Cathay. SA/Catai Tours Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay. SA/Catai Tours Bundle

Cathay. SA/Catai Tours navigates a competitive landscape shaped by significant buyer power and the ever-present threat of substitutes within the dynamic tourism sector. Understanding these forces is crucial for any strategic planning or investment decision.

The complete report reveals the real forces shaping Cathay. SA/Catai Tours’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Catai Tours' reliance on unique and tailor-made travel experiences means that suppliers offering these exclusive elements can wield significant bargaining power. For instance, securing access to a remote, high-end lodge in a less-traveled region, or engaging a highly sought-after local expert for a specialized cultural tour, presents limited substitution options for Catai. This scarcity of alternatives directly translates to stronger negotiating leverage for these specialized suppliers.

Catai's reliance on airlines for its long-haul travel packages means these carriers hold significant sway. If a limited number of airlines control key routes or have constrained capacity, they can dictate higher prices to Catai, impacting profitability.

Cathay's focus on luxury and personalized service means they likely partner with specific, high-end hotels and resorts. This selectivity can give these accommodation providers a stronger bargaining position.

Suppliers of unique or exclusive accommodations, particularly in sought-after destinations, can command higher prices and dictate terms. For instance, in 2024, luxury hotel occupancy rates in major European cities remained robust, often exceeding 80%, allowing top-tier properties to negotiate favorable contracts.

If Cathay relies heavily on a limited number of premium suppliers for its curated experiences, these suppliers gain leverage. This is especially true if these hotels offer amenities or locations not easily replicated by competitors, potentially impacting Cathay's cost structure and service delivery.

Technology and reservation system providers

Technology and reservation system providers hold significant bargaining power over tour operators like Cathay. These suppliers offer critical software for booking, customer relationship management (CRM), and daily operations. If their solutions are highly specialized or deeply integrated into Cathay's existing infrastructure, switching to a new provider becomes costly and complex.

This reliance means suppliers can dictate terms, potentially increasing prices or limiting service flexibility. For instance, a provider offering a unique, proprietary booking engine that is central to Cathay's sales process would have considerable leverage. The difficulty and expense associated with migrating vast amounts of customer data and retraining staff further solidify this supplier power.

- High Switching Costs: The integration of reservation systems and CRMs creates significant barriers to changing suppliers, giving existing providers more leverage.

- Specialized Solutions: Providers offering unique or highly tailored software essential for Cathay's operations possess greater bargaining power.

- Essential Services: The fundamental role of these technology providers in enabling bookings and customer management makes Cathay dependent on their services.

Consolidation within the supply chain

Consolidation among hotel chains and airline groups significantly bolsters supplier bargaining power. When fewer, larger entities control a substantial portion of the market, they can dictate terms more forcefully to buyers like Catai. This concentration means suppliers can potentially charge higher prices or offer less favorable contract conditions, as alternatives for buyers become scarcer.

While Catai, as a brand within the larger Ávoris group, can leverage group purchasing power to negotiate better deals, this doesn't entirely neutralize the threat from consolidated suppliers. Individual Catai operations might still encounter powerful suppliers who hold significant sway, particularly if the group's purchasing volume isn't enough to offset the supplier's market dominance in specific regions or service categories.

- Supplier Consolidation Impact: Increased leverage for hotel chains and airlines.

- Catai's Advantage: Ávoris group purchasing power can mitigate some supplier strength.

- Remaining Risk: Individual Catai operations may still face strong, consolidated suppliers.

- 2024 Trend: Ongoing M&A activity in the travel sector continues to drive supplier consolidation.

Suppliers of unique and exclusive travel components, such as remote luxury lodges or highly specialized local guides, can exert significant bargaining power over Catai Tours. This leverage stems from the limited availability of these niche offerings, making substitution difficult. For instance, in 2024, demand for unique, off-the-beaten-path experiences continued to rise, allowing providers of such services to command premium pricing and favorable contract terms, as demonstrated by the strong performance of boutique adventure travel operators.

Airlines, especially those controlling key routes or having limited capacity, also represent a powerful supplier group for Catai. Their ability to influence pricing and availability directly impacts Catai's package costs and profitability. The ongoing consolidation within the airline industry, with major carriers expanding their market share, further amplifies their negotiating strength.

