Caterpillar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caterpillar Bundle

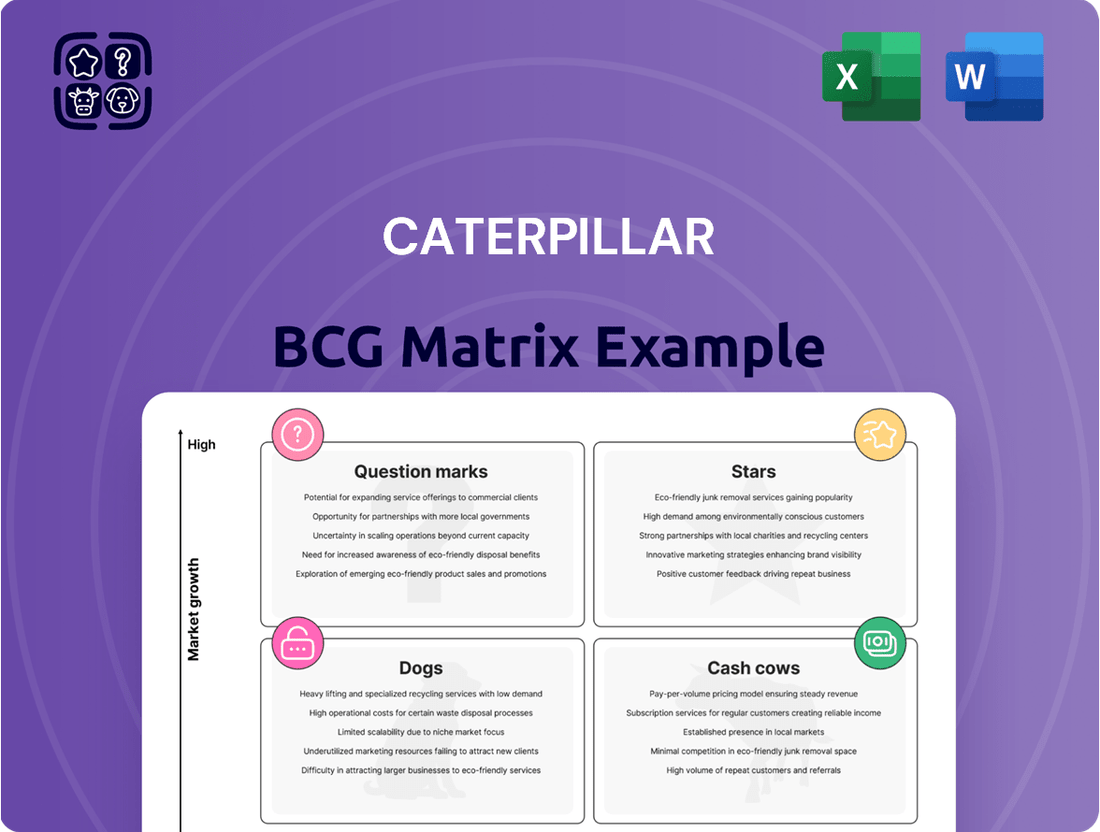

Understand where Caterpillar's product portfolio stands with our insightful BCG Matrix preview. See which products are market leaders, which are steady earners, and which might need a strategic rethink.

To truly unlock the potential of this analysis, purchase the full BCG Matrix report. It provides a comprehensive breakdown of each product's position within the Stars, Cash Cows, Dogs, and Question Marks quadrants, complete with actionable strategies for optimal resource allocation and future growth.

Stars

Caterpillar's autonomous mining solutions are a prime example of a Star in the BCG Matrix. This segment thrives in a rapidly expanding market, fueled by the mining industry's push for enhanced safety and greater operational efficiency.

With over a decade of experience, Caterpillar has demonstrated its prowess, having autonomously moved an impressive 8.6 billion tons of material without a single reported injury. This track record underscores their established leadership and the significant potential of these advanced systems in the high-growth autonomous mining sector.

