Caterpillar Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caterpillar Bundle

Curious about the engine powering Caterpillar's global dominance? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. This is your chance to dissect a proven success story.

Unlock the full strategic blueprint behind Caterpillar's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Caterpillar's global independent dealer network is a cornerstone of its operations, acting as the primary channel for sales, service, and support. This network spans 180 countries, ensuring customers have localized access to Caterpillar's vast product line and essential after-sales care.

These independent dealers are vital for maintaining equipment uptime and providing specialized local expertise. In 2023, Caterpillar reported that its dealers played a significant role in generating revenue, underscoring the financial importance of this partnership model.

Caterpillar actively pursues technology and innovation collaborations, notably with firms like Trimble. This partnership, extended in October 2024, focuses on advancing grade control solutions and accelerating the adoption of new technologies in the construction and mining sectors. These alliances are crucial for developing next-generation autonomous and electrified equipment.

Caterpillar maintains strategic relationships with a vast network of suppliers and manufacturers, crucial for its extensive product lines. These partnerships guarantee access to high-quality raw materials and specialized components, vital for maintaining production efficiency. For instance, in 2023, Caterpillar's procurement activities supported a global supply chain, ensuring the timely delivery of parts for its construction and mining equipment.

Financial Services Partners (e.g., Cat Financial)

Cat Financial, a wholly-owned subsidiary, is a crucial partner, offering vital financing and insurance services to Caterpillar's global customer base and dealer network. This internal financial arm directly supports equipment sales by providing accessible and attractive financing options, thereby boosting customer purchasing power.

By managing credit risk and offering tailored financial solutions, Cat Financial also plays a key role in enabling dealers to maintain healthy inventory levels and manage their own financial operations effectively. In 2023, Cat Financial reported revenues of $3.5 billion, highlighting its significant contribution to the overall business.

- Cat Financial's Role: Provides financing and insurance solutions to customers and dealers globally.

- Impact on Sales: Facilitates equipment purchases through attractive financing packages.

- Risk Management: Manages credit risk, supporting both customer affordability and dealer operations.

- Financial Contribution: Reported $3.5 billion in revenues in 2023.

Strategic Alliances for Sustainability Initiatives

Caterpillar actively forms strategic alliances to drive its sustainability agenda forward. These collaborations are essential for co-developing innovative technologies, such as advanced hydrogen-hybrid power systems and fully electric construction equipment, thereby accelerating the transition to lower-emission solutions. For instance, in 2024, Caterpillar announced a significant partnership with a leading battery technology firm to enhance the performance and range of its electric machine offerings, aiming to capture a larger share of the growing zero-emission equipment market.

These partnerships are not just about product development; they are crucial for navigating the complex and rapidly changing energy landscape. By working with specialized companies, Caterpillar can leverage external expertise and resources to accelerate the deployment of sustainable technologies. This approach allows them to expand their product portfolio to meet increasing customer demand for environmentally friendly options, positioning them as a leader in the industry's decarbonization efforts.

- Partnerships for Hydrogen-Hybrid Technology: Collaborations focused on integrating hydrogen fuel cell technology into heavy machinery.

- Battery Technology Alliances: Joint ventures to advance the development and integration of high-capacity batteries for electric-powered equipment.

- Research & Development Collaborations: Working with universities and research institutions to explore next-generation sustainable power sources and materials.

- Supply Chain Integration for Sustainability: Partnering with suppliers to ensure responsible sourcing and the development of circular economy principles within their operations.

Caterpillar's key partnerships extend to technology providers like Trimble, with whom they are advancing autonomous and electrified equipment, as seen in their October 2024 collaboration extension. This focus on innovation is critical for developing next-generation machinery. Furthermore, strategic alliances with battery technology firms in 2024 aim to boost the performance of electric offerings, tapping into the growing zero-emission market.

The company also relies on a robust supplier network for raw materials and specialized components, ensuring production efficiency and timely delivery of parts for its diverse equipment lines. Cat Financial, a wholly-owned subsidiary, is a vital internal partner, providing essential financing and insurance services that directly support equipment sales by enhancing customer purchasing power. In 2023, Cat Financial generated $3.5 billion in revenues, underscoring its financial contribution.

| Partner Type | Key Focus Areas | Example/Impact |

| Independent Dealers | Sales, Service, Support | Global network in 180 countries; vital for equipment uptime and local expertise. |

| Technology Providers (e.g., Trimble) | Innovation, Automation, Electrification | Extended partnership in Oct 2024 for grade control and autonomous solutions. |

| Suppliers & Manufacturers | Raw Materials, Components | Ensures high-quality parts for production efficiency; crucial for supply chain. |

| Cat Financial | Financing, Insurance | Supports equipment sales, manages credit risk; $3.5 billion revenue in 2023. |

| Sustainability Partners | Zero-Emission Tech, Hydrogen | 2024 battery tech partnership to enhance electric equipment; co-developing hybrid systems. |

What is included in the product

A detailed exploration of Caterpillar's business model, outlining its customer segments, value propositions, and channels to serve the global construction and mining industries.

This canvas provides a strategic overview of Caterpillar's operations, including key resources, activities, and revenue streams, designed for informed decision-making.

The Caterpillar Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of complex operational and strategic elements, enabling teams to quickly identify and address inefficiencies.

Activities

Caterpillar's commitment to Research and Development is a cornerstone of its strategy, with significant investments aimed at driving innovation in construction and mining equipment. In 2023, the company reported R&D expenses of approximately $2.4 billion, a clear indicator of its focus on future technologies.