Technology providers, crucial for booking and customer management systems, hold considerable sway due to high switching costs and specialized solutions. If Catai relies heavily on a proprietary booking engine, migrating data and retraining staff can be prohibitively expensive, solidifying the supplier's leverage. The travel tech market in 2024 saw continued investment in integrated platforms, making deep integration a common feature that increases supplier power.

| Supplier Type | Factors Influencing Bargaining Power | Example Impact on Catai Tours |

|---|---|---|

| Unique Experience Providers | Scarcity of offerings, limited substitution options | Higher costs for exclusive tours, potential service limitations if terms aren't met |

| Airlines | Route control, capacity constraints, industry consolidation | Increased airfare costs, potential route restrictions impacting package design |

| Technology/Software Providers | High switching costs, specialized/integrated solutions | Dependency on provider's pricing and service updates, complex migration if changing vendors |

What is included in the product

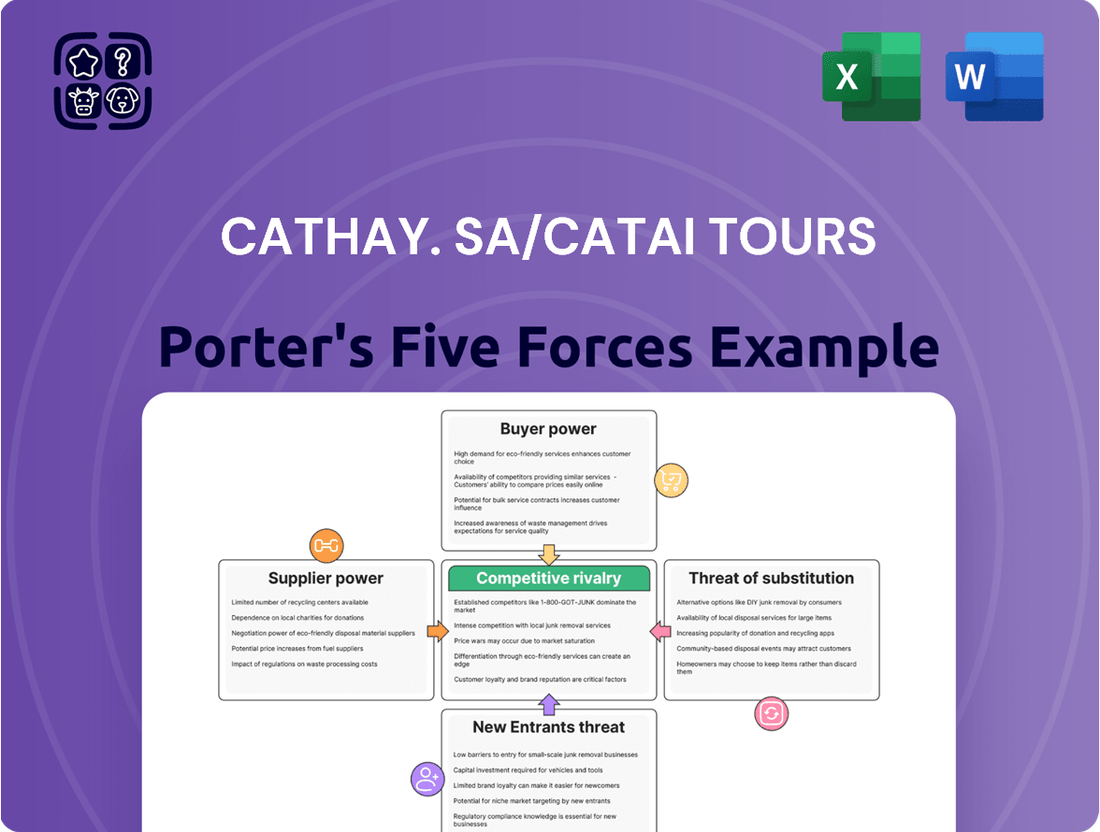

This analysis details Cathay. SA/Catai Tours' competitive environment, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces for Cathay SA/Catai Tours.

Gain actionable insights into industry dynamics, allowing for proactive strategies to relieve competitive pressures and enhance market position.