The global drive towards decarbonization is fueling significant growth in the electric construction equipment market. Caterpillar is strategically positioning itself in this high-growth area by introducing new electric models. For instance, the Cat 301.9 mini excavator and the Cat 906 small wheel loader are already on the market, with mid-sized electric machines undergoing testing. This proactive approach aims to establish Caterpillar as a key player in the evolving landscape of sustainable construction machinery.

Caterpillar's Cat Connect, representing its advanced digital and telematics solutions, is a significant investment targeting the burgeoning market for data-driven operational efficiency. With over 1.5 million connected assets as of early 2024, this initiative directly addresses the growing demand for sophisticated fleet management in construction and mining sectors.

These telematics technologies are instrumental in optimizing machine performance and generating actionable insights, thereby enhancing productivity and reducing downtime for customers. This focus on data analytics positions Cat Connect as a key growth driver, offering substantial value in an increasingly digitized industry landscape.

Next-Generation Compact Equipment

Caterpillar's commitment to the compact equipment market is evident with the introduction of eight new next-generation skid steer loader (SSL) and compact track loader (CTL) models. This strategic move, with launches spanning late 2023 and September 2024, underscores Caterpillar's recognition of this segment's growth potential.

These updated models are engineered for enhanced performance, featuring increased power, greater lift heights, and improved breakout forces. This focus on delivering higher capabilities directly addresses the evolving needs of customers who require more robust and efficient compact machinery for their operations.

- Market Focus: Introduction of 8 new SSL/CTL models late 2023 and Sept 2024.

- Performance Enhancements: Increased power, lift height, and breakout forces.

- Customer Demand: Catering to growing need for high-performance compact equipment.

Integrated Grade and Payload Technologies for Excavators

Caterpillar consistently enhances its hydraulic excavator offerings with advanced features like Cat Grade and Advanced Payload. These technologies address the growing need for precision and efficiency in construction, boosting productivity through real-time data and guidance. In 2024, Caterpillar's commitment to integrated technology solutions reinforces its market leadership in an evolving industry.

These integrated systems are designed to optimize operations and reduce waste on job sites. For instance, Cat Grade assists operators with digging accuracy, minimizing rework and material overage. Advanced Payload provides real-time weight measurement, ensuring trucks are loaded efficiently and safely, thereby improving cycle times and fuel economy.

- Enhanced Precision: Cat Grade technology offers sub-inch accuracy for digging depths and slopes.

- Improved Efficiency: Advanced Payload systems can increase truck loading accuracy by up to 15%.

- Productivity Gains: Integrated grade and payload solutions contribute to an estimated 10-15% increase in overall job site productivity.

Stars in Caterpillar's BCG Matrix represent business segments with high market share in high-growth industries. These are areas where Caterpillar is investing for future growth, leveraging innovation and market demand. The company's focus on autonomous mining, electric equipment, digital solutions, and advanced compact machinery positions these segments as potential future cash cows.

Caterpillar's investment in its compact equipment line, including eight new skid steer and compact track loader models launched between late 2023 and September 2024, highlights its commitment to a growing market segment. These updated machines offer enhanced performance, catering to customer needs for greater power and efficiency in demanding applications.

The company's Cat Connect telematics solutions, with over 1.5 million connected assets by early 2024, are a testament to its strategy in the data-driven operational efficiency market. These digital tools are crucial for optimizing fleet management and providing valuable insights, supporting growth in sectors demanding greater productivity and uptime.

| Segment | Market Growth | Caterpillar's Position | Key Initiatives/Data |

| Autonomous Mining Solutions | High | Market Leader | Moved 8.6 billion tons autonomously without injury. |

| Electric Construction Equipment | High | Growing Player | New electric models launched (e.g., Cat 301.9, Cat 906); mid-size electric machines in testing. |

| Cat Connect (Digital & Telematics) | High | Significant Investment | Over 1.5 million connected assets (early 2024); optimizing performance and providing actionable insights. |

| Compact Equipment (SSL/CTL) | High | Strengthening Position | 8 new models launched late 2023/Sept 2024 with increased power and lift. |

What is included in the product

The Caterpillar BCG Matrix analyzes its business units by market share and growth, identifying Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Quickly identify underperforming products, relieving the pain of wasted resources.

