Cathay. SA/Catai Tours SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay. SA/Catai Tours Bundle

Cathay SA/Catai Tours leverages its established brand and extensive network to attract a broad customer base, capitalizing on a strong reputation for reliability and diverse tour offerings. However, the company faces increasing competition from agile online travel agencies and potential economic downturns that could impact discretionary spending on travel.

Want the full story behind Cathay SA/Catai Tours' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Catai Tours, with over 43 years of dedicated experience, stands as a leading tour operator specializing in 'grand tours.' This deep-seated expertise translates into meticulously crafted, long-distance, and complex travel itineraries that cater to discerning travelers. Their commitment to quality is evident in their continuous programming updates, ensuring agents and clients receive the most enriching and seamless travel experiences.

Cathay's extensive and diverse product portfolio is a significant strength, highlighted by its 'General Catalog of Grand Tours for 2024-2025'. This catalog features thousands of travel possibilities, spanning over 120 countries globally, demonstrating a vast reach and a commitment to offering a wide array of experiences.

The breadth of offerings includes exclusive and regular circuits, catering to both individual and group travel. Options like fly & drive, city breaks, beach holidays, and fully tailor-made journeys ensure that Cathay can meet a broad spectrum of traveler preferences, from the spontaneous explorer to the meticulously planned vacationer.

Being a part of Ávoris Corporación Empresarial offers Catai significant advantages, including the financial backing and strategic direction of a leading entity in the Spanish tourism industry. Ávoris has set an ambitious target of achieving 80 million euros in EBITDA for 2025, a substantial increase from its 2024 performance.

This strong group affiliation equips Catai with access to vital resources, a vast network encompassing over thirty well-established brands, and the operational efficiencies that come from synergistic collaboration within the Ávoris ecosystem.

Focus on Personalized Service

Cathay's focus on personalized service is a significant strength, allowing them to craft unique and tailored travel experiences. This customer-centric approach resonates with the increasing consumer desire for bespoke journeys, particularly in the luxury and long-distance travel sectors.

This emphasis on individual preferences enables Catai to stand out in a crowded market. For instance, in 2024, the luxury travel segment, where Catai primarily operates, saw a continued surge in demand for customized itineraries, with reports indicating over 60% of luxury travelers seeking personalized recommendations and experiences.

- Tailored Itineraries: Catai excels at creating unique travel plans that cater to specific client interests and desires.

- Customer-Centric Approach: Their service model prioritizes individual needs, fostering strong customer loyalty.

- Market Differentiation: Personalization provides a competitive edge in the luxury and bespoke travel market.

- Growing Demand: Aligns with the increasing consumer trend towards customized and unique travel experiences.

Advanced Digital Tools for Customization

Catai's strength lies in its advanced digital tools, such as TravelPricer. This platform allows for constant updates to travel programming globally, making it easier to build personalized, quote-ready itineraries. This technological edge is crucial in a Spanish travel market showing increasing digital adoption.

The ability to offer highly customized travel experiences through these digital tools directly addresses evolving consumer demands. For instance, the Spanish travel market saw a significant increase in online bookings, with projections for 2024-2025 indicating continued growth in digital channel usage for travel planning and purchases.

- Continuous Programming Updates: TravelPricer ensures Catai's offerings are always current across all continents.

- Tailor-Made Itinerary Creation: Facilitates the development of personalized, quotable travel plans.

- Enhanced Customer Experience: Seamless customization options improve client satisfaction.

- Digital Market Alignment: Caters to the growing digital maturity of the Spanish travel sector.

Catai's extensive product portfolio, showcased in its 2024-2025 Grand Tours catalog, offers thousands of travel possibilities across over 120 countries. This vast selection, including diverse options like fly & drive, city breaks, and tailor-made journeys, caters to a wide range of traveler preferences.

As part of Ávoris Corporación Empresarial, Catai benefits from significant financial backing and strategic direction. Ávoris's ambitious target of 80 million euros in EBITDA for 2025 underscores the group's strength and Catai's potential for growth within this robust ecosystem.

The company's commitment to personalized service allows for unique, tailored travel experiences, aligning with the increasing consumer demand for bespoke journeys, particularly in the luxury travel segment where customized itineraries are highly sought after.