This investment fuels advancements in critical areas such as automation, which enhances operator efficiency and safety, and electrification, offering more sustainable power solutions for its machinery. These efforts are directly aligned with addressing evolving customer demands for lower emissions and improved operational performance.

Caterpillar's manufacturing and production is the heart of its operations, encompassing the design, engineering, and creation of heavy machinery and power systems. This involves a vast global network of facilities dedicated to producing everything from iconic construction equipment to powerful engines.

In 2024, Caterpillar continued to leverage its extensive manufacturing footprint, which includes numerous plants across the United States and internationally. These facilities are crucial for assembling their diverse product lines, which range from excavators and bulldozers to advanced diesel engines and power generation solutions.

The company's commitment to efficient production is evident in its ongoing investments in advanced manufacturing technologies. For instance, Caterpillar has been integrating robotics and automation to enhance quality and speed up production cycles across its global manufacturing sites.

Caterpillar's sales and marketing efforts are largely executed through its extensive global network of independent dealers, ensuring a localized approach to diverse customer needs across various industries. This network is crucial for reaching customers in construction, mining, and energy sectors.

The company employs sophisticated marketing strategies, including digital channels and direct engagement, to connect with its target markets. In 2023, Caterpillar reported that its dealers served over 190 countries, highlighting the vast reach of its sales and marketing infrastructure.

Aftermarket Parts and Services

Caterpillar's aftermarket activities are crucial, encompassing the sale of genuine parts, maintenance, and repair services. These offerings are designed to maximize equipment longevity and performance, directly impacting customer satisfaction and loyalty. For instance, in 2023, Caterpillar reported that its Services segment, which includes aftermarket support, generated a significant portion of its revenue, demonstrating the importance of this segment.

Beyond parts and repairs, Caterpillar also provides essential equipment rental and comprehensive training programs. This holistic approach ensures customers can maintain operational efficiency and effectively utilize their machinery. The company's commitment to supporting its products throughout their lifecycle is a cornerstone of its business strategy.

- Genuine Parts Sales: Providing authentic Caterpillar parts to ensure optimal equipment performance and reliability.

- Maintenance and Repair Services: Offering expert servicing to minimize downtime and extend equipment life.

- Equipment Rental: Supplying rental options for customers needing temporary access to machinery.

- Training Programs: Educating operators and technicians on proper equipment usage and maintenance.

Financial Product Offerings

Caterpillar's key financial product offerings are primarily managed through Cat Financial, providing essential financing and insurance solutions. These services are crucial for enabling customers and the dealer network to acquire Caterpillar equipment, thereby directly supporting sales and fostering long-term customer relationships.

Cat Financial's role extends to managing financial risks, making large equipment purchases more attainable through tailored financing plans. This strategic activity underpins the accessibility of Caterpillar's product line.

- Financing Solutions: Cat Financial offers a wide array of financing options, including retail and wholesale financing, leases, and loans, specifically designed for Caterpillar machinery and engines.

- Insurance Products: Complementing its financing, Cat Financial provides insurance coverage for equipment, protecting customers against potential losses and further de-risking their investments.

- Dealer Support: The company also extends financial services to its dealer network, facilitating inventory management and operational capital, which in turn enhances their ability to serve end customers.

- 2024 Performance Insight: As of Q1 2024, Cat Financial reported a retail loan portfolio of approximately $40.8 billion, demonstrating the substantial scale of its financial product offerings and their impact on Caterpillar's overall business.

Caterpillar's Key Activities are centered around its robust manufacturing capabilities, extensive dealer network for sales and marketing, and comprehensive aftermarket services. These activities are supported by continuous research and development and crucial financial product offerings through Cat Financial.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Manufacturing & Production | Designing, engineering, and assembling heavy machinery and power systems globally. | Operated numerous plants across the US and internationally in 2024. |

| Sales & Marketing | Leveraging an independent dealer network to reach customers in over 190 countries. | Dealers served customers in over 190 countries in 2023. |

| Aftermarket Services | Providing genuine parts, maintenance, repair, rental, and training to maximize equipment longevity. | Services segment revenue was a significant portion of total revenue in 2023. |

| Financial Product Offerings | Offering financing and insurance solutions through Cat Financial to facilitate equipment acquisition. | Cat Financial's retail loan portfolio was approximately $40.8 billion as of Q1 2024. |