Cash Cows

Caterpillar's traditional heavy construction equipment, such as excavators and bulldozers, are its established cash cows. By 2025, Caterpillar commanded a substantial 16.3% global market share in this sector.

These mature product lines, despite potential market growth fluctuations, consistently deliver robust and reliable cash flow. Their long-standing presence and demand ensure they remain a foundational pillar of Caterpillar's financial strength.

Caterpillar's established diesel-powered mining equipment lines remain robust Cash Cows. Despite the industry's shift towards electrification, these reliable workhorses continue to be the backbone of global mining operations, generating substantial and consistent revenue for the company. In 2023, Caterpillar reported revenues of $67.1 billion, with its Resource Industries segment, which includes mining equipment, playing a vital role.

Caterpillar's aftermarket parts and services represent a classic Cash Cow. In 2024, this segment achieved a record $24 billion in revenue, with projections aiming for $28 billion by 2026. This strong performance highlights a dominant market share in a segment characterized by stability and healthy profit margins.

The consistent and substantial revenue generated by aftermarket parts and services plays a crucial role in buffering Caterpillar's overall earnings against the inherent cyclicality of its core equipment manufacturing business. This segment provides a reliable income stream, contributing significantly to the company's financial resilience.

Financial Products Division

The Financial Products Division, encompassing Cat Financial, functions as a significant cash cow for Caterpillar. This division offers crucial financing and insurance services, directly bolstering equipment sales and ensuring a steady stream of revenue and profit. Its stability is a key asset, especially in a mature market segment.

In the first quarter of 2025, Caterpillar Financial Services Corporation reported revenues of $860 million. This figure underscores its consistent performance and its established position as a reliable cash generator within Caterpillar's broader portfolio. The division benefits from a well-established customer base and a mature market for its services.

- Stable Revenue Generation: Cat Financial consistently generates revenue by providing financing for Caterpillar equipment purchases.

- Profitability: The division contributes significantly to Caterpillar's overall profitability through interest income and fees.

- Market Maturity: Operating in a mature market, Cat Financial benefits from predictable demand and established operational efficiencies.

- Q1 2025 Performance: Reported revenues of $860 million in Q1 2025 highlight its ongoing strength as a cash cow.

Large Diesel and Natural Gas Engines for Power Generation

Caterpillar's large diesel and natural gas engines for power generation are firmly established as Cash Cows. This segment benefits from consistent, reliable demand across diverse industries requiring stable power solutions.

The market for these engines is mature, offering predictable revenue streams that significantly contribute to Caterpillar's overall financial health. This stability allows the company to fund investments in other business areas.

- Market Share: Caterpillar is a leading player in the large engine market, holding a significant share.

- Revenue Contribution: This segment consistently generates substantial revenue for Caterpillar, acting as a primary cash generator.

- Demand Stability: The ongoing need for reliable power generation ensures a steady demand for these products.

- Profitability: Mature products in established markets typically exhibit strong profitability due to economies of scale and optimized production.

Caterpillar's established product lines, like its traditional heavy construction equipment and robust diesel mining engines, operate as significant cash cows. These mature segments benefit from consistent demand, providing stable and substantial revenue streams that underpin the company's financial stability.