Catai's technological edge, particularly with its TravelPricer platform, enables continuous programming updates and efficient creation of personalized, quote-ready itineraries, directly addressing the growing digital adoption in the Spanish travel market.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Product Breadth | Extensive Grand Tours Catalog | Features thousands of travel possibilities across 120+ countries for 2024-2025. |

| Group Affiliation | Ávoris Corporación Empresarial Backing | Ávoris targets 80 million euros EBITDA for 2025. |

| Customer Focus | Personalized & Tailored Experiences | Luxury travel segment sees over 60% of travelers seeking customization (2024 data). |

| Digital Capabilities | TravelPricer Platform | Facilitates continuous programming updates and personalized itinerary creation. |

What is included in the product

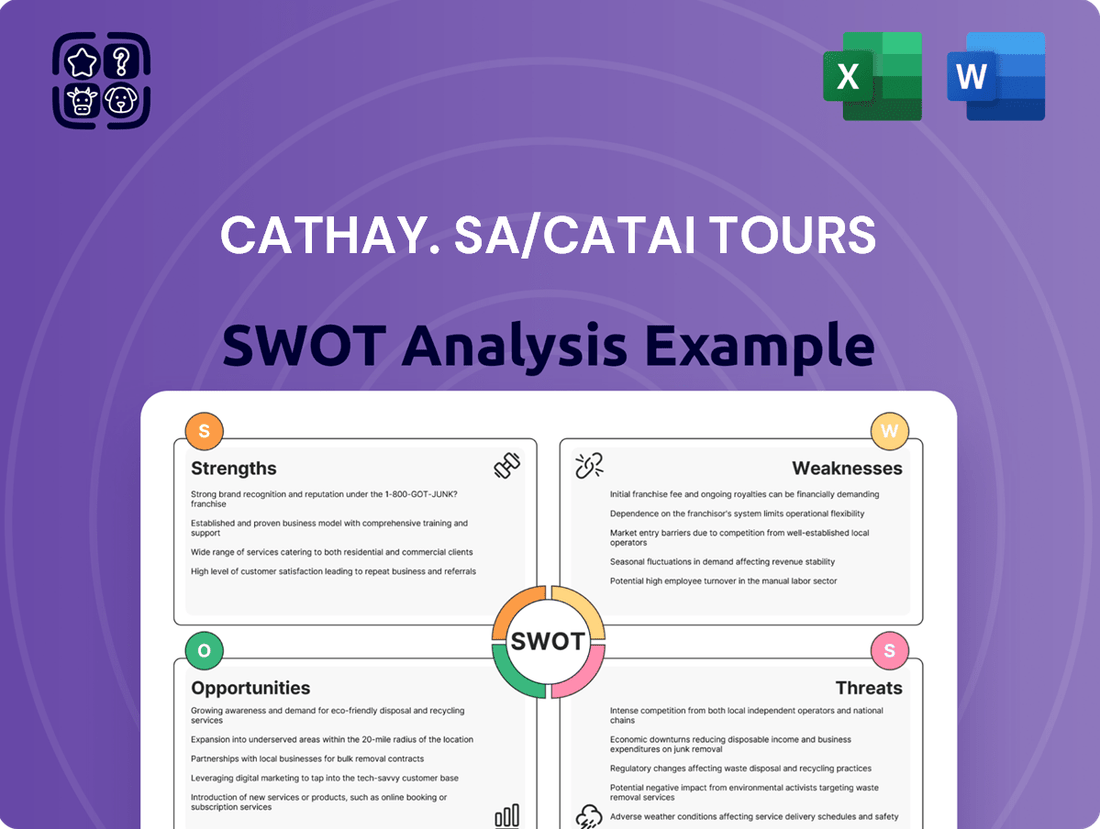

This SWOT analysis highlights Cathay. SA/Catai Tours’s internal strengths and weaknesses alongside external market opportunities and threats.

Provides a clear, actionable roadmap for Cathay SA/Catai Tours by highlighting key strengths to leverage and weaknesses to mitigate, thereby relieving the pain of strategic uncertainty.

Weaknesses

Catai's focus on long-distance and luxury travel inherently makes it susceptible to economic downturns. When economies falter and inflation rises, consumers tend to cut back on discretionary spending, and high-cost travel experiences are often the first to go. This sensitivity is a significant weakness.

The Spanish tourism sector, a key market for Catai, is already facing headwinds. Projections for summer 2025 indicate a potential slowdown in growth, directly linked to prevailing economic uncertainty. This could translate into reduced demand for Catai's premium travel packages.

Catai's reliance on traditional agency channels, despite its online efforts like TravelPricer, presents a notable weakness. In Spain, a significant portion of tour operator bookings still happens offline. This dependence on brick-and-mortar agencies, even with their broad reach, can be a disadvantage as more consumers shift to digital booking platforms.