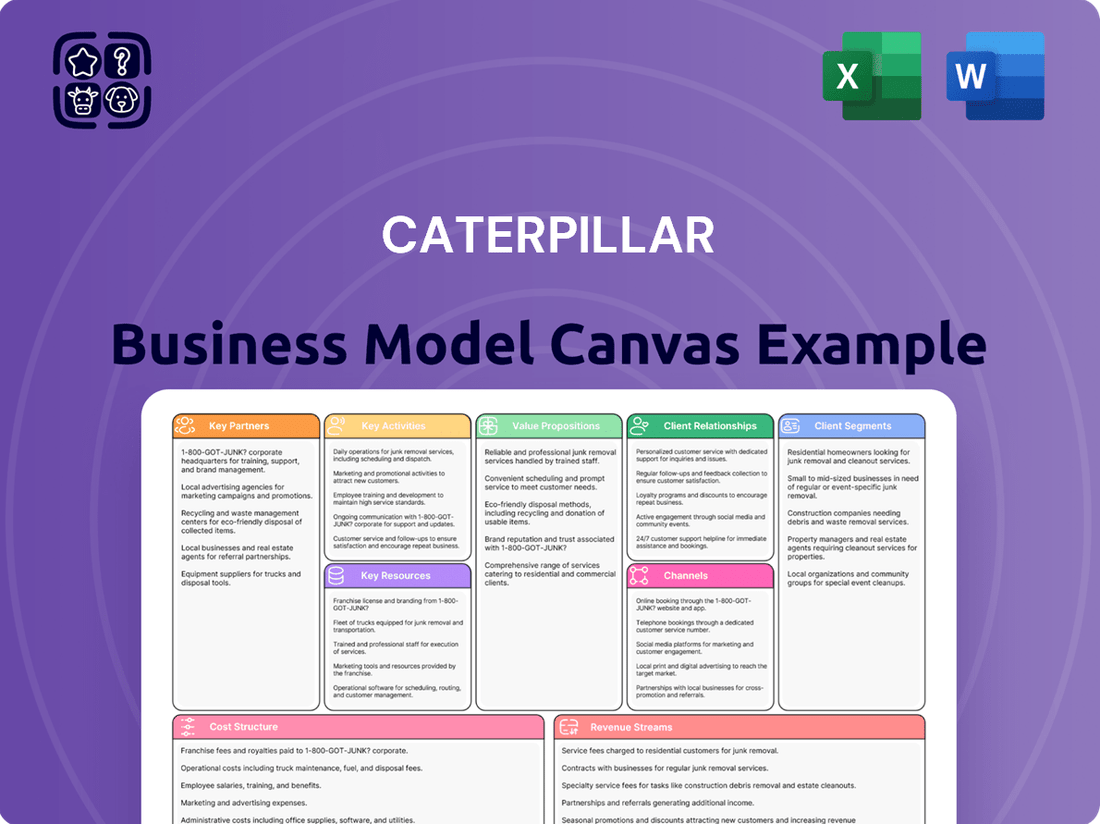

Delivered as Displayed

Business Model Canvas

The Caterpillar Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately apply its insights to your strategic planning.

Resources

Caterpillar's global dealer network is a cornerstone of its business model, acting as the primary interface for customers in over 180 countries. This extensive network of independent dealers is vital for sales, service, and ongoing support.

As of 2024, Caterpillar boasts approximately 160 independent dealers operating through around 3,600 locations globally. This vast reach is instrumental in driving both sales and rental revenues for the company.

Caterpillar's extensive intellectual property, encompassing thousands of patents for its cutting-edge machinery and manufacturing techniques, along with its globally recognized CAT trademark, forms a cornerstone of its business model. This robust IP portfolio safeguards its innovations, ensuring a distinct competitive edge in the market.

This intellectual capital is not just defensive; it's a proactive revenue generator. By protecting its unique designs and technologies, Caterpillar can leverage its patents and trademarks to create licensing opportunities, further enhancing its financial performance and market reach.

Caterpillar's global network of manufacturing facilities, numbering over 170 locations as of late 2023, represents a core asset. These plants are engineered for advanced production, allowing for the efficient and large-scale manufacturing of their extensive product lines, from construction equipment to energy solutions.

Significant ongoing investment fuels the expansion and technological enhancement of these production capabilities. For instance, in 2024, Caterpillar continued its strategic investments in its manufacturing footprint to boost efficiency and meet projected demand for its diverse product offerings.

Skilled Workforce and Expertise

Caterpillar's success hinges on its substantial and highly skilled global workforce. This team, comprising dedicated engineers, expert technicians, and specialized manufacturing personnel, is fundamental to the company's ability to innovate, operate efficiently, and deliver exceptional service.

As of fiscal year 2024, Caterpillar employed a significant 112,900 individuals worldwide. This vast pool of talent is a critical asset, driving product development and ensuring the quality of their heavy machinery and equipment.

- Engineers: Driving innovation and product design.

- Technicians: Ensuring operational efficiency and maintenance expertise.

- Manufacturing Personnel: Executing complex production processes.

- Global Reach: Supporting operations across diverse markets.

Brand Reputation and Customer Loyalty

Caterpillar's enduring brand reputation, synonymous with quality, durability, and reliability in the demanding heavy machinery sector, forms a cornerstone of its business model. This long-standing trust cultivated over decades significantly reduces perceived risk for customers, making Caterpillar a preferred choice. For instance, in 2023, Caterpillar reported revenues of $67.1 billion, a testament to the market's continued confidence in its offerings.

The company actively nurtures customer loyalty through extensive after-sales support, including parts availability, maintenance services, and dealer networks. This comprehensive approach ensures that customers can rely on their equipment throughout its lifecycle, fostering repeat business and long-term relationships. This commitment is reflected in their robust aftermarket services segment, which consistently contributes to their financial performance.

- Brand Equity: Caterpillar's brand is valued for its association with robust performance and longevity, a critical factor in high-value equipment purchases.

- Customer Loyalty: Strong relationships built on trust and reliable support lead to a high rate of repeat purchases and customer retention.

- After-Sales Support: A global network of dealers provides essential parts, service, and financing, reinforcing the value proposition and customer commitment.

- Market Trust: In 2023, Caterpillar's consistent revenue generation of $67.1 billion underscores the deep market trust in its brand and product quality.

Caterpillar's key resources include its extensive global dealer network, robust intellectual property, a worldwide manufacturing footprint, a skilled workforce, and its highly regarded brand reputation. These elements collectively enable the company to deliver its products and services effectively and maintain its market leadership.

The company's intellectual property, protected by thousands of patents, safeguards its innovative machinery designs and manufacturing processes. This IP not only provides a competitive advantage but also opens avenues for licensing revenue, bolstering financial performance and market expansion.

Caterpillar's vast manufacturing capabilities, spread across over 170 global facilities as of late 2023, are continuously enhanced through strategic investments. These facilities are crucial for the efficient, large-scale production of their diverse equipment range, ensuring they can meet evolving market demands.