The aftermarket parts and services division, along with the Financial Products Division (Cat Financial), also function as key cash cows. In 2024, aftermarket parts alone generated an impressive $24 billion in revenue, showcasing their reliable income generation and profitability. Cat Financial's Q1 2025 revenues of $860 million further highlight its role as a consistent cash generator.

| Category | Key Products/Services | 2024 Revenue (Approx.) | Key Characteristics |

| Heavy Construction Equipment | Excavators, Bulldozers | Significant portion of $67.1B total 2023 revenue | Mature market, stable demand, established market share |

| Mining Equipment | Diesel-powered machinery | Part of Resource Industries segment | Reliable workhorses, consistent revenue |

| Aftermarket Parts & Services | Replacement parts, maintenance | $24 Billion (2024) | High profitability, stable income stream |

| Financial Products | Cat Financial services | $860 Million (Q1 2025) | Supports equipment sales, steady profit |

Preview = Final Product

Caterpillar BCG Matrix

The Caterpillar BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just a professionally structured and insightful analysis ready for your strategic decision-making. You can confidently proceed with the understanding that the quality and content displayed here represent the final, uncompromised deliverable. This comprehensive report is designed to offer clear insights into Caterpillar's product portfolio, enabling you to identify growth opportunities and manage resources effectively.

Dogs

Caterpillar's older, less fuel-efficient models are likely positioned as Dogs in the BCG matrix. These products, while perhaps still generating some revenue, are characterized by low growth and low market share. As environmental regulations tighten and fuel costs fluctuate, demand for these less efficient machines is expected to continue its downward trend.

Niche, outdated attachments and ancillary products represent the Dogs in Caterpillar's BCG Matrix. These are specialized items, perhaps older models of hydraulic hammers or specific types of earthmoving buckets, that haven't kept pace with technological advancements or have seen their demand shrink as industry practices evolve. For instance, while Caterpillar's overall revenue was reported at $61.7 billion for 2023, these specific product lines likely contribute a negligible fraction, with sales volumes and market share being minimal.

These "dog" products typically generate little to no profit, often requiring continued investment in maintenance or inventory without a corresponding return. Their low sales volume means they don't command significant market share, and their outdated nature makes them uncompetitive against newer, more efficient alternatives. Caterpillar's strategy here would likely involve phasing them out or divesting them to focus resources on more promising product categories.

In regions where economic activity has been sluggish for an extended period, or where established local players dominate, some Caterpillar products may find it challenging to capture substantial market share. For example, in parts of Eastern Europe where industrial output has seen limited growth, certain heavy machinery lines might be experiencing this dynamic.

When these already slow-growing markets also face intense competition, products positioned within them are often categorized as Dogs in the BCG Matrix. This suggests a need for a critical evaluation of ongoing resource allocation. For instance, if a specific excavator model has consistently shown declining sales in a mature, saturated market like parts of South America, it could fit this classification.

In 2024, Caterpillar reported that while overall sales saw an increase, certain product segments in regions with persistent economic headwinds, such as some African nations, did not perform as robustly. This highlights the importance of analyzing regional market health alongside product competitiveness when making strategic decisions.

Specific Legacy Product Lines Not Aligned with New Strategy

Caterpillar's strategic pivot towards services, expanded offerings, operational excellence, and sustainability means some older product lines might no longer fit. These legacy products, potentially facing declining market share and limited growth prospects, could be candidates for divestiture. This would free up capital currently tied to underperforming assets, allowing for reinvestment in more strategic areas.

For instance, if a specific line of older, less fuel-efficient construction equipment is not seeing significant demand and doesn't align with Caterpillar's sustainability goals, it might be a prime example. Such products could be draining resources without contributing substantially to the company's future growth trajectory.

- Legacy Product Lines: Older equipment models with diminishing market relevance.

- Strategic Misalignment: Products not supporting the focus on services, sustainability, or new technologies.

- Financial Impact: Potential for low returns on investment and capital tied up in declining segments.

- Divestiture Consideration: Evaluating the sale or discontinuation of non-core, underperforming product lines.

Select Used Equipment with High Refurbishment Costs

Within Caterpillar's BCG Matrix, certain used equipment, particularly older models with substantial operating hours, can be classified as Dogs. These are items that demand significant and expensive refurbishment to align with current industry specifications and performance expectations. The investment required to bring them up to standard often outweighs the projected revenue from their sale or rental, making them a poor strategic fit.

