renewable energy infrastructure | IEA projected nearly 500 GW of global renewable capacity additions in 2024 |

PESTLE Analysis Data Sources

Our Caterpillar PESTLE analysis is meticulously crafted using data from official government reports, reputable economic forecasting firms, and leading industry publications. We integrate insights from regulatory bodies, market research databases, and technological trend analyses to provide a comprehensive view.