With 112,900 employees worldwide as of fiscal year 2024, Caterpillar leverages the expertise of its engineers, technicians, and manufacturing personnel. This substantial talent pool is fundamental to driving innovation, maintaining operational excellence, and providing superior customer support.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Global Dealer Network | Independent dealers in over 180 countries | Approx. 160 dealers, 3,600 locations |

| Intellectual Property | Patents, trademarks, proprietary technologies | Thousands of patents, CAT trademark |

| Manufacturing Facilities | Global production sites | Over 170 locations (late 2023) |

| Skilled Workforce | Engineers, technicians, manufacturing personnel | 112,900 employees (FY2024) |

| Brand Reputation | Association with quality, durability, reliability | $67.1 billion revenue (2023) reflects market trust |

Value Propositions

Caterpillar's value proposition centers on providing exceptionally reliable and durable equipment, including construction machinery, mining gear, and powerful engines. This robustness ensures customers experience minimal downtime, a critical factor in their operations.

This commitment to longevity directly translates into lower operating costs for users. For instance, Caterpillar's machines are engineered for extended service life, reducing the frequency of costly repairs and replacements, which is a significant benefit in industries where equipment availability is paramount.

In 2023, Caterpillar reported that its customers often see their equipment operating for tens of thousands of hours, a testament to its durability. This focus on uptime and reduced total cost of ownership is a cornerstone of their customer relationships.

Caterpillar's commitment to advanced technology is a cornerstone of its value proposition, offering customers solutions that significantly boost productivity, safety, and efficiency. This includes cutting-edge automation, sophisticated telematics for remote monitoring and management, and highly efficient, advanced engine designs.

The company actively invests in research and development, leading to groundbreaking innovations like fully autonomous hauling systems for mining operations and significant advancements in electrification technologies for both mining and construction sectors. These innovations are designed to meet evolving industry demands and provide a competitive edge.

In 2023, Caterpillar reported substantial investments in R&D, underscoring its dedication to technological leadership. For instance, their autonomous vehicle technology has been deployed in major mining projects, demonstrating tangible efficiency gains and safety improvements for operators.

Caterpillar's value proposition centers on providing comprehensive aftermarket support and services, ensuring customers get the most out of their heavy equipment. This includes access to genuine Caterpillar parts, expert maintenance, and repair services designed to keep machines running optimally and minimize downtime.

This robust support system extends to financial products and digital solutions, offering customers a complete package for ownership and operation. For instance, Caterpillar's Cat Financial Services provided financing and insurance solutions, supporting over 40% of equipment sales in recent years, demonstrating their commitment to customer success beyond the initial purchase.

The company's dedication to longevity and performance through these services significantly enhances the customer experience and their operational efficiency. In 2023, Caterpillar reported that their services segment generated over $15 billion in revenue, highlighting the critical role of aftermarket support in their overall business strategy and customer retention.

Tailored Solutions for Diverse Industries

Caterpillar excels at crafting specialized machinery and power solutions, meticulously tailored to the distinct demands of sectors like construction, mining, agriculture, power generation, and transportation. This granular approach ensures product relevance and effectiveness.

This industry-specific segmentation is a cornerstone of Caterpillar's value proposition. For instance, in 2024, the company continued to emphasize its broad portfolio, which includes over 300 products designed for a vast array of applications. This breadth allows them to address highly niche operational requirements across their customer base.

The ability to provide these tailored solutions directly impacts customer productivity and efficiency. Caterpillar's commitment to understanding industry nuances means their equipment is optimized for specific environments and tasks, leading to better performance and lower operating costs for their clients.

Key aspects of this tailored approach include:

- Industry-Specific Engineering: Developing machinery with features optimized for unique operating conditions, such as heavy-duty undercarriages for mining or specialized hydraulic systems for construction.

- Power Solutions Customization: Offering adaptable power generation equipment that can be configured for specific fuel types, emissions standards, and load requirements across various industries.

- Technology Integration: Incorporating relevant technologies, like advanced telematics and automation, that address the evolving needs and challenges within each industry segment.

- Service and Support Networks: Maintaining specialized dealer networks equipped to provide parts and service expertise relevant to the machinery operating in each particular industry.

Financial Solutions for Equipment Acquisition

Cat Financial provides customers with tailored financing and leasing solutions, significantly easing the acquisition of costly Caterpillar machinery. This accessibility is crucial for businesses needing to invest in essential equipment without upfront capital strain.

In 2023, Caterpillar Financial Services Corporation reported total revenues of $13.3 billion, demonstrating the scale of their financial operations and their ability to support customer investments.

- Flexible Financing Options: Cat Financial offers a range of loan and lease structures to match diverse customer needs and cash flows.

- Simplified Acquisition Process: The integrated approach with equipment sales streamlines the purchasing journey, reducing administrative burdens.

- Investment Support: By providing capital, Cat Financial enables customers to acquire the productive assets they need to grow their businesses.

Caterpillar's value proposition is built on delivering highly reliable and durable heavy equipment designed for demanding industries, ensuring customers benefit from reduced downtime and a lower total cost of ownership.

The company's commitment to technological innovation, including automation and electrification, enhances customer productivity, safety, and operational efficiency, keeping them at the forefront of industry advancements.

Comprehensive aftermarket support, genuine parts, and expert services are integral, maximizing equipment lifespan and performance, while Cat Financial offers tailored financing to ease acquisition.