Customers Bargaining Power

While travelers have numerous options for tour operators, the intricate process of researching, customizing, and booking complex, long-distance, and tailor-made journeys can establish significant perceived switching costs for Catai's clientele. This investment in planning makes customers less inclined to readily switch to a competitor.

For instance, a customer who has spent considerable time detailing a bespoke safari in Botswana with Catai, including specific lodges, private guides, and unique experiences, faces a substantial time and effort hurdle to replicate that level of personalization with another provider. This deep engagement fosters loyalty, even if alternative operators exist.

Customers today have unprecedented access to information, readily comparing tour operator pricing and sifting through peer reviews for destinations. This transparency significantly enhances their ability to scrutinize offerings. For instance, a quick online search can reveal competitor pricing for similar packages, putting pressure on Catai Tours to justify its rates if its unique selling points aren't effectively communicated.

The proliferation of online review platforms means customer experiences are highly visible. A substantial portion of travelers, estimated to be over 80% by some travel industry reports in 2024, rely on these reviews when making booking decisions. If Catai's service quality or value proposition doesn't align with positive online sentiment, customers can easily leverage this information to demand better terms or opt for alternatives.

Cathay's commitment to bespoke travel experiences means customers frequently arrive with highly specific itinerary requests. This focus on personalization inherently shifts leverage towards the consumer, as they can articulate precise needs that not all tour operators can fulfill.

The power of customers to dictate unique travel plans and personal preferences empowers them to negotiate terms or seek out alternative providers who can perfectly match their vision. For instance, a customer demanding a specific, rare cultural immersion experience might find fewer operators capable of delivering, but those who can will have greater pricing power, while the customer can also exert pressure on pricing due to the niche nature of their request.

Price sensitivity for luxury and long-distance travel

Even within the luxury segment, customers booking long-distance and high-value trips with Cathay Pacific can exhibit significant price sensitivity. This is particularly true during periods of economic uncertainty, leading them to actively compare Catai's offerings against competitors or even consider assembling their own travel itineraries. This behavior directly pressures Cathay's profit margins.

For instance, in 2024, global economic forecasts indicated a mixed outlook, with some regions experiencing inflationary pressures and others facing potential slowdowns. This environment often amplifies consumer focus on value, even for premium services. Travelers might seek out package deals, loyalty program benefits, or alternative carriers that offer comparable luxury for a lower price point.

- Price Comparison: Customers frequently utilize online travel agencies and comparison websites to benchmark Catai's pricing against other airlines and tour operators for similar long-haul routes.

- DIY Travel Trends: A growing segment of travelers, even those seeking luxury, are comfortable booking flights, accommodations, and activities independently, bypassing traditional tour operators like Catai.

- Economic Sensitivity: Fluctuations in disposable income and consumer confidence, as observed in 2024 economic reports, directly influence the willingness of customers to pay a premium for travel services.

Impact of customer loyalty and repeat business

Cathay's focus on personalized service is a key strategy to cultivate customer loyalty. By delivering exceptional experiences, the company aims to build trust and encourage repeat business. This approach can significantly diminish the bargaining power of customers.

When customers highly value the trust and quality associated with Cathay's service, they are less likely to be swayed by minor price variations. This prioritization of a positive customer relationship over cost savings naturally reduces their leverage in price negotiations.

- Customer Loyalty: Cathay's personalized service fosters strong customer relationships, leading to increased loyalty.

- Reduced Price Sensitivity: Loyal customers often prioritize service quality and trust over minor price differences.

- Repeat Business: Satisfied customers are more inclined to book with Cathay again, securing consistent revenue.

- Lower Bargaining Power: The combination of loyalty and trust diminishes customers' ability to demand lower prices.

While Catai's bespoke travel focus creates switching costs, the ease of online price comparison and the influence of peer reviews in 2024, where over 80% of travelers consult them, empower customers. This transparency allows them to scrutinize offerings and demand better terms, potentially impacting Catai's pricing power.