For instance, a 2015 Caterpillar 320D excavator with over 10,000 operating hours might require a complete engine overhaul, hydraulic system rebuild, and extensive structural repairs.

- High Refurbishment Costs: The expense of bringing older, high-hour equipment up to current standards can be prohibitive.

- Low Market Demand: Demand for heavily refurbished older models is often limited compared to newer or remanufactured units.

- Uncertain ROI: The return on investment for refurbishing these units may not justify the capital outlay due to low resale or rental rates.

- Strategic Re-evaluation: Caterpillar might consider divesting or discontinuing the refurbishment of such specific older equipment lines to focus resources on more profitable segments.

Products in the Dogs quadrant of Caterpillar's BCG Matrix are those with low market share and low market growth. These are often older, less efficient models or niche offerings that no longer align with evolving industry standards or customer demands. For example, certain legacy parts or attachments that have been superseded by newer technologies would fall into this category.

Caterpillar's strategic focus on sustainability and advanced technology means that older, less fuel-efficient machinery is increasingly being categorized as Dogs. These products, while perhaps still functional, are not competitive in a market prioritizing efficiency and environmental impact. In 2023, Caterpillar reported significant investments in new technologies and sustainable solutions, further marginalizing these older product lines.

These "dog" products typically generate minimal profits and can even drain resources due to ongoing support or inventory costs. Their low market share means they don't contribute significantly to overall sales volume, and their lack of growth prospects makes them unattractive for further investment. Caterpillar's approach usually involves a gradual phase-out or divestment to reallocate capital to more promising areas.

Consider older, specialized attachments that served specific, now-obsolete construction techniques. These items, while once useful, now represent a small fraction of Caterpillar's extensive product portfolio. With Caterpillar's 2024 revenue projected to be robust, these specific low-volume, low-growth items are unlikely to be significant contributors.

Question Marks

Caterpillar is making significant strides in the development of fully electric heavy-duty mining haul trucks, a move that positions them to capitalize on the burgeoning demand for sustainable mining solutions. These battery-electric prototypes are currently undergoing rigorous testing in surface mining operations, a sector poised for substantial growth as companies worldwide prioritize decarbonization efforts. For instance, the global electric mining equipment market was valued at approximately USD 2.5 billion in 2023 and is projected to reach over USD 10 billion by 2030, indicating a strong upward trend.

Despite this promising future, Caterpillar's current market share within the specific niche of commercially available, fully electric heavy-duty haul trucks remains relatively low. This is primarily because these advanced vehicles are still in the nascent stages of commercialization and widespread market adoption. As the technology matures and regulatory frameworks solidify, Caterpillar's position in this high-potential segment is expected to evolve.

Hydrogen-powered heavy equipment is a promising, albeit early-stage, market within the broader alternative fuels sector. Caterpillar's strategic focus on sustainability includes exploring alternative fuel options, but their current market share in dedicated hydrogen solutions is likely very small, placing these innovations in the question mark category of the BCG matrix.

While the global market for hydrogen fuel cell vehicles, including commercial applications, is projected for significant expansion, reaching an estimated USD 100 billion by 2030 according to some industry forecasts, the specific segment for heavy machinery is still developing. Caterpillar's investment in this area signals a forward-looking approach to decarbonization, aiming to capture future market share as the technology matures and adoption rates increase.

Caterpillar is investing heavily in advanced AI platforms that go beyond current telematics, aiming for groundbreaking autonomous operations and predictive maintenance. These sophisticated AI solutions are poised to unlock new efficiencies in site optimization, representing a significant high-growth potential for the company.

While these transformative AI capabilities are still maturing, with many in early adoption stages, Caterpillar is actively building market share in these nascent, high-potential segments. The company's commitment to developing these disruptive technologies underscores its strategic focus on future operational excellence.