Caterpillar's ability to engineer specialized machinery for distinct sectors like construction and mining ensures optimal performance and relevance for specific customer needs.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Durability & Reliability | Exceptional robustness of equipment for minimal downtime. | Customers often see equipment operating for tens of thousands of hours (2023). |

| Technological Innovation | Boosting productivity, safety, and efficiency through advanced tech. | Substantial R&D investments in 2023, including autonomous vehicle deployments. |

| Aftermarket Support & Services | Comprehensive support for maximum equipment lifespan and performance. | Services segment revenue exceeded $15 billion in 2023. |

| Industry-Specific Solutions | Tailored machinery for construction, mining, and other sectors. | Portfolio includes over 300 products designed for diverse applications (2024). |

| Financing Solutions | Tailored financing and leasing to ease equipment acquisition. | Cat Financial supported over 40% of equipment sales in recent years. |

Customer Relationships

Caterpillar cultivates deep customer loyalty via its extensive, independent dealer network, which serves as the primary interface for sales, service, and continuous support. These dealers are crucial in building enduring relationships by offering expert guidance and prompt, on-site assistance.

In 2024, this dealer network was instrumental in Caterpillar's performance, with dealers investing significantly in their operations to enhance customer experience and service capabilities. This localized approach ensures customers receive tailored solutions and immediate access to parts and expertise, reinforcing trust and satisfaction.

Caterpillar provides extensive after-sales support through maintenance and repair contracts, ensuring customers' machinery operates at peak performance. This commitment to ongoing service, including remote monitoring and a steady supply of genuine parts, is crucial for maximizing equipment uptime.

In 2024, Caterpillar's focus on robust after-sales service continues to be a cornerstone of its customer relationship strategy. This dedication not only minimizes operational disruptions for clients but also fosters deep loyalty, significantly reducing customer churn and reinforcing Caterpillar's position as a reliable partner.

Caterpillar actively cultivates customer relationships through robust digital channels, offering an e-commerce platform for seamless parts procurement. This digital approach is designed to streamline the customer journey and foster greater convenience.

The Cat Central mobile application serves as a key digital touchpoint, providing valuable maintenance insights and direct access to machine-specific data. This empowers customers with timely information, enhancing their operational efficiency.

In 2024, Caterpillar continued to invest in its digital infrastructure, aiming to deepen customer engagement and provide more personalized support. This focus on digital solutions reflects a commitment to improving the overall customer experience and building lasting loyalty.

Direct Engagement for Large and Strategic Accounts

For major corporations, government bodies, and clients in specialized sectors needing tailored equipment, Caterpillar actively pursues direct sales channels. This approach fosters direct engagement and cultivates robust relationships, essential for understanding and meeting unique client demands.

This direct engagement is crucial for developing customized solutions and facilitating deep collaboration on intricate, large-scale projects. It allows Caterpillar to act as a strategic partner, not just a supplier.

- Direct Sales Force: Dedicated teams manage relationships with key accounts, ensuring personalized service and support.

- Customized Solutions: Equipment and services are often adapted to meet the specific operational needs and project requirements of large clients.

- Long-Term Partnerships: Caterpillar aims to build enduring relationships through consistent performance and collaborative problem-solving.

- Project-Specific Support: For significant infrastructure or development projects, Caterpillar provides dedicated technical and logistical support throughout the project lifecycle.

Customer Training and Education

Caterpillar invests in comprehensive training programs designed to equip customers with the knowledge to effectively operate and maintain their machinery. This focus on customer education directly enhances equipment performance and longevity.

These training initiatives are crucial for fostering strong customer relationships. By empowering clients to maximize their operational efficiency and prioritize safety, Caterpillar builds trust and loyalty.

- Optimized Equipment Performance: Caterpillar's training helps customers understand best practices for operation, leading to improved productivity and reduced downtime.

- Enhanced Safety Standards: Education on safe operating procedures directly contributes to a safer working environment for customers' employees.

- Increased Customer Loyalty: By providing valuable knowledge and support, Caterpillar strengthens its bond with clients, encouraging repeat business and positive referrals.

- Data-Driven Training Evolution: Caterpillar utilizes feedback and performance data from its training programs to continuously refine its educational content, ensuring relevance and effectiveness in the evolving industry landscape. For instance, in 2024, Caterpillar reported a significant increase in customer engagement with its digital training modules, indicating a growing demand for accessible and flexible learning solutions.

Caterpillar's customer relationships are built on a foundation of extensive support, primarily through its vast dealer network. These independent dealers act as the frontline, offering sales, service, and ongoing assistance, fostering deep customer loyalty by providing tailored solutions and immediate access to expertise.

In 2024, Caterpillar continued to enhance its digital customer engagement, with platforms like Cat Central offering machine data and maintenance insights, streamlining parts procurement via e-commerce. This digital push aims to improve customer experience and build lasting loyalty.

For large clients and specialized sectors, Caterpillar employs direct sales channels, enabling customized solutions and collaborative partnerships on complex projects. This direct approach ensures unique client demands are met, solidifying Caterpillar's role as a strategic partner.

| Customer Relationship Aspect | Key Features | 2024 Focus/Data |

|---|---|---|

| Dealer Network | Independent dealers provide sales, service, and support. | Dealers invested in operations to enhance customer experience. |

| After-Sales Support | Maintenance contracts, genuine parts, remote monitoring. | Focus on maximizing equipment uptime and minimizing disruptions. |

| Digital Engagement | E-commerce platform, Cat Central mobile app. | Investment in digital infrastructure for deeper engagement and personalized support. |

| Direct Sales | Tailored solutions for major corporations and specialized sectors. | Fostering direct engagement for complex, large-scale projects. |

| Customer Education | Training programs for operation and maintenance. | Increased engagement with digital training modules reported in 2024. |

Channels

Caterpillar's global independent dealer network is its lifeblood for reaching customers and providing essential services. These dealers, numbering over 175 worldwide, are the primary touchpoint for sales, parts, and support, ensuring local expertise and accessibility for clients in more than 180 countries.