Customers booking complex, high-value trips with Catai can exhibit significant price sensitivity, especially given mixed global economic forecasts in 2024. This leads them to compare offerings or even plan independently, directly pressuring Catai's profit margins by seeking better value.

| Factor | Impact on Catai's Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Information Access | Increases bargaining power through easy price and review comparison. | High; over 80% of travelers rely on reviews. |

| DIY Travel Trends | Increases bargaining power as customers can bypass operators. | Growing; even luxury travelers are comfortable booking independently. |

| Economic Sensitivity | Increases bargaining power due to focus on value and cost savings. | High; mixed economic forecasts amplified consumer focus on value. |

Preview the Actual Deliverable

Cathay. SA/Catai Tours Porter's Five Forces Analysis

This preview showcases the complete Cathay SA/Catai Tours Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no hidden content or discrepancies. You can confidently acquire this comprehensive analysis, ready for immediate use in your strategic planning.

Rivalry Among Competitors

The long-distance, tailor-made, and luxury travel sector is notably fragmented, featuring a multitude of niche operators, from boutique agencies to larger, established entities. This diverse landscape fuels robust competition as companies strive to capture a share of a discerning, specialized clientele.

In 2024, the luxury travel market continued its upward trajectory, with global spending projected to reach over $1.5 trillion, underscoring the significant revenue potential but also the intense rivalry for these affluent travelers.

This fragmentation means that companies like Cathay need to differentiate themselves strongly, perhaps through unique experiences, exceptional service, or exclusive partnerships, to stand out amidst numerous competitors vying for the same high-value customers.

Catai operates within the Ávoris Corporación Empresarial, a significant player in the travel industry. However, it faces intense competition from other large, diversified travel conglomerates. These rivals often boast substantial marketing expenditures, allowing them to reach a wider audience and build stronger brand recognition.

These larger groups leverage their extensive distribution networks, encompassing online travel agencies, physical retail outlets, and strategic partnerships, to offer a comprehensive range of travel products. Their scale enables them to negotiate better terms with suppliers, potentially leading to more competitive pricing for consumers.

For instance, in 2024, major travel groups continued to consolidate their market positions through acquisitions and strategic alliances, further intensifying the competitive landscape for specialized tour operators like Catai. This trend highlights the constant pressure to innovate and differentiate within a crowded marketplace.

Catai's competitive edge hinges on crafting distinctive travel experiences and providing highly personalized service. The degree of rivalry intensifies if competitors can easily mimic these unique selling propositions, or if Catai struggles to effectively convey its specialized offerings to potential customers.

The travel industry in 2024 saw a strong rebound, with many consumers prioritizing experiential travel. For instance, in the first half of 2024, global tourism receipts reached an estimated $500 billion, indicating a significant demand for differentiated travel services.

Online travel agencies (OTAs) and direct booking platforms

While Catai Tours specializes in curated, bespoke travel experiences, the competitive landscape is significantly shaped by online travel agencies (OTAs) and direct booking platforms. These channels offer customers the flexibility to book individual travel components, such as flights and accommodations, independently, creating an indirect but potent form of competition. This self-service model and the aggregation of travel options by OTAs intensify overall market rivalry by providing accessible alternatives to fully packaged tours.

The rise of OTAs and direct booking has fundamentally altered customer behavior. For instance, in 2024, the global online travel market was valued at over $800 billion, with OTAs holding a substantial share. This indicates a strong customer preference for platforms that allow for granular control over travel planning, directly impacting the demand for comprehensive tour packages.

- OTA Dominance: Platforms like Booking.com and Expedia continue to capture a significant portion of the travel booking market, offering vast inventories and competitive pricing that can be difficult for specialized tour operators to match on individual components.

- Direct Booking Growth: Airlines and hotel chains are increasingly investing in their direct booking channels, often incentivizing customers with loyalty programs and exclusive deals, thereby bypassing intermediaries and potentially reducing the appeal of bundled tour offerings.

- Customer Empowerment: The ease of comparing prices and customizing itineraries on digital platforms empowers consumers to act as their own travel agents, increasing the pressure on companies like Catai to demonstrate the unique value proposition of their managed experiences.

Marketing and brand reputation investment

The travel industry, particularly for tour operators like Catai, demands substantial investment in marketing and brand reputation. This is essential to cut through the noise and attract customers in a crowded marketplace. A strong brand image, built on consistent quality and reliability, directly influences customer choice and loyalty.

In 2024, the travel sector saw continued aggressive marketing from major players. For instance, TUI Group, a significant competitor, reported substantial marketing spend to drive bookings and reinforce its brand presence. This highlights the ongoing need for Catai to allocate resources effectively to maintain its competitive edge. Customer reviews and online reputation management are paramount, as negative feedback can quickly erode trust.