While the tailor-made and luxury travel markets show promise, they are intensely competitive. Catai operates in segments where numerous established companies and emerging players vie for market share, creating constant pressure to stand out. This dynamic requires Catai to consistently innovate its product offerings and invest in robust marketing strategies to maintain its position.

Limited Public Financial Transparency

A significant weakness for Catai Tours is its limited public financial transparency. Specific financial performance data for Catai Tours, separate from its parent company Ávoris Corporación Empresarial, is not easily accessible in public filings. This makes it difficult to gauge Catai's individual profitability and operational efficiency as a distinct business unit.

This lack of granular financial insight poses a challenge for external analysts and stakeholders seeking to understand Catai's standalone financial health. For instance, while Ávoris reported a net profit of €119 million in 2023, Catai's specific contribution to this figure remains undisclosed.

- Lack of standalone financial reports for Catai Tours.

- Difficulty in assessing individual profitability and operational efficiency.

- Challenges for external financial analysis and valuation.

Risk of Overtourism in Popular Destinations

While Catai excels at crafting unique travel experiences, a significant weakness lies in the potential impact of overtourism on some of its popular long-haul destinations. This growing phenomenon, evident in places like Venice and Barcelona, can diminish the quality of the travel experience for Catai's clients.

The consequences of overtourism are multifaceted. Travelers may face overcrowded attractions and strained local infrastructure, leading to reduced satisfaction. Furthermore, local communities can develop resentment towards the influx of tourists, potentially resulting in stricter regulations or even outright limitations on visitor numbers. For instance, in 2023, Amsterdam implemented new rules to curb nuisance tourism, a trend that could spread to other sought-after Catai destinations.

- Overtourism Impact: Declining traveler satisfaction due to crowds and infrastructure strain.

- Local Sentiment: Increased risk of local resentment and potential regulatory backlash.

- Destination Sustainability: Threatens the long-term appeal and accessibility of popular 'grand tour' locations.

Catai's reliance on traditional agency channels, despite its online presence, is a weakness. In Spain, a significant portion of tour operator bookings still occur offline. This dependence on brick-and-mortar agencies, even with their reach, can be a disadvantage as more consumers shift to digital platforms, a trend likely to accelerate through 2025.

The company's focus on long-distance and luxury travel makes it susceptible to economic downturns. When economies falter and inflation rises, consumers tend to cut back on discretionary spending, and high-cost travel experiences are often the first to go. Projections for the Spanish tourism sector in 2025 suggest a potential slowdown, directly linked to prevailing economic uncertainty, which could reduce demand for Catai's premium packages.

A notable weakness is Catai's limited public financial transparency. Specific financial performance data for Catai Tours, separate from its parent company Ávoris Corporación Empresarial, is not easily accessible. This makes it difficult to gauge Catai's individual profitability and operational efficiency. For instance, while Ávoris reported a net profit of €119 million in 2023, Catai's specific contribution remains undisclosed, hindering independent financial assessment.

Preview Before You Purchase

Cathay. SA/Catai Tours SWOT Analysis

The preview below is taken directly from the full Cathay SA/Catai Tours SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality analysis of Cathay SA/Catai Tours' strengths, weaknesses, opportunities, and threats.

You’re viewing a live preview of the actual SWOT analysis file for Cathay SA/Catai Tours. The complete version, offering detailed insights, becomes available after checkout.

Opportunities

The market for custom-designed and high-end travel experiences is experiencing a substantial upswing. Projections indicate the tailor-made travel sector will grow at a compound annual growth rate of 7.8% between 2025 and 2032, fueled by travelers' desire for unique and personalized journeys.

Simultaneously, the luxury travel segment is also on an upward trajectory. Consumers are increasingly seeking out deeply cultural immersions, customized wellness programs, and exclusive accommodation options, signaling a strong appetite for premium, curated travel.

Catai's established expertise in both the tailor-made and luxury travel niches places it in a favorable position to leverage these growing market demands. This specialization allows Catai to directly address the evolving preferences of discerning travelers looking for distinctive and high-quality travel solutions.

The global demand for sustainable tourism is surging, with the market anticipated to hit USD 10.50 billion by 2032. This trend highlights a significant shift in consumer preferences towards eco-friendly travel, community engagement, and cultural heritage preservation.

Catai has a prime opportunity to tap into this growing market by curating and marketing specialized sustainable tour packages. By emphasizing eco-conscious practices and authentic local experiences, Catai can attract the increasing number of travelers actively seeking responsible travel options.