In 2024, this network continues to be a critical differentiator, enabling Caterpillar to offer tailored solutions and responsive service. The dealers' deep understanding of local markets and customer needs allows Caterpillar to maintain its strong market position and drive revenue growth through localized sales and service strategies.

Caterpillar leverages direct sales to major accounts, engaging with governmental bodies, multinational corporations, and entities with unique equipment needs. This approach facilitates direct negotiation, allowing for the crafting of highly customized solutions. In 2024, this channel is crucial for securing large-volume orders and building long-term relationships with key industry players.

Caterpillar's e-commerce platforms and mobile applications, like Cat Central, are crucial for parts sales, product information access, and efficient customer account management. These digital tools significantly boost customer convenience and accessibility, streamlining interactions and parts procurement.

In 2024, Caterpillar reported that its digital initiatives, including these platforms, are increasingly driving customer engagement and sales. For instance, the Cat Central app provides real-time equipment data and service history, empowering owners to optimize their operations and maintenance schedules, directly impacting uptime and productivity.

Trade Shows and Industry Exhibitions

Trade shows and industry exhibitions are a vital channel for Caterpillar to connect with its customer base. These events allow the company to demonstrate its cutting-edge machinery and technological advancements firsthand, fostering direct engagement with both new and returning clients. Caterpillar's presence at events like MINExpo 2024, a premier mining industry trade show, highlights their commitment to showcasing solutions that address industry challenges.

These exhibitions serve as a critical platform for lead generation and market intelligence. By exhibiting, Caterpillar can gauge customer interest in new products and gather feedback that informs future development. For instance, in 2024, Caterpillar leveraged these events to highlight its investments in sustainability and digital solutions, which are increasingly important to their customers.

- Showcasing Innovation: Caterpillar uses trade shows to display new equipment and technologies, like those seen at MINExpo 2024.

- Customer Engagement: Direct interaction at exhibitions allows for relationship building and understanding customer needs.

- Market Reach: Global trade shows provide access to a broad audience of potential buyers and industry influencers.

- Sales Pipeline: These events are crucial for generating leads and driving sales, contributing significantly to the company's revenue streams.

Financial Services (Cat Financial)

Cat Financial is a crucial channel for Caterpillar, offering integrated financial products and services. This directly supports customers in acquiring equipment, making large purchases more accessible. In 2023, Cat Financial reported total revenues of $3.9 billion, demonstrating its significant role in enabling sales.

By providing financing solutions, Cat Financial removes a key barrier for customers, thereby increasing equipment sales volume. This channel also extends to Caterpillar's extensive dealer network, which further facilitates customer access to financial products. The company's commitment to financing is evident in its managed portfolio, which stood at $43.5 billion at the end of 2023.

- Integrated Financing: Cat Financial offers a comprehensive suite of financial products tailored to equipment purchases.

- Dealer Network Support: The channel leverages Caterpillar's vast dealer network to reach customers and manage financing needs.

- Revenue Contribution: In 2023, Cat Financial generated $3.9 billion in total revenues, underscoring its financial impact.

- Portfolio Size: The managed portfolio reached $43.5 billion in 2023, highlighting the scale of its financial operations.

Caterpillar's channels are multifaceted, extending from its robust dealer network to direct sales and digital platforms. The global dealer network, comprising over 175 independent dealers in more than 180 countries, remains the primary conduit for sales, parts, and service, offering localized expertise. Direct sales engage major accounts, including governmental and multinational entities, securing large orders and fostering key relationships. E-commerce and mobile applications, such as Cat Central, streamline parts sales and customer account management, enhancing convenience and providing real-time equipment data in 2024.

Trade shows and industry exhibitions, like MINExpo 2024, serve as vital platforms for showcasing innovation and gathering market intelligence, facilitating direct customer engagement and lead generation. Cat Financial is another critical channel, providing integrated financing solutions that directly support equipment acquisition, having generated $3.9 billion in revenue in 2023 with a managed portfolio of $43.5 billion.

| Channel | Description | 2023/2024 Relevance |

|---|---|---|

| Global Dealer Network | Independent dealers providing sales, parts, and service. | Over 175 dealers in 180+ countries; critical for local support and sales. |

| Direct Sales | Engaging major accounts and governmental bodies. | Crucial for large-volume orders and long-term relationships in 2024. |

| Digital Platforms (e.g., Cat Central) | E-commerce for parts, product info, and account management. | Driving customer engagement and sales; providing real-time equipment data. |

| Trade Shows/Exhibitions | Demonstrating new equipment and technologies. | Key for lead generation, market intelligence, and customer feedback (e.g., MINExpo 2024). |

| Cat Financial | Integrated financial products and services for equipment acquisition. | Generated $3.9B revenue in 2023; $43.5B managed portfolio. |

Customer Segments

Construction industry companies, encompassing everything from local builders to massive infrastructure developers, represent a core customer segment for Caterpillar. These businesses rely heavily on heavy equipment like excavators, bulldozers, and loaders to complete projects, and Caterpillar's extensive product line directly addresses these needs. In 2024, the global construction market was valued at approximately $11.5 trillion, a significant portion of which is driven by demand for the very machinery Caterpillar provides.