- Brand Investment: Companies like Catai must continuously invest in marketing campaigns, digital advertising, and public relations to build and sustain brand awareness.

- Reputation Management: Proactive management of online reviews and customer feedback is critical for maintaining a positive brand reputation, a key differentiator.

- Competitive Differentiation: A strong brand and reputation allow Catai to stand out from competitors, justifying premium pricing and fostering customer loyalty.

- Market Share: Effective marketing and a trusted brand are directly linked to market share, enabling Catai to attract and retain a larger customer base.

The competitive rivalry within the long-distance, tailor-made, and luxury travel sector is intense due to its fragmented nature, featuring numerous niche operators. In 2024, the luxury travel market's projected global spending exceeding $1.5 trillion highlights both the opportunity and the fierce competition for affluent travelers.

Major travel conglomerates, including those Catai's parent company Ávoris Corporación Empresarial competes with, leverage substantial marketing budgets and extensive distribution networks to gain market share. These larger entities often benefit from economies of scale, enabling them to negotiate better supplier terms and offer more competitive pricing, as seen in their continued market consolidation through acquisitions in 2024.

The rise of online travel agencies (OTAs) and direct booking platforms presents a significant indirect competitive challenge. With the global online travel market valued at over $800 billion in 2024, customer preference for granular control over bookings intensifies rivalry for comprehensive tour packages.

Catai's ability to differentiate through unique experiences and personalized service is crucial, as competitors can potentially replicate these offerings. Maintaining a strong brand reputation through consistent quality and effective marketing, especially in the face of aggressive campaigns by major players like TUI Group in 2024, is paramount for customer loyalty and market share.

| Competitor Type | Key Competitive Actions | 2024 Market Context |

|---|---|---|

| Niche Operators | Specialized experiences, personalized service | Fragmented market, focus on discerning clientele |

| Large Travel Conglomerates | Extensive marketing, broad distribution networks, economies of scale | Market consolidation through M&A, strong brand recognition |

| OTAs & Direct Booking Platforms | Price comparison, self-service customization, loyalty programs | Dominant online presence, customer empowerment, shift from bundled tours |

SSubstitutes Threaten

Independent travel planning is a significant threat to Catai Tours. Customers can easily research and book flights, hotels, and activities themselves through numerous online travel agencies and direct booking sites.

The accessibility and often lower costs associated with DIY bookings can make packaged tours seem less appealing. For example, in 2024, online travel bookings are projected to reach over $1.5 trillion globally, indicating a strong consumer preference for self-service travel arrangements.

This trend directly siphons potential customers away from traditional tour operators like Catai, as travelers increasingly value flexibility and the ability to customize their trips without the premium often associated with curated packages.

The threat of substitutes for Cathay Pacific's long-haul, tailored travel experiences is significant, particularly from alternative leisure activities and domestic tourism. In 2024, many consumers are increasingly drawn to shorter, more accessible vacation options. For instance, the rise of staycations and domestic travel packages, often promoted by local tourism boards, offers a compelling alternative for those seeking relaxation and new experiences without the cost and time commitment of international flights.

Furthermore, the cruise industry continues to present a strong substitute. Cruises bundle accommodation, dining, and entertainment, appealing to a broad demographic looking for value and convenience. In 2023, the global cruise industry saw a robust recovery, with passenger numbers nearing pre-pandemic levels, indicating a sustained consumer interest that diverts spending from traditional airline travel.

While not a direct replacement for physical travel, the growing sophistication of virtual reality (VR) and immersive online experiences presents a potential threat to Cathay's core business. These technologies offer increasingly realistic ways to explore destinations, potentially diminishing the perceived necessity for certain types of travel, especially those focused on discovery and initial exploration.

For instance, by 2024, the global VR market was projected to reach over $60 billion, indicating significant investment and consumer interest in these alternative experiences. This trend could lead some travelers, particularly those on discovery-focused tours or seeking a preliminary understanding of a location, to opt for virtual exploration instead of booking a physical trip, thereby impacting demand for Cathay's services.