Specialized Equipment for New Energy Infrastructure

As the world increasingly turns to renewable energy sources, Caterpillar is strategically positioning itself to capitalize on the burgeoning demand for specialized equipment in new energy infrastructure projects. Think of massive solar farms and the intricate components needed for offshore wind turbines – these are creating entirely new, high-growth construction markets. Caterpillar is actively developing or adapting its existing equipment lines to meet the unique demands of these emerging applications, where its market share is still developing.

The company's investment in this sector is evident in its ongoing research and development. For instance, Caterpillar's 2024 financial reports indicate increased capital expenditure allocated towards advanced manufacturing and new product development, which directly supports its expansion into these specialized niches. This focus is crucial as the company aims to capture a significant portion of a market that is projected to grow substantially in the coming years.

- Market Growth: The global renewable energy market is experiencing robust expansion, with significant investments pouring into solar and wind power infrastructure.

- Equipment Adaptation: Caterpillar is likely adapting its heavy machinery, such as excavators and dozers, with specialized attachments for tasks like site preparation for solar arrays or handling large wind turbine components.

- Emerging Market Share: While Caterpillar has a dominant presence in traditional construction, its share in the specialized new energy infrastructure equipment market is still in its growth phase.

- Investment Focus: Caterpillar's 2024 strategic priorities include innovation and expansion into high-growth sectors, directly aligning with the opportunities presented by new energy infrastructure development.

Solutions for Enhanced Circular Economy in Equipment Lifecycle

While Caterpillar's remanufacturing operations are a strong Cash Cow, the company is actively exploring new avenues for a more robust circular economy. This includes investing in advanced material recovery and component reuse strategies that go beyond traditional remanufacturing processes. These initiatives are crucial for capturing market share in a rapidly evolving sustainability landscape.

Caterpillar's commitment to sustainability is evident in its ongoing investments in circular economy solutions. For instance, the company has been expanding its Cat Certified Rebuild program, which extends the life of equipment through comprehensive overhauls. In 2023, Caterpillar reported significant progress in its sustainability goals, with a focus on reducing waste and increasing the use of recycled materials in its products, underscoring the strategic importance of these circular economy efforts.

- Advanced Material Recovery: Developing technologies to efficiently reclaim valuable materials from end-of-life equipment, enabling higher recycling rates and reducing reliance on virgin resources.

- Component Reuse Beyond Remanufacturing: Identifying and implementing new models for reusing functional components in different applications or as spare parts, maximizing their value.

- Digitalization for Circularity: Leveraging digital tools and data analytics to track component lifecycles, optimize remanufacturing processes, and facilitate the secondary market for used parts.

- Partnerships for Innovation: Collaborating with technology providers and research institutions to accelerate the development and adoption of cutting-edge circular economy solutions.

Caterpillar's ventures into fully electric and hydrogen-powered heavy equipment, along with advanced AI for autonomous operations, represent significant potential growth areas but currently hold small market shares. These initiatives are categorized as Question Marks due to their early-stage development and the evolving nature of their respective markets. For example, while the electric mining equipment market is expanding rapidly, Caterpillar's share in the specific niche of heavy-duty electric haul trucks is still nascent.

The company's strategic investments in these nascent technologies, including exploring hydrogen power and sophisticated AI, highlight a forward-looking approach to decarbonization and operational efficiency. As these technologies mature and market adoption increases, Caterpillar aims to capture substantial future market share, transforming these Question Marks into Stars or Cash Cows.

The success of these Question Mark initiatives hinges on continued innovation, market acceptance, and the development of supportive infrastructure and regulatory frameworks. Caterpillar's 2024 capital expenditures, for instance, reflect a commitment to research and development in these high-potential, yet unproven, market segments.

BCG Matrix Data Sources

Our Caterpillar BCG Matrix is built on robust data, including financial reports, market share analysis, industry growth rates, and competitive intelligence to provide a comprehensive view.