Caterpillar’s mining segment targets global mining operations, offering a comprehensive suite of specialized heavy machinery. This includes massive mining trucks, powerful shovels, and advanced autonomous solutions tailored for both surface and underground extraction. In 2024, the mining industry continued to be a significant driver for heavy equipment manufacturers, with Caterpillar’s mining division playing a crucial role in supporting large-scale, long-term equipment requirements for major mining enterprises worldwide.

Power Generation and Industrial Customers represent a vital segment for Caterpillar, encompassing businesses that rely on robust engine and power solutions. This includes entities in oil and gas, marine, and rail industries, all of which require reliable diesel and natural gas engines, as well as industrial gas turbines.

In 2024, Caterpillar's Energy & Transportation segment, which heavily serves these customers, saw strong performance. For instance, the company reported significant revenue from its Power Generation division, reflecting the ongoing demand for reliable energy infrastructure solutions globally.

Agriculture and Forestry Businesses

Agriculture and forestry businesses are key customers for Caterpillar, relying on its heavy machinery for a wide range of operations. These include everything from preparing land for planting to harvesting crops and managing timber resources. Caterpillar's durable and powerful equipment is specifically designed to handle the demanding conditions found in these sectors.

For instance, in 2024, the global agricultural machinery market was projected to reach over $200 billion, highlighting the significant demand for the types of products Caterpillar offers. Similarly, the forestry sector continues to invest in advanced equipment to improve efficiency and sustainability.

- Land Preparation: Tractors, dozers, and excavators are used for clearing land, tilling soil, and building access roads.

- Harvesting Operations: Specialized harvesters and logging equipment are vital for efficient crop and timber collection.

- Material Handling: Loaders and telehandlers are essential for moving harvested goods, logs, and other materials on-site and for transport.

- Fleet Management: These businesses often leverage telematics and support services to optimize the performance and longevity of their Caterpillar fleet.

Governmental Agencies and Large Fleets

Governmental agencies and large fleet operators represent a significant customer segment for Caterpillar, often requiring substantial investments in heavy machinery for infrastructure development, maintenance, and defense. These entities typically engage in direct procurement processes with Caterpillar, valuing reliability, durability, and comprehensive support services. For instance, in 2024, the U.S. Department of Defense continued to be a major purchaser of heavy equipment, with significant allocations for military construction and logistical support.

These customers often have specialized needs, demanding equipment that meets stringent performance and safety standards. Caterpillar's direct sales approach allows for tailored solutions and long-term service agreements, crucial for maintaining operational readiness and cost-efficiency across vast fleets. The scale of their operations means that procurement decisions are often influenced by total cost of ownership and the availability of aftermarket support.

- Governmental Agencies: Public sector entities like municipalities, state departments of transportation, and federal agencies are key buyers for road construction, public works, and infrastructure projects.

- Large Fleets: Major construction companies, mining operations, and large-scale logistics providers that operate extensive fleets of heavy equipment.

- Direct Sales: This segment predominantly interacts with Caterpillar through direct sales channels, enabling customized solutions and negotiated contracts.

- Key Value Drivers: Reliability, lifecycle cost, fuel efficiency, and robust aftermarket support are paramount for these customers.

Beyond the primary industries, Caterpillar also serves a diverse range of smaller, specialized businesses. This includes rental companies that lease heavy equipment to various sectors, often requiring flexible financing and maintenance options. Additionally, Caterpillar's product offerings cater to customers in waste management and quarrying, each with unique demands for durability and specialized attachments.

Cost Structure

The Cost of Goods Sold (COGS) is a major expense for Caterpillar, representing the direct costs tied to creating their heavy machinery, engines, and other equipment. This includes the price of raw materials like steel, the wages paid to factory workers, and manufacturing expenses such as factory utilities and depreciation on production equipment.

In 2024, Caterpillar reported a substantial COGS of $40.199 billion. This figure highlights the immense scale of their manufacturing operations and the significant investment required in materials and labor to produce their extensive product line.

Caterpillar's commitment to Research and Development (R&D) is a cornerstone of its strategy, fueling innovation and maintaining its competitive edge. In 2024, the company continued its significant investment in R&D, allocating substantial resources to develop next-generation machinery, advanced technologies, and sustainable solutions. This focus ensures Caterpillar remains at the forefront of the industry, offering customers cutting-edge products that enhance efficiency and performance.

These R&D expenditures are not merely costs; they are vital investments in Caterpillar's future growth and market positioning. By consistently pushing the boundaries of engineering and technology, Caterpillar aims to anticipate and meet evolving customer needs and regulatory requirements, particularly in areas like emissions reduction and automation. For instance, their ongoing work in electrification and alternative fuels directly stems from these R&D efforts, positioning them for long-term success.

Selling, General, and Administrative (SG&A) expenses encompass the costs associated with marketing, sales efforts, product distribution, and the overall management of Caterpillar's corporate operations. These are crucial for reaching customers and maintaining the company's global presence.

For the year 2024, Caterpillar reported operating expenses, which include SG&A, totaling $51.737 billion. This figure reflects the significant investment the company makes in its sales channels, brand promotion, and administrative infrastructure to support its vast product lines and extensive dealer network worldwide.

Distribution and Logistics Costs

Caterpillar's distribution and logistics costs are substantial due to its global operations and the sheer size of its equipment. These expenses cover the transportation of heavy machinery and parts across continents, warehousing to ensure product availability, and the intricate management of its vast dealer network. For instance, in 2023, Caterpillar reported total operating expenses of $47.7 billion, a significant portion of which would be allocated to these critical logistical functions.

- Transportation: Moving large, heavy equipment globally involves significant freight and shipping expenses.

- Warehousing and Inventory Management: Maintaining strategically located distribution centers to house finished goods and spare parts incurs substantial costs.