Specialized niche travel providers

The threat of substitutes for Cathay Pacific's tour operations, particularly Catai Tours, is elevated by the rise of highly specialized niche travel providers. These niche operators often focus on specific experiences, like adventure trekking or cultural immersion in a particular region, offering a more tailored and authentic product than a general tour operator might. For instance, a customer seeking a unique Everest Base Camp trek in 2024 might bypass a larger entity like Catai to book directly with a reputable Nepalese trekking company, which can often provide more specialized expertise and local knowledge.

This direct booking trend represents a significant substitution threat. Customers can unbundle travel services, opting to arrange flights with Cathay Pacific directly while sourcing unique ground experiences from specialized local providers. This disintermediation means Catai risks losing not just the tour package revenue but also the ancillary services that often accompany such bookings. In 2023, the global adventure tourism market alone was valued at approximately $1.4 trillion, with a significant portion driven by direct bookings with local specialists.

- Direct Booking Trend: Customers increasingly bypass traditional tour operators to book niche experiences directly with local, specialized providers.

- Unbundling of Services: This allows travelers to pick and choose components, such as flights from Cathay Pacific and unique ground tours from smaller operators.

- Specialized Expertise: Niche providers offer deep local knowledge and tailored experiences that broader operators may struggle to match.

- Market Value: The adventure tourism sector, a prime area for niche providers, demonstrates the significant financial draw of specialized travel.

Package tours from generalist operators

While Cathay Pacific's Catai Tours specializes in bespoke travel experiences, a significant threat comes from package tours offered by generalist operators. These alternatives often provide a more standardized, less personalized travel itinerary. For instance, in 2024, the global online travel market, which includes package tours, was valued at over $800 billion, indicating a substantial market segment accessible to these competitors.

Customers may choose these package tours due to their perceived budget-friendliness and streamlined booking processes. Many travelers, particularly those seeking convenience, might find the all-inclusive nature of these packages more appealing than the detailed customization Catai offers. This can be especially true for shorter trips or for travelers less concerned with unique, tailored experiences.

- Lower Price Points: Generalist operators can leverage economies of scale to offer package tours at lower price points compared to customized itineraries.

- Simplicity of Booking: Standardized packages often feature a straightforward booking process, appealing to customers who prioritize ease and speed.

- Brand Recognition: Large, established generalist tour operators benefit from significant brand recognition, which can instill confidence in potential customers.

- Accessibility: These operators often have wider distribution channels and marketing reach, making their offerings more visible and accessible to a broader audience.

The threat of substitutes for Catai Tours is substantial, driven by the increasing ease of independent travel planning and the growing appeal of alternative leisure activities. Customers can now readily book flights, accommodations, and experiences directly online, often at lower costs than packaged tours. This trend is underscored by the global online travel market's projected value exceeding $1.5 trillion in 2024, demonstrating a clear consumer preference for self-directed travel arrangements.

Furthermore, the cruise industry presents a compelling substitute, bundling travel components for convenience and value. The sector's robust recovery, with passenger numbers nearing pre-pandemic levels in 2023, highlights sustained consumer interest that diverts spending from traditional tour operators. Even evolving virtual reality technologies offer immersive destination exploration, potentially reducing the perceived need for certain types of physical travel, especially for initial discovery.

| Substitute Type | Key Characteristics | Impact on Catai Tours | Market Data/Trends |

| Independent Travel Planning | DIY booking, flexibility, customization | Siphons customers, reduces demand for packages | Global online travel bookings > $1.5 trillion (2024) |

| Alternative Leisure Activities | Staycations, domestic travel, cruises | Diverts spending and travel time | Cruise passenger numbers near pre-pandemic levels (2023) |

| Virtual Reality Experiences | Immersive online exploration | Potential reduction in demand for discovery travel | Global VR market > $60 billion (2024 projection) |

Entrants Threaten

The long-distance and tailor-made travel sector demands significant upfront investment. Establishing robust supplier networks, sophisticated marketing campaigns, and reliable technology infrastructure are crucial, alongside the complexities of managing global logistics. These substantial capital requirements act as a formidable barrier, effectively deterring many potential new players from entering the market.

For instance, in 2024, the average cost for a travel agency to establish a global operational presence, including technology and initial marketing, could easily range from $500,000 to over $2 million. This high entry cost means only well-funded entities can realistically consider competing, thereby limiting the threat of new entrants.