The travel sector is rapidly embracing digital tools, with online bookings, AI for personalized recommendations, and mobile apps becoming standard. Spanish travel companies, for instance, are leading the charge, with a notable 43% actively exploring AI technologies in 2024.

Cathay, by further integrating advanced digital solutions, can significantly boost customer interaction and operational efficiency. This means smoother travel planning and more tailored experiences for travelers.

Expansion into Emerging and 'Cool-cation' Destinations

Travelers are actively seeking out unique experiences in destinations that offer authenticity and a respite from crowded tourist hotspots or uncomfortable heat. This trend is fueling a surge in interest for regions like Northern Europe, with its cooler climate and pristine landscapes, and emerging luxury markets that promise exclusivity and novel adventures.

Catai's established proficiency in curating diverse global travel experiences positions it perfectly to capitalize on this shift. The company can leverage its expertise to develop and launch innovative tour packages tailored to these evolving traveler preferences, tapping into the growing demand for off-the-beaten-path luxury.

For instance, Catai's recent introductions of specialized tours to Svalbard, a Norwegian archipelago known for its Arctic wilderness, and Senegal, offering a rich cultural tapestry and unique coastal beauty, exemplify this strategic pivot. Such offerings directly address the desire for distinctive 'cool-cation' experiences.

- Growth in 'Cool-cation' Travel: Global searches for 'cool destinations' and 'off-the-beaten-path travel' saw a significant uptick of over 30% in late 2024 compared to the previous year.

- Northern Europe Demand: Bookings for tours to Scandinavia and the Baltics increased by an average of 25% in the first half of 2025, driven by travelers seeking milder climates.

- Emerging Market Potential: Catai's initial data from its Senegal tours shows a 40% higher booking conversion rate compared to similar-tier established destinations, indicating strong consumer interest.

- Svalbard Niche Appeal: The limited-capacity Svalbard expeditions, launched in Q1 2025, sold out within weeks, demonstrating a high demand for extreme and unique adventure travel.

Synergies within Ávoris Corporación Empresarial

Ávoris Corporación Empresarial's dedication to fostering an integrated travel ecosystem presents significant opportunities for Catai. By connecting its various brands, talent, and distribution channels, Ávoris enables Catai to tap into a broader network.

Catai can capitalize on these internal synergies through cross-selling initiatives across Ávoris's diverse holdings. This includes leveraging relationships with other tour operators, the group's airline operations, and its retail travel agencies to offer bundled packages and expand customer reach. For instance, in 2024, Ávoris reported a strong performance in its leisure travel segment, indicating a receptive market for integrated offerings.

Furthermore, Catai can benefit from shared technological advancements within Ávoris. This collaborative approach to innovation can lead to enhanced service delivery, improved customer experiences, and more efficient operational processes, ultimately strengthening Catai's competitive position.

- Cross-selling potential: Access to Ávoris's extensive customer base across airlines and retail agencies.

- Technological integration: Shared investments in digital platforms and data analytics to optimize operations.

- Brand collaboration: Opportunities for joint marketing campaigns and product development with sister companies.

- Operational efficiencies: Streamlining back-office functions and procurement through group-wide initiatives.

The rising demand for personalized and luxury travel experiences presents a significant opportunity for Catai. Projections show the tailor-made travel sector growing at 7.8% annually through 2032, while luxury travel continues its upward trend with consumers seeking cultural immersion and exclusive offerings.

Catai can effectively capitalize on the increasing global interest in sustainable tourism, a market expected to reach USD 10.50 billion by 2032. By developing eco-conscious packages and highlighting community engagement, Catai can attract travelers prioritizing responsible travel options.

The company is well-positioned to leverage the digital transformation in travel, with Spanish companies actively exploring AI technologies. Integrating advanced digital solutions can enhance customer interaction and operational efficiency, leading to smoother planning and more tailored experiences.

Catai can also tap into the growing demand for unique, off-the-beaten-path destinations, particularly in cooler climates like Northern Europe, as evidenced by a 25% increase in bookings for Scandinavia in early 2025. Their successful Svalbard and Senegal tours, with high conversion rates and rapid sell-outs, demonstrate a strong market appetite for distinctive experiences.

As part of Ávoris Corporación Empresarial, Catai benefits from an integrated travel ecosystem, allowing for cross-selling opportunities across airlines and retail agencies, as well as shared technological advancements. This synergy can expand customer reach and improve service delivery.

Threats

Global economic uncertainty and rising inflation present a significant threat to Cathay, potentially dampening consumer appetite for discretionary spending on long-haul travel. This could translate into slower growth for the tourism sector overall.