- Dealer Network Support: Costs associated with supporting and managing the global dealer network, which is crucial for sales, service, and parts distribution.

- Supply Chain Optimization: Investments in technology and processes to ensure efficient and timely delivery of products and parts worldwide.

Financial Products Segment Costs

The financial products segment incurs significant costs, including credit losses, interest expenses on borrowed funds, and the administrative overhead tied to managing loans. These operational expenses are crucial to understanding the segment's profitability.

For instance, in 2024, Caterpillar Financial Services reported a profit before income taxes of $533 million. This figure directly reflects the impact of these various costs on the segment's financial performance.

- Credit Losses: Provisions set aside to cover potential defaults on loans provided to customers.

- Interest Expense: The cost of borrowing money to fund the financial products offered.

- Administrative Costs: Expenses related to loan application processing, servicing, and customer support.

Caterpillar's cost structure is dominated by its Cost of Goods Sold (COGS), reflecting the materials and labor for its heavy machinery. In 2024, COGS reached $40.199 billion, underscoring the significant investment in production. Selling, General, and Administrative (SG&A) expenses, totaling $51.737 billion in operating expenses for 2024, cover sales, marketing, and corporate functions. Distribution and logistics are also substantial costs due to the global scale and size of equipment.

| Cost Category | 2024 Data (USD Billions) | Key Components |

| Cost of Goods Sold (COGS) | 40.199 | Raw materials (steel), factory labor, manufacturing overhead |

| Operating Expenses (incl. SG&A) | 51.737 | Sales, marketing, R&D, administrative functions |

| Distribution & Logistics | (Implied within Operating Expenses) | Global freight, warehousing, dealer network support |

| Financial Products Costs | (Impact on segment profit) | Credit losses, interest expense, administrative costs |

Revenue Streams

Caterpillar's most significant revenue source is the sale of its extensive range of machinery and equipment. This includes heavy-duty construction vehicles, sophisticated mining machinery, and powerful engines that serve a global customer base. In 2024, the company reported impressive full-year sales and revenues totaling $64.8 billion, underscoring the dominance of this core business segment.

Caterpillar's aftermarket parts and services represent a significant and consistent revenue source. This includes the sale of genuine spare parts, along with vital maintenance contracts, repair services, and other support for their extensive existing equipment fleet.

In 2024, this segment demonstrated robust performance, with service revenue climbing to $24 billion. This marks a healthy 4% increase compared to the previous year, highlighting the ongoing demand for Caterpillar's support offerings.

Caterpillar's Financial Products segment, known as Cat Financial, is a significant revenue generator. It offers crucial financing, leasing, and insurance solutions to both Caterpillar customers and its extensive dealer network. This segment plays a vital role in enabling equipment acquisition and supporting ongoing operations.

In 2024, Cat Financial demonstrated strong performance, reporting revenues of $3.49 billion. This figure represents a healthy 7% increase compared to the previous year, highlighting the segment's growing importance and effectiveness in serving the market.

Engine and Power Systems Sales

Caterpillar's revenue streams include the sale of robust engine and power systems. These offerings encompass diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives, serving critical sectors like power generation, marine, and rail transportation. This diversified approach ensures a broad market reach.

In fiscal year 2024, Caterpillar's Energy and Transportation segment, which heavily features these engine and power systems, reported a significant revenue of $28.85 billion. This figure underscores the substantial contribution of these products to the company's overall financial performance.

- Core Products: Diesel and natural gas engines, industrial gas turbines, diesel-electric locomotives.

- Target Industries: Power generation, marine, rail, and other industrial applications.

- Fiscal Year 2024 Revenue: $28.85 billion from the Energy and Transportation segment.

Technology Licensing and Royalties

Caterpillar earns revenue by licensing its vast intellectual property, encompassing patents and trademarks, to third-party companies. This strategy allows Caterpillar to monetize its technological advancements and brand recognition beyond its core equipment sales, generating an additional income stream.

While not a dominant revenue source, these licensing agreements provide a way to leverage Caterpillar's innovation and established reputation in new markets or applications. For instance, in 2023, Caterpillar continued to explore and execute licensing deals that support its brand and technology portfolio.

- Intellectual Property Monetization: Caterpillar licenses patents and trademarks, generating revenue beyond product sales.

- Brand Leverage: This allows other companies to utilize Caterpillar's established technology and brand name.

- Ancillary Revenue: It contributes to overall revenue by capitalizing on existing technological assets.

Caterpillar's diverse revenue streams are anchored by the sale of machinery and equipment, complemented by a robust aftermarket services business and financial products. The company also generates income from its engine and power systems, alongside intellectual property licensing.

| Revenue Stream | Description | 2024 Revenue (USD Billions) |

|---|---|---|

| Machinery & Equipment Sales | Sale of construction, mining, and other heavy machinery. | $64.8 (Total Sales & Revenues) |

| Aftermarket Parts & Services | Sale of spare parts, maintenance, and repair services. | $24.0 (Service Revenue) |

| Financial Products | Financing, leasing, and insurance solutions through Cat Financial. | $3.49 (Cat Financial Revenue) |

| Engines & Power Systems | Sale of diesel/natural gas engines, turbines, locomotives. | $28.85 (Energy & Transportation Segment) |

| Intellectual Property Licensing | Licensing of patents and trademarks to third parties. | Not specified separately, ancillary. |

Business Model Canvas Data Sources

The Caterpillar Business Model Canvas is built upon extensive market research, internal operational data, and Caterpillar's financial disclosures. These diverse data sources ensure a comprehensive and accurate representation of the company's strategic framework.