New entrants face a significant hurdle in replicating Cathay's well-established global supplier networks. Building trust and securing preferential rates with airlines, hotels, and local operators worldwide requires years of consistent business and relationship nurturing. For instance, in 2024, the travel industry saw continued consolidation, making it even harder for newcomers to break into established supply chains.

Furthermore, the depth of expertise Catai possesses across numerous destinations is a formidable barrier. This knowledge encompasses everything from navigating local regulations to understanding niche market demands, which is crucial for delivering high-quality travel experiences. A new player would find it incredibly difficult and costly to acquire this level of destination-specific intelligence quickly.

In the personalized and luxury travel sector, brand reputation and trust are incredibly important. Newcomers struggle to build this crucial credibility, especially when customers are making significant investments in their travel. For instance, Cathay Pacific, a major player, has spent decades cultivating a loyal customer base, making it hard for new brands to compete directly for these discerning travelers.

Regulatory hurdles and licensing requirements

The travel industry is heavily regulated, with new entrants facing significant barriers due to licensing and compliance with international travel laws. For instance, operating as a tour operator often requires specific permits and adherence to consumer protection regulations, which can be costly and time-consuming to obtain. In 2024, many countries continued to update their travel advisories and entry requirements, adding another layer of complexity for businesses looking to expand their reach.

Navigating these complexities acts as a substantial deterrent for potential new competitors. These requirements can include:

- Obtaining operating licenses and permits from national and international tourism bodies.

- Meeting financial solvency requirements to protect customer deposits and ensure operational stability.

- Complying with consumer protection laws, such as those related to package travel and data privacy.

- Adhering to safety and security standards, particularly for aviation and accommodation providers.

Economies of scale and scope within existing groups

Catai, as a component of Ávoris Corporación Empresarial, leverages significant economies of scale. This translates into substantial purchasing power for flights, accommodations, and other travel services, allowing them to negotiate more favorable rates than smaller, newer competitors. For instance, in 2024, the broader Ávoris group's consolidated revenue reached over €3 billion, underscoring the financial muscle behind its subsidiaries.

The scope of operations within Ávoris also presents a formidable barrier. Catai benefits from shared marketing resources, technological platforms, and administrative functions. This broad operational base means that a new, independent entrant would struggle to match the cost efficiencies and service breadth that Catai can offer, making it difficult to compete effectively on price or product variety without substantial initial investment.

The threat of new entrants is therefore mitigated by these inherent advantages:

- Economies of Scale: Catai's ability to buy in bulk reduces per-unit costs, a feat difficult for new entrants to replicate quickly.

- Economies of Scope: Shared resources and services across Ávoris's portfolio lower operational overhead for Catai.

- Brand Recognition and Distribution: Established brands within Ávoris, including Catai, benefit from existing customer bases and distribution channels.

- Capital Requirements: The significant capital needed to achieve comparable scale and scope deters many potential new players in the travel sector.

The threat of new entrants for Catai is considerably low due to the substantial capital investment required to establish a global presence and robust supplier networks. For example, in 2024, setting up a comparable travel operation could cost upwards of $2 million. Furthermore, building brand trust and replicating Catai's extensive destination expertise and established supplier relationships, cultivated over years, presents a significant challenge for newcomers. The travel industry’s complex regulatory landscape, demanding compliance with international laws and consumer protection standards, adds another formidable barrier.

| Barrier Type | Description | Estimated 2024 Impact |

| Capital Requirements | High upfront investment for global operations, technology, and marketing. | $500,000 - $2 million+ |

| Supplier Networks & Relationships | Years needed to build trust and secure preferential rates with global partners. | Difficult to replicate in the short-to-medium term. |

| Brand Reputation & Trust | Crucial for high-value travel; takes decades to establish. | New entrants struggle to compete with established loyalty. |

| Regulatory Compliance | Licensing, permits, consumer protection, and safety standards. | Time-consuming and costly to obtain and maintain. |

| Economies of Scale & Scope (via Ávoris) | Purchasing power and shared resources offer cost advantages. | Ávoris's €3 billion+ revenue in 2024 highlights financial leverage. |

Porter's Five Forces Analysis Data Sources

Our Cathay Tours Porter's Five Forces analysis is built upon a robust foundation of data, including Cathay Tours' annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial data from sources such as Bloomberg.