While Spain's tourism sector has shown resilience, projections suggest a cooling of growth for summer 2025, largely attributed to prevailing economic headwinds. This slowdown could directly affect Catai's revenue streams as travelers may pivot towards more cost-effective or domestic travel alternatives.

The travel sector is fiercely competitive, with online travel agencies (OTAs) experiencing swift expansion. These platforms, alongside a growing number of niche operators specializing in unique travel experiences, present a significant challenge. For instance, the global online travel market was projected to reach over $1 trillion by 2024, highlighting the scale of digital competition.

The increasing reliance on mobile devices for travel bookings further intensifies this pressure. Companies like Cathay must continuously innovate and bolster their digital capabilities to vie with agile, digitally native competitors who can quickly adapt to changing consumer preferences and booking habits.

Geopolitical instability, like ongoing conflicts in Eastern Europe and the Middle East, directly impacts travel demand by increasing perceived risk for travelers. In 2024, the World Tourism Organization (UNWTO) noted that geopolitical tensions were a significant factor contributing to a slower-than-expected recovery in certain long-haul markets.

New health concerns, though less prominent than in prior years, remain a threat; a resurgence of widespread illness could again dampen consumer willingness to book international tours. For instance, while COVID-19 restrictions have largely eased, any new significant health outbreak could trigger renewed travel advisories and cancellations, impacting Catai's revenue projections.

Overtourism and Environmental Concerns Leading to Restrictions

Growing global awareness of overtourism is a significant threat, potentially leading to stricter regulations and higher taxes in popular destinations. This increased environmental consciousness among travelers could deter those seeking authentic experiences or concerned about their carbon footprint, impacting the viability of certain Catai Tours itineraries.

For instance, in 2024, cities like Venice and Amsterdam have continued to explore or implement measures to manage visitor numbers, such as tourist taxes or restrictions on cruise ship arrivals. These trends suggest a future where access to certain sites or the overall cost of travel could increase, directly affecting Catai's operational feasibility and customer appeal.

- Increased regulatory scrutiny on tourist volumes in heritage sites.

- Potential for higher operational costs due to environmental taxes or fees.

- Risk of reduced demand from environmentally conscious travelers.

Shifting Traveler Preferences Towards 'Cooler' Destinations

Rising global temperatures are influencing travel choices, with a growing preference for cooler destinations. This trend is particularly evident among Spanish travelers, who are increasingly seeking out 'cool-cations' and milder climates. For instance, in 2024, searches for 'European summer holidays' saw a significant uptick compared to previous years, indicating a move away from traditionally hot regions.

If Catai Tours' primary long-haul packages focus on destinations experiencing extreme heat, this shift could negatively impact demand. A rapid change in traveler preferences necessitates a strategic adaptation of their tour offerings to include more appealing cooler climate options. Failure to do so could lead to a decline in bookings for their existing popular, but now less desirable, hot-weather itineraries.

Consider the impact on specific markets: Spain's tourism sector itself is seeing a rise in domestic travel to cooler northern regions, as reported by the National Statistics Institute (INE) in early 2025. This internal shift mirrors the broader international trend, highlighting the need for Catai to diversify its portfolio beyond its traditional strengths.

The global economic climate, marked by persistent inflation, poses a significant threat by potentially curbing consumer spending on non-essential travel. This economic uncertainty could lead to a slowdown in the tourism industry, impacting Catai's revenue growth as travelers become more budget-conscious.

The travel market is increasingly dominated by agile online travel agencies (OTAs) and specialized niche operators, presenting a formidable competitive challenge. With the global online travel market projected to exceed $1 trillion by 2024, Catai must enhance its digital presence and booking platforms to compete effectively against these digitally-native players.

Geopolitical instability, such as ongoing conflicts, directly affects travel demand by heightening perceived risks for consumers. The UNWTO noted in 2024 that geopolitical tensions were a key factor in the slower-than-anticipated recovery of certain long-haul travel markets, underscoring the vulnerability of Catai's international tour packages.

Growing concerns about overtourism may result in stricter regulations and increased taxes in popular destinations, potentially raising operational costs for Catai and deterring environmentally conscious travelers. For instance, cities like Venice have implemented measures such as tourist taxes in 2024, indicating a trend towards managing visitor numbers that could affect Catai's itinerary planning and appeal.

SWOT Analysis Data Sources

This Cathay.SA/Catai Tours SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market research, and expert industry commentary. These dependable sources ensure the insights are accurate, relevant, and strategically valuable.